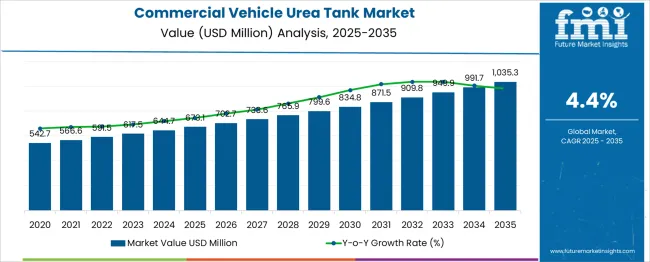

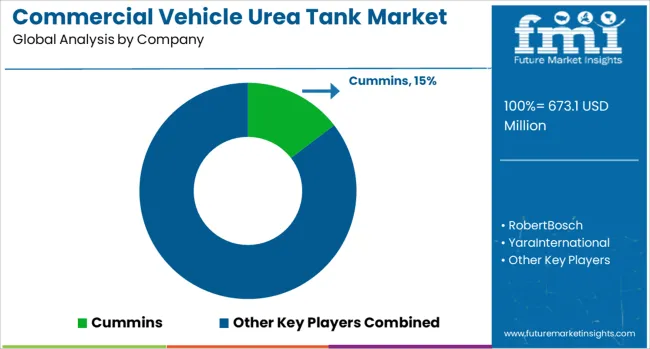

The Commercial Vehicle Urea Tank Market is estimated to be valued at USD 673.1 million in 2025 and is projected to reach USD 1035.3 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

The commercial vehicle urea tank market is set to expand from USD 673.1 million in 2025 to USD 1,035.3 million by 2035 at a 4.4 % CAGR. Ratio based analysis shows that during the first half decade (2025–2030) the market grows from USD 673.1 million to USD 799.6 million, adding USD 126.5 million or 34.9 % of total expansion. In the second half (2030–2035) it increases from USD 799.6 million to USD 1,035.3 million, contributing USD 235.7 million or 65.1 % of cumulative growth.

This establishes a contribution ratio of approximately 1.86:1 in favor of the latter phase. Phase multipliers reinforce acceleration dynamics: the first five‑year segment posts a 1.19× increase, while the second achieves 1.29×. Average annual additions rise from around USD 25.3 million per year in the early phase to roughly USD 47.1 million per year in the later phase, confirming a near doubling of yearly growth intensity.

Such an asymmetrical distribution indicates that demand drivers stricter emission requirements, retrofit programs, and aftermarket penetration are expected to intensify after 2030. Suppliers and OEMs will need to align capacity expansions, inventory buffers, and R&D roadmaps with this back loaded opportunity to optimize returns and manage supply‑chain dynamics effectively.

| Metric | Value |

|---|---|

| Commercial Vehicle Urea Tank Market Estimated Value in (2025 E) | USD 673.1 million |

| Commercial Vehicle Urea Tank Market Forecast Value in (2035 F) | USD 1035.3 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The commercial vehicle urea tank segment captures 20–22 % of the SCR systems market, since every heavy‑duty diesel fitted with SCR requires a dedicated diesel exhaust fluid (DEF) reservoir to meet NOx limits. Within the broader emission control components space, a share of 10–12 % is recorded, as diesel particulate filters, exhaust gas recirculation valves, and sensors command larger budgets.

Heavy‑duty truck and bus component spending assigns 3–4 % to urea tanks because driveline, chassis, and braking modules dominate investment. In the on‑highway powertrain fluid storage systems market-which spans fuel, hydraulic, coolant, and DEF tanks—urea reservoirs secure 25–28 %, reflecting rising DEF consumption under Euro VI and EPA 2027 regulations. The automotive fluid reservoirs and tanks category, covering windshield‑washer, coolant, fuel, and DEF containers across light and commercial vehicles, allocates 8–10 % to urea tanks.

Demand growth is being driven by tightening emission standards, fleet replenishment cycles, and telematics‑enabled DEF level monitoring that prevents derating penalties. Lightweight polyethylene designs, integrated heating elements for cold climates, and modular mounting brackets are being adopted to save mass and simplify installation, reinforcing the role of urea tanks in ensuring reliable SCR performance throughout diverse commercial vehicle duty cycles.

The commercial vehicle urea tank market is gaining traction globally as governments continue to enforce stringent emission norms under programs such as Euro VI, Bharat Stage VI, and China VI. The widespread adoption of Selective Catalytic Reduction systems in diesel-powered commercial vehicles has created consistent demand for durable and efficient urea storage solutions. Urea tanks have evolved to support vehicle-specific requirements in terms of placement flexibility, temperature stability, and capacity optimization.

Growth has been further driven by the accelerating production of commercial vehicles, increased freight movement, and stricter compliance mandates across regions. OEMs and component suppliers are investing in high-volume plastic molding techniques, integrated sensor systems, and modular tank designs to offer scalable solutions for fleets.

The need for lighter components to meet fuel efficiency goals, alongside improvements in chemical compatibility and freeze-resistance, is shaping product innovations in this space. As long-haul logistics, e-commerce delivery, and infrastructure projects expand globally, the demand for high-performance urea tanks is expected to sustain strong growth over the coming years.

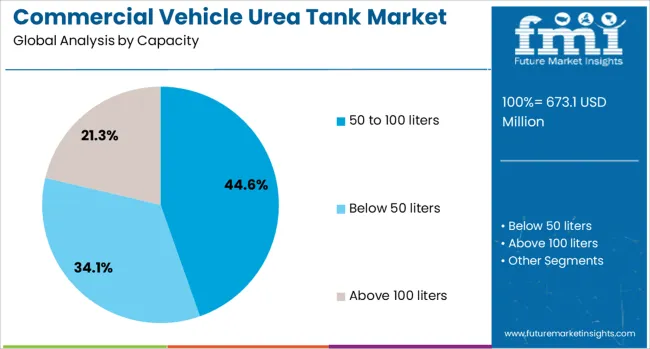

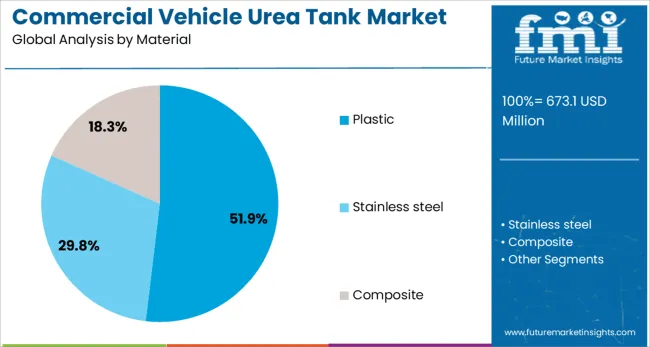

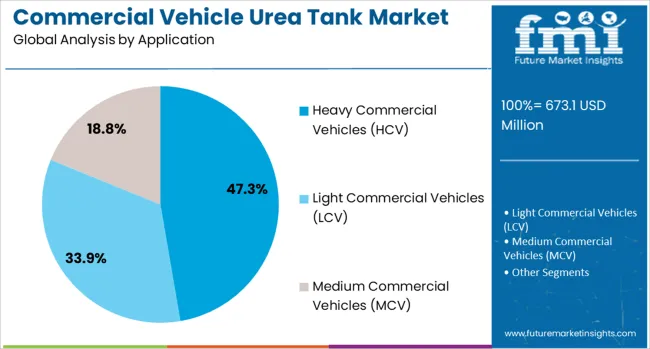

The commercial vehicle urea tank market is segmented by capacity, material, application, sales channel, and geographic regions. Based on the capacity of the commercial vehicle urea tank, the market is divided into 50 to 100 liters, below 50 liters, and above 100 liters. In terms of material, the commercial vehicle urea tank market is classified into Plastic, Stainless steel, and Composite. Based on the application of the commercial vehicle urea tank market, it is segmented into Heavy Commercial Vehicles (HCV), Light Commercial Vehicles (LCV), and Medium Commercial Vehicles (MCV). The commercial vehicle urea tank market is segmented by sales channel into OEM and Aftermarket. Regionally, the commercial vehicle urea tank industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 50 to 100 liters capacity segment is projected to account for 44.6% of the commercial vehicle urea tank market revenue share in 2025, making it the leading segment by volume. This dominance is being driven by the optimal balance this range offers between payload efficiency and fluid autonomy, particularly in medium to heavy-duty vehicles that operate across regional and long-haul routes.

The segment has benefited from the growing need for compact tank systems that can be integrated without sacrificing cargo space or violating underbody design constraints. OEMs have increasingly preferred this capacity range to ensure regulatory compliance with emission standards while minimizing refill frequencies.

The segment's growth is also supported by the rising adoption of mid-size trucks and heavy commercial vehicles in both emerging and developed logistics markets. Urea tanks in this capacity category have also demonstrated compatibility with advanced thermal insulation materials and inbuilt level sensors, making them suitable for varied climatic conditions and operational demands.

The plastic material segment is expected to hold 51.9% of the revenue share in the commercial vehicle urea tank market in 2025, underscoring its status as the most preferred material type. This preference has been largely attributed to the lightweight properties of engineered plastics, which contribute to improved fuel economy and lower total vehicle weight.

The chemical resistance of high-density polyethylene and polypropylene compounds used in urea tank manufacturing allows for long-term exposure to urea solutions without degradation, making them suitable for long-haul and high-frequency use. Plastic tanks also offer design flexibility, enabling more complex geometries that optimize underbody space utilization.

Advancements in blow molding and rotational molding processes have allowed manufacturers to produce high-strength, low-porosity tanks that meet both durability and emission compliance standards. Additionally, plastic urea tanks offer improved recyclability and cost-effective production scalability, factors that have reinforced their widespread adoption among commercial vehicle OEMs across global markets.

The heavy commercial vehicles segment is projected to contribute 47.3% of the total revenue share in the commercial vehicle urea tank market in 2025, representing the most prominent application category. The dominance of this segment is supported by the high engine output and extended operating ranges characteristic of heavy-duty trucks, which require larger and more durable urea tanks to ensure uninterrupted SCR system performance.

Regulatory pressure to reduce nitrogen oxide emissions from high-emission diesel fleets has led fleet operators and OEMs to integrate robust urea tank solutions tailored for HCV configurations. These vehicles often operate across extreme terrains and climates, demanding tank systems with high chemical resistance, temperature tolerance, and low maintenance.

The consistent demand for urea tanks in HCVs is further strengthened by the growth of cross-border logistics, infrastructure construction, and long-distance freight transportation. Manufacturers have responded by developing custom-fit tanks with integrated heating elements, level sensors, and anti-freeze mechanisms, enabling operational continuity under diverse environmental and load conditions.

Commercial vehicle urea tanks are components used in diesel engines equipped with selective catalytic reduction systems to reduce nitrogen oxide emissions. Adoption has increased across heavy-duty transport sectors as regulatory regimes have enforced stricter emission limits. Tanks are manufactured from high-density plastics, aluminum and stainless alloys to meet durability, chemical compatibility and thermal performance standards. Demand has been observed in long-haul trucking fleets, buses and vocational vehicles. Manufacturers offering corrosion-resistant construction, high purity lining and validated certification are positioned to support global clean vehicle deployment initiatives.

Commercial vehicle urea tanks are being supplied to fleets that operate diesel trucks, buses and utility vehicles subject to nitrogen oxide emission standards. As jurisdictions introduced tighter limits in line with Euro VI, BS VI or EPA Tier regulations, SCR systems with urea dosing have been mandated. Urea tanks capable of withstanding DEF chemistry, thermal cycling and vibration have been specified to ensure reliability across operating conditions. Fleet operators have sought tanks with low permeation rates, robust fill assemblies and standardized filling interfaces to simplify servicing and safety compliance. OEM partnerships and standardized retrofit kits have supported wider deployment in commercial vehicle lines. As emission compliance became central to fleet operations, secure urea tank solutions have been required for regulatory alignment and vehicle uptime.

Adoption of urea tanks has been limited by compatibility concerns related to material selection, sealing and DEF crystallization under varying temperature conditions. Improperly designed tanks may be affected by DEF contamination, thermal expansion or leak risk, compromising dosing accuracy and leading to system faults. Integration in older chassis or legacy vehicle platforms has required custom tank mounting, filling connections and exhaust packaging modifications. Certification under emission testing frameworks and crash safety protocols has added development time and cost. Availability of certified replacement tanks in aftermarket supply chains has been inconsistent, particularly in emerging markets where local sourcing is limited. As fleet owners balance emission compliance with retrofit complexity and cost, uptake has remained measured in price-sensitive regions.

Integration of level sensors and wireless communication modules within urea tanks is enabling real‑time monitoring of DEF consumption and refill alerts. Service providers are leveraging telematics platforms to offer predictive refill planning and route optimization, reducing downtime for commercial fleets. Bundled maintenance contracts covering tank inspection, DEF quality testing, and fluid delivery services are being introduced to enhance customer convenience. Growth in subscription‑based DEF provision models is expected to secure recurring revenue streams for OEMs and distributors. Expansion into off‑highway equipment, such as construction, mining, and agricultural vehicles, is opening new application segments. Partnerships with fuel station networks are being established to increase DEF availability in key logistics corridors, supporting broader market penetration.

Composite materials such as fiberglass‑reinforced plastics are being adopted to reduce tank weight without compromising structural integrity, improving vehicle payload capacity and fuel efficiency. Tanks featuring modular mounting kits facilitate rapid assembly and replacement in diverse chassis layouts. Advanced dosing systems with proportional valve control are being integrated to optimize DEF usage based on real‑time engine load and exhaust conditions. Automated self‑draining and cleaning mechanisms are emerging to simplify maintenance and prevent contamination. Connectivity standards for DEF quality sensors and tank telemetry are being standardized to ensure interoperability across vehicle makes and fleet management platforms. Focus on compact designs for dual‑tank configurations is increasing for urban delivery vans and light‑commercial vehicles, where space is constrained.

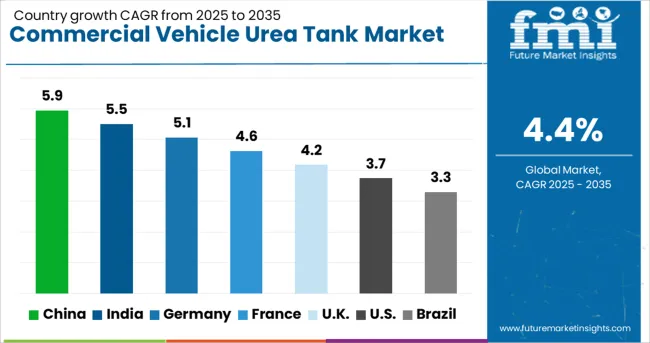

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The global commercial vehicle urea tank market is projected to grow at a 4.4% CAGR from 2025 to 2035, supported by emission control regulations and adoption of SCR (Selective Catalytic Reduction) systems. China leads with 5.9%, driven by domestic truck manufacturing and export growth in heavy-duty vehicles. India follows at 5.5%, fueled by BS-VI norms and increased production of commercial fleets for logistics. Germany posts 5.1%, where Euro VI regulations and premium OEM demand dominate adoption. France records 4.6%, supported by sales of light-duty commercial vehicles with SCR integration. The United Kingdom grows at 4.2%, with demand tied to aftermarket replacement tanks and fleet retrofits. The report includes insights on 40+ countries, with five key markets detailed below.

China is forecast to grow at a 5.9% CAGR, supported by expansion in heavy-duty truck production and stringent emission norms under the China VI standards. The commercial vehicle urea tank market in China benefits from strong OEM integration of SCR systems in long-haul trucks, construction vehicles, and buses. Large fleet operators prioritize urea tanks with enhanced durability, optimized weight, and high-capacity designs to ensure compliance with NOx reduction requirements. Domestic manufacturers are investing in modular tank configurations and advanced materials like HDPE for superior performance. Replacement demand is also rising from aging vehicle fleets and aftermarket suppliers across provincial logistics hubs. Partnerships with AdBlue suppliers and telematics integration for monitoring urea levels are emerging as secondary growth drivers.

India is projected to expand at a 5.5% CAGR, supported by BS-VI emission regulations and accelerated growth in freight transportation networks. The commercial vehicle urea tank market in India is shaped by OEM requirements for medium- and heavy-duty trucks used in logistics and mining operations. Demand for robust tanks with thermal insulation and anti-corrosion properties is increasing as vehicles operate under harsh conditions. Local manufacturers are enhancing blow-molding techniques to produce lightweight tanks compatible with SCR dosing modules. Integration of smart sensors for real-time fluid monitoring is emerging in premium fleets. Growth in aftermarket replacements is driven by small fleet operators seeking cost-effective compliance solutions. Government incentives for cleaner commercial transportation further reinforce adoption trends.

Germany is expected to post a 5.1% CAGR, driven by Euro VI emission compliance and strong demand from premium commercial vehicle OEMs. The commercial vehicle urea tank market in Germany benefits from advanced engineering standards, which prioritize weight optimization, UV resistance, and enhanced durability for long-distance transport applications. Increasing penetration of electric-diesel hybrid trucks that combine SCR systems with energy recovery features is expanding the scope of urea tank adoption. German manufacturers are leading in designing multi-chamber tanks that integrate heating elements for cold weather performance. Aftermarket demand is also stable, supported by fleet modernization programs and regulatory mandates for NOx reduction. The focus on circular economy principles is encouraging recycling initiatives for end-of-life plastic tanks.

France is projected to register a 12.1% CAGR, supported by increased investment in offshore renewable projects and the modernization of subsea oil and gas assets. ROVs (remotely operated vehicles) and autonomous underwater systems are widely deployed for inspection and repair tasks in harsh marine conditions. Subsea interconnector projects are gaining traction to enhance cross-border energy exchange within Europe. French firms are integrating AI-based predictive maintenance into subsea systems for better operational uptime. Collaborative ventures with EPC contractors are enabling efficient deployment of subsea infrastructure across wind and hydrocarbon projects.

The United Kingdom is projected to grow at a 4.2% CAGR, driven by Euro VI compliance requirements and rising adoption of aftermarket retrofits. The commercial vehicle urea tank market in the UK is influenced by the electrification trend, where hybrid commercial trucks still rely on SCR systems for emissions control. Replacement demand from aging fleets, particularly in logistics and municipal transport sectors, remains strong. Local suppliers are introducing custom-designed tanks that offer compatibility with multiple SCR dosing configurations and telematics-enabled monitoring. Fleet operators are prioritizing tanks with extended service intervals and ease of installation to minimize downtime. A shift toward lightweight material usage and advanced sealing technologies is evident across OEM and aftermarket channels.

The commercial vehicle urea tank market is characterized by competition among established global suppliers such as Cummins, Robert Bosch, Yara International, Scania AB, Elkamet Kunststofftechnik, Röchling, Elkhart Plastics, Autoliv, KUS Auto, Shaw Development, ITB, and Hitachi Zosen. The market operates within a concentrated industry structure where stringent emissions regulations, capital-intensive manufacturing processes, and the need for compliance with ISO and OEM quality standards impose high entry barriers.

Supplier power remains moderate as raw materials like high-density polyethylene (HDPE) and specialized sealing components are readily available, while buyer power is influenced by large OEMs and fleet operators demanding reliable, durable, and compliant urea tanks to meet SCR (Selective Catalytic Reduction) system requirements. The threat of substitutes is minimal since urea tanks are critical for emissions control in diesel-powered commercial vehicles.

Competitors are segmented strategically based on technology differentiation, manufacturing scale, and geographic reach, with firms like Cummins and Bosch leading through integrated SCR solutions. Cost leadership derives from economies of scale, proprietary tank designs, and efficient supply chains, whereas differentiation is achieved through innovations in lightweight materials, corrosion resistance, and tank modularity. Value chain analysis highlights vertical integration and partnerships with automotive OEMs as key to maintaining pricing power and quality assurance.

Competitive advantages are sustained by patents, technical expertise, and high switching costs due to stringent certification processes. Future market dynamics will be influenced by tightening global emission standards, electrification trends, and expansion in emerging markets, with firms focusing on R&D investments, production capacity expansion, and collaborations to capture growing demand in commercial transportation. Benchmarking includes capacity utilization, quality certifications, and aftermarket support services.

Regulatory momentum and supplier action have been observed reshaping the commercial vehicle urea tank landscape during the past months. In March 2024, Phase 3 heavy-duty greenhouse gas standards were issued by the US EPA, compelling OEM programs to incorporate larger heated AdBlue reservoirs for model year 2027 vehicles. A Euro 7 draft implementing regulation was circulated in April 2025, tightening off-cycle NOx verification and reinforcing performance benchmarks for onboard fluid storage. OPmobility released first-quarter 2025 results, reporting stronger orders for selective catalytic reduction fluid modules across North America and Europe, with revenue lifted by 3.3 percent. Research outlooks suggest a 4.4 percent CAGR through 2034 as fleet retrofit activity widens in the United States.

| Item | Value |

|---|---|

| Quantitative Units | USD 673.1 Million |

| Capacity | 50 to 100 liters, Below 50 liters, and Above 100 liters |

| Material | Plastic, Stainless steel, and Composite |

| Application | Heavy Commercial Vehicles (HCV), Light Commercial Vehicles (LCV), and Medium Commercial Vehicles (MCV) |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cummins, RobertBosch, YaraInternational, ScaniaAB, ElkametKunststofftechnik, Röchling, ElkhartPlasticsAutoliv, KUSAuto, ShawDevelopment, ITB, and HitachiZosen |

| Additional Attributes | Dollar sales are segmented by tank type (HDPE, composite, metal) and vehicle class (light, medium, heavy-duty commercial vehicles). Global demand is driven by SCR integration for emission control and compliance with Euro VI and equivalent standards. Regional adoption is highest in Asia-Pacific and Europe, supported by fleet modernization. Innovation focuses on lightweight polymers, integrated heating, telematics-enabled monitoring, and modular tank designs for improved efficiency and durability. |

The global commercial vehicle urea tank market is estimated to be valued at USD 673.1 million in 2025.

The market size for the commercial vehicle urea tank market is projected to reach USD 1,035.3 million by 2035.

The commercial vehicle urea tank market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in commercial vehicle urea tank market are 50 to 100 liters, below 50 liters and above 100 liters.

In terms of material, plastic segment to command 51.9% share in the commercial vehicle urea tank market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA