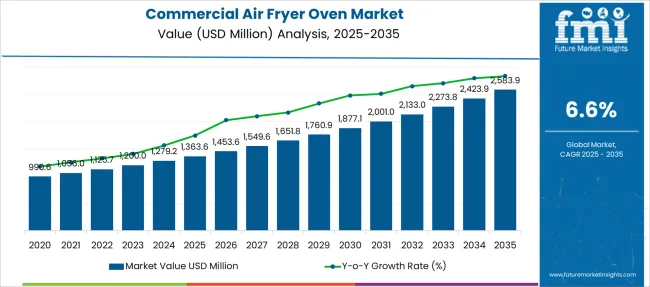

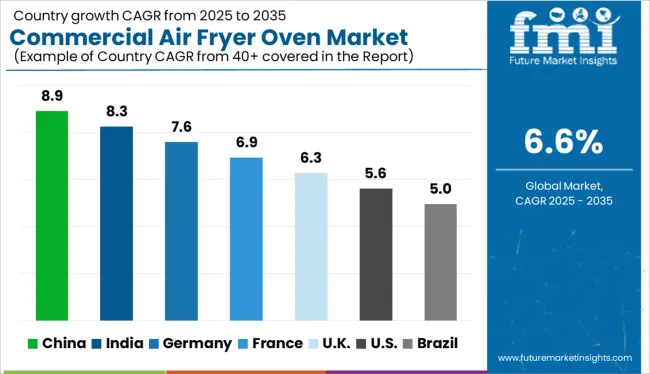

The Commercial Air Fryer Oven Market is estimated to be valued at USD 1363.6 million in 2025 and is projected to reach USD 2583.9 million by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Air Fryer Oven Market Estimated Value in (2025 E) | USD 1363.6 million |

| Commercial Air Fryer Oven Market Forecast Value in (2035 F) | USD 2583.9 million |

| Forecast CAGR (2025 to 2035) | 6.6% |

The commercial air fryer oven market is experiencing sustained growth as food service establishments increasingly adopt healthier and energy efficient cooking appliances. Rising consumer demand for low oil preparation, combined with regulatory pressures to reduce trans fat and oil waste, has accelerated the adoption of air frying technology in commercial kitchens.

The expansion of fast casual and quick service restaurants has also fueled demand for appliances that deliver speed, consistency, and healthier cooking outcomes. Improvements in heating elements, air circulation technologies, and user friendly interfaces have further improved product reliability and cooking performance.

As commercial food operators prioritize operational efficiency, reduced maintenance, and energy savings, the market for commercial air fryer ovens is expected to witness consistent investment and expansion. The future outlook remains strong with increasing innovation in programmable systems, larger capacity units, and integration with digital kitchen management platforms.

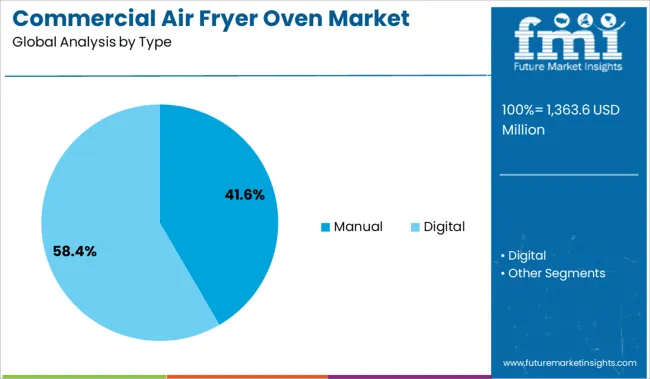

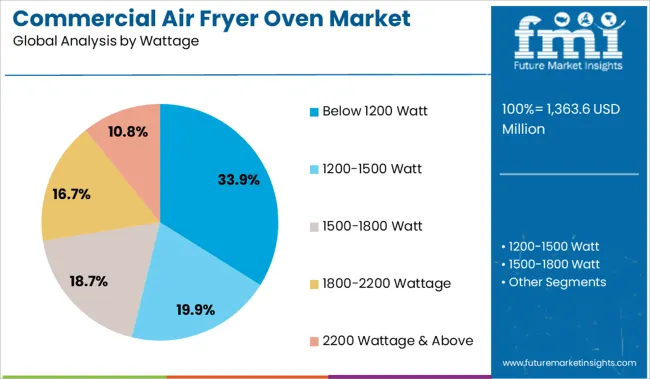

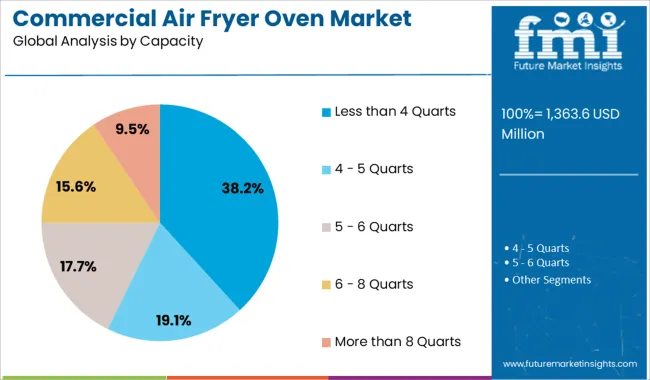

The market is segmented by Type, Wattage, and Capacity and region. By Type, the market is divided into Manual and Digital. In terms of Wattage, the market is classified into Below 1200 Watt, 1200-1500 Watt, 1500-1800 Watt, 1800-2200 Wattage, and 2200 Wattage & Above. Based on Capacity, the market is segmented into Less than 4 Quarts, 4 - 5 Quarts, 5 - 6 Quarts, 6 - 8 Quarts, and More than 8 Quarts. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The manual segment is projected to represent 41.60% of total market revenue by 2025 within the type category, establishing it as the dominant format. This segment has gained traction due to its simplicity, affordability, and ease of operation, making it a preferred choice among small to medium sized food businesses.

Manual controls offer greater flexibility for operators who prefer intuitive temperature and time adjustments without relying on programmed presets. This segment also benefits from lower maintenance requirements and compatibility with a broad range of commercial kitchen setups.

As budget conscious operations seek reliable and efficient cooking solutions without complex interfaces, the manual type continues to dominate in adoption and demand.

The below 1200 watt segment is expected to account for 33.90% of the total market share by 2025 in the wattage category. This preference stems from the need for energy efficient appliances that deliver consistent performance without overloading commercial power systems.

Lower wattage models are particularly suited for smaller food establishments, kiosks, and outlets with limited electrical infrastructure. These models also help reduce utility expenses while maintaining cooking quality, especially in operations with high frequency use.

As energy optimization becomes a critical priority for commercial kitchens, the below 1200 watt segment is projected to maintain strong traction across cost sensitive and space constrained environments.

The less than 4 quarts capacity segment is forecasted to contribute 38.20% of market revenue by 2025 under the capacity category. This size range caters to compact commercial operations where space and portion control are key considerations.

Operators benefit from faster preheat and cook times, reduced food waste, and optimized batch cooking with smaller units. It is especially advantageous in establishments offering made to order or low volume specialty dishes.

This segment also aligns with evolving consumer demand for fresh and personalized food servings. As food service providers increasingly look for compact, efficient, and space saving cooking appliances, the less than 4 quarts capacity segment continues to secure a leading role in commercial air fryer oven adoption.

Air fryers have lately gained popularity due to the enduring desire for fried foods and rising health concerns. More potatoes are consumed in America than any other vegetable, and 40% of the market is made up of frozen foods like French fries.

The growth of nuclear families, which promotes the consumption of nutritious foods and changes in lifestyle and customer preferences, is another factor boosting demand for commercial air fryer oven.

The need for new, innovative, and technologically sophisticated products is also expected to increase, and consumers' preference for less-oily, healthier meals is likely to fuel the market's expansion over the forecast period.

Commercial air fryer ovens promote their product as a way to prepare and consume fried meals without the negative health impacts of fried food. To address the increased demand for healthy functional meals and drinks, manufacturers are expected to invest in revolutionary technology.

The rise in food production capacity and the food processing industry in emerging economies is likely to boost the growth of the commercial air fryer oven market.

Some people are dubious about the alleged health benefits of air-fried foods, while others are cautious about the potential health risks of using this unique method of cooking, primarily as they are concerned about toxicity and cancer. High initial investment costs and rising manufacturing expenses as a result of rising energy and labor costs impede commercial air fryer oven market expansion.

Continuous improvements in product performance are driving up the cost of the finished product, and the availability of substitute products at low prices is anticipated to limit the commercial air fryer oven market growth.

Additionally, the longer cooking times of air fryers that result in higher energy and electricity usage are hampering the demand for commercial air fryer ovens. Additionally, an air fryer takes at least 20 to 25 minutes, compared to 10 to 12 minutes for a standard fryer. Therefore, it is anticipated that these factors are likely to restrain market expansion throughout the upcoming years.

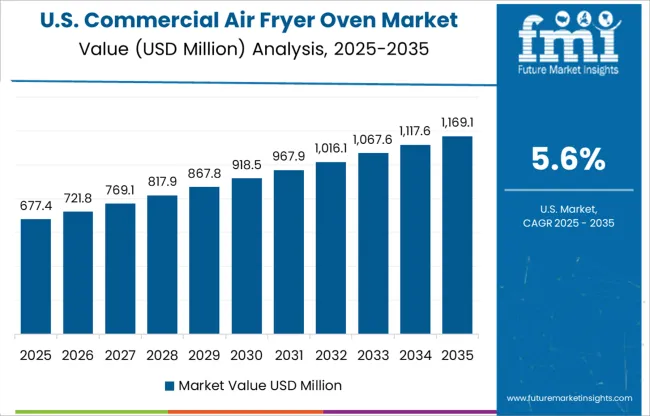

Switching to air-fried dishes from deep-fried ones and regularly consuming fewer harmful oils can also help with weight loss. The USA commercial air fryer oven market is therefore anticipated to reach USD 1363.6 million in 2025 due to its adaptability.

Sales are being boosted by consumers' growing acceptance of modular design and smart kitchen appliances. Additionally, manufacturers are pushing for improved market access and increased investment in Research and Development (R&D).

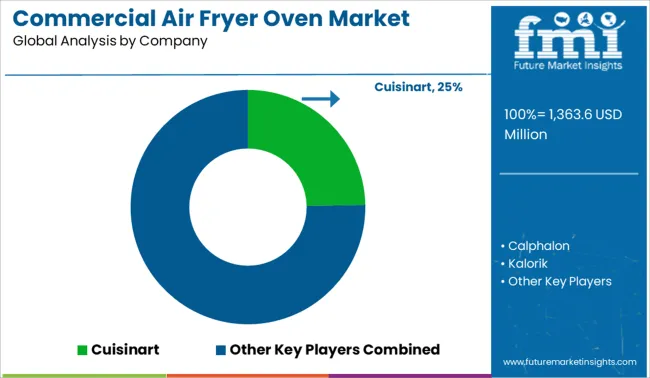

The USA market is somewhat consolidated, with the bulk of commercial air fryer oven market share going to well-established, internationally renowned manufacturers, with the exception of Tier 2 businesses and start-ups, who provide a greater variety of product choices.

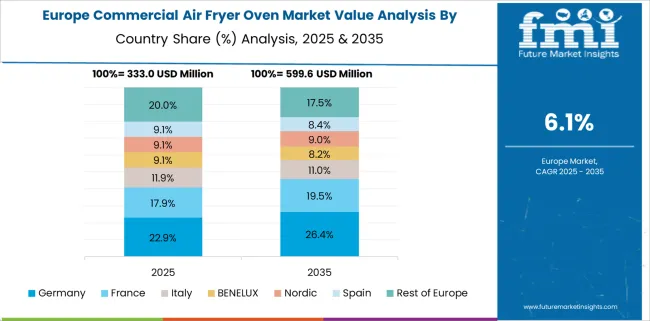

By 2035, Europe is anticipated to have the biggest market share, at 40%. The most influential local market in Europe is Germany. Consumer health awareness is rising, online usage is expanding, and easy financing options, together with specials and promotions from major e-retailers, are all contributing to the increase in sales of commercial air fryer ovens.

Furthermore, it is anticipated that the presence of well-known producers like Philips, Ninja, and Prestige is likely to increase demand for commercial air fryer oven in Germany.

Due to its developing economy, expanding industrial base of food processing services driven by rapid urbanization, and rising demand for convenience food, which is fueled by customers' soaring disposable income and spending power of convenient yet healthy and less oily food, the German market is witnessing notable progress.

| Countries | Innovations |

|---|---|

| Korea | Although the general elements of commercial air fryer ovens remain the same. But manufacturers are still concentrating on innovation and customization. For instance:

|

| China | The commercial air fryer oven market is likely to expand as a result of an increase in the domestic use of air fryers due to China's availability of low-cost goods and customers' increased disposable incomes. |

Digital commercial air fryer ovens are leading the market value and are expected to grow with more than 4.5% CAGR over the forecast period. The preference of consumers for digital commercial air fryers over manual air fryers has mostly changed as a result of time savings, high cooking capabilities, and consistency in flavor and texture.

As a result, digital commercial air fryers are quickly increasing their market share, and manufacturers have been concentrating on making products that are trendy and have modern features.

Commercial air fryer ovens with a capacity of more than 8 quarts hold the majority of the market share. This is because air fryers retain heat rather than increasing the temperature of the kitchen area like a regular oven does, which saves a lot of space for the food service and food processing industries and maintains the ambient temperature at a comfortable level.

Active commercial air fryer oven market participants have been able to survive in the fiercely competitive consumer-centric industry due to ongoing improvements in product performance and functionality, as well as ongoing consumer input.

Recent Development

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; and MEA |

| Key Countries Covered | USA, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, and UAE |

| Key Segments Covered |

Product Type, Wattage, Capacity, Region |

| Key Companies Profiled | Cuisinart; Calphalon; Kalorik; Black & Decker; Havells; Brava Home; Ninja Kitchen; Hamilton Beach Brands; COSORI; Breville; Philips; GoWISE; Inalsa; KENT |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global commercial air fryer oven market is estimated to be valued at USD 1,363.6 million in 2025.

The market size for the commercial air fryer oven market is projected to reach USD 2,583.9 million by 2035.

The commercial air fryer oven market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in commercial air fryer oven market are manual and digital.

In terms of wattage, below 1200 watt segment to command 33.9% share in the commercial air fryer oven market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA