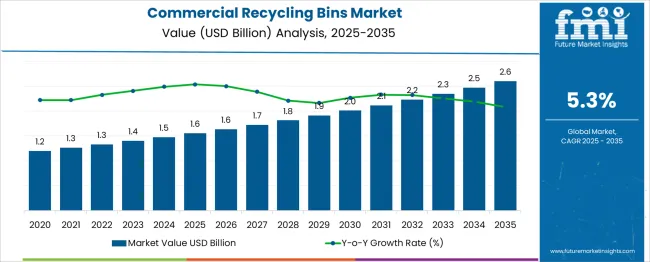

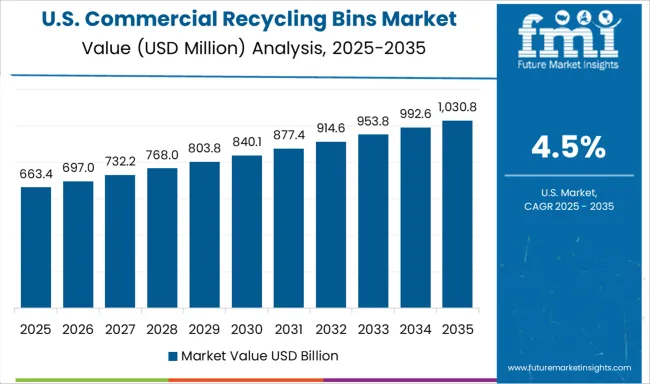

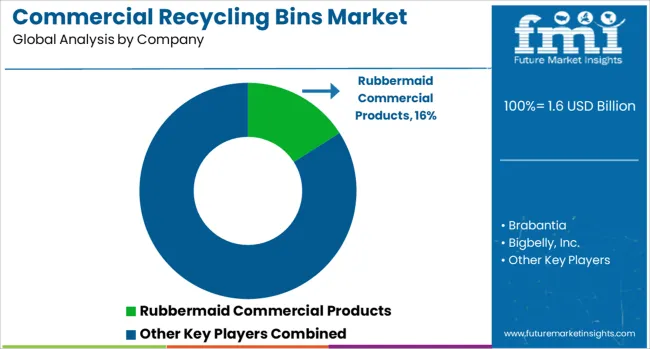

The Commercial Recycling Bins Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. To determine seasonality or cyclicality, the annual trend in market value from 2025 to 2035 is examined for recurring fluctuations, irregular growth intervals, or alternating growth rates that would indicate cyclical demand patterns.

From the data, growth appears linear and consistently incremental. The market is expected to hold at USD 1.6 billion from 2025 to 2026, then progress gradually by USD 0.1 billion per year through 2030. Between 2031 and 2034, annual additions increase slightly to USD 0.2 billion in some years, followed by a smaller final increment of USD 0.1 billion in 2035. No sharp drops, reversals, or uneven spikes in value are observed across any consecutive years, eliminating signs of market contraction or rebound phases.

The absence of alternating high and low growth years suggests a non-cyclical demand structure. Furthermore, no periodic surges are seen that would imply seasonal spikes linked to fiscal cycles, regulations, or procurement schedules. Instead, the pattern reflects a steady adoption curve, driven by gradually expanding awareness and policy mandates, rather than episodic or time-bound triggers. This implies the market remains largely stable without seasonal or cyclical disturbances.

| Metric | Value |

|---|---|

| Commercial Recycling Bins Market Estimated Value in (2025 E) | USD 1.6 billion |

| Commercial Recycling Bins Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The commercial recycling bins market is witnessing consistent growth, driven by rising institutional focus on sustainability, waste segregation mandates, and public-private partnerships for waste management infrastructure. Regulatory frameworks mandating color-coded recycling systems and corporate ESG commitments have led to greater adoption of structured recycling solutions across office buildings, educational institutions, hospitality venues, and industrial campuses.

Government procurement initiatives and green building certification programs are encouraging investment in standardized and recyclable bin models. Technological enhancements, such as RFID-enabled monitoring and sensor-based fill-level alerts, are further transforming the functionality and adoption rate of modern commercial bins.

Looking forward, the market is expected to benefit from circular economy policies, increasing awareness of post-consumer waste segregation, and a gradual shift toward modular, durable materials that align with environmental compliance goals.

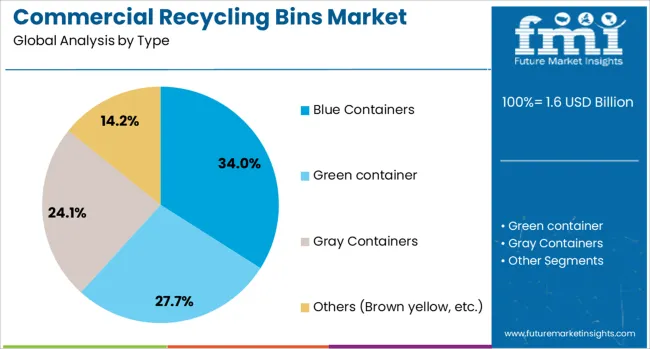

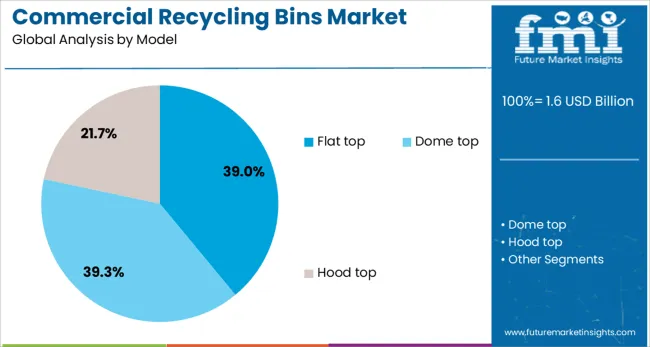

The commercial recycling bins market is segmented by type, model, material, end-use distribution channel, and geographic regions. The commercial recycling bins market is divided into Blue Containers, Green containers, Gray Containers, and others (Brown, yellow, etc.). In terms of the model of the commercial recycling bins market, it is classified into Flat top, Dome top, and Hood top.

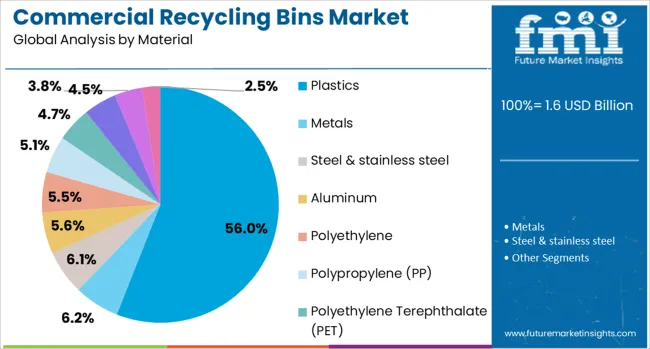

The commercial recycling bins market is segmented into Plastics, Metals, Steel & stainless steel, Aluminum, Polyethylene, Polypropylene (PP), Polyethylene Terephthalate (PET), Acrylonitrile Butadiene Styrene (ABS), Fiberglass, and others (Polycarbonate (PC), Galvanized Steel). By end use of the commercial recycling bins market is segmented into Supermarkets, Department Stores, Cafes and Coffee Shops, Educational institutes, Offices, Retail stores, HospitalsOthers (Convenience Stores, Specialty Stores, Parks, etc.).

By distribution channel of the commercial recycling bins market is segmented into Direct salesIndirect sales. Regionally, the commercial recycling bins industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Blue containers are anticipated to lead the type segment with a 34.0% revenue share in 2025. Their dominance is driven by widespread regulatory endorsement of blue as the standardized color for recyclable waste, particularly paper and mixed dry recyclables.

Consistency in visual identification across municipal and commercial settings has improved user compliance, aiding waste sorting efficiency. Blue containers are also favored for their visibility and ease of integration within multi-stream recycling programs.

Institutional buyers have increasingly adopted blue-coded bins to align with LEED certification requirements and internal sustainability protocols. The segment's sustained performance is further supported by education-driven adoption in schools, offices, and public spaces seeking to encourage environmentally responsible behavior.

Flat top models are expected to account for 39.0% of the market revenue by 2025, making them the most preferred bin configuration. Their popularity stems from their space-saving design, stackability, and ease of placement in high-traffic or compact commercial zones.

These models provide uniform aesthetics, which aligns well with modern office design and facility management standards. The flat surface also enables convenient labeling and signage for waste categorization, improving sorting accuracy at the source.

Flat tops are increasingly used in modular recycling stations due to their compatibility with other bin types and receptacles. Maintenance efficiency, simple user interface, and reduced risk of contamination from open tops have all contributed to the leading position of this segment.

Plastics are projected to dominate the material segment with a 56.0% share of market revenue in 2025. The segment’s strength is attributed to the material’s lightweight nature, corrosion resistance, and cost-effective manufacturing.

Plastic recycling bins are easy to clean, durable under frequent use, and available in multiple colors, making them highly adaptable to commercial waste segregation standards. The rising use of recycled plastic content in bin production is aligning well with procurement policies focused on circular economy integration.

Furthermore, their lower carbon footprint during transportation and handling makes plastic bins a practical and eco-efficient solution for large-scale deployment. Ongoing improvements in UV resistance and impact strength are ensuring longer product lifecycles, supporting their continued preference across industries.

The commercial recycling bins market has grown alongside efforts to improve material segregation and recovery in workplaces, public spaces, institutions, and multi-tenant buildings. These bins have served as essential tools for facilitating separation of recyclables such as paper, cardboard, plastics, metals, and glass at the point of disposal. Commercial buyers have prioritized bins offering high capacity, modular design, and clear waste stream labeling. The increasing enforcement of collection mandates and building-level waste audits has expanded procurement of bins across commercial sectors.

A major driver for the commercial recycling bins market has been the demand from institutions such as universities, hospitals, corporate campuses, and government buildings. These locations have required structured waste sorting infrastructure to comply with regional waste reduction mandates. Bin designs featuring color coding, pictographic labels, and segmenting lids have been adopted to minimize contamination. Procurement decisions have increasingly considered ergonomics, material durability, and compatibility with custodial equipment. In high-footfall areas, bins with higher volumes and vandal resistance have been preferred. Facilities teams have prioritized bin placements near cafeterias, restrooms, and printer stations to increase user participation. This sector has influenced innovation in multi-stream bin configurations and hybrid designs integrating smart fill monitoring.

The hospitality and retail sectors have emphasized aesthetics, signage clarity, and user convenience in recycling bin selection. Hotels, restaurants, and shopping centers have deployed designer bins that complement interior decor while maintaining waste segregation functionality. Clear communication of accepted materials has been vital to improve compliance among transient users. Stackable liners, concealed bagging systems, and foot-operated lids have enhanced operational efficiency for custodial staff. In foodservice zones, moisture resistance and odor control have become priorities, while outdoor bins have required UV-stable, rust-resistant materials. Consumer-facing locations have also driven adoption of recycling bins made from recycled plastics or metals to showcase commitment to circular practices.

Technology integration has increasingly influenced commercial recycling bin procurement, particularly in large buildings and public infrastructure. Sensors embedded within bin compartments have enabled monitoring of fill levels, triggering notifications to optimize collection routes. Data from smart bins have been analyzed to evaluate recycling behavior, contamination incidents, and bin utilization efficiency. RFID-enabled bins have allowed better asset tracking, while integrated compaction features have increased bin capacity between servicing. Software platforms have been used to manage multiple bin sites, visualize trends, and generate compliance reports. Smart bin technologies have been selectively adopted in airports, transport hubs, and stadiums where cost recovery through efficiency gains can justify initial investment.

Despite advances, improper use of commercial recycling bins and mixed waste disposal have lowered material recovery rates. Contamination from food residues, non-recyclable plastics, or liquid waste has degraded recyclability of otherwise recoverable streams. Mislabeling or inconsistent signage across buildings has confused users and reduced sorting accuracy. Inadequate servicing frequencies and overflowing bins have further discouraged proper usage. Bins placed in isolated or low-visibility locations have seen minimal participation. These limitations have prompted a shift toward staff training, signage standardization, and bin audits. Without continued emphasis on behavioral guidance and bin design optimization, the effectiveness of commercial recycling programs may remain constrained.

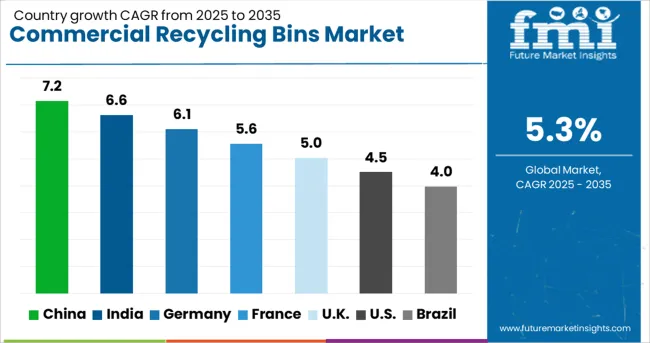

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The commercial recycling bins market is anticipated to witness a CAGR of 5.3% from 2025 to 2035, influenced by stricter waste segregation mandates, infrastructure modernization, and institutional procurement. China, growing at 7.2%, dominates due to large-scale public sector installations and robust plastic and metal bin manufacturing capacity. India, expected to grow at 6.6%, shows momentum through smart city programs and rising commercial awareness in urban hubs. Germany, at 6.1%, continues to upgrade facilities across municipalities and public utilities with differentiated bin systems. The UK, forecasted at 5.0%, relies on stringent recycling regulations and innovation in modular designs. The USA market, growing at 4.5%, remains shaped by school, corporate, and hospitality deployments emphasizing eco-friendly waste handling. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is anticipated to grow at a CAGR of 7.2% in the commercial recycling bins market between 2025 and 2035, owing to intensifying waste classification mandates across Tier 1 and Tier 2 cities. Municipal partnerships with private waste solution providers are contributing to the rollout of centralized bin systems in urban districts, transit stations, and commercial complexes. Durable bins made from high-density polyethylene and stainless steel are prioritized for compatibility with smart sensor modules. Chinese manufacturers are scaling bin capacity ranges and expanding compartment configurations to support plastics, e-waste, organics, and residual waste separation.

India is expected to register a CAGR of 6.6% through 2035, driven by the rising involvement of municipalities and corporate campuses in structured recycling programs. State-level waste segregation policies are incentivizing deployment of three-bin systems across shopping centers, transportation hubs, and housing societies. Local manufacturers are adopting UV-stabilized and vermin-proof materials to ensure outdoor bin durability. Branding agencies and FMCG retailers are collaborating on aesthetically designed bins for customer-facing environments.

Germany is projected to achieve a CAGR of 6.1%, supported by commercial waste recovery targets and rising adoption of fire-resistant recycling bins in public buildings. Demand is strong for EU-certified bin designs with tamper-proof locks, ergonomic foot pedals, and modular linings. Emphasis on source-segregation is driving use of four-bin systems separating metal, glass, plastics, and organic waste. Commercial centers and event venues have adopted wheeled bins with RFID for smart monitoring of waste volume and bin replacement schedules.

The United Kingdom is expected to grow at a CAGR of 5.0%, led by integration of commercial bins into property management and public sector recycling programs. Multi-bin installations with weather-resistant coatings are deployed in universities, hospitals, and high-traffic public zones. Color-coded bins with anti-vandal features and customizable signage are favored by facility managers. Focus has increased on compliance with WRAP guidelines, prompting uptake of stackable and wall-mounted bin models for indoor recycling.

The United States is forecasted to grow at a CAGR of 4.5%, driven by private sector efforts to integrate commercial recycling bins within office buildings, malls, and entertainment venues. Demand is rising for ADA-compliant bin designs with anti-leak features and interchangeable labels. Manufacturers are targeting LEED-certified projects by offering bins made of recycled content and low-emission materials. Public institutions are transitioning to metal-frame bins with touchless lid systems to improve hygiene and accessibility.

The commercial recycling bins market brings together manufacturers focused on functionality, modularity, and sustainable materials to serve offices, municipalities, hospitality, and educational institutions. Rubbermaid Commercial Products maintains leadership through a broad line of durable, high-capacity recycling containers tailored for indoor and outdoor deployment.

Toter LLC specializes in heavy-duty carts and rotationally molded bins with long lifecycle performance for municipal and commercial waste management needs. Brabantia and Simplehuman deliver aesthetically designed containers for office and hospitality use, balancing form with recyclability. Busch Systems International Inc. emphasizes modular station formats and customizable signage to promote waste stream segregation in corporate, healthcare, and school environments.

Bigbelly, Inc. introduces a smart technology layer, integrating solar-powered, sensor-enabled bins that optimize urban collection schedules. Orbis Corporation and United Solutions offer rugged plastic-based commercial recycling infrastructure supported by efficient logistics systems.

Rising recycling mandates, green certification requirements, and centralized waste sorting practices are reshaping bin design parameters. Demand favors bins that support multi-stream separation, encourage user compliance, and withstand high-traffic usage across commercial and institutional sites.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Type | Blue Containers, Green container, Gray Containers, and Others (Brown yellow, etc.) |

| Model | Flat top, Dome top, and Hood top |

| Material | Plastics, Metals, Steel & stainless steel, Aluminum, Polyethylene, Polypropylene (PP), Polyethylene Terephthalate (PET), Acrylonitrile Butadiene Styrene (ABS), Fiberglass, and Others (Polycarbonate (PC), Galvanized Steel) |

| End use | Supermarkets, Department Stores, Cafes and Coffee Shops, Educational institutes, Offices, Retail stores, Hospitals, and Others (Convenience Stores, Specialty Stores, Parks, etc.) |

| Distribution channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rubbermaid Commercial Products, Brabantia, Bigbelly, Inc., Busch Systems International Inc., Carlisle Foodservice Products, Commercial Zone Products, Orbis Corporation, Prestwick (Max r), Recycle away, Roadware, Safco Products Company, Simple human, Toter LLC, United Solutions, and Witt Industries |

| Additional Attributes | Dollar sales by bin type and end-use sector, demand dynamics across office spaces, educational institutions, healthcare facilities, and hospitality venues, regional trends in installation across North America, Europe, and Asia-Pacific, innovation in sensor-enabled fill monitoring, modular bin configurations, and recycled-content manufacturing, environmental impact of bin production, lifecycle durability, and waste diversion efficiency, and emerging use cases in smart waste management systems, public space sustainability programs, and zero-waste corporate initiatives. |

The global commercial recycling bins market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the commercial recycling bins market is projected to reach USD 2.6 billion by 2035.

The commercial recycling bins market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in commercial recycling bins market are blue containers, green container, gray containers and others (brown yellow, etc.).

In terms of model, flat top segment to command 39.0% share in the commercial recycling bins market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Recycling Trucks Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA