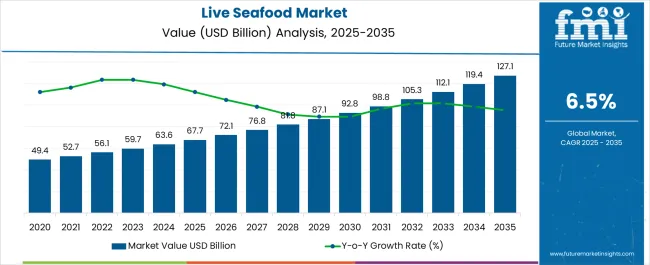

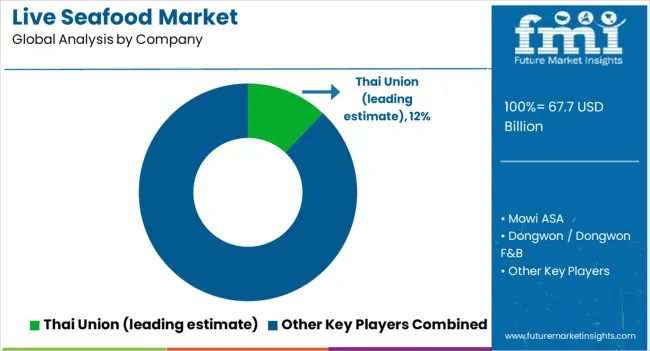

The live seafood market is estimated to be valued at USD 67.7 billion in 2025 and is projected to reach USD 127.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The market maturity curve shows early adoption during 2020–2024, with annual growth from USD 49.4 billion in 2020 to USD 63.6 billion in 2024, driven by increasing demand in restaurants, retail outlets, and high-end consumer segments. By 2025, adoption enters the scaling phase as supply chains expand, cold storage and transport logistics improve, and market acceptance grows. Between 2025–2030, the market grows from USD 67.7 billion to USD 92.8 billion, reflecting wider distribution and growing consumer preference.

During the 2030–2035 consolidation phase, the market expands from USD 98.8 billion in 2030 to USD 127.1 billion by 2035, as leading suppliers consolidate distribution networks and establish dominant market positions. Growth moderates as market penetration reaches maturity and procurement patterns stabilize across restaurants, retail, and export channels. The adoption lifecycle reflects a clear progression: early adoption (2020–2024) characterized by experimental supply chains, scaling (2025–2030) with rapid expansion and broader acceptance, and consolidation (2030–2035) with established suppliers optimizing logistics, distribution, and operational efficiency, creating a structured and predictable market environment.

| Metric | Value |

|---|---|

| Live Seafood Market Estimated Value in (2025 E) | USD 67.7 billion |

| Live Seafood Market Forecast Value in (2035 F) | USD 127.1 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

Seasonality in the live seafood market is largely influenced by harvest cycles, festive periods, and peak consumer demand. Data indicates that Q3 and Q4 often account for 40–45% of annual revenue, coinciding with summer consumption peaks and year-end holiday demand. Conversely, Q1 typically records 10–15% lower activity, as suppliers adjust inventories and plan harvest schedules. Seasonal festivals, cultural events, and peak restaurant demand drive short-term revenue spikes of 10–15% above baseline, requiring careful coordination of live transport, cold storage, and supply chain logistics. Suppliers plan production and distribution to meet these seasonal fluctuations efficiently. Cyclicality reflects broader trends in seafood harvesting, aquaculture production, and infrastructure investment.

Live seafood production and distribution often follow 3–5 year expansion or upgrade cycles, generating periodic surges that can increase annual market value by USD 5–10 billion. Regulatory changes, environmental factors, or shifts in export-import policies may temporarily accelerate procurement, producing short-term spikes of 5–10% above projected growth. These cyclical trends overlay the underlying CAGR of 6.5%, creating alternating periods of rapid expansion and moderate stabilization. Recognizing these patterns allows suppliers and distributors to optimize inventory, transport, and sales planning effectively.

The market is experiencing steady expansion, driven by increasing consumer demand for fresh, premium-quality seafood products that maintain their nutritional value and taste. Rising global disposable incomes and a growing preference for high-protein diets have contributed to sustained demand in both developed and emerging economies.

Technological advancements in live storage, transportation, and aquaculture have enhanced product availability and reduced mortality rates, enabling suppliers to cater to distant markets with consistent quality. The market is also benefiting from the expansion of cold chain logistics and live holding facilities, which support year-round availability of a wide variety of species.

Increasing emphasis on sustainable sourcing and traceability is shaping industry practices, with aquaculture emerging as a significant contributor to supply stability With the foodservice sector continuing to prioritize live seafood offerings for premium dining experiences, and consumer awareness about the health benefits of fresh seafood growing, the market is well positioned for continued growth in the coming years.

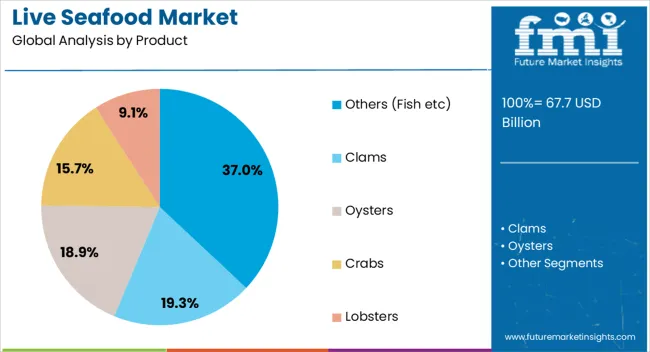

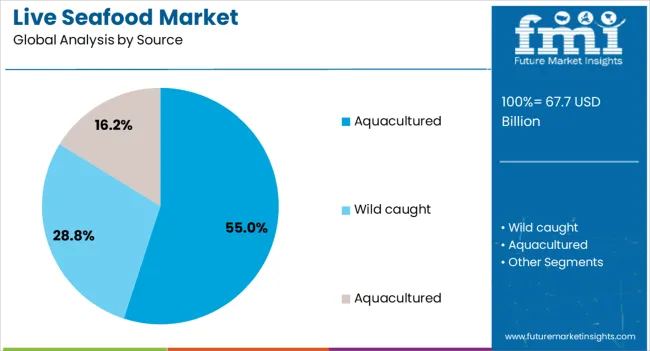

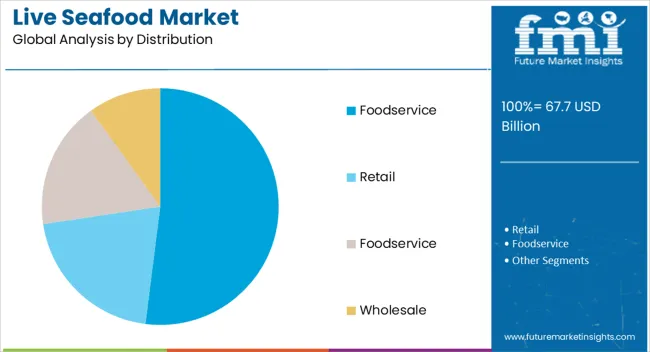

The live seafood market is segmented by product, source, distribution, end use, and geographic regions. By product, live seafood market is divided into clams, oysters, crabs, lobsters, and others. In terms of source, live seafood market is classified into aquacultured, wild caught, and aquacultured. Based on distribution, live seafood market is segmented into foodservice, retail, foodservice, and wholesale. By end use, live seafood market is segmented into foodservice, household, and foodservice. Regionally, the live seafood industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The others segment within the product category is projected to hold 37% of the live seafood market revenue share in 2025, positioning it as the leading product type. This dominance has been supported by the broad variety of fish species demanded by both retail and foodservice channels, enabling suppliers to cater to diverse culinary traditions and preferences. The category benefits from stable year-round supply facilitated by efficient aquaculture systems and advanced logistics solutions. The adaptability of fish to various cooking methods and their wide acceptance across cultures have reinforced steady consumption patterns. Additionally, the ability to integrate sustainable farming practices and meet evolving food safety standards has increased consumer trust and willingness to pay a premium for live fish products The segment's growth has also been strengthened by its competitive pricing compared to more premium seafood categories, allowing for greater accessibility in both mass market and high-end consumption segments.

The aquacultured source segment is anticipated to account for 55% of the market revenue share in 2025, making it the leading supply source. This leadership position has been reinforced by the industry’s ability to ensure consistent, year-round availability of seafood species through controlled farming environments. Aquaculture practices allow for better regulation of quality, biosecurity, and sustainability, addressing concerns about overfishing and environmental impact. The adoption of advanced feed technologies, water quality management systems, and disease control measures has enhanced production yields and product survival rates during transportation. The sector also benefits from its adaptability in meeting specific market demands, such as size, taste profile, and freshness standards. Regulatory support for sustainable seafood production and investments in modern aquaculture facilities have further cemented the segment’s market position This stable and scalable supply model has made aquacultured seafood the preferred choice for both domestic consumption and export markets.

The foodservice distribution segment is projected to hold 52% of the market revenue share in 2025, establishing it as the dominant distribution channel. This growth has been driven by the strong demand from restaurants, hotels, and catering services that prioritize live seafood to deliver premium dining experiences. The segment benefits from the ability of live seafood to command higher menu prices while meeting consumer expectations for freshness and quality. Foodservice operators have increasingly invested in live holding tanks and display systems, enhancing the visual appeal and perceived value of offerings. The rise of fine dining and specialty cuisine outlets in urban centers has accelerated adoption, with live seafood serving as a key differentiator in competitive markets. Additionally, strong supply chain partnerships between producers, distributors, and foodservice providers have ensured consistent availability and quality This alignment between supply capabilities and consumer preferences has solidified the foodservice sector’s role as the leading channel for live seafood distribution.

The live seafood market is expanding due to rising consumer preference for fresh, high-quality seafood and increasing demand in restaurants, hotels, and e-commerce seafood deliveries. Asia-Pacific dominates due to high seafood consumption, aquaculture growth, and traditional culinary practices, while North America and Europe focus on premium dining and traceability. Key players such as Thai Union Group, Dongwon Industries, Mazzetta Company, Pacific Seafood, and Clearwater Seafoods invest in advanced cold chain logistics, live transport systems, and sustainable aquaculture. Market growth is driven by freshness perception, convenience, and high-value species demand. Challenges include short shelf life, regulatory compliance, and high operational costs for live transport and storage. Until innovations in packaging, aquaculture, and logistics improve efficiency, live seafood remains a premium segment catering primarily to high-end restaurants and discerning consumers.

The foodservice sector, including restaurants, hotels, and fine dining establishments, is a major driver for live seafood demand. Chefs and consumers prioritize freshness, flavor, and texture, which live seafood ensures compared to frozen alternatives. Key players such as Clearwater Seafoods and Pacific Seafood supply live lobsters, crabs, and shellfish directly to restaurants through specialized live transport systems. Adoption is strongest in North America, Europe, and Asia-Pacific’s urban centers, where seafood consumption is high and culinary standards are premium. Live seafood enables chefs to showcase freshness and provide unique dining experiences, enhancing customer satisfaction. Challenges include maintaining optimal water quality, temperature control, and oxygenation during storage and transport. Until innovations in live storage and transport reduce mortality rates and operational costs, the market will continue to cater primarily to the high-end hospitality sector.

The rise of e-commerce platforms for groceries and specialty foods has increased demand for live seafood delivered directly to consumers. Companies like Thai Union Group and Dongwon Industries invest in cold chain logistics and specialized packaging to maintain water quality and oxygenation during transit. Adoption is highest in regions with high disposable income, such as North America, Europe, and parts of Asia-Pacific. Consumers increasingly value traceability, freshness, and convenience, creating opportunities for subscription-based seafood services and premium delivery models. Operational challenges include minimizing transit times, maintaining animal health, and adhering to regional regulations for live seafood transportation. Until alternative preservation technologies become widely available, e-commerce deliveries will rely heavily on live transport expertise, limiting widespread adoption to regions with efficient logistics networks and supporting infrastructure.

Aquaculture production of high-value species such as lobsters, crabs, shrimp, and oysters supports the live seafood market by ensuring supply consistency and reducing reliance on wild-caught stocks. Leading companies like Thai Union Group and Mazzetta Company are integrating breeding programs, water quality monitoring, and health management systems to enhance survival rates during harvesting and transport. Asia-Pacific leads in aquaculture output due to favorable climate, labor availability, and government support, while North America and Europe focus on high-value species and quality standards. Challenges include disease management, water treatment, and environmental compliance. Until wild-capture supply chains improve or live transport efficiency advances, aquaculture will remain the primary source for reliable, premium-quality live seafood across commercial and retail channels.

The live seafood market is competitive, with major players differentiating through supply chain efficiency, species variety, and live transport technologies. Clearwater Seafoods and Pacific Seafood emphasize premium lobsters and shellfish, while Dongwon Industries focuses on scale and diversified species. Companies invest in cold chain logistics, oxygenation systems, and real-time monitoring to maintain quality. Regional suppliers often compete on cost and local availability but lack global reach and expertise in live transport. Partnerships with restaurants, retailers, and e-commerce platforms strengthen market penetration. Until innovations in live packaging, transportation, and storage enhance shelf life and reduce costs, key players maintain competitive advantage through operational reliability, technological investment, and strong brand reputation in premium seafood segments.

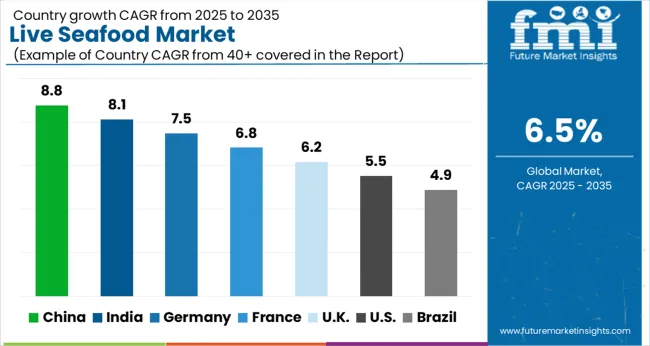

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global market is projected to grow at a CAGR of 6.5% through 2035, supported by increasing demand across aquaculture, seafood processing, and retail distribution channels. Among BRICS nations, China has been recorded with 8.8% growth, driven by large-scale production and deployment in aquaculture and seafood distribution, while India has been observed at 8.1%, supported by rising utilization in commercial fisheries and seafood supply chains. In the OECD region, Germany has been measured at 7.5%, where production and adoption for seafood retail and processing applications have been steadily maintained. The United Kingdom has been noted at 6.2%, reflecting consistent use in live seafood distribution and aquaculture, while the USA has been recorded at 5.5%, with production and utilization across commercial fisheries, aquaculture, and retail sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The live seafood market in China is growing at a CAGR of 8.8%, driven by high domestic demand for fresh seafood in restaurants, retail, and online delivery platforms. Consumers prefer live seafood for quality, taste, and freshness, making aquaculture and live transport solutions essential. Restaurants and specialty markets are investing in tanks and logistics to maintain live stock until purchase or consumption. The market is supported by established cold chain systems and regional seafood hubs that facilitate efficient transport from farms to markets. Rising urban population and disposable income boost the preference for premium seafood options. Retail and online channels further increase accessibility. Live seafood supply chains focus on careful handling, temperature control, and hygiene to ensure quality. The trend of consuming fresh and live seafood supports steady market growth in China.

The live seafood market in India is expanding at a CAGR of 8.1%, fueled by increasing consumer preference for fresh seafood in urban centers and coastal regions. Restaurants, hotels, and seafood retailers focus on offering live seafood to meet expectations for quality and taste. Aquaculture farms, specialized logistics, and cold chain transport ensure live seafood reaches end-users without compromising freshness. Urban population growth and higher disposable incomes drive increased consumption of premium seafood varieties. Online platforms and supermarkets are making live seafood more accessible to wider audiences. The market relies on strict handling, temperature management, and hygiene practices to maintain quality. Increasing awareness about freshness and taste continues to support the expansion of the live seafood market in India, making it a growing segment in the country’s food and hospitality sector.

The live seafood market in Germany is growing at a CAGR of 7.5%, with demand primarily driven by specialty restaurants, seafood retailers, and high-end catering services. Consumers value live seafood for its quality, taste, and freshness, prompting suppliers to invest in aquaculture facilities and live transport systems. Retailers and restaurants utilize advanced cold chain systems to maintain the integrity of live seafood during storage and delivery. Urban and coastal areas see higher consumption, supported by awareness about seafood provenance and freshness. The market emphasizes careful handling, temperature control, and hygiene standards to meet regulatory requirements and consumer expectations. Growing popularity of premium seafood in dining and retail establishments contributes to consistent market growth. The live seafood market in Germany continues to expand as demand for fresh and live products remains strong.

The live seafood market in the United Kingdom is expanding at a CAGR of 6.2%, driven by demand from restaurants, seafood retailers, and catering services. Fresh and live seafood is preferred by consumers for taste and quality, prompting suppliers to maintain proper live storage and transport systems. Retailers, restaurants, and online platforms are increasingly offering live seafood options to meet consumer expectations. Cold chain logistics and careful handling practices are essential to preserve product integrity. The market benefits from increasing awareness of seafood quality and freshness. Growth in premium dining and specialty seafood consumption supports market expansion. Suppliers focus on hygiene, temperature control, and efficient delivery to ensure live seafood remains viable for end-users. These factors contribute to a steady increase in the live seafood market in the UK.

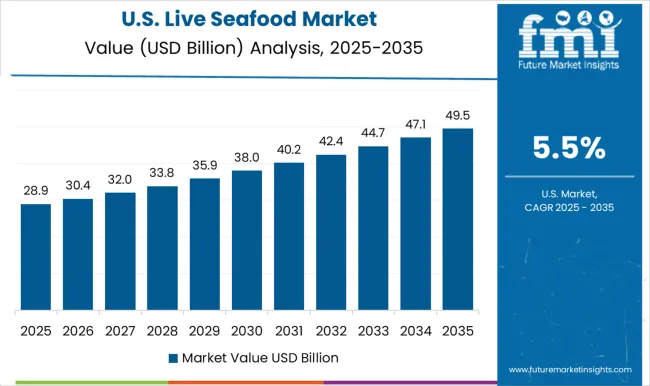

The live seafood market in the United States is growing at a CAGR of 5.5%, driven by demand from high-end restaurants, seafood retailers, and specialty food markets. Consumers prefer live seafood for quality, freshness, and culinary experience, encouraging suppliers to adopt live transport and cold chain storage systems. Coastal and urban regions show the highest consumption, supported by aquaculture farms and regional seafood hubs. Restaurants and retailers emphasize hygiene, temperature control, and careful handling to maintain product integrity. Online seafood delivery platforms are expanding market reach, allowing consumers to access fresh and live seafood conveniently. Growth in gourmet dining, culinary tourism, and seafood consumption further fuels market demand. The live seafood segment in the USA continues to grow steadily as consumer preference for fresh and live seafood remains strong.

The live seafood market plays a crucial role in the global seafood industry, catering to both retail and foodservice sectors. Increasing consumer demand for fresh, high-quality seafood, combined with rising awareness of sustainable sourcing, has driven growth in this market. Live seafood is particularly popular in Asia-Pacific regions, where it is considered a premium product and is often used in restaurants, hotels, and specialty markets. Key market trends include the adoption of advanced aquaculture practices, improved logistics for live transport, and sustainable harvesting methods. Thai Union is a leading player, recognized for its integrated seafood operations and focus on sustainable supply chains.

Mowi ASA, a major global aquaculture company, provides high-quality live seafood through its advanced farming and distribution networks. Dongwon / Dongwon F&B specializes in premium live seafood offerings with extensive export capabilities, while Nippon Suisan Kaisha (Nissui) focuses on Japanese markets with an emphasis on freshness and product traceability. Pacific Seafood / Trident caters to North American markets, supplying live seafood to restaurants, retail, and institutional buyers with strong logistical expertise. The market is expected to grow as consumer preference shifts towards fresh and high-value seafood, and technological innovations in live transport and storage improve product quality. Companies are also increasingly investing in sustainability initiatives to ensure environmentally responsible sourcing, making live seafood not only a premium choice but also a more eco-conscious option in global seafood consumption.

| Item | Value |

|---|---|

| Quantitative Units | USD 67.7 billion |

| Product | Others (Fish etc), Clams, Oysters, Crabs, and Lobsters |

| Source | Aquacultured, Wild caught, and Aquacultured |

| Distribution | Foodservice, Retail, Foodservice, and Wholesale |

| End Use | Foodservice, Household, and Foodservice |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thai Union (leading estimate), Mowi ASA, Dongwon / Dongwon F&B, Nippon Suisan Kaisha (Nissui), and Pacific Seafood / Trident |

| Additional Attributes | Dollar sales by type including fish, shellfish, and crustaceans, application across restaurants, retail, and export markets, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising consumer preference for fresh seafood, expanding aquaculture practices, and increasing demand from hospitality and gourmet food sectors. |

The global live seafood market is estimated to be valued at USD 67.7 billion in 2025.

The market size for the live seafood market is projected to reach USD 127.1 billion by 2035.

The live seafood market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in live seafood market are others (fish etc), clams, oysters, crabs and lobsters.

In terms of source, aquacultured segment to command 55.0% share in the live seafood market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liver Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Liver Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Livestock Panel Gates Market Size and Share Forecast Outlook 2025 to 2035

Livestock Trailer Market Size and Share Forecast Outlook 2025 to 2035

Live Cell RNA Detection Market Size and Share Forecast Outlook 2025 to 2035

Liver Health Supplements Market Analysis - Size, Growth, and Forecast 2025 to 2035

The Liver Transplantation Market is segmented by Treatment type and End User from 2025 to 2035

Live Cell Encapsulation Market Analysis & Forecast for 2025 to 2035

Liver Fibrosis Treatment Market - Innovations & Future Trends 2025 to 2035

Global Live Stock Vaccine Market Analysis – Size, Share & Forecast 2024-2034

Liver Fluke Treatment Market

Live Vaccines Market

Livestock Monitoring System Market

Olive Market Size and Share Forecast Outlook 2025 to 2035

Olive Oil Market Size and Share Forecast Outlook 2025 to 2035

Olive and Olive Derivatives Market – Growth, Demand & Industry Insights

Olive Leaf Extract Market

Delivery Management Software Market Size and Share Forecast Outlook 2025 to 2035

Delivery Tracking Platform Market Size and Share Forecast Outlook 2025 to 2035

Wire Livestock Panels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA