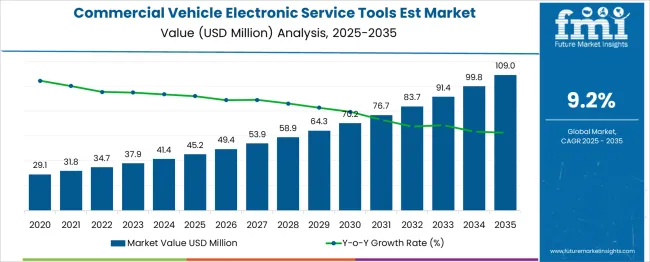

The Commercial Vehicle Electronic Service Tools Est Market is estimated to be valued at USD 45.2 million in 2025 and is projected to reach USD 109.0 million by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period. Over the ten-year span, the multiplying factor stands at approximately 2.41x. Total absolute growth reaches USD 63.8 million, with annual increments increasing steadily from USD 4.2 million in 2025–2026 to USD 9.2 million by 2034 to 2035.

Between 2025 and 2030, the market gains USD 25.1 million, reaching USD 70.2 million. The following five years, from 2030 to 2035, contribute USD 38.8 million, indicating a sharper compounding effect in the later stage. This shift reflects broadening implementation of diagnostic systems, telematics integration, and software-centric maintenance in heavy-duty and light commercial fleets.

The consistent upward trend, without deceleration or saturation, confirms ongoing digitization of fleet servicing across OEMs and aftermarket networks. The compound absolute growth curve exhibits an accelerating slope, validating market maturity through sustained investment in electronic diagnostics and repair automation. The second-half compounding exceeds the first by over 50%, indicating a reliable shift in demand intensity and long-term adoption across fleet service ecosystems.

| Metric | Value |

|---|---|

| Commercial Vehicle Electronic Service Tools EST Market Estimated Value in (2025 E) | USD 45.2 million |

| Commercial Vehicle Electronic Service Tools EST Market Forecast Value in (2035 F) | USD 109.0 million |

| Forecast CAGR (2025 to 2035) | 9.2% |

The commercial vehicle electronic service tools market draws influence from five primary parent sectors. Roughly 30% of demand originates from manufacturer OEM service tool kits, where diagnostic software and specialized adapters support maintenance and warranty protocols.

Nearly 25% corresponds to independent repair and aftermarket workshops, which use multi-brand electronic testers, fault code readers, and ECU reprogramming modules. Commercial fleet operators-including trucking companies and logistics firms-represent about 20%, investing in onboard diagnostic tools to manage uptime and vehicle health.

Rental and leasing services account for around 15%, deploying service tool suites to support routine checks and turnover fleets. The remaining 10% comes from vocational service networks and specialty segments like bus, refuse, and construction vehicle maintenance, where branded or customized diagnostic devices are needed for performance optimization and regulatory compliance.

The market is expanding due to the increasing complexity of vehicle electronics and the growing need for precise diagnostics. Companies such as Snap-on, Bosch, Continental, Cummins, Bendix, Navistar, and WABCO are driving innovation through cloud-based platforms, wireless handheld devices, and AI-integrated diagnostic solutions.

These tools enable real-time fault detection, over-the-air updates, and ECU reprogramming to support fleet maintenance and compliance. Integration with telematics systems is enhancing predictive servicing while modular hardware systems reduce workshop downtime. Growth is supported by the expansion of logistics networks, increased regulatory checks, and a shift toward digitized servicing for commercial fleets across global markets.

The commercial vehicle electronic service tools market is progressing steadily as digital diagnostics and intelligent servicing become core to fleet maintenance strategies. The integration of electronic systems in commercial vehicles has made traditional mechanical tools obsolete, thereby pushing demand for advanced, software-compatible service solutions. A growing emphasis on minimizing vehicle downtime, improving predictive maintenance, and complying with emission regulations has supported the market’s upward trajectory.

Light-duty commercial vehicles, which form a significant part of last-mile delivery and urban logistics, are contributing to increased tool deployments. Scanners and related diagnostic tools have become essential for real-time vehicle health monitoring, enabling technicians to identify and resolve complex issues efficiently.

Business models centered on one-time purchases remain dominant as fleet owners prioritize ownership and in-house servicing over subscription-based services. With digitization accelerating across commercial fleets and OEMs expanding vehicle-specific tool offerings, the market is expected to witness continued investment and technological adoption, particularly in developed transportation ecosystems..

The commercial vehicle electronic service tools market is segmented by vehicle, tool, business model, connectivity, application, distribution channel and geographic regions. By vehicle type, the commercial vehicle electronic service tools market is divided into Light-duty, Medium-duty, and Heavy-duty. In terms of tools for commercial vehicle electronic service, the market is classified into Scanners, Analyzers, System-specific tools, and Telematics. Based on the business model of the commercial vehicle electronic service tools, the market is segmented into Purchase, Subscription-based, and Pay-per-use.

By connectivity of the commercial vehicle electronic service tools, the market is segmented into Bluetooth, Wi-Fi, USB, Cellular, and Cloud. By application of the commercial vehicle electronic service tools, the market is segmented into Fault detection & diagnostics, Predictive & preventive maintenance, Performance monitoring & calibration, Repair & maintenance services, and Vehicle tracking & telematics service.

By distribution channel of the commercial vehicle electronic service tools, the market is segmented into Online and Offline. Regionally, the commercial vehicle electronic service tools industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

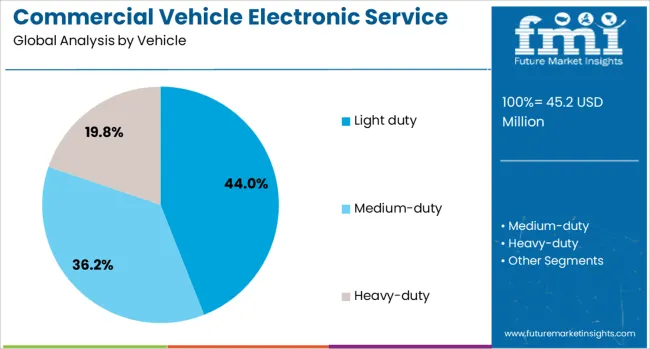

The light-duty segment is projected to account for 44% of the Commercial Vehicle Electronic Service Tools market revenue share in 2025, positioning it as the leading vehicle category. The rapid expansion of last-mile delivery services and e-commerce transportation fleets has shaped this segment’s dominance. Light-duty commercial vehicles are being increasingly integrated with advanced ECUs and onboard diagnostics, which necessitate regular servicing through specialized electronic tools.

The higher frequency of usage and shorter maintenance intervals have reinforced demand for diagnostics and calibration tools tailored for these vehicles. It has also been noted that the growing electrification trend in the light commercial vehicle segment requires new categories of service tools to interface with electric powertrains and battery systems.

With a strong presence in urban operations and higher fleet turnover rates, light-duty vehicles are driving sustained investment in in-house diagnostic infrastructure. These factors together have contributed to the significant share of this segment within the market..

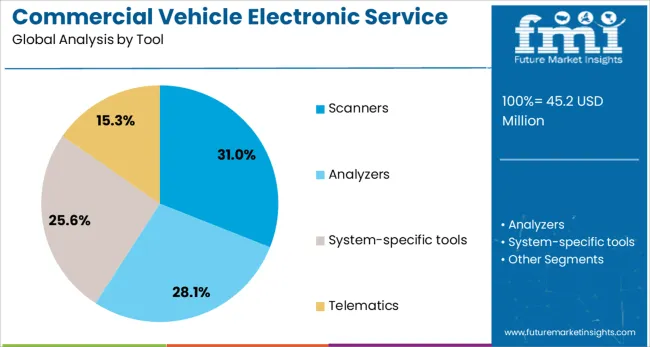

The scanners segment is estimated to hold 31% of the Commercial Vehicle Electronic Service Tools market revenue share in 2025, emerging as the dominant tool type. The widespread use of electronic control units in commercial vehicles has necessitated efficient scanning tools that can interface across multiple vehicle systems and protocols. Scanners have been adopted as the go-to solution for identifying fault codes, monitoring live data, and conducting comprehensive diagnostics without component disassembly.

Their versatility, portability, and integration with software updates make them indispensable in both OEM-authorized service centers and independent garages. The increasing complexity of vehicle architecture, including advanced driver-assistance systems and emission controls, has underscored the need for high-performance scanners capable of handling multi-brand platforms.

As the market shifts toward more intelligent and connected diagnostics, scanners continue to hold an essential role, especially for light and medium-duty vehicle servicing. Their effectiveness in reducing service times and ensuring precision has solidified their leading position..

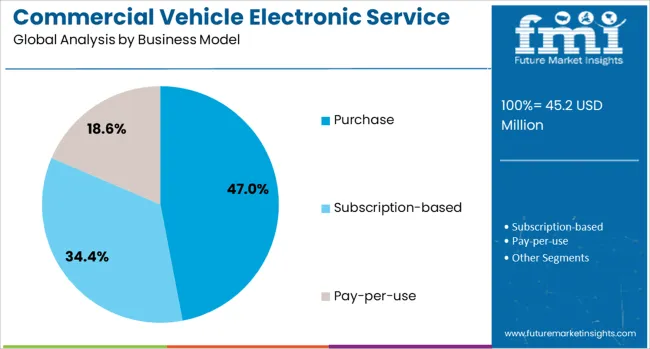

The purchase segment is expected to lead with a 47% revenue share in the Commercial Vehicle Electronic Service Tools market in 2025, maintaining its position as the preferred business model. This trend has been driven by the demand for asset ownership among fleet operators and service providers, who seek long-term cost control and flexibility. Ownership-based models have allowed businesses to integrate tools into their workflows without recurring fees, which is particularly attractive for in-house workshops and large fleets.

The purchase model also supports better tool customization and integration with proprietary software, enhancing operational consistency and diagnostic accuracy. In regions where aftermarket service networks are widespread, the availability of one-time purchase tools has contributed to their broader adoption.

Additionally, the model's appeal is strengthened by reduced dependency on software leasing agreements, lower total cost of ownership over time, and full access to system capabilities without usage restrictions. These advantages have enabled the purchase model to retain its strong hold across both small and large commercial servicing operations..

Demand for electronic diagnostic and programming service tools has grown due to the rising complexity of modern commercial vehicle systems. In 2024, more than 46% of new heavy-duty truck maintenance centers installed multi-brand electronic scan tools.

About 38% of light commercial vehicle workshops adopted fleet-level software platforms with remote diagnostics capabilities. Demand from North America and Asia Pacific led investment in digital service kits. Electronic service tools capable of ECU reprogramming, fault code reading, and firmware upgrades have become standard. Growth was driven by maintenance outsourcing trends and regulations requiring emission system checks.

Electronic service tool adoption has been propelled by rising software complexity and stringent emissions diagnostics requirements. Fleet servicing facilities and OEM dealers specified diagnostic modules for engine, transmission, and aftertreatment systems in over 41% of new installations. Emission fault detection routines for SCR, DPF, and EGR systems demanded electronic calibration in approx 47% of heavy-duty vehicle services.

As CAN bus and multiplexed data architectures became standard, legacy analog tools were phased out. Real-time ECU parameter adjustment and firmware flashing became critical for hybrid and Euro VI compliant vehicles. Technician productivity improved by about 23% due to reduced manual intervention. Fleet management capability expanded as service records were updated electronically through automated protocols.

Widespread deployment of specialized electronic service tools has been hindered by high acquisition costs and training needs. Premium diagnostic kits cost up to 29% more than basic scan tools, impacting small independent workshops. Integration with proprietary OEM software platforms required licensing fees and periodic renewals, which were incurred by about 22% of service providers.

Technical complexity caused training cycles of up to three days per technician, depleting workforce operational hours. Approximately 17% of workshops reported underutilization of advanced features due to unfamiliarity. Firmware version mismatches and communication protocol updates caused compatibility issues in 9% of servicing encounters. Smaller service outlets faced adoption delays owing to these barriers.

Subscription-based diagnostic platforms and telematics integration have unlocked new value propositions in fleet service management. Over 27% of tool providers now offer real-time telematic download capabilities for ECUs via Bluetooth alongside diagnostic software. Remote fault reading and proactive issue flagging allowed service planning in approximately 24% of commercial fleets.

Fleet operators were offered tool-as-a-service models that bundle hardware and software updates, reducing upfront cost expectations. Partnerships between OEMs and tool vendors enabled branded access for remote programming and warranty resets. Tool suppliers are expanding road-side and mobile service line offerings to support preventive diagnostics, driving extended product lifecycles and operator uptime guarantees.

Commercial vehicle diagnostic tools featuring mobile apps and wireless interfaces were introduced in over 32% of new dealer-specific kits. Edge computing diagnostic units capable of processing fault codes without a laptop connection gained a share of 26% of new tool orders. Firmware over‑the‑air (OTA) update features for ECUs became available in approximately 29% of previously released tool-virus-free diagnostic lines.

Tools now support remote error visualization via cloud dashboards. Customizable error code libraries and interactive repair guides are embedded in 21% of service tool apps. Security protection, including encrypted CAN session handling and branded authentication protocols, is being adopted in 18% of new commercial vehicle diagnostic systems.

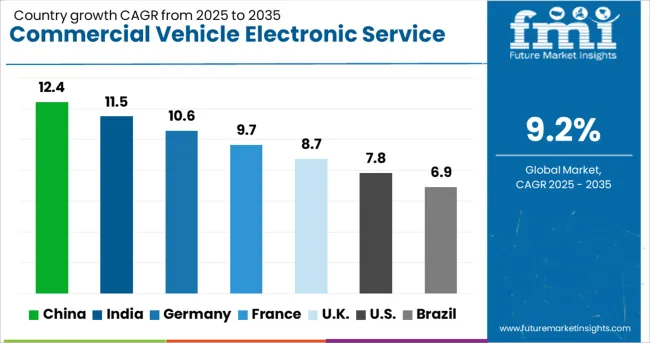

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

The commercial vehicle electronic service tools market is projected to grow at a global CAGR of 9.2% from 2025 to 2035. China is leading with a CAGR of 12.4%, outperforming the global pace due to fleet digitization and strong aftermarket demand. India follows at 11.5%, supported by rapid commercial vehicle production growth and rising OEM diagnostics integration.

Germany is advancing at 10.6%, backed by legislative push for emission monitoring and electronic compliance. The UK is growing at 8.7%, slightly below the global average, while the USA is at 7.8%, reflecting maturity in service networks. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The commercial vehicle electronic service tools market in China is expected to grow at a CAGR of 12.4% from 2025 to 2035. Electronic diagnostic toolkits have been installed across truck fleets to manage powertrain configurations and emission compliance. Multi-protocol scan tools have seen rising deployment in medium-duty commercial vans, especially within intercity freight carriers. Domestic OEMs are incorporating embedded software diagnostic modules in newly launched electric logistics vehicles. Aftermarket workshops are procuring tablet-based service platforms to calibrate ECU parameters and run real-time performance diagnostics. CAN bus interfaces and J1939 communication systems are being supported across newer tool versions. Adoption of remote diagnostics software is being promoted through OEM-linked repair contracts across tier-1 cities and logistics clusters.

India is projected to record an 11.5% CAGR in the commercial vehicle EST market from 2025 to 2035. Heavy-duty diesel truck servicing has shifted toward OBD-II compatible diagnostic systems due to emission upgrades. Independent repair centers are increasing their use of handheld diagnostics tools to perform DPF regeneration, engine derating resets, and real-time fuel system analysis. Government-led fleet modernization has contributed to the demand for standardized electronic diagnostics across interstate logistics providers. Technical institutes are investing in simulation-based EST kits to train commercial vehicle technicians. Integration with telematics dashboards has been pursued by service providers operating across state borders. Vehicle inspection centers are now required to verify sensor calibration using digital test benches.

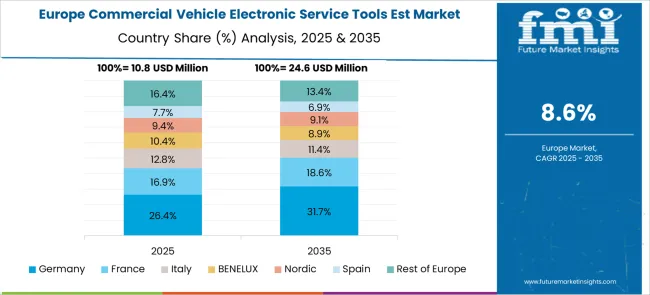

Germany is forecasted to grow at a CAGR of 10.6% in the commercial vehicle EST market between 2025 and 2035. Advanced EST modules with predictive maintenance features have gained traction across urban bus fleets. Euro VI-compliant diagnostics suites are being deployed by service stations working with articulated trucks and long-haul vehicles. Cloud-based vehicle health monitoring has been introduced into regional delivery van fleets, with data shared across integrated workshop networks. OEM-authorized service partners are employing high-precision digital testers to recalibrate transmission systems and brake sensors. Digital maintenance history logs linked to EST platforms are being used by leasing firms to improve asset uptime and compliance. Real-time diagnostics are now considered critical for multi-axle fleet reliability.

The United Kingdom is set to grow at a CAGR of 8.7% in the commercial vehicle electronic service tools market through 2035. Public sector procurement for smart fleet diagnostics has led to increased demand for remote service tools within municipal truck operations. Transport service providers are emphasizing fault prediction and real-time performance monitoring through software-integrated EST modules. The shift toward electric commercial vehicles has prompted the introduction of high-voltage battery management diagnostics within servicing protocols. Fleet operators are using multi-language software platforms to handle pan-European operations with uniform tools. Certified repair centers are being required to maintain compatibility with dual-brand OEM standards, particularly in electric vans and hybrid delivery trucks.

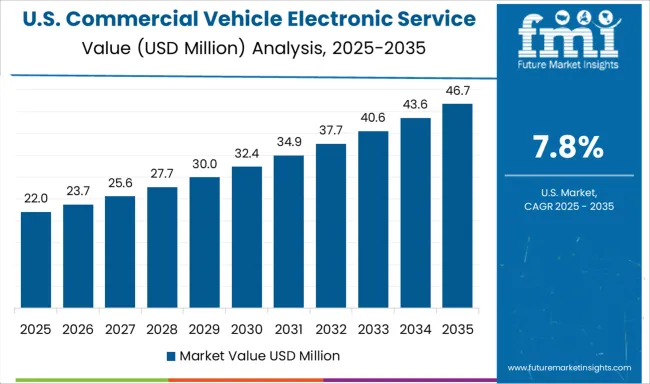

The United States is expected to grow at a CAGR of 7.8% in the commercial vehicle EST market during 2025 to 2035. Freight operators have adopted advanced service toolkits to reduce diagnostics cycle time and improve repair turnaround. Commercial fleet maintenance centers have shifted to software-guided engine and transmission diagnostics. Large-scale service franchises are standardizing EST modules for cross-brand support in heavy-duty trucks. Predictive failure analytics have been enabled through API-linked diagnostic systems across logistics networks. Fleet uptime optimization has driven investment in portable diagnostics scanners with cloud sync. Commercial EV fleet expansion is prompting upgrades in high-voltage diagnostics capacity, with new tools tailored to EV motor controllers and battery packs.

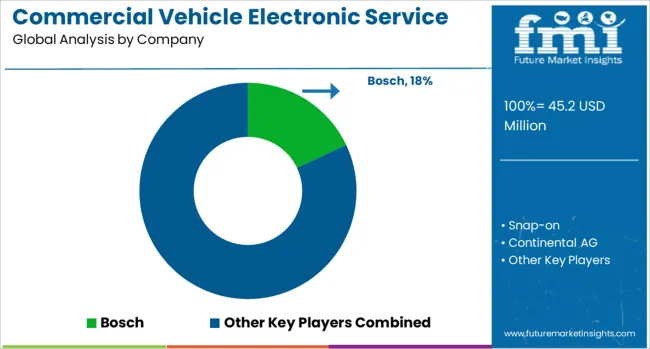

The commercial vehicle electronic service tools market features suppliers of diagnostics and calibration systems for heavy-duty fleets, buses, and transport vehicles. Bosch offers multi-brand diagnostic tools and electronic control unit (ECU) programming devices widely adopted in workshops and OEM service centers. Snap-on supports commercial fleet maintenance through its MODIS and VERUS platforms that offer wireless diagnostics and component testing. Continental AG delivers intelligent service interfaces and automated testing systems integrated with onboard vehicle electronics, especially across European fleets and connected trucks.

Delphi Technologies focuses on engine management diagnostics, with specialized tools for emissions control and aftertreatment systems. Launch Tech Co., Ltd. supplies diagnostic scanners and telematics-enabled tools used extensively in aftermarket repair environments in Asia, Europe, and Latin America.

Actia Group provides multiplexing systems, remote diagnostic interfaces, and calibration tools used in vehicle inspection stations and authorized service providers. Key competitive priorities include software compatibility with evolving ECUs, regular updates for vehicle model coverage, and integration with remote fleet management platforms. Increasing electronic content in vehicles has raised the demand for precision calibration tools, flash programming interfaces, and CAN bus communication analyzers that comply with global emissions and safety regulations.

Key players like Snap-on, Noregon Systems, TEXA, and Cojali introduced multi-brand compatible tools with cloud-based diagnostics. OEMs such as Cummins, Volvo, and PACCAR enhanced proprietary platforms for real-time monitoring and remote troubleshooting.

The rise of predictive maintenance and technician-as-a-service models supported fleet uptime and emissions compliance. Demand grew in heavy-duty and commercial trucking sectors, with a focus on integrating software and hardware for efficient vehicle servicing.

| Item | Value |

|---|---|

| Quantitative Units | USD 45.2 Million |

| Vehicle | Light duty, Medium-duty, and Heavy-duty |

| Tool | Scanners, Analyzers, System-specific tools, and Telematics |

| Business Model | Purchase, Subscription-based, and Pay-per-use |

| Connectivity | Bluetooth, Wi-Fi, USB, Cellular, and Cloud |

| Application | Fault detection & diagnostics, Predictive & preventive maintenance, Performance monitoring & calibration, Repair & maintenance services, and Vehicle tracking & telematics service |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, Snap-on, Continental AG, Delphi Technologies, Launch Tech Co., Ltd., and Actia Group |

| Additional Attributes | Dollar sales by tool type (diagnostics scanners, calibration tools, ECU programmers) and application (maintenance, repair, fleet diagnostics), demand driven by truck fleet electrification, predictive maintenance, and after-sales service contracts, regional trends led by Asia Pacific with North America catching up, innovation in cloud-based telematics integration, vehicle OEM update platforms, and handheld tablet-based tools for fast diagnostics. |

The global commercial vehicle electronic service tools est market is estimated to be valued at USD 45.2 million in 2025.

The market size for the commercial vehicle electronic service tools est market is projected to reach USD 109.0 million by 2035.

The commercial vehicle electronic service tools est market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in commercial vehicle electronic service tools est market are light duty, medium-duty and heavy-duty.

In terms of tool, scanners segment to command 31.0% share in the commercial vehicle electronic service tools est market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle SCR Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Remote Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Telematics Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Retarder Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Propeller Shaft Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Urea Tank Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Automotive Thermal System Market Analysis by Application, Vehicle Type, Propulsion Type, Component, and Region Through 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Commercial Restaurant Rangers Market

Vehicle as a Service Market Size and Share Forecast Outlook 2025 to 2035

Pest Control Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Vehicle Moving Services Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Food Service Equipment Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA