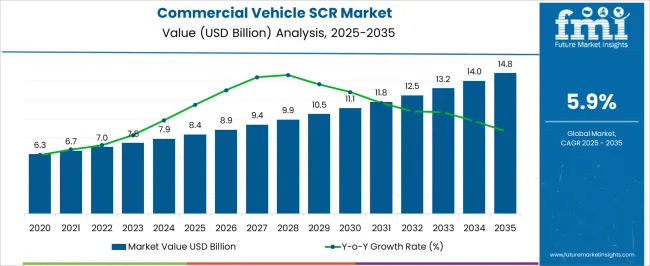

The commercial vehicle SCR market is estimated to be valued at USD 8.4 billion in 2025 and is projected to reach USD 14.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period. The 5-year growth block analysis of the commercial vehicle SCR market indicates a steady and consistent expansion, with market value projected to rise from USD 8.4 billion in 2025 to USD 11.1 billion by 2030, reflecting a compound annual growth rate (CAGR) of 5.9%.

Growth during the early years is expected to be gradual, moving from USD 8.4 billion in 2025 to USD 8.9 billion in 2026, reaching USD 9.9 billion by 2028. This trend reflects the rising adoption of selective catalytic reduction systems in commercial vehicles, where regulatory compliance, fuel efficiency, and operational reliability are increasingly influencing purchasing and fleet upgrade decisions.

By 2030, the commercial vehicle SCR market is anticipated to reach USD 11.1 billion, underscoring the growing reliance on advanced emission control systems to enhance vehicle performance and minimize operational risks. The market trajectory highlights that vehicle manufacturers and fleet operators are focusing on dependable, efficient, and durable SCR technologies to meet industry standards and ensure long-term performance. The steady growth pattern suggests opportunities for suppliers of high-quality catalytic solutions and integrated systems, as demand continues to expand across regions with stringent emission norms. This outlook positions the commercial vehicle SCR market as a critical component in modern fleet management and regulatory compliance strategies.

The commercial vehicle SCR market is a specialized segment within the broader commercial vehicle market, where it currently holds approximately 6-7% share, driven by increasing regulatory pressure to reduce NOx emissions from trucks, buses, and other heavy-duty vehicles. Within the automotive emission control systems market, SCR (Selective Catalytic Reduction) solutions represent about an 8-9% share, as they are critical for meeting stringent emission standards such as Euro VI, EPA 2010, and other global regulations.

In the heavy-duty truck and bus market, commercial vehicle SCR systems capture roughly a 10-12% share, reflecting their role in enhancing fuel efficiency while ensuring compliance with environmental norms. Within the diesel engine components market, SCR units account for approximately a 5-6% share, as they integrate with exhaust systems and work alongside diesel particulate filters to optimize engine performance and reduce harmful emissions.

Meanwhile, in the broader automotive aftertreatment systems market, the share of commercial vehicle SCR systems is around 7-8%, emphasizing their importance as a core technology for sustainable operations in commercial fleets. Collectively, these parent markets underscore the pivotal role of SCR technology in enabling cleaner, more efficient commercial transportation. With rising regulatory requirements, fleet modernization, and increasing adoption of heavy-duty vehicles worldwide, the commercial vehicle SCR market is expected to expand steadily, strengthening its share across these parent sectors over the coming decade.

| Metric | Value |

|---|---|

| Commercial Vehicle SCR Market Estimated Value in (2025 E) | USD 8.4 billion |

| Commercial Vehicle SCR Market Forecast Value in (2035 F) | USD 14.8 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The commercial vehicle SCR (Selective Catalytic Reduction) market is expanding due to stringent emission regulations, increasing production of heavy-duty vehicles, and the global shift toward cleaner diesel technologies. Governments across Europe, North America, and Asia are enforcing Euro VI, BS-VI, and similar standards, which mandate NOx reduction technologies like SCR in commercial fleets.

Growing freight and logistics operations have also driven SCR demand, especially in long-haul trucks where emission control is critical. OEM integration of SCR systems into new models, along with retrofitting initiatives for older fleets, is contributing to sustained market growth.

Technological advancements such as compact catalysts, lightweight designs, and improved urea dosing systems are improving SCR efficiency and adoption across multiple applications.

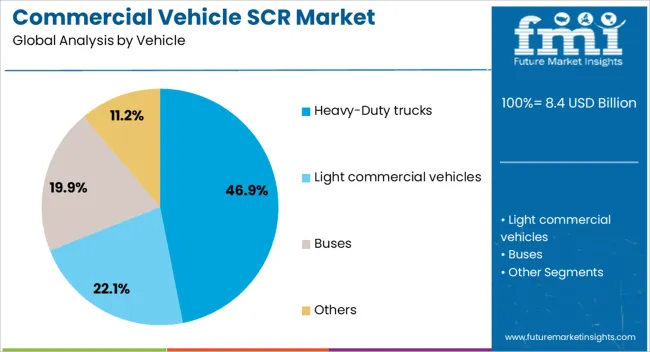

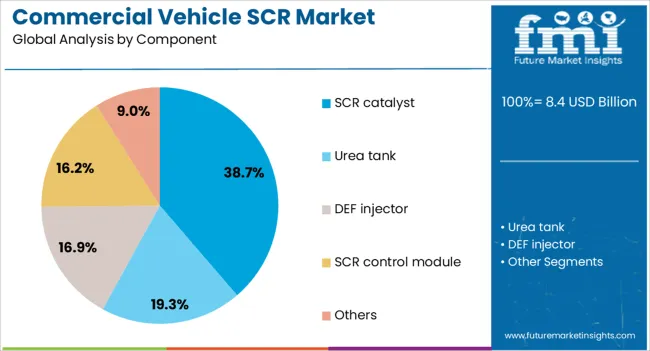

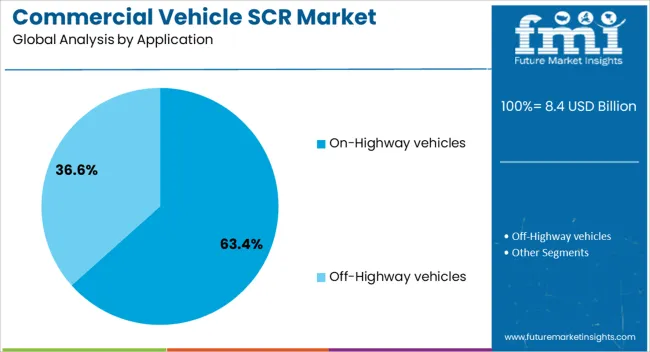

The commercial vehicle SCR market is segmented by vehicle, component, application, sales channel, and geographic regions. By vehicle, the commercial vehicle SCR market is divided into Heavy-Duty trucks, Light commercial vehicles, Buses, and Others. In terms of components, the commercial vehicle SCR market is classified into SCR catalyst, Urea tank, DEF injector, SCR control module, and Others. Based on application, the commercial vehicle SCR market is segmented into On-Highway vehicles and Off-Highway vehicles.

By sales channel, the commercial vehicle SCR market is segmented into OEM and Aftermarket. Regionally, the commercial vehicle SCR industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Heavy-duty trucks are expected to lead the vehicle segment with a 46.90% market share in 2025. This dominance is driven by high-volume emissions from long-distance freight trucks and increasing regulatory pressure to curb nitrogen oxides.

SCR systems are highly effective in heavy-duty applications due to their ability to operate under high temperatures and continuous engine loads. Manufacturers are focusing on integrating durable, efficient SCR units into newer truck models to meet compliance standards and reduce operational penalties.

The expansion of logistics, e-commerce, and industrial transportation is expected to maintain this segment's demand through 2035.

SCR catalysts are projected to capture 38.70% of the market in the component category by 2025, emerging as the largest revenue contributor. These catalysts are the functional core of SCR systems, facilitating the chemical reduction of harmful NOx emissions into nitrogen and water vapor.

Ongoing R&D in catalyst formulations, especially vanadium, zeolite, and copper-based designs, is enhancing efficiency while lowering material costs. The rising need for high-durability catalysts with thermal resistance is pushing their adoption across varied commercial vehicle classes.

Their widespread applicability in both OEM and retrofit markets further strengthens this segment’s leadership.

On-highway vehicles are expected to dominate the application segment with a 63.40% share by 2025. These include long-haul freight trucks, transit buses, and intercity coaches, where emission regulations are strictly enforced and SCR system performance is critical.

The growing adoption of SCR systems for on-road applications stems from better infrastructure, centralized urea refilling networks, and the increased operational time spent in regulatory zones.

Enhanced SCR durability and integration into fleet compliance strategies are making on-highway deployments more economically and technically viable, reinforcing their market share through the forecast period.

The commercial vehicle SCR market is expanding due to stringent emission regulations and demand for cleaner diesel vehicles. Opportunities lie in retrofit and aftermarket solutions, while trends highlight advanced catalysts and integrated emission systems. Challenges include high costs and operational maintenance complexities. Overall, market growth is supported by regulatory compliance needs, technological innovation, and increasing adoption of SCR systems across commercial fleets worldwide.

The commercial vehicle selective catalytic reduction (SCR) market is being driven by increasingly stringent emission standards globally, including Euro 6, Bharat Stage VI, and EPA Tier 4 regulations. Fleet operators and OEMs are adopting SCR technology to reduce nitrogen oxide (NOx) emissions and comply with regulatory mandates. Demand is particularly strong in Europe, North America, and Asia-Pacific, where urban air quality concerns are prompting government interventions. Integration of SCR systems ensures vehicles meet performance, fuel efficiency, and environmental compliance requirements, supporting sustained market growth.

Significant opportunities exist in aftermarket and retrofit SCR systems for existing commercial vehicle fleets. Many operators seek cost-effective solutions to upgrade older diesel vehicles to meet emission norms without full replacement. Retrofit SCR kits are increasingly adopted in trucks, buses, and construction machinery, creating new revenue streams for suppliers. Additionally, the growing trend of hybrid and advanced diesel engines allows manufacturers to offer modular SCR solutions, enhancing compatibility and operational efficiency. Expanding urban delivery networks and logistics sectors further drive potential for retrofit SCR adoption.

A key trend is the development of advanced catalysts and integrated emission control systems. SCR systems are being paired with diesel particulate filters (DPF), exhaust gas recirculation (EGR), and ammonia sensors to enhance NOx reduction efficiency. Innovations include optimized catalyst coatings, lightweight modules, and improved dosing control, which improve system performance and reduce fuel consumption. OEMs are increasingly integrating SCR technology during vehicle design to optimize space, cost, and emission compliance, reflecting the shift toward smarter, more efficient emission control solutions in commercial vehicles.

The commercial vehicle SCR market faces challenges due to high upfront costs and complex maintenance requirements. Installation of SCR systems increases vehicle acquisition costs, and precise operation depends on high-quality diesel exhaust fluid (DEF) availability. Improper maintenance or DEF quality issues can reduce efficiency and cause engine warnings, impacting fleet operations. Supply chain limitations for catalysts and dosing systems in certain regions can also hinder adoption. Manufacturers and fleet operators must address cost management, training, and reliable DEF supply to ensure consistent SCR system performance and compliance.

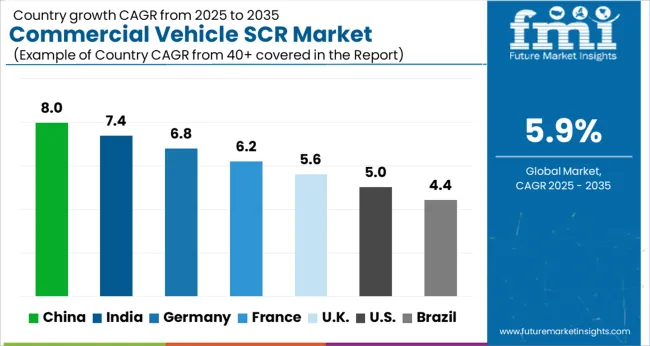

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The global commercial vehicle SCR market is projected to grow at a CAGR of 5.9% from 2025 to 2035. China leads with a growth rate of 8%, followed by India at 7.4% and France at 6.2%. The United Kingdom records a growth rate of 5.6%, while the United States shows the slowest growth at 5%. Expansion is supported by increasing adoption of emission control technologies, stricter regulatory compliance for NOx reduction, and rising commercial vehicle production. Emerging markets like China and India benefit from growing logistics, fleet expansion, and government incentives for cleaner vehicles, while developed markets such as the USA, UK, and France focus on retrofitting existing fleets and integrating advanced SCR systems. This report includes insights on 40+ countries; the top markets are shown here for reference.

The commercial vehicle SCR market in China is growing at 8% CAGR, the highest among leading nations. Growth is driven by strict emission regulations, rising commercial vehicle production, and expansion of freight and logistics sectors. Adoption of SCR systems in trucks, buses, and industrial vehicles is increasing. Manufacturers are introducing efficient, durable, and low-maintenance solutions to meet emission norms and performance requirements. Government incentives promoting cleaner transportation reinforce market growth.

The commercial vehicle SCR market in India is advancing at a 7.4% CAGR, fueled by increasing commercial vehicle production, rising logistics and fleet operations, and stricter emission norms. Adoption of SCR systems is supported in heavy-duty trucks and buses to meet Bharat Stage VI standards. Manufacturers focus on cost-effective, durable, and high-performance SCR solutions tailored for Indian road conditions. Government programs promoting cleaner transportation further enhance market growth.

The commercial vehicle SCR market in France is growing at 6.2% CAGR, supported by stringent Euro VI emission regulations and rising commercial transport demand. Adoption of SCR systems in trucks, buses, and industrial vehicles ensures compliance with NOx emission standards. Retrofit projects for older vehicles and integration of advanced exhaust after-treatment solutions contribute to steady growth. Manufacturers focus on high-efficiency, low-maintenance SCR systems to enhance operational performance.

The commercial vehicle SCR market in the United Kingdom is expanding at 5.6% CAGR, influenced by emission compliance, fleet modernization, and growing logistics operations. Adoption of SCR systems in trucks and buses ensures adherence to Euro VI and local environmental standards. Manufacturers are introducing durable, high-performance solutions for long-haul and urban commercial vehicles. Infrastructure upgrades and government incentives for cleaner vehicles further enhance market growth.

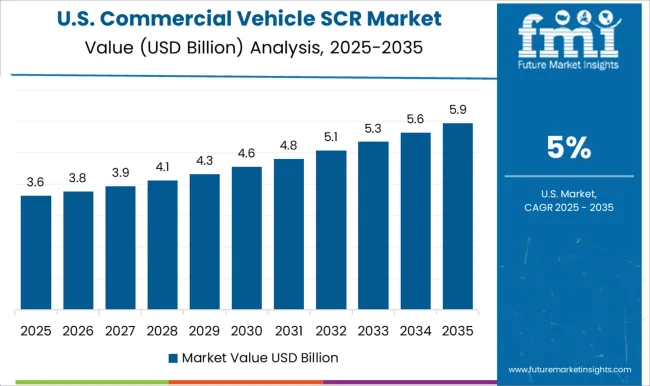

The commercial vehicle SCR market in the United States is growing at 5% CAGR, the slowest among leading nations. Emission regulations, fleet expansion, and adoption of advanced exhaust after-treatment systems support growth. Manufacturers focus on high-performance, low-maintenance SCR solutions for trucks, buses, and industrial vehicles. Retrofit projects for existing fleets, combined with government programs for cleaner transportation, contribute to steady adoption.

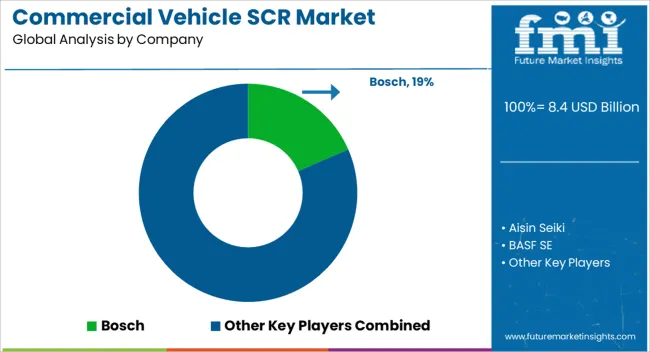

Leading companies in the commercial vehicle SCR market, such as Bosch, BASF SE, and BorgWarner, are competing by offering selective catalytic reduction systems that reduce nitrogen oxide emissions and comply with stringent global regulations. Bosch emphasizes high-efficiency SCR units with durable catalysts and integrated control systems, presenting brochures that highlight reliability, fuel efficiency, and low maintenance.

BASF focuses on catalyst formulations, promoting long-lasting performance and consistency under heavy-duty operating conditions. BorgWarner and Continental market complete SCR modules designed for commercial trucks, emphasizing optimized dosing, compact design, and seamless integration with existing exhaust systems. Other key players, including Cummins, Denso, Magna, Tenneco, and ZF Friedrichshafen, differentiate through advanced emission control technologies, lightweight components, and application-specific designs for trucks, buses, and off-road vehicles.

Cummins highlights modular SCR systems that simplify installation and reduce operational downtime, while Denso emphasizes precision dosing and durability in extreme conditions. Product brochures consistently focus on emission reduction efficiency, regulatory compliance, and system robustness. Market competition is driven by the ability to deliver reliable, high-performance SCR solutions that improve fuel economy, extend component life, and enable manufacturers to meet evolving global emission standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.4 Billion |

| Vehicle | Heavy-Duty trucks, Light commercial vehicles, Buses, and Others |

| Component | SCR catalyst, Urea tank, DEF injector, SCR control module, and Others |

| Application | On-Highway vehicles and Off-Highway vehicles |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, Aisin Seiki, BASF SE, BorgWarner, Continental, Cummins, Denso, Magna, Tenneco, and ZF Friedrichshafen |

| Additional Attributes | Dollar sales by system type (selective catalytic reduction kits, integrated SCR systems) and vehicle type (light, medium, heavy-duty) are key metrics. Trends include rising demand for emissions-compliant solutions, adoption in commercial fleets, and integration with advanced engine technologies. Regional adoption, regulatory standards, and technological advancements are driving market growth. |

The global commercial vehicle SCR market is estimated to be valued at USD 8.4 billion in 2025.

The market size for the commercial vehicle SCR market is projected to reach USD 14.8 billion by 2035.

The commercial vehicle SCR market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in commercial vehicle SCR market are heavy-duty trucks, light commercial vehicles, buses and others.

In terms of component, SCR catalyst segment to command 38.7% share in the commercial vehicle SCR market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

Commercial Food Refrigeration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Commercial Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA