The commercial vehicle telematics market is estimated to be valued at USD 27.4 billion in 2025 and is projected to reach USD 92.3 billion by 2035, registering a compound annual growth rate (CAGR) of 12.9% over the forecast period. This rapid expansion can be attributed to several key factors, including the rising need for operational efficiency, fuel optimization, and regulatory compliance in commercial fleets. Telematics solutions, which integrate GPS tracking, vehicle diagnostics, and real-time data analytics, are becoming critical for fleet operators seeking to reduce costs and enhance safety.

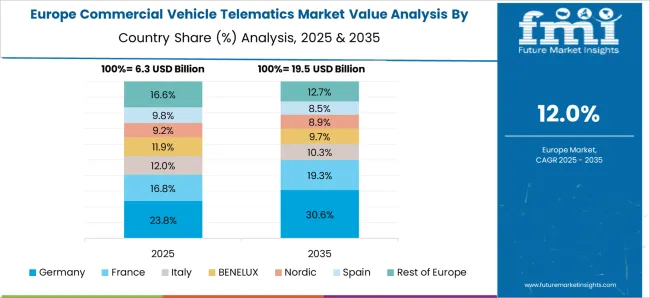

Moreover, the growth is fueled by the increasing trend of connected vehicles and the adoption of Internet of Things (IoT) technologies, enabling predictive maintenance, route optimization, and driver behavior monitoring. Geographically, North America and Europe currently dominate the market due to stringent safety regulations and high penetration of telematics, while the Asia-Pacific region is expected to exhibit rapid growth owing to expanding logistics sectors and urbanization.

| Metric | Value |

|---|---|

| Commercial Vehicle Telematics Market Estimated Value in (2025 E) | USD 27.4 billion |

| Commercial Vehicle Telematics Market Forecast Value in (2035 F) | USD 92.3 billion |

| Forecast CAGR (2025 to 2035) | 12.9% |

The current market landscape is being shaped by advancements in real-time data analytics, cloud-based telematics platforms, and the integration of AI for predictive maintenance and route optimization. With the rapid digital transformation across transportation systems, businesses are increasingly leveraging telematics to reduce fuel costs, monitor driver behavior, and enhance vehicle utilization. Future growth is expected to be further supported by expanding deployment across small and medium commercial fleets and the evolution of intelligent transportation infrastructure.

As operational transparency becomes a competitive necessity and government policies continue to support smart mobility initiatives, the demand for scalable and customizable telematics solutions is projected to strengthen significantly across global commercial vehicle markets.

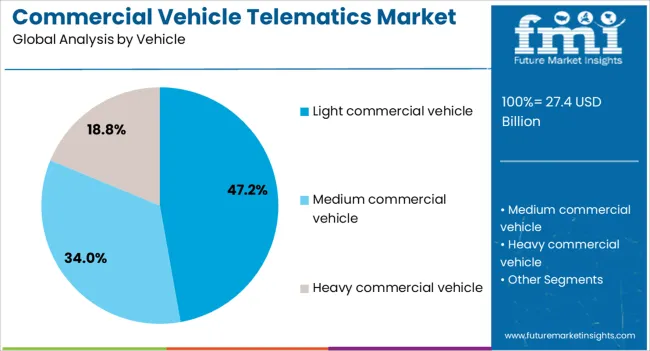

The commercial vehicle telematics market is segmented by offering, vehicle, end use, sales channel, and geographic regions. By offering, the commercial vehicle telematics market is divided into solutions. In terms of vehicles, the commercial vehicle telematics market is classified into Light commercial vehicles, Medium commercial vehicles, and Heavy commercial vehicles.

Based on end use, the commercial vehicle telematics market is segmented into Transportation & logistics, Government & utilities, Travel & tourism, Construction, and Others. By sales channel, the commercial vehicle telematics market is segmented into OEM and Aftermarket. Regionally, the commercial vehicle telematics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solution segment is anticipated to hold 64.8% of the Commercial Vehicle Telematics market revenue in 2025, establishing it as the most dominant offering category. This leading share is being attributed to the increasing reliance on software platforms that deliver real-time vehicle monitoring, advanced analytics, route optimization, and predictive diagnostics.

Fleet operators are prioritizing solutions that provide actionable insights to improve safety, reduce operating costs, and ensure compliance with local and international regulations. As the industry shifts from hardware-driven models to cloud-based, subscription-enabled platforms, telematics solutions have gained traction for their flexibility, scalability, and integration capabilities.

The rapid expansion of SaaS-based telematics platforms has made implementation more cost-effective and accessible, particularly for small to mid-size fleet operators. With businesses focusing on digitalization of fleet operations, the solution segment is expected to retain its market leadership by delivering continuous value through software enhancements and analytics-driven performance improvements.

The light commercial vehicle segment is projected to account for 47.2% of the overall Commercial Vehicle Telematics market revenue in 2025, making it the most significant vehicle category. This growth is being supported by the rising deployment of telematics systems in last-mile delivery, service vehicles, and small fleet operations where light commercial vehicles dominate.

As e-commerce and on-demand services expand globally, fleet owners are increasingly investing in telematics to improve delivery efficiency, optimize routes, and reduce idle times. Light commercial vehicles offer a higher return on investment for telematics integration due to their frequent usage and operational variability.

Additionally, growing regulatory emphasis on vehicle tracking, emissions control, and driver behavior monitoring has accelerated adoption in this category. The scalability of telematics in light commercial fleets, along with the need for competitive operational performance, continues to drive the segment’s dominance within the market.

The transportation and logistics segment is expected to capture 38.5% of the Commercial Vehicle Telematics market revenue in 2025, positioning it as the leading end-use industry. This segment’s growth is being fueled by the critical need for real-time fleet visibility, delivery tracking, and route optimization in a sector characterized by tight schedules and high operational volumes.

Companies within transportation and logistics are prioritizing telematics adoption to enhance productivity, reduce delivery times, and ensure compliance with safety and environmental standards. The demand for end-to-end supply chain transparency has intensified the integration of telematics into fleet management systems, supporting key functions such as load tracking, geofencing, fuel monitoring, and automated reporting.

As global trade volumes increase and logistics operations become more complex, the industry’s reliance on intelligent vehicle data is expected to deepen. Continued investment in digitizing supply chains and optimizing vehicle uptime is reinforcing the dominance of transportation and logistics as the primary consumer of telematics technologies.

The commercial vehicle telematics market is driven by the need for operational efficiency and fleet management. Regional growth in key markets and the adoption of EVs and AI-powered optimization solutions offer significant opportunities.

The demand for commercial vehicle telematics is primarily driven by the need for improved fleet management and operational efficiency. These systems enable real-time tracking, route optimization, fuel monitoring, and driver performance analysis, which directly contribute to cost reduction. The increasing emphasis on regulatory compliance and safety standards also drives the adoption of telematics solutions. Fleet operators are keen to monitor vehicle health, reduce maintenance costs, and improve uptime. As logistics and transportation networks expand globally, the importance of telematics in optimizing operations across various industries is set to grow, reinforcing its role in supply chain management.

The initial high investment costs remain a significant barrier for small to medium-sized fleet operators, limiting the widespread adoption of telematics systems. While the long-term savings can be substantial, the upfront costs of hardware, software, and installation may deter some businesses from adopting these technologies. Concerns about data security, privacy, and the complexity of integrating telematics with existing fleet management software can hinder adoption. For legacy systems, the integration process often involves substantial costs and time. The need for proper training and understanding of the system also poses a challenge to operators.

Commercial vehicle telematics systems are increasingly being integrated with electric vehicles (EVs) in commercial fleets. This shift presents new opportunities for telematics providers to develop solutions that support the unique needs of electric fleets, such as monitoring battery life and optimizing charging schedules. The push for fleet optimization through data-driven insights presents growth potential. By combining telematics with AI-powered analytics, operators can better predict maintenance needs, reduce idle time, and optimize fuel consumption. As fleet electrification and automation continue to rise, telematics will play a crucial role in driving efficiency and improving environmental outcomes in commercial transportation.

The commercial vehicle telematics market shows significant regional growth, particularly in North America, Europe, and parts of Asia-Pacific. North America continues to dominate, supported by advanced infrastructure and high fleet adoption. In Europe, the demand is driven by stringent regulatory standards and a growing focus on reducing carbon footprints. Asia-Pacific is emerging as a key market, fueled by rapid growth in logistics and transportation sectors in countries like China and India. As the demand for commercial telematics solutions expands globally, regional strategies tailored to specific regulatory environments, technological infrastructure, and market needs will shape the industry's growth trajectory.

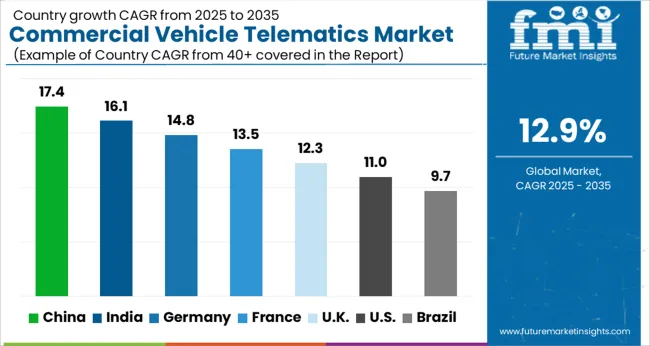

The commercial vehicle telematics market is projected to grow globally at a CAGR of 12.9% between 2025 and 2035, supported by the growing demand for fleet management solutions, improved vehicle tracking, and real-time data analytics. China leads with a CAGR of 17.4%, driven by the rapid expansion of its logistics and transportation sectors, along with large-scale fleet operations. India follows with a CAGR of 16.1%, fueled by the surge in e-commerce, expansion of commercial fleets, and the integration of telematics solutions in logistics. France records 13.5%, supported by the adoption of telematics in both commercial vehicle fleets and public transport systems. The United Kingdom stands at 12.3%, driven by an emphasis on vehicle safety, route optimization, and the need for efficient fleet operations. The United States records 11.0%, with growth driven by demand for real-time vehicle diagnostics, fleet management, and regulatory compliance. The analysis spans over 40 countries, with these five serving as benchmarks for investment priorities, market penetration strategies, and technology integration in the global commercial vehicle telematics market.

The UK commercial vehicle telematics market is projected to achieve a CAGR of 12.3% during 2025–2035, above the global benchmark of 12.9%, supported by increased demand for fleet optimization and vehicle tracking solutions. During 2020–2024, the CAGR was around 9.8%, driven by the growing adoption of fleet management systems in logistics, transportation, and public sectors. The acceleration in the coming decade is due to the rise of real-time monitoring, compliance with regulations, and adoption of predictive maintenance solutions. Factors such as government policies promoting connected vehicle adoption, a stronger logistics sector, and advancements in data analytics are expected to fuel growth.

China is expected to post a CAGR of 17.4% during 2025–2035, surpassing the global benchmark of 12.9%, due to rapid growth in logistics, transportation, and smart city projects. During 2020–2024, the CAGR was around 14.0%, driven by the rapid adoption of telematics in large-scale logistics and public transportation sectors. The higher growth in the next decade will be fueled by the expansion of e-commerce, increased logistics fleet sizes, and government-backed initiatives supporting smart transportation infrastructure. The focus on improving supply chain efficiency and optimizing fleet operations will drive demand for telematics solutions.

India is projected to achieve a CAGR of 16.1% during 2025–2035, surpassing the global growth rate of 12.9%, driven by expanding commercial fleet sizes, e-commerce growth, and government focus on improving logistics infrastructure. The CAGR between 2020–2024 was around 13.2%, as the government implemented initiatives to modernize transportation, improve road safety, and introduce regulations for fleet monitoring systems. The increase in growth from 2020 to 2024 to the next decade will be driven by greater adoption of telematics systems in small and medium-sized fleets, as well as increased integration with AI-powered analytics for predictive maintenance and route optimization.

The commercial vehicle telematics market in France is projected to grow at a CAGR of 13.5% during 2025–2035, surpassing the global average of 12.9%. The growth during 2020–2024 was around 11.6%, driven by the need for fleet management solutions in public transport, logistics, and utilities sectors. In the coming decade, the growth will be driven by the adoption of telematics to improve fleet efficiency, reduce fuel consumption, and comply with government regulations. Additionally, increased interest in electric vehicles (EVs) for public transportation and logistics fleets will spur the need for telematics systems to monitor battery health and optimize charging schedules.

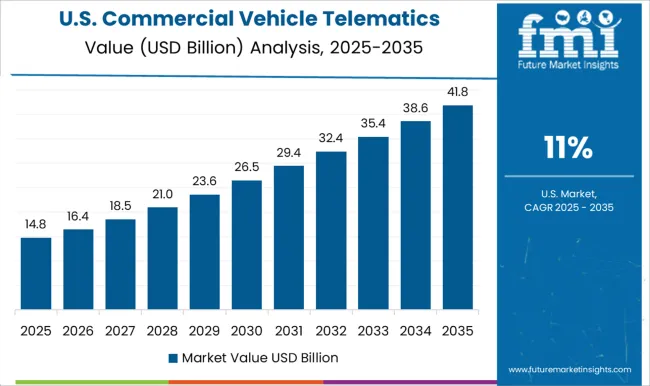

The United States is expected to grow at a CAGR of 11.0% for 2025–2035, below the global growth rate of 12.9%, driven by the continued expansion of commercial fleets and logistics networks. During 2020–2024, the CAGR was around 9.2%, supported by the adoption of telematics for vehicle diagnostics, route optimization, and driver behavior monitoring. The market's growth in the coming decade will be fueled by an increased focus on real-time fleet management, stricter environmental regulations, and growing demand for data analytics-driven fleet optimization solutions. Advances in autonomous vehicles and smart transportation will also contribute to growth.

Verizon, a major player in the IoT and telematics space, offers a wide range of solutions for fleet management, emphasizing connectivity and data insights for improving fleet efficiency. Bosch and Continental, both leaders in automotive technology, leverage their expertise in sensors, connected systems, and diagnostics to provide telematics solutions tailored for commercial vehicles.

Geotab and Omnitracs are known for their specialized fleet management platforms, providing real-time monitoring, vehicle health tracking, and predictive maintenance services. Qualcomm and Samsara focus on integrating cloud-based solutions with telematics hardware to enhance fleet operations, providing real-time route optimization and driver safety analytics. Teletrac and TomTom, with their emphasis on GPS tracking and fleet management software, continue to evolve their platforms for improving logistics and operational costs.

Trimble focuses on offering solutions for both field services and logistics operations, offering strong integration with data analytics for fleet optimization. Competitive strategies in this market revolve around improving data accuracy, integration with autonomous vehicle technologies, and expanding into emerging markets, with strategic partnerships and global network expansion as key drivers for growth.

| Item | Value |

|---|---|

| Quantitative Units | USD 27.4 Billion |

| Offering | Solution |

| Vehicle | Light commercial vehicle, Medium commercial vehicle, and Heavy commercial vehicle |

| End Use | Transportation & logistics, Government & utilities, Travel & tourism, Construction, and Others |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Verizon, Bosch, Continental, Geotab, Omnitracs, Qualcomm, Samsara, Teletrac, TomTom, and Trimble |

| Additional Attributes | Dollar sales, market share by region and product type, growth trends, customer adoption rates, competitive landscape, and emerging technologies. |

The global commercial vehicle telematics market is estimated to be valued at USD 27.4 billion in 2025.

The market size for the commercial vehicle telematics market is projected to reach USD 92.3 billion by 2035.

The commercial vehicle telematics market is expected to grow at a 12.9% CAGR between 2025 and 2035.

The key product types in commercial vehicle telematics market are solution, _fleet tracking and monitoring, _driver management, _safety and compliance, _insurance telematics and _others.

In terms of vehicle, light commercial vehicle segment to command 47.2% share in the commercial vehicle telematics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

Commercial Food Refrigeration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Commercial Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA