A total valuation of USD 105.0 million has been forecasted for the global Ectoin-infused skincare market by 2025, with expectations that the figure will reach USD 185.9 million by 2035. This trajectory reflects a 5.9% compound annual growth rate (CAGR), fueled by rising demand for skin-barrier protection, microbiome-safe actives, and clinically validated ingredients.

Ectoin-Infused Skincare Market Key Takeaways

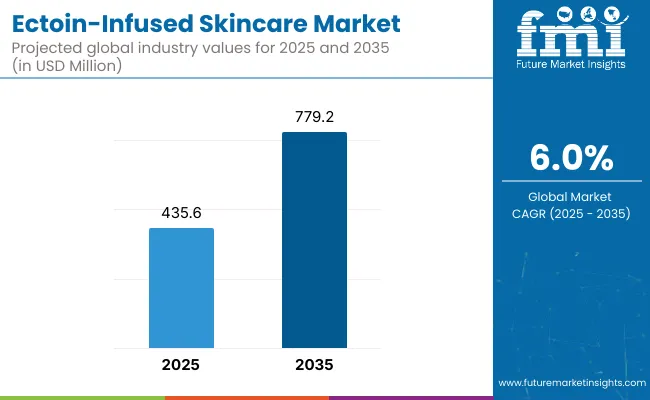

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 435.6 million |

| Forecast Value in (2035F) | USD 779.2 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The decade-long expansion represents an absolute growth of USD 80.9 million, signaling a structural shift toward biotech-infused skincare innovation. The increasing alignment of Ectoin formulations with clean beauty, anti-pollution defense, and cellular protection trends has been observed to intensify adoption across both mass-market and dermocosmetic channels.

The first five-year phase from 2025 to 2030 has been projected to record a rise from USD 105.0 million to USD 141.0 million, reflecting an incremental addition of USD 36.0 million equivalent to 44.5% of the decade’s total market expansion. This period is expected to be defined by early-stage brand integrations, dermatologist-endorsed rollouts, and performance-based positioning in moisturizers, serums, and anti-aging segments. Strong traction has been anticipated in North America and Europe, supported by ingredient transparency and microbiome research maturity.

The second half of the forecast period from 2030 to 2035 has been forecasted to add another USD 44.9 million, or 55.5% of the total decade growth, as adoption scales further through East Asia and South Asia & Pacific. Accelerated penetration is likely to be driven by cosmeceutical branding, digital-first product discovery, and the widening influence of biotech-based skincare narratives. By 2035, serums and ampoules are expected to dominate, backed by consumer preference for concentrated, multifunctional formats with visible efficacy.

From 2020 to 2024, the Ectoin-Infused Skincare Market expanded steadily due to rising formulation demand in hydration, anti-aging, and barrier-repair applications. Clinical backing and safety validation enabled strong product integration across pharmacy and derma-cosmetic channels. During this period, European manufacturers with cosmeceutical expertise dominated with over 45% of market value, while Asian ingredient suppliers led raw material supply.

By 2025, global demand is expected to reach USD 435.6 million, with a visible shift in revenue concentration toward microbiome-friendly, evidence-based formulations. The market is being redefined not just by product efficacy, but by regulatory trust, ingredient transparency, and sustainability narratives.

Traditional derma brands are now facing increasing competition from biotech-led clean beauty innovators offering multi-functional, minimal-ingredient solutions with strong digital outreach. Value creation is being driven by ecosystem strength, including dermatologist partnerships, clinical trial data, and subscription-based skincare platforms. As ingredient authenticity and skin compatibility become non-negotiable, the competitive edge is moving from marketing claims to science-backed credibility and consumer trust.

Growth in the Ectoin-infused skincare market has been strongly supported by rising consumer awareness of skin barrier health, environmental stressors, and anti-aging efficacy. Ectoin’s unique role as a natural extremolyte has been increasingly recognized for its ability to stabilize cell membranes, reduce inflammation, and offer long-lasting hydration traits that have aligned well with the evolving demand for microbiome-friendly and dermatologically safe products. This has led to its integration into premium skincare formats, especially serums, moisturizers, and eye treatments.

The expansion of dermo-cosmetic formulations and physician-recommended skincare routines has also been observed to create new growth pathways. In parallel, clean-label positioning and minimal-ingredient trends have favored Ectoin due to its well-documented safety and multifunctionality.

Additionally, product innovation by niche biotechnology firms and major skincare brands has continued to diversify applications across both facial and body care segments. As urban pollution and blue light exposure intensify, the protective function of Ectoin-based skincare is projected to gain mainstream consumer traction.

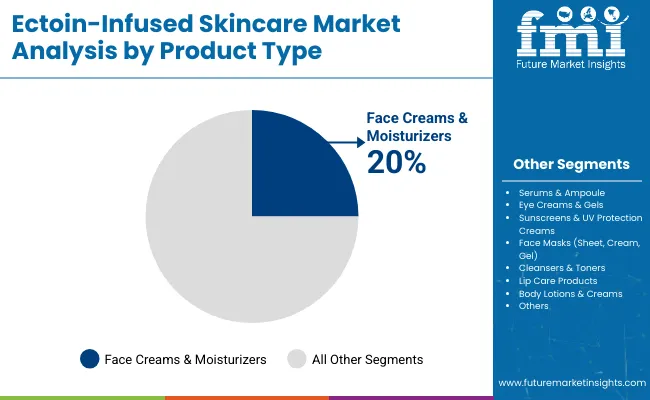

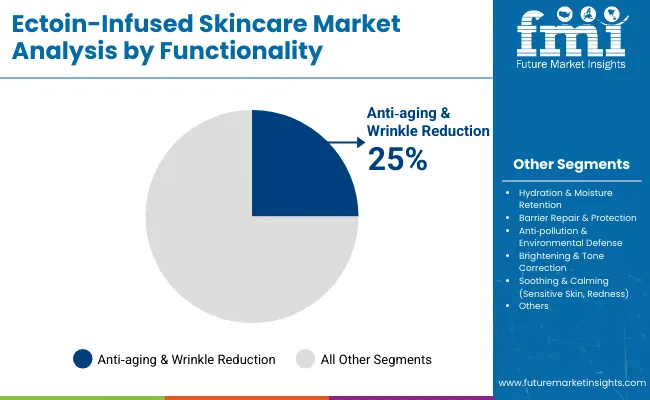

The Ectoin-infused skincare market has been segmented based on Product Type, Functionality, and Formulation Type each revealing distinctive consumer behaviors, efficacy preferences, and brand positioning strategies. Product type segmentation captures diverse topical delivery systems such as serums, creams, gels, and lotions, all tailored to specific application needs, skin conditions, and age groups.

Functionality segmentation highlights the primary benefits sought by consumers ranging from anti-aging and hydration to environmental defense and calming effects showcasing the breadth of Ectoin's biological activity. Meanwhile, formulation type segmentation addresses the texture, delivery, and consumer sensory experience preferences, impacting product absorption, layering compatibility, and application convenience. Together, these three pillars help map the strategic direction of the market and inform how Ectoin’s dermatological performance is being tailored across consumer segments, skin types, and environmental contexts.

| Product Type | 2025 Share % |

|---|---|

| Face Creams & Moisturizers | 20% |

| Serums & Ampoules | 15% |

| Eye Creams & Gels | 8% |

| Sunscreens & UV Protection Creams | 10% |

| Face Masks (Sheet, Cream, Gel) | 10% |

| Cleansers & Toners | 12% |

| Lip Care Products | 5% |

| Body Lotions & Creams | 20% |

In 2025, face creams and moisturizers, along with body lotions and creams, are anticipated to collectively lead the product type segment with a combined market share of 40%. This dominance has been driven by their familiarity among consumers, ease of integration into daily skincare routines, and broad dermatological applicability.

Ectoin’s water-binding, anti-inflammatory, and anti-aging properties have been effectively harnessed in these emollient-rich formulations, which offer both preventive and reparative skincare benefits. Increased demand for barrier-strengthening products in polluted and urban environments has further reinforced the appeal of creams and lotions.

While creams have been preferred for facial hydration and overnight repair, body lotions have increasingly gained traction for full-body moisturization, particularly in regions with arid climates. As multifunctional products continue to gain favor, these formats are expected to remain foundational in the Ectoin-based skincare segment throughout the forecast period.

| Functionality | 2025 Share % |

|---|---|

| Anti aging & Wrinkle Reduction | 25% |

| Hydration & Moisture Retention | 20% |

| Barrier Repair & Protection | 15% |

| Anti pollution & Environmental Defense | 10% |

| Brightening & Tone Correction | 15% |

| Soothing & Calming (Sensitive Skin, Redness) | 15% |

The anti-aging and wrinkle reduction segment is forecasted to hold the largest share at 25% in 2025, followed by hydration and moisture retention at 20%. The market’s growth has been accelerated by the rising demand for preventive skincare and bioactive ingredients that mitigate visible signs of aging.

Ectoin has emerged as a preferred compound due to its ability to reduce oxidative stress, protect against UV-induced damage, and improve skin elasticity. Simultaneously, hydration-related formulations have gained traction, driven by consumer awareness around skin barrier health, particularly in response to environmental stress and frequent cleansing routines.

With Ectoin’s proven humectant and anti-inflammatory properties, hydration-focused products have been positioned as everyday essentials for sensitive and dry skin types. These functionality segments are likely to retain leadership due to their wide appeal across demographics and geographies, especially as aging populations and pollution-related skin concerns continue to rise.

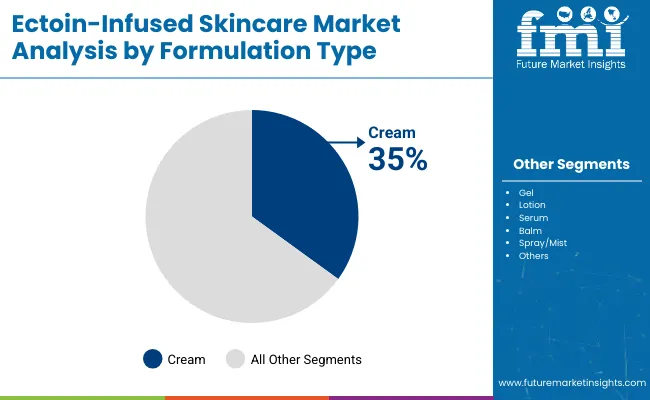

| Formulation Type | 2025 Share % |

|---|---|

| Cream | 35% |

| Gel | 15% |

| Lotion | 20% |

| Serum | 15% |

| Balm | 8% |

| Spray/Mist | 7% |

Creams are projected to dominate the formulation type segment with a 35% share in 2025, maintaining their role as the most preferred vehicle for Ectoin delivery. Their thick, occlusive nature has enabled superior retention of Ectoin’s protective and hydrating functions, especially in overnight repair and anti-aging treatments.

Lotions, holding a 20% share, have been widely accepted for their light texture and full-body application, particularly in hot and humid regions. Meanwhile, serums, capturing 15% of the segment, have emerged as high-efficacy solutions targeting specific concerns like fine lines and barrier dysfunction.

The rise of multi-step skincare routines in developed markets and minimalist regimens in emerging economies has driven balanced demand across these formulations. As clean beauty trends and ingredient transparency further influence buyer preferences, formulation types offering both sensorial appeal and functional performance are expected to shape the market’s future.

High-performance demands and dermatological validation continue to redefine the Ectoin-infused skincare space, even as formulation cost constraints and clinical substantiation hurdles temper widespread integration across value-tier offerings.

Therapeutic Dermatology Convergence in Functional Skincare

A convergence between therapeutic dermatology and premium skincare has been observed to significantly influence the commercial trajectory of Ectoin-based formulations. Dermatologists and clinical institutions have increasingly endorsed Ectoin for its cytoprotective and anti-inflammatory mechanisms, especially in treating atopic dermatitis, eczema, and photoaged skin.

These endorsements have accelerated cross-industry collaborations, allowing cosmeceutical brands to co-develop skin-barrier-centric products under medical supervision. As functional skincare increasingly overlaps with therapeutic claims, demand for Ectoin formulations has been propelled beyond traditional cosmetic positioning. This convergence has also unlocked entry into insurance-covered derma-cosmetic programs in select European markets, supporting deeper institutional penetration.

Regulatory-Backed Ingredient Storytelling in Clean Beauty Positioning

A strategic pivot toward regulatory-backed ingredient storytelling has been identified as a critical trend within clean beauty portfolios. Ectoin’s INCI-approved status and clinical documentation have enabled brands to structure transparent narratives backed by evidence rather than marketing rhetoric.

As consumers become increasingly skeptical of exaggerated “natural” claims, actives like Ectoin supported by peer-reviewed studies and EU compliance are being positioned as scientifically clean. This alignment of regulatory trust and emotional engagement has positioned Ectoin-infused products at the forefront of next-generation clean beauty, particularly within premium skincare lines targeting barrier repair, urban defense, and inflammation control.

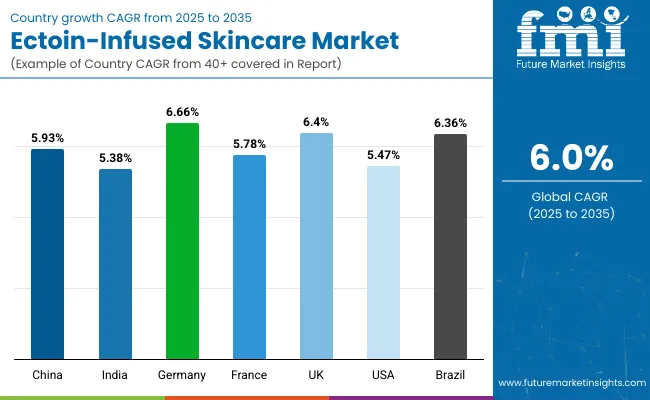

| Countries | CAGR |

|---|---|

| China | 5.93% |

| India | 5.38% |

| Germany | 6.66% |

| France | 5.78% |

| UK | 6.40% |

| USA | 5.47% |

| Brazil | 6.36% |

Marked variations in product adoption and innovation pace have been observed across global markets for Ectoin-infused skincare, shaped by cultural skincare routines, regulatory support for active ingredients, and the maturity of dermo-cosmetic ecosystems. Asia-Pacific is poised to evolve as a high-potential growth hub, with China expanding at a CAGR of 5.93% and India closely following at 5.38%.

In China, consumer preference for multifunctional actives and science-backed claims has driven early adoption through TCM-integrated cosmeceuticals and premium DTC platforms. Governmental encouragement of biotech-based skincare ingredients and a thriving e-commerce ecosystem have further enhanced product visibility. India’s growth trajectory has been linked to a rising focus on dermatological skin health, increased influence of K-beauty and J-beauty regimens, and dermatologist-led prescription skin routines within urban segments.

Europe remains a center for formulation innovation, with Germany (6.66%), UK (6.40%), and France (5.78%) leading growth due to their established cosmeceutical supply chains and demand for clinically tested actives. Regulatory alignment with REACH and emphasis on allergen-free, microbiome-safe ingredients have favored the uptake of Ectoin in derma-backed offerings.

In North America, the USA market (5.47%) continues to reflect strong interest in ingredient transparency and barrier-repair science, although broader penetration into mass-market segments remains gradual. Growth in the Brazilian market (6.36%) has been supported by increasing dermatological awareness and rising investments in biotech-based actives tailored to tropical climates.

| Years | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| USA | 25.2 | 26.9 | 28.3 | 30.2 | 32.1 | 34.3 | 36.3 | 38.4 | 40.3 | 42.6 | 45.5 |

The Ectoin-infused skincare market in the United States is projected to expand at a CAGR of 5.47% from 2025 to 2035, supported by clinical dermatology collaborations, heightened awareness of skin barrier protection, and the mainstreaming of microbiome-safe skincare. Increasing demand has been observed across the anti-aging and hydration segments, particularly among aging millennials and health-conscious Gen Z consumers. The formulation of Ectoin into prescription-strength skincare often co-developed with dermatologists is gaining momentum as cosmeceuticals become integrated into personalized skin treatment plans.

A marked rise in formulation bundling strategies has also been observed, with Ectoin often combined with ceramides, niacinamide, or peptides to target multiple concerns in single-use regimens. This approach has aligned well with consumer preferences for high-efficacy minimalist routines.

The Ectoin-infused skincare market in the United Kingdom is projected to grow at a CAGR of 6.40%, driven by strong alignment with clinical dermatology protocols, NHS-backed skin health initiatives, and rising demand for sensitive-skin formulations. Growth has been supported by Ectoin’s increasing inclusion in barrier-repair and rosacea-control regimens, particularly among adults with reactive or hypersensitive skin.

Widespread consumer trust in evidence-backed actives has elevated Ectoin’s positioning, with premium pharmacy brands leveraging its documented efficacy in anti-inflammatory and hydration support. Formulators have also begun integrating Ectoin into multi-functional, fragrance-free skincare, aligning with minimalist routines and dermatologist recommendations.

India’s Ectoin-infused skincare market is expected to grow at a CAGR of 5.38%, supported by increased dermatologist outreach, rising skincare literacy in urban centers, and growing demand for multi-tasking actives in compact formulations. Ectoin’s compatibility with Indian skin types and humid climates has positioned it favorably in hydration, pigmentation, and pollution defense products.

Adoption has been further enhanced through prescriptive dermatology channels, with dermatologists increasingly recommending Ectoin-based creams for barrier repair and anti-inflammatory benefits. As Indian consumers gravitate toward minimalist, skin-first routines, Ectoin’s clean-label appeal and multifunctional performance are being recognized across pharmacy chains and digital-first beauty platforms.

The Chinese Ectoin-infused skincare market is forecasted to grow at a CAGR of 5.93%, underpinned by accelerated consumer shift toward biotech-enhanced functional skincare. Rising demand for microbiome-safe, barrier-strengthening actives especially among urban women aged 25-45 has elevated the adoption of Ectoin in daily-use creams, facial serums, and sunscreen formats.

Domestic brands have actively positioned Ectoin as a next-gen clean active, supported by regulatory recognition under China's evolving Ingredient Whitelist System. Integration into TCM-meets-biotech skin treatments is being explored by niche DTC players, fueling visibility across Tier 1 and Tier 2 cities.

| Countries | 2025 | 2035 |

|---|---|---|

| UK | 20.44% | 19.50% |

| Germany | 20.99% | 20.00% |

| Italy | 11.11% | 11.27% |

| France | 13.41% | 12.27% |

| Spain | 9.56% | 9.85% |

| BENELUX | 6.74% | 5.22% |

| Nordic | 5.69% | 5.54% |

| Rest of Europe | 12% | 16% |

Germany is projected to record the highest growth rate among European markets, with a CAGR of 6.66% between 2025 and 2035. Deep-rooted consumer preference for science-validated, allergy-safe formulations has led to widespread trust in Ectoin-based derma products, especially those targeting inflammation, UV-induced aging, and barrier dysfunction.

Formulations containing Ectoin have been increasingly recommended by German dermatologists for atopic dermatitis, post-procedure care, and pollution-induced redness. Pharmacy-led retail channels and cosmeceutical brands have responded by expanding their Ectoin product lines across creams, emulsions, and gels for both adult and pediatric use.

| Product Type | 2025 Share % |

|---|---|

| Face Creams & Moisturizers | 22% |

| Serums & Ampoules | 16% |

| Eye Creams & Gels | 8% |

| Sunscreens & UV Protection Creams | 9% |

| Face Masks (Sheet, Cream, Gel) | 11% |

| Cleansers & Toners | 12% |

| Lip Care Products | 5% |

| Body Lotions & Creams | 17% |

The Ectoin-infused skincare market in Japan is projected to reach USD 9.98 million in 2025, with face creams & moisturizers contributing the highest share at 22%, followed by body lotions & creams (17%) and serums & ampoules (16%). This product mix reflects Japan’s cultural preference for hydration-centric, lightweight formulations that support skin clarity, resilience, and long-term health.

Consumer adoption has been shaped by Japan’s deep-rooted skincare philosophy of layered treatment systems, in which each product type serves a distinct therapeutic function. Ectoin’s compatibility with sensitive skin and its ability to support barrier integrity and cellular hydration have been particularly aligned with local skincare expectations.

Advanced formulation science is being prioritized by Japanese manufacturers, with a growing shift toward multifunctional, biotech-derived actives. These trends are supported by strong dermatological research networks and consumer demand for clean-label, clinically validated ingredients. As Japan continues to lead in ingredient safety, efficacy regulation, and sensorial excellence, the market is poised for stable long-term expansion.

| Functionality | 2025 Share % |

|---|---|

| Anti aging & Wrinkle Reduction | 28% |

| Hydration & Moisture Retention | 20% |

| Barrier Repair & Protection | 14% |

| Anti pollution & Environmental Defense | 10% |

| Brightening & Tone Correction | 15% |

| Soothing & Calming (Sensitive Skin, Redness) | 13% |

The Ectoin-infused skincare market in South Korea is projected to reach USD 7.88 million in 2025, with the anti-aging & wrinkle reduction segment leading at 28%, followed by hydration & moisture retention (20%) and brightening & tone correction (15%). These segments have been prioritized due to South Korea’s advanced skincare culture, where performance-led, clinically aligned actives are deeply embedded in multi-step routines.

Consumer preferences have been observed to shift toward functional cosmetics offering real, visible skin improvement, especially in the areas of barrier repair, inflammation control, and age prevention. Ectoin’s ability to offer anti-inflammatory, antioxidant, and moisture-retention benefits without disrupting skin microbiota has positioned it as a hero active in both prescription skincare and premium K-beauty lines.

Local formulators have increasingly focused on biotech-derived ingredients that support product claims around environmental protection, post-exfoliation recovery, and skin sensitivity. South Korea’s cosmetic innovation ecosystem bolstered by regulatory clarity, R&D collaboration, and ingredient traceability has been instrumental in accelerating Ectoin’s inclusion across functional skincare formats.

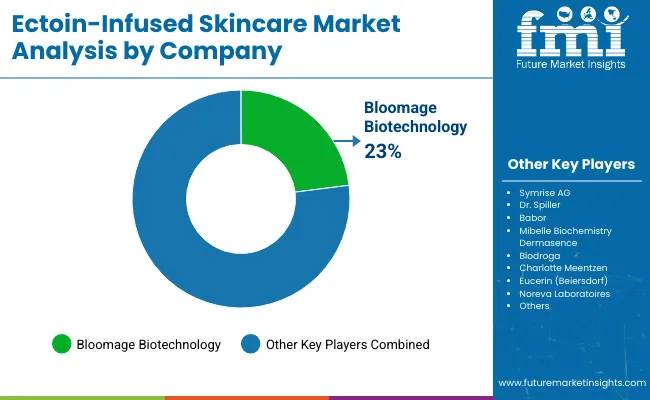

| Players | Global Value Share 2025 |

|---|---|

| Bloomage Biotechnology | 23% |

| Others | 77% |

The Ectoin-infused skincare market has been observed to be moderately fragmented, with global ingredient suppliers, mid-sized derma-cosmetic brands, and specialized clinical skincare labels competing across varied consumer and therapeutic use cases. Global players such as Symrise AG have maintained a dominant upstream presence through the supply of biotech-derived hydrating Ectoin actives, often integrated via long-term partnerships with formulation houses and premium cosmetic brands. Their strategic advantage has been reinforced by clinical validation pipelines, INCI-compliant positioning, and extensive cross-category application potential.

Established derma-cosmetic manufacturers including Dr. Spiller, Babor, Dermasence, and Mibelle Biochemistry have been observed to focus on science-led skincare, targeting sensitive skin, barrier repair, and inflammation control. These brands have integrated Ectoin into serums, creams, and ampoules, particularly within anti-aging and hydration portfolios. Market penetration has been enhanced through dermatologist-backed marketing and pharmacy channel distribution in Europe and Asia.

Specialist skincare brands such as Biodroga, Annemarie Börlind, Charlotte Meentzen, and NorevaLaboratoires have captured niche segments by emphasizing clean-label, fragrance-free, and vegan formulations, supported by targeted ingredient transparency.

The competitive focus has gradually shifted from mere product efficacy to regulatory-backed claims, microbiome compatibility, and multifunctional formulation strategies. As regulatory compliance and therapeutic skincare overlap, brand credibility is increasingly being built around Ectoin’s clinical data, sustainability sourcing, and sensitivity safety, signaling a continued shift toward evidence-based product ecosystems.

| Item | Value |

|---|---|

| Quantitative Units | USD 435.6 Million |

| Component | Ectoin Active Ingredient, Finished Skincare Products (Creams, Serums, Lotions, Masks, Sunscreens) |

| Functionality | Anti-aging & Wrinkle Reduction, Hydration & Moisture Retention, Barrier Repair, Brightening, Anti-pollution, Soothing |

| Formulation Type | Cream, Gel, Lotion, Serum, Balm, Spray/Mist |

| Product Type | Face Creams & Moisturizers, Serums & Ampoules, Eye Creams & Gels, Sunscreens, Face Masks, Cleansers & Toners, Lip Care, Body Lotions |

| End-use Application | Dermatologist-Recommended Skincare, OTC Retail Skincare, Pharmacy-based Cosmeceuticals, Online DTC Brands |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Symrise AG, Bloomage Biotech, Dr. Spiller, Babor, Mibelle Biochemistry, Dermasence, Biodroga, Charlotte Meentzen, Eucerin (Beiersdorf), Noreva Laboratoires |

| Additional Attributes | Market segmentation by functionality and formulation; CAGR by region and format; Ectoin demand in derma vs. OTC segments; Clean-label and biotech-derived ingredient growth; Integration into post-procedure skin recovery routines; Region-specific product development; Dermatologist endorsements and regulatory-approved positioning |

The global Ectoin-Infused Skincare Market is estimated to be valued at USD 435.6 million in 2025.

The market size for the Ectoin-Infused Skincare Market is projected to reach approximately USD 779.2 million by 2035.

The Ectoin-Infused Skincare Market is expected to expand at a compound annual growth rate (CAGR) of 6.0% between 2025 and 2035.

The key product types include face creams & moisturizers, serums & ampoules, body lotions & creams, cleansers & toners, sunscreens, face masks, lip care, and eye creams & gels.

In terms of product type, face creams & moisturizers and body lotions & creams are each projected to command 20% market share in 2025, leading the segment.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA