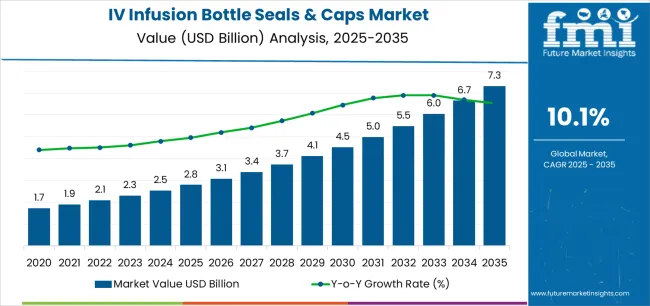

The global IV infusion bottle seals & caps market is projected to grow from USD 2.8 billion in 2025 to approximately USD 7.3 billion by 2035, recording an absolute increase of USD 4.5 billion over the forecast period. This translates into a total growth of 160.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 10.1% between 2025 and 2035. The overall market size is expected to grow by approximately 2.6X during the same period, supported by increasing demand for parenteral drug delivery systems, growing prevalence of chronic diseases requiring intravenous therapy, and rising requirements for contamination-free closure solutions across pharmaceutical manufacturing, healthcare facilities, and clinical administration sectors.

Between 2025 and 2030, the IV infusion bottle seals & caps market is projected to expand from USD 2.8 billion to USD 4.6 billion, resulting in a value increase of USD 1.8 billion, which represents 40.0% of the total forecast growth for the decade. This phase of development will be shaped by increasing demand for sterile closure systems, rising hospital admissions requiring intravenous medication, and growing availability of advanced elastomeric formulations across pharmaceutical packaging facilities and medical device manufacturing establishments.

Between 2030 and 2035, the market is forecast to grow from USD 4.6 billion to USD 7.3 billion, adding another USD 2.7 billion, which constitutes 60.0% of the overall ten-year expansion. This period is expected to be characterized by the advancement of high-performance barrier materials, the integration of tamper-evident security features for product integrity, and the development of premium silicone-free elastomer compounds across diverse pharmaceutical container categories. The growing emphasis on biologics packaging compatibility and particulate-free administration will drive demand for advanced closure varieties with enhanced chemical resistance, improved penetration consistency, and superior sealing performance characteristics.

Technological advancements are reshaping the competitive landscape. Manufacturers are increasingly producing latex-free, siliconized, and low-extractables seals to minimize allergic reactions and ensure compatibility with sensitive formulations. Automation and high-precision molding techniques have improved consistency, reducing the likelihood of defects and enabling large-scale production with higher sterility assurance levels. Smart packaging features that track integrity and tampering are gradually emerging in high-value pharmaceutical applications, reflecting the growing convergence of packaging and digital healthcare.

Growth in infectious disease management, vaccination campaigns, and emergency preparedness has also expanded usage of IV solutions, pushing the need for dependable closure systems. Events such as pandemic preparedness programs and increased stockpiling of essential IV solutions further strengthen demand across global health systems. At the same time, rising outpatient care, home infusion therapy, and ambulatory surgical centers require packaging components that ensure safety during decentralized care, supporting a broader consumption base beyond hospitals alone.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.8 billion |

| Forecast Value in (2035F) | USD 7.3 billion |

| Forecast CAGR (2025 to 2035) | 10.1% |

Market expansion is being supported by the increasing global demand for parenteral drug delivery solutions and the corresponding shift toward advanced closure systems that can provide superior contamination protection outcomes while meeting user requirements for sterile manufacturing and regulatory-compliant packaging processes. Modern pharmaceutical companies are increasingly focused on incorporating closure technologies that can enhance product safety while satisfying demands for reliable, consistently performing container systems and optimized quality assurance practices. IV infusion bottle seals & caps' proven ability to deliver barrier protection benefits, needle penetration reliability, and diverse pharmaceutical compatibility makes them essential components for quality-conscious manufacturers and safety-focused healthcare providers.

The growing emphasis on biologics manufacturing and product integrity is driving demand for high-performance closure systems that can support distinctive barrier outcomes and comprehensive contamination control positioning across injectable pharmaceuticals, parenteral nutrition, and critical care medication categories. User preference for technologies that combine sealing excellence with regulatory compliance is creating opportunities for innovative implementations in both traditional and emerging pharmaceutical applications. The rising influence of sterile manufacturing standards and drug safety regulations is also contributing to increased adoption of closure systems that can provide authentic protection benefits and validated performance characteristics.

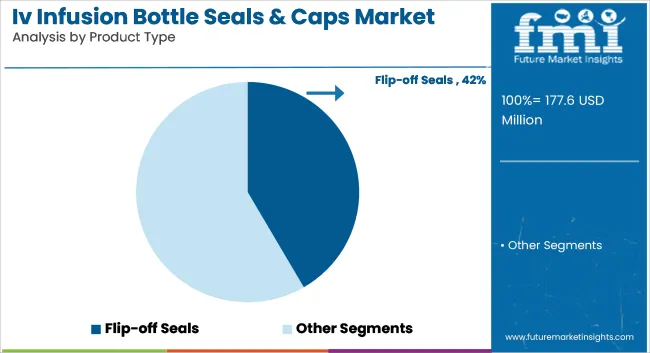

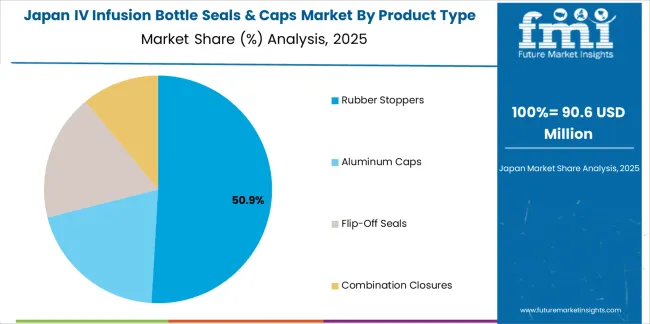

The market is segmented by product type, material type, sterilization method, end-use application, and region. By product type, the market is divided into rubber stoppers, aluminum caps, flip-off seals, and combination closures. Based on material type, the market is categorized into butyl rubber, natural rubber, synthetic elastomers, and aluminum alloys. By sterilization method, the market includes steam sterilization, gamma irradiation, ethylene oxide, and electron beam. By end-use application, the market encompasses hospitals, pharmaceutical manufacturers, contract packaging organizations, clinical research facilities, and other applications. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and other regions.

The rubber stoppers segment is projected to account for 52% of the IV infusion bottle seals & caps market in 2025, reaffirming its position as the leading closure category. Pharmaceutical manufacturers and packaging facilities increasingly utilize rubber stoppers for their superior sealing characteristics, established penetration reliability, and essential functionality in sterile closure applications across diverse medication categories. Rubber stoppers' standardized performance characteristics and proven barrier effectiveness directly address user requirements for reliable contamination protection and optimal packaging integrity in parenteral applications.

This product segment forms the foundation of modern pharmaceutical closure patterns, as it represents the format with the greatest regulatory acceptance potential and established compatibility across multiple drug delivery systems. Industry investments in material optimization and quality standardization continue to strengthen adoption among safety-conscious manufacturers. With users prioritizing container-closure integrity and sterilization compatibility, rubber stoppers align with both regulatory objectives and performance requirements, making them the central component of comprehensive parenteral packaging strategies.

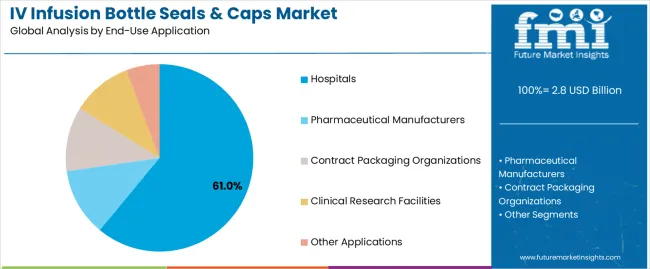

Hospitals are projected to represent 61% of the IV infusion bottle seals & caps market in 2025, underscoring their critical role as the primary application for quality-focused healthcare facilities seeking superior medication safety benefits and enhanced patient protection credentials. Healthcare providers and hospital pharmacies prefer hospital applications for their established procurement patterns, proven clinical acceptance, and ability to maintain exceptional safety profiles while supporting sterile medication administration during diverse treatment experiences. Positioned as essential applications for patient-centered facilities, hospital offerings provide both safety excellence and regulatory compliance advantages.

The segment is supported by continuous improvement in closure inspection technology and the widespread availability of established pharmaceutical supply infrastructure that enables quality verification and premium positioning at the institutional level. Additionally, hospital procurement departments are optimizing vendor qualification protocols to support quality differentiation and standardized safety pricing. As closure technology continues to advance and healthcare providers seek validated pharmaceutical packaging, hospital applications will continue to drive market growth while supporting patient safety and medication integrity strategies.

The IV infusion bottle seals & caps market is advancing rapidly due to increasing medication safety consciousness and growing need for sterile closure choices that emphasize superior contamination protection outcomes across pharmaceutical manufacturing and hospital administration applications. However, the market faces challenges, including stringent regulatory validation requirements, extractables and leachables testing complexities, and material compatibility concerns affecting formulation stability. Innovation in silicone-free elastomers and advanced barrier coatings continues to influence market development and expansion patterns.

The growing adoption of IV infusion bottle seals & caps in biologics manufacturing and specialty pharmaceutical production is enabling manufacturers to develop packaging patterns that provide distinctive barrier protection benefits while commanding premium positioning and enhanced safety characteristics. Biologic applications provide superior contamination control while allowing more sophisticated quality management across various therapeutic categories. Users are increasingly recognizing the competitive advantages of advanced closure positioning for premium pharmaceutical packaging and compliance-conscious formulation integration.

Modern closure manufacturers are incorporating advanced security features, tamper-evident technologies, and track-and-trace protocols to enhance product integrity, improve authentication outcomes, and meet regulatory demands for pharmaceutical supply chain protection solutions. These systems improve safety effectiveness while enabling new applications, including serialization integration and anti-counterfeiting programs. Advanced security integration also allows manufacturers to support premium market positioning and quality leadership beyond traditional closure operations.

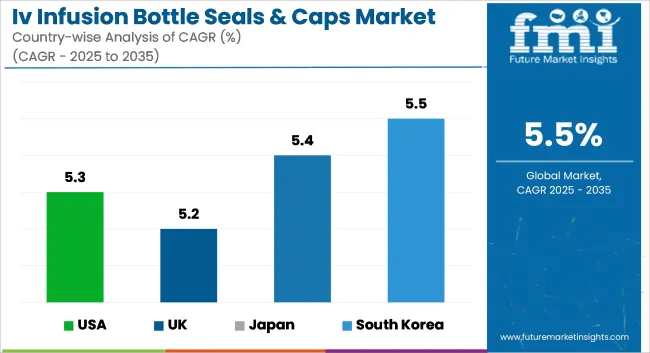

| Country | CAGR (2025-2035) |

|---|---|

| USA | 9.6% |

| Germany | 9.1% |

| UK | 8.7% |

| China | 11.8% |

| Japan | 8.3% |

The IV infusion bottle seals & caps market is experiencing robust growth globally, with China leading at a 11.8% CAGR through 2035, driven by the expanding pharmaceutical manufacturing sector, growing healthcare infrastructure investment, and increasing adoption of parenteral drug delivery systems. The USA follows at 9.6%, supported by rising biologics production, expanding hospital networks, and growing acceptance of advanced closure validation solutions. Germany shows growth at 9.1%, emphasizing established pharmaceutical excellence and comprehensive regulatory compliance development. The UK records 8.7%, focusing on premium medication safety standards and healthcare quality expansion. Japan demonstrates 8.3% growth, prioritizing precision manufacturing solutions and pharmaceutical innovation advancement.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from IV infusion bottle seals & caps consumption and sales in the USA is projected to exhibit exceptional growth with a CAGR of 9.6% through 2035, driven by the country's rapidly expanding pharmaceutical manufacturing sector, favorable regulatory frameworks supporting medication safety, and initiatives promoting quality assurance optimization across major production regions. The USA's position as a leading pharmaceutical market and increasing focus on biologics development are creating substantial demand for high-quality closure systems in both commercial and hospital markets. Major pharmaceutical companies and specialized packaging providers are establishing comprehensive production capabilities to serve growing safety demand and emerging biologic medication opportunities.

Revenue from IV infusion bottle seals & caps products in Germany is expanding at a CAGR of 9.1%, supported by rising pharmaceutical sophistication, growing manufacturing innovation, and expanding quality control infrastructure. The country's developing regulatory capabilities and increasing commercial investment in precision closure systems are driving demand for advanced closures across both imported and domestically produced applications. International pharmaceutical companies and domestic packaging providers are establishing comprehensive operational networks to address growing market demand for quality closure systems and validated pharmaceutical packaging solutions.

Revenue from IV infusion bottle seals & caps products in the UK is projected to grow at a CAGR of 8.7% through 2035, supported by the country's mature pharmaceutical market, established healthcare culture, and leadership in medication safety standards. Britain's sophisticated healthcare infrastructure and strong support for quality assurance are creating steady demand for both traditional and innovative closure system varieties. Leading pharmaceutical companies and specialized packaging providers are establishing comprehensive operational strategies to serve both domestic markets and growing export opportunities.

Revenue from IV infusion bottle seals & caps products in China is projected to grow at a CAGR of 11.8% through 2035, driven by the country's emphasis on pharmaceutical expansion, manufacturing leadership, and sophisticated production capabilities for medications requiring specialized closure system varieties. Chinese manufacturers and distributors consistently seek pharmaceutical-grade technologies that enhance product safety and support healthcare operations for both traditional and innovative parenteral applications. The country's position as an Asian manufacturing leader continues to drive innovation in specialty closure system applications and commercial production standards.

Revenue from IV infusion bottle seals & caps products in Japan is projected to grow at a CAGR of 8.3% through 2035, supported by the country's emphasis on quality manufacturing, safety standards, and advanced technology integration requiring efficient closure solutions. Japanese businesses and pharmaceutical companies prioritize quality performance and precision manufacturing, making closure systems essential technology for both traditional and modern pharmaceutical applications. The country's comprehensive manufacturing excellence and advancing healthcare patterns support continued market expansion.

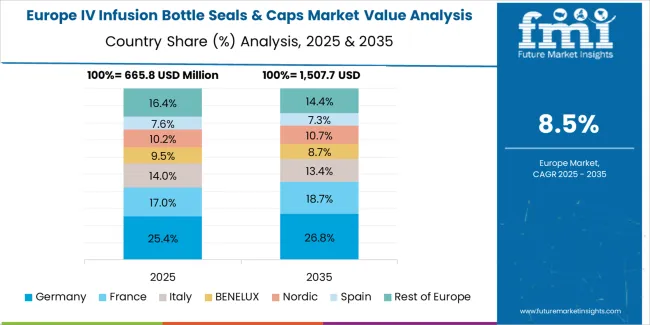

The Europe IV infusion bottle seals & caps market is projected to grow from USD 0.9 billion in 2025 to USD 2.1 billion by 2035, recording a CAGR of 8.8% over the forecast period. Germany leads the region with a 36.0% share in 2025, moderating slightly to 35.5% by 2035, supported by its strong pharmaceutical manufacturing culture and demand for premium, validated closure systems. The United Kingdom follows with 24.0% in 2025, easing to 23.5% by 2035, driven by a sophisticated healthcare market and emphasis on medication safety and regulatory compliance standards.

France accounts for 18.0% in 2025, rising to 18.5% by 2035, reflecting steady adoption of pharmaceutical packaging solutions and quality consciousness. Italy holds 11.0% in 2025, expanding to 11.8% by 2035 as pharmaceutical innovation and specialty drug applications grow. Spain contributes 5.5% in 2025, growing to 6.0% by 2035, supported by expanding healthcare infrastructure and hospital procurement handling. The Nordic countries rise from 4.0% in 2025 to 4.2% by 2035 on the back of strong quality adoption and advanced pharmaceutical integration. BENELUX remains at 1.5% share across both 2025 and 2035, reflecting mature, premium-focused markets.

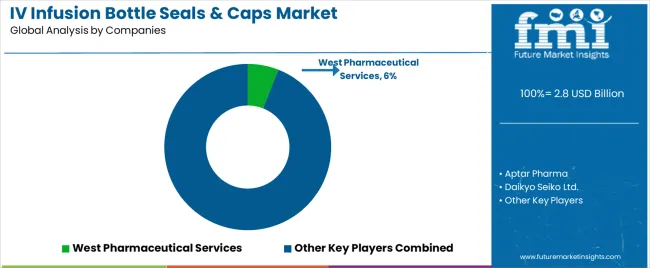

The IV infusion bottle seals & caps market features 10–15 players with moderate concentration, where the top three companies collectively hold around 44–50% of global market share, driven by strong pharmaceutical packaging capabilities, strict regulatory compliance, and long-term supply partnerships with IV solution manufacturers, hospitals, and contract manufacturing organizations. The leading company, West Pharmaceutical Services, commands roughly 6% of the market share, supported by its extensive range of sterilizable elastomeric seals, aluminum caps, and advanced closure technologies designed for parenteral and IV infusion systems. Competition centers on sterilization compatibility, material integrity, particulate control, regulatory certifications, and consistent supply reliability rather than price alone.

Market leaders such as West Pharmaceutical Services, Aptar Pharma, and Daikyo Seiko Ltd. maintain dominant positions by offering high-performance elastomer and aluminum closure systems engineered for aseptic filling, high barrier protection, and compatibility with various IV formulations. Their competitive strengths lie in advanced molding technologies, low-particulate elastomers, and strong global validation support.

Challenger companies including Nipro Corporation, Gerresheimer AG, and Datwyler Holding Inc. focus on specialized seals and caps for IV bottles and flexible containers, emphasizing quality consistency, extractables/leachables control, and robust sterilization performance.

Additional competition comes from Ompi (Stevanato Group), Shandong Pharmaceutical Glass, Samsung Medical Rubber, and Jiangsu Best New Medical Material, which enhance their regional presence through cost-effective manufacturing, integrated glass-and-closure supply, and strong partnerships with Asian IV solution producers.

The success of IV infusion bottle seals & caps in meeting pharmaceutical safety demands, healthcare-driven quality requirements, and regulatory compliance integration will not only enhance medication outcomes but also strengthen global pharmaceutical manufacturing capabilities. It will consolidate emerging regions' positions as hubs for efficient pharmaceutical packaging and align advanced economies with commercial safety systems. This calls for a concerted effort by all stakeholders -- governments, industry bodies, pharmaceutical manufacturers, distributors, and investors. Each can be a crucial enabler in preparing the market for its next phase of growth.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How Distributors and Pharmaceutical Industry Players Could Strengthen the Ecosystem?

How Pharmaceutical Manufacturers Could Navigate the Shift?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.8 billion |

| Product Type | Rubber Stoppers, Aluminum Caps, Flip-Off Seals, Combination Closures |

| Material Type | Butyl Rubber, Natural Rubber, Synthetic Elastomers, Aluminum Alloys |

| Sterilization Method | Steam Sterilization, Gamma Irradiation, Ethylene Oxide, Electron Beam |

| End-Use Application | Hospitals, Pharmaceutical Manufacturers, Contract Packaging Organizations, Clinical Research Facilities, Other Applications |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, Other Regions |

| Countries Covered | United States, Germany, United Kingdom, China, Japan, and 40+ countries |

| Key Companies Profiled | West Pharmaceutical Services, Aptar Pharma, Daikyo Seiko Ltd., Nipro Corporation, Gerresheimer AG, Datwyler Holding Inc., Ompi (Stevanato Group), Shandong Pharmaceutical Glass Co. Ltd., Samsung Medical Rubber Co. Ltd., and Jiangsu Best New Medical Material Co. Ltd. |

| Additional Attributes | Dollar sales by product type, material type, sterilization method, end-use application, and region; regional demand trends, competitive landscape, technological advancements in elastomer engineering, validation integration initiatives, safety enhancement programs, and premium product development strategies |

The global iv infusion bottle seals & caps market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the iv infusion bottle seals & caps market is projected to reach USD 7.3 billion by 2035.

The iv infusion bottle seals & caps market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in iv infusion bottle seals & caps market are rubber stoppers, aluminum caps, flip-off seals and combination closures.

In terms of end-use application, hospitals segment to command 61.0% share in the iv infusion bottle seals & caps market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Market Share Trends in IV Infusion Bottle Seals & Caps

IV Infusion Gravity Bags Market Size and Share Forecast Outlook 2025 to 2035

Bottle Dividers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Bottle Dividers Suppliers

Live Cell Encapsulation Market Analysis & Forecast for 2025 to 2035

IV Disinfecting Caps Market Trends - Growth, Demand & Forecast 2025 to 2035

Automotive Seals and Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Indicative Seals Market

MRI-Compatible IV Infusion Pump Systems Market Growth – Trends & Forecast 2025-2035

IVC Host Market Size and Share Forecast Outlook 2025 to 2035

Capsule Vision Inspection Solution Market Size and Share Forecast Outlook 2025 to 2035

IV Pole Market Size and Share Forecast Outlook 2025 to 2035

Capsule Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Infusion Pumps Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Capsule Hotels Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

IV Disposables Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA