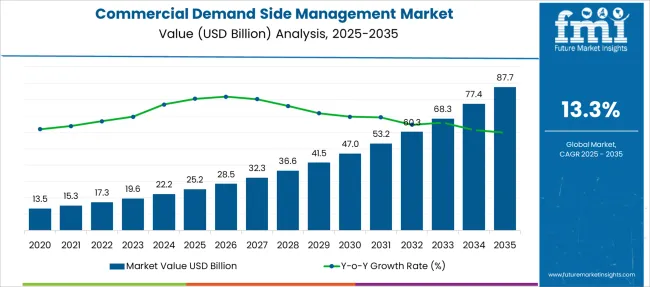

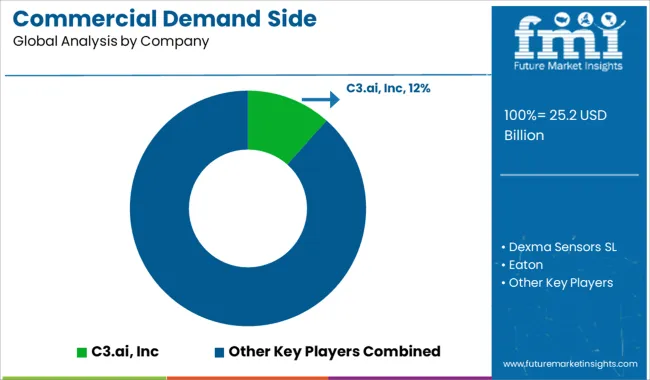

The Commercial Demand Side Management Market is estimated to be valued at USD 25.2 billion in 2025 and is projected to reach USD 87.7 billion by 2035, registering a compound annual growth rate (CAGR) of 13.3% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Demand Side Management Market Estimated Value in (2025 E) | USD 25.2 billion |

| Commercial Demand Side Management Market Forecast Value in (2035 F) | USD 87.7 billion |

| Forecast CAGR (2025 to 2035) | 13.3% |

The commercial demand side management market is expanding steadily as commercial establishments seek to optimize energy consumption, reduce operational costs, and meet regulatory efficiency standards. Heightened awareness around energy sustainability and the need for grid stability are encouraging the adoption of advanced demand-side management strategies.

Digitalization and the integration of smart technologies are reshaping how energy demand is monitored and controlled in real time across commercial buildings, offices, and retail environments. Additionally, utility-driven incentive programs and time-based pricing models are reinforcing the shift toward proactive energy usage patterns.

The market outlook remains positive, supported by increased investments in intelligent building infrastructure and supportive government policies promoting efficient energy practices. As the demand for carbon footprint reduction intensifies, commercial facilities are expected to increasingly leverage demand-side management solutions as a key component of their energy management strategy.

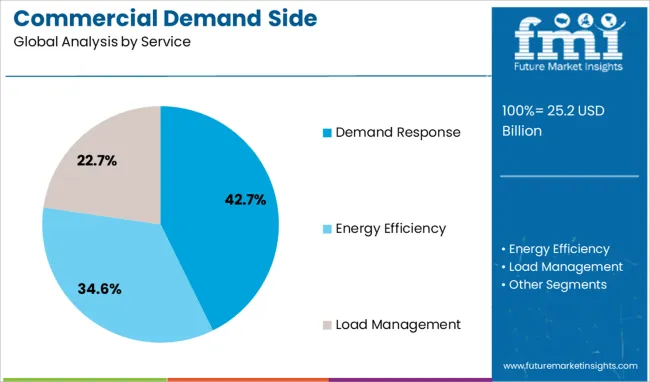

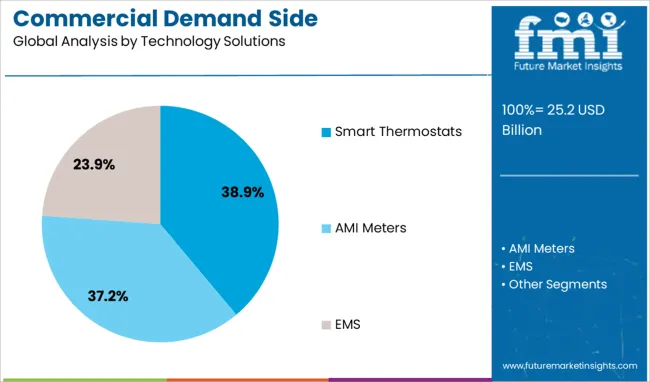

The commercial demand side management market is segmented by service, technology solutions, and geographic regions. The commercial demand side management market is divided into Demand Response, Energy Efficiency, and Load Management. In terms of technology solutions of the commercial demand side management market is classified into Smart Thermostats, AMI Meters, and EMS. Regionally, the commercial demand side management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The demand response segment leads the service category with a 42.7% share, emphasizing its pivotal role in managing peak load demand and enhancing grid reliability. Demand response services enable commercial users to adjust or reduce power consumption during periods of high demand in response to grid signals or pricing incentives.

These services are particularly effective in preventing outages and reducing energy costs, which makes them attractive to both utilities and commercial consumers. The segment's growth is further fueled by the increasing deployment of automation and real-time energy management systems that streamline demand response participation.

Regulatory frameworks encouraging grid resilience and energy conservation are reinforcing adoption across the commercial sector. As energy volatility and consumption patterns evolve, demand response services are expected to remain central to demand-side management strategies due to their proven impact on cost savings and operational efficiency.

Smart thermostats account for 38.9% of the market within the technology solutions category, driven by their effectiveness in optimizing HVAC operations and enabling precise temperature control in commercial spaces. These devices provide real-time monitoring, remote access, and adaptive learning capabilities, which contribute significantly to energy efficiency and occupant comfort.

The commercial sector has increasingly adopted smart thermostats to manage energy loads during peak demand while maintaining a comfortable environment for employees and customers. Integration with building automation systems and compatibility with demand response programs enhance the value proposition of these devices.

As more businesses prioritize sustainability and cost reduction, smart thermostats are being recognized as a practical and scalable solution for long-term energy management. Continued innovation in sensor technology, AI integration, and cloud-based controls is expected to support the sustained growth of this segment.

The commercial demand‑side management market is expanding as businesses adopt energy control solutions to reduce electricity cost and improve efficiency. These systems include demand response, load management and energy efficiency platforms that optimize usage during peak periods. Smart meters, building automation systems, and energy analytics enable businesses to shift or curtail electricity use in response to price signals or grid needs. Growth is driven by rising electricity prices, regulatory incentives, and commercial building modernization in regions like North America, Europe and Asia‑Pacific.

Commercial entities face significant financial hurdles when installing demand‑side management systems. The capex required includes advanced metering infrastructure, energy management software, sensors, and connectivity hardware. For many mid‑size and smaller enterprises, the expense does not justify the perceived short‑term return. This upfront cost causes hesitancy even if payback occurs over time through electricity bill reductions or peak‑demand penalties avoidance. Budget constraints limit participation in demand response programs without incentive schemes. Even where utilities offer rebates, the eligibility process adds complexity. As a result, actual adoption is slower than potential, especially in developing regions or segments with lean operating margins. Education gaps compound this issue. If financial models and benefit clarity improve, more commercial operators could commit to deployment. The high entry threshold remains a critical restraint and restrains broader uptake.

Policies and utility frameworks shape how commercial organizations can implement and benefit from demand‑side management. Diverse jurisdictions impose different rules for participating in demand response or energy efficiency programs. Time‑of‑use pricing, emergency response schemes, or ancillary service markets vary significantly. Some utilities lack financial incentives for commercial customers to reduce demand. In many regions, legacy grid infrastructure does not support automated response or real‑time control. Integration with older building systems requires costly upgrades and custom engineering. Lack of standardized protocols creates compatibility hurdles between meters, EMS platforms, and utility systems. As a result, deployment can require lengthy coordination and approval cycles. Organizations that aim for regional or global rollout must navigate differing rules and grid readiness. These factors complicate planning and delay project timelines. Suppliers and installers must offer flexible solutions that adapt to multiple regulatory environments to achieve scale.

The commercial demand‑side management market is adopting advanced analytics and control platforms to optimize energy use. Automated systems now use real‑time data from smart meters and building sensors to detect patterns and suggest actionable demand shifts or load curtailments. Cloud‑based energy management systems enable centralized control of HVAC, lighting, and production loads. Some platforms integrate machine learning to predict peak events and automate response sequences. Internet of Things-enabled devices allow remote monitoring, fault detection, and scheduling adjustments. Combined solutions connect demand response dispatch signals from utilities to automated control for immediate response. This integration improves cost savings, enhances grid reliability, and reduces manual intervention. As more commercial facilities add sensor networks, labeled data sets, and digital dashboards, demand‑side programs become more precise and reliable. This evolution supports broader take‑up as organizations seek both operational insight and cost control without user intervention.

Commercial implementations of demand‑side management collect significant operational and usage data. Protecting this information is essential, but it is often underdeveloped. Many facilities lack secure communication protocols and data governance to support analytics platforms, smart meters, or connected devices. If systems are compromised, operators risk exposing sensitive operational details or triggering false control actions. Distrust over data misuse prevents some businesses from enabling automated control. In addition, compliance with data protection regulations such as GDPR or sector‑specific rules can be unclear. Vulnerabilities can arise from IoT device access points, EMS software or third‑party integrations. The cost and complexity of securing systems add to the installation burden. Until confidence in cybersecurity frameworks improves, some commercial operators may avoid full deployment of DSM. Vendors who provide strong encryption, compliance documentation and third‑party certification boost credibility. As demand‑side systems increase in scale, these privacy and security safeguards will determine user acceptance and adoption rates.

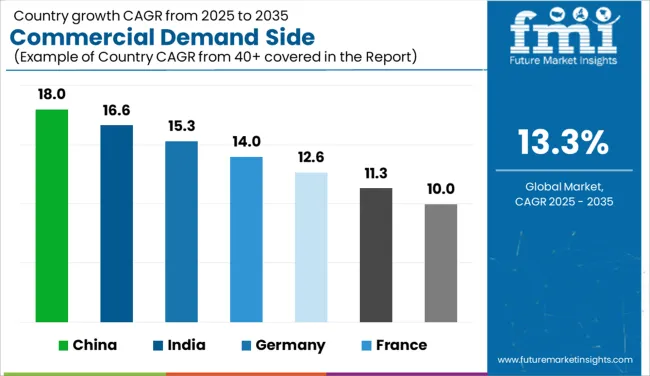

| Country | CAGR |

|---|---|

| China | 18.0% |

| India | 16.6% |

| Germany | 15.3% |

| France | 14.0% |

| UK | 12.6% |

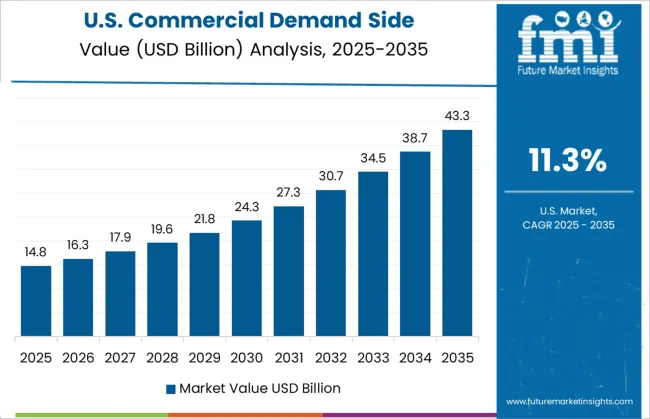

| USA | 11.3% |

| Brazil | 10.0% |

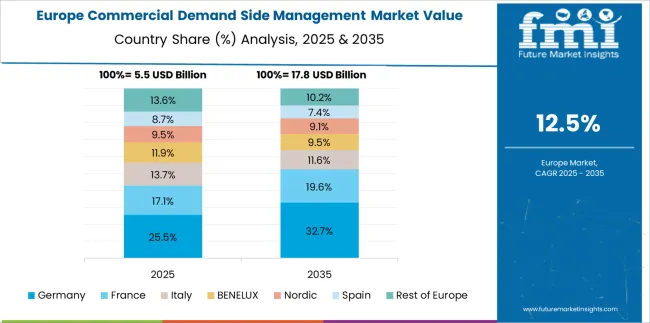

The global commercial demand side management market is projected to grow at a CAGR of 13.3% through 2035, supported by wider implementation of energy control strategies across commercial facilities. Among BRICS nations, China leads with 18.0% growth, driven by policy-backed energy curtailment measures and advanced load balancing practices. India follows at 16.6%, where peak demand control has been prioritized in metro regions and commercial hubs. In the OECD region, Germany records 15.3% growth, supported by the deployment of grid-interactive systems and price-responsive consumption frameworks. The United Kingdom, at 12.6%, has expanded its focus on commercial energy flexibility through third-party aggregators and capacity contracts. The United States, at 11.3%, continues to emphasize programmatic load response in retail, office, and institutional buildings. Tariff structuring rules, grid participation guidelines, and performance-based incentive schemes have shaped market expansion. This report includes insights on 40+ countries; the top markets are shown here for reference.

Market expansion in China has been paced at an 18.0% CAGR, driven by significant participation from commercial real estate, data centers, and urban infrastructure developers. Provincial grid authorities have actively supported the deployment of demand response programs. Commercial buildings have implemented peak load reduction solutions integrated with automated control systems. Load-shifting strategies using chilled water storage and HVAC modulation have contributed to energy cost savings. Large-scale retail and office complexes have adopted energy monitoring systems for better consumption analytics. Partnerships between utility firms and commercial consumers have supported rollouts of incentive-based DSM models. Pilot projects involving AI-based load forecasting tools have been executed in high-demand districts.

India has achieved a 16.6% CAGR in its commercial demand side management market, supported by increased load optimization efforts across IT parks, malls, and institutional buildings. Demand response aggregation platforms have been introduced to link building loads with utility incentives. Energy audits have prompted action among property developers to install automated lighting and ventilation systems. Smart meters and centralized BMS platforms have been deployed across several metro regions. Mid-size commercial establishments have opted for appliance-level monitoring to reduce peak-time consumption. Energy service companies have partnered with local utilities to offer time-of-day pricing solutions. Integration of backup power sources with load control has added flexibility to grid participation.

In Germany, a 15.3% CAGR has been recorded in the commercial demand side management space, with significant activity centered around green building initiatives and grid-interactive infrastructure. Corporate campuses and shopping centers have adopted distributed energy resource management systems (DERMS) to enable active load balancing. Integration of rooftop solar and battery storage with DSM protocols has increased, particularly in energy-intensive regions. Regulatory mechanisms promoting flexible tariffs have encouraged demand control among facility managers. Software-based automation tools have been integrated into HVAC and elevator systems to reduce operational overheads. Utility companies have collaborated to build networks to enable real-time load visibility.

The commercial DSM market in the United Kingdom has advanced with a 12.6% CAGR, supported by a focus on energy resilience in offices, hospitals, and hospitality chains. Peak load shaving programs have been adopted to ensure supply security during grid stress events. Retail park operators have incorporated centralized demand dashboards to track consumption in real time. Load response capabilities have been embedded in commercial chillers and boilers using modular control panels. Industrial estates have adopted customized DSM plans backed by performance-based incentives. Cloud-based energy tracking software has gained preference among facility management firms. Energy aggregators have collaborated with regional distribution networks for faster deployment.

The United States has shown an 11.3% CAGR in its commercial demand side management market, led by increased reliance on smart grid technologies in large urban corridors. Demand flexibility programs have been extended to corporate headquarters, airports, and logistics centers. Automated curtailment protocols have been activated during critical grid congestion periods. Building managers have adopted user-level analytics platforms to refine internal load distribution. Peak-time usage adjustments have been coordinated with demand aggregation services. Integration of EV charging load with demand profiles has begun in select urban installations. Commercial DSM pilot schemes funded by state-level energy boards have expanded across several states.

The commercial demand side management (DSM) market is shaped by vendors offering intelligent energy optimization solutions that reduce peak load, enhance grid responsiveness, and lower operational costs for commercial buildings. C3.ai, Inc. leads with AI-driven platforms that aggregate and analyze enterprise-scale energy data, enabling predictive load control and real-time efficiency tuning across large facility networks.

Dexma Sensors SL, a European provider, specializes in scalable energy intelligence software tailored for mid-sized commercial properties, offering granular consumption tracking and automatic anomaly detection. Eaton and Emerson Electric Co. support DSM through integrated power distribution and automation solutions, enabling facilities to shift loads and manage equipment cycles based on pricing signals or grid demand. eSight Energy focuses on cloud-based energy management platforms for multisite commercial operations, providing user-friendly dashboards and cost allocation tools that support targeted energy-saving actions. General Electric and Honeywell International Inc. deliver advanced building energy management systems that incorporate demand forecasting, HVAC optimization, and intelligent lighting controls for real-time load response. IBM leverages its analytics and IoT frameworks to integrate DSM with broader smart building and grid interoperability strategies.

Johnson Controls and Schneider Electric provide full-scale energy automation ecosystems, from BMS integration to demand forecasting and DR participation. Optimum Energy LLC. delivers HVAC optimization specifically for chilled water plants in large buildings. Sky Foundry supports fault detection analytics through its Sky Spark platform. Meanwhile, Telkonet, Inc. addresses hotel and institutional energy control via occupancy-based smart thermostats and plug load management tools.

On March 17, 2025, ICF company announced it secured over $35 million in contract renewals from a major Southern USA utility to continue delivering commercial and residential demand-side management programs using its AI-powered cloud platform, enhancing energy savings and grid reliability. According to Edo, the company appointed Tim Guiterman as Director of Utility Programs, strengthening its utility-facing demand flexibility and virtual power plant solutions for commercial buildings, including key initiatives like Spokane Connected Communities and Connecticut Innovative Energy Solutions (IES).

| Item | Value |

|---|---|

| Quantitative Units | USD 25.2 Billion |

| Service | Demand Response, Energy Efficiency, and Load Management |

| Technology Solutions | Smart Thermostats, AMI Meters, and EMS |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | C3.ai, Inc, Dexma Sensors SL, Eaton, Emerson Electric Co., eSight Energy, General Electric, Honeywell International Inc., IBM, Johnson Controls, Optimum Energy LLC., Rockwell Automation, Inc., Schneider Electric, Siemens, SkyFoundry, and Telkonet, Inc. |

| Additional Attributes | Dollar sales by commercial DSM type including demand response, energy efficiency, and load management services; by technology such as smart thermostats, AMI meters, and energy management systems (EMS); by geographic region including North America, Europe, and Asia‑Pacific; demand driven by rising electricity costs, regulatory mandates, and corporate sustainability initiatives; innovation in AI‑enabled automation, IoT-enabled analytics, and grid-interactive EMS; costs influenced by smart meter deployment, IT integration, and regulatory compliance. |

The global commercial demand side management market is estimated to be valued at USD 25.2 billion in 2025.

The market size for the commercial demand side management market is projected to reach USD 87.7 billion by 2035.

The commercial demand side management market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in commercial demand side management market are demand response, energy efficiency and load management.

In terms of technology solutions, smart thermostats segment to command 38.9% share in the commercial demand side management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA