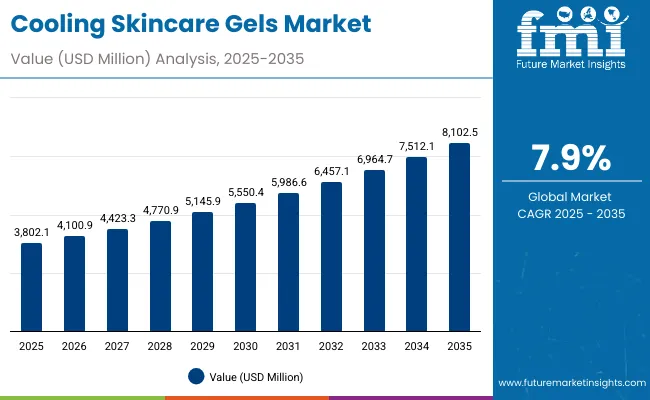

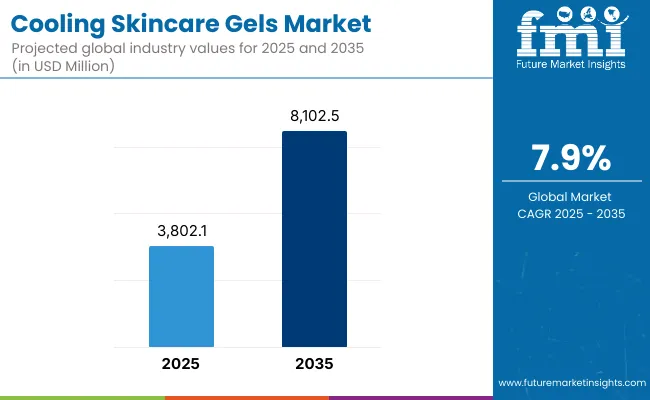

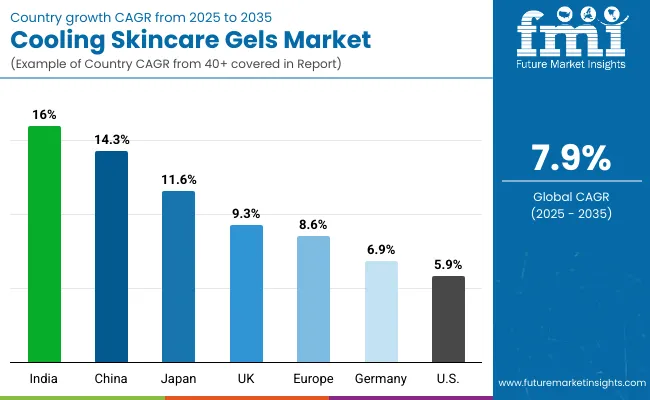

The Global Cooling Skincare Gels Market is expected to record a valuation of USD 3,802.1 million in 2025 and USD 8,102.5 million in 2035, with an increase of USD 4,300.4 million, which equals a growth of over 113% over the decade. The overall expansion represents a CAGR of 7.9%, reflecting a 2.1X increase in market size, driven by strong consumer demand for multifunctional skincare solutions, particularly those targeting sunburn relief, post-exposure recovery, and hydration enhancement.

Global Cooling Skincare Gels Market Key Takeaways

| Metric | Value |

|---|---|

| Global Cooling Skincare Gels Market Estimated Value (2025E) | USD 3,802.1 million |

| Global Cooling Skincare Gels Market Forecast Value (2035F) | USD 8,102.5 million |

| Forecast CAGR (2025 to 2035) | 7.90% |

During the first five-year period from 2025 to 2030, the market grows from USD 3,802.1 million to USD 5,550.4 million, adding USD 1,748.3 million, which accounts for nearly 41% of the total decade growth. This phase marks a period of accelerated adoption across North America, Europe, and East Asia, driven by a surge in after-sun and hydrating gel applications. The preference for aloe vera– and cucumber extract–based cooling gels dominates this phase, as consumers increasingly shift toward plant-based, paraben-free, and dermatologically tested products. E-commerce and pharmacy chains capture significant sales momentum due to convenience and access to dermatological brands such as Neutrogena, Clinique, and The Face Shop.

The second half from 2030 to 2035 contributes an additional USD 2,552.1 million, equal to 59% of total decade growth, as the market surges from USD 5,550.4 million to USD 8,102.5 million. This period is characterized by rapid penetration of advanced cooling formulations infused with menthol, hyaluronic acid, and chamomile, alongside the introduction of smart skincare gels integrated with temperature-regulating microcapsules and long-lasting hydration technology. The Asia-Pacific region especially China, Japan, and India emerges as the fastest-growing cluster, supported by local innovation, K-beauty and J-beauty expansion, and consumer inclination toward affordable, multipurpose skincare. India records the highest CAGR of 16.0%, followed by China (14.3%) and Japan (11.6%), underscoring the growing influence of Asian consumers in shaping product trends.

From 2020 to 2024, the Global Cooling Skincare Gels Market expanded steadily as climate change awareness and rising UV exposure drove consumer adoption of soothing skincare products. The market value rose from approximately USD 2,800 million in 2020 to USD 3,700 million in 2024, driven by increased usage of after-sun gels and hydrating aloe-based cooling products in both personal care and dermatological settings. During this phase, global skincare conglomerates such as Neutrogena, Nature Republic, and Banana Boat maintained leadership through product diversification, launching lightweight, non-sticky formulations suitable for sensitive and combination skin. These companies controlled nearly 25–30% of total market revenue, emphasizing safety certifications, clinical testing, and cross-channel retail expansion through pharmacies and online stores.

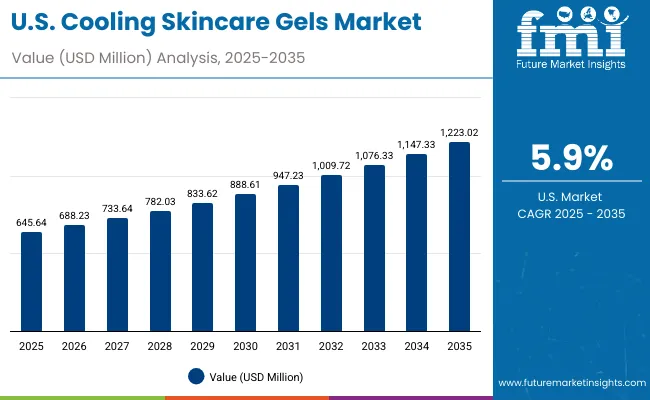

Between 2025 and 2035, the Global Cooling Skincare Gels Market evolves from a seasonal relief category to an everyday hydration and recovery segment. The market transition is influenced by a growing consumer shift toward multifunctional skincare, combining hydration, cooling, and anti-inflammatory properties in a single product. The USA market, valued at USD 645.6 million in 2025, is projected to exceed USD 1,223.0 million by 2035, representing consistent growth of over 6% annually, driven by awareness of post-sun and post-workout skin relief routines. Meanwhile, China, already one of the top five skincare markets globally, is rapidly expanding its cooling gel category through ingredient innovation led by Aloe Vera (41.2% share) and retail expansion on Tmall, JD.com, and Douyin.

The competitive landscape is moderately fragmented, with Nature Republic holding the highest global market share of 8.3% in 2025. South Korean brands like Innisfree, Etude House, and HolikaHolika capitalize on consumer trust in K-beauty formulations, while Western brands such as Neutrogena, Clinique, and Banana Boat focus on dermatological efficacy and SPF synergy. The industry is witnessing increased collaboration between cosmetic labs and ingredient suppliers to create bioactive, fast-absorbing cooling systems using microgel and water-lock technologies. The emergence of clean-label and eco-conscious packaging trends further fuels product differentiation, especially across Europe and North America.

By 2035, software-like personalization in skincare enabled by AI-based skin diagnostics and customized hydration formulas will influence the cooling gel segment’s future direction. Digital platforms and subscription-based D2C channels are expected to account for over 40% of total global sales, reshaping consumer-brand interaction and retention dynamics.

Advancements in skincare science and ingredient biotechnology have revolutionized the way cooling gels deliver hydration, repair, and temperature relief. These formulations now incorporate hyaluronic acid complexes, nano-encapsulated menthol, and botanical extracts to create rapid-acting, long-lasting skin-cooling effects. Rising global temperatures, lifestyle-driven skin stress, and increased outdoor activity have amplified demand for sunburn relief and hydration-boosting skincare products.

The adoption of cooling gels is also expanding due to post-procedure dermatology, where patients require gentle, anti-inflammatory formulations after laser treatments or peels. Moreover, the rise in men’s skincare and unisex categories has broadened the consumer base, with gender-neutral marketing emphasizing functionality over fragrance. The growth in sensitive-skin prone consumers, now accounting for nearly 20% of total users, has fueled innovation in paraben-free, alcohol-free, and dermatologist-tested cooling gels.

E-commerce and pharmacy retail are the strongest performing channels, contributing to over 60% of total global sales by 2035. Online platforms have enabled emerging brands to scale rapidly through influencer marketing and real-time consumer feedback loops. Asia-Pacific, led by India, China, and Japan, is expected to drive the fastest adoption curve due to cultural integration of natural ingredients like aloe vera, mint, and cucumber extract into daily skincare routines.

Overall, the Global Cooling Skincare Gels Market is evolving into a science-backed, lifestyle-driven skincare segment that merges dermatological efficacy with wellness positioning, ensuring sustained double-digit growth across emerging and developed economies alike.

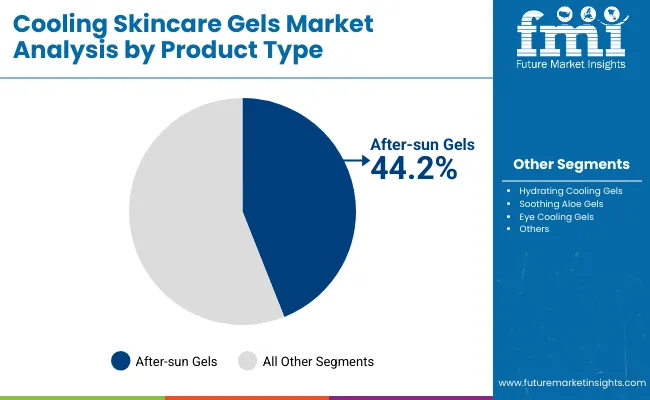

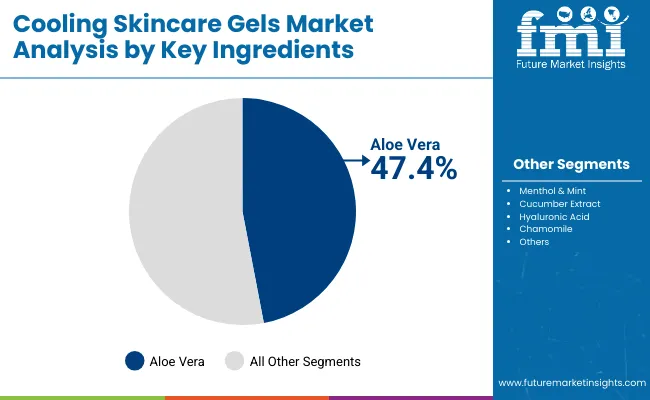

The Global Cooling Skincare Gels Market is segmented by Product Type, Key Ingredients, Function, Channel, End User, and Geography. By Product Type, the market covers After-sun gels, Hydrating cooling gels, Soothing aloe gels, and Eye cooling gels, each addressing specific skincare needs such as sunburn recovery, moisture retention, and fatigue reduction. Based on Key Ingredients, segmentation includes Aloe vera, Menthol & mint, Cucumber extract, Hyaluronic acid, and Chamomile, representing the natural and bioactive bases that define product differentiation and sensory appeal. By Function, the market spans Sunburn relief, Hydration boost, Soothing sensitive skin, and Anti-inflammatory care, aligning with evolving consumer priorities toward comfort and skin protection. Distribution is classified under E-commerce, Pharmacies/drugstores, Specialty beauty retail, and Supermarkets, reflecting the dual dominance of online and pharmaceutical retail in accessibility. The End User segmentation includes Women, Men, Unisex, and Sensitive-skin prone consumers, demonstrating an inclusive appeal across demographics, while regionally, the market scope extends across North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa, capturing global variations in climate, culture, and skincare consumption behavior.

| Product Type | Value Share% 2025 |

|---|---|

| After-sun gels | 44.2% |

| Others | 55.8% |

The After-sun gels segment is projected to contribute 44.2% of the Global Cooling Skincare Gels Market revenue in 2025, maintaining its lead as the dominant product type. Its strong performance is driven by the increasing frequency of outdoor exposure, rising incidences of sunburn and redness, and heightened awareness of post-sun skin care among consumers. After-sun gels, formulated with Aloe vera and menthol, have become the preferred remedy for skin recovery, providing rapid cooling and hydration. These products are widely used not only during summer months but also year-round in regions with high UV indices. Their ease of application, non-greasy texture, and immediate soothing effects make them a staple in personal skincare routines. The growth of the segment is also attributed to brand innovations focused on combining SPF protection with post-sun repair in hybrid formulations, ensuring all-day skincare protection.

| Key Ingredients | Value Share% 2025 |

|---|---|

| Aloe vera | 47.4% |

| Others | 52.6% |

The Aloe vera segment is forecasted to hold 47.4% of the market share in 2025, solidifying its position as the leading ingredient in cooling skincare gels. Aloe vera’s long-recognized healing, moisturizing, and anti-inflammatory properties make it a cornerstone of cooling formulations. It effectively treats sunburns, provides instant hydration, and calms irritated skin, making it indispensable for sensitive-skin consumers. The ingredient’s natural appeal aligns with the global clean beauty trend, and its adaptability across product types—from after-sun to daily hydration gels—ensures broad commercial use. Manufacturers are further enhancing aloe-based products with vitamin-enriched and probiotic complexes to boost cellular repair and improve skin resilience. The proliferation of K-beauty and tropical-origin skincare brands has also reinforced Aloe vera’s dominance, particularly in Asia-Pacific and Latin America, where natural ingredient sourcing and transparency influence purchase decisions.

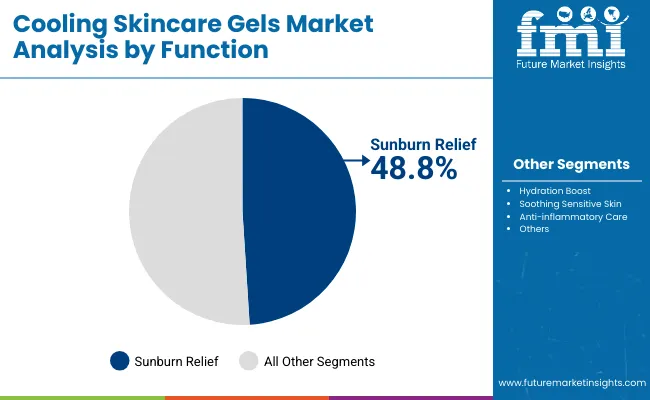

| Function | Value Share% 2025 |

|---|---|

| Sunburn relief | 48.8% |

| Others | 51.2% |

The Sunburn relief segment is projected to account for 48.8% of the Global Cooling Skincare Gels Market revenue in 2025, establishing it as the most demanded function category. This dominance stems from rising global temperatures and increasing UV exposure, which have made sunburn prevention and recovery an essential skincare need. The segment’s popularity is reinforced by its overlap with medical-grade and dermatology-endorsed applications, where soothing gels are used for post-laser, chemical peel, and clinical aftercare. Brands are investing in multifunctional sunburn relief gels that not only reduce redness but also replenish moisture, strengthen the skin barrier, and enhance cooling sensation through the infusion of mint, cucumber extract, and hyaluronic acid. Consumers increasingly prefer lightweight gel-based textures over creams due to faster absorption and compatibility with other skincare routines, ensuring sustained demand growth through 2035.

Surge in Post-Exposure Skincare Routines and Climate-Linked Skin Sensitivity

One of the most influential growth drivers for the Global Cooling Skincare Gels Market is the worldwide rise in UV radiation exposure and heat-induced skin sensitivity, prompting consumers to adopt post-exposure skincare routines. Over the past decade, dermatologists have increasingly emphasized cooling and hydration therapy as an essential recovery step after sun, pollution, or laser exposure. This behavioral shift is reflected in the after-sun gels segment, which alone contributes 44.2% of the market value in 2025. As global temperatures rise and outdoor recreational activities surge, demand for instant relief products that soothe inflammation and redness has intensified. The USA and UK markets have seen strong traction in daily-use post-sun gels, while Asian consumers, particularly in China, Japan, and India, are integrating these products into year-round skincare due to humid climates and pollution exposure. The functional value of cooling gels has evolved from being “seasonal relief” to an integral component of skin barrier recovery and temperature regulation, ensuring sustained consumption across demographics.

Ingredient Innovation and Bioactive Formulation Synergy

A second major driver is the advancement of ingredient innovation, particularly in combining Aloe vera, hyaluronic acid, and menthol-based formulations with biotechnological actives. Brands are investing in hybrid formulations that merge natural soothing agents with scientific delivery systems, resulting in superior absorption and prolonged cooling effects. For instance, Korean and Japanese manufacturers are developing “smart hydration gels” using micro-encapsulation techniques that release moisture and menthol gradually, maintaining a cooling sensation for hours. This ingredient-driven innovation has reshaped consumer expectations products are no longer judged solely on immediate cooling but on their hydration retention, pH balance restoration, and antioxidant load. Moreover, cross-category innovation is emerging as cooling gels are being positioned as post-gym and post-procedure skincare essentials, supported by collaborations between skincare and dermatology clinics. This multi-functionality approach has accelerated adoption across both genders, especially in urban centers where heat exposure, stress, and pollution overlap.

Limited Product Stability and Ingredient Volatility Under High Temperatures

A significant restraint for the Global Cooling Skincare Gels Market is the thermal instability of natural cooling ingredients such as menthol, cucumber, and Aloe vera extracts, which tend to lose potency when stored under high or fluctuating temperatures. This volatility limits shelf life and performance consistency critical factors for both online and offline retail. The issue is particularly prevalent in emerging markets across South Asia, Latin America, and Africa, where temperature-controlled logistics are underdeveloped. Even premium formulations risk phase separation, viscosity loss, and discoloration when exposed to excessive heat, compromising consumer trust. Manufacturers are investing in stabilizers and improved emulsification processes, yet these solutions raise production costs and complicate clean-label claims. Hence, while ingredient purity attracts eco-conscious consumers, maintaining efficacy and compliance with natural formulation standards remains an operational challenge for brands expanding into tropical and high-humidity regions.

Saturation of Low-Differentiation SKUs and Brand Cannibalization in E-commerce

The rapid growth of online retail channels has paradoxically created a saturation challenge for cooling gel manufacturers. Hundreds of similar SKUs many claiming identical “Aloe-based cooling” or “hydration-boosting” benefits are flooding marketplaces like Amazon, Shopee, and Tmall. This oversupply has led to brand cannibalization and pricing erosion, particularly in the mid-tier and mass-market segments. New entrants often mimic formulations and packaging aesthetics of established players, blurring differentiation and compressing margins. Moreover, algorithmic visibility on e-commerce platforms heavily favors discount-driven listings, which weakens brand equity for premium players such as Clinique and Neutrogena that rely on dermatological credibility. As a result, while online platforms contribute to accessibility, they simultaneously foster a race-to-the-bottom pricing environment, forcing brands to shift focus toward exclusive ingredient sourcing, patented formulations, and brand storytelling to retain long-term consumer loyalty.

Convergence of Cooling Gels with Functional Wellness and Smart Skin Diagnostics

A defining trend shaping the market from 2025 onward is the integration of functional wellness and skin-tech personalization within cooling gel formulations. Emerging brands are developing “smart cooling gels” that respond to skin temperature or moisture levels, using thermosensitive polymers and adaptive hydration systems. These products align with the global shift toward data-informed skincare, where AI-driven diagnostic apps and smart mirrors recommend personalized cooling products based on real-time skin condition analysis. For example, premium Korean brands are linking cooling gels to skin-analyzing devices that measure hydration deficit and suggest appropriate gel intensity. This convergence of cosmetic science, wearable tech, and personalized beauty not only increases consumer engagement but also builds subscription-based digital ecosystems that ensure brand retention. The rise of skin-tech collaboration marks a structural evolution beyond traditional topical skincare.

Clean-Label, Climate-Conscious Formulations and Eco-Packaging Revolution

Another major trend is the climate-conscious reformulation wave, where sustainability and minimalism drive innovation. Consumers are demanding vegan, cruelty-free, paraben-free, and microplastic-free cooling gels that align with their environmental values. This has led to the development of bio-based gels derived from fermented Aloe vera and seaweed extracts, reducing reliance on synthetic thickeners. Furthermore, packaging is undergoing a visible transformation major brands are adopting biodegradable pouches, refillable jars, and recyclable sugarcane bioplastics. These efforts not only resonate with Gen Z and millennial consumers but also comply with stricter EU and ASEAN sustainability regulations. The eco-reformulation trend is pushing R&D investments toward sustainable sourcing, green emulsifiers, and traceable ingredient origins, turning cooling skincare into a symbol of ethical consumption. As sustainability becomes a core brand differentiator, companies balancing efficacy, transparency, and environmental stewardship are likely to dominate the decade ahead.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 14.3% |

| USA | 5.9% |

| India | 16.0% |

| UK | 9.3% |

| Germany | 6.9% |

| Japan | 11.6% |

| Europe | 8.6% |

Between 2025 and 2035, the Global Cooling Skincare Gels Market demonstrates diverse regional growth trajectories shaped by climatic conditions, consumer awareness, and innovation ecosystems. India (16.0% CAGR) and China (14.3% CAGR) emerge as the two most dynamic markets, driven by a blend of tropical climates, increasing disposable incomes, and strong adoption of natural ingredient-based skincare. In India, local and regional brands are expanding aggressively through e-commerce and pharmacy chains, offering affordable, Aloe vera- and cucumber-based gels that appeal to heat-exposed consumers. Meanwhile, China’s skincare industry is evolving toward bioactive and multi-layer hydration gels, integrating menthol, hyaluronic acid, and plant-derived actives. Domestic giants and K-beauty entrants are shaping consumer behavior through digital-first retail and influencer-led marketing. Japan follows closely with an 11.6% CAGR, reflecting its mature yet innovation-driven beauty sector. Japanese consumers are gravitating toward minimalist cooling gels with functional hydration, particularly for sensitive and aging skin, where the combination of hyaluronic acid and chamomile extract ensures daily use beyond sunburn relief.

In contrast, mature Western markets like the United States (5.9%), Germany (6.9%), and the United Kingdom (9.3%) exhibit more moderate but stable growth, reflecting product saturation and strong brand competition. In these regions, innovation centers on dermatology-grade formulations, SPF-integrated cooling gels, and clinical positioning led by brands such as Neutrogena and Clinique. The USA market remains a global leader in volume terms, projected to surpass USD 1,223 million by 2035, supported by wellness-driven consumption and the expansion of unisex, fragrance-free formulations. Europe collectively maintains a CAGR of 8.6%, fueled by sustainability-conscious consumers and the growing influence of eco-packaging regulations across the EU. Brands in Germany and the UK are shifting toward vegan-certified and refillable cooling gel lines, aligning skincare innovation with environmental stewardship. Overall, the regional pattern underscores the coexistence of innovation-led growth in Asia and sustainability-driven maturity in Western markets, making Asia-Pacific the epicenter of expansion within the Global Cooling Skincare Gels Market.

| Year | USA Cooling Skincare Gels Market (USD Million) |

|---|---|

| 2025 | 645.64 |

| 2026 | 688.23 |

| 2027 | 733.64 |

| 2028 | 782.03 |

| 2029 | 833.62 |

| 2030 | 888.61 |

| 2031 | 947.23 |

| 2032 | 1009.72 |

| 2033 | 1076.33 |

| 2034 | 1147.33 |

| 2035 | 1223.02 |

The Global Cooling Skincare Gels Market in the United States is projected to grow at a CAGR of 5.9% from 2025 to 2035, supported by the rising demand for dermatology-endorsed cooling and hydration products. The market’s expansion is underpinned by increasing consumer awareness of post-sun exposure recovery, anti-redness care, and skin temperature regulation, particularly across coastal and southern USA states where UV intensity remains high. The segment’s evolution beyond seasonal use has strengthened its adoption within daily skincare routines, especially among consumers with sensitive and combination skin types. Leading brands such as Neutrogena, Banana Boat, and Clinique continue to dominate the space, combining cooling effects with SPF and antioxidant protection, positioning these gels as both preventive and restorative skincare solutions. The rise of pharmacy-exclusive clinical formulations and fragrance-free unisex gels is fueling market penetration among male and mature skin users.

The Cooling Skincare Gels Market in the United Kingdom is expected to grow at a CAGR of 9.3% between 2025 and 2035, driven by the strong adoption of eco-certified, multifunctional skincare products. British consumers are increasingly inclined toward Aloe vera- and cucumber-based cooling gels that offer hydration, redness reduction, and post-exercise soothing. The segment is benefitting from the UK’s growing wellness culture, where skincare aligns with mental and physical well-being. Herbal apothecaries, beauty retailers, and online brands are expanding their range of “clean and minimal” cooling gels featuring chamomile and mint extracts. The trend toward refillable and sustainable packaging has further accelerated growth, aligning with national sustainability regulations. Premium skincare players such as Clinique and The Body Shop are introducing hybrid cooling-serum formulations that combine hydration with antioxidant protection, appealing to consumers seeking minimalist routines.

India is witnessing rapid expansion in the Cooling Skincare Gels Market, forecast to record the highest CAGR globally at 16.0% through 2035. This growth is driven by high heat exposure, pollution-linked skin sensitivity, and the affordability of natural cooling gels. Tier-2 and Tier-3 cities are driving adoption through pharmacy and supermarket chains, aided by the growing penetration of Ayurvedic and herbal beauty brands. Indian consumers increasingly prefer Aloe vera, cucumber, and mint-based gels that provide instant relief from sunburn, rashes, and heat-induced irritation. Local players are leveraging cost-effective packaging and small-size SKUs to capture rural and middle-income segments. In parallel, premium urban consumers are transitioning to lightweight, dermatologically approved gels that integrate ingredients such as hyaluronic acid and chamomile for all-day hydration. Seasonal spikes in demand during summer and festival periods are further amplified by digital marketing and influencer-led product education.

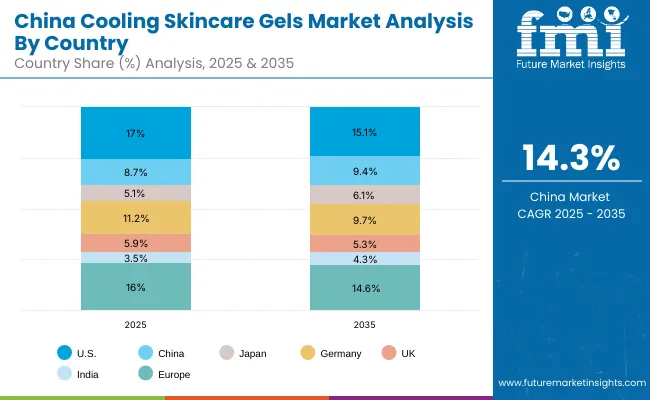

The Cooling Skincare Gels Market in China is expected to grow at a CAGR of 14.3%, marking one of the strongest global growth rates. The surge is primarily driven by bioactive skincare innovation, e-commerce dominance, and digital-native beauty consumerism. The market benefits from the fusion of K-beauty and C-beauty influences, emphasizing Aloe vera and hyaluronic acid-based hydrating cooling gels. Local manufacturers are increasingly introducing temperature-adaptive and fast-absorbing gel textures, appealing to younger consumers seeking lightweight skincare suitable for humid climates. Government-backed initiatives encouraging domestic cosmetic R&D have fostered ingredient innovation, while livestreaming and social commerce on Douyin and Tmall have accelerated sales growth. As affordability meets advanced formulation, China’s market is becoming the global hub for tech-integrated skincare, including sensor-based cooling applicators and AI-recommended products.

| Country | 2025 Share (%) |

|---|---|

| USA | 17.0% |

| China | 8.7% |

| Japan | 5.1% |

| Germany | 11.2% |

| UK | 5.9% |

| India | 3.5% |

| Europe | 16.0% |

| Country | 2035 Share (%) |

|---|---|

| USA | 15.1% |

| China | 9.4% |

| Japan | 6.1% |

| Germany | 9.7% |

| UK | 5.3% |

| India | 4.3% |

| Europe | 14.6% |

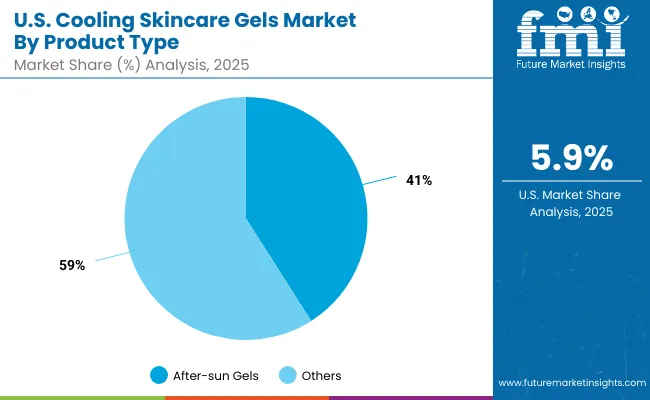

| USA By Product Type | Value Share% 2025 |

|---|---|

| After-sun gels | 40.9% |

| Others | 59.1% |

The Cooling Skincare Gels Market in the United States is projected at USD 645.6 million in 2025, with After-sun gels contributing 40.9% of total revenue, reflecting the country’s strong seasonal and dermatological demand patterns. The USA market demonstrates a well-established preference for clinically tested, multifunctional cooling gels, primarily distributed through pharmacies, dermatology clinics, and online channels. Consumers are prioritizing post-sunburn recovery, redness reduction, and long-lasting hydration, leading to increased adoption of products that blend Aloe vera, hyaluronic acid, and mint-based actives. Demand is strongest in sun-intensive states such as Florida, California, and Texas, where UV exposure drives year-round consumption.

This growth trajectory is reinforced by the evolution of after-sun gels into daily skincare essentials as part of broader wellness and anti-inflammatory routines. Dermatologist-endorsed brands like Neutrogena and Clinique have expanded portfolios with lightweight, fragrance-free cooling gels designed for sensitive and mature skin. Meanwhile, new entrants and D2C brands are leveraging digital marketing and influencer campaigns to reach younger consumers seeking instant relief products. The USA market’s moderate yet steady CAGR of 5.9% highlights its maturity, where innovation is driven less by novelty and more by dermatological efficacy, ingredient transparency, and long-term skin barrier protection.

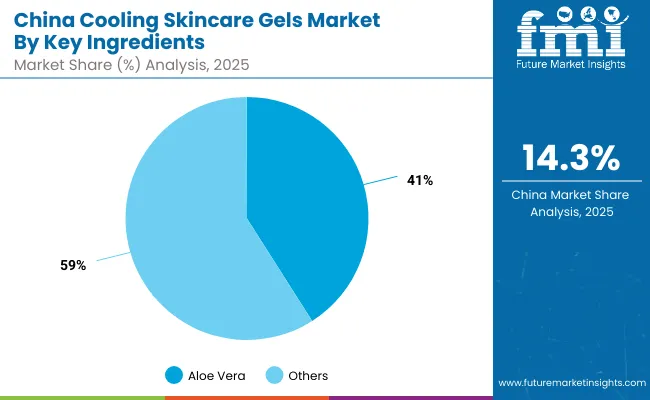

| China By Key Ingredients | Value Share% 2025 |

|---|---|

| Aloe vera | 41.2% |

| Others | 58.8% |

The Cooling Skincare Gels Market in China is valued at USD 330 million (approx.) in 2025, expanding rapidly at a CAGR of 14.3% among the highest globally. Aloe vera-based formulations account for 41.2% of total sales, underscoring the popularity of natural, plant-derived skincare among Chinese consumers. The country’s humid subtropical climate, high pollution exposure, and digital-first retail landscape have created a favorable environment for hydrating, soothing, and temperature-regulating skincare gels. Domestic brands and K-beauty entrants are leading innovation by combining Aloe vera with hyaluronic acid, chamomile, and mint extracts to deliver instant freshness and anti-inflammatory benefits.

E-commerce ecosystems especially Tmall, Douyin, and JD.com play a pivotal role in driving volume sales through influencer-led campaigns and live commerce. Local consumers value lightweight, non-greasy textures, particularly among younger urban populations in Guangzhou, Shanghai, and Beijing, where skincare routines have evolved to emphasize comfort, cooling, and hydration. The emergence of AI-driven beauty apps and virtual skincare diagnostics is accelerating product personalization. China’s growth is also supported by domestic R&D investments in bioactive and fermentation-based gel technologies, positioning the country as a hub for next-generation cooling skincare innovations.

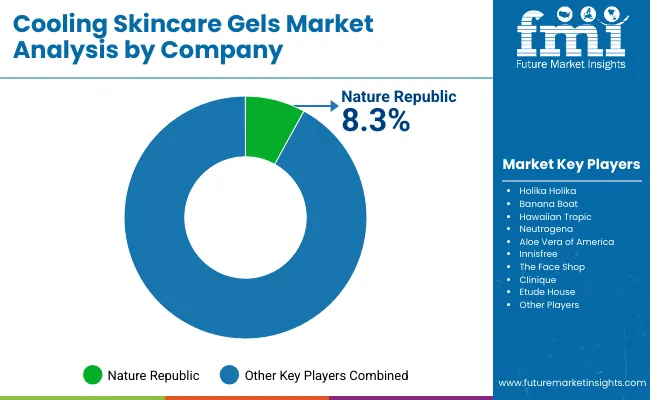

| Company | Global Value Share 2025 |

|---|---|

| Nature Republic | 8.3% |

| Others | 91.7% |

The Global Cooling Skincare Gels Market is moderately fragmented, with a mix of multinational cosmetic majors, regional Asian beauty innovators, and dermatological specialists competing across skincare applications such as sunburn relief, hydration, and anti-inflammatory care. Nature Republic leads globally with an 8.3% market share in 2025, owing to its extensive range of Aloe-based cooling gels and wide availability across Asia-Pacific retail networks. The company’s product success stems from its high-purity Aloe vera sourcing and temperature-stable gel formulations, which have achieved strong consumer trust. Other leading players such as Neutrogena, Innisfree, and Clinique leverage their dermatological credentials and clinical testing to dominate Western and global pharmacy channels, especially in the USA and Europe.

K-beauty brands including HolikaHolika, The Face Shop, and Etude House are gaining global visibility through influencer-driven campaigns and cross-border e-commerce partnerships. Their strength lies in aesthetic branding, lightweight formulations, and rapid innovation cycles suited to humid climates. Banana Boat and Hawaiian Tropic, on the other hand, focus on SPF-infused after-sun gels catering to outdoor and travel users. The market is witnessing a strategic convergence of cosmetic wellness and dermatological functionality, as brands introduce multi-benefit cooling gels featuring ingredients such as hyaluronic acid, green tea, and chamomile.

Competitive differentiation is increasingly driven by ingredient purity, sustainability, and clinical validation rather than brand heritage alone. The industry is moving toward AI-integrated skincare ecosystems, eco-friendly packaging, and subscription-based D2C models that sustain consumer loyalty. With Asia-Pacific brands leading product innovation and Western companies driving clinical credibility, the competitive outlook of the Cooling Skincare Gels Market reflects a balanced mix of heritage expertise and digital agility, setting the stage for continuous transformation through 2035.

Key Developments in Cooling Skincare Gels Market

| Item | Value |

|---|---|

| Quantitative Units | USD million |

| Product Type | After-sun gels, Hydrating cooling gels, Soothing aloe gels, and Eye cooling gels |

| Key Ingredients | Aloe vera, Menthol & mint, Cucumber extract, Hyaluronic acid, and Chamomile |

| Function | Sunburn relief, Hydration boost, Soothing sensitive skin, and Anti-inflammatory care |

| Distribution Channel | E-commerce, Pharmacies/drugstores, Specialty beauty retail, and Supermarkets |

| End User | Women, Men, Unisex, and Sensitive-skin prone |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, China, Japan, India, United Kingdom, Germany |

| Key Companies Profiled | Nature Republic, Holika Holika, Banana Boat, Hawaiian Tropic, Neutrogena, Aloe Vera of America, Innisfree, The Face Shop, Clinique, Etude House |

| Additional Attributes | Dollar sales by product type and key ingredient, ingredient innovation in Aloe vera and hyaluronic acid blends, rise in multifunctional sunburn and hydration formulations, seasonal-to-year-round product adoption trends, premiumization of cooling gels through dermatology-backed validation, integration of AI-driven skin diagnostics for personalization, expansion of D2C e-commerce channels, and sustainability-driven innovations in gel texture and packaging. |

The Global Cooling Skincare Gels Market is estimated to be valued at USD 3,802.1 million in 2025.

The market size for the Global Cooling Skincare Gels Market is projected to reach USD 8,102.5 million by 2035.

The Global Cooling Skincare Gels Market is expected to grow at a CAGR of 7.9% between 2025 and 2035.

The key product types in the Global Cooling Skincare Gels Market are After-sun gels, Hydrating cooling gels, Soothing aloe gels, and Eye cooling gels.

In terms of key ingredients, Aloe vera–based formulations are expected to command a 47.4% share of the Global Cooling Skincare Gels Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cooling Tower Fans Market Size and Share Forecast Outlook 2025 to 2035

Cooling Laser Power Measurement Sphere Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Pump Market Size and Share Forecast Outlook 2025 to 2035

Cooling Essences Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Cooling Boxes Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Cooling Tower Rental Market Size, Growth, and Forecast 2025 to 2035

Cooling Management System Market - Growth & Demand 2025 to 2035

Cooling Fans Market Growth - Trends & Forecast 2025 to 2035

Cooling Water Treatment Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cooling and Heating as a Service Market Growth – Trends & Forecast 2025-2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA