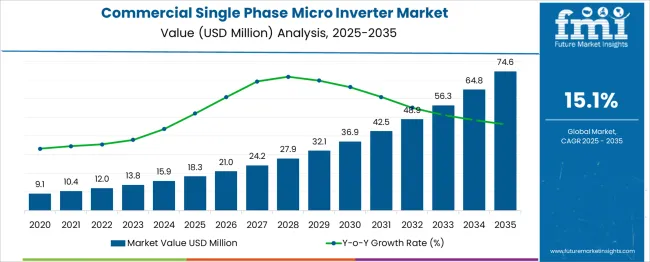

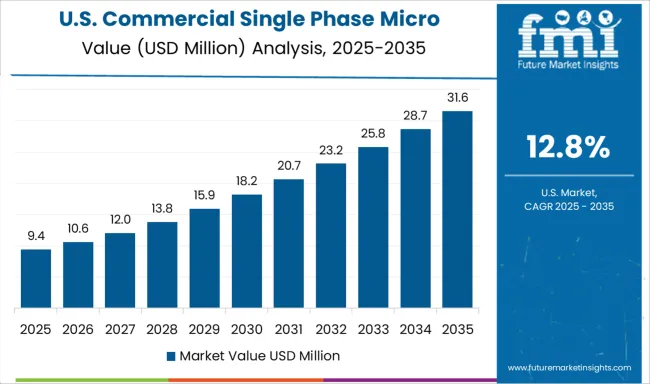

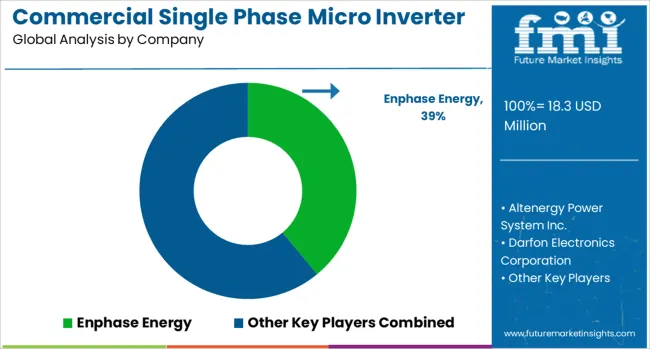

The Commercial Single Phase Micro Inverter Market is estimated to be valued at USD 18.3 million in 2025 and is projected to reach USD 74.6 million by 2035, registering a compound annual growth rate (CAGR) of 15.1% over the forecast period. The commercial single phase micro inverter market is expected to climb to USD 32.1 million by 2030, reflecting a rapid adoption curve and a CAGR trend consistent with the long-term 15.1% rate. This growth is supported by increasing installation of distributed energy systems in commercial properties, where efficient power conversion and module-level optimization offer tangible operational benefits.

Businesses are increasingly favoring configurations that allow greater flexibility in design and performance monitoring, leading to higher demand for micro inverters over string-based solutions. In this period, early-stage market expansion is driven by new adopters and smaller-scale commercial projects upgrading their systems to enhance reliability and yield. From 2030 to 2035, the market accelerates sharply, rising from USD 32.1 million to USD 74.6 million.

This surge is fueled by widespread adoption across larger commercial facilities, coupled with the scaling of energy projects that require more granular control over power generation units. Upgrades and replacements for earlier micro inverter installations become a meaningful contributor to sales, adding to the momentum from first-time deployments.

Additionally, competitive pricing and improved product availability enable broader access in developing markets. By 2035, the market’s expansion reflects a shift from early growth to a firmly established position within commercial energy infrastructure.

| Metric | Value |

|---|---|

| Commercial Single Phase Micro Inverter Market Estimated Value in (2025 E) | USD 18.3 million |

| Commercial Single Phase Micro Inverter Market Forecast Value in (2035 F) | USD 74.6 million |

| Forecast CAGR (2025 to 2035) | 15.1% |

Rising electricity costs, stricter carbon regulations, and financial incentives for renewable energy adoption are shaping market momentum. The use of micro inverters in commercial solar installations has increased due to their ability to maximize power output from individual solar panels, reduce the impact of shading, and improve system visibility and diagnostics. Innovations in power electronics and embedded software have enhanced the performance and life span of these systems, making them an attractive choice for commercial properties.

The increasing demand for scalable and modular solar solutions has also contributed to this growth, as commercial users seek flexible installations that can align with varying rooftop dimensions and energy goals. With supportive policies, technological advancement, and rising awareness of long-term return on investment, the commercial sector is expected to be a primary driver of sustained market expansion..

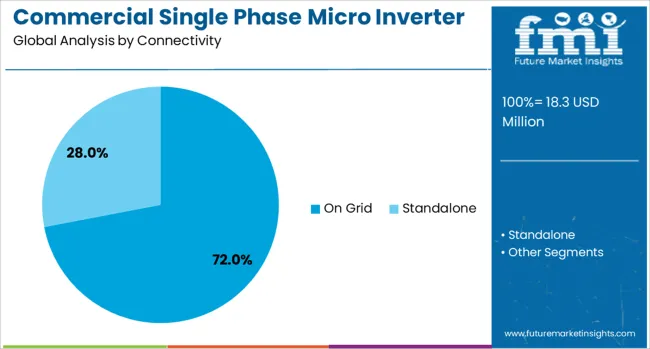

The commercial single-phase micro inverter market is segmented by connectivity and geographic regions. The connectivity of the commercial single-phase micro inverter market is divided into On-Grid and Standalone. Regionally, the commercial single-phase micro inverter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The on grid subsegment in the connectivity segment is projected to account for 72% of the Commercial Single Phase Micro Inverter market revenue share in 2025, positioning it as the leading connectivity type. This dominance has been supported by the growing adoption of grid-tied solar systems across commercial establishments that aim to reduce energy expenses while remaining connected to public utility networks.

Businesses have increasingly favored on grid systems due to their ability to export excess power back to the grid, benefiting from net metering policies and utility rebates. The use of micro inverters in on grid applications has been preferred for their superior energy harvesting capabilities, panel-level monitoring, and simplified design that reduces installation complexity.

Additionally, government programs and commercial incentives for grid integration have significantly encouraged investment in on grid infrastructure. The reliability and low maintenance associated with these systems, combined with their compatibility with smart grid technologies, have solidified the on grid model as the most practical and cost-effective solution for commercial solar deployments..

The commercial single phase micro inverter market is growing as small and medium-scale solar installations increase in popularity. These inverters improve energy harvest, simplify installation, and enhance system monitoring for distributed solar applications. Commercial properties benefit from their ability to operate independently at the module level, reducing the impact of shading and panel mismatch. While higher upfront costs and technical skill requirements remain challenges, demand is supported by renewable energy adoption policies and the push toward efficient, reliable solar power conversion.

Commercial single phase micro inverters are increasingly deployed in distributed solar power systems where independent module control improves total energy yield. They allow each solar panel to operate at its optimal capacity, minimizing losses from shading, dirt, or performance mismatches. This advantage is valuable for commercial rooftops with irregular layouts or partial obstructions. The market is seeing growth from small business owners, schools, and community buildings seeking reliable, low-maintenance energy solutions. In addition to improving energy production, micro inverters facilitate straightforward system expansion, enabling property owners to add panels without redesigning the inverter system. Built-in module-level monitoring provides real-time performance data, allowing operators to identify and address underperforming modules quickly. As distributed solar deployment expands in both urban and rural areas, commercial users are recognizing the operational efficiency benefits micro inverters provide compared to string inverter systems, especially in installations with variable panel orientations or exposure.

One of the major restraints in the commercial single phase micro inverter market is the relatively high upfront investment compared to traditional string inverters. Each solar panel requires its own inverter, which increases hardware and installation costs. Skilled labor is often needed to correctly mount and configure multiple inverters, adding to project expenses. In some commercial projects, the cost gap between micro inverters and string systems can influence purchasing decisions, particularly in price-sensitive markets. Additionally, installation requires careful planning to ensure electrical code compliance and optimal energy harvesting. Businesses with limited budgets may opt for alternative inverter solutions unless the long-term benefits of micro inverters are clearly demonstrated. However, suppliers that provide training programs, bundled hardware packages, and financing options can help mitigate these concerns. Over time, the potential for improved lifetime energy production and reduced maintenance costs can offset the initial price difference, improving adoption among commercial customers.

Government incentives and regulatory frameworks promoting solar energy adoption present strong opportunities for the commercial single phase micro inverter market. Many countries and regions offer tax credits, feed-in tariffs, or net metering benefits that make solar projects more financially attractive. Commercial property owners can leverage these incentives to reduce payback periods, making the case for higher-efficiency micro inverter systems stronger. Furthermore, policies aimed at increasing renewable penetration in the grid are encouraging the use of technologies that enhance reliability and performance. Micro inverters align well with these goals by enabling more consistent power output, even under challenging site conditions. Local regulations requiring rapid shutdown capabilities for safety also favor micro inverters, as they often integrate this functionality. Manufacturers that position their products to comply with varying regional standards and align with incentive-driven project models can capture market share, particularly in regions with strong solar policy frameworks and distributed generation targets.

Maintenance efficiency is a significant driver for micro inverter adoption in commercial projects. With each module operating independently, system faults can be isolated and addressed without taking the entire array offline. This modular approach minimizes downtime and maintenance costs, which is particularly valuable for commercial sites where operational disruptions can be costly. The ability to remotely monitor and diagnose issues helps facility managers respond quickly and plan maintenance activities more effectively. Micro inverters also tend to have longer warranties than string inverters, adding to their appeal for long-term investments. By avoiding the single point of failure risk associated with central or string inverters, they improve overall system reliability. For commercial owners looking to maximize energy production and reduce operational risks, micro inverter systems offer a compelling value proposition. Vendors emphasizing durability, warranty coverage, and remote management capabilities are well-positioned to meet the needs of performance-focused commercial solar installations.

| Country | CAGR |

|---|---|

| China | 20.4% |

| India | 18.9% |

| Germany | 17.4% |

| France | 15.9% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

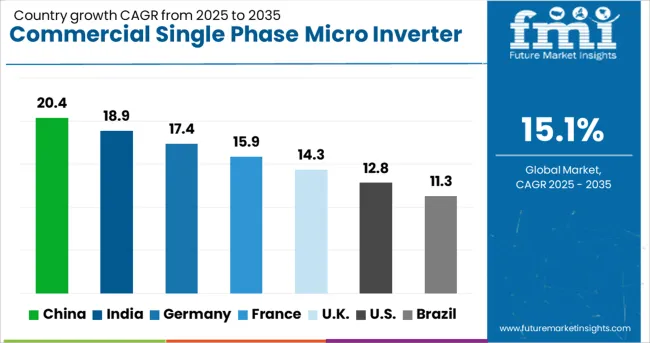

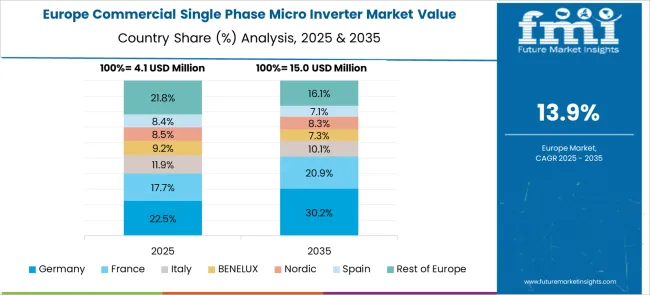

The global commercial single phase micro inverter market is expanding at a CAGR of 15.1%, driven by the rapid adoption of solar energy, decentralized power generation, and advancements in inverter efficiency. China leads with 20.4% growth, supported by large-scale solar installations and strong domestic manufacturing capabilities. India follows at 18.9%, fueled by government incentives for renewable energy projects and growing demand in the commercial sector. Germany records 17.4% growth, reflecting its leadership in solar technology integration and stringent grid compliance standards. France grows at 15.9%, driven by supportive policy frameworks and expansion of distributed solar systems. The United Kingdom posts 14.3% growth, focusing on energy independence and rooftop solar adoption. The United States, at 12.8%, remains a significant market, shaped by technological innovation, evolving regulatory requirements, and demand for high-performance, long-lifespan inverters. Market trends are influenced by module-level monitoring, energy storage compatibility, and grid stability needs. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is leading the commercial single phase micro inverter market with a 20.4% CAGR, driven by rapid solar energy deployment in commercial buildings. Supportive government policies and feed-in tariff programs are boosting adoption of micro inverters for improved energy yield and panel-level monitoring. The push for distributed solar generation in urban areas is increasing demand for compact, high-efficiency systems. Local manufacturers are enhancing product designs with higher conversion efficiency, advanced cooling systems, and remote monitoring capabilities. Integration with energy storage solutions is also gaining momentum as businesses look to maximize self-consumption.

India is recording an 18.9% CAGR in the commercial single phase micro inverter market, supported by the growing shift toward renewable energy in small and medium businesses. Net metering policies and falling solar panel costs are driving installations in offices, schools, and retail outlets. Micro inverters are being preferred for their scalability and ease of maintenance, especially in installations with partial shading. Domestic suppliers are offering cost-optimized solutions tailored for the local climate. The integration of Wi-Fi-enabled monitoring systems is helping businesses track energy production and consumption in real time.

Germany is seeing an 8.5% CAGR in the medium voltage electric capacitor market, supported by the country's strong renewable energy adoption and grid modernization programs. Capacitors are being used to ensure voltage stability in grids with high shares of intermittent wind and solar power. Manufacturers are focusing on eco-friendly dielectric materials and advanced monitoring systems for predictive maintenance. The industrial sector, especially manufacturing and automotive production, is also contributing to demand by installing capacitors to improve power factor and reduce operational costs.

The United Kingdom is registering a 7.0% CAGR in the medium voltage electric capacitor market, driven by the expansion of offshore wind energy and the need for improved grid efficiency. Power distribution companies are installing capacitor banks to manage reactive power and reduce energy losses. Smart monitoring capabilities are being integrated to track performance and predict maintenance needs. The commercial and industrial segments are also increasing adoption to meet energy efficiency targets and reduce electricity costs.

The United States is posting a 6.3% CAGR in the medium voltage electric capacitor market, supported by investments in grid resilience and renewable integration. Utilities are deploying capacitors to optimize voltage profiles and manage reactive power in distribution systems. The aging power infrastructure is prompting modernization projects where capacitors are key components. Growth in electric vehicle charging infrastructure is also driving demand for capacitors in distribution networks. Manufacturers are offering advanced designs with higher thermal stability and improved energy efficiency.

The commercial single phase micro inverter market is expanding as businesses seek reliable and efficient ways to convert solar energy for commercial applications. These microinverters optimize energy harvest by converting direct current (DC) generated by solar panels into alternating current (AC) at the panel level, enhancing system performance and providing better monitoring capabilities.

Leading companies in this market include Enphase Energy, known for its advanced microinverter technology offering high efficiency and scalable solutions tailored for commercial rooftops. Altenergy Power System Inc. focuses on innovative designs that balance cost and performance, making solar installations more accessible to small and medium enterprises.

Darfon Electronics Corporation provides robust microinverter products emphasizing durability and compatibility with various solar modules. Chilicon Power LLC delivers compact and smart inverters with easy installation and real-time data analytics, improving operational management.

SMA Solar Technology AG offers comprehensive solar solutions, including microinverters that integrate with their broader energy management systems, supporting commercial customers with reliable energy conversion and grid interaction. As commercial sectors increasingly adopt solar power to reduce energy expenses and improve power reliability, the demand for efficient single-phase microinverters that offer flexibility, scalability, and enhanced monitoring is expected to grow steadily.

On October 22, 2024, Enphase Energy projected its fourth-quarter revenue to range between USD 360-400 million, below Wall Street expectations, citing weakened European demand. The company also announced plans to start USA production of commercial microinverters and batteries with higher domestic content.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.3 Million |

| Connectivity | On Grid and Standalone |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Enphase Energy, Altenergy Power System Inc., Darfon Electronics Corporation, Chilicon Power LLC, and SMA Solar Technology AG |

| Additional Attributes | Dollar sales vary by connectivity, including stand-alone vs. on-grid systems; by end-user, such as small commercial buildings, retail, offices, and industrial rooftops; and by region, led by Asia-Pacific, Europe, and North America. Growth is driven by panel-level monitoring, modular expansion, grid resilience, and clean-energy incentives. |

The global commercial single phase micro inverter market is estimated to be valued at USD 18.3 million in 2025.

The market size for the commercial single phase micro inverter market is projected to reach USD 74.6 million by 2035.

The commercial single phase micro inverter market is expected to grow at a 15.1% CAGR between 2025 and 2035.

The key product types in commercial single phase micro inverter market are on grid and standalone.

In terms of , segment to command 0.0% share in the commercial single phase micro inverter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA