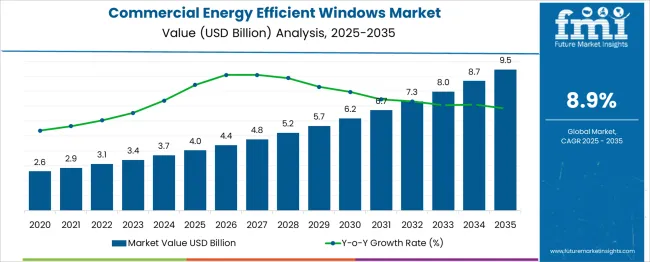

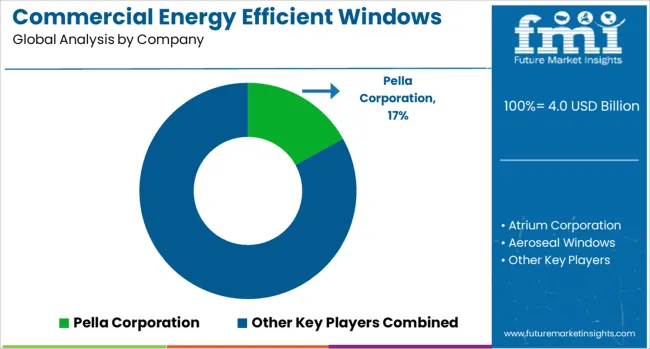

The Commercial Energy-Efficient Windows Market is estimated to be valued at USD 4.0 billion in 2025 and is projected to reach USD 9.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period. The commercial energy-efficient windows market is navigating a steady path along the market maturity curve. In the initial years (2025–2029), the market is in the early growth phase, driven by rising environmental awareness, energy cost pressures, and sustainability regulations.

Adoption during this period is led by early adopters, mainly green building developers, institutional investors, and government-backed infrastructure projects, who view energy efficiency as both a compliance measure and value differentiator. From 2030 onward, the market enters the early majority stage, with a broader base of commercial property developers integrating energy-efficient windows into new builds and retrofits.

This is fueled by stricter building energy codes, improved ROI from reduced HVAC costs, and growing alignment with ESG goals. As the market expands beyond USD 6.2 billion in 2031, innovations in glazing, smart glass integration, and lifecycle efficiency reinforce its value proposition.

By 2035, as revenues approach USD 9.5 billion, the industry will begin entering the mature growth phase, marked by product standardization, price competition, and widespread adoption. At this stage, energy-efficient windows will become a default commercial building component rather than a premium option.

| Metric | Value |

|---|---|

| Commercial Energy-Efficient Windows Market Estimated Value in (2025 E) | USD 4.0 billion |

| Commercial Energy-Efficient Windows Market Forecast Value in (2035 F) | USD 9.5 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The commercial energy efficient windows market is witnessing strong momentum, driven by rising environmental regulations, energy cost concerns, and sustainable construction mandates in commercial infrastructure. Building codes across key regions are increasingly emphasizing energy performance standards, prompting real estate developers and facility managers to retrofit or design buildings with thermally advanced window solutions.

Integration of intelligent façade systems and automation-ready glazing is contributing to energy modeling compliance and operational cost savings. Technological progress in low-emissivity coatings, inert gas fills, and spacer systems is enabling superior insulation performance, especially in large commercial properties.

Additionally, green building certifications and net-zero construction goals are acting as catalysts for adoption. The market outlook remains optimistic, supported by incentives for retrofitting, government-backed energy efficiency programs, and architectural trends that promote daylighting while minimizing HVAC loads.

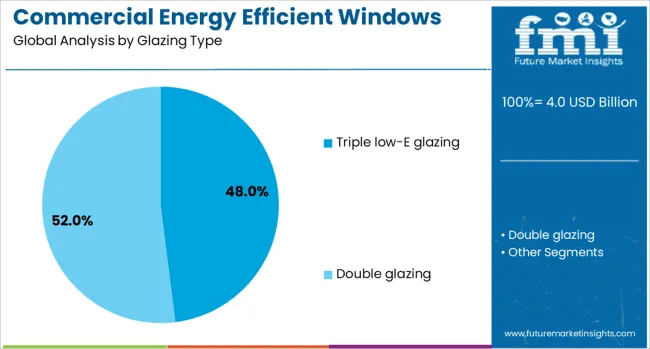

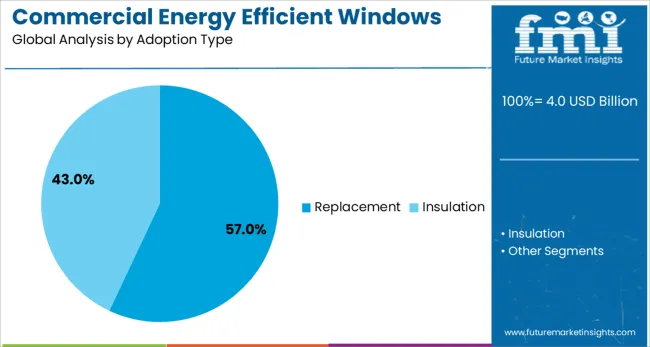

The commercial energy-efficient windows market is segmented by glazing type, adoption type, number of windows, and geographic regions. By glazing type, the commercial energy-efficient windows market is divided into Triple low-E glazing and Double glazing. In terms of the adoption type of the commercial energy-efficient windows market, it is classified into Replacement and Insulation.

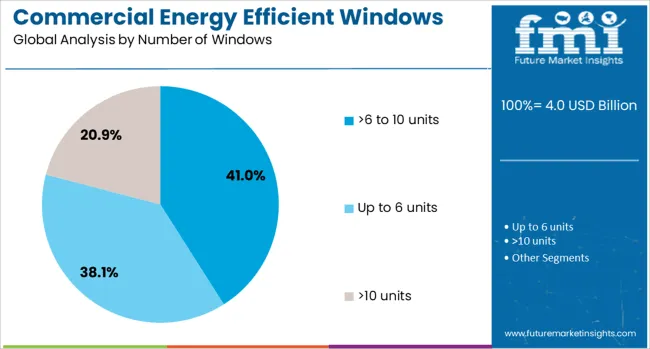

Based on number of windows of the commercial energy-efficient windows market is segmented into >6 to 10 units, Up to 6 units>10 units. Regionally, the commercial energy-efficient windows industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Triple low-E glazing is anticipated to dominate the commercial segment with a 48.0% revenue share in 2025. This position is being reinforced by its superior thermal insulation capabilities, which reduce both heat gain and loss, contributing to building energy efficiency targets.

The inclusion of multiple low-emissivity coatings within triple-pane configurations significantly improves U-values and reduces solar heat gain, making it highly suitable for energy-intensive commercial environments. Its performance consistency across temperature extremes has made it favorable in both temperate and cold climates.

Continued improvements in spacer technology and gas fill optimization are enabling enhanced efficiency without compromising visual clarity or daylight penetration. As cost differentials narrow due to scale economies and local manufacturing, triple low-E glazing is emerging as the default specification in large-scale retrofits and new commercial builds.

Replacement applications are projected to account for 57.0% of market revenue in 2025, making this the dominant adoption segment. The rise in commercial retrofitting activity, driven by aging building stock and evolving energy performance regulations, is fueling demand for window replacement over new installations.

Facilities aiming to achieve LEED or other energy ratings are prioritizing upgrades that offer quick payback through utility savings. Replacement windows with advanced thermal, acoustic, and UV-filtering capabilities are being selected to minimize disruption and optimize ROI across office spaces, retail stores, and healthcare facilities.

Government subsidies and utility rebate programs targeting energy upgrades in older commercial properties have further accelerated the adoption of replacements. The flexibility to install high-performance windows without structural redesign is reinforcing its market position.

Installations involving more than six and up to ten windows are projected to lead the market with a 41.0% revenue share in 2025. This segment reflects the adoption pattern seen in medium-sized commercial spaces such as small office buildings, retail outlets, and educational centers.

The balance between cost feasibility and energy return in this range is encouraging facility managers to prioritize targeted window upgrades. High-performance glazing in this window count range delivers measurable improvements in heating and cooling loads without requiring full-building redesigns.

The logistical ease of installing 6 to 10 units within standard renovation cycles has made this configuration especially attractive for phased energy retrofits. Additionally, segment dominance is supported by procurement strategies that align energy upgrades with tenant satisfaction, operational savings, and regulatory thresholds for building envelope improvements.

The commercial energy efficient windows market is growing as demand increases for building materials that support reduced operational energy use and indoor comfort. These windows are essential in lowering HVAC loads, improving daylight utilization, and achieving regulatory compliance. With expanding green construction and tighter energy codes, commercial developers are prioritizing window systems that support long-term cost savings. Manufacturers focus on advanced glazing, gas-filled units, and thermally broken frames to enhance performance, while building owners seek certified products that help meet sustainability benchmarks.

In the commercial real estate sector, property owners face increasing pressure to improve building energy performance due to escalating utility costs, tenant expectations, and environmental regulations. Energy efficient windows play a crucial role by limiting heat transfer, improving insulation, and reducing the strain on HVAC systems. Office buildings, retail spaces, and educational institutions are adopting high-performance windows as part of broader energy-saving retrofits or new green construction. These windows contribute not only to lower electricity bills but also to enhanced indoor comfort and improved natural lighting, which can boost worker productivity and tenant satisfaction. Real estate developers recognize that energy efficient buildings offer better returns through higher occupancy rates and longer lease terms. Many municipalities now require commercial buildings to meet performance standards that exceed traditional codes. As the push for energy reduction grows more intense, demand for efficient window solutions continues to rise, particularly in dense urban centers and climate-sensitive regions.

While energy efficient windows offer long-term savings, their adoption is often limited by high upfront costs and complex installation requirements. Commercial-grade energy efficient windows are typically composed of advanced materials such as low-emissivity glass, inert gas fills, and thermally broken aluminum or composite frames, all of which add to production costs. Installation can be labor-intensive, requiring precise alignment and sealing to achieve performance targets, especially in high-rise or structurally unique commercial buildings. Retrofitting existing commercial properties is particularly challenging, as it may require modification of window frames, disruption of building operations, and alignment with older architecture. These complexities can deter investment, particularly for smaller developers or property managers operating under tight capital budgets. Without strong financial incentives or clear payback timelines, some commercial stakeholders opt for partial upgrades or delay projects altogether. These challenges slow market penetration, despite strong long-term economic and environmental advantages associated with energy efficient window technologies.

Increasing adoption of green building standards and government incentives is creating new growth channels for energy efficient windows in commercial properties. Programs such as LEED, WELL, and ENERGY STAR reward projects that meet high energy performance standards, with windows often forming a critical component of certification criteria. Many regions have introduced building performance standards that require improved thermal insulation and reduced building envelope leakage, encouraging the use of advanced glazing systems. Some governments also offer tax credits, grants, or low-interest loans to support investments in energy-saving upgrades, making high-performance windows more financially viable for developers. Property owners that pursue certifications not only benefit from energy savings but also increase the market value and reputation of their buildings. These benefits align well with growing investor interest in ESG (environmental, social, governance) benchmarks. As codes tighten and certifications become common requirements for commercial leases and funding, demand for qualifying energy efficient windows continues to grow.

The production of commercial energy efficient windows relies heavily on a consistent supply of specialized raw materials such as high-quality float glass, noble gases like argon or krypton, low-e coatings, and engineered frame systems. Any disruption in these inputs can delay window production and inflate prices. Supply chain issues, whether due to transportation bottlenecks, geopolitical constraints, or labor shortages, can cause significant project delays. Many commercial building projects operate on fixed timelines and budgets, making reliable sourcing essential. Moreover, some advanced window systems require custom dimensions, specific performance certifications, or integration with façade automation systems, which further complicate procurement. Manufacturers are increasingly seeking local or regional suppliers to reduce dependency on global logistics networks, but not all markets have established local capabilities. To stay competitive, companies must balance innovation in performance with resilience in sourcing and delivery. Ongoing instability in global supply chains remains a key restraint for large-scale commercial window adoption.

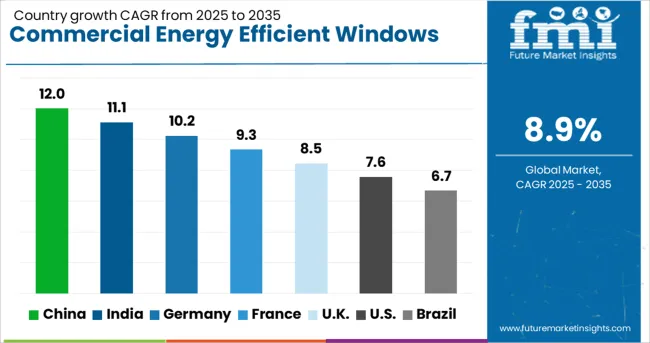

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

| USA | 7.6% |

| Brazil | 6.7% |

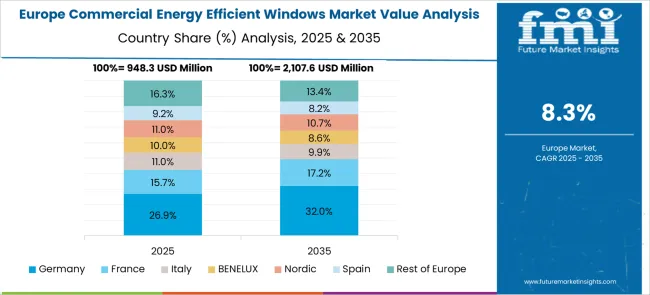

The global commercial energy efficient windows market is expanding at a CAGR of 8.9%, driven by stricter building energy codes, demand for green certifications, and advancements in glazing technologies. China leads with 12.0% growth, backed by large-scale commercial construction and government mandates for sustainable infrastructure. India follows at 11.1%, fueled by rapid urbanization and increasing awareness of energy conservation in commercial buildings. Germany records 10.2% growth, reflecting its leadership in passive building standards and adoption of advanced insulation technologies. The United Kingdom shows steady growth at 8.5%, with strong emphasis on reducing carbon emissions through building retrofits. The United States, at 7.6%, remains a mature yet growing market, driven by energy-efficient building codes, LEED-certified projects, and rising operational cost concerns. Market dynamics are shaped by thermal performance ratings, smart glass integration, and lifecycle cost savings. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is leading the commercial energy efficient windows market with a 12.0% CAGR, driven by national policies on sustainable construction and building energy codes. Rapid urbanization and commercial real estate development are pushing demand for high-performance glazing systems. Government-led green building certifications are encouraging adoption in office towers, hotels, and public infrastructure. Domestic manufacturers are investing in advanced technologies such as low-E coatings, vacuum-insulated glazing, and smart glass systems. Retrofit projects across tier-1 cities are also fueling the replacement market. Local production scale is helping reduce costs, increasing accessibility across commercial developers. Rising electricity costs and air quality regulations are further supporting energy-saving solutions in building design.

India is seeing an 11.1% CAGR in the commercial energy efficient windows market, propelled by smart city projects, infrastructure growth, and energy conservation efforts. Builders and architects are increasingly specifying energy-efficient glass for office complexes, malls, and educational institutions. Rising temperatures and power costs are influencing adoption in tier-1 and tier-2 cities. Indian glass manufacturers are scaling up their production capabilities and partnering with international firms to introduce low-emissivity and double-glazed solutions. The Bureau of Energy Efficiency is actively promoting energy-efficient building standards, encouraging adoption in commercial sectors. Growth in IT parks and business hubs is also a key contributor to rising demand.

Germany is reporting a 10.2% CAGR in the commercial energy efficient windows market, underpinned by strict building energy codes and emphasis on sustainable architecture. Commercial developers are prioritizing thermal insulation and solar control to meet stringent EU energy efficiency targets. The market is benefiting from refurbishment mandates on older buildings and energy performance certifications. Advanced triple-glazing, inert gas fills, and integrated shading systems are increasingly being used in office and retail construction. German manufacturers are leading innovation in recyclable window frames and modular glazing units. Government subsidies for green retrofits and digital tools for energy modeling are supporting market penetration.

The United Kingdom is experiencing an 8.5% CAGR in the commercial energy efficient windows market, supported by stricter environmental regulations and commercial retrofitting activity. Developers are favoring low-U-value window systems for compliance with building performance standards. Public sector infrastructure upgrades, including hospitals and council buildings, are adopting advanced glazing to cut energy costs. Double- and triple-glazed units with argon gas fills are widely used in new commercial projects. Demand is also increasing for acoustic insulation and UV protection features. The rise of net-zero building targets is influencing R&D in vacuum glazing and photochromic technologies. Import-reliant supply chains are gradually diversifying due to local demand.

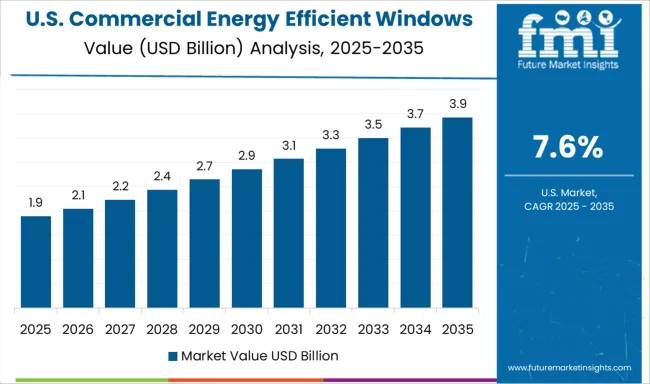

The United States is observing a 7.6% CAGR in the commercial energy efficient windows market, shaped by rising energy costs, commercial retrofits, and LEED certification programs. Office buildings, schools, and healthcare facilities are integrating low-E and solar-control windows to meet energy performance goals. Major cities are offering incentives for energy-saving upgrades, driving window replacements in older commercial properties. Manufacturers are investing in multi-pane solutions with thermal breaks and spectrally selective coatings. The commercial sector’s focus on occupant comfort and energy reduction is increasing demand for dynamic glazing and daylight optimization. Tax incentives and building code updates are supporting steady market growth.

The commercial energy efficient windows market is growing steadily as building owners and developers seek to reduce energy loss and improve interior comfort in commercial spaces. These windows are designed to minimize heat transfer, helping maintain consistent indoor temperatures and lowering heating and cooling costs. The shift in construction practices, favoring energy-conscious design and regulatory compliance, has created strong demand for high-performance window systems across office buildings, retail outlets, hospitals, schools, and industrial facilities.

Major players like Pella Corporation, Jeld-Wen, and Marvin Windows & Doors offer a broad range of commercial-grade window solutions featuring double or triple glazing, low-emissivity coatings, and advanced framing materials. These companies serve large-scale projects with customized window designs that meet regional codes and energy benchmarks. Manufacturers such as Milgard Manufacturing, Champion Window, and Winco Window contribute to mid-size and retrofit projects with a focus on product durability and improved thermal performance.

Specialist companies including Alpen High Performance Products and Aeroseal Windows focus on high-efficiency installations for institutional and government buildings, often working on façade upgrades and retrofits. Fenesta and Atrium Corporation maintain a strong presence in regional markets by offering a mix of performance and affordability. As commercial buildings increasingly prioritize energy management, the demand for these advanced window systems is expected to remain strong, supported by growing compliance requirements and the long-term benefits of operational cost reduction.

Cascadia Windows & Doors and LuxWall officially partnered to launch an ultra-high-performance commercial window system. Using LuxWall’s Enthermal Plus™ transparent insulation integrated into Cascadia’s Universal Series™ fiberglass frame, the system achieves an impressive R‑11+ insulating value, dramatically outperforming traditional window options.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.0 Billion |

| Glazing Type | Triple low-E glazing and Double glazing |

| Adoption Type | Replacement and Insulation |

| Number of Windows | >6 to 10 units, Up to 6 units, and >10 units |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Pella Corporation, Atrium Corporation, Aeroseal Windows, Alpen High Performance Products, Champion Window, Fenesta, Jeld-Wen, Marvin Windows & Doors, Milgard Manufacturing, and Winco Window |

| Additional Attributes | Dollar sales vary by glazing type and adoption scope, with double glazing dominating and triple low‑E glazing gaining momentum, especially in retrofit projects. North America leads value, while Europe and Asia‑Pacific drive growth through regulation and urbanization. Pricing fluctuates with materials and certification costs. Growth accelerates via smart electrochromic glass, net‑zero building mandates, and occupant comfort initiatives under sustainability pressures. |

The global commercial energy-efficient windows market is estimated to be valued at USD 4.0 billion in 2025.

The market size for the commercial energy-efficient windows market is projected to reach USD 9.5 billion by 2035.

The commercial energy-efficient windows market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in commercial energy-efficient windows market are triple low-e glazing and double glazing.

In terms of adoption type, replacement segment to command 57.0% share in the commercial energy-efficient windows market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA