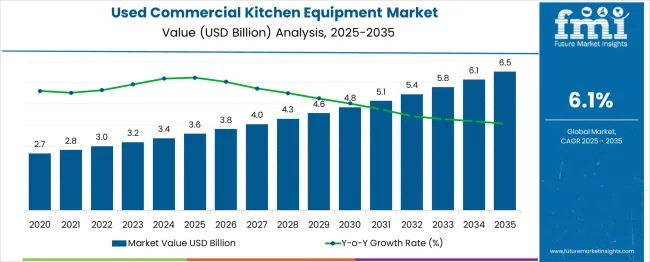

The Used Commercial Kitchen Equipment Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 6.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

The used commercial kitchen equipment market is gaining momentum as cost-consciousness, sustainability imperatives, and the growth of the foodservice sector align to create favorable conditions. Businesses are increasingly opting for refurbished or pre-owned equipment to minimize capital expenditure without compromising operational efficiency.

The market has been shaped by a heightened awareness of environmental impact, as reuse of durable kitchen assets supports circular economy principles and reduces waste. Future expansion is expected to be facilitated by the increasing number of restaurants and cloud kitchens, particularly in emerging markets, where affordability is a primary concern.

Improvements in equipment refurbishment practices, combined with the growing professionalization of the secondary market, are paving the way for further adoption. Rising entrepreneurial activity and demand for flexible kitchen setups are expected to sustain market growth and strengthen its position in the broader foodservice supply chain.

The market is segmented by Equipment and Application and region. By Equipment, the market is divided into Cooking Equipment, Refrigeration Equipment, Storage Equipment, Food Prep Equipment, and Others. In terms of Application, the market is classified into Full-Service Restaurants, Quick Service Restaurants, Indoor & Outdoor Canteens, Commercial Canteens, Hotels & Resorts, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Equipment and Application and region. By Equipment, the market is divided into Cooking Equipment, Refrigeration Equipment, Storage Equipment, Food Prep Equipment, and Others. In terms of Application, the market is classified into Full-Service Restaurants, Quick Service Restaurants, Indoor & Outdoor Canteens, Commercial Canteens, Hotels & Resorts, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by equipment, cooking equipment is projected to account for 34.50 % of the total market revenue in 2025, making it the leading equipment segment. This leadership is attributed to the essential role of cooking equipment in every foodservice operation, with demand being sustained by its high durability and ease of refurbishment.

The robust construction of ranges, ovens, grills, and fryers allows them to retain functionality even after extended use, which has encouraged their reuse. The segment has also benefited from operators prioritizing critical production assets when making cost-sensitive purchasing decisions, favoring secondhand options that deliver reliable performance at reduced cost.

Furthermore, the ability to source branded, high-quality equipment in the used market at accessible prices has reinforced confidence and adoption. This combination of functional necessity, durability, and economic advantage has positioned cooking equipment at the forefront of the used commercial kitchen equipment market.

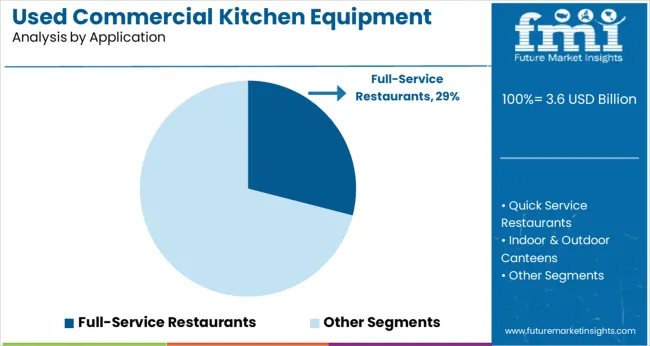

In terms of application, full service restaurants are expected to hold 29.00 % of the total market revenue in 2025, ranking as the leading application segment. This prominence has been supported by the segment’s extensive reliance on a broad array of kitchen equipment to deliver varied and complex menus, driving consistent demand for affordable solutions.

Full service operators have increasingly turned to the used market to maintain profitability in competitive environments while meeting operational needs. The segment has also been reinforced by the preference of restaurateurs for trusted, branded equipment that can be procured pre-owned and still perform reliably under high-volume conditions.

Additionally, the ability to refurbish and customize used equipment to fit specific kitchen layouts and menu requirements has added to its appeal. The growing number of independent restaurants and the pressure to optimize initial investments have solidified full service restaurants as the primary adopters of used commercial kitchen equipment.

Consumers rely on market players who assist them with everything they need to run a successful commercial kitchen or restaurant, from layout and design to a full-time working facility. These suppliers have expanded their end-user segment by marketing and distributing their products to customers that need to operate first-class commercial kitchens, restaurants, food trucks, concessions, bars, catering services, or even convenience stores. In addition, these players claim to be appreciated for their product features such as easy usability, smooth operations, high performance, and longer service life. They also offer repair services to their valued clients, along with customized products in line with the requirements detailed by these revered clients.

Most market players believe in the quality of their products which they claim can be used straight away without any further fine-tuning. Moreover, the adoption of used commercial kitchen equipment is likely to surge as the players have a strong relationship with their manufacturers and other suppliers who provide the best quality materials and also believe in consistently updating the collections. There are also a plethora of family-owned and operated businesses that have years of experience in the food & beverage industry, both offline and online. They offer a wide variety of quality, new, and used restaurant equipment, kitchen supplies, home furniture, and decor. Additionally, people can also buy and sell used commercial kitchen equipment through websites, at auctions, and at headquarter locations of the market players.

Certain market players stand behind their products and services and even provide their end users with guarantees and warranties. Furthermore, they also offer several food service accessories or items such as mixer bowls and attachments, mixer-grinder blades and knives, dough cutters, oven racks, and more. These factors are anticipated to drive product demand and create market opportunities that lead to the expansion of the global used commercial kitchen equipment market size.

Quick-service restaurants and full-service restaurants are increasing in number across the world. Hotels and restaurants require effective and advanced superior kitchen appliances for effective operations in the kitchen, at a lower cost. Hence, market players are focusing on accumulating used commercial kitchen equipment that is incorporated with advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), robotics, etc.

Certain market players are also collaborating with restaurants to promote and market their products and services and secure firm, semi-permanent relationships with these restaurants. Furthermore, the increasing awareness regarding food safety, energy-efficient equipment, and smart kitchen appliances are expected to spark innovations in the used commercial kitchen equipment market trends.

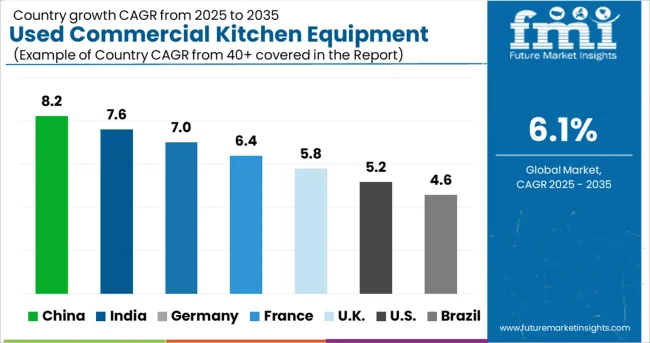

The statistics accumulated by Future Market Insights, reveal the global forum of used commercial kitchen equipment which has witnessed an unprecedented surge over the past few years. The manufacturers in the market are in conjunction with the increasing demand for used commercial kitchen equipment. There has been a gradual rise from a CAGR of 1.9% registered during the period of 2020 to 2025 and is likely to expand at a steady 6.1% in the forecast period.

The significant growth in the market can be attributed to the increasing demand for second-hand commercial kitchen equipment from restaurants, cafés, and hotels & resorts. By investing in used equipment, these establishments still have a remaining substantial budget that can be expended on other important amenities and facilities such as interior decor, social media marketing, staff hiring, furniture, etc.

An increasing number of people traveling for business purposes has surged the opening of several hotels and restaurants which is the main reason for the growth in the food service industry. People from all over the world are more likely to use commercial cooking equipment that has been improved. Additionally, the need for commercial cooking equipment is increasing owing to the growing popularity of modular kitchens with high-tech features. On the other hand, over the next few years, the used commercial kitchen equipment market share is likely to grow because more people want energy-efficient and cost-effective products, as cloud kitchens increase in popularity.

Refrigeration Equipment - By Equipment Type

By equipment type, the market is segmented into cooking equipment, refrigeration equipment, storage equipment, and food prep equipment. It has been studied by the analysts at Future Market Insights that the refrigeration equipment segment is estimated to hold a major market share, recording a CAGR of 43.1% through the forecast period.

The pivotal elements determining the momentum of this segment are:

Quick Service Restaurants - By Application Type

By application type, the market is segmented into full-service restaurants, quick-service restaurants, indoor & outdoor canteens, commercial canteens, and hotels & resorts. It has been researched by the analysts at Future Market Insights that the quick service restaurants segment is likely to hold a major market share, recording a CAGR of 26.4% through the forecast period.

The vital attributes determining the momentum of this segment are:

Cost-effective services that can be provided to improve food quality are being focused on by equipment manufacturers. Additionally, it has become obligatory to monitor and cater to the qualitative services of any equipment in the current market scenario. Hence, the adoption of used commercial kitchen equipment is likely to rise since key providers claim to sell equipment that undergo thorough cleaning and inspection.

Used commercial kitchen equipment is not only budget-friendly, but due to the high turnover rate of the restaurant industry, they also work like brand-new equipment. Moreover, the increased popularity of Quick Service Restaurants (QSRs) and the growth of the travel and tourism industry are estimated to propel product demand.

These equipment are being increasingly sold on e-commerce platforms. This is because online suppliers let the customer quickly compare a wide variety of brands and prices without having to visit a store. Furthermore, the growing sedentary lifestyle and lockdowns imposed by governments due to the pandemic have augmented the growth of QSRs which is expected to boost the demand for used commercial kitchen equipment.

One major hindrance that can decline the sales of purchasing used commercials is that many of the warranties in this equipment are no longer valid. Hence, the customer becomes responsible for the repair costs which be fairly expensive. Furthermore, the history of ownership or repairs is often unavailable to the customers. These factors are expected to hamper the market growth.

On the contrary, supportive government regulations are promoting energy-efficient commercial kitchen equipment which curbs energy consumption. In addition, key providers are able to expand their product portfolio owing to the steady entrance of various commercial kitchen equipment integrated with advanced technologies. This enhances their market presence and is anticipated to present lucrative market opportunities.

The United States of America currently holds the largest share of the used commercial kitchen equipment market with a revenue of 28.5%. This is attributed to the presence of several restaurant equipment suppliers. Moreover, the growth in this country is also owing to the high spending capacity of the people starting a restaurant business.

There has been an influx of new entrants in the restaurant business who are purchasing a range of commercial cookware to raise the kitchen performance and improve the menu. In addition, food trucks and fast-food joints have been increasing in number across the country which is expected to surge the demand for used commercial kitchen equipment.

Warehouses of most market players in the US are set to repair, recondition, and refurbish all types of used kitchen equipment. Before being promoted, each piece of equipment undergoes a rigorous 10-step used equipment restoration process. Furthermore, all used equipment is deep cleaned, including being completely detailed and stripped to ensure the best quality of the product.

The key companies employ a team of experienced technicians with more than 100 years of experience combined, who inspect, analyze, and complete all needed repairs and requirements. Moreover, the early adoption of technologically advanced equipment and increasing usage of different types of kitchen appliances in commercial spaces. These factors are likely to expand the global used commercial kitchen equipment market size.

With a revenue of 6.7%, the United Kingdom is a growing used commercial kitchen equipment market. This is owing to the food service business focusing on automated technology-enabled equipment. Furthermore, different types of commercial kitchen equipment are being increasingly used in business spaces.

Market players in the UK supply good quality refurbished kitchen equipment at competitive prices. This is because their extensive range of used commercial kitchen equipment gives big savings to the customer, compared to buying brand new equipment. This is likely to boost the global used commercial kitchen equipment market growth.

Players in the UK also offer various amenities for their end users such as site and extraction surveys, planning & installation services, catering equipment reconditioning, affordable reconditioned catering equipment supply, expert advice & commercial kitchen design, etc. Furthermore, suppliers in the UK also offer responses beyond working hours to ensure that their clients get back to operational efficiency expeditiously.

Several consumers gravitate towards used commercial kitchen equipment since the market players offer full kitchen equipment site clearances by recycling all redundant kitchen equipment, ranging from individual items to complete kitchen removals. This is likely to surge the demand for used commercial kitchen equipment.

India holds a moderate share of 8.7% in the global used commercial kitchen equipment market. This is attributed to the emerging hospitality industry and the growing investment by the key players, especially in the Asia Pacific region.

Restaurants in India are incorporating multi-cuisine food preparations such as Mexican, Italian, Japanese, and Continental in their food menu owing to an increasing number of customers who are interested in experimenting with new food and acquiring a taste for different cuisines. Hence, the adoption of used commercial kitchen equipment is surging in restaurants as they are affordable and cater to this growing demand.

Experienced professionals of the key companies use modern machines and tools, to select and supply these products in compliance with the set industry standards. Moreover, newly established hotel groups always look for used equipment considering the price benefit and rely on a reputable platform that supplies the best quality used segment. This is likely to surge the sales of used commercial kitchen equipment.

Australia is a growing used commercial kitchen equipment market with a revenue of 2%. This is owing to the rising popularity of different cuisines and the high number of restaurants and cafés in the country.

Market players in Australia offer a range of quality used commercial kitchen equipment, as well as used bakery equipment at prices that would not break the bank. Additionally, they continually promote special offers and deals every month, coupled with complimentary items when purchasing several pieces of used equipment.

The sales of used commercial kitchen equipment are estimated to increase, as go through operational checks, and are strong and durable that may go well beyond their warranty date if used with care. Furthermore, several e-commerce platforms are available for end users to purchase used kitchen equipment since the country has witnessed a rapid emergence of fine dining restaurants.

Start-up companies are getting creative with the accumulation of used commercial kitchen equipment and implementing various strategies to acquire equipment, especially those that are energy-efficient and equipped with advanced technologies such as AI, IoT, robotics, etc.

The increasing need for affordable kitchen equipment is accelerating the market share. This is because when a customer purchases commercial kitchen equipment from a reputable second-hand dealer or online store, customers can generally feel confident about the purchase as the latter usually inspect the equipment to ensure it is in working order before pricing it.

Start-up companies are recognizing the high demands from restaurants that are on a tight budget, which surges them to generate new and exciting trends. Through the advent of technology, and efforts by start-up companies, restaurants are able to access different kinds of used commercial kitchen equipment easily at affordable prices, which is likely to expand the global used commercial kitchen equipment market size.

To develop their market presence and strengthen their service offerings, the top market players are adopting strategies to acquire small regional players. Moreover, the development of innovative services and products are the result of increasing prices of kitchen equipment, which may be unattainable for new/start-up restaurant owners. These are likely to create promising scopes for the used commercial kitchen equipment market share.

TOP MARKET PLAYERS IN THE USED COMMERCIAL KITCHEN EQUIPMENT MARKET

iFoodEquipment.ca - It is a family-owned business and a leading restaurant supply store that works with businesses all across Canada. For over 10 years, they have partnered with big and small food service establishments, helping them with projects of every size.

Bid on Equipment - It was launched in 2001 in Hampshire, Illinois. The core concepts of this new venture were that the Item Listings and Buyer inquiries would be free of charge. Recognizing the potential of Internet sales in expanding their customer base, they decided to develop a marketplace that would allow other dealers to list their Packaging and Processing Machinery.

Machineseeker Group GmBH - It operates the leading online network for used machines and commercial vehicles in Europe with its marketplaces Machineseeker, the German equivalent Maschinensucher, TruckScout24, and Werktuigen with its English version W-Equipment. More than 10,000 sellers currently advertise over 250,000 machines on these platforms. Over 10 million monthly visitors generate an inquiry volume of more than 7 billion euros per month.

SilverChef - It provides flexible equipment finance for hospitality businesses. They are proudly investing more than USD 1 Billion into the hospitality industry - and counting. They are also a proud certified B Corp; a new kind of business that balances purpose with profit, changing the world for the better.

Gillette Restaurant Equipment - It has grown to be one of the area’s largest restaurant supply facilities with 2 locations and 5 warehouses. Gillette continues to add new product lines and increase the inventory amount of used equipment.

The latest developments in the used commercial kitchen equipment market are

The global used commercial kitchen equipment market is estimated to be valued at USD 3.6 billion in 2025.

It is projected to reach USD 6.5 billion by 2035.

The market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types are cooking equipment, _oven, _range, _deep fryer, _grill, _griddles, _holding equipment, _others, refrigeration equipment, _refrigerator, _freezer, _ice machine, _beverage dispensers, storage equipment, _shelving, _bussing and utility carts, _sheet pan racks, _others, food prep equipment, _food processors, _prep tables, _mixers, _spice grinder, _blenders and others.

full-service restaurants segment is expected to dominate with a 29.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Used EV Market Size and Share Forecast Outlook 2025 to 2035

Used E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Used Passenger Car Sales Market

Used Restaurant Equipment Market Size and Share Forecast Outlook 2025 to 2035

Used Commercial Freezer Market Size and Share Forecast Outlook 2025 to 2035

Focused Ultrasound System Market Trends and Forecast 2025 to 2035

CBD-Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cica-Infused Healing Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

GABA-Infused Drinks Market Size and Share Forecast Outlook 2025 to 2035

Metric Value Industry Size (2025E) USD 32.0 billion Industry Value (2035F) 46.9 billion CAGR (2025 to 2035) 3.9%

Herb-Infused Water Market Analysis by Nature, Packaging, Herb Type, and Region through 2025 to 2035

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Ectoin-Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cancer-focused Genetic Testing Service Market Analysis – Growth & Industry Insights 2024-2034

Peptide-Infused Anti-Aging Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Peptide-Infused Tinted Moisturizers Market Size and Share Forecast Outlook 2025 to 2035

Graphene Infused Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retinoid-Infused Night Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Caffeine-Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

Turmeric-Infused Actives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA