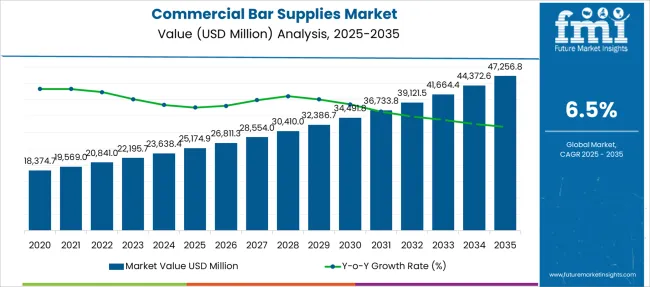

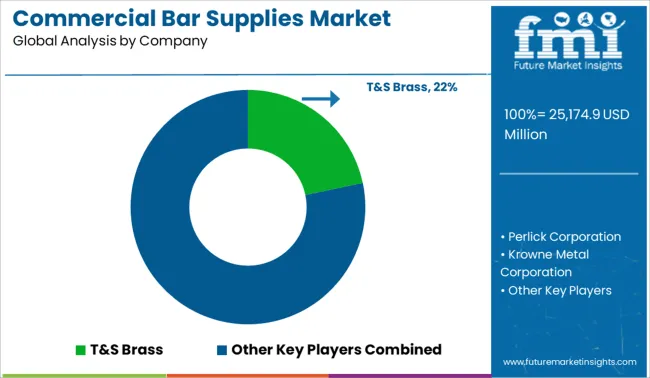

The Commercial Bar Supplies Market is estimated to be valued at USD 25174.9 million in 2025 and is projected to reach USD 47256.8 million by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Bar Supplies Market Estimated Value in (2025 E) | USD 25174.9 million |

| Commercial Bar Supplies Market Forecast Value in (2035 F) | USD 47256.8 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The commercial bar supplies market is experiencing steady expansion due to the global recovery of the hospitality industry, increased consumer spending on social dining, and rising investments in upscale bar and beverage service infrastructure. The growing emphasis on themed and experiential dining environments has elevated demand for premium bar equipment and supplies that enhance service aesthetics and operational efficiency.

Innovations in material durability, ergonomic design, and modular storage are driving product advancements. As commercial establishments prioritize hygiene, speed, and presentation, suppliers are introducing solutions that balance functionality with brand appeal.

Urbanization, tourism growth, and expansion of global hotel chains continue to provide favorable conditions for long term market growth, especially in regions witnessing strong hospitality development pipelines.

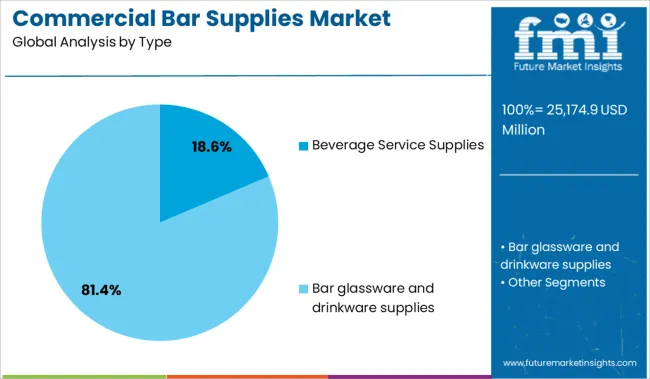

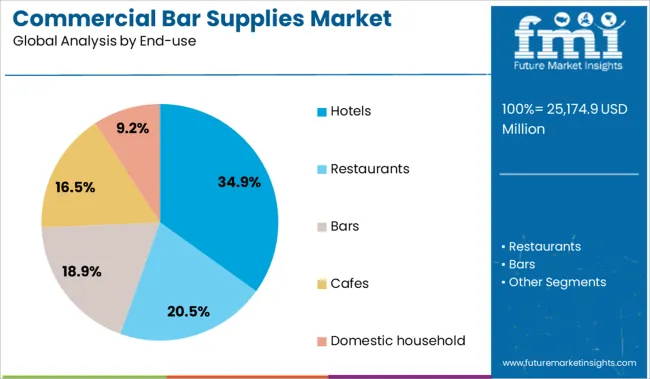

The market is segmented by Type and End-use and region. By Type, the market is divided into Beverage Service Supplies, Bar glassware and drinkware supplies, Metal Bar equipment supplies, Ice supplies, Cocktail supplies, Food service supplies, Bartender supplies, and Ware-washing supplies. In terms of End-use, the market is classified into Hotels, Restaurants, Bars, Cafes, and Domestic household. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The beverage service supplies segment is anticipated to account for 18.60% of total market revenue by 2025 within the type category, establishing itself as a key growth contributor. This trend is being driven by the increasing demand for efficient and visually appealing service tools in commercial bar settings.

Beverage supplies such as glassware, dispensers, shakers, and garnish trays are essential for maintaining service consistency, speed, and presentation standards. With greater consumer focus on drink aesthetics and the growth of craft cocktail culture, bars and lounges are investing more in high quality service accessories.

These tools are also central to staff productivity and customer satisfaction, thereby strengthening their position within the commercial bar setup.

The hotels segment is projected to represent 34.90% of the total commercial bar supplies market revenue by 2025, making it the dominant end use segment. This leadership is attributed to the comprehensive beverage service offerings present in hotels, including lobby bars, rooftop lounges, banquet halls, and in room dining services.

Hotels have increasingly positioned their bar services as integral to guest experience and brand differentiation, prompting significant investment in modern, high efficiency bar infrastructure. Additionally, the expansion of luxury hotel chains, international tourism, and full service hospitality formats is driving consistent procurement of premium and durable bar supplies.

The integration of hotel bars into lifestyle branding and curated guest experiences further reinforces the hotels segment as a key revenue generator in the commercial bar supplies market.

A new report published by Future market insights projects the global commercial bar supplies market to reach USD 41,664.4 million during the forecast period, up from USD 15,211.47 million during the historical period.

Global drinking patterns have drastically changed in recent years. New trends emerge every year, driving the bar business in new ways and bringing about more transformations. In 2025, customers are typically more concerned with what they put into their bodies, which has led to a rise in interest in foods and drinks that are healthy. The adoption of professional bar supply is the result of this.

The market for commercial bar supplies is growing rapidly, propelled by demand from a supermarket and industrial distributors. The increased demand is driven by the need for more efficient and cost-effective operations in the food and beverage industry. Commercial bar accessories are essential for businesses that serve alcohol, as they provide the necessary equipment and products for bartenders to create cocktails and other drinks.

The market is also expected to continue growing in the coming years as the food and beverage industry continues to evolve and grow. This growth will be driven by the increasing demand from consumers for new and innovative products, as well as the need for more efficient operations in the industry.

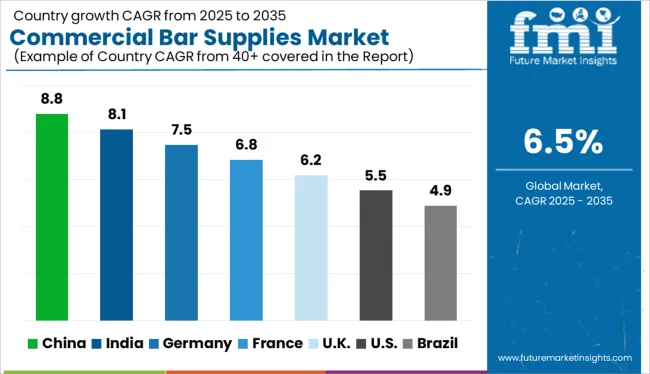

In recent years, the commercial barware supplies market in North America has been growing at a rapid pace. This is due to the increasing popularity of bars and restaurants in the region. The market is expected to continue growing in the coming years as more people are likely to visit bars and restaurants.

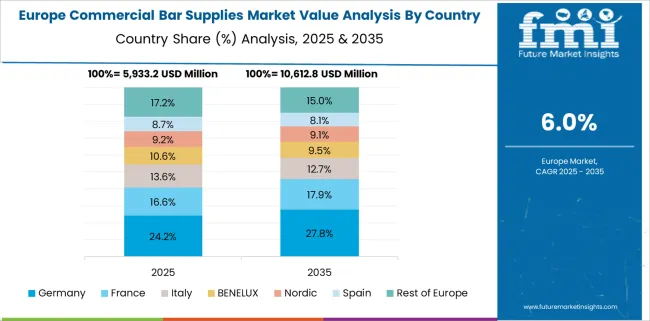

On the other hand, in recent years, the market for commercial bar supplies in Europe has been growing steadily. This is due to the fact that many countries in Europe have adopted more liberal policies toward alcohol consumption, which has led to an increase in the number of bars and restaurants in operation.

Additionally, the European Union has been working to promote trade between member states, which has made it easier for businesses to source commercial bar accessories from other countries in Europe.

The Asia Pacific region is expected to see the highest growth in the market due to the increasing number of bars and restaurants in countries of this region. The high growth rate can be attributed to the growing hospitality industry and rising disposable incomes in developing countries of Asia Pacific. The market for commercial bar supplies is fragmented, with a large number of small and medium-sized players operating in this space.

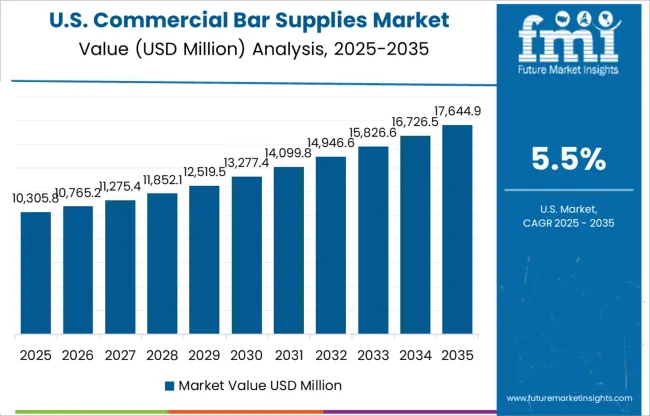

The United States commercial bar supplies market is the largest in North America. This is due to the large number of bars and restaurants in the country along with the large number of players operating in it. The leading players in this market are T&S Brass, Perlick Corporation, Krowne Metal Corporation, Advance Tabco, American Beverage Equipment Company LLC., and John Boos & Company. These companies hold a significant share of the USA market.

Currently, the USA accounts for around 60% of the North American commercial bar supplies market. This is mostly due to the wide range of product offerings by market players and their vast nationwide network of distribution channels.

Construction of in-house bars is increasing in the USA, which has an impact on market trends for commercial bar supplies and equipment. The younger generation in the United States now prefers to host home parties over going out to bars, which raises the need for bar equipment in residential areas due to the shift in consumer lifestyle.

The market in the USA is also being driven by the high alcohol consumption rate throughout the country, as well as a consumer lifestyle that involves drinking cocktails and mocktails to celebrate every occasion. Due to the growing interest from customers who are health-conscious, the consumption of low-alcohol beverages such as cocktails has increased in the area.

Since bar supplies are mostly used to produce cocktails, the growing consumption of cocktails is anticipated to spur market expansion. Apart from companies, a considerable portion of the population of the United States consumes alcohol, which considerably increases the need for bar accessories, especially in the residential regions of the country.

Canada and Mexico are also significant markets for commercial bar supplies due to the growing popularity of these businesses in these countries. Greenland is a small market for commercial bar supplies, but it is expected to grow in the future as more people become interested in this type of business.

A significant market share for commercial bar supplies is expected to belong to Europe at the end of 2025, with France accounting for the majority of that proportion. One of the largest wine producers in the world, France is also one of the countries where the market is expanding most quickly due to increased travel there.

The European commercial bar supplies market is also expanding as a result of rising premium wine consumption, a large tourist population that enjoys wine tasting, and other important aspects, which are causing a rise in commercial bar supplies sales.

Over the next five years, industry revenue is expected to rebound in tandem with lessening regulatory constraints, rising discretionary income, and increased consumer confidence. As people strive to take advantage of loosening coronavirus regulations, the sector is expected to profit from pent-up demand from both local customers and a return of foreign visitors.

The Japanese commercial bar supplies market is largely driven by the rising frequency of eating out despite time-constrained schedules and the growing effect of cross-cultural dietary patterns due to the significant presence of food service providers. One peculiar issue that has cost the Japanese government money is that its youth don't drink enough. Even a contest is being held by the Japanese government to come up with innovative ideas for getting young people to drink more.

For instance, according to the official competition website, the Sake Viva! campaign, which is run by the National Tax Agency, solicits submissions on how to stimulate demand among young people for alcohol through new services, promotional strategies, products, designs, and even sales techniques utilizing artificial intelligence or the metaverse.

Promoting any sort of Japanese alcoholic beverage was allowed in the contest. Commercial bar suppliers now have several chances to craft bar equipment to satisfy this rising demand.

As customers become more concerned with their health, the South Korean liquor industry is progressively moving in favor of beverages with a lower alcohol level. This has increased the demand and popularity of cocktail culture throughout Korea. Owing to this scenario, the increased adoption of commercial bar supplies by bars and homes is driving the market in Korea.

Hoesik, or getting together with coworkers for drinks after work once a month, was a common corporate tradition in South Korea. The increased interest among customers in specialty or niche food and beverage offers benefits to independent businesses.

Convenience and online ordering will be essential for customers in 2024, as home delivery or takeaway of alcohol and a rise in home use of alcohol. All these factors are contributing to the Korean commercial bar supplies market.

The commercial bar supplies market is expected to grow at a CAGR of 6.5% during the forecast period (2025 to 2035). The growth of the market is being propelled by distribution channels like supermarkets which are playing a vital role in the growth and expansion of the market.

Supermarkets are providing a one-stop solution for all the bar needs, which is increasing the convenience for customers and driving market growth.

They are also offering a wide range of products, which is giving customers more choices and driving up sales. In addition, supermarkets are also providing promotional activities and discounts, which is attracting more customers to purchase bar supplies from them. The rising popularity of home bars and pubs is another factor that is driving the growth of this segment.

New Players to Promote Innovation in the Global Market

Start-ups with a focus on the wine sector have slowly emerged over the past several years, working on anything from linked corks to tech-enabled wine preservation. Additionally, a large number of digital companies have emerged that are using cutting-edge technology to disrupt the long-established wine industry. The existence of several small and major competitors has led to the fragmentation of the global market.

Leading Startups to Keep an Eye on

| Start-up Company | Plum |

|---|---|

| Country | United States |

| Description | Plum offers a wine refrigerator that is internet-connected and can identify, store, and keep wine cold for up to 90 days. The gadget, which can hold up to two different bottles of wine, uses argon gas and a motorized needle to avoid wine oxidation. Once the bottles are in the device, users may pour wine. There are also more affordable reusable argon gas canisters for the gadget. Additionally, Plum provides hotels with a special service. |

| Start-up Company | D-Vine |

|---|---|

| Country | France |

| Description | By-the-glass wine pouring equipment called the 10-Vins was developed by D-Vine. This device aims to provide the ideal serving conditions for the beverage by swiftly aerating the wine and bringing it to the appropriate serving temperature. Each glass-sized portion of the wine is packaged in a tube with a chip that contains information about the suggested serving size. |

The market is highly competitive due to the presence of a large number of manufacturers. The manufacturers are focused on offering products that are cost-effective and meet customer requirements. In order to survive in the market, it is important for manufacturers to offer products that are differentiated from those offered by their competitors.

Recent Developments

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East and Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | By Type, By livestock, By End-user, By Region, By Distribution Channel |

| Key Companies Profiled | T&S Brass; Perlick Corporation; Krowne Metal Corporation; Advance Tabco; American Beverage Equipment Company LLC.; John Boos & Company.; Carlisle Products; Cocktail Kingdom LLC; Cresimo; Viski; Norpro Inc.; OXO; SAHM; Vacu Vin; Rabbit and Juliska |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global commercial bar supplies market is estimated to be valued at USD 25,174.9 million in 2025.

The market size for the commercial bar supplies market is projected to reach USD 47,256.8 million by 2035.

The commercial bar supplies market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in commercial bar supplies market are beverage service supplies, _bottle service supplies, _beer liquor and wine bags, _pitchers, _underbar glass rack storage units, _portable beer dispensers and accessories, _key racks, ice molds, _paper napkins, _beer growler and accessories, _ice molds, _paper napkins, _beer growlers, bar glassware and drinkware supplies, _beer glass, _cocktail glasses, _rock glasses, _shot glasses, _tasting flights, _beverageware, _reusable plastic beverageware, _novelty plastic barware, metal bar equipment supplies, _beer dispensers, _bottle coolers, _glass chillers and fosters, _underbar sinks, _undercounter ice machines, _wine refrigeration, _underbar sinks, _undercounter ice machines, _wine refrigeration, _backbar coolers, _commercial blenders/ food blenders, _commercial juicers, ice supplies, _ice transport buckets and accessories, _underbar equipment’s, _commercial equipment and supplies, _ice scoops, shovels, racks, paddles, _underbar equipment parts and accessories, _reusable hotel ice buckets, _glass filler faucets and station, cocktail supplies, _cocktail shakers, _garnishing tool sand kits, _bar utensils, _bitter bottles, _jiggers, _glass rimmers, _liquor pourers, _glass rimmers, food service supplies, _non-skid trays, _plastic cutlery/utensils, _straws, _menu-table tents and tabletop displayettes, _paper food trays, _restaurant pagers and accessories, _bbq accessories, bartender supplies, _bar candles, _bar mats and shelf liners, _bar towels/kitchen towels, _plastic storage containers & pourers, _corkscrews and bottle openers, _speed rails and speed racks, _bartender kits, _kitchen cutlery, _beer towers, _cocktail smoke guns& accessories, ware-washing supplies, _bar glass and glass washing &sanitizing chemicals, _glasswasher machine, _glass washing / polishing machines and _underbar sinks.

In terms of end-use, hotels segment to command 34.9% share in the commercial bar supplies market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA