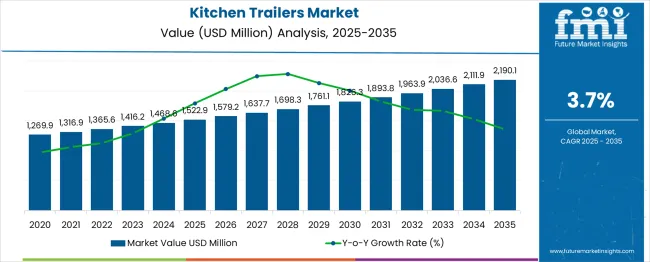

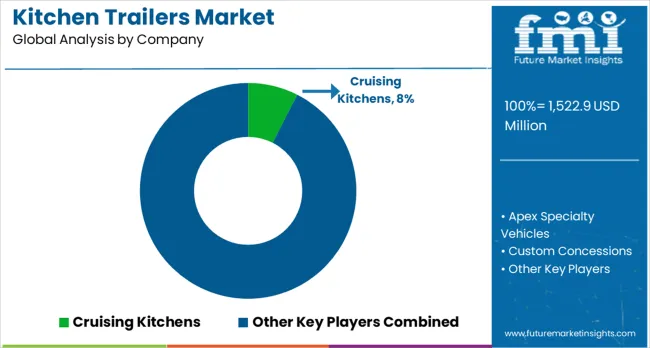

The global kitchen trailers market is projected to grow from USD 1,522.9 million in 2025 to approximately USD 2,190.0 million by 2035, recording an absolute increase of USD 673.5 million over the forecast period. This translates into a total growth of 44.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.7% between 2025 and 2035. The overall market size is expected to grow by nearly 1.44X during the same period, supported by the rising demand for mobile food service solutions and increasing adoption of specialized catering equipment for events, hospitality, and institutional applications.

Between 2025 and 2030, the kitchen trailers market is projected to expand from USD 1,522.9 million to USD 1,828.0 million, resulting in a value increase of USD 305.1 million, which represents 45.3% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for mobile food service solutions in urban areas, increasing adoption of food trucks in emerging markets, and growing popularity of outdoor catering and event services. Service providers are expanding their fleet capabilities to address the growing complexity of modern food service requirements and regulatory compliance.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,522.9 million |

| Forecast Value in (2035F) | USD 2,190.0 million |

| Forecast CAGR (2025 to 2035) | 3.7% |

From 2030 to 2035, the market is forecast to grow from USD 1,828.0 million to USD 2,190.0 million, adding another USD 368.4 million, which constitutes 54.7% of the overall ten-year expansion. This period is expected to be characterized by expansion of specialized kitchen trailer configurations, integration of advanced cooking and refrigeration technologies, and development of eco-friendly power solutions across different application sectors. The growing adoption of mobile catering services and disaster relief applications will drive demand for more sophisticated kitchen trailer designs and specialized equipment packages.

Between 2020 and 2025, the kitchen trailers market experienced steady expansion, driven by increasing adoption of mobile food services and growing demand for flexible catering solutions. The market developed as food service operators recognized the benefits of mobile kitchen units for reaching diverse customer bases and reducing overhead costs. Regulatory frameworks and food safety standards began establishing guidelines for mobile kitchen operations while supporting market growth.

Market expansion is being supported by the rapid increase in mobile food service demand worldwide and the corresponding need for specialized kitchen trailer solutions across various applications. Modern food service operations require flexible, fully-equipped mobile kitchens that can provide consistent food quality and safety standards while serving diverse locations and customer needs. The growing popularity of food trucks, outdoor events, and mobile catering services is driving demand for sophisticated kitchen trailer configurations.

The increasing focus on disaster preparedness and emergency response capabilities is creating significant opportunities for specialized kitchen trailers in government and institutional applications. Educational institutions, healthcare facilities, and corporate catering services are increasingly adopting mobile kitchen solutions to enhance their food service flexibility and operational efficiency. Regulatory requirements and health department specifications are establishing standardized kitchen trailer designs that require specialized equipment and certified installations.

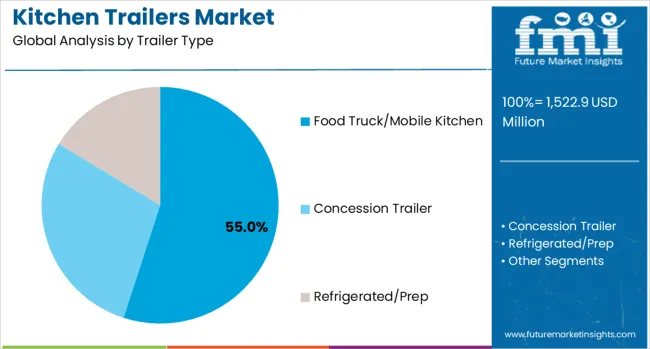

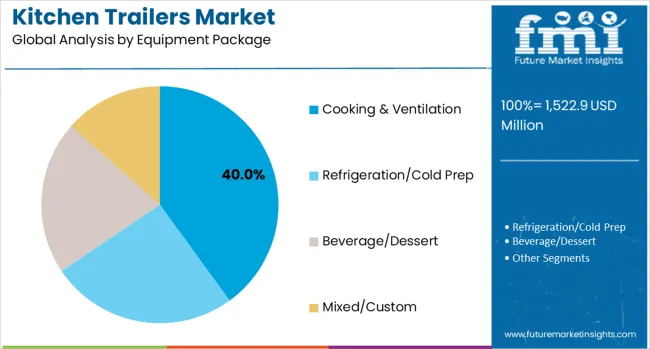

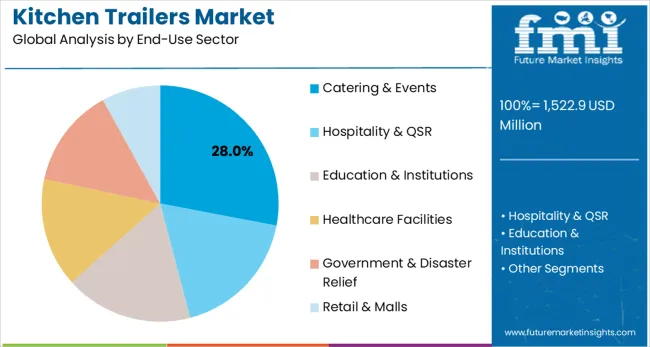

The market is segmented by trailer type, power/utilities, equipment package, end-use sector, and region. By trailer type, the market is divided into food truck/mobile kitchen, concession trailer, and refrigerated/prep units. Based on power/utilities, the market is categorized into generator-powered, shore power, and hybrid systems. In terms of equipment package, the market is segmented into cooking & ventilation, refrigeration/cold prep, beverage/dessert, and mixed/custom configurations. By end-use sector, the market is classified into catering & events, hospitality & QSR, education & institutions, healthcare facilities, government & disaster relief, and retail & malls. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The food truck/mobile kitchen segment is projected to account for 55% of the kitchen trailers market in 2025, making it the dominant trailer type. These units are increasingly popular across urban and suburban markets, where mobile food services cater to fast-paced consumer lifestyles and growing street food culture. Equipped with comprehensive cooking facilities, storage, and customer service windows, food truck trailers are well-suited for both independent entrepreneurs and restaurant brands looking to expand into mobile formats.

This segment benefits from well-established trailer designs, broad equipment compatibility, and flexible layouts that support a wide variety of cuisines. Suppliers offer standardized as well as customizable solutions, making food trucks accessible to small businesses while also scalable for larger chains. Rising consumer demand for convenience, diversity in dining options, and experiential food formats ensures continued growth of food truck/mobile kitchen trailers as the market leader.

Generator-powered kitchen trailers are expected to represent 50% of the power/utilities demand in 2025, reflecting their critical role in enabling mobile food operations. Unlike grid-powered alternatives, generator-based systems provide independence from external power sources, allowing kitchen trailers to function at events, construction sites, and remote venues. This makes them particularly valuable for operators that prioritize flexibility and reliability.

The segment is further supported by advancements in fuel-efficient and low-noise generator technologies, which reduce operational costs while improving environmental performance. Growing demand for autonomous and portable solutions also drives adoption, as food operators seek to maximize mobility without sacrificing functionality. With the mobile food industry continuing to expand into diverse environments, generator-powered trailers remain the most practical and versatile utility configuration, ensuring they maintain leadership in the market.

The cooking & ventilation equipment package segment is projected to account for 40% of the kitchen trailers market in 2025, representing the core functionality required in most trailer applications. These packages typically include commercial-grade stoves, fryers, ovens, and grills, paired with high-capacity exhaust hoods and ventilation systems. Together, they ensure safe, compliant, and efficient food preparation in mobile environments.

This segment is supported by the universal need for robust cooking capability and adherence to local health regulations, which require proper ventilation and fire safety measures. Equipment suppliers increasingly design modular packages that accommodate diverse menus, from fast food to specialty cuisines. With food safety requirements becoming more stringent and consumers expecting restaurant-quality meals from mobile vendors, cooking and ventilation systems remain the foundation of the kitchen trailer equipment market.

The catering & events segment is estimated to hold 28% of the kitchen trailers market in 2025, highlighting its role as a significant end-use sector. Weddings, corporate functions, festivals, and private gatherings increasingly rely on mobile kitchen trailers to provide flexible, high-quality food service at venues where permanent facilities are limited. These trailers allow caterers to prepare and serve meals on-site, ensuring freshness and efficiency.

The segment also benefits from growing consumer demand for personalized dining experiences and convenience in event planning. Specialized catering companies invest in adaptable trailer configurations that can handle varying service volumes and menu styles. With the global events industry continuing to expand, particularly in emerging markets, the need for mobile catering solutions is expected to rise, securing the catering & events sector as a key driver of kitchen trailer demand.

The kitchen trailers market is advancing steadily due to increasing mobile food service adoption and growing recognition of operational flexibility benefits. However, the market faces challenges including high initial equipment costs, need for continuous compliance with evolving food safety regulations, and varying operational requirements across different jurisdictions. Standardization efforts and certification programs continue to influence equipment quality and market development patterns.

The growing deployment of specialized kitchen trailer configurations is enabling customized solutions for specific food service applications, from gourmet food trucks to disaster relief operations. Advanced equipment packages provide comprehensive cooking, refrigeration, and service capabilities while maintaining portability and regulatory compliance. These configurations are particularly valuable for operators requiring specific equipment combinations and high-volume food production capabilities.

Modern kitchen trailer manufacturers are incorporating eco-friendly power systems and energy-efficient refrigeration technologies that reduce environmental impact and operating costs. Integration of solar power systems, advanced battery storage, and hybrid power solutions enables more sustainable mobile food service operations. Advanced technologies also support operation of next-generation cooking equipment including induction systems and energy-efficient ventilation.

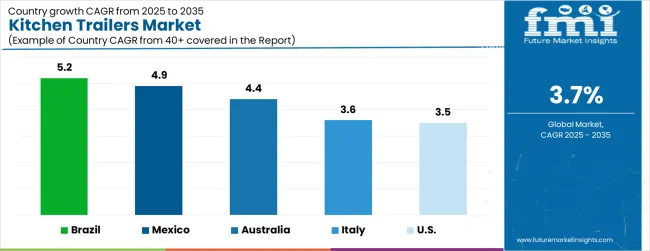

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.2% |

| Mexico | 4.9% |

| Australia | 4.4% |

| Italy | 3.6% |

| United States | 3.5% |

The kitchen trailers market is growing rapidly, with Brazil leading at a 5.2% CAGR through 2035, driven by expanding food truck culture, urbanization trends, and growing mobile food service adoption. Mexico follows at 4.9%, supported by rising street food modernization and increasing mobile catering demand in tourist and urban areas. Australia grows steadily at 4.4%, integrating mobile kitchen solutions into its established food service industry. Italy records 3.6%, emphasizing quality food preparation and mobile catering services. The USA shows steady growth at 3.5%, focusing on food truck innovation, regulatory compliance, and market maturation. Overall, Brazil and Mexico emerge as the leading drivers of global kitchen trailers market expansion.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from kitchen trailers in Brazil is projected to exhibit the highest growth rate with a CAGR of 5.2% through 2035, driven by rapid expansion of food truck operations and increasing consumer acceptance of mobile food services. The country's growing urban population and expanding middle class are creating significant demand for convenient, affordable food options served from mobile kitchen units. Major food service operators and entrepreneurs are establishing comprehensive mobile kitchen fleets to serve diverse metropolitan and tourist markets.

Revenue from kitchen trailers in Mexico is expanding at a CAGR of 4.9%, supported by modernization of traditional street food operations and growing demand for mobile catering services in tourist and business districts. The country's established food culture and increasing focus on food safety standards are driving adoption of professional kitchen trailer solutions. Authorized mobile food operators and catering companies are gradually establishing capabilities to serve growing consumer demand for high-quality mobile food services.

Revenue from kitchen trailers in Australia is growing at a CAGR of 4.4%, driven by innovation in mobile food service operations and increasing adoption of specialized catering solutions for events and institutional applications. The country's established food service industry is integrating advanced kitchen trailer technologies to enhance operational flexibility and customer reach. Food service operators and catering companies are investing in sophisticated equipment packages and power systems to address growing market demand.

Demand for kitchen trailers in Italy is projected to grow at a CAGR of 3.6%, supported by the country's emphasis on food quality and growing adoption of mobile catering services for events and tourism applications. Italian food service operators are implementing comprehensive kitchen trailer solutions that maintain traditional cooking methods while providing operational mobility. The market is characterized by focus on quality equipment, advanced food preparation capabilities, and compliance with stringent food safety regulations.

Demand for kitchen trailers in the USA is expanding at a CAGR of 3.5%, driven by continued innovation in food truck operations and growing emphasis on specialized mobile catering solutions. Large food service networks and independent operators are establishing comprehensive kitchen trailer fleets to serve diverse customer needs across urban and suburban markets. The market benefits from established regulatory frameworks and comprehensive equipment availability that support consistent service quality and operational compliance.

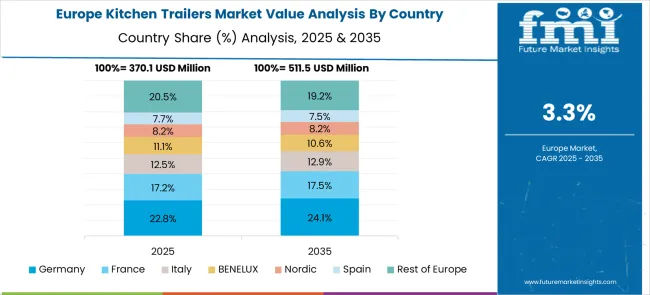

The European kitchen trailers market demonstrates sophisticated development across major economies with the UK leading through its mobile catering expertise and specialized vehicle manufacturing sector, supported by companies like The Trailer Company (UK) and Prestige Food Trucks pioneering innovative mobile kitchen technologies for diverse applications. Italy shows significant strength through VS Veicoli Speciali, leveraging expertise in specialized vehicle manufacturing and custom design solutions.

Germany and France exhibit expanding adoption in event catering and emergency response applications, driven by growing demand for mobile food service solutions. Eastern European countries contribute through companies like Karpatia Trucks, focusing on cost-effective and robust trailer solutions. The market benefits from strict food safety regulations, quality manufacturing standards, and growing demand for mobile catering services across festivals, corporate events, and emergency response scenarios. Nordic countries emphasize sustainable and energy-efficient mobile kitchen solutions, while Mediterranean regions show growing interest in tourism and hospitality applications. The region's leadership in automotive engineering and food safety standards positions Europe as a key innovation center for next-generation kitchen trailer solutions across multiple applications.

The kitchen trailers market is defined by competition among specialized manufacturers, mobile food service companies, and equipment suppliers. Companies are investing in advanced kitchen designs, sustainable power systems, standardized configurations, and comprehensive service support to deliver reliable, efficient, and cost-effective kitchen trailer solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Apex Specialty Vehicles, USA-based, offers comprehensive kitchen trailer manufacturing with focus on custom configurations, quality construction, and technical innovation. Cruising Kitchens, operating in the USA, provides specialized mobile kitchen solutions with emphasis on food truck designs and operational efficiency. Custom Concessions, USA, delivers technologically advanced kitchen trailer systems with standardized procedures and comprehensive equipment packages. Karpatia Trucks, Netherlands, emphasizes European market solutions and international expansion capabilities.

Marioffert Food Trucks, Spain, offers kitchen trailer solutions integrated with European food service standards and regulatory compliance. MobiChef Trailers, UAE, provides comprehensive kitchen trailer manufacturing with focus on Middle Eastern markets and specialized configurations. Prestige Food Trucks, USA, delivers high-quality kitchen trailer solutions with emphasis on premium designs and advanced equipment integration. Prime Design Food Trucks, USA, offers specialized manufacturing expertise and customization capabilities.

The Trailer Company (UK), operating in the UK, provides kitchen trailer solutions with focus on European markets and regulatory compliance. VS Veicoli Speciali, Italy, offers specialized kitchen trailer manufacturing with emphasis on quality construction, advanced equipment integration, and comprehensive service support across European and international markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,522.9 Million |

| Trailer Type | Food Truck/Mobile Kitchen, Concession Trailer, Refrigerated/Prep |

| Power/Utilities | Generator-Powered, Shore Power, Hybrid |

| Equipment Package | Cooking & Ventilation, Refrigeration/Cold Prep, Beverage/Dessert, Mixed/Custom |

| End-Use Sector | Catering & Events, Hospitality & QSR, Education & Institutions, Healthcare Facilities, Government & Disaster Relief, Retail & Malls |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Apex Specialty Vehicles, Cruising Kitchens, Custom Concessions, Karpatia Trucks, Marioffert Food Trucks, MobiChef Trailers, Prestige Food Trucks, Prime Design Food Trucks, The Trailer Company (UK), and VS Veicoli Speciali |

| Additional Attributes | Dollar sales by trailer size and equipment configuration, regional demand trends, competitive landscape, buyer preferences for rental versus ownership models, integration with mobile catering/foodservice platforms, innovations in lightweight materials, modular layouts, and energy-efficient appliances |

The global kitchen trailers market is estimated to be valued at USD 1,522.9 million in 2025.

The market size for the kitchen trailers market is projected to reach USD 2,190.1 million by 2035.

The kitchen trailers market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in kitchen trailers market are food truck/mobile kitchen, concession trailer and refrigerated/prep.

In terms of power/utilities, generator-powered segment to command 50.0% share in the kitchen trailers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kitchen/ Toilet Roll Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Tools and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Hood System Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Hood Market Insights – Trends & Growth Forecast 2025 to 2035

Kitchen Islands and Carts Market

Kitchen Storage Market

Kitchen & Dining Furniture Market

Toy Kitchens and Play Food Market Size and Share Forecast Outlook 2025 to 2035

MEA Kitchen Storage Market Growth – Trends & Forecast 2025 to 2035

Smart Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Cloud Kitchen Market Trends – Size, Demand & Forecast 2025-2035

Small Kitchen Appliances Market Growth – Demand & Trends to 2033

Outdoor Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Built-In Kitchen Appliance Market Outlook – Size, Share & Innovations 2025 to 2035

Household Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Table and Kitchen Linen Market Size and Share Forecast Outlook 2025 to 2035

Commercial Kitchen Ventilation System Market Growth - Trends & Forecast 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA