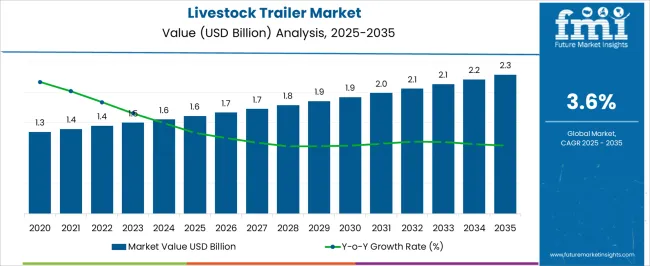

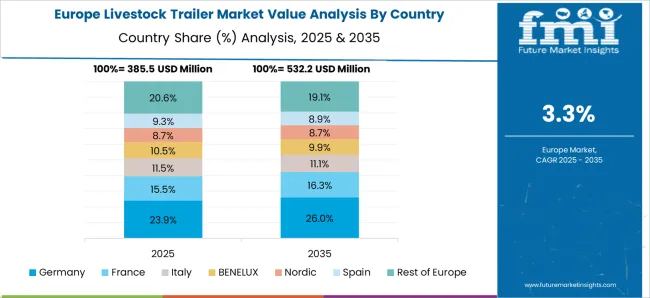

The livestock trailer market is projected to grow from USD 1.6 billion in 2025 to USD 2.3 billion by 2035, with a CAGR of 3.6%. A Growth Rate Volatility Index (GRVI) analysis reveals a relatively low volatility in the market’s growth, indicating a stable and predictable growth pattern with slight fluctuations. Between 2025 and 2030, the market grows from USD 1.6 billion to USD 1.9 billion, contributing USD 0.3 billion in growth, with a CAGR of 3.9%. This early-phase growth is driven by increasing demand in agricultural transportation, particularly in emerging markets where livestock farming is expanding. The need for efficient, durable, and large-capacity trailers to transport animals safely is fueling market demand. From 2030 to 2035, the market continues its upward trajectory, moving from USD 1.9 billion to USD 2.3 billion, contributing USD 0.4 billion in growth, with a slightly lower CAGR of 3.5%. This slower growth indicates the market’s maturation, where growth becomes more incremental as most of the demand has been met, and the focus shifts to replacement and innovation in trailer designs. The GRVI suggests a stable market with minimal volatility, as steady demand from the agricultural and transportation sectors continues to support growth, despite small fluctuations in the growth rate.

| Metric | Value |

|---|---|

| Livestock Trailer Market Estimated Value in (2025 E) | USD 1.6 billion |

| Livestock Trailer Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The livestock trailer market is experiencing notable growth, fueled by expanding commercial livestock farming and increasing demand for efficient animal transport solutions. Industry developments have highlighted the need for trailers that ensure animal welfare, comply with regulatory standards, and optimize transport logistics.

The growth of commercial farming operations has necessitated trailers designed for larger herd sizes with improved ventilation and safety features. Technological innovations in trailer design have enhanced durability and ease of use, making them attractive for both small and large scale livestock operations.

Additionally, the rising demand for meat and dairy products globally has spurred investment in transportation infrastructure, supporting market expansion. Looking ahead, the market is expected to benefit from stricter animal transport regulations and the adoption of trailers that improve animal comfort and reduce stress during transit. Segmental growth is anticipated to be led by cattle trailers, commercial applications, and gooseneck trailers due to their capacity and maneuverability advantages.

The livestock trailer market is segmented by livestock, application, trailer type, and region. By livestock, it is divided into cattle, pigs, sheep, horses, and others. In terms of application, the market is classified into commercial and personal. Based on trailer type, it is segmented into gooseneck, bumper pull, double deck, horse trailers, and others. Regionally, the livestock trailer industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

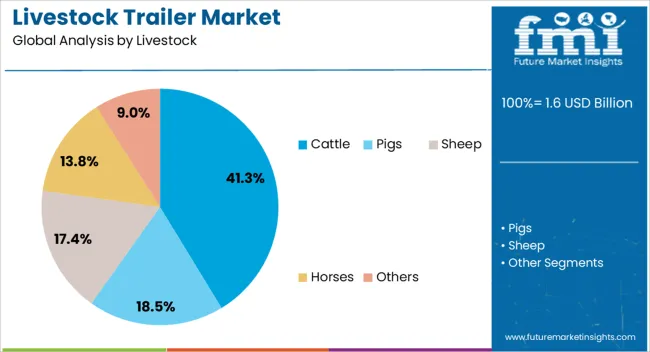

The cattle segment is projected to hold 41.3% of the livestock trailer market revenue in 2025, reflecting its leadership among livestock categories. This segment’s growth is driven by the widespread prevalence of cattle farming and the large scale movement of cattle between farms, markets, and processing facilities.

Trailers designed specifically for cattle have been favored due to their capacity to safely transport large animals while ensuring adequate ventilation and comfort. Regulatory focus on humane animal handling has pushed manufacturers to innovate features such as anti-slip flooring and adjustable partitions in cattle trailers.

Additionally, commercial cattle producers require trailers that can accommodate high volumes efficiently, supporting segment growth. As cattle farming remains a critical component of the livestock industry, this segment is expected to maintain its dominant position.

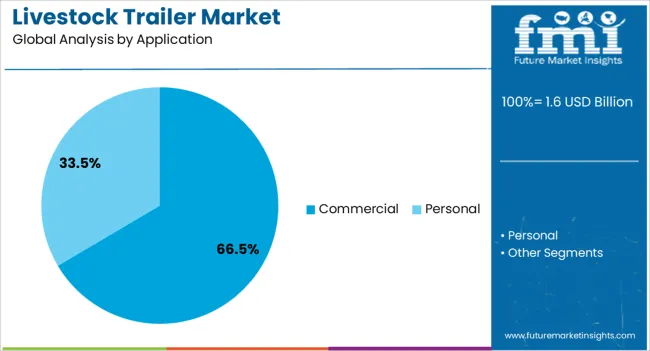

The commercial application segment is projected to account for 66.5% of the livestock trailer market revenue in 2025, maintaining its leading role. This segment’s expansion has been supported by the growth of professional livestock farming and the increasing scale of commercial operations.

Commercial users demand trailers that meet high standards for animal safety, durability, and compliance with transportation regulations. The rising adoption of modern farming practices and logistical efficiencies has necessitated trailers capable of frequent and long-distance transport.

Furthermore, commercial operators often require customized trailer solutions to meet specific herd sizes and operational workflows. As the livestock industry continues to industrialize, the commercial application segment is expected to dominate the market, driven by demand for reliable and scalable transportation solutions.

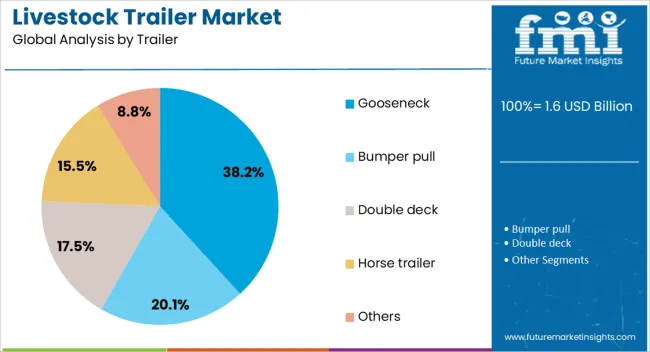

The gooseneck trailer segment is projected to hold 38.2% of the livestock trailer market revenue in 2025, securing its position as the leading trailer type. Growth in this segment is attributed to the superior stability and maneuverability offered by gooseneck designs, especially for larger and heavier loads.

The configuration of gooseneck trailers allows for better weight distribution and improved towing performance, making them popular among commercial livestock transporters. These trailers also provide greater cargo space and easier access for loading and unloading animals, which enhances operational efficiency.

Additionally, the growing preference for gooseneck trailers in regions with challenging terrains and long transport distances has supported segment growth. As transportation requirements become more demanding, the gooseneck trailer is expected to remain the favored choice for livestock haulers.

The livestock trailer market is growing due to increasing demand in the agricultural and transportation industries for efficient, safe, and reliable transportation of livestock. These trailers are designed to safely carry animals such as cattle, pigs, and sheep while ensuring their well-being during long-distance travel. The market is driven by the rise in global meat consumption, increased livestock farming, and the need for specialized transport solutions. Innovations in trailer design, materials, and safety features continue to drive growth, though challenges such as regulatory compliance and high manufacturing costs remain.

The key driver of the livestock trailer market is the increasing demand for efficient and humane transportation of livestock due to the global rise in meat consumption and the expansion of the agricultural sector. As the livestock farming industry continues to grow, the need for specialized transportation solutions to safely and efficiently move animals is becoming more critical. Livestock trailers are essential in ensuring the safe transit of animals, minimizing stress and injury during long-distance travel. In addition, technological advancements in trailer design, including enhanced ventilation systems, ergonomic loading mechanisms, and temperature controls, have made these trailers more reliable and functional. The growing focus on improving animal welfare standards and meeting regulations for livestock transportation is further driving the demand for specialized trailers that meet industry standards and regulations.

One of the significant challenges in the livestock trailer market is ensuring compliance with stringent government regulations regarding the transport of animals. Many countries have implemented strict guidelines on the welfare of animals during transportation, requiring trailers to meet specific standards related to ventilation, flooring, and space. Meeting these requirements increases production costs, making trailers more expensive to manufacture and purchase. Additionally, the high cost of materials such as high-quality steel and aluminum used in trailer construction can raise prices, further limiting accessibility for smaller agricultural operators. The complexity of ensuring durability, safety, and comfort for livestock while keeping costs manageable is a key hurdle for manufacturers, especially in regions with smaller-scale farming operations or limited financial resources.

The livestock trailer market presents several growth opportunities through innovations in technology and the expansion of the agricultural sector in emerging markets. Technological advancements in trailer design, such as GPS tracking, automated loading systems, and advanced ventilation systems, offer manufacturers the chance to improve trailer performance, safety, and efficiency. The rise of smart trailers with real-time monitoring systems allows farmers to track animal welfare and monitor conditions such as temperature and humidity during transport. Emerging markets in regions such as Asia-Pacific, Latin America, and Africa are experiencing increased demand for livestock products, driving the need for efficient transportation solutions. As the global agricultural sector continues to expand, these regions present significant opportunities for manufacturers to introduce modern livestock trailers tailored to meet the growing demands of the industry.

A significant trend in the livestock trailer market is the increasing emphasis on animal welfare and the development of trailers designed to ensure the safe and comfortable transport of livestock. The focus on minimizing stress, injury, and discomfort during transportation is shaping trailer designs, with manufacturers incorporating advanced features such as anti-slip flooring, temperature regulation, and better ventilation systems. The integration of smart technologies in livestock trailers is gaining traction. GPS systems, real-time tracking, and automated systems for loading and unloading are transforming how livestock is transported. These innovations improve efficiency, reduce transportation time, and enhance animal welfare, aligning with the industry's growing focus on compliance with animal welfare standards and regulations. The trend toward smarter, more connected trailers is expected to continue as the need for data-driven, efficient transportation solutions increases.

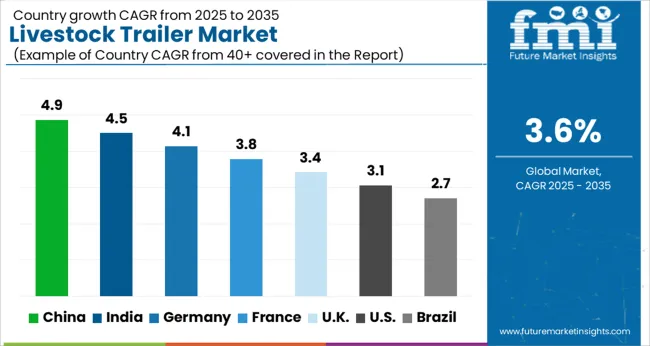

The global livestock trailer market is projected to grow at a CAGR of 3.6% from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 4.9%, followed by India at 4.5%, and Germany at 4.1%, while France records 3.8% and the United States posts 3.1%. These rates translate to a growth premium of +36% for China, +25% for India, and +15% for Germany versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: increasing adoption of livestock trailers in farming, animal transportation, and agriculture in China and India. The analysis includes over 40+ countries, with the leading markets detailed below.

Sales of livestock trailers in China are growing at a CAGR of 4.9% through 2035. The country’s expanding agricultural sector, particularly in the livestock industry, is the primary driver for the growth in demand for livestock trailers. With the rise of industrial-scale farming and transportation of animals across the country, livestock trailers are increasingly being used to improve efficiency and reduce transportation costs. Government initiatives focused on modernizing the agriculture and livestock sectors are further supporting the market’s growth. Additionally, China’s vast landmass and growing demand for meat products contribute significantly to the need for better livestock transportation solutions.

Demand for livestock trailers in India is projected to grow at a CAGR of 4.5% through 2035. India’s rapidly expanding agricultural sector, with a strong focus on livestock farming, is driving the demand for efficient animal transportation solutions. The country’s large rural population and the increasing need for animal-based products such as dairy and meat further contribute to the growth of the livestock trailer market. With government schemes supporting agricultural infrastructure and the rising need for modernized transportation systems in rural India, the demand for livestock trailers is expected to increase significantly.

Demand for livestock trailers in Germany is growing at a CAGR of 4.1% through 2035. Germany’s advanced agricultural sector, with a focus on livestock farming and transportation, drives the adoption of livestock trailers. The country’s well-established infrastructure for farming, coupled with its emphasis on mechanization and efficiency, contributes to the market growth. Germany’s large meat and dairy industries create a consistent need for transportation solutions that ensure animal welfare and reduce transportation costs. Government regulations focusing on livestock welfare during transportation further promote the use of advanced trailers in the country.

The livestock trailers market in the United Kingdom is expected to grow at a 3.4% CAGR through 2035. The U.K.’s well-established agricultural and livestock sectors, with a strong focus on sustainable farming practices, contribute to the growth of the livestock trailer market. As demand for animal-based products rises, the need for efficient, cost-effective transportation solutions increases. The U.K.’s regulatory framework ensuring animal welfare during transportation and its emphasis on reducing carbon emissions in agriculture further encourage the use of modern livestock trailers. The country’s expanding export markets also drive the demand for reliable transportation solutions

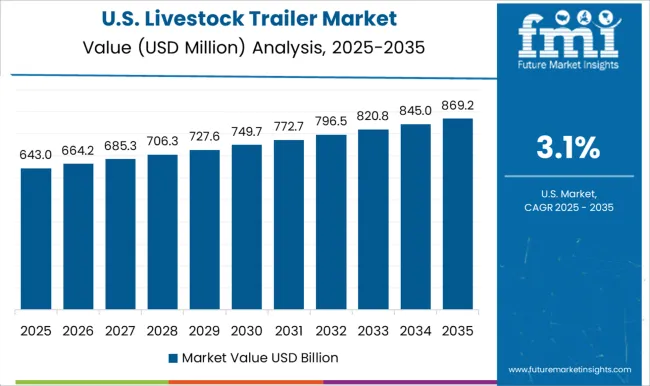

The U.S. livestock trailer market is projected to grow at a 3.1% CAGR through 2035. The demand for livestock trailers is driven by the expansion of animal farming, particularly in meat and dairy production. The U.S. market benefits from a large agricultural sector with significant investments in modern farming techniques and transportation solutions. The rise of transportation technologies, combined with increasing government regulations focused on animal welfare, contributes to the adoption of specialized trailers. The growing demand for U.S. livestock exports, along with improved supply chain efficiency, is expected to further support market growth.

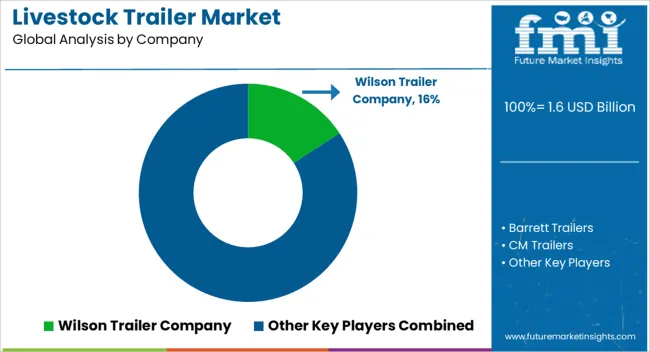

The livestock trailer market is driven by leading manufacturers offering durable and efficient trailers designed to transport livestock safely and comfortably. Wilson Trailer Company is a market leader, known for its high-quality livestock trailers that provide superior strength, durability, and ease of use, catering to a wide range of livestock transportation needs. Barrett Trailers offers a range of customizable livestock trailers, with a focus on quality materials and innovative design features to ensure safe, efficient transportation. CM Trailers and Delta Trailers specialize in providing livestock trailers that prioritize safety and comfort for both animals and operators. Their offerings include advanced features such as ventilation systems, easy loading/unloading mechanisms, and sturdy construction.

Eby Trailers is a well-known player, offering a variety of livestock trailers designed for strength, functionality, and ease of maintenance, serving both small and large-scale livestock operations. Exiss Trailers and Featherlite Trailers provide high-performance, lightweight, and durable livestock trailers, designed to meet the transportation needs of farmers and ranchers while ensuring the welfare of the animals. Hillsboro Industries and Merritt Trailers offer reliable and customizable livestock trailers with a focus on durability and versatility, catering to different livestock transportation requirements. Sundowner Trailers is recognized for its premium livestock trailers, offering solutions with advanced features such as efficient loading ramps, enhanced ventilation, and high durability. These products are widely used in both personal and commercial livestock transportation.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Livestock | Cattle, Pigs, Sheep, Horses, and Others |

| Application | Commercial and Personal |

| Trailer | Gooseneck, Bumper pull, Double deck, Horse trailer, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wilson Trailer Company; Barrett Trailers; CM Trailers; Delta Trailers; M.H. EBY (Eby Trailers); Exiss Trailers; Featherlite Trailers; Hillsboro Industries; Merritt Trailers; Sundowner Trailers. |

| Additional Attributes | Dollar sales by product type (gooseneck trailers, bumper pull trailers, livestock semi-trailers) and end-use segments (livestock farmers, commercial operators, transportation services). Demand dynamics are influenced by the increasing need for safe, efficient, and reliable livestock transportation, rising meat consumption, and growing concerns about animal welfare during transit. Regional trends show strong growth in North America due to the high demand for agricultural and livestock products, while Asia-Pacific is expanding as urbanization increases the need for efficient livestock transportation solutions. |

The global livestock trailer market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the livestock trailer market is projected to reach USD 2.3 billion by 2035.

The livestock trailer market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in livestock trailer market are cattle, pigs, sheep, horses and others.

In terms of application, commercial segment to command 66.5% share in the livestock trailer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trailer & Cargo Container Tracking Market Size and Share Forecast Outlook 2025 to 2035

Livestock Panel Gates Market Size and Share Forecast Outlook 2025 to 2035

Trailer Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Trailer Surge Brake Market Growth - Trends & Forecast 2024 to 2034

Trailer Assist System Market

Trailer Stabilizer Market

Trailer Spindles Market

Livestock Monitoring System Market

Boat Trailers Market Size and Share Forecast Outlook 2025 to 2035

Semi-Trailer Market Size and Share Forecast Outlook 2025 to 2035

Wire Livestock Panels Market Size and Share Forecast Outlook 2025 to 2035

Roll Trailer Market Growth – Trends & Forecast 2025 to 2035

Travel Trailer Market Size and Share Forecast Outlook 2025 to 2035

Modular Trailer Market Forecast and Outlook 2025 to 2035

Kitchen Trailers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hooklift Trailer Market Size and Share Forecast Outlook 2025 to 2035

Precision Livestock Farming Market Size and Share Forecast Outlook 2025 to 2035

Automotive Trailer Drawbar Market Growth – Trends & Forecast 2024-2034

Japan Boat Trailer Market Growth – Trends & Forecast 2024-2034

Korea Boat Trailer Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA