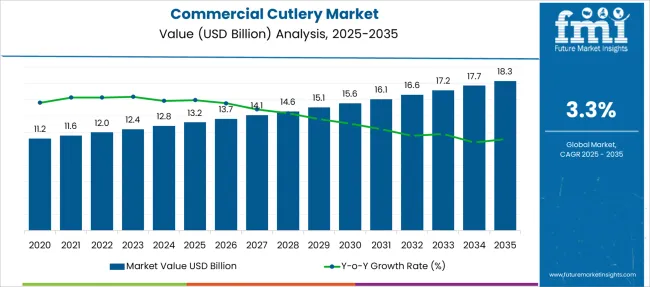

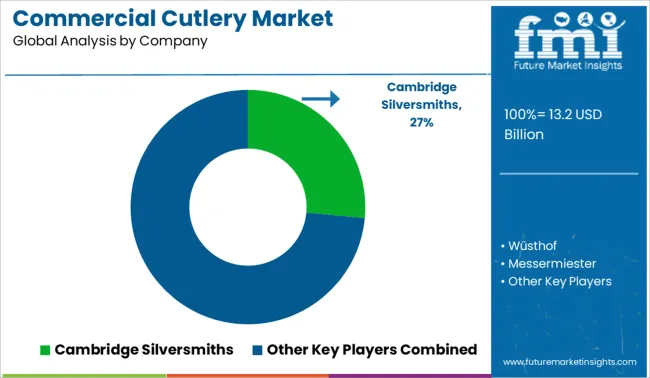

The Commercial Cutlery Market is estimated to be valued at USD 13.2 billion in 2025 and is projected to reach USD 18.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Cutlery Market Estimated Value in (2025 E) | USD 13.2 billion |

| Commercial Cutlery Market Forecast Value in (2035 F) | USD 18.3 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The commercial cutlery market is advancing steadily due to the rising global demand for premium dining experiences and the emphasis on durability, hygiene, and aesthetic appeal in food service environments. Increasing investments in hospitality infrastructure and the proliferation of fine dining establishments are driving demand for long lasting and visually refined cutlery.

Material innovations focusing on corrosion resistance, weight balance, and ergonomic design are further enhancing product appeal among commercial users. Environmental considerations and brand positioning are encouraging restaurants to adopt cutlery that aligns with sustainability and long term value.

As the hospitality sector rebounds with stronger footfall and curated dining experiences, the market for high performance commercial cutlery is expected to witness consistent growth across hotels, restaurants, and catering services.

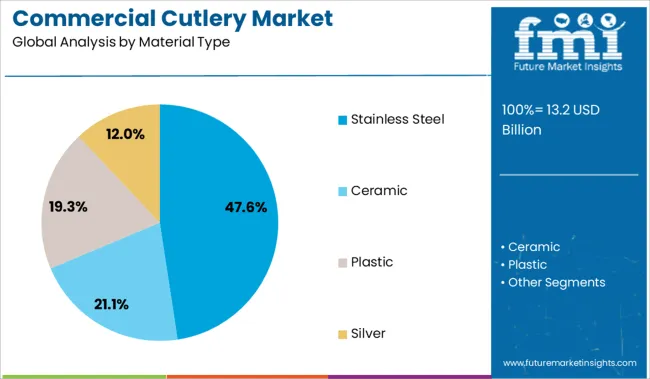

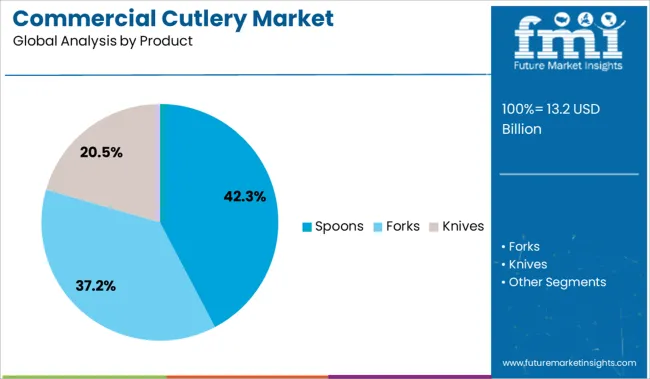

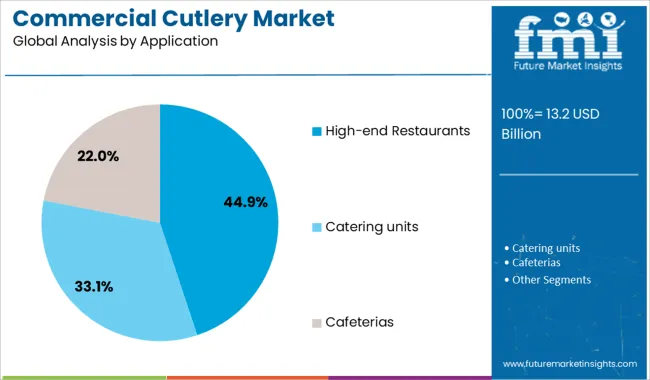

The market is segmented by Material Type, Product, and Application and region. By Material Type, the market is divided into Stainless Steel, Ceramic, Plastic, and Silver. In terms of Product, the market is classified into Spoons, Forks, and Knives. Based on Application, the market is segmented into High-end Restaurants, Catering units, and Cafeterias. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stainless steel segment is anticipated to represent 47.60% of total market revenue by 2025 within the material type category, making it the leading segment. This growth is supported by the material’s exceptional resistance to rust, ease of maintenance, and suitability for repeated commercial use.

Stainless steel offers a favorable balance of strength and presentation, making it a preferred choice for both functionality and aesthetics. Its compatibility with dishwashers and high temperature sterilization processes ensures compliance with hygiene standards.

Additionally, the availability of various finishes and grades supports customization for different levels of service environments. These advantages have established stainless steel as the dominant material in the commercial cutlery sector.

The spoons segment is projected to account for 42.30% of the market revenue by 2025 within the product category, emerging as the most utilized item. This dominance is driven by its high frequency of use across meal types and courses in commercial food service operations.

Spoons are essential in diverse cuisines and service formats including fine dining, quick service, and institutional catering. Their functionality spans both consumption and service roles, which reinforces consistent demand.

With increasing preference for curated table settings and coordinated flatware, spoons in stainless steel designs are seeing greater demand for both utility and presentation purposes. These combined factors sustain the leadership of the spoons segment within the commercial cutlery market.

The high end restaurants segment is expected to capture 44.90% of total market revenue by 2025 under the application category, positioning it as the most significant user segment. This growth is being fueled by the premiumization of dining experiences, where table aesthetics and material quality are integral to brand identity and guest satisfaction.

High end establishments prioritize cutlery that complements curated menus and refined tableware, placing emphasis on design consistency and visual appeal. Additionally, durable materials like stainless steel align with the operational needs of upscale restaurants that require both performance and style.

The demand for custom engraved or branded cutlery is also higher in this segment, reflecting the need for differentiation and exclusivity. These factors collectively reinforce the dominance of high end restaurants in the commercial cutlery market.

To meet consumer demand and boost sales, manufacturing companies are anticipated to attempt to build up their operations as omnichannel businesses. The sales of commercial cutlery are likely to increase with a rise in the hospitality business, as it is a significant user of commercial cutlery, therefore the industry's rebound is anticipated to fuel growth.

Due to the increased penetration of fast-food restaurant brands like Subway, Taco Bell, Pizza Hut, and Domino's, the commercial cutlery market size is anticipated to increase. Fast food has become more popular in modern times since it is prepared, accessible, and delicious. The National Center for Health Statistics reports that youth are more likely to eat fast food, with 36.6% of the population doing so on any given day.

| Attribute | Details |

|---|---|

| Commercial Cutlery Market Value (2025) | USD 12.4 billion |

| Commercial Cutlery Market Forecast Value (2035) | USD 17.1 billion |

| Commercial Cutlery Market CAGR (2025 to 2035) | 3.3% |

| USA Commercial Cutlery Market Share (2025) | 68.0% |

The stainless steel category is anticipated to exhibit the greatest CAGR of 5.7% from 2025 to 2035. Stainless steel is the most prevalent material used to make commercial cutlery. Knives made of stainless steel are long-lasting, simple to maintain, and corrosion-resistant.

They are a fantastic choice for chefs who are conscious of their budget as they are also reasonably priced. It is simple to disinfect stainless steel. In an environment where food is prepared, hygiene is crucial, thus stainless steel also held a considerable share in the global commercial cutlery market.

The spoon product category had the most revenue in 2025 and is anticipated to hold its position as the industry leader for the duration of the market projection. This is attributable to rising health concerns in nations like China and India as well as rising demand for flavored spoons. Additionally, it is anticipated that a rise in flours devoid of artificial chemicals would boost demand for cutlery in the United States.

However, the Fork category is anticipated to see the largest CAGR growth throughout the projection period due to improved design, form, and flavor along with a rise in customer desire for goods created with natural ingredients in nations like Canada.

The adoption of commercial cutlery in upscale restaurants is expanding along with the food service sector. Using commercial cutlery has several benefits, including the following:

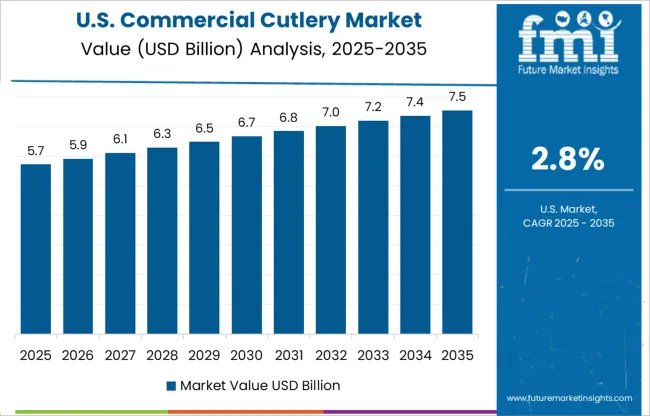

In 2025, the USA commercial cutlery market is estimated to account for a 68% share, with a value of USD 3.2 billion. The commercial cutlery business in the United States is developing quickly. This is caused by several things, one of which is the rising popularity of cooking competition shows.

A growing portion of the Indian population has been migrating to nations like Canada and the USA, which has increased demand for commercial cutlery in the region of North America. There are several potentials for growth in the market for commercial cutlery as a result of the trend of opening restaurants, cafés, and small eateries that serve Indians in these nations.

People are getting increasingly eager to experiment at home as they are exposed to a wider variety of foods and cooking methods. As a result, there is now more demand for high-quality cookware and silverware. The increase in disposable money is another aspect fuelling market expansion. People are willing to pay more for longer-lasting, higher-quality goods when their disposable income increases.

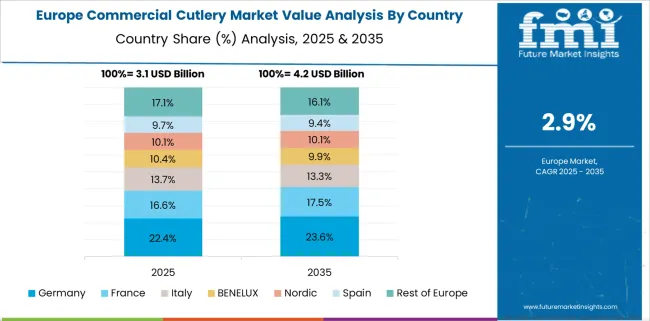

With an estimated market value of USD 13.2 billion in 2025, the United Kingdom commercial cutlery market is projected to hold a 22% share of the Europe region. Performance in the commercial cutlery industry in the United Kingdom is uneven. Others have found it difficult to compete with foreign producers, while other British businesses have been able to establish themselves as major suppliers of commercial cutlery.

The manufacturing of personalized cutlery is one industry in which United Kingdom commercial cutlery businesses have seen great success. Due to this, companies have been able to target a certain market and command high prices for their products.

The Japanese commercial cutlery market accounted for 18% of the Asia Pacific market in 2025, with a value of USD 700 million. Japan is one of the top manufacturers of commercial cutlery, contributing a considerable share of the global supply.

Due to its abundant production capacity and inexpensive labor, the nation currently controls a large portion of the industry and provides shops throughout the world with both high-end and budget-friendly alternatives.

Japanese commercial cutlery is often seen as low quality than products from Western nations, however, recent years have witnessed a noticeable increase in the country's workmanship. The nation's position as one of the leading providers of commercial cutlery is set to further strengthen as it continues to expand its production capabilities.

Korea reportedly has become one of the fastest-growing regions in the commercial cutlery business. The demand for commercial cutlery has significantly increased in Korea due to the region's huge population, fast urbanization, and rising consumer disposable income. The market for commercial cutlery in Korea saw a fall as a result of COVID.

However, the market has rebounded, and all commercial cutlery manufacturing and distribution operations are practically back to full capacity. The market is expected to have beneficial effects as a result of the higher pay rates for production workers. The commercial cutlery market in Korea is expected to be primarily driven by the hospitality industry.

To influence customers' decisions and set their products apart from the competition, businesses are concentrating on producing items with distinctive textures, graphics (on-pack marketing), eye-catching colors, and creative concepts.

For sweets, food tasting, hot and cold cuisine, as well as outdoor festivals and events, customers can utilize wooden cutlery. Providers of commercial cutlery solutions might take advantage of this chance by launching new product lines targeted exclusively at consumers who are concerned about the environment.

Furthermore, to boost profitability and strengthen their market position, players in the commercial cutlery sector have made new launches and acquisitions a fundamental part of their growth strategy.

Additionally, players have focused on company growth to maintain their competitiveness in the international market Accordingly, the need for various types of commercial cutleries is likely to increase as nations make increasing expenditures in the development of office buildings, hotels, retail stores, malls, hospitals, and other commercial infrastructure.

A few dominant players in the market for commercial cutlery are:

One of the biggest producers of professional knives in the USA is Dexter-Russell, and many restaurants employ their goods. Another significant participant in the market for industrial cutlery is Victorinox, and many chefs choose their Swiss Army knives.

German Company Wüsthof has been producing high-quality knives for generations, and many chefs adore their offerings. Although several smaller businesses provide high-quality items, these three dominate the market for commercial cutlery.

Recent Developments in the Commercial Cutlery Market

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East and Africa (MEA) |

| Key Countries Covered | India, USA, Germany, China, United Kingdom, Japan, Denmark, Canada, Thailand, Malaysia, Mexico, Poland, Turkey, Vietnam, Indonesia, Cambodia, France, Italy, Spain, South Korea, Russia, Australia, Brazil, Argentina, South Africa |

| Key Segments Covered | Material Type, Product, Application, Region |

| Key Companies Profiled | Cambridge Silversmiths; Wüsthof; Messermiester; Royal Doulton; Farberware; Denby Pottery Company Ltd.; Multifunction Tools & Knives; Oneida; Villeroy & Bosch AG; Steelite International; Zwilling JA Henkels; Churchill China Ltd.; Dexter-Russel; Victorinox; Hunting & Survival Knives |

| Report Coverage | DROT Analysis, Market Forecast, Company Share Analysis, Market Dynamics and Challenges, Competitive Landscape, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global commercial cutlery market is estimated to be valued at USD 13.2 billion in 2025.

The market size for the commercial cutlery market is projected to reach USD 18.3 billion by 2035.

The commercial cutlery market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in commercial cutlery market are stainless steel, ceramic, plastic and silver.

In terms of product, spoons segment to command 42.3% share in the commercial cutlery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA