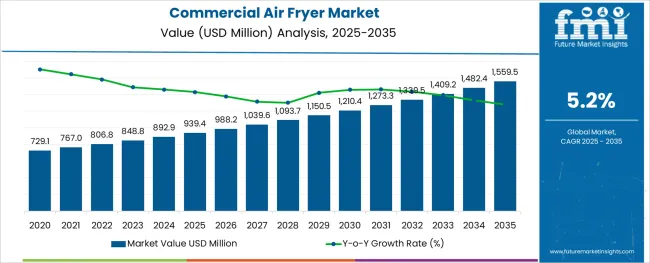

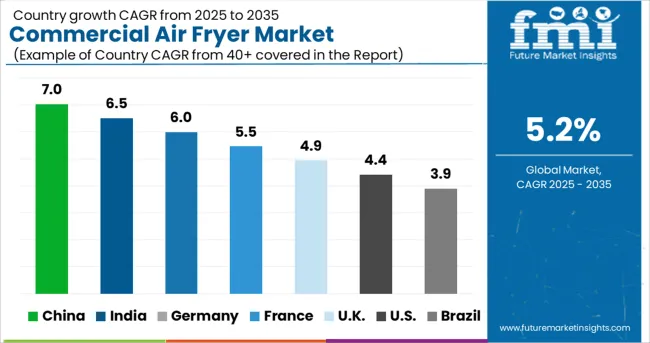

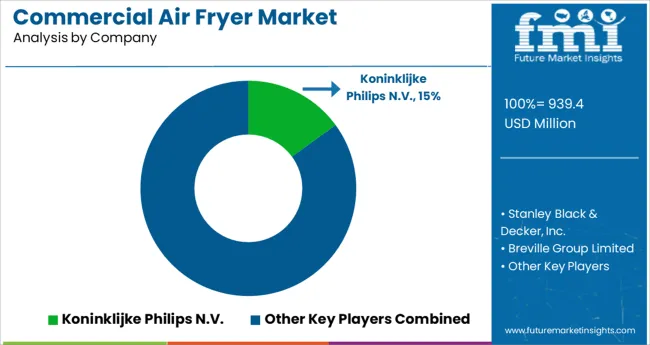

The Commercial Air Fryer Market is estimated to be valued at USD 939.4 million in 2025 and is projected to reach USD 1559.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The commercial air fryer market is gaining significant momentum as the foodservice industry shifts toward healthier cooking practices, energy efficiency, and faster preparation times. Growing awareness of health-conscious dining, coupled with operational cost pressures in commercial kitchens, has accelerated the transition from traditional frying methods to air-based technology.

Enhanced product durability, consistent output quality, and reduced oil dependency are key factors propelling adoption across restaurants, hotels, and catering services. Future growth is expected to be supported by technological advancements such as programmable interfaces, improved heat distribution systems, and energy-efficient designs tailored for high-volume usage.

Increasing consumer demand for low-fat meals, along with regulatory scrutiny of trans-fat and oil waste management, is anticipated to reinforce the trend toward air frying solutions. Rising investments in compact, versatile appliances that align with modern kitchen layouts and sustainability goals are paving the path for further market expansion.

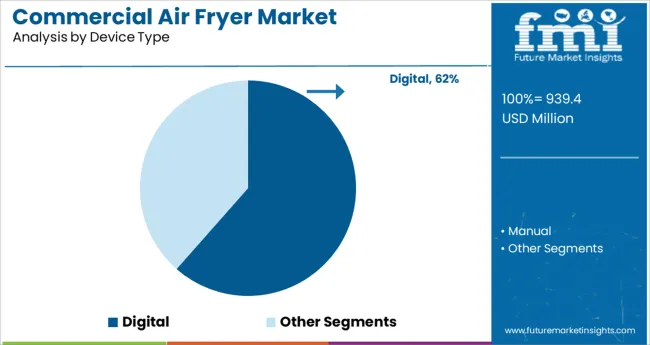

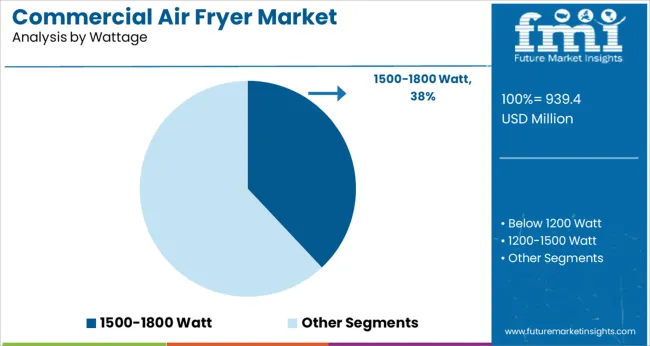

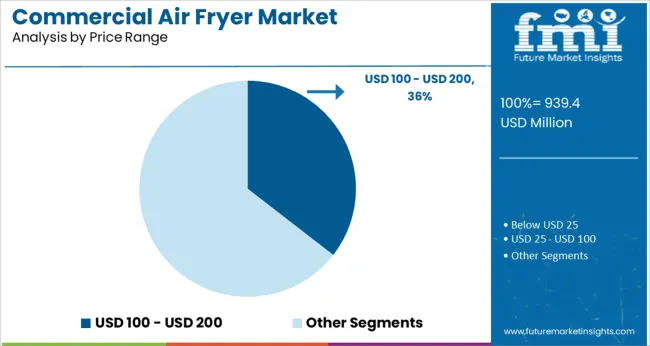

The market is segmented by Device Type, Wattage, Price Range, and Sales Channel and region. By Device Type, the market is divided into Digital and Manual. In terms of Wattage, the market is classified into 1500-1800 Watt, Below 1200 Watt, 1200-1500 Watt, 1800-2200 Wattage, and 2200 Wattage & Above. Based on Price Range, the market is segmented into USD 100 - USD 200, Below USD 25, USD 25 - USD 100, USD 200 - USD 300, and USD 300 & Above. By Sales Channel, the market is divided into Online Retailers, Direct Sales, Supermarket/Hypermarket, Department Stores, Specialty Stores, and Other Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

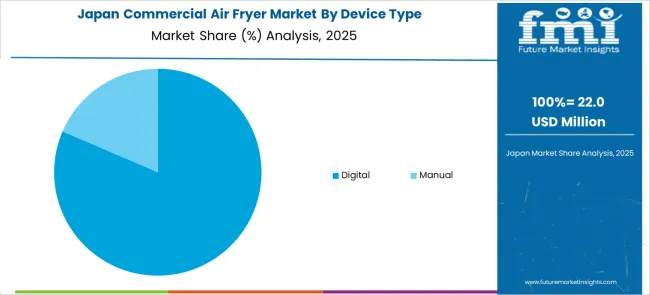

When segmented by device type, the digital segment is anticipated to command 61.5% of the total market revenue in 2025, positioning it as the leading subsegment. This leadership is attributed to the growing preference for precise, programmable controls that enhance operational efficiency and consistency in commercial environments.

Digital models have been adopted widely due to their intuitive interfaces, customizable cooking modes, and ability to store multiple presets, which streamline workflow in busy kitchens. The integration of touchscreens and smart sensors has improved user experience, minimized errors, and allowed better monitoring of cooking parameters, further strengthening their appeal.

As kitchens increasingly prioritize output quality and operational speed, the ability of digital devices to deliver repeatable, high-quality results with minimal supervision has reinforced their dominant market share.

Segmenting by wattage reveals that the 1500 to 1800 watt segment is expected to hold 38.0% of the market revenue in 2025, maintaining its prominence. This dominance has been shaped by the optimal balance these appliances offer between energy efficiency and cooking performance.

Units in this wattage range have been widely adopted as they deliver sufficient power to meet commercial volume demands while minimizing energy costs, an important consideration for operators managing tight margins. The reliability of this range in achieving rapid heat-up times and consistent air circulation without overloading electrical systems has made it a preferred choice in diverse foodservice settings.

Additionally, advancements in heating elements and insulation materials have enhanced the efficiency of these wattage models, further supporting their strong position within the market.

When segmented by price range, the USD 100 to USD 200 segment is projected to capture 35.5% of the market revenue in 2025, emerging as the leading category. This leadership stems from the accessibility and value proposition offered by products in this range, which align well with the budget constraints of small and medium-sized commercial establishments.

Appliances priced within this bracket have been favored for offering a balance between advanced features, durability, and affordability, making them attractive for widespread adoption. The ability of this price segment to deliver professional-grade performance without requiring significant capital investment has made it particularly appealing in emerging markets and among independent operators.

Strong demand from businesses seeking efficient yet economical solutions has continued to drive this segment’s market share, solidifying its position at the forefront of the pricing spectrum.

Air fryers are synonymous with healthy food concepts. They offer convenience and help cook an extensive range of food products, including French fries, battered seafood, chicken wings, chips, etc. With surging demand for healthier meals even while dining out, several restaurant chains are adopting appliances that promote healthier ways of meal preparation. Thus, the demand for air fryers that help cook ‘fried’ food with little to no oil without compromising on crispiness, taste, and health has been gaining traction recently. Further, the availability of commercial air fryers in various sizes, capacities, and styles, as a stand-alone appliance or as well-suited for a countertop, are adding to its demand from fast-food facilities, restaurants, bars, school cafeterias, and food trucks.

Modern air fryers are now available for larger kitchens, having a basket capacity of 1 gallon, large enough for preparing several portions at once. These units have pre-programmed settings for chicken, fries, steak, and fish, etc., with a manual mode to control the temperature and cooking time. The quick cooking time of advanced air fryers aids will boost the satisfaction of final customers, thus, increasing its uptake by concession stands, cafés, food trucks, or catering businesses that serve fried foods. More technological innovations in the market include premium digital air fryers that allow crispy and evenly cooked food with greater efficiency in a matter of few seconds. Further, the development of new air fryers allowing the simultaneous meal preparation of two separate dishes has been gaining popularity as of late. The new air fryer/toaster oven units in the market, which offers the convenience of an air fryer and the versatility of an oven, offering pre-programmed settings for pizza, French fries, defrosting, barbeque, and roasting, are drawing the interest of the stakeholders.

Market players are further innovating affordable air fryer solutions for small businesses like food trucks and catering businesses. Further, several businesses are investing in this equipment to keep up with the consumer’s adoption of oil-free diets for health reasons. Additional sales propellants include new recipe developments, specific to the air fryers, and health and wellness trends surfacing on social media platforms that promote the consumption of low or no-oil-based foods due to their health benefits.

According to World Customs Organization (WCO), more than two million counterfeit pieces were seized during WCO operations in the Balkans in March 2025. The ineptitude of procurement networks to solve this issue is posing a severe challenge to key players, thus resulting in reduced consumer confidence and sales of new appliances. This problem is more prominent in online retail due to the lack of an appropriate verification process for product authenticity during delivery. Additionally, owing to new, more sophisticated counterfeiting processes, consumers are facing more difficulty distinguishing genuine versus counterfeit products, thus adversely impacting product sales and revenue.

Air fryers have plastic coatings on cooking surfaces, which in the long-term results in the release of toxic materials. Additionally, the high price of air fryers, coupled with frequent requirements for extra accessories at an additional cost, might dissuade customers, especially small businesses like food trucks and catering businesses, from purchasing commercial air fryers. LACK OF SKILLED PEOPLE

A manual air fryer, also known as an analog air fryer, is controlled by two simple dials responsive to cooking temperature and cooking time and has no other smart function. The manual air fryer holds the largest market share, accounting for 72.8% of the entire market share. This could be ascribed to the high demand for cheap air fryers to cut down the overall costs of businesses. Moreover, the congruent price range for a top manual air fryer and an entry-level digital air fryer seems to favor the demand for manual air fryers. Additionally, analog air fryers are easy to use for commercial purposes as many professionals are yet to be familiarized with the advanced, more complex digital air fryers. Also, the simple and fewer functions of manual air fryers make for the low repair cost of air fryers of this category, thus resulting in its heightened sales in the forthcoming years.

As the general wattage required by air fryers is around 1425 watts, the demand for air fryers within the range of 1200 -1500 watts is gaining huge demand. The market share held by 1200-1500 watts accounted for 27.3% of the overall market share of commercial air fryers. Moderately low power consumption of air fryers, in contrast to microwaves, deep fryers, and traditional ovens, is also boosting the product demand over the forecast period.

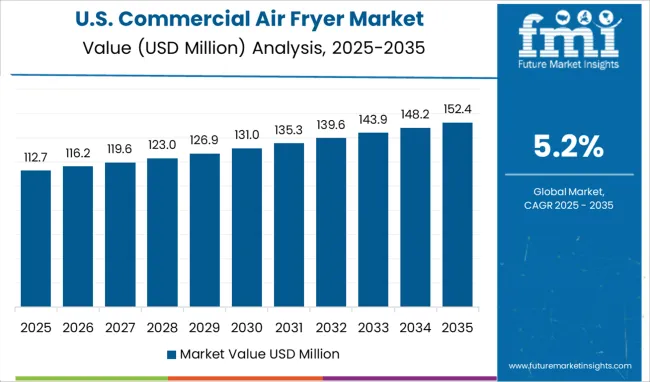

With almost 19.8% of the estimated market share in terms of sales in 2035, the USA is predicted to dominate the global market. The USA is expected to enjoy the largest market share on account of the surging adoption of air fryers for commercial purposes due to the rising awareness regarding the health benefits of food items prepared using air fryers. Further, the rising acceptance of smart kitchen equipment in the hotels, restaurants, and cafes (HORECA) sector to promote efficiency and modular aesthetics is also invigorating the market growth in the region.

The market is further driven by the high obesity rate in the USA, linked with a high incidence of cancers, thus propelling the demand for modern appliances promoted for their health benefits. Additionally, the market is supported by research and development activities in the market. In addition to this, the high density of well-established and widely-known players in the market is a significant factor contributing to the expansion of the commercial air fryer market size in the region.

The German commercial air fryer market is expected to account for the second-largest market share of 8.4% in 2035. The market growth for commercial air fryers looks promising in Germany. Several factors contributing towards the market growth in the region include rising investments, growing health consciousness and responsiveness for consuming a healthy diet, the launch of innovative products with new features and improved designs, and rising adoption of air fryers in shops, café, fast food restaurants, and hotels. Additionally, the market is propelled by the directed shift towards multi-functional air fryers from traditional deep fryers. Moreover, the rising demand for easy-to-use and quicker-to-operate appliances is supporting the demand for air fryers for commercial purposes.

Owing to the surge in momentum for the commercial use of air fryers, the Japan commercial air fryer market is predicted to account for a market share of 5.4% in the year 2035. The rising standards of living, the emerging trend of low-fat or oil-based cooking, and growing health consciousness among consumers are collectively aiding the growth of Japan's commercial air fryer market. Further, the high health consciousness of the Japanese populace, expanding food services sector in the country, new developments in air fryers accommodating larger capacities, well-suited cafes, hotels, and restaurants (HORECA) sector, are some of the factors facilitating the market growth in the region.

The Australian commercial air fryer market is estimated to represent 3.2% of the global commercial air fryer market in 2035. The market growth over the forecast period can be attributed to the new players expanding in the region due to lucrative growth opportunities in Australia. Additionally, ongoing collaborations as well as the acquisition of smaller companies are aiding the market growth of commercial air fryers in the region. The market is further influenced by the willingness of food service establishments to adopt appliances that support healthy eating practices. In addition to this, the growing sports and fitness-conscious consumers in the country are anticipated to propel the demand for air-fried food at food junctions.

Due to their comparable product portfolios and clientele, start-ups are now engaged in severe competition. Over the projected period, it is anticipated that new fast-food companies seeking an enlarged customer base, encompassing health-conscious consumers, in addition to the expansion of operations would have a favorable effect on commercial air fryer demand.

Several start-ups have begun selling their goods online. To guarantee the widest possible product distribution, start-ups are partnering with distributors across the world. This assists them in growing both their customer base and the reach of their goods. Additionally, the industry is anticipated to benefit from rising internet penetration in both developed and emerging nations.

LightFry

LightFry, located in Sweden, offers air fryers and follows up on the installation of the product. The start-up is determined to grow awareness around this technology to expand its customer base. Additionally, the firm is taking action to ensure that the customers achieve great results in terms of improved production, financial savings, and an enhanced working environment.

The presence of several well-known competitors, such as Koninklijke Philips N.V., Stanley Black & Decker, Inc., and Breville Group Limited, as well as numerous small and medium-sized competitors, dominate the market. Furthermore, the commercial air fryer industry is marked by intense competition since the top commercial air fryer manufacturers have such a large client base. The players are well-established, have robust and wide-ranging distribution networks, and they can satisfy the demands of the food chain industry.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.2% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | By Device Type, By Wattage, By Price Range, By Sales Channel, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East & Africa; Oceania |

| Key Countries Profiled | The USA, Canada, Brazil, Mexico, Germany, Italy, France, The UK, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Koninklijke Philips N.V.; Stanley Black & Decker, Inc.; Breville Group Limited; Groupe SEB; SharkNinja Operating LLC (CDH Private Equity); Cuisinart Corporation (Conair Corporation); Meyer Manufacturing Company Limited; GoWISE USA (Ming’s Mark Inc); NuWave, LLC; De’ Longhi Appliances S.r.l |

| Customization & Pricing | Available upon Request |

The global commercial air fryer market is estimated to be valued at USD 939.4 million in 2025.

It is projected to reach USD 1,559.5 million by 2035.

The market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types are digital and manual.

1500-1800 watt segment is expected to dominate with a 38.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Air Fryer Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA