The global commercial kitchen ventilation industry is anticipated to experience steady progress from 2025 to 2035, fueled by a rising focus on indoor air quality regulations intended to safeguard public health. While foodservice establishments continue their worldwide expansion to fulfil the nutritional needs of a burgeoning population, the necessity for mechanized ventilation systems that can efficiently dissipate heat, grease, smoke and noxious fumes is growing in tandem.

The drive for green construction certifications and adherence to stringent ecological protocols has further encouraged the selection of energy-efficient and eco-friendly kitchen ventilation alternatives proportionate to varying needs.

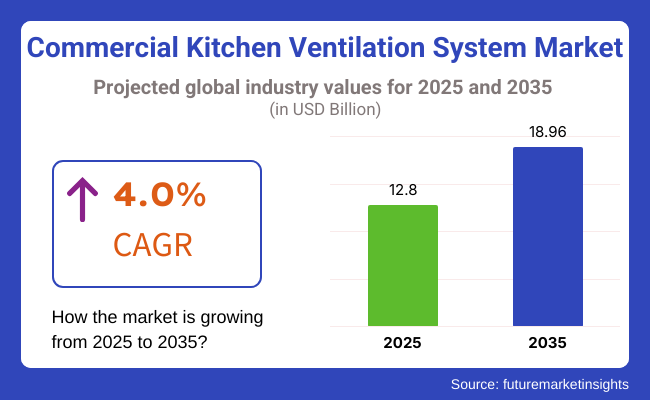

While valued at approximately USD 12.80 billion in 2025, projections for the commercial kitchen ventilation system market place it achieving USD 18.96 billion by 2035. This calculated compound annual growth rate of 4.0% highlights an increasing perception of ventilation systems as integral components of a safe, breathable and legally compliant commercial food preparation space. Technological refinements in exhaust hoods, demand-modulated ventilation systems and air refinement machines are contributing to industry progress.

Moreover, the integration of sophisticated sensors and internet-enabled controls now permits eatery owners and facility administrators to track and modify ventilation performance in real-time, enhancing energy efficiency and reducing operational costs according to distinct circumstances.

North America continues to be a dominant market for commercial kitchen ventilation systems due to numerous local cuisine providers and strict directives concerning fumes and smoke emissions from dining facilities. Especially in the United States, comprehensive benchmarks for grease and smoke handling have been instituted, necessitating widespread installation of sophisticated airflow management.

Furthermore, environmental concerns and financially savvy operations are spurring adoption of intelligent demand-controlled ventilation and heat recovery, cultivating expansion. Meanwhile, ghost kitchens and cloud kitchens burgeoning prevalence demands compact yet innovative solutions be devised to suit burgeoning urban areas constrained for space yet abundant in appetite.

Throughout Europe, ventilating commercial kitchens continues vitalizing eco-friendly practices and scrubbing circling indoor air. For instance, Britain, Germany, and France enacted rigorous directives targeting energy consumption and carbon emissions, rendering very efficient ventilation machinery a ubiquitous necessity.

The proliferating tendency to refurbish aging foodservice facilities with thrift technologies, combined with additional eateries achieving green credentials at a quickening exponential pace, exponentially multiplies requirement for pioneering ventilation solutions in an exponential manner.

Furthermore, the widespread carrying out of smart ventilation systems outfitted with incorporated sensors and remote monitoring abilities spreads extensively across Europe. However, some outdated kitchens present perplexing retrofitting difficulties that must be overcome, nevertheless energy-efficient renovations stay crucial for completing sustainability aims.

The refurbishing trend, joined with novel construction adhering to sustainable standards, confirms that the necessity for clever appliances capable of optimizing functionality while slashing costs and emissions will persist into the foreseeable future. Fresh restaurants and modernized facilities showcase innovations assisting environmental progress through novel examples of advancement with some cases serving as inspiring models of what's possible.

The Asia-Pacific region is projected to see the swiftest development in the commercial kitchen ventilation systems market, fueled by speedy urbanization, broadening of the foodservice industry, and intensifying mindfulness of indoor air quality. Nations for example China, India, and Japan are observing a rise in fresh restaurant openings as well as overhauls of prevailing kitchens, culminating in higher necessity for effective ventilation solutions.

The locale’s developing focus on worker safety, cleanliness, and adherence to air quality regulations is also contributing to market expansion. Local manufacturers are debuting reasonably priced, energy-proficient ventilation systems to meet the diverse demands of small and medium-sized foodservice establishments.

In some cities, new restaurants are springing up weekly and retrofitting outdated ventilation in older kitchens. Meanwhile, other areas have seen surges of entrepreneurs opening smaller cafes and takeaway joints, with varying needs for well-designed ventilation appropriate for their size.

Challenge

High Installation Costs and Compliance with Fire Safety Regulations

High installation costs, regulatory compliance, and regular maintenance needs are some of the challenges faced by the Commercial Kitchen Ventilation System Market. Strict NFPA 96 and ANSI regulations govern the break room and commercial kitchens in restaurants, hotels, and food processing facilities for air quality and fire safety, making these areas ripe for innovation opportunities to change the function of the space.

But advanced ventilation system with fire suppression integration raises capital expenditure and needs specialized manpower. Moreover, unlike most conventional dishwashers, they must be cleaned and their filters replaced frequently to avoid grease build-up and fire risks, which can add to the maintenance costs.

These complexities can be attended to by producing low-cost as well as modular duct ventilation and energy-efficient filtration systems, but manufacturers need to take into consideration an automated grease management system that guarantees compliance and lowers the expense of operation.

Opportunity

Expansion of Smart Ventilation and Energy-Efficient Kitchen Exhaust Systems

Significant opportunities lie for the commercial kitchen ventilation system market as there is an increasing demand for energy-efficient ventilation systems and smart kitchen automation. Restaurants and food service businesses are investing in intelligent exhaust systems with AI-controlled air quality monitoring, variable air volume (VAV) systems, and demand-controlled ventilation that optimize airflow to conserve energy. Moreover, for urban commercial kitchens, developing UV-C and electrostatic precipitation technology for grease and odour control finds establishment.

Cloud-based monitoring systems and IoT-enabled sensors provide real-time diagnostics and predictive maintenance, extending system longevity and reducing downtime. Advanced filtration, energy recovery ventilators (ERVs) core, and automated fire suppression-integrated hoods will drive the market as food service operators continue to focus on sustainability and regulatory compliance among their priorities.

Between 2020 and 2024, the commercial kitchen ventilation system market witnessed a steady growth trajectory, primarily due to heightened fire safety regulations, increased demand for energy-efficient ventilation, and the expansion of quick-service restaurant chains. The focus on improved air quality and sustainability led restaurants and food processing units to install advanced ventilation systems with HEPA filters and grease containment systems.

But, high installation costs, supply chain disruptions and the need to conduct frequent repairs limited market expansion. As a result, companies created modular exhaust hoods, grease filtration systems, and adaptive ventilation controls, their purpose to increase efficiency and compliance.

We will see transformative advancements in smart kitchen ventilation, AI-based automation, and low-energy air purification, and more from 2025 to 2035 in the market. Sensor-based airflow optimization, automated grease removal, and self-cleaning exhaust hoods are examples of how system efficiency can be improved while reducing labour-intensive maintenance. Of course, revolutionary ductless kitchen ventilation options, heat recovery systems, and carbon-neutral exhaust technology will be in keeping with sustainability objectives in the commercial food setting.

As regulatory authorities tighten emission and indoor air quality constraints, demand for intelligent, adaptive ventilation solutions will increase. The next stage of innovation will come from companies that focus on everything-AI-integrated fire prevention, eco-friendly air filtration, cost-effective retrofitting solutions.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with NFPA 96, ANSI, and OSHA ventilation standards |

| Technological Advancements | Growth in HEPA filters and high-efficiency grease filtration |

| Industry Adoption | Increased use in restaurants, hotels, and food processing plants |

| Supply Chain and Sourcing | Dependence on traditional exhaust duct manufacturing |

| Market Competition | Dominance of established kitchen ventilation system manufacturers |

| Market Growth Drivers | Demand for fire prevention and improved air quality in commercial kitchens |

| Sustainability and Energy Efficiency | Initial adoption of energy-saving kitchen hoods |

| Integration of Smart Monitoring | Limited adoption of IoT-enabled ventilation control |

| Advancements in Modular Ventilation Systems | Use of fixed, high-cost kitchen exhaust installations |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of AI-driven fire prevention and air quality compliance technologies. |

| Technological Advancements | Integration of AI-based airflow optimization, automated grease removal, and smart fire suppression. |

| Industry Adoption | Expansion into cloud kitchens, mobile food units, and automated commercial cooking hubs. |

| Supply Chain and Sourcing | Shift toward modular, prefabricated, and customizable ventilation solutions for commercial kitchens. |

| Market Competition | Rise of start-ups offering smart, energy-efficient, and retrofitting-friendly ventilation solutions. |

| Market Growth Drivers | Increased investment in AI-powered ventilation, real-time monitoring, and carbon-neutral exhaust systems. |

| Sustainability and Energy Efficiency | Full-scale implementation of low-energy, heat recovery ventilators, and automated air purification systems. |

| Integration of Smart Monitoring | AI-powered real-time diagnostics, predictive maintenance, and cloud-based kitchen air quality tracking. |

| Advancements in Modular Ventilation Systems | Development of compact, modular, and retrofit-friendly ventilation solutions for flexible commercial applications. |

The United States commercial kitchen ventilation industry has been bolstered considerably by increasingly stringent public health and safety regulations, the breakneck proliferation of quick-service dining establishments, and a rising predilection for energy-efficient solutions attuned to exhaust handling needs.

Standards instituted by the National Fire Protection Association and regulations from the Occupational Safety and Health Administration now mandate the installation of top-tier exhaust filtration assemblies in commercial food preparation spaces.

Meanwhile, the burgeoning phenomena of cloud kitchens and meal delivery applications has necessarily increased demand for compact yet high-performance ventilation units with optimized functionality. Likewise, the hospitality sector and institutional foodservice realms including hotels, medical centers, and schools have proven to be stalwart patrons of cutting-edge kitchen effluent management systems.

Thanks to continual innovation in air purification technology and systems recovering expelled energy, analysts anticipate the USA commercial kitchen ventilation marketplace will maintain a steady expansion going forward.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3% |

The United Kingdom's commercial kitchen ventilation industry has flourished considerably due to sizeable investments funnelled into modernizing restaurant infrastructure and enforcing stringent regulations regarding air quality and sustainability. The Health and Safety Executive and pertinent Building Regulations mandate suitable extraction apparatuses in foodservice facilities to ensure both fire safety and air quality standards are satisfied.

The growths of upscale dining and fast food sectors coupled with a rising implementation of energy-efficient and low-decibel ventilation units have stoked demand substantially. Furthermore, the increasing focus on achieving carbon neutrality in kitchen operations is propelling the adoption of eco-friendly filtration and heat recovery mechanisms.

With ever-growing capital funnelled into intelligent kitchen ventilation solutions, the market within the UK is primed for steady expansion going forward.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

The ever-evolving kitchen ventilation sector within the European Union has undergone substantial transformations influenced by rising environmental expectations and innovations in technology. Nations like Germany and France have demonstrated early leadership in adopting sustainable solutions and fire-safe equipment compliant with stringent policies aimed at reducing impacts on air quality and climate from commercial food operations.

Stricter regulations including the Energy Performance of Buildings Directive and performance standards for ventilation systems have necessarily increased focus on options consuming less power while filtering air more thoroughly. Moreover, the integration of sensors, connectivity and automated controls in newer units allows for more intelligent management of indoor air quality leveraging Internet of Things tools and constant monitoring of particulate matter, temperature, humidity and airflow.

As demand strengthens for exhaust hoods and complementary products delivering energy savings, heightened safety and networked intelligence, analysts foresee the EU's commercial kitchen ventilation market continuing to develop steadily alongside the growing emphasis within Europe's foodservice industry on sustainability and efficiency in all operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.1% |

The continually developing Japanese commercial kitchen ventilation system market is driven by heightened requirements for compact and automated solutions in light of stricter indoor air quality guidelines, as well as heightening adoption of grease management frameworks. Japan's emphasis on space-savvy, high-performance cooking gear is stimulating need for low-profile range hoods and high-limit exhaust cooling fans.

The lodging and fast-food ventures, particularly in sprawling Tokyo and the humming metropolis of Osaka, are significant users of innovative ventilation frameworks with AI-driven wind current controls. What's more, the developing pattern of mechanized and robotic kitchens is pushing interest for sensor-based and versatile ventilation frameworks.

With progressing advances in hushed and energy-productive ventilation innovation, the Japanese business cooking ventilation framework commercial center is set up for consistent extension and development.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

The South Korean commercial kitchen ventilation system industry has witnessed steady progress, motivated by expanding restaurant and foodservice sectors, heightening government regulations regarding fire protection, and increasing demands for high-performance ventilation answers. According to the Korean Fire Safety Code and air pollution management policies, advanced exhaust and filtration structures must be placed in commercial kitchens.

The growing numbers of cloud kitchens, fast food chains, and smart eateries have amplified requirements for compact yet sophisticated ventilation devices empowered by synthetic intelligence. Moreover, the embracing of UV-founded grease filtration and self-cleaning exhaust mechanisms has bolstered industry expansion.

With ongoing investments in clever and energy-efficient ventilation answers, projections are that the South Korean commercial kitchen ventilation system market will keep developing soundly. New technologies like automatic dampers and smart sensor-driven fans promise to optimize performance and energy efficiency. However, higher equipment and installation costs may somewhat impede broader adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

Commercial kitchen ventilation systems are heavily invested by restaurants and hotels, as owners focus on providing good indoor air quality, following safety protocols, and optimizing kitchen workflow operations. These high-performance ventilation solutions are critical to the removal of airborne grease, smoke, and odours from commercial kitchens and are a mainstay across restaurants, hotels, corporate dining facilities and institutions.

Restaurant ventilation systems have become the most powerful air purification equipment and provide heat and smoke extraction, and enhanced air circulation and meet fire safety regulations. Unlike traditional HVAC control systems, the ventilation systems specifically designed for commercial kitchens offer specialized air extraction and grease filtration, leading to an efficient and comfortable cooking environment.

The growing chain development in the fast-casual dining segment and quick-service restaurant (QSR) chains is lead to expandtion of high-volume cooking exhaust mitigation, resulting in broad commercial acceptance of the effective ventilation system amid a renewed focus on indoor air quality and hygiene among food service operators.

According to research, high-performance restaurant ventilation systems more than reduce airborne levels of grease and smoke by over 75 percent and provide better passive compliance with health and safety regulations.

Deploying more widespread kitchen ventilation systems in upscale fine dining restaurants equipped with custom-designed exhaust hoods and air purification systems has cemented the impetus for the markets and are fast-tracking adoption among restaurant kitchen segment.

AI-powered airflow management consisting of grease filter real-time monitoring and exhaust fan speed regulation is also boosting adoption, improving energy efficiency and slashing maintenance costs.

Self-cleaning kitchen ventilation hoods equipped with auto-fat trap technology and UV light sterilization, have become essential for optimal growth in market, enabling higher sustainability in commercial kitchen environments.

The rise of demand-controlled ventilation systems, that include the modulation of smart exhaust fans for energy savings, has further influenced the market growth, providing better adaptability in fluctuant culinary workloads.

Although an effective solution for improving air quality, reducing fire hazards, and increasing energy efficiency, restaurant ventilation systems come with high costs of installation, regular maintenance, and adhering to evolving environmental directives.

The opportunities for the restaurant ventilation systems market growth lies in the latest developments including, AI-powered airflow optimization, next-gen grease filtration technology and modular kitchen ventilation design, which are enhancing efficiency, adaptability and cost-efficiency, thereby shaping the restaurant ventilation systems market positively.

There has been positive market adoption of hotel kitchen ventilation systems over the past few years, especially in five-star hotels, resorts, and fine-dining restaurants, as hoteliers invest in high-efficiency ventilation solutions to comply with environmental regulations while maintaining air quality and guest comfort.

In contrast, since hotel kitchen ventilation works with the central HVAC systems of multiple areas, it is equipped for centralized airflow control throughout different parts of the kitchen unlike stand-alone restaurant ventilation systems.

High-performance kitchen air management solutions have also benefited from the increasingly stringent requirements surrounding the cooling and transport of high-heat cooking environments that use premium grade exhaust hoods individuals mounted on noise-reduction ductwork as five-star hotels grow in prevalence. Over 60% less odour spread and heat build-up thanks to a state-of-the-art hotel kitchen ventilation system.

Market growth is further supported by the pervasiveness of energy-saving ventilation systems in boutique hotels due to the inclusion of heat recovery and air cleaning technologies, thus making eco-friendly hospitality premises as the way forward for more energy-efficient lodging spaces.

This is complemented by better environmental sustainability and energy management, which drives increased adoption for IoT-enabled kitchen air monitoring, which encompasses features such as real-time air quality tracking and remote-controlled exhaust systems.

Moreover, advancements in industrial kitchen exhaust, including multi-zone filtration and automated grease removal event systems, have driven the growth of the market, enhancing the adaptability of high-space hotel kitchens.

Increasing adoption of hybrid hotel ventilation systems that provide variable air volume control for energy efficiency bolstered market growth as they closely meet requirements of eco-friendly buildings and USGBC LEED certifications.

Although hotel kitchen ventilation systems benefit from various features like enhancing guest comfort, meeting the ventilation regulatory requirements, and optimizing operational efficiency, it also has certain challenges like high integration costs, energy-intensive nature for large scale operations, and demand for specialized maintenance services.

But new advances in artificial intelligence-driven energy-conscious venting, automated smart kitchen extraction and next gen air cleansing tech are enhancing usability, sustainability and cost efficiency for the long-haul, assuring ongoing growth for hotel kitchen venting systems.

The high volume low-speed (HVLS) fans and centrifugal fan sets are potential factors driving growth of the global commercial kitchen ventilation fan market, pertaining advanced type of fan for improving airflow distribution with limited or no noise in the kitchen premises.

High Volume Low Speed (HVLS) fans are rapidly becoming one of the most commonly used ventilation techniques, providing improved air flow, decreased energy usage and increased cooling efficiency. HVLS fans also work at a lower rotation speed, but spread over a much wider area than traditional high-speed fans, and provide uniform air distribution in commercial kitchens.

Increase in demand of HVLS fans across large commercial cuisines with (very high volume low speed) oversized blade design, which provide homogeneous airflow have acted as a key enabler to adoption of energy efficient ventilation solution, as restaurants and hotels prioritize indoor air quality and temperature regulation. Research shows that HVLS fans help reduce ambient kitchen temperatures by as much as 10°F, providing a better working environment for chefs and kitchen employees.

HVLS fans finding use in industrial catering services and cloud kitchens due to their low noise generation capabilities and minimal maintenance requirements, are anticipated to push market demand, ensuring increased usage in high output food production applications.

Further fostering uptake are AI-powered fan speed modulation (often sensor-driven) and humidity control, which enhance energy efficiency and temperature opacity in commercial kitchens.

Firstly, the development of lightweight, high-durability HVLS fan blades made from composite materials to increase usability by improving longevity and usability in high-temperature cooking environments has offset market growth.

HVLS Fans offer benefits of improved air circulation, reduced energy costs, and enhanced comfort, but their higher upfront costs, limited effectiveness for smaller cooking areas and space constraints can prove to be a challenge in compact kitchen layouts. Nevertheless, the introduction of modern technologies - AI-powered airflow optimization; hybrid fan motor designs; and generation-changing ultra-quiet HVLS fan models - are bolstering efficiency, adaptability and affordability, translating to continued growth in the HVLS fan market.

Centrifugal plant sets have seen significant market penetration, especially in heavy commercial kitchens, industrial catering companies, and large food production plants, as companies continue to invest in high-pressure air change systems to address the exhaust of gratified air, smoke, and warming. High-capacity Kitchen Ventilation Systems Use centrifugal fan sets that generate more static pressure than axial fans.

To cater to them, with kitchens in five-star hotels having the highest demand, high-power centrifugal fan sets are used to improve exhaust performance, further stimulating the popularity and development of heavy-duty ventilation.

The market has secured conditions of high-end restaurant chains and corporate dining system which require multi speed and noise reduction mechanisms within the centrifugal fan technology and this has further driven demand for the market.

The rise of AI-powered fan diagnostics - which include monitoring vibration and automatically optimizing efficiency - has helped, too, by delivering better reliability and lower maintenance costs in commercial kitchens.

Although they possess benefits like increased high-pressure exhaust, better air flow management, and more effective grease removal, centrifugal fan sets also come with disadvantages like added mounting difficulty, more energy usage and limited area in small kitchens.

Nonetheless, new technologies including AI-driven fan control, energy-efficient motor technologies, and hybrid centrifugal-axial fan designs are increasing efficiency, adaptability, and cost-effectiveness across the life cycle, guaranteeing ongoing growth of centrifugal fan ventilation solutions.

Increasing demand for effective smoke, grease, and odour management in restaurants, hotels, hospitals, and food processing units is driving the growth of the commercial kitchen ventilation system market.

Key companies are specifically investing in energy-efficient exhaust hoods, Artificial Intelligence powered air filtration, and fire suppression-integrated ventilation systems to improve indoor air quality, regulatory compliance, and operational efficiency.

Global HVAC solution providers and specialized commercial kitchen ventilation manufacturers perform as players in the market, both contributing to improvements in ductless hoods, demand-controlled ventilation systems, and high-efficiency grease filters.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| CaptiveAire Systems, Inc. | 15-20% |

| Halton Group | 12-16% |

| Greenheck Fan Corporation | 10-14% |

| Systemair AB | 8-12% |

| Accurex (Greenheck Group) | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| CaptiveAire Systems, Inc. | Develops high-performance exhaust hoods, demand-controlled ventilation (DCV), and grease management systems. |

| Halton Group | Specializes in smart kitchen ventilation, UV-C filtration, and energy-saving air exchange solutions. |

| Greenheck Fan Corporation | Manufactures commercial-grade range hoods, high-efficiency exhaust fans, and makeup air units. |

| Systemair AB | Provides advanced kitchen exhaust systems, high-performance air purifiers, and smart air flow controls. |

| Accurex (Greenheck Group) | Offers modular kitchen ventilation systems, fire-rated ductwork, and low-noise exhaust solutions. |

Key Company Insights

CaptiveAire Systems, Inc. (15-20%)

The largest manufacturer of commercial kitchen ventilation systems, CaptiveAire provides intelligence-driven demand-controlled ventilation and high-efficiency exhaust hoods.

Halton Group (12-16%)

Halton is a leader in fire-rated duct systems, UV filtration and smart air handling for foodservice operations.

Greenhec Fan Corporation (10-14%)

Greenhec sells high-performance exhaust systems that help filter the air going into your kitchen as well as grease buildup.

Systemair AB (8-12%)

Systemair specializes in developing low-noise ventilation solutions for efficient, energy-abating air purification in commercial kitchens.

Accurex (5-9%)

Accurex produces high-performance commercial kitchen ventilation products that combine fire suppression systems and energy-efficient exhaust hoods.

Other Key Players (40-50% Combined)

Many HVAC and air purification companies are driving innovations in next-generation ventilation, AI-driven airflow monitoring, and sustainable exhaust solutions. These include

The overall market size for Commercial Kitchen Ventilation System Market was USD 12.80 Billion in 2025.

The Commercial Kitchen Ventilation System Market expected to reach USD 18.96 Billion in 2035.

The demand for commercial kitchen ventilation systems will be driven by factors such as stringent health and safety regulations, the need for improved air quality, energy efficiency, and fire safety in commercial kitchens. Additionally, the growing food service industry and advancements in ventilation technologies will further boost market growth.

The top 5 countries which drives the development of Commercial Kitchen Ventilation System Market are USA, UK, Europe Union, Japan and South Korea.

High Volume Low-Speed Fans and Centrifugal Fan Sets Drive Market Growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Application Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Application Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Application Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Application Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Application Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Application Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Application Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Application Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Fan Type, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Fan Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Application Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 16: Global Market Attractiveness by Application Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Fan Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Application Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 34: North America Market Attractiveness by Application Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Fan Type, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Application Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Application Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Fan Type, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Application Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Application Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Fan Type, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Application Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Application Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Fan Type, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Application Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Application Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Fan Type, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Application Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Application Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Fan Type, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Fan Type, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Application Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Fan Type, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Fan Type, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Fan Type, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Fan Type, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Application Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Fan Type, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA