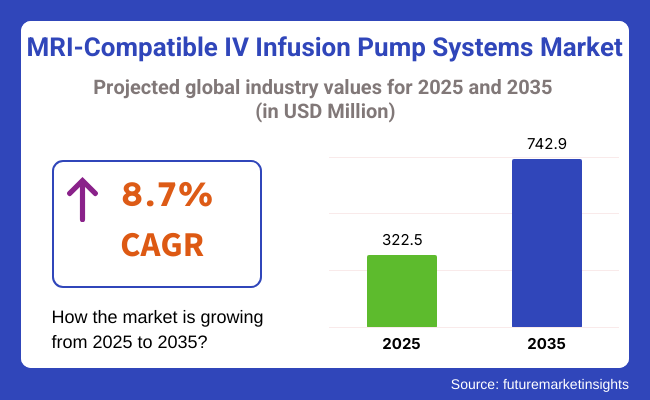

The global MRI-Compatible IV Infusion Pump Systems Market is estimated to be valued at USD 322.5 million in 2025 and is projected to reach USD 742.9 million by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period.

The growth of the market is driven by rising chronic disease prevalence, which drives frequent MRI diagnostics and the critical safety requirement of uninterrupted drug delivery during imaging. MRI-compatible pumps address hazards associated with ferrous materials in high-field environments, supporting uninterrupted therapeutic regimens for sedatives, contrast agents, and antimicrobials.

Technological enhancements such as ultrasonic non-magnetic drive mechanisms and advanced drug libraries are bolstering clinical utility. Increasing adoption in oncology and neurology suites for continuous infusion during MRI-guided interventions further supports expansion.

Expanded insurance coverage and hospital investment in integrated MRI suites are also encouraging broader deployment. With public health priorities increasingly focused on workflow efficiency and procedural safety, demand for specialized infusion pumps in MRI contexts is projected to accelerate.

Key players advancing the MRI-compatible IV infusion pump market include Iradimed Corporation, B. Braun, Fresenius Kabi, Baxter International, and Becton Dickinson. These manufacturers are prioritizing technological differentiation, regulatory approvals, and strategic expansions. In 2025, Iradimed received FDA 510(k) clearance for the MRidium® 3870, featuring an ultrasonic, non-ferrous motor, touchscreen interface, and modern drug library.

This advanced, MRI-compatible infusion pump extends Iradimed’s unique position as the world’s only supplier of non-magnetic MRI infusion. “We are thrilled to receive FDA 510(k) clearance for the MRidium® 3870, a milestone that underscores our commitment to advancing MRI-compatible medical technology,” said Roger Susi, President and CEO of Iradimed Corporation.

Manufacturers are also enhancing their product portfolios with multi-channel systems, streamlined tubing sets, and software protocols aligned with hospital pharmacy programs. Expansion in ambulatory surgical centers and imaging suites is being supported through distribution partnerships and in-service training. As health systems adopt integrated MRI-therapy modalities, demand for non-magnetic infusion pumps is expected to rise.

North America leads the MRI-compatible IV pump market with over 40% market share in 2025. This dominance is being driven by high MRI adoption rates across outpatient and inpatient settings, Medicare reimbursement for MRI-guided infusion procedures, and large academic health systems integrating infusion safety protocols.

The FDA’s clearance of advanced non-magnetic pump systems, coupled with hospital value-based purchasing programs, has facilitated adoption. Integration of infusion pumps into standardized MRI workflows particularly in neurology and oncology centres is also supporting demand. Ongoing focus on reducing sedation complications during MRI scans is expected to sustain USA leadership.

Europe is projected to experience steady growth in MRI-compatible IV infusion pumps, characterized by increasing investment in hybrid imaging suites under national health programs and EU cancer care modernization plans. Germany and the UK. have spearheaded adoption through hospital-level protocols mandating safe infusion delivery during MRI-guided interventions.

Additionally, collaborative pilot projects in rural diagnostics and mobile MRI units are driving demand for portable pump systems. As infusion therapy becomes standard in MRI protocols for chronic care monitoring and tumor ablation, adoption in specialized imaging networks is expected to rise.

The below table presents the expected CAGR for the global MRI-compatible IV infusion pump systems market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2035, the business is predicted to surge at a CAGR of 5.8%, followed by a slightly lower growth rate of 5.5% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 5.8% (2024 to 2035) |

| H2 | 5.5% (2024 to 2035) |

| H1 | 5.1% (2025 to 2035) |

| H2 | 4.6% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 5.1% in the first half and decrease moderately at 4.6% in the second half. In the first half (H1) the market witnessed a decrease of 70.00 BPS while in the second half (H2), the market witnessed an increase of 90.00 BPS.

The magnetic-resistant MRI-compatible IV infusion pumps segment is expected to dominate the market with a 57.2% revenue share in 2025 due to its critical safety and operational benefits in high-field MRI environments. These devices have been engineered using non-ferrous components, thereby eliminating electromagnetic interference and ensuring accurate, uninterrupted fluid delivery during imaging procedures.

The segment’s leadership has been driven by growing awareness of the risks associated with conventional pumps, which include inadvertent magnetic attraction and drug delivery errors. Regulatory guidance emphasizing MRI compliance and the integration of infusion systems with magnetic shielding have reinforced product demand across diagnostic radiology and surgical oncology suites.

Additionally, ongoing innovations in portable, compact designs have allowed these pumps to be easily accommodated in confined imaging environments. As MRI procedures become increasingly prevalent in chronic disease management and critical care, the use of magnetic-resistant devices is being standardized in hospital protocols, further supporting segment expansion.

Hospitals are projected to account for 64.0% of the MRI-compatible IV infusion pump market revenue in 2025, due to their centralized role in performing complex imaging and infusion-dependent therapies. This dominance has been underpinned by the high volume of MRI scans conducted in inpatient settings, particularly in departments such as neurology, oncology, and critical care.

Hospitals have increasingly adopted advanced MRI-compatible systems to mitigate risks associated with traditional infusion pumps and to ensure uninterrupted delivery of medications during imaging. Institutional procurement priorities favor safety-certified, interoperable devices capable of integration with hospital information systems.

Furthermore, hospital accreditation standards and quality mandates have required the use of infusion equipment that complies with MRI safety protocols. Capital investment in hybrid imaging suites and the deployment of mobile MRI units across tertiary centers have also driven higher unit adoption. As patient throughput and imaging volumes rise, hospitals are expected to continue representing the primary setting for infusion pump deployment.

Technological Advancements in Material Science Have Revolutionized the Design of MRI-Compatible IV Infusion Pumps

Technological advances in material science have revolutionized the design of MRI-compatible IV infusion pumps through enhanced magnetic shielding and non-magnetic components. Such innovations are becoming a critical driver for the market because they solve unique challenges related to high-magnetic-field environments within MRI scanners, such as 1.5T and 3T systems. Traditional infusion pumps are unsuitable for such settings because magnetic interference can lead to device malfunctions, inaccurate drug delivery, and potential patient safety risks.

The infusion pumps are MRI compatible because they incorporate advanced magnetic shielding materials, like specialized alloys and high-strength polymers, ensuring that the infusion pumps are not affected by the strong magnetic fields. Moreover, the use of non-magnetic components in areas such as motors and sensors makes them more MRI compatible. Such improvements have minimized the risk of electromagnetic interference significantly, thus making infusion therapy run smoothly and accurately during imaging procedures.

The development is not only related to meeting one of the basic safety requirements but also the enlargement of the field of application for infusion pumps with advanced diagnostic imaging. Due to their reliability, MRI-compatible pumps are now considered indispensable by imaging facilities. Consequently, increased demands for high-field MRI scanners lead to faster acceleration in infusion pumps with magnetic shielding and nonmagnetic designs to expand the market.

The Growing Utilization of MRI-compatible IV Infusion Pumps in Standalone Diagnostic Imaging Centers Is a Significant Driver for The Market.

Diagnostic imaging centers are gaining preference from patients and health care providers as specialized centers providing imaging services. These centers typically have to manage high volumes of MRI procedures every day. Hospitals, on the other hand, focus solely on providing health care services. Such specialized service requires sophisticated equipment for accuracy, safety, and efficient functioning. Thus, MRI-compatible IV infusion pumps become a must in diagnostic imaging centers.

The requirement of continuous intravenous drug administration - contrast agents, sedatives or essential medications given during MRI procedure - has obliged these centers to invest in specialized pumps compatible with MRI. Being designed to perform safely in such high-magnetic-field environments ensures uninterrupted drug delivery and minimizes risks associated with traditional pumps through electromagnetic interference and malfunction.

Another reason their role as critical end-users is increasing rapidly with the growing trend of outsourcing the diagnostic services to standalone centers. Hospitals and clinics refer many patients to these standalone centers for the advanced imaging modalities like MRI scans, creating a need for high-performing equipment like MRI-compatible infusion pumps.

As diagnostic imaging centers continue to increase their services in terms of meeting a rising demand for MRI procedures, the adoption of MRI-compatible IV infusion pumps is expected to rise, further fueling expansion and technological advancements in this market.

Enhanced Magnetic Shielding Technology Is a Key Driver in The Growth of The MRI-Compatible IV Infusion Pump Systems Market

Enhanced magnetic shielding technology is a more significant market driving force for MRI-Compatible IV infusion pump systems against the challenges offered by high-magnetic-field environments: 1.5T and 3T in MRI scanners, where traditional infusion pumps might not be tolerated because of such strong magnetic fields that could produce malfunctions on the device level, disrupt drugs delivery, or compromise patient safety.

The innovations in material science have recently given birth to new high-end magnetic shielding solutions and non-magnetic components. With these, infusion pumps can safely and reliably be used in MRI suites without causing electromagnetic interference. High-strength polymers, non-magnetic materials, and special alloys used in components like motors and sensors ensure that the pumps function without being influenced by the magnetic fields of MRI systems.

The growth in research for higher-field MRI systems, like 5T MRI scanners, is likely to increase the demand for infusion pumps that are more resistant to stronger magnetic fields. The advancement toward 5T MRI scanners, which can provide better imaging, will increase the need for better magnetic shielding to make infusion pumps operate safely in advanced environments.

The development of these advanced technologies not only ensures uninterrupted drug delivery during MRI scans but also improves patient safety and operational efficiency. As the adoption of high-field MRI systems continues to rise, especially with the growing research into 5T scanners, the demand for MRI-compatible infusion pumps will continue to fuel the growth of the market.

High Cost of MRI-Compatible IV Infusion Pumps Is Emerging as Significant Growth Barrier for Phlebotomy Equipment Market.

One major obstacle that is limiting the growth of the MRI-Compatible IV infusion pump systems market is the high cost of MRI-compatible IV infusion pumps. These specialized pumps are devised for safe operation within the high-magnetic-field environment of MRI scanners and thus require the use of advanced components such as magnetic shielding materials, non-magnetic motors, and sensors. The incorporation of these materials along with strict safety protocols to prevent electromagnetic interference leads to more expensive costs compared to standard infusion pumps.

The average cost of an MRI-compatible IV infusion pump can go from USD 5,000 to USD 10,000, with variations according to brand and features. On the other hand, a standard, non-MRI-compatible IV infusion pump might cost between USD 1,000 and USD 3,000. That cost difference is so large because of the extra engineering, specialized materials, and testing that go into making the pump work with an MRI.

With significant front-end costs associated with these pumps, it remains a significant deterring factor especially for smaller hospitals, outpatient clinics, and limited budget diagnostic centers. Facilities based in regions with significantly lower healthcare budget or those having larger volumes might avoid purchasing them as they would defer the purchase decision until the need and demand are relatively higher, so that they are forced to be dependent on old pumps or administer drugs manually under MRI.

This cost barrier can limit the widespread adoption of MRI-compatible infusion pumps, especially in emerging markets or lower-income healthcare settings, thus hindering market growth and access to advanced medical technologies.

The global MRI-compatible IV infusion pump systems industry recorded a CAGR of 5.5% during the historical period between 2020 and 2024. The growth of MRI-compatible IV infusion pump systems industry was positive as it reached a value of USD 281.5 million in 2024 from USD 209.6 million in 2020.

The overall strategy of the MRI-Compatible IV infusion pump systems market is toward meeting the increased demand for safe, uninterrupted intravenous drug delivery during MRI procedures. The market has seen drastic changes over time, influenced by the development of material science, magnetic shielding technology, and increasingly complex MRI systems, including 1.5T and 3T MRI scanners.

Initially, MRI-compatible pumps was a niche market but nowadays, because of the increasing requirements for high-quality diagnostics and continuous infusion during imaging, these systems appear to be a critical component in modern healthcare setups.

Several future market trends include connectivity and IoT-enabled systems for long-distance monitoring that could ensure efficacy as well as safety in patient care. Moreover, the latest designs are all miniaturized and portable, therefore increasing integration in compact MRI suites. The continuous research into higher-field MRI scanners, like the 5T MRI system, will drive the demand for more advanced infusion pumps to enable exposure to stronger magnetic fields.

Furthermore, advances in AI-based predictive maintenance and data analytics will help the management of pumps. This will minimize downtime and improve infusion therapy. With more health care facilities focusing on superior patient care and efficient operations, these trends are also likely to propel market growth in the near future.

Tier 1 companies comprise market leaders with a significant market share of 26.1% in global market. These companies engage in strategic partnerships and acquisitions to expand their product portfolios and access cutting-edge technologies.

Additionally, they emphasize extensive clinical trials to validate the efficacy and safety of their products. Prominent companies in tier 1 include Becton, Dickinson Company (Carefusion), Baxter International Inc. and B.Braun Melsungen AG.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market and holds around 33.5% market share. They typically pursue partnerships with academic institutions and research organizations to leverage emerging technologies and expedite product development.

These companies often emphasize agility and adaptability, allowing them to quickly bring new treatments to market, additionally targeting specific types medical conditions. Additionally, they focus on cost-effective production methods to offer competitive pricing. Prominent companies in tier 2 include iRadimed Corporation and Fresenius Kabi AG.

Finally, Tier 3 companies, such as Smiths Medical (Smiths Group plc.) and Arcomed AG Inc. They specialize in specific products and cater to niche markets, adding diversity to the industry.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the MRI-compatible IV infusion pump systems sales remains dynamic and competitive.

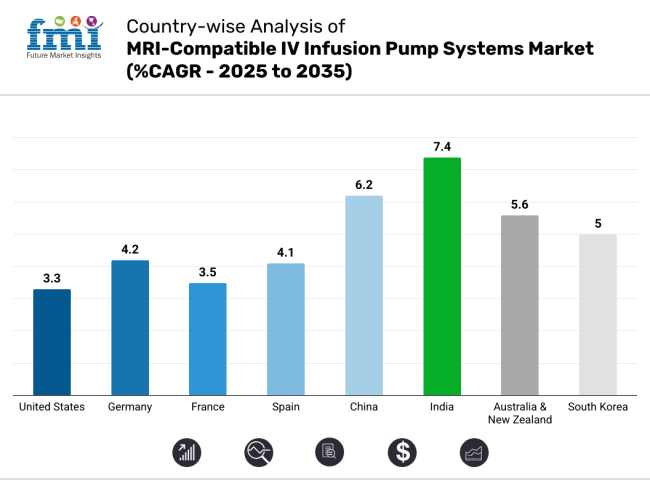

The section below covers the industry analysis for the market for MRI-compatible IV infusion pump systems for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle Ease & Africa, is provided. The United States is anticipated to remain at the forefront in North America, with higher market share through 2035. In South Asia & Pacific, India is projected to witness a CAGR of 7.4% by 2035.

United States. MRI-compatible IV infusion pump systems market is poised to exhibit a CAGR of 3.3% between 2025 and 2035. Currently, it holds the highest share in the North American market.

The presence of significant medical device manufacturers such as Medtronic, Baxter, and Smiths Medical results in added advantages when it comes to innovation,

manufacturing, and distributing MRI-compatible infusion pumps. These players are well-positioned for uniquely tailoring high-quality, state-of-the-art medical devices, remaining capable of MR semiclassical infusion pump development.

The important manufacturing capacity of these players enables large-scale manufacturing of MRI-compatible pumps, thus sustaining their management of the ever-growing demands from hospitals, outpatient clinics, and diagnostic imaging centers. These companies also have well-established distribution networks throughout the USA, ensuring the quick delivery of supplies to providers. Continuously pouring new investments into research and development promotes uninterrupted improvements in MRI-compatible infusion pump technology and keeps the USA market at the forefront of all innovations.

China’s market for MRI-compatible IV infusion pump systems is poised to exhibit a CAGR of 6.2% between 2025 and 2035. Currently, it holds the highest share in the East Asia market, and the trend is expected to continue during the forecast period.

China has become a global manufacturing center for medical devices, especially using its sophisticated production capabilities, low-cost manufacturing processes, and large-scale production capacity. This allows the Chinese manufacturer to offer MRI-compatible infusion pumps at competitive prices and make them appealing to both domestic and international healthcare facilities.

Chinese companies are now aggressively going to emerging markets in Southeast Asia, Africa, and Latin America. There is increased healthcare infrastructure in these areas and rapid medical equipment needs. Several places in these regions are cost-constrained and prefer lower costs. Affordability and accessibility of MRI-compatible pumps from China make them a go-to choice. Therefore, Chinese manufacturers are increasing their market share globally and making China a major exporter of medical devices. This is contributing to the rapid growth of the MRI-compatible infusion pump market in the world.

India’s market for MRI-compatible IV infusion pump systems is poised to exhibit a CAGR of 7.4% between 2025 and 2035. Currently, it holds the highest share in the South Asia & Pacific market, and the trend is expected to continue during the forecast period.

The private health sectors have led the diagnostic imaging sector as a highly lucrative business, hospitals, freestanding imaging centers, and diagnostic chains catering for the healthcare needs of the majority of the population. Many of these players are spending more on sophisticated technologies like MRI-compatible IV infusion pumps to scale up quality of care to keep patients in need of precision and interrupted care within and after MRI procedures.

Many of these chains are also opening new branches all over tier 2 and tier 3 cities owing to increasing healthcare awareness and demand for high-end diagnostics in such neglected regions. Another trend empowering the private healthcare sector-emerging that is the segment of rising expectations from patients towards high-quality care; the overall compatibility of market growth within India amidst this has been amplified.

The market players are using strategies to stay competitive, such as product differentiation through innovative formulations, strategic partnerships with healthcare providers for distribution. Another key strategic focus of these companies is to actively look for strategic partners to bolster their product portfolios and expand their global market presence.

Recent Industry Developments in MRI-Compatible IV Infusion Pump Systems Market

In terms of product type, the industry is divided into- non-magnetic MRI-compatible IV infusion pumps and magnetic-resistant MRI-compatible IV infusion pumps.

In terms of application, the industry is segregated into- neurological disorders, oncology, cardiovascular disorders, orthopedic applications and others.

In terms of end user, the industry is segregated into- hospitals, diagnostic imaging centers, ambulatory surgical centers (ASCs) and specialty clinics.

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia and Middle East and Africa (MEA) have been covered in the report.

The global market for MRI-compatible IV infusion pump systems is projected to witness CAGR of 9.5% between 2025 and 2035.

The global MRI-compatible IV infusion pump systems industry stood at USD 322.5 million in 2025.

The global market for MRI-compatible IV infusion pump systems is anticipated to reach USD 742.9 million by 2035 end.

India is set to record the highest CAGR of 8.7% in the assessment period.

The key players operating in the global market for MRI-compatible IV infusion pump systems include Becton, Dickinson Company (Carefusion), Baxter International Inc., B.Braun Melsungen AG, iRadimed Corporation, Fresenius Kabi AG, Smiths Medical (Smiths Group plc.) and Arcomed AG.

Table 01: Global Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 02: Global Volume (Units) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 03: Global Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By End User

Table 04: Global Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Segment 3

Table 05: North America Market Value (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Country

Table 06: North America Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 07: North America Volume (Units) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 08: North America Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By End User

Table 09: Latin America Market Value (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Country

Table 10: Latin America Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 11: Latin America Volume (Units) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 12: Latin America Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By End User

Table 13: Europe Market Value (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Country

Table 14: Europe Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 15: Europe Volume (Units) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 16: Europe Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By End User

Table 17: South Asia Market Value (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Country

Table 18: South Asia Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 19: South Asia Volume (Units) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 20: South Asia Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By End User

Table 21: East Asia Market Value (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Country

Table 22: East Asia Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 23: East Asia Volume (Units) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 24: East Asia Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By End User

Table 25: Oceania Market Value (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Country

Table 26: Oceania Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 27: Oceania Volume (Units) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 28: Oceania Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By End User

Table 29: MEA Market Value (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Country

Table 30: MEA Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 31: MEA Volume (Units) Analysis 2012 to 2021 and Forecast 2022 to 2032, By Product

Table 32: MEA Market Size (US$ Million) Analysis 2012 to 2021 and Forecast 2022 to 2032, By End User

Figure 01: Global Market Volume (Units), 2012 to 2021

Figure 02: Global Market Volume (Units) Y-o-Y Growth (%) Analysis, 2022 to 2032

Figure 03: Pricing Analysis per unit (US$), in 2022

Figure 04: Pricing Forecast per unit (US$), in 2032

Figure 05: Global Market Value Analysis (US$ Million), 2012 to 2021

Figure 06: Global Market Value Forecast (US$ Million), 2022 to 2032

Figure 07: Global Market Absolute $ Opportunity, 2021 - 2031

Figure 08: Global Market Share Analysis (%), By Product, 2022 to 2032

Figure 09: Global Market Y-o-Y Analysis (%), By Product, 2022 to 2032

Figure 10: Global Market Attractiveness Analysis By Product, 2022 to 2032

Figure 11: Global Market Share Analysis (%), By End User, 2022 to 2032

Figure 12: Global Market Y-o-Y Analysis (%), By End User, 2022 to 2032

Figure 13: Global Market Attractiveness Analysis by End User, 2022 to 2032

Figure 14: Global Market Share Analysis (%), By Segment, 2022 to 2032

Figure 15: Global Market Y-o-Y Analysis (%), By Segment, 2022 to 2032

Figure 16: Global Market Attractiveness Analysis by Segment, 2022 to 2032

Figure 17: North America Market Value Share, By Product, 2022 (E)

Figure 18: North America Market Value Share, By End User, 2022 (E)

Figure 19: North America Market Value Share, By Country, 2022 (E)

Figure 20: North America Market Value Analysis (US$ Million), 2012 to 2021

Figure 21: North America Market Value Forecast (US$ Million) 2022 to 2032

Figure 22: North America Market Attractiveness Analysis By Product, 2022 to 2032

Figure 23: North America Market Attractiveness Analysis, By End User 2022 to 2032

Figure 24: North America Market Attractiveness Analysis by Country, 2022 to 2032

Figure 25: The USA Market Share Analysis (%), By Product, 2022 to 2032

Figure 26: The USA Market Share Analysis (%), By End User, 2022 to 2032

Figure 27: The USA Market Value Analysis (US$ Million) 2022 to 2032

Figure 28: Canada Market Share Analysis (%), By Product, 2022 to 2032

Figure 29: Canada Market Share Analysis (%), By End User, 2022 to 2032

Figure 30: Canada Market Value Analysis (US$ Million) 2022 to 2032

Figure 31: Latin America Market Value Share, By Product, 2022 (E)

Figure 32: Latin America Market Value Share, By End User, 2022 (E)

Figure 33: Latin America Market Value Share, By Country, 2022 (E)

Figure 34: Latin America Market Value Analysis (US$ Million) 2012 to 2021

Figure 35: Latin America Market Value Forecast (US$ Million) 2022 to 2032

Figure 36: Latin America Market Attractiveness Analysis by Product, 2022 to 2032

Figure 37: Latin America Market Attractiveness Analysis by End User, 2022 to 2032

Figure 38: Latin America Market Attractiveness Analysis by Country, 2022 to 2032

Figure 39: Brazil Market Share Analysis (%), By Product, 2022 to 2032

Figure 40: Brazil Market Share Analysis (%), By End User, 2022 to 2032

Figure 41: Brazil Market Value Analysis (US$ Million) 2022 to 2032

Figure 42: Mexico Market Share Analysis (%), By Product, 2022 to 2032

Figure 43: Mexico Market Share Analysis (%), By End User, 2022 to 2032

Figure 44: Mexico Market Value Analysis (US$ Million) 2022 to 2032

Figure 45: Argentina Market Share Analysis (%), By Product, 2022 to 2032

Figure 46: Argentina Market Share Analysis (%), By End User, 2022 to 2032

Figure 47: Argentina Market Value Analysis (US$ Million), 2022 to 2032

Figure 48: Europe Market Value Share, By Product, 2022 (E)

Figure 49: Europe Market Value Share, By End User, 2022 (E)

Figure 50: Europe Market Value Share, By Country, 2022 (E)

Figure 51: Europe Market Value Analysis (US$ Million), 2012 to 2021

Figure 52: Europe Market Value Forecast (US$ Million), 2022 to 2032

Figure 53: Europe Market Attractiveness Analysis by Product, 2022 to 2032

Figure 54: Europe Market Attractiveness Analysis by End User, 2022 to 2032

Figure 55: Europe Market Attractiveness Analysis by Country, 2022 to 2032

Figure 56: Germany Market Share Analysis (%), By Product, 2022 to 2032

Figure 57: Germany Market Share Analysis (%), By End User, 2022 to 2032

Figure 58: Germany Market Value Analysis (US$ Million), 2022 to 2032

Figure 59: Italy Market Share Analysis (%), By Product, 2022 to 2032

Figure 60: Italy Market Share Analysis (%), By End User, 2022 to 2032

Figure 61: Italy Market Value Analysis (US$ Million), 2022 to 2032

Figure 62: France Market Share Analysis (%), By Product, 2022 to 2032

Figure 63: France Market Share Analysis (%), By End User, 2022 to 2032

Figure 64: France Market Value Analysis (US$ Million), 2022 to 2032

Figure 65: The UK Market Share Analysis (%), By Product, 2022 to 2032

Figure 66: The UK Market Share Analysis (%), By End User, 2022 to 2032

Figure 67: The UK Market Value Analysis (US$ Million), 2022 to 2032

Figure 68: Spain Market Share Analysis (%), By Product, 2022 to 2032

Figure 69: Spain Market Share Analysis (%), By End User, 2022 to 2032

Figure 70: Spain Market Value Analysis (US$ Million), 2022 to 2032

Figure 71: BENELUX Market Share Analysis (%), By Product, 2022 to 2032

Figure 72: BENELUX Market Share Analysis (%), By End User, 2022 to 2032

Figure 73: BENELUX Market Value Analysis (US$ Million), 2022 to 2032

Figure 74: Russia Market Share Analysis (%), By Product, 2022 to 2032

Figure 75: Russia Market Share Analysis (%), By End User, 2022 to 2032

Figure 76: Russia Market Value Analysis (US$ Million), 2022 to 2032

Figure 77: South Asia Market Value Share, By Product, 2022 (E)

Figure 78: South Asia Market Value Share, By End User, 2022 (E)

Figure 79: South Asia Market Value Share, By Country, 2022 (E)

Figure 80: South Asia Market Value Analysis (US$ Million), 2012 to 2021

Figure 81: South Asia Market Value Forecast (US$ Million), 2022 to 2032

Figure 82: South Asia Market Attractiveness Analysis By Product, 2022 to 2032

Figure 83: South Asia Market Attractiveness Analysis By End User, 2022 to 2032

Figure 84: South Asia Market Attractiveness Analysis by Country, 2022 to 2032

Figure 85: India Market Share Analysis (%), By Product, 2022 to 2032

Figure 86: India Market Share Analysis (%), By End User, 2022 to 2032

Figure 87: India Market Value Analysis (US$ Million), 2022 to 2032

Figure 88: Indonesia Market Share Analysis (%), By Product, 2022 to 2032

Figure 89: Indonesia Market Share Analysis (%), By End User, 2022 to 2032

Figure 90: Indonesia Market Value Analysis (US$ Million), 2022 to 2032

Figure 91: Thailand Market Share Analysis (%), By Product, 2022 to 2032

Figure 92: Thailand Market Share Analysis (%), By End User, 2022 to 2032

Figure 93: Thailand Market Value Analysis (US$ Million), 2022 to 2032

Figure 94: Malaysia Market Share Analysis (%), By Product, 2022 to 2032

Figure 95: Malaysia Market Share Analysis (%), By End User, 2022 to 2032

Figure 96: Malaysia Market Value Analysis (US$ Million), 2022 to 2032

Figure 97: East Asia Market Value Share, By Product, 2022 (E)

Figure 98: East Asia Market Value Share, By End User, 2022 (E)

Figure 99: East Asia Market Value Share, By Country, 2022 (E)

Figure 100: East Asia Market Value Analysis (US$ Million), 2012 to 2021

Figure 101: East Asia Market Value Forecast (US$ Million), 2022 to 2032

Figure 102: East Asia Market Attractiveness Analysis By Product, 2022 to 2032

Figure 103: East Asia Market Attractiveness Analysis By End User, 2022 to 2032

Figure 104: East Asia Market Attractiveness Analysis by Country, 2022 to 2032

Figure 105: China Market Share Analysis (%), By Product, 2022 to 2032

Figure 106: China Market Share Analysis (%), By End User, 2022 to 2032

Figure 107: China Market Value Analysis (US$ Million), 2022 to 2032

Figure 108: Japan Market Share Analysis (%), By Product, 2022 to 2032

Figure 109: Japan Market Share Analysis (%), By End User, 2022 to 2032

Figure 110: Japan Market Value Analysis (US$ Million), 2022 to 2032

Figure 111: South Korea Market Share Analysis (%), By Product, 2022 to 2032

Figure 112: South Korea Market Share Analysis (%), By End User, 2022 to 2032

Figure 113: South Korea Market Value Analysis (US$ Million), 2022 to 2032

Figure 114: Oceania Market Value Share, By Product, 2022 (E)

Figure 115: Oceania Market Value Share, By End User, 2022 (E)

Figure 116: Oceania Market Value Share, By Country, 2022 (E)

Figure 117: Oceania Market Value Analysis (US$ Million), 2012 to 2021

Figure 118: Oceania Market Value Forecast (US$ Million), 2022 to 2032

Figure 119: Oceania Market Attractiveness Analysis by Product, 2022 to 2032

Figure 120: Oceania Market Attractiveness Analysis by End User, 2022 to 2032

Figure 121: Oceania Market Attractiveness Analysis by Country, 2022 to 2032

Figure 122: Australia Market Share Analysis (%), By Product, 2022 to 2032

Figure 123: Australia Market Share Analysis (%), By End User, 2022 to 2032

Figure 124: Australia Market Value Analysis (US$ Million), 2022 to 2032

Figure 125: New Zealand Market Share Analysis (%), By Product, 2022 to 2032

Figure 126: New Zealand Market Share Analysis (%), By End User, 2022 to 2032

Figure 127: New Zealand Market Value Analysis (US$ Million), 2022 to 2032

Figure 128: MEA Market Value Share, By Product, 2022 (E)

Figure 129: MEA Market Value Share, By End User, 2022 (E)

Figure 130: MEA Market Value Share, By Country, 2022 (E)

Figure 131: MEA Market Value Analysis (US$ Million), 2012 to 2021

Figure 132: MEA Market Value Forecast (US$ Million), 2022 to 2032

Figure 133: MEA Market Attractiveness Analysis by Product, 2022 to 2032

Figure 134: MEA Market Attractiveness Analysis by End User, 2022 to 2032

Figure 135: MEA Market Attractiveness Analysis by Country, 2022 to 2032

Figure 136: GCC Countries Market Share Analysis (%), By Product, 2022 to 2032

Figure 137: GCC Countries Market Share Analysis (%), By End User, 2022 to 2032

Figure 138: GCC Countries Market Value Analysis (US$ Million), 2022 to 2032

Figure 139: Turkey Market Share Analysis (%), By Product, 2022 to 2032

Figure 140: Turkey Market Share Analysis (%), By End User, 2022 to 2032

Figure 141: Turkey Market Value Analysis (US$ Million), 2022 to 2032

Figure 142: South Africa Market Share Analysis (%), By Product, 2022 to 2032

Figure 143: South Africa Market Share Analysis (%), By End User, 2022 to 2032

Figure 144: South Africa Market Value Analysis (US$ Million), 2022 to 2032

Figure 145: North Africa Market Share Analysis (%), By Product, 2022 to 2032

Figure 146: North Africa Market Share Analysis (%), By End User, 2022 to 2032

Figure 147: North Africa Market Value Analysis (US$ Million), 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IV Pole Market Size and Share Forecast Outlook 2025 to 2035

IV Disposables Market Size and Share Forecast Outlook 2025 to 2035

IVD Antibodies Market Size and Share Forecast Outlook 2025 to 2035

IV Bag Market Outlook - Growth, Demand & Forecast 2025 to 2035

IV Fluid Transfer Drugs Devices Market Trends – Growth & Forecast 2025 to 2035

IV Disinfecting Caps Market Trends - Growth, Demand & Forecast 2025 to 2035

Market Share Breakdown of the IV Bag Market

IV Therapy and Vein Access Devices Market Insights – Trends & Forecast 2024-2034

Global IVD Contract Manufacturing Market Trends – Size, Forecast & Growth 2024-2034

IVF Workstation Market

IV Infusion Bottle Seals & Caps Market Size and Share Forecast Outlook 2025 to 2035

IV Infusion Gravity Bags Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in IV Infusion Bottle Seals & Caps

HIV Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Dive Computer Market Forecast and Outlook 2025 to 2035

Diving And Survival Equipment Market Size and Share Forecast Outlook 2025 to 2035

Divided Motor Core Market Size and Share Forecast Outlook 2025 to 2035

Liver Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

HIV Self-testing Market Size and Share Forecast Outlook 2025 to 2035

Liver Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA