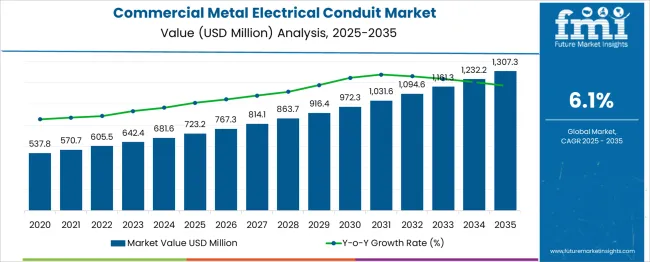

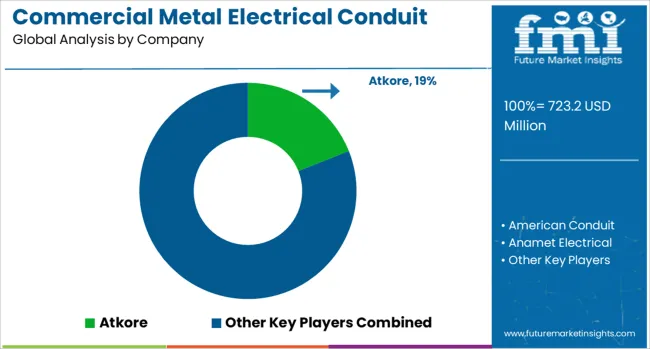

The Commercial Metal Electrical Conduit Market is estimated to be valued at USD 723.2 million in 2025 and is projected to reach USD 1307.3 million by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. This upward path displays moderate elasticity to broader macroeconomic shifts, particularly those tied to construction volume, industrial electricity usage, and building code compliance. From 2025 to 2030, a 34.4% cumulative rise was registered, tracking closely with infrastructure budgets and industrial output growth in mid-income economies. This consistency reflects stable demand across both retrofitting and new construction applications. Between 2030 and 2035, the market moved from USD 972.3 million to USD 1,307.3 million, marking a 34.4% gain over five years.

The trajectory aligned with mild shifts in global PMI (Purchasing Managers’ Index), but remained largely resilient against short-term capital spending contractions. Changes in commodity pricing, such as aluminum and steel, exhibited limited drag on value growth, implying low sensitivity to raw material cost volatility. Even with fluctuations in interest rates and labor cost indices, the market expanded at a steady clip, suggesting its evolution is being influenced more by long-cycle utility projects and regional electrification mandates than transient macroeconomic pressures.

| Metric | Value |

|---|---|

| Commercial Metal Electrical Conduit Market Estimated Value in (2025 E) | USD 723.2 million |

| Commercial Metal Electrical Conduit Market Forecast Value in (2035 F) | USD 1307.3 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

The commercial metal electrical conduit market is experiencing steady expansion, driven by stricter building codes, rising non-residential construction, and growing emphasis on electrical safety and fire resistance. Regulatory mandates in commercial buildings for shielding conductors against mechanical damage have spurred adoption of metal conduits over plastic alternatives. Additionally, expanding urban infrastructure, including data centers, hospitals, and industrial facilities, is increasing the demand for durable and corrosion-resistant conduit systems.

Stakeholders are also prioritizing metallic conduit systems for their superior grounding capabilities and minimal electromagnetic interference, critical for high-performance wiring environments. Growing investments in smart building technologies and energy-efficient retrofitting are expected to further drive conduit replacement cycles.

Manufacturers are focusing on lightweight, easy-to-install variants, along with pre-fabricated solutions, to meet labor efficiency needs across commercial installations. As electrification efforts grow globally, particularly in emerging markets, the demand outlook for commercial metal conduit systems remains robust.

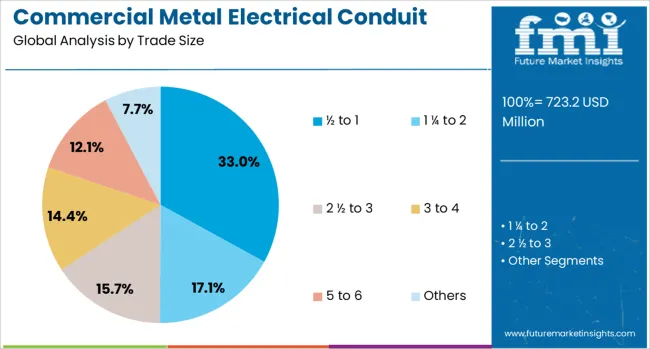

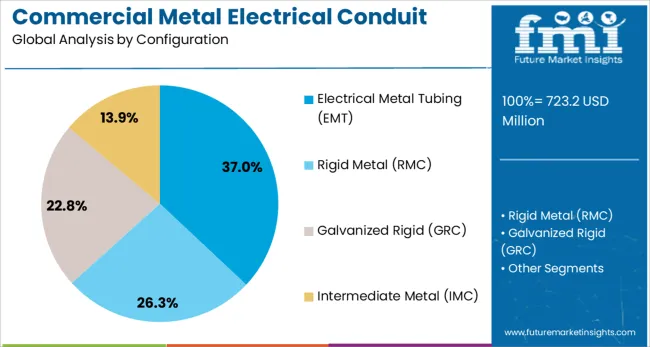

The commercial metal electrical conduit market is segmented by trade size, configuration and geographic regions. By trade size, the commercial metal electrical conduit market is divided into ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and others. In terms of configuration, the commercial metal electrical conduit market is classified into Electrical Metal Tubing (EMT), Rigid Metal (RMC), Galvanized Rigid (GRC), and Intermediate Metal (IMC). Regionally, the commercial metal electrical conduit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ½ to 1 trade size category is projected to hold 33.00% of total market revenue in 2025, making it the leading trade size segment. This prominence is due to its widespread use in standard commercial electrical wiring systems, where compact routing and space optimization are essential.

The ½ to 1 trade sizes strike a balance between mechanical protection and installation flexibility, allowing them to be deployed efficiently across ceiling cavities, walls, and partitions in commercial buildings. Their compatibility with a broad range of conductor types and voltages further supports their high-volume adoption.

In addition, the growing trend toward modular construction and tenant improvements in offices and retail facilities is increasing the need for conduits that are easily adaptable, with minimal tooling. As electrical specifications become more standardized in commercial settings, the preference for this trade size range continues to dominate procurement decisions.

Electrical Metal Tubing (EMT) is expected to lead the market with a 37.00% revenue share in 2025, establishing it as the most utilized conduit configuration in commercial applications. EMT's dominance stems from its lightweight construction, cost-effectiveness, and ease of bending during installation. Its galvanized steel structure offers adequate mechanical protection while maintaining maneuverability, making it suitable for exposed runs in offices, schools, and commercial utility areas.

EMT's compliance with NEC codes for commercial wiring and its ability to house multiple circuits within a single pathway contribute to installation efficiencies. Additionally, EMT systems support faster project delivery timelines and are increasingly integrated into prefabricated conduit assemblies.

With sustainability becoming a procurement criterion, the recyclability of EMT components and the reduced need for coupling accessories reinforce its relevance in commercial conduit design. As construction professionals seek solutions that balance durability with lower installation costs, EMT continues to be the configuration of choice.

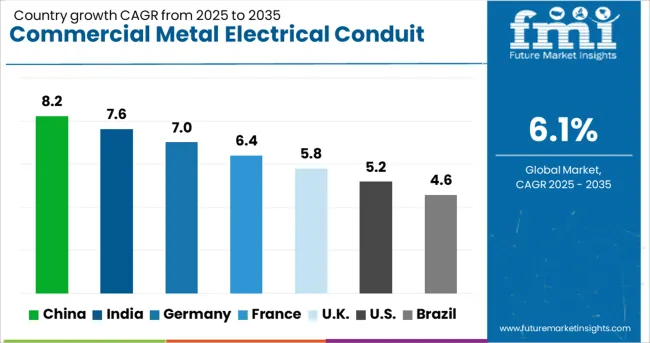

Global demand for commercial metal electrical conduit is forecast to increase at a CAGR of 6.1% between 2025 and 2035. China, India, and Germany are positioned above this baseline with growth rates of 8.2%, 7.6%, and 7.0% respectively. These translate to premiums of +34%, +25%, and +15%. The United Kingdom and United States, with CAGRs of 5.8% and 5.2%, are forecast to trail by –5% and –15%. China has prioritized domestic manufacturing of high-precision conduit for smart grid projects. India has expanded installations across industrial corridors in partnership with ASEAN-aligned zones. Germanys adoption is linked to safety-compliant retrofits in OECD infrastructure. Meanwhile, lower growth in the United Kingdom and United States reflects staggered investments in commercial rewiring and code-mandated upgrades.

The commercial metal electrical conduit market in China is expected to register a CAGR of 8.2% from 2025 to 2035, surpassing the global average by 34%. The shift from plastic to fire-resistant steel conduit has gained prominence across utility hubs and semiconductor parks. Industrial zones near Tianjin, Shenzhen, and Chongqing have expanded domestic production lines for rigid and intermediate formats. High demand for certified conduit systems has emerged from integrated command centers, surveillance facilities, and high-rise business parks. Government mandates for fire resilience and EMI control in digital infrastructure have contributed to stable annual procurement. Regional sourcing across ASEAN has influenced design specifications and pricing structures, especially in ports and energy corridors. Growth is expected to remain strong across state-led construction pipelines.

The market for commercial metal electrical conduit in India is projected to grow at a CAGR of 7.6% between 2025 and 2035, showing a 25% premium above the global average. Key demand zones include commercial logistics parks and airport modernisation hubs across Ahmedabad, Hyderabad, and Bengaluru. Public-private construction projects have favoured coated galvanized formats for embedded energy-efficient wiring. Adoption has increased across special economic zones with manufacturing clusters aligned to ASEAN supply chains. State-level policies have incentivised certified electrical conduit for medium-rise business parks, retail complexes, and transport interchanges. EMI-compliant conduit systems have gained traction in areas adopting smart metering and remote monitoring infrastructure. Imports of finished conduit declined slightly in 2024 due to local fabrication expansion.

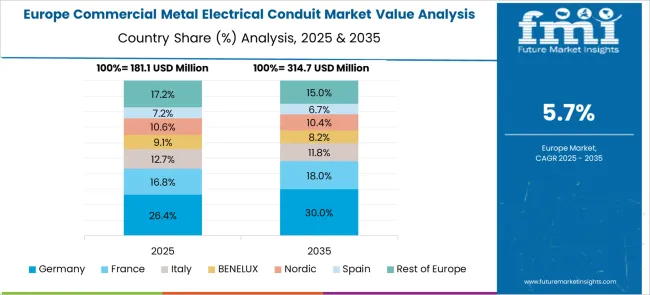

The commercial metal electrical conduit market in Germany is forecast to expand at a CAGR of 7.0% from 2025 to 2035, 15% above the global baseline. National fire code amendments and energy transition policies have accelerated conduit upgrades in both private and public commercial spaces. Office parks, hospitals, and logistics terminals across Frankfurt, Berlin, and Stuttgart have integrated high-grade metallic systems with multi-layered shielding. Regional focus has shifted toward a conduit that supports high-density wiring and precision controls in automated facilities. EU-aligned regulations have increased procurement of recyclable and corrosion-resistant materials, particularly for institutions receiving public funding. Export-ready variants have emerged from North Rhine-Westphalia for wider OECD distribution, following ISO-linked quality benchmarks.

The United Kingdom commercial metal electrical conduit market is projected to grow at a CAGR of 5.8% from 2025 to 2035, slightly under the global average by 5%. Policy-linked upgrades under the Building Safety Act have influenced adoption in London, Glasgow, and Birmingham. Most installations target critical facilities, including NHS hospitals, railway stations, and energy control centres. Galvanized steel conduit has replaced PVC in buildings undergoing regulatory audits or safety compliance reviews. Import dependency from continental Europe remained high, particularly for UL-listed products with EMI resistance. Commercial fit-outs in mixed-use high-rises also supported demand, although price sensitivity and labour shortages delayed several tenders. Retrofit activity remained dominant compared to new installations.

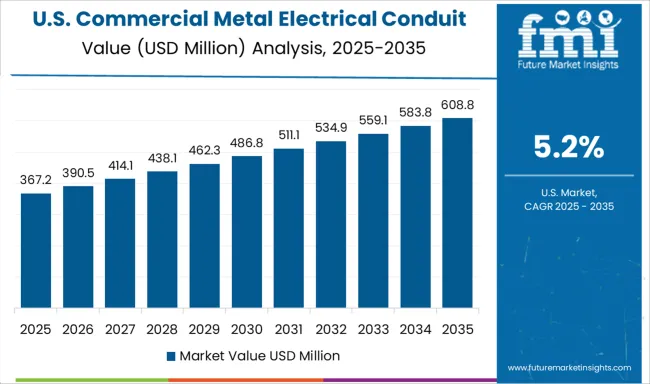

The United States commercial metal electrical conduit market is expected to expand at a CAGR of 5.2% through 2035, falling short of the global average by 15%. Demand growth is strongest across hospital construction, warehousing zones, and corporate data campuses in Texas, California, and Ohio. Rigid conduit with magnetic shielding remains preferred in high-voltage environments. Slow adoption in school and municipal upgrades has restricted market breadth. Supply chain volatility in steel pricing and labour constraints delayed several federal infrastructure rollouts in 2024. Imports from OECD countries have risen due to tighter local steel capacity. Product selection increasingly prioritises UL certification, corrosion resistance, and thermal stability across multiphase installations.

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

Global demand for commercial metal electrical conduit is forecast to increase at a CAGR of 6.1% between 2025 and 2035. China, India, and Germany are positioned above this baseline with growth rates of 8.2%, 7.6%, and 7.0% respectively. These translate to premiums of +34%, +25%, and +15%. The United Kingdom and United States, with CAGRs of 5.8% and 5.2%, are forecast to trail by –5% and –15%. China has prioritized domestic manufacturing of high-precision conduit for smart grid projects. India has expanded installations across industrial corridors in partnership with ASEAN-aligned zones. Germanys adoption is linked to safety-compliant retrofits in OECD infrastructure. Meanwhile, lower growth in the United Kingdom and United States reflects staggered investments in commercial rewiring and code-mandated upgrades.

The commercial metal electrical conduit market in China is expected to register a CAGR of 8.2% from 2025 to 2035, surpassing the global average by 34%. The shift from plastic to fire-resistant steel conduit has gained prominence across utility hubs and semiconductor parks. Industrial zones near Tianjin, Shenzhen, and Chongqing have expanded domestic production lines for rigid and intermediate formats. High demand for certified conduit systems has emerged from integrated command centers, surveillance facilities, and high-rise business parks. Government mandates for fire resilience and EMI control in digital infrastructure have contributed to stable annual procurement. Regional sourcing across ASEAN has influenced design specifications and pricing structures, especially in ports and energy corridors. Growth is expected to remain strong across state-led construction pipelines.

The market for commercial metal electrical conduit in India is projected to grow at a CAGR of 7.6% between 2025 and 2035, showing a 25% premium above the global average. Key demand zones include commercial logistics parks and airport modernisation hubs across Ahmedabad, Hyderabad, and Bengaluru. Public-private construction projects have favoured coated galvanized formats for embedded energy-efficient wiring. Adoption has increased across special economic zones with manufacturing clusters aligned to ASEAN supply chains. State-level policies have incentivised certified electrical conduit for medium-rise business parks, retail complexes, and transport interchanges. EMI-compliant conduit systems have gained traction in areas adopting smart metering and remote monitoring infrastructure. Imports of finished conduit declined slightly in 2024 due to local fabrication expansion.

The commercial metal electrical conduit market in Germany is forecast to expand at a CAGR of 7.0% from 2025 to 2035, 15% above the global baseline. National fire code amendments and energy transition policies have accelerated conduit upgrades in both private and public commercial spaces. Office parks, hospitals, and logistics terminals across Frankfurt, Berlin, and Stuttgart have integrated high-grade metallic systems with multi-layered shielding. Regional focus has shifted toward conduit that supports high-density wiring and precision controls in automated facilities. EU-aligned regulations have increased procurement of recyclable and corrosion-resistant materials, particularly for institutions receiving public funding. Export-ready variants have emerged from North Rhine-Westphalia for wider OECD distribution, following ISO-linked quality benchmarks.

The United Kingdom commercial metal electrical conduit market is projected to grow at a CAGR of 5.8% from 2025 to 2035, slightly under the global average by 5%. Policy-linked upgrades under the Building Safety Act have influenced adoption in London, Glasgow, and Birmingham. Most installations target critical facilities, including NHS hospitals, railway stations, and energy control centres. Galvanized steel conduit has replaced PVC in buildings undergoing regulatory audits or safety compliance reviews. Import dependency from continental Europe remained high, particularly for UL-listed products with EMI resistance. Commercial fit-outs in mixed-use high-rises also supported demand, although price sensitivity and labour shortages delayed several tenders. Retrofit activity remained dominant compared to new installations.

The United States commercial metal electrical conduit market is expected to expand at a CAGR of 5.2% through 2035, falling short of the global average by 15%. Demand growth is strongest across hospital construction, warehousing zones, and corporate data campuses in Texas, California, and Ohio. Rigid conduit with magnetic shielding remains preferred in high-voltage environments. Slow adoption in school and municipal upgrades has restricted market breadth. Supply chain volatility in steel pricing and labour constraints delayed several federal infrastructure rollouts in 2024. Imports from OECD countries have risen due to tighter local steel capacity. Product selection increasingly prioritises UL certification, corrosion resistance, and thermal stability across multiphase installations.

Atkore has remained a dominant participant in the commercial metal electrical conduit market, offering galvanized steel and aluminum conduits widely adopted in infrastructure, healthcare, and manufacturing facilities. American Conduit and Zekelman Industries have been leveraging domestic steel supply advantages to meet Buy America requirements, especially in institutional and government construction. Nucor Tubular Products has been strengthening its market share through vertical integration and energy-efficient production of steel conduit solutions for commercial and light industrial projects. Schneider Electric and Legrand are focused on conduit systems that integrate with their broader electrical distribution portfolios, enabling bundled solutions for data centers and high-load installations.

Gibson Stainless & Specialty has gained traction through stainless conduit offerings that are corrosion-resistant, serving wastewater plants and coastal installations. Anamet Electrical, Flexa, and Techno Flex specialize in flexible metallic conduit systems, which are in demand for dynamic or vibration-sensitive commercial machinery wiring. Meanwhile, B.E.C. Conduits and Weifang East Steel Pipe continue to expand their export presence, especially in ASEAN and African construction markets. OEMs in this market are focusing on fire-rated, tamper-proof, and halogen-free metal conduits to meet evolving building code standards and ESG-compliant construction frameworks across OECD-regulated geographies.

A large-scale manufacturing plant was launched in Saudi Arabia, increasing monthly conduit capacity. In the USA, production expansions supported growing retrofitting demand. Smart conduit innovations with embedded tracking systems also emerged, aligning with energy infrastructure upgrades across the EU, Japan, South Korea, and the United States.

| Item | Value |

|---|---|

| Quantitative Units | USD 723.2 Million |

| Trade Size | ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Configuration | Electrical Metal Tubing (EMT), Rigid Metal (RMC), Galvanized Rigid (GRC), and Intermediate Metal (IMC) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atkore, American Conduit, Anamet Electrical, B.E.C. Conduits, Flexa, Gibson Stainless & Specialty, HellermannTyton, Legrand, Nucor Tubular Products, Schneider Electric, Techno Flex, Weifang East Steel Pipe, and Zekelman Industries |

| Additional Attributes | Dollar sales by conduit type (rigid, IMC, EMT) and end-use sectors, demand driven by electrical safety codes and commercial construction, Asia-Pacific leads, innovation in corrosion-resistant alloys and flexible designs, environmental gain via longevity, and emerging use in EV infrastructure and smart city grids. |

The global commercial metal electrical conduit market is estimated to be valued at USD 723.2 million in 2025.

The market size for the commercial metal electrical conduit market is projected to reach USD 1,307.3 million by 2035.

The commercial metal electrical conduit market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in commercial metal electrical conduit market are ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of configuration, electrical metal tubing (emt) segment to command 37.0% share in the commercial metal electrical conduit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Scale Non Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA