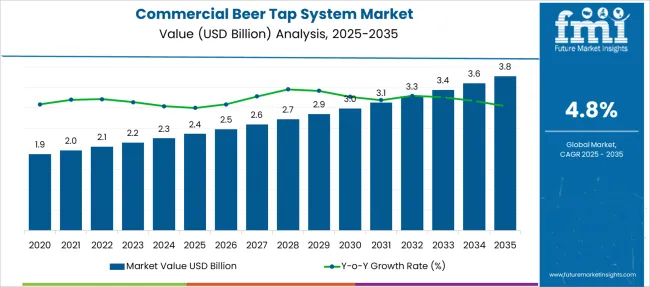

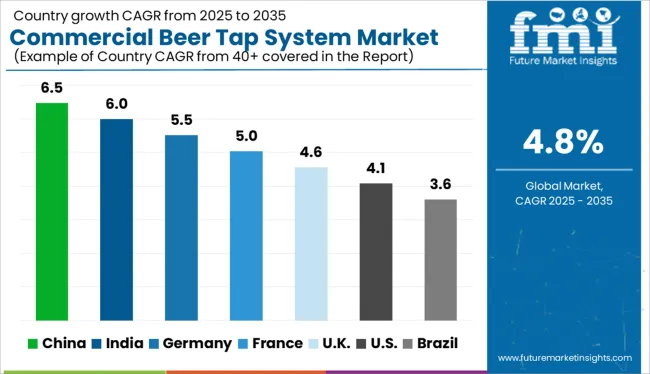

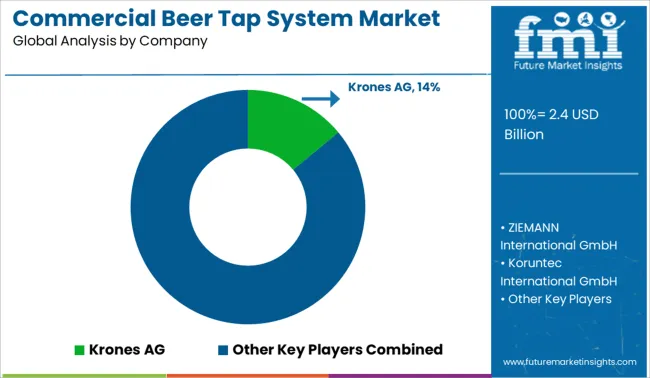

The Commercial Beer Tap System Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 3.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Beer Tap System Market Estimated Value in (2025 E) | USD 2.4 billion |

| Commercial Beer Tap System Market Forecast Value in (2035 F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The Commercial Beer Tap System market is showing steady growth, influenced by the expansion of the foodservice and hospitality industries and the rising preference for draft beer experiences. Increasing demand for premium and craft beer offerings across bars, pubs, and restaurants is contributing to the adoption of efficient and customizable beer dispensing systems.

Press releases from leading brewing equipment manufacturers and investor calls from hospitality brands have noted a trend toward enhancing the consumer experience with advanced beer tap technologies that ensure freshness and consistency. Modular and software-assisted configurations are also being introduced to support real-time monitoring, precise temperature control, and energy-efficient operation.

As outlined in industry journals and commercial equipment trade news, the growth outlook is supported by a shift toward smart infrastructure in commercial kitchens and bar environments Upgrades in bar aesthetics and increased focus on customer engagement through product presentation have further reinforced the demand for visually appealing and performance-optimized beer tap systems, setting the stage for continued market expansion.

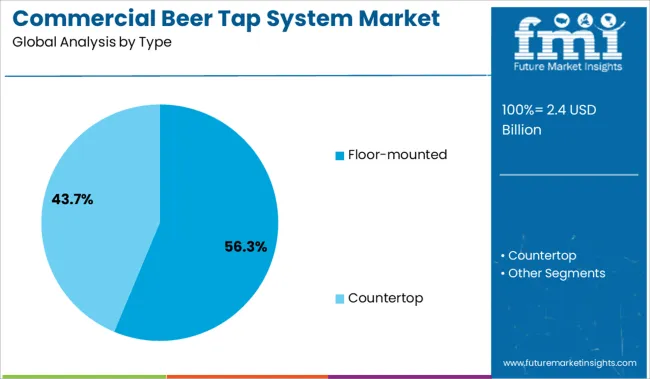

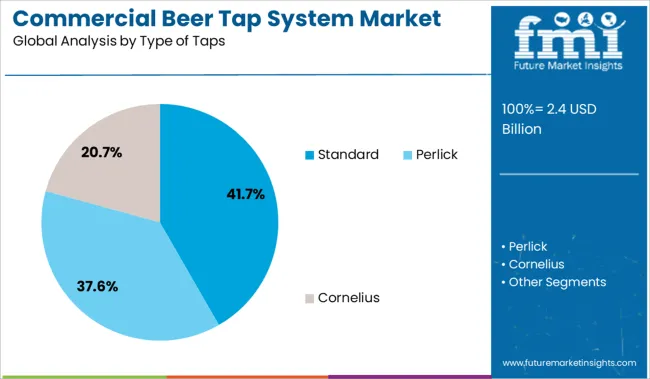

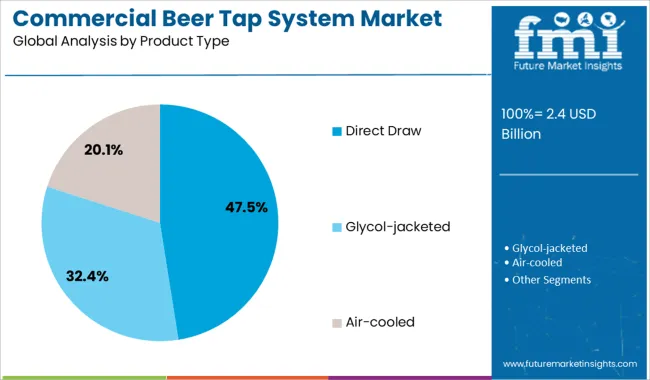

The market is segmented by Type, Type of Taps, Product Type, and Application and region. By Type, the market is divided into Floor-mounted and Countertop. In terms of Type of Taps, the market is classified into Standard, Perlick, and Cornelius. Based on Product Type, the market is segmented into Direct Draw, Glycol-jacketed, and Air-cooled. By Application, the market is divided into Bar, Restaurants, and Cafeteria. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The floor-mounted segment is anticipated to contribute 56.3% of the Commercial Beer Tap System market revenue share in 2025, positioning it as the leading segment by type. This dominance is being driven by the segment’s superior stability, higher capacity, and flexibility in supporting multiple beer lines, as reported in technical specifications and installation case studies.

Floor-mounted systems are widely installed in high-volume commercial venues where robust performance and long-term durability are required. Trade publications have observed that these systems are being favored for their ability to handle a larger variety of beverages simultaneously, without compromising on pour quality.

In addition, statements from commercial kitchen planners have highlighted the preference for floor-mounted configurations due to easier access for maintenance and their compatibility with under-counter refrigeration units The ability to integrate advanced cooling technologies and minimize downtime has further supported the growth of this segment, making it the preferred choice for large-scale hospitality operations globally.

The standard type of taps segment is projected to account for 41.7% of the market share in 2025, leading among tap configurations. This position has been strengthened by the widespread use of standard taps in traditional and modern bar setups where reliability, ease of use, and low maintenance are prioritized.

Trade media reports and hospitality supplier updates have noted that standard taps are being adopted due to their consistent flow control, cost-effectiveness, and compatibility with a wide range of kegerator and dispensing systems. Commercial operators have continued to favor this configuration for its proven track record and ability to serve both commercial-scale and craft operations effectively.

The long-established supply chains, simplified user training, and broad aftermarket support for standard tap components have further reinforced its market leadership As the segment continues to meet both functional and operational needs across diverse business models, it is expected to maintain its substantial share in the industry.

The direct draw segment is expected to command 47.5% of the revenue share in the Commercial Beer Tap System market in 2025, emerging as the leading product type. This preference is being shaped by the compact and self-contained design of direct draw systems, which allow for ease of installation and portability in smaller and mid-sized establishments.

According to supplier brochures and hospitality design publications, direct draw units are increasingly deployed in bars, event venues, and quick-service environments due to their minimal setup requirements and efficient cooling integration. These systems are known for reducing the length of beer lines, which contributes to product freshness and reduces waste.

Feedback from bar operators has emphasized the benefits of direct draw setups in ensuring consistent pour quality and simplifying keg replacement processes Their versatility in mobile applications and compatibility with limited-space operations have solidified their status as the preferred choice for venues seeking efficient and cost-effective beer dispensing solutions.

According to Future Market Insights, the global market for commercial beer tap systems grew at 3.5% CAGR during the historical period from 2020 to 2025 and reached a valuation of USD 1,285.5 million at the end of 2025.

However, with the rising popularity of craft beer worldwide, the overall sales of commercial beer tap systems are projected to rise at a steady CAGR of 4.8% between 2025 and 2035.

Commercial beer tap systems are expected to continue to grow in popularity in the coming years. This growth is being driven by the increasing popularity of craft beer and the desire of consumers for fresh, locally-brewed beer. Tap systems offer breweries a way to dispense their product directly to consumers, without having to bottle or can it.

End users like bars, restaurants, and cafeterias are increasingly installing commercial beer tap systems in their facilities to easily provide fresh high-quality beer to their customers. Thus, the growth of these end-use sectors will eventually boost sales of commercial beer tap systems during the forthcoming decade.

A number of influential factors have been identified that are expected to spur growth in the global market for commercial beer tap systems during the projection period (2025 to 2035). Besides the proliferating aspects prevailing in the market, the analysts at FMI have also analyzed the restraining elements, lucrative opportunities, and upcoming threats that can somehow influence commercial beer tap system sales.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

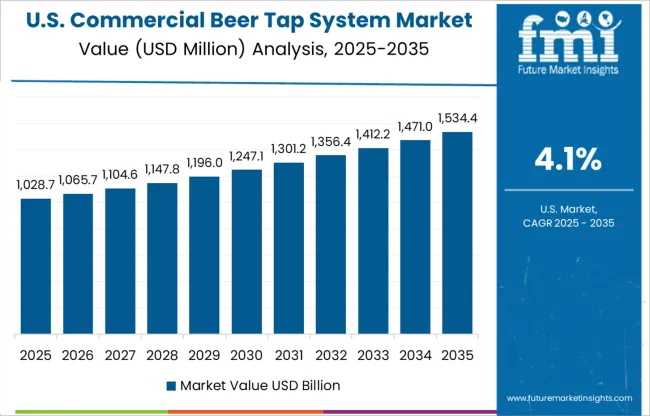

Increasing Consumption of Craft Beer Driving Demand in the USA

As per FMI, demand for commercial beer tap systems will continue to grow at a strong pace across the USA during the forecast period owing to the rising popularity of draught beer and an increasing number of bars and pubs.

Similarly, the increasing number of craft breweries in the country and the willingness of consumers to spend more on quality beer is positively influencing the sales of commercial beer tap systems in the USA.

As per the Brewers Association Annual Growth Report (2020), there were around 8,275 craft breweries operating in 2020 and this number is expected to further surge during the next few decades amid an increasing number of beer lovers in the country. This will indirectly boost the commercial beer taps system industry in the USA.

Moreover, the presence of a large number of commercial beer tap system manufacturers and suppliers in the country will aid in the expansion of the USA market over the next ten years.

Rising Demand for Energy-efficient Systems Boosting Market in the UK

The UK market for commercial beer tap systems is growing rapidly. This is due to several factors, including the increasing popularity of draft beer and the growing demand for energy-efficient systems.

Commercial beer tap systems are becoming increasingly popular in the country due to their energy efficiency and ability to dispense a variety of different beers. These systems are also becoming more popular because they allow businesses to save money on their energy bills.

Similarly, increasing consumption of craft beer is driving up demand for commercial beer tap systems. As consumers become more knowledgeable about the different types of beer available, they are more likely to purchase products that offer a wider range of options.

Bars to Generate Lucrative Opportunities for Commercial Beer Tap System Manufacturers

Based on application, the global market for commercial beer tap systems is segmented into bars, restaurants, and cafeterias. Among these, the bar segment will experience the highest growth rate, followed by restaurants and cafeterias. This can be attributed to the rising number of bars worldwide that are continuously installing commercial beer tap systems.

In recent years there has been an increase in the popularity of craft beer and the willingness of consumers to spend more on quality beer. As a result, many bars are investing in commercial beer tap systems to offer a wider variety of beers to their customers. This is expected to create lucrative opportunities for commercial beer tap system manufacturers during the forecast period.

As the market for commercial beer tap systems continues to grow, so does the competition. Key manufacturers of commercial beer tap systems are adopting various organic and inorganic strategies such as new product launches, mergers, acquisitions, collaborations, and facility expansions to increase their revenues and gain a competitive edge in the market. for instance,

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 2.4 billion |

| Projected Market Size (2035) | USD 3.8 billion |

| Anticipated Growth Rate (2025 to 2035) | 4.8% CAGR |

| Forecast period | 2025 to 2035 |

| Historical data available for | 2020 to 2025 |

| Market analysis | USD million in value |

| Key regions covered | North America; Eastern Europe; Western Europe; Japan; South America; Asian Pacific; Middle East and Africa (MEA) |

| Key countries covered | USA, Germany, France, Italy, Canada, The UK, Spain, China, India, Australia |

| Key Segments Covered | Type, Type of Taps, Product Type, Application, Region |

| Key Companies Profiled | Krones AG; ZIEMANN International GmbH; Koruntec International GmbH; 3M Europe; Criveller; JBT Corporation; Alfa Laval AB; Robert Bosch GmbH; Parker Hannifin |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, DROT Analysis, Market Dynamics, Challenges, and Strategic Growth Initiatives |

The global commercial beer tap system market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the commercial beer tap system market is projected to reach USD 3.8 billion by 2035.

The commercial beer tap system market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in commercial beer tap system market are floor-mounted and countertop.

In terms of type of taps, standard segment to command 41.7% share in the commercial beer tap system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA