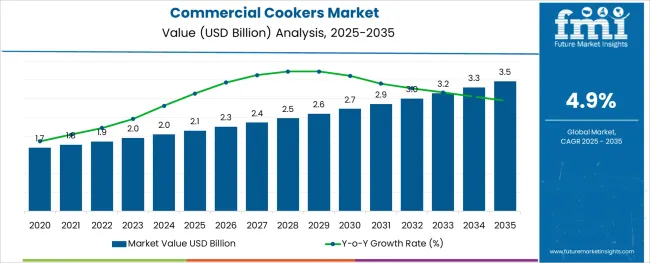

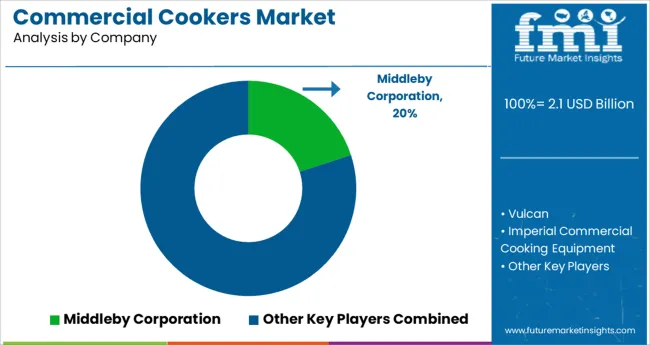

The Commercial Cookers Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

The commercial cookers market is exhibiting steady growth as foodservice establishments increasingly invest in efficient, durable, and high-performance cooking equipment to meet rising consumer demand and operational efficiency targets. This growth is being shaped by trends such as energy efficiency mandates, evolving kitchen designs, and the need for consistent food quality across service formats.

Adoption is further supported by advancements in materials and safety features, which have enhanced durability and compliance with regulatory standards. Future expansion is expected to benefit from the proliferation of organized foodservice outlets, rising investments in modernizing kitchens, and an emphasis on reducing operational costs.

Technological improvements combined with increased customization to suit diverse cuisines and layouts are paving the way for broader adoption across geographies and market tiers.

The market is segmented by Type, Burner, and End Use and region. By Type, the market is divided into Gas, Electric, and Dual. In terms of Burner, the market is classified into 4 Burners, 2 Burners, 3 Burners, 5 Burners, and 6 Burners. Based on End Use, the market is segmented into Full-Service Restaurants, Quick-Service Restaurants, and Catering. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

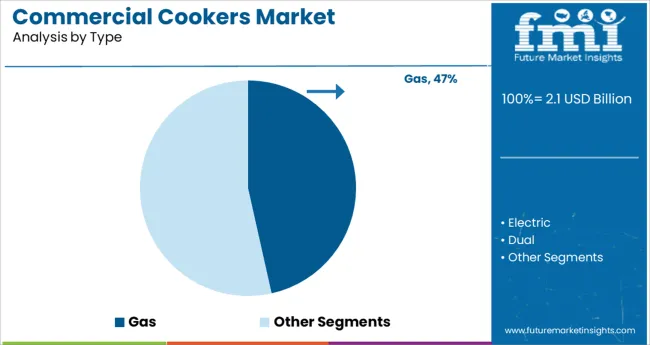

Insights into the Gas Type Segment

When segmented by type, the gas segment is projected to account for 46.5% of the total market revenue in 2025, establishing itself as the dominant choice. This leadership has been reinforced by the preference for precise heat control, faster cooking times, and superior compatibility with a variety of cooking techniques.

Gas cookers have been adopted extensively due to their ability to deliver high output even during peak hours, ensuring consistency in busy kitchens. Their operational resilience during power outages and lower operating costs compared to certain electric alternatives have also contributed to their prominence.

Additionally, their adaptability to different burner configurations and kitchen sizes has made them a favored option for full-scale foodservice operations striving for performance and reliability.

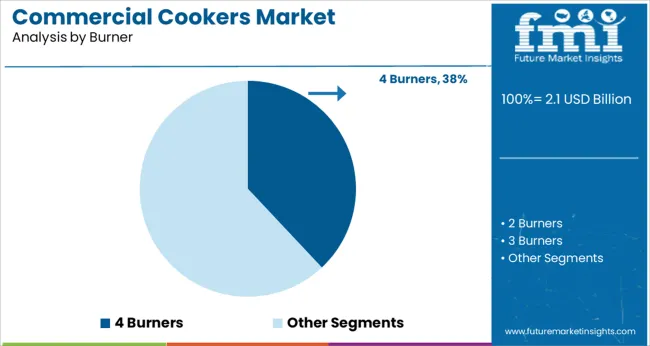

Segmented by burner configuration, the 4 burners segment is expected to hold 38.0% of the market revenue in 2025, maintaining its leadership position. This prominence has been driven by its optimal balance between capacity and space efficiency, making it suitable for medium to large kitchen environments.

The configuration allows chefs to execute multiple dishes simultaneously without overcrowding the workspace, improving workflow and reducing service times. Its popularity is also reinforced by its compatibility with standard commercial kitchen layouts, enabling easy integration and maintenance.

The versatility of 4 burner models in supporting diverse cooking needs and their availability across a wide range of price points have ensured continued preference among professional kitchens seeking efficiency and flexibility.

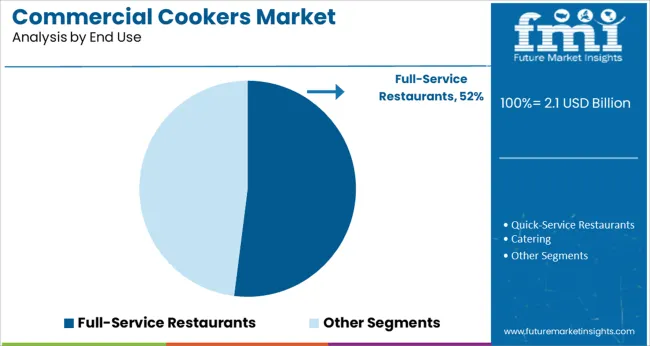

When segmented by end use, full service restaurants are forecast to capture 52.0% of the market revenue in 2025, securing their position as the leading end use category. This dominance has been supported by the need for high-capacity, reliable, and versatile cooking solutions that can handle varied menus and high customer volumes.

Full service restaurants have prioritized investment in advanced cookers to maintain food quality, optimize cooking times, and comply with stringent health and safety standards. The emphasis on delivering consistent dining experiences and the necessity of operating through extended hours have further reinforced their reliance on commercial-grade cookers.

The segment’s growth has also been propelled by the expansion of fine dining and casual dining formats, where kitchens require robust equipment to meet both aesthetic and functional expectations of discerning patrons.

The global commercial cookers market was expanding at a 1.4% CAGR from 2020 to 2025. According to FMI, by 2035, demand for commercial cookers would rise by 4.9%. Initially, the market size was USD 1,771.2 million in 2020.

The commercial cooker sector is changing due to advancements in automation, cutting-edge appliances, and digital sensors, much like any other sector of the economy. The goal of all these technologies is to simplify and streamline cooking.

As a result, the market size is worth USD 1,872.3 million in 2025. Additionally, there has been a significant change in buying habits. If financing choices are accessible and inexpensive, more and more restaurant owners are more likely to make an investment in a modern kitchen, which in turn raises the demand for commercial cookers.

In the instance of manufacturers of refrigeration, the leasing system has been observed to be profitable. Because of this, other producers of culinary equipment are now taking the same approach to reach more consumers, regardless of their scale or financial situation, and commercial cookers are no exception.

The surge in Demand for Cost-effective Products

About 20% less energy is used by commercial cookers than by conventional ones. As a result, energy- and money-saving industrial cooking equipment is becoming more and more well-liked in the food service sector.

In consequence, this is anticipated to create a significant window of opportunity for the commercial cooker industry to expand over the coming years.

Digital Transformation

End-use sectors are now selecting commercial cookers that have built-in digital transformation technologies, such as the Internet of Things (IoT) and Artificial Intelligence (AI), which are assisting them in continuously providing services to their clients.

Safety Hazards

Consumers are generally discouraged from purchasing pressure cookers as a result of many incidents of crockery product explosion brought on by companies' subpar product offers, which restrains market expansion.

For instance, six American consumers sued Instant Brands Inc., a major producer of multipurpose crockery items in the USA, between March 2020 and April 2024 as a result of several explosion incidents with Instant Pot cookers.

In addition, the demand for multipurpose crockery is being constrained by its greater price among middle-class and lower-income individuals. Additionally, fierce competition from local industry competitors and their aggressive pricing are impeding commercial cookers market expansion.

Gas cookers can be more advantageous for baking bread or pies since the crusts are less prone to dry out because they have a tendency to be slightly more humid. Reducing the operating costs of gas cookers purely due to the lower cost of electricity compared to gas.

However, short-term savings on an electric stove might not be worthwhile in the long run,

This is why gas commercial cookers are preferred by consumers and are expected to dominate the market with a share of 68.4%.

Full-service restaurants are expected to lead the commercial cookers market with a share of 43.8% by 2035.

These full-service restaurants provide a wide selection of foods and beverages, in addition to other services like lodging and upscale facilities. Rich locals and rich tourists like dining at exclusive establishments.

When customers desire to experience new dishes at a fair price, full-service restaurants are more inclined to adopt innovative technologies to manufacture quick-serve foods. The market share expands as a result of people having more discretionary income to spend on luxuries and take their families out to restaurants.

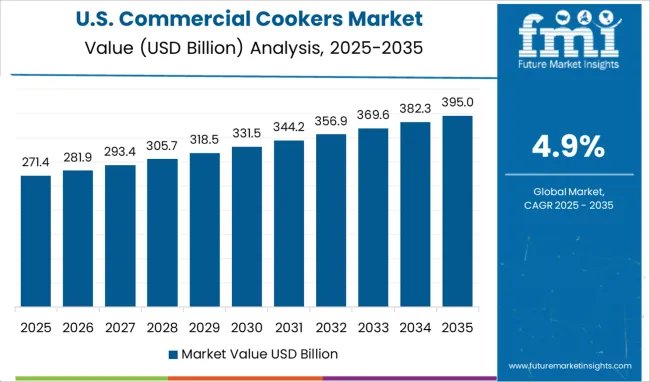

The US commercial cookers market is anticipated to have the largest market share of 28.5% by 2035.

The largest market for commercial cookers is the hotel sector in North America. This is due to the fact that the US consumes faster food than people in other regions of the world, and frequently purchases innovative items like smart deep fryers and cookers. The demand for commercial cookers in the area has expanded significantly due to the increase in restaurants and outside dining options.

The increased demand for electric pressure crockery items from customers in the USA and Canada caused the North American market to expand more quickly. More than 300,000 electric quick crockery pots were purchased through the American Amazon portal in July 2020 by Instant Brands Inc.

The continued popularity of baking and cooking among Americans and Canadians helps to sustain the region's high rate of product consumption.

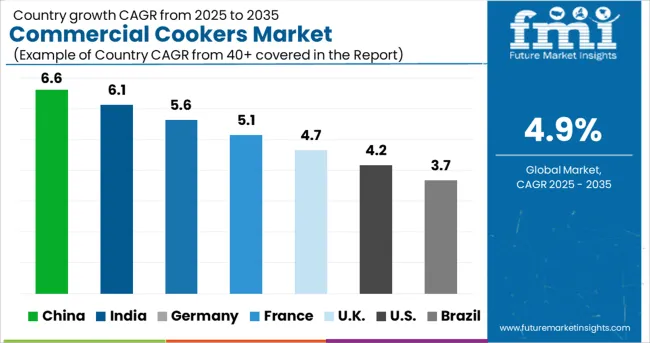

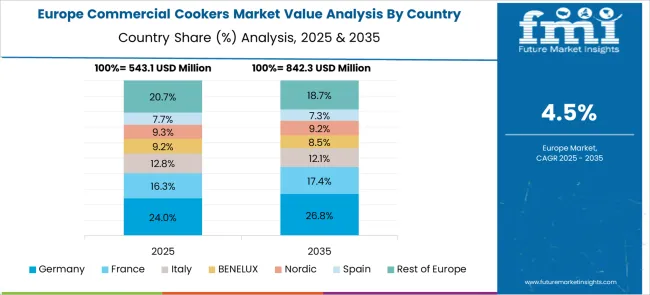

The commercial cookers market in Europe is found in the UK, Germany, France, Italy, and Spain. The expansion of the food service sector has contributed to the expansion of the European commercial cookers market. As it is affordable, widely available, and used in more locations, the UK is expected to have a CAGR of 3.9% by 2035.

A small-scale electric pressure crockery trial was started by Clasp. ngo, a UK-based producer of sustainable energy solutions, in June 2024 to encourage and increase demand for sustainably built appliances among Tanzania's rural population. These initiatives hasten market expansion across the Middle East and Africa.

The Asia Pacific region's quick-service restaurant market is predicted to expand significantly over the coming years, as numerous foreign chains and local firms expand their operations there. Foreign QSR chains are increasingly attempting to cater to local tastes. Similar to this, Indian restaurants are adding multi-cuisine food preparations to their menus, including Italian, Mexican, and Continental dishes, and are expected to develop at a 7.7% CAGR.

This is as more and more consumers are trying new foods and acquiring a taste for various cuisines. Due to the enormous consumption of kitchen appliances for daily culinary needs among the Chinese and Indian populations, the region holds an adequate position in the global market.

Retail sales of home appliances in China totaled USD 12,732.6 million from January 2024 to August 2024, according to survey data provided by the China Household Electrical Appliances Association (CHEAA). This makes China expand at a CAGR of 6.4% by 2035.

Manufacturers aim to produce cutting-edge products with lower prices to keep up with their company’s profit and market trends as well

A small number of sensors could significantly reduce the amount of time and energy used by conventional cooking apparatus. IoT-based culinary equipment offers astoundingly numerous options and advantages. Chefs can keep an eye on the meal from a distance, saving time, fuel, and electricity.

Additionally, restaurants may reduce food waste significantly with such commercial cookers. Chefs are therefore more likely to choose cooking tools that provide the greatest degree of versatility. Additionally, the increased focus on sustainability and electricity costs has made flexibility more significant than ever.

For instance, Instant Brands Inc. offered the Instant Pot Duo 7 in 1 electric pressure cooker on the American Amazon website in August 2024 for a promotional price of USD 69.95 or less. The item also functions as a yogurt maker.

Although these advances are on the market, the most difficult part is the price of such cutting-edge cooking equipment. But in order to boost the usage of cutting-edge cooking equipment, manufacturers of commercial cookers have worked hard to address this issue by creating new financing plans, interest-free deals, and leasing options.

As a result, commercial cooker manufacturers have spent a lot of money launching goods that no one even knew they needed. Development of commercial cookers in 2025.

How Competitors are Coping Up with New Commercial Cookers Market Trends?

Commercial cooker producers are concentrating on strategic alliances and mergers & acquisitions to outperform their rivals and increase their reach among end users.

The global commercial cookers market is estimated to be valued at USD 2.1 billion in 2025.

It is projected to reach USD 3.5 billion by 2035.

The market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types are gas, electric and dual.

4 burners segment is expected to dominate with a 38.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA