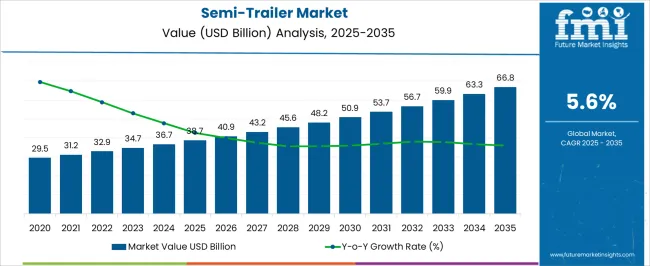

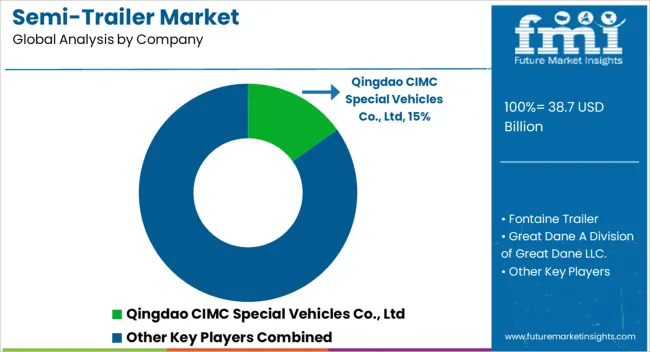

The Semi-Trailer Market is estimated to be valued at USD 38.7 billion in 2025 and is projected to reach USD 66.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Semi-Trailer Market Estimated Value in (2025 E) | USD 38.7 billion |

| Semi-Trailer Market Forecast Value in (2035 F) | USD 66.8 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The Semi-Trailer market is expanding steadily, supported by rising global demand for efficient freight transportation across industries such as construction, mining, agriculture, and logistics. Increasing movement of heavy machinery, raw materials, and bulk goods is fueling the adoption of semi-trailers due to their higher payload capacity and cost efficiency compared to other transport modes. Regulatory focus on vehicle safety and road efficiency is also prompting fleet operators to invest in modern trailers with advanced braking, telematics, and load optimization technologies.

Moreover, infrastructure expansion projects and growing international trade are accelerating the need for durable and high-capacity transport equipment. The integration of lightweight materials and aerodynamic designs is improving fuel efficiency, reducing operating costs, and supporting sustainability goals, which is a key priority for logistics providers.

Additionally, digital fleet monitoring and predictive maintenance solutions are enhancing operational reliability and uptime With a strong focus on optimizing transportation efficiency, reducing carbon emissions, and improving asset utilization, the Semi-Trailer market is projected to witness consistent growth, driven by the need for safe, cost-effective, and technologically advanced heavy transport solutions worldwide.

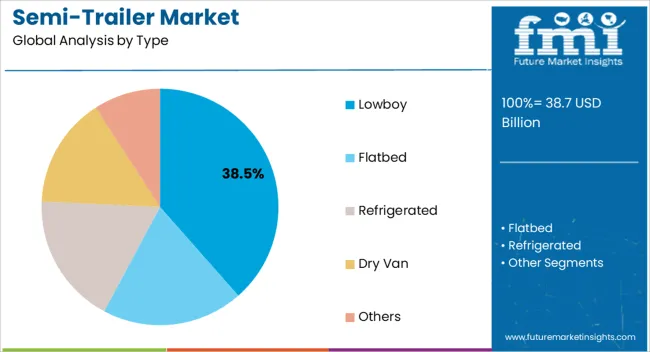

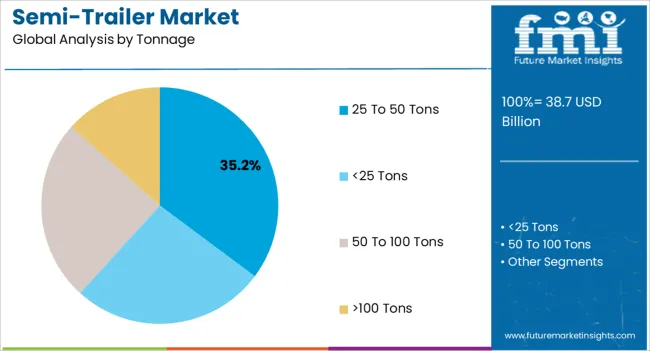

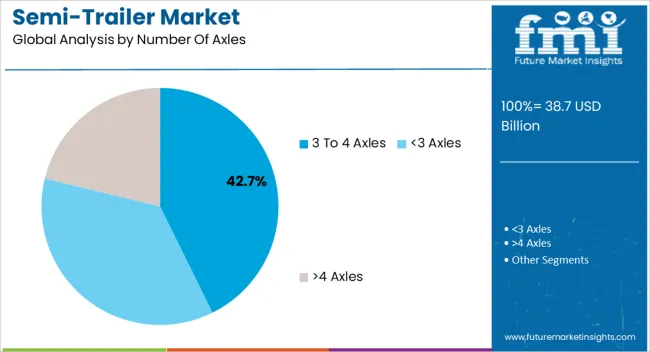

The semi-trailer market is segmented by type, tonnage, number of axles, end-use, and geographic regions. By type, semi-trailer market is divided into Lowboy, Flatbed, Refrigerated, Dry Van, and Others. In terms of tonnage, semi-trailer market is classified into 25 To 50 Tons, <25 Tons, 50 To 100 Tons, and >100 Tons. Based on number of axles, semi-trailer market is segmented into 3 To 4 Axles, <3 Axles, and >4 Axles. By end-use, semi-trailer market is segmented into Heavy Industry, FMCG, Automotive, Logistic, and Healthcare. Regionally, the semi-trailer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The lowboy type segment is projected to account for 38.5% of the Semi-Trailer market revenue share in 2025, positioning it as the leading trailer type. Growth is being supported by its widespread use in transporting heavy construction machinery, mining equipment, and oversized loads that cannot be carried by standard trailers. The low deck height provides stability and allows for easier loading of tall or bulky equipment while complying with clearance restrictions on highways.

This makes it particularly valuable for industries engaged in infrastructure development, energy projects, and industrial transport. The adaptability of lowboy trailers in carrying loads with varying dimensions adds to their popularity among logistics operators. Strong demand from the construction and heavy equipment industries across emerging markets is also reinforcing segment leadership.

Technological advancements in axle configuration, load distribution systems, and material strength are further improving performance and safety As global infrastructure projects continue to expand, the lowboy segment is expected to maintain its dominant position, supported by its reliability, flexibility, and cost efficiency.

The 25 to 50 tons tonnage segment is anticipated to capture 35.2% of the Semi-Trailer market share in 2025, establishing it as the dominant capacity category. This segment’s leadership is being driven by its versatility in transporting medium to heavy cargo across industries such as construction, agriculture, and logistics. Fleet operators prefer this range as it offers an optimal balance between payload capacity and cost efficiency, ensuring profitable operations while maintaining regulatory compliance.

The ability to handle diverse types of loads without requiring specialized permits enhances its appeal, especially for cross-border and regional transport. Increasing industrial output, infrastructure expansion, and growing demand for agricultural products are fueling the need for mid-range tonnage trailers. Moreover, trailers in this capacity segment are benefiting from advancements in lightweight materials and braking technologies, which improve efficiency and safety.

Their adaptability in multiple sectors and cost-effectiveness compared to higher tonnage vehicles make them highly sought after With consistent demand across global industries, the 25 to 50 tons tonnage segment is expected to remain the key contributor to market revenue growth.

The 3 to 4 axles segment is forecasted to hold 42.7% of the Semi-Trailer market revenue share in 2025, positioning it as the leading axle configuration. Growth is being driven by the ability of these trailers to provide an optimal balance between load distribution, maneuverability, and durability. The increased load-bearing capacity compared to lower axle configurations makes them highly suitable for medium to heavy-duty transport requirements across industries.

Operators benefit from reduced wear and tear on individual axles and improved stability, which enhances safety during long-distance transport of heavy goods. Additionally, regulatory frameworks in many regions favor the use of 3 to 4 axle configurations to ensure road safety and compliance with load restrictions. Their versatility in serving diverse applications, from construction and mining to logistics and agriculture, is also a key growth driver.

Advancements in suspension systems, braking technology, and telematics integration are further enhancing performance With rising demand for durable and efficient transport solutions, the 3 to 4 axles segment is expected to continue leading the market, supported by its proven reliability and operational efficiency.

According to FMI, the Global Semi-Trailer Market is estimated to be valued at US$ 34,738.7 Million in 2025 and is projected to increase at a CAGR of 5.6% in the forecast period from 2025 to 2035.

The semi-trailer is a freight vehicle without a front axle, with most of its weight supported by a tractor unit or a removable front axle and some of its weight partially supported by the semi-trailer itself. Semi-trailers can be relocated to the desired location. Rather than using full trailers, semi-trailers are more frequently used for cargo transportation. Detachable semi-trailers provide more flexibility than entire trailers. Most of owners use semi-trailers to transport both finished goods and raw materials. The semi-trailer incorporates the key trends, including logistics, electrification of vehicles, and autonomous trucks.

Rapid growth is being seen in the utilization of trucks and trailers for cargo transportation. People are more likely to demand the delivery of goods and products as a result of changing lifestyles and urbanization. Delivery to consumers is handled by suppliers, fast-moving consumer goods (FMCG) companies, e-commerce retailers, and suppliers. This has led to a rise in the demand for semi-trailers in the global market.

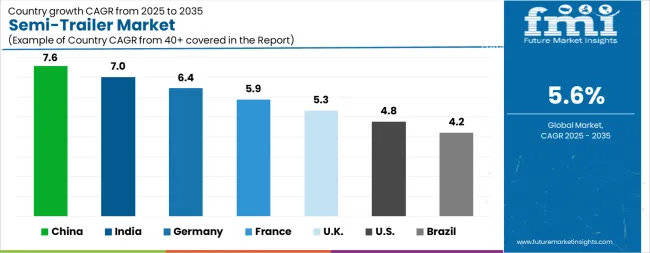

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The Semi-Trailer Market is expected to register a CAGR of 5.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.6%, followed by India at 7.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.2%, yet still underscores a broadly positive trajectory for the global Semi-Trailer Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.4%. The USA Semi-Trailer Market is estimated to be valued at USD 14.6 billion in 2025 and is anticipated to reach a valuation of USD 23.2 billion by 2035. Sales are projected to rise at a CAGR of 4.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.8 billion and USD 995.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 38.7 Billion |

| Type | Lowboy, Flatbed, Refrigerated, Dry Van, and Others |

| Tonnage | 25 To 50 Tons, <25 Tons, 50 To 100 Tons, and >100 Tons |

| Number Of Axles | 3 To 4 Axles, <3 Axles, and >4 Axles |

| End-Use | Heavy Industry, FMCG, Automotive, Logistic, and Healthcare |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Qingdao CIMC Special Vehicles Co., Ltd, Fontaine Trailer, Great Dane A Division of Great Dane LLC., Kögel, KRONE Trailer, LAMBERET SAS, Polar Tank Trailer., Schmitz Cargobull., Utility Trailer Manufacturing Company, Wabash National Corporation., and HYUNDAI TRANSLEAD |

The global semi-trailer market is estimated to be valued at USD 38.7 billion in 2025.

The market size for the semi-trailer market is projected to reach USD 66.8 billion by 2035.

The semi-trailer market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in semi-trailer market are lowboy, flatbed, refrigerated, dry van and others.

In terms of tonnage, 25 to 50 tons segment to command 35.2% share in the semi-trailer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA