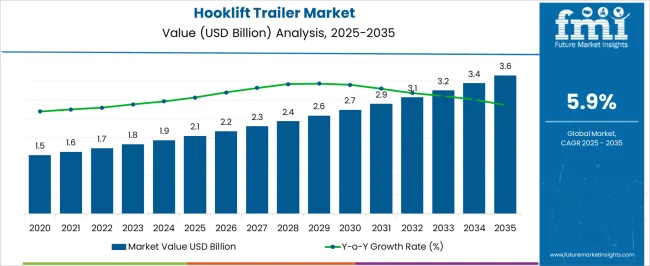

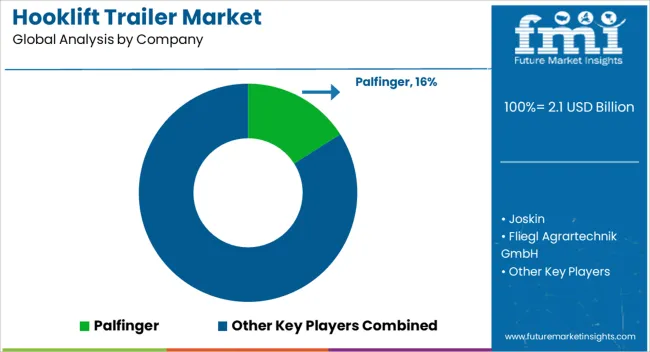

The hooklift trailer market is valued at USD 2.1 billion in 2025 and is expected to expand to USD 3.6 billion by 2035, registering a CAGR of 5.9%. Between 2021 and 2025, the market will rise from USD 1.5 billion to USD 2.1 billion, reflecting steady adoption as industries seek flexible waste handling, transport, and logistics solutions. Annual increments indicate consistent growth, with values reaching USD 1.6 billion in 2022, USD 1.7 billion in 2023, USD 1.8 billion in 2024, and USD 1.9 billion immediately before attaining USD 2.1 billion in 2025.

Increased urban infrastructure development, municipal fleet upgrades, and rising awareness of operational efficiency in waste management and construction sectors primarily drive early growth contributions. From 2026 to 2030, the market advances from USD 2.1 billion to USD 2.7 billion. Incremental values rise to USD 2.2 billion in 2026, USD 2.3 billion in 2027, USD 2.4 billion in 2028, USD 2.6 billion in 2029, and USD 2.7 billion in 2030.

This phase highlights notable growth contributions from regional fleet expansions, adoption of multi-functional hooklift systems, and government initiatives supporting modular transport solutions. Between 2031 and 2035, the market strengthens further, rising from USD 2.9 billion to USD 3.6 billion. Values progress to USD 3.1 billion in 2031, USD 3.2 billion in 2032, USD 3.4 billion in 2033, USD 3.4 billion in 2034, and USD 3.6 billion in 2035.

| Metric | Value |

|---|---|

| Hooklift Trailer Market Estimated Value in (2025 E) | USD 2.1 billion |

| Hooklift Trailer Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The hooklift trailer market is shaped by multiple parent markets that drive its demand across construction, logistics, agriculture, and industrial applications. The commercial vehicle market forms the largest parent, with hooklift trailers representing about 15-18% of this sector. They are considered specialized transport solutions that allow a single vehicle to handle different types of containers, reducing fleet costs and improving overall efficiency.

The construction equipment market contributes around 12-15%, as hooklift trailers are widely used on construction sites for hauling heavy materials, transporting machinery, and removing debris. Their ability to switch container bodies makes them highly effective for dynamic construction environments. The logistics and freight transport market adds roughly 10-12% to the share, since hooklift trailers are valued for their versatility in moving freight, containers, and industrial waste. Their quick loading and unloading ability supports faster turnaround times in transport operations.

The waste management and recycling market contributes approximately 8-10%, where hooklift trailers are essential for transporting skips, waste containers, and recyclables. Their adaptability and ease of container handling make them indispensable in collection and disposal operations. The agricultural equipment and transport market accounts for about 6-8% of the share, where these trailers are used to transport silage, crops, feed, and machinery. Their flexibility makes them suitable for both seasonal agricultural tasks and year-round farm logistics.

The ability of hooklift trailers to handle a variety of container types and capacities has positioned them as an efficient and cost-effective choice for operators seeking operational flexibility. Increasing infrastructure development projects and heightened emphasis on sustainable waste transportation have further supported adoption.

Advances in hydraulic systems and chassis designs have improved loading efficiency, reduced downtime, and enhanced safety, making these trailers suitable for both urban and remote operations. The market outlook remains strong, supported by growing fleet modernization initiatives and rising preference for multi-purpose equipment to optimize capital expenditure.

Furthermore, integration with telematics and load-monitoring systems is enabling real-time performance tracking, which aligns with industry trends toward digital fleet management. As end-users continue to prioritize productivity and adaptability, hooklift trailers are expected to play an increasingly central role in material handling and logistics.

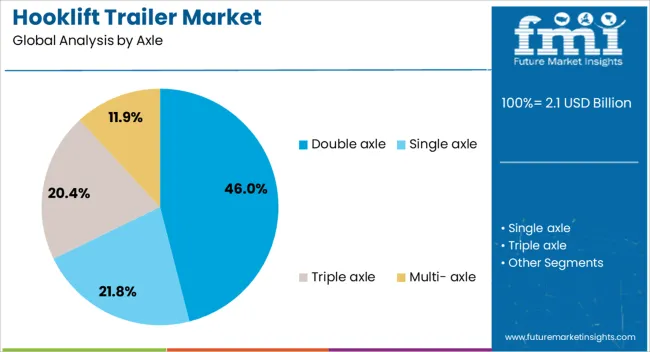

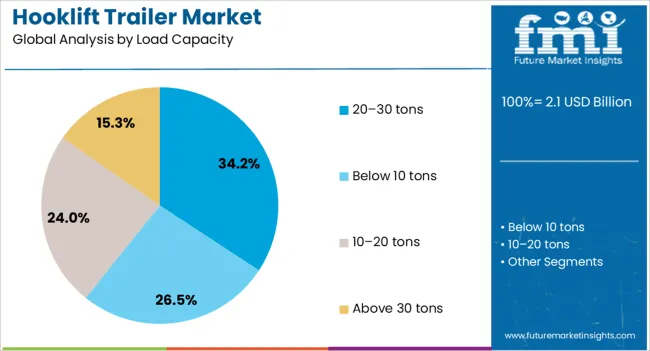

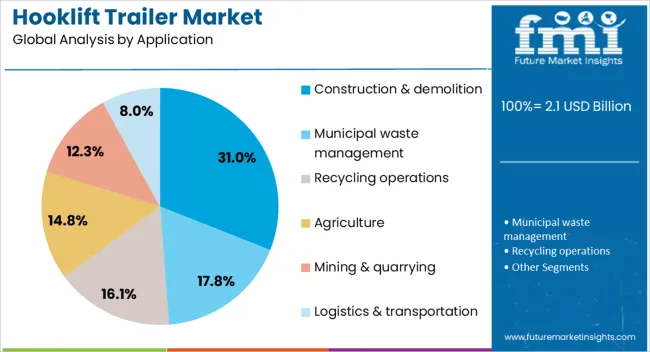

The hooklift trailer market is segmented by axle, load capacity, application, and geographic regions. By axle, hooklift trailer market is divided into Double axle, Single axle, Triple axle, and Multi- axle. In terms of load capacity, hooklift trailer market is classified into 20–30 tons, Below 10 tons, 10–20 tons, and Above 30 tons.

Based on application, hooklift trailer market is segmented into Construction & demolition, Municipal waste management, Recycling operations, Agriculture, Mining & quarrying, and Logistics & transportation. Regionally, the hooklift trailer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The double axle segment is projected to hold 46% of the Hooklift Trailer market revenue share in 2025, making it the leading axle configuration. This dominance has been attributed to the enhanced load distribution and stability offered by double axle designs, which improve safety and handling under heavy payload conditions.

The ability to support larger container sizes and operate efficiently across varied terrains has made double axle trailers a preferred choice for operators managing diverse hauling needs. Increased durability and lower maintenance requirements compared to single axle configurations have also supported their adoption.

In sectors where high uptime is essential, double axle hooklift trailers provide the reliability and operational flexibility required to meet demanding schedules. Their capability to carry heavier loads without compromising maneuverability has further reinforced their market position, making them an optimal solution for high-volume material transport in multiple industries.

The 20–30 tons load capacity segment is anticipated to account for 34.23% of the Hooklift Trailer market revenue share in 2025, positioning it as the leading capacity range. The preference for this range has been influenced by its ability to balance high payload capability with operational efficiency. This capacity is particularly suited for industries that require frequent transportation of bulk materials without exceeding road weight regulations.

Operators benefit from reduced trips and fuel savings while maintaining compliance with legal load limits. The adaptability of trailers in this range to handle a variety of container sizes and types has enhanced their operational versatility. Furthermore, their compatibility with both urban and rural delivery routes makes them attractive for a broad spectrum of applications. The combination of efficiency, compliance, and versatility has ensured the sustained dominance of the 20–30 tons segment in the overall market.

The construction and demolition application segment is expected to hold 31% of the Hooklift Trailer market revenue share in 2025, making it the leading application category. The increasing scale of urban development projects and infrastructure upgrades worldwide has driven growth in this segment. Hooklift trailers have been preferred in construction and demolition due to their ability to transport large volumes of debris, aggregates, and equipment efficiently.

Their quick container swapping capability reduces downtime, enabling continuous operation on busy worksites. Durability and adaptability to varying load types have also contributed to their widespread use in this sector. As regulatory requirements for waste segregation and recycling become more stringent, hooklift trailers provide a practical solution for separating and transporting materials efficiently The sector’s ongoing expansion, coupled with demand for reliable and versatile hauling equipment, is expected to maintain the leadership of construction and demolition in the application segment.

The hooklift trailer market is driven by demand for efficient, flexible transport solutions in construction, waste management, and agriculture. Their ability to handle multiple container types with one vehicle supports productivity and versatility. High upfront costs, intensive maintenance needs, and regulatory requirements remain barriers, particularly for smaller operators. Expanding opportunities are emerging in recycling and construction logistics, where hooklift systems streamline operations. Trends such as hydraulic innovations, lightweight designs, and telematics integration are shaping growth, positioning hooklift trailers as critical assets for diverse industrial and logistics applications.

The hooklift trailer market is expanding as industries increasingly require flexible and efficient transport solutions for handling diverse loads. These trailers allow rapid container changes, enabling a single vehicle to perform multiple tasks, which enhances fleet productivity and reduces downtime. Construction, waste management, and agriculture sectors are major adopters, as hooklift trailers simplify the movement of bulk materials and specialized containers. Their compatibility with multiple body types such as skips, flatbeds, and tankers further adds to their versatility. Growing demand for equipment that reduces manual handling and supports operational efficiency is also fueling adoption. Fleet operators value hooklift systems for their adaptability, as one vehicle can replace several single-purpose units. With rising infrastructure and logistics activity worldwide, the ability to optimize resource use and streamline material handling processes is reinforcing the importance of hooklift trailers in modern transport operations.

Advanced hooklift systems incorporate hydraulic mechanisms, reinforced chassis, and safety features that elevate costs compared to conventional trailers. For small operators or firms in cost-sensitive regions, this creates affordability challenges. Maintenance requirements are also greater, as hydraulic components and mechanical linkages demand regular servicing to ensure safe and reliable performance. Wear and tear caused by frequent heavy-duty use can add to operational expenses over time. The availability of skilled technicians to maintain and repair hooklift systems is limited in certain markets, restricting adoption. Regulatory compliance around load handling and safety standards can also increase complexity and costs. These factors make widespread adoption slower in smaller fleets, although larger operators with higher volumes continue to benefit from long-term cost savings.

Waste collection companies increasingly use hooklift trailers to manage containers of varying sizes, enabling efficient collection routes and rapid turnaround. Construction firms benefit from their ability to transport aggregates, equipment, and demolition debris using a single vehicle, reducing the need for specialized fleets. Recycling operations also utilize hooklift trailers to streamline the transport of sorted materials. Manufacturers are responding by offering trailers with enhanced load capacities, stronger hydraulic systems, and customizable configurations. Integration with telematics is also creating opportunities for operators to track load usage, optimize routes, and reduce idle time. As industries prioritize operational flexibility and productivity, hooklift trailers are positioned as versatile solutions capable of addressing varied demands, making them attractive investments across growing application areas.

Manufacturers are developing lightweight yet durable materials to enhance load capacity while reducing vehicle weight, addressing efficiency needs. Advances in hydraulic systems are improving safety, precision, and speed of container handling, making hooklift systems more user-friendly. Regional growth is strong in developed markets, where infrastructure projects and waste management programs drive consistent demand, while emerging economies are showing rising adoption as industrialization expands. Strategic partnerships between trailer manufacturers and logistics companies are fostering the development of tailored solutions. The introduction of connected technologies such as telematics and remote monitoring is also shaping fleet management practices. These trends underline the market’s transition toward more advanced, adaptable, and region-specific solutions, reinforcing the role of hooklift trailers in modern logistics and industrial operations.

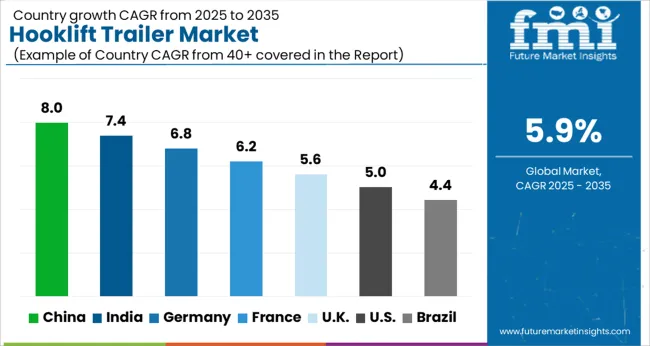

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The hooklift trailer market is projected to grow globally at a CAGR of 5.9% between 2025 and 2035. China leads expansion at 8.0%, followed by India at 7.4% and France at 6.2%, while the United Kingdom records 5.6% and the United States posts 5.0%. China and India outperform with growth premiums of +2.1% and +1.5% above the baseline, supported by large-scale infrastructure projects, logistics expansion, and construction growth. France maintains steady momentum through municipal waste and construction demand. The UK and USA show slower but reliable growth, driven by industrial modernization and increasing adoption across municipal and mining sectors. The analysis spans over 40+ countries, with the leading markets shown below.

China is expected to dominate the global hooklift trailer market, expanding at a CAGR of 8.0% between 2025 and 2035. The country’s rapid industrialization, coupled with strong logistics and construction activities, has driven greater reliance on heavy-duty transport solutions. Hooklift trailers are increasingly used in waste management, mining, and material transport, enhancing efficiency for industrial operators. Growing infrastructure investments and the expansion of e-commerce logistics have added momentum to trailer demand. Domestic manufacturers are strengthening product quality while global suppliers are entering through joint ventures and collaborations. The integration of automation in fleet management and vehicle tracking is further improving adoption rates.

The hooklift trailer market in India is forecasted to expand at a CAGR of 7.4% from 2025 to 2035. Growth is being shaped by infrastructure projects, urban development, and increased demand for efficient transport of construction and industrial materials. Hooklift trailers are being widely adopted for solid waste management, agricultural logistics, and heavy material transportation. The rising e-commerce sector is contributing to logistics expansion, pushing demand for advanced trailer solutions. Domestic manufacturers are focusing on cost-efficient models to address the growing needs of small and medium enterprises, while multinational players are introducing high-performance trailers to cater to large-scale projects.

France is projected to grow at a CAGR of 6.2% between 2025 and 2035 in the hooklift trailer market. Demand is largely driven by construction activities, municipal waste management, and specialized freight solutions.. Construction and road maintenance projects are further adding to the requirement for heavy-duty transport solutions. Local manufacturers are emphasizing innovation in design and durability, while European suppliers are strengthening competition with advanced product lines. Hooklift trailers are also finding increased application in agriculture and forestry logistics. With strong regulatory standards on vehicle performance and efficiency, manufacturers are focusing on offering technologically enhanced products.

The United Kingdom is anticipated to record a CAGR of 5.6% from 2025 to 2035 in the hooklift trailer market. The growth outlook is shaped by the rising adoption of heavy-duty transport equipment across construction, agriculture, and municipal waste sectors. Infrastructure renovation projects, particularly in urban areas, are contributing to greater reliance on advanced trailers. Hooklift trailers are also seeing wider integration in recycling and waste segregation operations, reflecting the demand for efficient logistics systems. Domestic distributors are actively partnering with European suppliers to expand product portfolios, while aftermarket services are playing a larger role in supporting adoption.

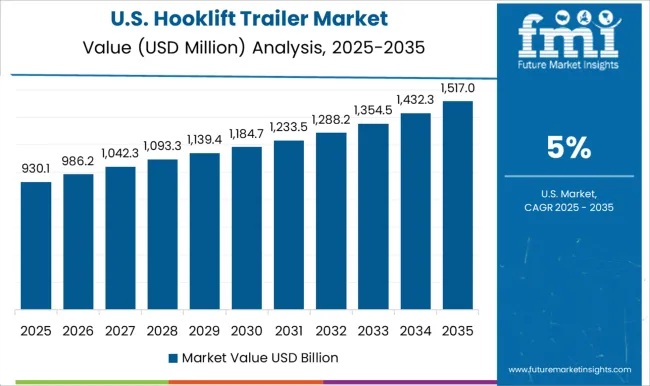

The United States is projected to grow at a CAGR of 5.0% from 2025 to 2035 in the hooklift trailer market. Growth is being supported by construction, mining, and municipal waste sectors, all of which rely heavily on advanced transport systems. Increasing demand from logistics companies and municipal authorities is boosting adoption, particularly for large-scale waste collection and distribution networks. The mining industry continues to be a critical end-user, requiring durable and high-capacity trailers. USA-based manufacturers are investing in product innovation, offering enhanced load capacities, automation, and digital fleet integration. Competition from European manufacturers has introduced advanced technologies, raising performance standards.

In the hooklift trailer market, competition is centered on payload efficiency, modularity, and adaptability to agricultural, construction, and waste management operations. Palfinger leads with its Multilift hooklift systems, integrating robust hydraulic technology that allows operators to switch between containers and bodies with ease, enabling high utilization rates across industries. Joskin competes with agricultural-focused hooklift trailers engineered for slurry tanks, spreaders, and bulk transport, emphasizing heavy-duty chassis and versatility on farms. Fliegl Agrartechnik GmbH highlights modular hooklift trailers tailored to agriculture and forestry, focusing on quick container exchange and weight optimization to maximize transport efficiency.

Meiller positions its hooklift solutions in the construction and waste sectors, relying on precise hydraulic control, rugged build quality, and integration with trucks and trailers designed for urban and industrial use. Kromhout competes in regional markets with reliable hooklift trailers targeted at logistics and construction customers requiring cost-efficient but durable systems. Strategies across leading players emphasize design innovation, customization, and alignment with sector-specific requirements. Palfinger focuses on expanding global market reach with standardized yet scalable Multilift systems. Joskin strengthens its position by offering integrated solutions for agricultural operators, providing compatibility with a wide range of farm equipment. Fliegl invests in modular product concepts, appealing to users who require flexible configurations for multiple applications. Meiller differentiates with precision engineering and a reputation for longevity in high-duty cycles.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Axle | Double axle, Single axle, Triple axle, and Multi- axle |

| Load Capacity | 20–30 tons, Below 10 tons, 10–20 tons, and Above 30 tons |

| Application | Construction & demolition, Municipal waste management, Recycling operations, Agriculture, Mining & quarrying, and Logistics & transportation |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Palfinger, Joskin, Fliegl Agrartechnik GmbH, Meiller, Kromhout, Multilift / Ampliroll brands, and Other regional manufacturers |

| Additional Attributes | Dollar sales by product type (standard, heavy-duty, specialized), load capacity (light, medium, heavy), and chassis compatibility (truck, trailer, multi-axle platforms). Demand dynamics are influenced by logistics expansion, waste management modernization, and construction sector growth. Regional trends indicate strong adoption in Europe and North America, driven by industrial modernization and regulatory emphasis on operational safety and efficiency. |

The global hooklift trailer market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the hooklift trailer market is projected to reach USD 3.6 billion by 2035.

The hooklift trailer market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in hooklift trailer market are double axle, single axle, triple axle and multi- axle.

In terms of load capacity, 20–30 tons segment to command 34.2% share in the hooklift trailer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trailer & Cargo Container Tracking Market Size and Share Forecast Outlook 2025 to 2035

Trailer Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Trailer Surge Brake Market Growth - Trends & Forecast 2024 to 2034

Trailer Assist System Market

Trailer Stabilizer Market

Trailer Spindles Market

Boat Trailers Market Size and Share Forecast Outlook 2025 to 2035

Semi-Trailer Market Size and Share Forecast Outlook 2025 to 2035

Roll Trailer Market Growth – Trends & Forecast 2025 to 2035

Travel Trailer Market Size and Share Forecast Outlook 2025 to 2035

Modular Trailer Market Forecast and Outlook 2025 to 2035

Kitchen Trailers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Livestock Trailer Market Size and Share Forecast Outlook 2025 to 2035

Automotive Trailer Drawbar Market Growth – Trends & Forecast 2024-2034

Japan Boat Trailer Market Growth – Trends & Forecast 2024-2034

Korea Boat Trailer Market Growth – Trends & Forecast 2024-2034

Snowmobile Trailer Axle Market

Refrigerated Trailer Market Size and Share Forecast Outlook 2025 to 2035

Self loading Trailer Market

North America Boat Trailer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA