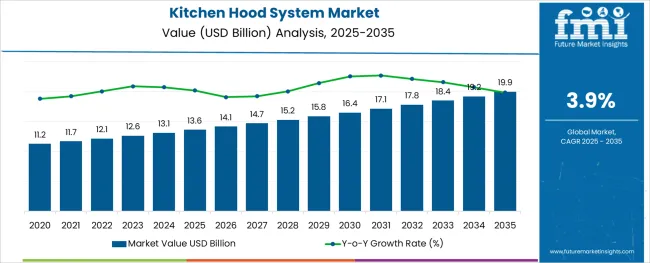

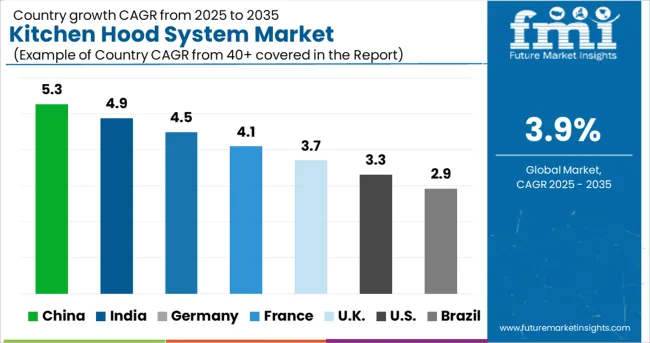

The Kitchen Hood System Market is estimated to be valued at USD 13.6 billion in 2025 and is projected to reach USD 19.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

The kitchen hood system market is experiencing steady growth as rising urbanization, changing lifestyle patterns, and heightened focus on indoor air quality continue to drive demand. Increasing awareness of the health risks associated with indoor pollutants and cooking fumes has motivated widespread adoption in both residential and commercial settings.

Advancements in design aesthetics and energy-efficient technologies have further enhanced consumer appeal, while regulatory pressures to improve ventilation standards have reinforced market expansion. Future growth is expected to be shaped by the integration of smart controls, improved noise reduction mechanisms, and premium finishes catering to evolving consumer preferences.

The shift toward sustainable materials and the trend of open kitchen designs are paving the way for broader penetration and long-term growth opportunities.

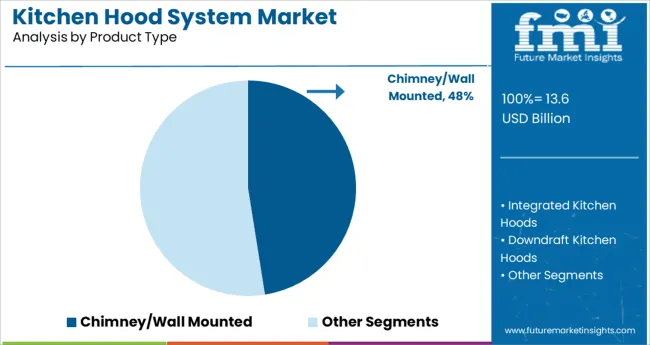

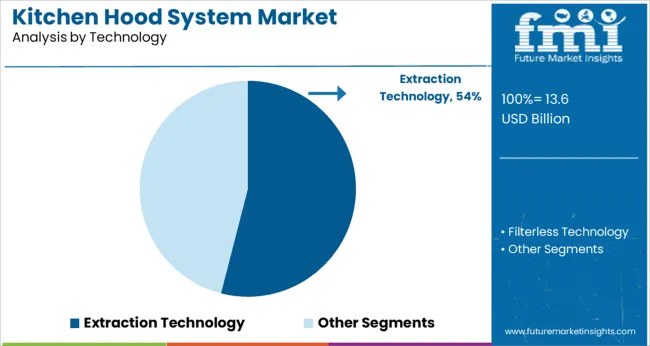

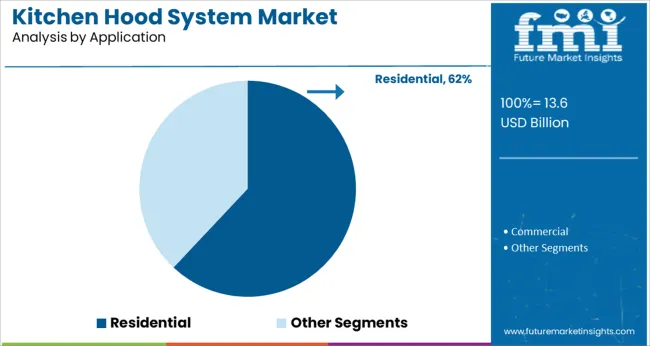

The market is segmented by Product Type, Technology, Application, and Sales Channel and region. By Product Type, the market is divided into Chimney/Wall Mounted, Integrated Kitchen Hoods, and Downdraft Kitchen Hoods. In terms of Technology, the market is classified into Extraction Technology and Filterless Technology. Based on Application, the market is segmented into Residential and Commercial. By Sales Channel, the market is divided into Multi-Branded Stores, Exclusive Stores, Online Stores, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Chimney Wall Mounted Product Type Segment

When segmented by product type the chimney wall mounted segment is projected to hold 47.5% of the total market revenue in 2025 positioning itself as the leading product type. This leadership has been reinforced by its space-saving design which aligns well with modern kitchen layouts and its ability to effectively channel fumes and grease away from cooking areas.

The segment has also benefited from its versatility to complement a wide range of interior styles making it a preferred choice among homeowners and developers alike. Enhanced suction power and ease of installation have further contributed to its popularity in residential and light commercial spaces.

The ability to combine functionality with aesthetic appeal has ensured its dominance particularly in urban households where optimizing both space and air quality is critical.

Segmented by technology the extraction technology segment is expected to account for 54.0% of the market revenue in 2025 making it the leading technology segment. This prominence has been driven by its proven efficiency in removing smoke odors and airborne grease more effectively than recirculation alternatives.

Manufacturers have increasingly focused on enhancing motor performance and energy efficiency within extraction systems which has improved their operating costs and environmental footprint. The segment’s strong position is also supported by its compatibility with advanced filtration technologies enabling better compliance with indoor air quality norms.

Its ability to deliver robust ventilation performance and meet the needs of demanding cooking environments has solidified its leadership in both residential and commercial applications.

When segmented by application the residential segment is forecast to capture 62.0% of the market revenue in 2025 maintaining its dominance as the primary application segment. This leadership has been shaped by the widespread adoption of modular kitchens rising disposable incomes and heightened awareness of the benefits of proper kitchen ventilation among homeowners.

The trend toward smaller living spaces and open-plan kitchens has underscored the necessity for efficient and quiet ventilation solutions driving demand within this segment. Innovations in design customization and user-friendly controls tailored specifically for home use have further bolstered its appeal.

The residential segment has also been strengthened by its alignment with government initiatives promoting healthy indoor environments ensuring its continued prominence in the kitchen hood system market.

Appliances for the home kitchen are becoming quite popular in several areas throughout the world. The use of technologically advanced kitchen gadgets like kitchen exhaust hoods has been greatly influenced by busy lives. Manufacturers of kitchen hood systems are attempting to gain market share through social media. More customers are drawn in by various promotions, campaigns, commercials, and deals.

The developers of kitchen hood systems are making investments in new product research and development. This can be attributed to the existence of hydraulic efficiency requirements, such as those about venting and ventilation systems for ovens, as well as restrictions for fuel combustion emissions associated with operations. Manufacturers now carve sweeping patterns into marble as part of interior decoration, combining the kitchen hood and backsplash with a startling sinuousness.

By introducing technologically advanced kitchen hood systems that are collected with the Internet of Things, manufacturers are catering to consumers. Global manufacturers are incorporating up-to-date technology like noise reduction, internet connectivity, and the inclusion of sensors like infrared and optical in hoods. Innovative goods including self-cleaning appliances, transportable kitchen hoods, and UV protection hoods are being developed by manufacturers. Smart home kitchen appliances are anticipated to gain appeal during the forecast year.

| Report Attribute | Details |

|---|---|

| Kitchen Hood System Market Value (2025) | USD 12.58 Billion |

| Kitchen Hood System Market Anticipated Value (2035) | USD 18.45 Billion |

| Kitchen Hood System Market Projected Growth Rate (2025 to 2035) | 3.9% |

| Kitchen Hood System Market Historical Growth Rate (2020 to 2025) | 1.5% |

After conducting a thorough market analysis, analysts from Future Market Insight found that the kitchen hood system market has witnessed significant growth in recent years. From 1.5% between 2020 and 2025 to 3.9% between 2025 and 2035, the CAGR of this market climbed progressively. The overall market value increased by around USD 13.6 million from 2025 to 2025.

Major factors influencing the current global expansion of restaurants and hotels, as well as rapid urbanization in developing nations, are what dominate the kitchen hood system market. From fast food to dining and quick service, many nations and cultures have distinct types of service. The hotel business is expanding constantly. The expansion of the hotel sector is being fueled by an increase in consumer buying power, a need for distinctive travel experiences, and an increase in the number of virtual influences. As a result, an expanding number of hotels are driving the adoption of kitchen hood systems.

Another important element driving the growth of the kitchen hood system market is the changing lifestyles of people around the globe. Consumers now demand wirelessly accessible smart home appliances with cutting-edge features like sensor devices for performance enhancement. On the other hand, the introduction of strict hygiene and cleanliness standards in restaurants and other food chains mandating the installation of kitchen cooking hoods.

Over time, people have identified the importance of installing kitchen hood systems because of the advantages it offers, including heat reduction, clean air maintenance, greater safety, and consumer awareness of the value of maintaining a clean and healthy cooking environment. The growth of e-commerce retail channels, increasing disposable income, and successful strategic marketing activities are further factors that support the kitchen hood system market. Additionally, during the foreseeable period, kitchen hood system market participants will have access to considerable prospects due to recent breakthroughs and debuts.

Chimney/ Wall Mounted - By Product Type

The kitchen hood system market is segmented into chimney/wall-mounted, integrated kitchen hoods, and downdraft kitchen hoods based on the top product type. The chimney/wall-mounted category is anticipated to have the largest global market share throughout the projected period, accounting for almost 39.4% of the entire market. The following factors are boosting market expansion:

Extraction Technology - By Technology

The kitchen hood system market is bifurcated into extraction technology and filterless technology in terms of technology. Since it is the most accepted technology among these categories among customers, the extraction technology segment has the biggest market share, which is around 58.2% of the global market. The following factors are accountable for its ongoing development:

The kitchen hood system market in North America is still dominated by the USA. By the end of 2035, the US kitchen hood system market is expected to acquire almost 21.6% of the entire market. The primary market drivers are the quick uptake of technological innovations and the resulting requirement for connected and smart devices. The demand for kitchen hood systems in the USA is also rising due to the ongoing expansion of the residential sector brought on by the rising number of families and significant home renovation projects carried out by individuals.

Instead of doing routine maintenance, homeowners are spending more on initiatives that improve their quality of life. In addition, the trend of millennials purchasing houses, especially older properties, is increasing the demand for repairs. According to HomeAdvisor research, millennials invest in more home improvement projects annually than other age groups do. The growing tendency will increase demand for kitchen hood systems in the USA.

Kitchen hood system market expansion in Europe, particularly in the UK, is being driven by rising preference as a result of more consumer understanding of the advantages of the products. The UK kitchen hood system market is anticipated to expand at a CAGR of 6.9% during the forecast period. The presence of several eateries and hotels, a sizable tourist sector, and high consumer disposable income are the primary drivers of domination. Additionally, the market in this country is also expanding due to rising demand for customized kitchens, rising expenditure on kitchen belongings, and rising disposable income.

As the number of working people rises, there is a growing need for simple home cleaners, which is further boosting the supply. Furthermore, factors like the development of the hospitality sector, rising consumer health consciousness, stringent government energy efficiency regulations, rising demand for energy-efficient and cost-effective products, and expansion of the food service sector are also contributing to the expected growth of the UK kitchen hood system market.

The Chinese kitchen hood system market is expanding quickly due to rising consumer buying power and strong demand brought on by more customer understanding of the advantages of the products. China is expected to grow at a CAGR of 8.2% during the forecast period. China is expected to have vast potential in the upcoming years due to its rapidly rising population. The demand for the product is also being driven by an increase in the demand for practical cleaning solutions due to the rising number of working people. Consumers favour practical kitchen designs, such as modular patterns, which are likely to further fuel demand, given the rising urbanization and the widespread tendency of small and compact dwellings.

A significant manufacturer of both industrial and consumer goods worldwide is China. Rising disposable income in China is anticipated to accelerate kitchen hood system market expansion soon. Modern cooking equipment is being purchased by the growing working population. Hong Kong is the leading export market of China, more than 80% of kitchen hood systems are from China. Due to the growing number of Quick Service Restaurants (QSRs) and new eateries, the requirement for cooking hoods is also expected to increase nationwide.

New competitors in the kitchen hood system market are developing fresh goods and obtaining a competitive edge by utilizing technical breakthroughs. These companies continuously spend money on Research and Development in order to stay on top of changing customer tastes and expectations from the end-use industry. Sales of kitchen hood systems are aided by initiatives taken by start-ups to improve their standing in the global market.

Leading Start-ups in the Kitchen Hood System Market Right Now

Kitchen Air Inc - United States of America

After recognizing a clear need for a different sort of service provider in the niche field of commercial kitchen ventilation, Kitchen Air Inc. was established in January 2010. A certified member of the National Balancing Council since 2013, Kitchen Air Inc. started offering airflow testing and balancing services for whole restaurants in 2013 and is still doing so today. Kitchen Air Inc started creating its own kitchen ventilation systems in 2020 and started privately labeling them. The first Grease Hood Filter deep Cleaning/Exchange division was introduced by Kitchen Air Inc. in 2020.

Sagar Air Pvt Ltd - India

In 1987, V V Murthy launched Sagar Air Pvt Ltd. Since its beginning, Sagar Air has worked diligently to provide cutting-edge technology in several HVAC & R industries. This sector stands out as one of India's oldest producers of HVAC equipment. AHUs, Air Washers, Wet Scrubbers, Air Ventilation Units, FCUs, Plenums, kitchen hoods, industrial Centrifugal Fans, Axial Flow Fans, and Air Distribution Products- Grilles, Dampers, Diffusers, and Desiccant Dehumidifiers are just a few of the many HVAC components the firm offers.

In 2010, Elica SpA established a joint venture in India called Elica PB Whirlpool Kitchen Appliances Private Limited (formerly Elica PB India Private Limited). Pune, Maharashtra, is where the Indian manufacturing facility is situated. The machinery, automated assembly lines, and equipment in this cutting-edge manufacturing facility were all imported from Italy. Italy provides technical help for each production phase. With the ability to manufacture more than 15 kinds of built-in cooktops and more than 50 variations of kitchen exhaust. The company is prepared to completely transform the Indian kitchen hood system market.

Every home needs a kitchen, and Ciarra Appliances, a top manufacturer of professional cooking hoods, is aware of this. The business has been around for a while and has planned ahead to provide more enjoyable culinary experiences.

Impex Appliances Pvt. Ltd., a manufacturer, importer, and marketer of appliances and home goods in India and the Middle East, offers a variety of items in the kitchen appliance, home appliance, and home entertainment sectors. It boasts an expanding professional business system and efficient, qualified management. The business sells its goods under a variety of well-known names, including Impex and luxury labels like Delici. With a range of almost 400 items, more than 100 regional partners, and 5000 retailers, Impex has a solid reputation in the market and industry.

Recent Developments

The global kitchen hood system market is estimated to be valued at USD 13.6 billion in 2025.

It is projected to reach USD 19.9 billion by 2035.

The market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types are chimney/wall mounted, integrated kitchen hoods and downdraft kitchen hoods.

extraction technology segment is expected to dominate with a 54.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kitchen/ Toilet Roll Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Tools and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Trailers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Kitchen Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Islands and Carts Market

Kitchen Storage Market

Kitchen & Dining Furniture Market

Kitchen Hood Market Insights – Trends & Growth Forecast 2025 to 2035

Toy Kitchens and Play Food Market Size and Share Forecast Outlook 2025 to 2035

MEA Kitchen Storage Market Growth – Trends & Forecast 2025 to 2035

Smart Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Cloud Kitchen Market Trends – Size, Demand & Forecast 2025-2035

Small Kitchen Appliances Market Growth – Demand & Trends to 2033

Outdoor Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Built-In Kitchen Appliance Market Outlook – Size, Share & Innovations 2025 to 2035

Household Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Table and Kitchen Linen Market Size and Share Forecast Outlook 2025 to 2035

Commercial Kitchen Ventilation System Market Growth - Trends & Forecast 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA