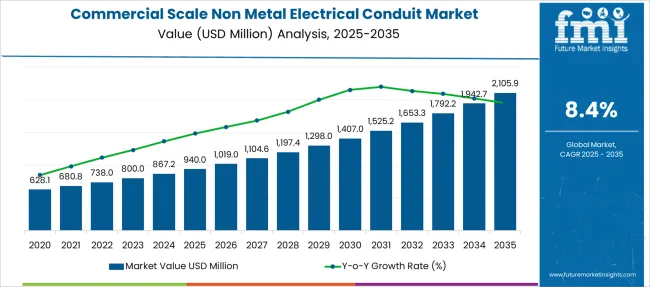

The Commercial Scale Non Metal Electrical Conduit Market (CSNMEC) is estimated to be valued at USD 940.0 million in 2025 and is projected to reach USD 2105.9 million by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Scale Non Metal Electrical Conduit Market Estimated Value in (2025E) | USD 940.0 million |

| Commercial Scale Non Metal Electrical Conduit Market Forecast Value in (2035F) | USD 2105.9 million |

| Forecast CAGR (2025 to 2035) | 8.4% |

The Commercial Scale Non Metal Electrical Conduit market is experiencing strong momentum, driven by expanding construction activity, retrofitting of aging infrastructure, and increasing adoption of non-metallic materials for electrical protection. Growing emphasis on cost-effective, corrosion-resistant, and easy-to-install solutions has encouraged the shift from traditional metallic conduits to non-metallic alternatives, particularly in commercial and light industrial settings.

Regulatory encouragement for halogen-free and fire-retardant materials is further supporting the adoption of advanced non-metallic conduits in office buildings, educational institutions, and data centers. As electrical systems become more sophisticated, flexible and scalable conduit systems are being preferred to support high-density wiring.

Furthermore, rising investment in green buildings and sustainable construction practices is encouraging the use of recyclable and lightweight PVC conduits. With advancements in materials engineering and growing awareness of lifecycle cost benefits, the market outlook remains positive, supported by evolving building codes, energy standards, and the increasing complexity of electrical distribution networks in commercial spaces.

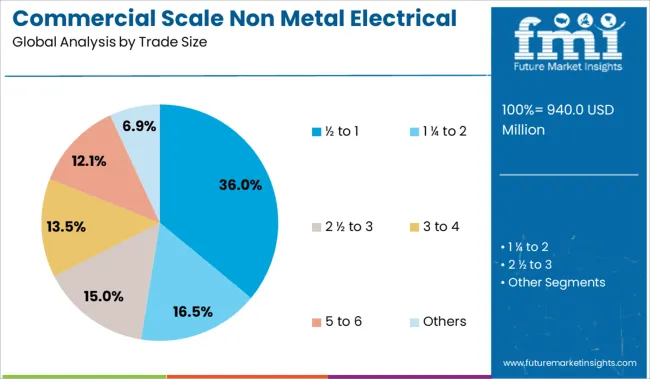

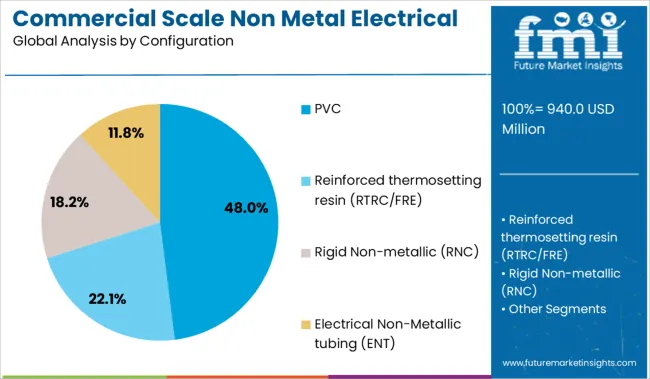

The market is segmented by trade size, configuration, and region. By Trade Size, the market is divided into ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others. In terms of Configuration, the market is classified into PVC, Reinforced thermosetting resin (RTRC/FRE), Rigid Non-metallic (RNC), and Electrical Non-Metallic tubing (ENT). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ½ to 1 trade size segment is projected to contribute 36% of the Commercial Scale Non Metal Electrical Conduit market revenue share in 2025, establishing it as the leading trade size category. This dominance has been driven by its widespread usage in low to medium voltage commercial wiring applications, especially where space constraints and tight bends are frequent.

Installers have consistently preferred this size due to its ease of routing in confined spaces such as drop ceilings, walls, and raised floors. Additionally, the ½ to 1 size range has been associated with lower material cost and quicker installation time, both of which are critical in high-volume commercial projects.

Its compatibility with a wide range of fittings and fixtures has also contributed to its continued preference across commercial office buildings and retail facilities. As commercial developers seek scalable, lightweight, and flexible solutions that reduce installation complexity, the ½ to 1 trade size has continued to demonstrate superior utility and cost-efficiency across multiple project types.

The PVC configuration segment is expected to account for 48% of the Commercial Scale Non Metal Electrical Conduit market revenue share in 2025, marking it as the leading material configuration. The growth of this segment has been supported by PVC’s inherent advantages, including high durability, low cost, flame resistance, and excellent insulating properties.

In commercial environments, PVC conduits have been widely used due to their resistance to moisture and chemicals, which makes them ideal for both interior and exterior installations. Installers and project managers have favored PVC because of its lightweight nature, ease of cutting and joining, and its compliance with safety standards across commercial buildings.

The material’s adaptability to structural shifts and its reduced risk of corrosion have reinforced its utility in large-scale commercial wiring systems. Moreover, as building designs evolve toward increased modularity and sustainability, PVC continues to offer a reliable and economical solution that aligns with long-term performance and maintenance objectives in commercial infrastructure.

The commercial-scale non-metal electrical conduit market is gaining momentum through modular wiring opportunities. From 2023 to 2025, pre-configured conduit systems enabled faster installations, easier reconfigurations, and minimal disruption during upgrades.

These solutions have transformed conduits from static enclosures into dynamic infrastructure assets, making them highly attractive for commercial retrofits and tenant-driven renovations. Vendors providing modular, snap-in conduit designs are positioned to lead in adaptability-focused construction markets.

Enhancements in fire safety requirements have been recognized as a principal catalyst in the expansion of non-metal electrical conduit systems across commercial projects. In 2023, new building regulations mandated plenum-rated non-metal conduits in data centers and office high-rises to inhibit smoke and flame propagation.

By 2024, jurisdictions introduced additional codes requiring continuous electrical system integrity during fire events, prompting contractors to specify flexible PVC and fiberglass conduits. In 2025, large campuses and institutional facilities were observed to retroactively replace metal conduits with listed non-metal alternatives in risers and cable trays. These shifts suggest that compliance with evolving fire-code standards, rather than aesthetic or cost preference, is driving broad adoption of non-metal conduit solutions

In 2023, modular electrical infrastructure components were first embraced within non-metal conduit systems, enabling pre-configured cable pathways that reduced on-site labor. By 2024, plug-and-play conduit segments equipped with snap-in junctions were being specified in commercial fit-outs for tenant spaces, streamlining reconfiguration processes.

In 2025, large-scale retrofit projects within office parks and universities were observed to benefit from re-customizable non-metal conduit routes, minimizing downtime during upgrades. These developments indicate that non-metal conduits can evolve beyond passive raceways into active network infrastructure, allowing operators to adapt wiring layouts rapidly. Manufacturers offering modular conduit kits with standardized interface elements are thus being positioned to dominate flexible commercial electrical installations.

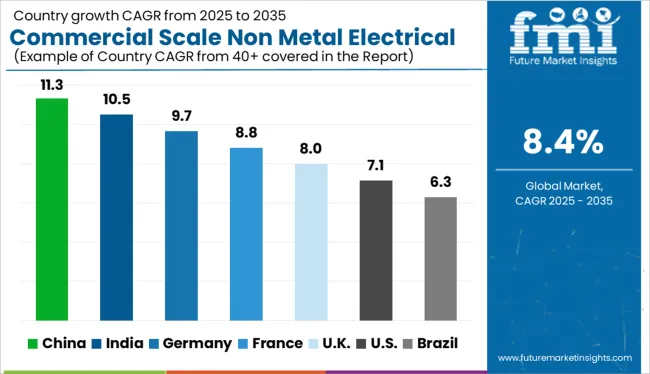

| Countries | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

| USA | 7.1% |

| Brazil | 6.3% |

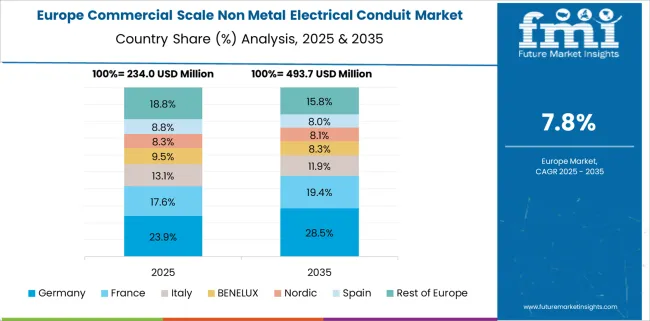

The global commercial scale non-metal electrical conduit market is projected to grow at a CAGR of 8% from 2025 to 2035. China leads with 11.3%, followed by India at 10.5% and Germany at 9.7%. France aligns above the global average at 8.8%, while the United Kingdom posts the slowest growth among the five profiled nations at 8.0%.

Rapid commercial construction, fire-rated plastic conduit demand, and code-driven wiring protection in China and India push market momentum. Germany’s preference for halogen-free conduit systems in offices and data centers supports steady expansion. France invests in public building retrofits, while the UK progresses with structured cabling upgrades across educational and retail assets.

China is forecast to lead the commercial non-metal electrical conduit market with an 11.3% CAGR, fueled by smart commercial building projects and fire-code-driven electrical safety upgrades. Polyvinyl chloride (PVC), high-density polyethylene (HDPE), and flexible corrugated conduits are increasingly specified for data lines, low-voltage wiring, and HVAC automation. Manufacturers are scaling low-halogen and zero-halogen variants for LEED-certified buildings and high-rise installations.

India is projected to grow its commercial non-metal electrical conduit market at a 10.5% CAGR, led by infrastructure growth in office parks, malls, airports, and healthcare facilities. Tiered fire resistance ratings and BIS compliance are becoming procurement norms across public and private sector projects. Flexible non-metallic conduits are preferred in retrofitting older concrete buildings with concealed wiring. Domestic suppliers are expanding their PVC and FRLS conduit offerings for turnkey MEP contracts.

Germany is forecast to grow at a 9.7% CAGR in the commercial non-metal electrical conduit segment, supported by sustainable building codes, smart energy infrastructure, and demand for halogen-free wiring systems. Hospitals, logistics centers, and data hubs increasingly rely on low-smoke conduit solutions paired with high-performance cabling. Conduit systems are integrated into raised floor cable management and under-slab wiring in modular commercial construction.

France is projected to grow at an 8.8% CAGR, with adoption supported by electrification retrofits in mid-rise commercial buildings, government buildings, and transport hubs. Contractors are shifting to halogen-free, thermoplastic conduit systems in light commercial refurbishments and fire-zoned installations. Preference for snap-fit and flexible corrugated conduits is increasing in suspended ceiling and drywall partitions.

The United Kingdom is forecast to grow its commercial non-metal conduit market at 8.0% CAGR, driven by refurbishment of aging retail properties, school campuses, and commercial extensions. Installers prefer easy-bend PVC and polypropylene conduit for routing in confined utility voids. IP-rated conduit systems are deployed in damp-area applications such as kitchens and plant rooms. Structured cabling contractors use low-friction conduit for data and PoE wiring pathways.

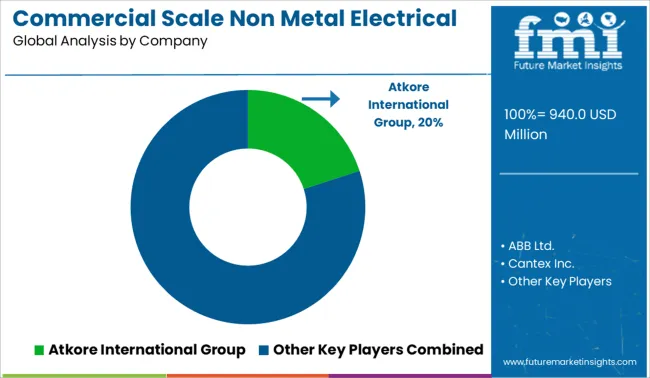

The commercial scale non-metal electrical conduit market is moderately consolidated, led by Atkore International Group with a significant market share. The company holds a dominant position through its extensive offering of PVC and fiberglass conduit systems, broad commercial construction presence, and certified product lines meeting rigorous safety and code standards.

Dominant player status is held exclusively by Atkore International Group. Key players include ABB Ltd., Cantex Inc., Prime Conduit Inc., and Allied Tube & Conduit Corp. - each offering non-metallic conduit solutions tailored for commercial and institutional electrical infrastructure, emphasizing corrosion resistance, flexibility, and ease of installation.

Emerging players are currently limited in this space due to high regulatory compliance requirements and established brand dominance. Market demand is driven by increasing commercial construction activity, preference for lightweight non-conductive materials, and evolving safety standards for cable protection systems.

Electri-Flex announced on January 18, 2024, that its Liquatite® LNMP-Food Grade conduit received the 2023 Top Product Award. The antimicrobial, nonmetallic conduit is ideal for hygienic environments like food processing, as mentioned in electriflex.com’s official press release.

| Item | Value |

|---|---|

| Quantitative Units | USD 940.0 Million |

| Trade Size | ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Configuration | PVC, Reinforced thermosetting resin (RTRC/FRE), Rigid Non-metallic (RNC), and Electrical Non-Metallic tubing (ENT) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atkore International Group, ABB Ltd., Cantex Inc., Prime Conduit Inc., and Allied Tube & Conduit Corp. |

| Additional Attributes | Dollar sales by conduit type & size, regional demand trends, competitive landscape, buyer preferences for fire resistance & flexibility, integration with smart building systems, innovations in UV-resistant and self‑extinguishing formulations. |

The global commercial scale non metal electrical conduit market is estimated to be valued at USD 940.0 million in 2025.

The market size for the commercial scale non metal electrical conduit market is projected to reach USD 2,105.9 million by 2035.

The commercial scale non metal electrical conduit market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in commercial scale non metal electrical conduit market are ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of configuration, pvc segment to command 48.0% share in the commercial scale non metal electrical conduit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA