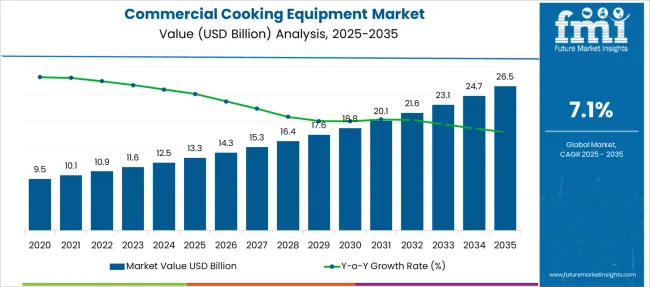

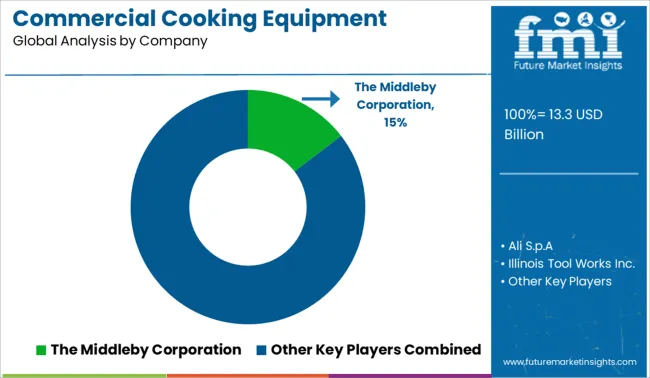

The Commercial Cooking Equipment Market is estimated to be valued at USD 13.3 billion in 2025 and is projected to reach USD 26.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Cooking Equipment Market Estimated Value in (2025 E) | USD 13.3 billion |

| Commercial Cooking Equipment Market Forecast Value in (2035 F) | USD 26.5 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The Commercial Cooking Equipment market is experiencing consistent growth, driven by increasing demand for energy-efficient, space-saving, and automated kitchen solutions across foodservice establishments. Technological advancements have encouraged manufacturers to design smart, programmable equipment that optimizes cooking times, reduces operational costs, and meets modern culinary standards. Growing consumer preference for dine-in experiences and the recovery of hospitality operations have significantly influenced demand across key regions.

Rising compliance with food safety and hygiene regulations has also compelled commercial kitchens to invest in updated and certified equipment. Expansion in the foodservice industry, combined with the global rise in urbanization and the increasing number of quick service and full-service restaurants, is expected to create continued demand for scalable and multifunctional appliances.

Industry stakeholders have been focused on innovation in both design and energy efficiency, supported by rising investment in commercial kitchen infrastructure These factors are collectively contributing to a positive outlook for the market in the years ahead.

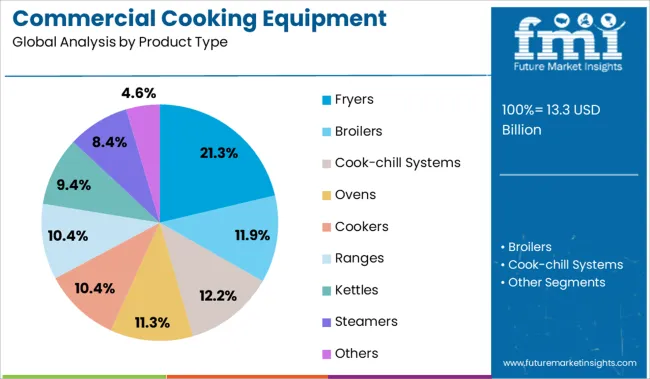

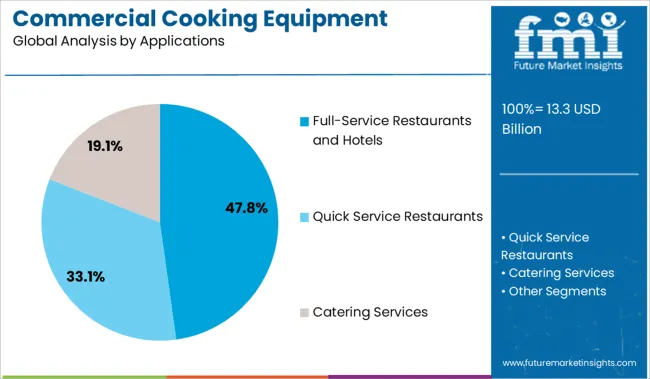

The market is segmented by Product Type and Applications and region. By Product Type, the market is divided into Fryers, Broilers, Cook-chill Systems, Ovens, Cookers, Ranges, Kettles, Steamers, and Others. In terms of Applications, the market is classified into Full-Service Restaurants and Hotels, Quick Service Restaurants, and Catering Services. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fryers segment is projected to contribute 21.3% of the Commercial Cooking Equipment market revenue share in 2025, establishing itself as a prominent product type segment. This growth has been supported by increasing demand for deep-fried foods across restaurants, hotels, and fast-food chains, where speed and consistency in food preparation are critical. Fryers have been favored for their ability to deliver high-volume output with uniform quality, and the segment has benefited from technological upgrades such as programmable settings, oil filtration systems, and energy-efficient designs.

These improvements have been aligned with commercial operators' goals to reduce operating costs while maintaining food quality. In addition, the ease of cleaning and reduced oil consumption in modern fryer models has contributed to operational efficiency and hygiene compliance.

The segment’s growth has also been reinforced by rising investment in commercial kitchens, particularly in expanding markets where Western-style menus are being adopted These factors have collectively sustained the segment's significant share in the overall market.

The full-service restaurants and hotels segment is expected to hold 47.8% of the Commercial Cooking Equipment market revenue share in 2025, making it the leading application segment. This dominance has been supported by the ongoing recovery and expansion of the global hospitality sector, where consistent quality, speed, and compliance are essential for daily operations. Full-service establishments require a wide variety of cooking equipment to support extensive menu offerings, and investment in advanced, multifunctional appliances has increased to meet customer expectations.

Hotels and restaurants have also prioritized sustainability and energy savings, which has driven the adoption of energy-efficient, programmable cooking systems. Additionally, the focus on enhancing customer experience through high-quality food service has reinforced the need for reliable and efficient kitchen infrastructure.

Commercial kitchens in these establishments are increasingly investing in modular and automated cooking equipment that meets both volume demand and safety regulations These drivers have positioned the segment at the forefront of equipment adoption within the commercial cooking industry.

The global commercial cooking equipment market is anticipated to expand at 7.1% CAGR between 2025 and 2035 in comparison to the 5.4% CAGR registered during the historical period from 2020 to 2025.

The rapid expansion of the food service industry across the world and increasing consumption of fast food are some of the key factors providing impetus to the growth of the commercial cooking equipment market.

Commercial cooking equipment is being increasingly used in restaurants, hotels, and other commercial kitchens for the preparation of food. These machines allow end users to prepare a wide range of food products in quick intervals of time while minimizing human intervention.

Thus, the increasing number of restaurants and hotels, along with the growing demand for fast food across the globe, will continue to boost the worldwide commercial equipment market. Similarly, advancements in cooking technology and growing demand for multi-functional, efficient, and space and time-saving commercial cooking equipment are expected to further aid in the expansion of the global market.

A number of influential factors have been identified that are expected to drive the global commercial equipment market forward during the projection period (2025 to 2035). Besides the proliferating aspects prevailing in the market, the analysts at FMI have also analyzed the restraining elements, lucrative opportunities, and upcoming threats that can somehow impact market dynamics.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

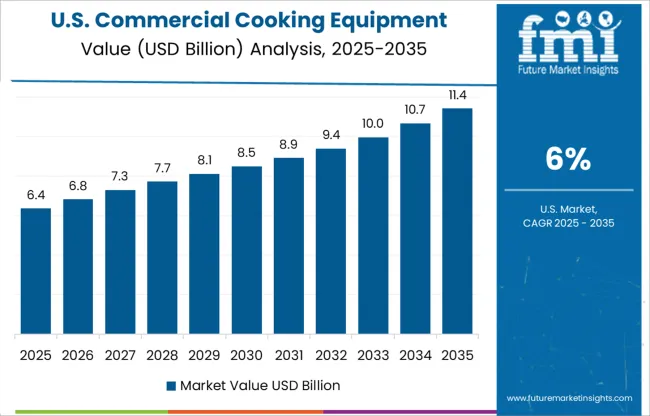

Rising Consumer Spending Boosting the US Market

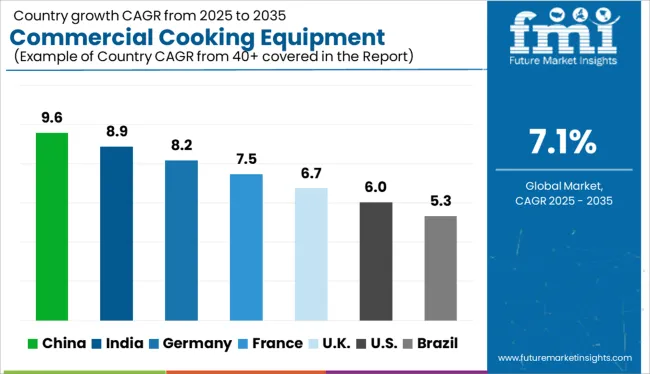

The US commercial cooking equipment market is currently valued at around USD 1,344.5 Million, and it accounts for 34% of the overall North American commercial cooking equipment market. This is due to a boom in fast food and quick service restaurants and rising consumer spending on fast food across the United States.

In recent years, changing lifestyles and increasing consumer spending has boosted sales across restaurants in the US According to the National Restaurant Association, despite the COVID-19 impact, restaurant industry sales totaled USD 12.5 billion in 2024. This will continue to boost the commercial cooking equipment market in the country during the forecast period.

Similarly, the growing need for preparing food in a short time and maintaining the freshness of the food along with the rising popularity of cloud kitchens n is increasing the demand for commercial cooking equipment across the country.

Rapid Expansion of Food Service Industry Pushing Demand in the UK Market

The UK commercial cooking equipment market is expected to surpass a valuation of USD 1,191.0 Million in 2025 and expand robustly during the next ten years. Currently, the UK holds around 32% of the European commercial cooking equipment market.

Growth in the UK commercial cooking equipment market is driven by rapid urbanization and the booming food service industry. In recent years, there has been a substantial rise in the number of quick-service restaurants across the UK. This has generated huge demand for advanced cooking equipment, and the trend is likely to continue during the forecast period.

Rapidly Growing Population and Availability of Low-Cost Products is Boosting Sales in China

According to FMI, China's commercial cooking equipment market is valued at over USD 977.0 Million, and it accounts for 35% of the Asia Pacific commercial cooking equipment market. This can be attributed to the rising fast-food consumption nationwide due to the rapidly growing population and economic boom.

Similarly, the easy availability of advanced commercial cooking equipment at much lower prices is positively influencing the commercial cooking equipment market in the country.

Ranges Remain the Top Selling Product Type Category

As per FMI, the ranges segment currently holds the largest market share of the global commercial cooking equipment market, and it is expected to grow at a healthy pace over the next ten years. This can be attributed to the rising adoption of ranges across various end-use sectors.

End users like restaurants and hotels are continuously investing in cooking ranges that are time- and space-saving and can easily perform multiple functions such as cooking, boiling, grilling, frying, and baking.

However, the fryer segment is likely to grow at the highest CAGR during the forecast period, owing to the increasing usage of commercial fryers for deep-fat frying a variety of foods, including meats and vegetables like fries, onion rings, or tempura.

Quick Service Restaurants to Generate Maximum Revenues

Based on applications, the global commercial cooking equipment market is segmented into full-service restaurants and hotels, quick-service restaurants, and catering services. Among these, the quick-service restaurant segment holds the largest revenue share, and it is expected to grow at the highest CAGR during the projection period.

The growth of the target segment is attributed to the rising adoption of commercial cooking equipment across quick-service restaurants.

In recent years, factors such as growing consumer preference for fast food, changing lifestyles, an increase in the working women population, and rapid urbanization have resulted in the expansion of quick service restaurants globally and the trend is likely to continue during the forecast period. This, in turn, will generate high demand for commercial cooking equipment like broilers, fryers, ovens, cookers, ranges, and kettles.

The global commercial cooking equipment market has become highly competitive due to the large presence of regional and domestic players. In order to capitalize and gain an upper hand in the market, companies are adopting strategies such as new product launches, mergers, acquisitions, collaborations, partnerships, and the strengthening of distribution channels. For instance,

The ever-increasing demand for commercial cooking equipment has tempted various companies to enter this market. As a result, there has been a rapid rise in the number of start-ups offering cooking equipment for used commercial commercial kitchens. One such company is Srihari Kitchen Equipment.

Headquartered in Coimbatore, Tamil Naidu, India, Srihari Kitchen Equipment is a privately held company founded in 2010. The company manufactures and supplies cooking equipment to end users, like restaurants and hotels.

Since its establishment, Srihari Kitchen Equipment has become a leading manufacturer and exporter of equipment for commercial kitchens, canteens, bakeries, hotels & messes, etc. The company offers high-quality and cost-efficient kitchen equipment like gas ranges.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 13.3 billion |

| Projected Market Size (2035) | USD 26.5 billion |

| Anticipated Growth Rate (2025 to 2035) | 7.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East & Africa (MEA) |

| Key Countries Covere | The USA, Canada, Mexico, Germany, The UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Product Type, Applications, Region |

| Key Companies Profiled | Ali S.p.A; Illinois Tool Works Inc.; Duke Manufacturing Co. Inc.; The Middleby Corporation; Alto-Shaam, Inc.; Edward Don & Company; Fujimak Corporation; Manitowac Company Inc.; Rational AG and AB Electrolux.; ACP, Inc.; AMTek Microwaves; Bizerba USA Inc.; Caddy Corporation; Duke Manufacturing Co.; Electrolux AB; R.M Kitchen Equipments Pvt. Ltd.; RM GASTRO s.r.o. |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global commercial cooking equipment market is estimated to be valued at USD 13.3 billion in 2025.

The market size for the commercial cooking equipment market is projected to reach USD 26.5 billion by 2035.

The commercial cooking equipment market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in commercial cooking equipment market are fryers, broilers, cook-chill systems, ovens, cookers, ranges, kettles, steamers and others.

In terms of applications, full-service restaurants and hotels segment to command 47.8% share in the commercial cooking equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA