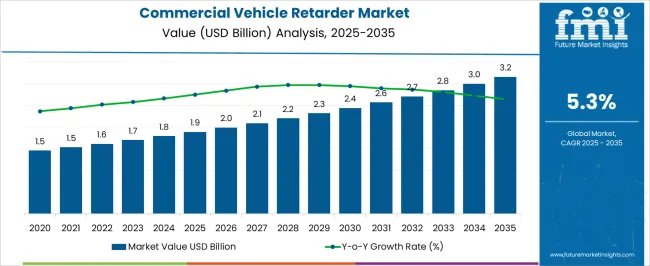

The commercial vehicle retarder market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

Growth in the first half of the forecast is expected to be fueled by the rising demand for advanced braking systems that enhance safety and performance in heavy-duty trucks, buses, and long-haul transport fleets. Retarders are increasingly being integrated into vehicles to reduce wear on traditional braking systems, lower maintenance costs, and ensure smoother operation under demanding driving conditions. This segment is gaining traction as transport operators focus on reliability and efficiency. From 2030 to 2035, the market is expected to add substantial value, reaching USD 3.2 billion and further reinforcing the role of retarders in commercial transport safety. Expansion will be supported by stricter regulatory standards on vehicle safety, growing adoption of long-haul logistics, and the need for better downhill braking control in heavy commercial fleets.

The absolute sales opportunity reflects the continued replacement of conventional braking reliance with retarder systems, particularly in regions with challenging terrain and extensive freight transport operations. Manufacturers are positioned to benefit by offering durable, efficient, and low-maintenance solutions, catering to both OEM installations and aftermarket demand. This steady trajectory demonstrates that commercial vehicle retarders are not just complementary systems but are becoming critical components in shaping the performance standards of the modern heavy transport sector.

| Metric | Value |

|---|---|

| Commercial Vehicle Retarder Market Estimated Value in (2025 E) | USD 1.9 billion |

| Commercial Vehicle Retarder Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The commercial vehicle retarder market represents a critical safety and efficiency component within several wider automotive and transportation domains, with its share reflecting its specialized but indispensable role. Within the commercial vehicle components market, retarders account for about 6%, as they form part of the broader system of drivetrain and safety-related components. In the heavy-duty vehicle braking systems market, their contribution is higher at nearly 15%, since retarders are directly tied to auxiliary braking and play a vital role in enhancing control on slopes and long hauls. Within the automotive safety systems market, the share of retarders is around 5%, as they supplement conventional braking and stability technologies but remain more niche compared to airbags or ABS. In the commercial vehicle aftermarket parts market, retarders contribute close to 7%, driven by replacement demand, retrofitting, and long service lifecycles in heavy fleets.

Finally, in the freight and logistics vehicle equipment market, retarders represent about 4%, reflecting their adoption in long-haul trucks and buses that prioritize load safety and operational efficiency. Collectively, these percentages illustrate that while retarders are a relatively small segment in broader automotive and logistics markets, they carry higher significance in braking-specific domains. Their stronger presence in heavy-duty braking highlights their indispensable role in safety and performance, while their modest but steady contributions in aftermarket and logistics equipment show their importance in maintaining fleet reliability and regulatory compliance.

The commercial vehicle retarder market is gaining momentum due to rising demand for heavy-duty vehicle safety systems, stringent regulations on brake wear, and growing logistics volumes across long-haul freight networks. Retarders are increasingly being adopted to reduce braking system strain, especially in hilly or high-load operations.

Enhanced vehicle longevity, improved braking efficiency, and lower maintenance costs are key drivers fostering adoption across fleet operators. The integration of retarders into OEM vehicle design, particularly in trucks and medium-to-heavy commercial vehicles, is expected to boost market penetration.

Regional infrastructure expansion, especially in Asia-Pacific and Europe, along with growing adoption of electrified and automated drivetrains, is reinforcing the relevance of advanced auxiliary braking systems.

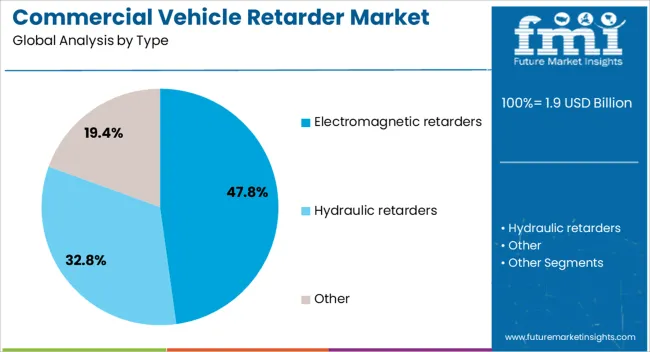

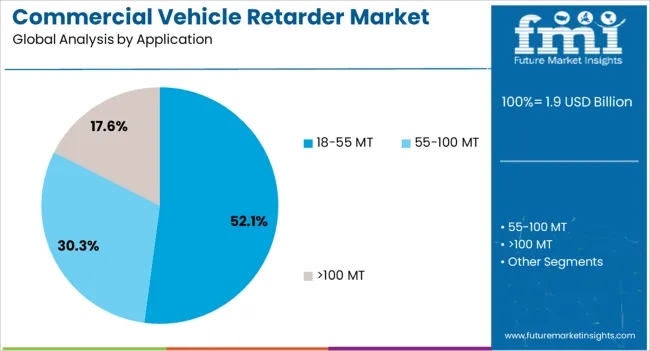

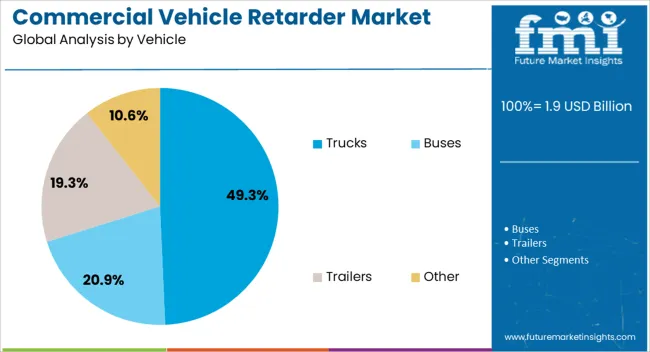

The commercial vehicle retarder market is segmented by type, application, vehicle, and geographic regions. By type, commercial vehicle retarder market is divided into electromagnetic retarders, hydraulic retarders, and others. In terms of application, commercial vehicle retarder market is classified into 18-55 MT, 55-100 MT, and >100 MT. Based on vehicle, commercial vehicle retarder market is segmented into trucks, buses, trailers, and others. Regionally, the commercial vehicle retarder industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Electromagnetic retarders are anticipated to lead with a 47.80% share of the total market in 2025, owing to their superior performance in controlling vehicle speed without relying on the primary brake system. Their contactless operation enables lower maintenance, quieter functionality, and enhanced reliability under extreme load and downhill conditions. These retarders are especially preferred in intercity transport, logistics, and bus segments due to their ability to maintain consistent deceleration. The push toward vehicle electrification and automation further aligns with electromagnetic systems that integrate seamlessly with digital control units, paving the way for wider adoption in the next-generation vehicle architecture.

The 18–55 MT segment is expected to dominate the application landscape with 52.10% share in 2025. Vehicles in this weight range are widely used in industrial and construction transportation, where frequent braking under load conditions causes wear and overheating in conventional systems. Retarders serve as a reliable solution to reduce thermal stress and mechanical degradation. With increasing emphasis on operational efficiency and safety compliance, fleet operators are investing in vehicles with integrated retarders for medium and heavy cargo capacity. Government mandates for load safety and growing private logistics demand are likely to sustain segmental growth.

Trucks are projected to contribute the largest share of 49.30% in the commercial vehicle retarder market by 2025. This leadership stems from the segment’s dominance in freight transport, both regionally and globally. Long-haul trucks frequently traverse steep gradients and require consistent auxiliary braking to protect cargo and reduce driver fatigue. OEM integration of retarders in new truck models, especially in Europe and China, is significantly improving system standardization. Moreover, the transition toward high-performance logistics fleets and safety-focused vehicle design is making retarders a strategic addition to modern trucking solutions.

The commercial vehicle retarder market is expanding as demand for advanced braking solutions grows across freight, passenger, and mining fleets. Opportunities are strengthening in long-haul and construction vehicles, while trends emphasize integration with transmissions, electronic control systems, and lightweight designs. Challenges remain in high upfront costs, limited awareness, and maintenance complexities. In my opinion, manufacturers that deliver affordable, application-specific, and easy-to-maintain retarders will hold a competitive edge, ensuring long-term adoption as safety and operational efficiency remain priorities in global commercial transport industries.

Demand for commercial vehicle retarders has been reinforced by the growing emphasis on road safety and extended braking performance in heavy-duty trucks, buses, and coaches. These systems reduce wear on traditional brakes, improve downhill control, and enhance safety in long-haul operations. Fleet operators are increasingly adopting retarders to minimize maintenance costs and downtime while meeting regulatory safety requirements. In my opinion, demand will continue to rise as logistics, passenger transport, and mining fleets prioritize reliable braking solutions that combine safety, cost-efficiency, and operational reliability.

Opportunities are evident in long-haul transportation, mining, and construction sectors where vehicles frequently operate in challenging terrains and carry heavy loads. Retarders are being integrated to ensure stability and reduce accident risks in such high-demand conditions. The aftermarket sector also offers opportunities as operators retrofit existing fleets to improve performance. I believe manufacturers offering tailored retarder systems for specific applications, supported by maintenance packages, will capture significant opportunities, particularly as global freight transport and resource extraction industries expand and require durable braking technologies.

Trends highlight the integration of retarders with automatic transmissions and electronic control systems, enhancing efficiency and driving comfort. Hydraulic, electric, and electromagnetic retarders are being optimized for different vehicle classes, expanding their application scope. Another trend is the focus on compact, lightweight designs to improve fuel efficiency. In my opinion, these developments mark a transition toward highly integrated drivetrains where retarders serve not only as safety components but also as contributors to performance optimization and vehicle lifecycle cost reduction in commercial fleets.

Challenges for the commercial vehicle retarder market include high upfront costs and limited awareness among smaller fleet operators. The expense of installation and integration often deters adoption in cost-sensitive markets, despite long-term benefits. Maintenance complexity and the need for skilled technicians also restrict widespread usage. Competition from traditional braking systems, perceived as sufficient by some operators, further slows penetration. In my assessment, success will depend on educating operators about lifecycle savings and safety benefits while offering cost-efficient solutions that lower the entry barrier for diverse fleet owners.

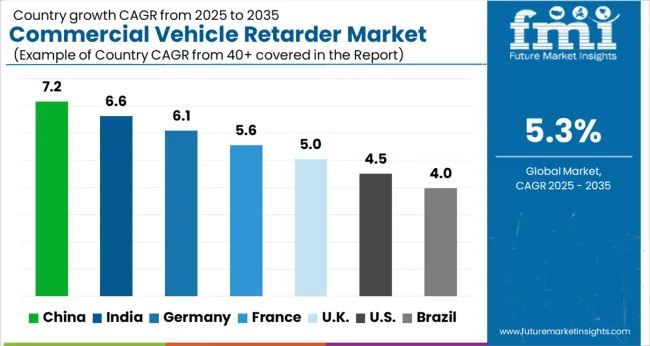

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The global commercial vehicle retarder market is projected to grow at a CAGR of 5.3% from 2025 to 2035. China leads with a growth rate of 7.2%, followed by India at 6.6%, and Germany at 6.1%. The United Kingdom records a growth rate of 5%, while the United States shows the slowest growth at 4.5%. Rising commercial fleet sizes, stricter road safety regulations, and the adoption of advanced braking systems are driving expansion. Emerging economies such as China and India are experiencing faster growth due to rapid infrastructure development and high demand for heavy-duty trucks and buses, while mature regions like Germany, the UK, and the USA emphasize safety compliance, technological innovation, and aftermarket servicing. This report includes insights on 40+ countries; the top markets are shown here for reference.

The commercial vehicle retarder market in China is projected to grow at a CAGR of 7.2%. Rising logistics activity, increasing demand for long-haul trucking, and stringent road safety regulations are accelerating adoption. The expansion of urban transportation systems and investments in electric and hybrid buses are also boosting demand for retarders. Domestic manufacturers are enhancing their technological capabilities to offer cost-effective solutions, while global suppliers are forming partnerships to capture market share. Government-backed initiatives promoting advanced braking and safety systems further strengthen the market outlook.

The commercial vehicle retarder market in India is expected to grow at a CAGR of 6.6%. Increasing demand for passenger buses, commercial trucks, and freight vehicles is driving adoption of retarders. Rapid expansion of national highways and logistics networks is supporting greater need for advanced braking systems. Safety awareness campaigns and government regulations on vehicle safety are encouraging OEMs and fleet operators to integrate retarders into their vehicles. The rise of heavy-load transport across industrial corridors is also contributing to consistent demand for auxiliary braking solutions.

The commercial vehicle retarder market in Germany is projected to grow at a CAGR of 6.1%. Germany’s strong automotive manufacturing base and emphasis on road safety regulations are key growth drivers. Heavy trucks and buses in Germany are increasingly adopting retarders for improved braking efficiency and vehicle longevity. The country’s focus on emission reduction and adoption of hybrid and electric vehicles are also shaping demand for advanced braking systems. Germany remains a leading hub for innovation in automotive components, with global manufacturers actively investing in retarder technology.

The commercial vehicle retarder market in the UK is projected to grow at a CAGR of 5%. Growth is supported by regulatory emphasis on road safety and the adoption of advanced vehicle technologies. The UK’s logistics and public transport sectors are integrating retarders into fleets to enhance braking safety and efficiency. The increasing number of electric buses and trucks is creating opportunities for suppliers to provide compatible braking solutions. Market demand is also shaped by the UK’s strong aftermarket service networks, ensuring reliable adoption across vehicle fleets.

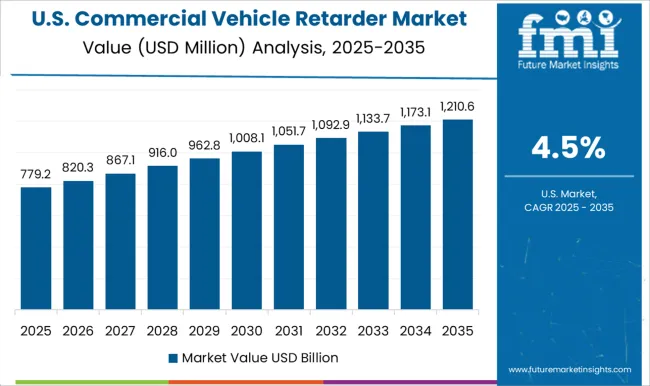

The commercial vehicle retarder market in the USA is projected to grow at a CAGR of 4.5%. While slower compared to Asia, steady demand is driven by a large fleet of heavy-duty trucks and long-haul freight vehicles. Adoption is supported by regulations promoting vehicle safety and the need for reliable auxiliary braking systems to reduce wear on primary brakes. The USA aftermarket for retarders remains significant, with fleet operators investing in upgrades and replacements. Technological innovation, particularly integration with smart braking and telematics systems, is shaping long-term market adoption.

Competition in the commercial vehicle retarder segment is marked by engineering depth, global partnerships, and application diversity across heavy trucks, buses, and long-haul fleets. Telma and Voith are widely recognized for electromagnetic and hydrodynamic solutions, while ZF Friedrichshafen builds integration with its transmission portfolio. Cummins leverages engine-braking expertise to expand into auxiliary braking systems, and Frenelsa and Klam focus on specialized aftermarket and OEM segments. Asian players such as Brakes India, Shaanxi Fast, SORL, and TBK drive scale advantages in regional fleets, while Nippon Steel extends its material science strength into components that promise durability and heat management.

Strategies have centered on efficiency, safety, and compliance with emission-linked regulations. Players emphasize extended brake life, reduced maintenance cycles, and compatibility with electrified drivetrains. Voith and ZF push software-linked retarders with predictive load management, while Telma and Frenelsa highlight energy efficiency and reduced wear. Cost competitiveness from Asian suppliers challenges European incumbents, leading to localized assembly and service programs. Partnerships with bus manufacturers, fleet operators, and OEMs form a core approach, ensuring integration at production lines while reinforcing aftermarket networks. Product brochures typically highlight torque capacity, thermal stability, lightweight construction, and noise reduction. Visuals focus on cutaway diagrams of braking assemblies, side-by-side comparisons with conventional braking wear, and lifecycle cost savings.

Specifications are presented with emphasis on response speed, load adaptability, and integration with electronic stability programs. By stressing durability, safety reassurance, and operational economy, brochures are designed to capture both fleet operators prioritizing long-term reliability and OEMs seeking seamless driveline compatibility. This mix of technical precision and performance assurance positions retarders as critical components in heavy-duty transport efficiency narratives.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 billion |

| Type | Electromagnetic retarders, Hydraulic retarders, and Other |

| Application | 18-55 MT, 55-100 MT, and >100 MT |

| Vehicle | Trucks, Buses, Trailers, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Telma, Brakes India, CAMA, Cummins, Frenelsa, Klam, Nippon Steel, Shaanxi Fast, SORL, TBK, Voith, and ZF Friedrichshafen |

| Additional Attributes | Dollar sales by product type (hydraulic, electric, electromagnetic), Dollar sales by application (buses, trucks, coaches), Trends in vehicle safety regulations and long-haul transport demand, Use in braking efficiency and downhill control, Growth of electric driveline integration, Regional adoption differences across Europe, Asia-Pacific, and North America. |

The global commercial vehicle retarder market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the commercial vehicle retarder market is projected to reach USD 3.2 billion by 2035.

The commercial vehicle retarder market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in commercial vehicle retarder market are electromagnetic retarders, hydraulic retarders and other.

In terms of application, 18-55 mt segment to command 52.1% share in the commercial vehicle retarder market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

Commercial Food Refrigeration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Commercial Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA