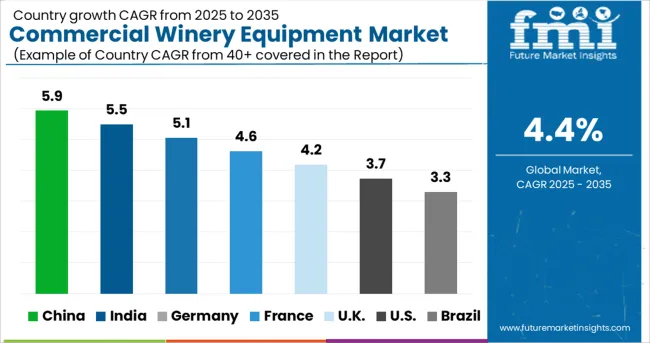

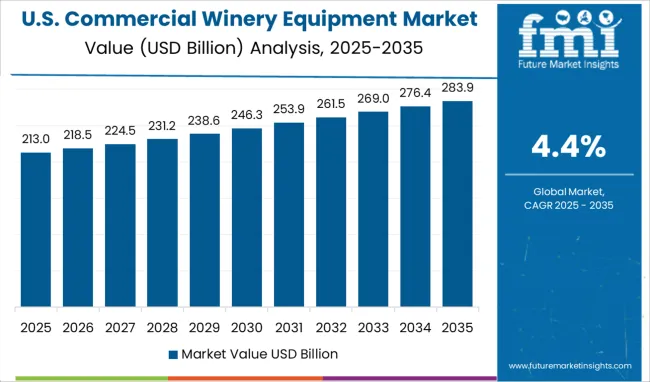

The Commercial Winery Equipment Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

The commercial winery equipment market is undergoing consistent growth as wineries modernize their production facilities to meet increasing consumer demand and quality expectations. Advances in automation, precision control technologies, and energy-efficient designs are transforming traditional winemaking into a more scalable and sustainable process.

Rising consumption of premium and craft wines is driving investments in equipment that enhances consistency, reduces waste, and complies with stringent hygiene standards. Future growth is expected to be fueled by the adoption of smart monitoring systems, modular equipment designs, and increased focus on sustainable production practices.

Strategic collaborations between equipment manufacturers and wineries are paving the way for tailored solutions that align with evolving market needs, regulatory requirements, and consumer preferences.

The market is segmented by Type, Wine, Application, and Distribution Channel and region. By Type, the market is divided into Fermenters, Crushers & Filtration, Centrifuge, Pumps, Chillers, Filling and Bottling, and Others. In terms of Wine, the market is classified into Red Wine, Rose Wine, White Wine, Champagne, and Others. Based on Application, the market is segmented into Micro-Winery, Farm Winery, Urban Winery, and Others. By Distribution Channel, the market is divided into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

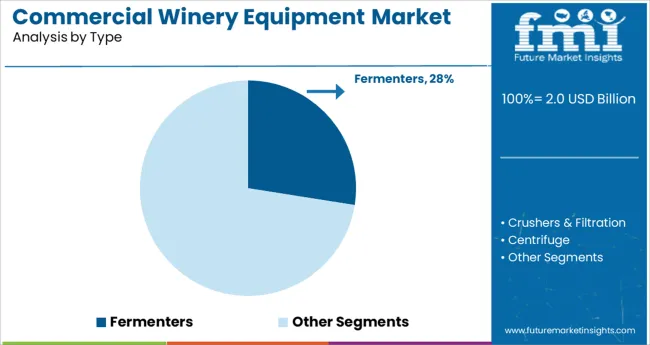

When segmented by type, fermenters are expected to hold 27.5% of the total market revenue in 2025, positioning it as the leading type segment. This leadership has been supported by the central role fermenters play in controlling critical winemaking variables such as temperature, oxygen exposure, and fermentation speed

Manufacturers have enhanced fermenter designs with stainless steel constructions, automated controls, and integrated sensors to ensure uniformity and improve efficiency.

Their ability to handle large batch sizes while preserving flavor integrity has made them indispensable in both small and large-scale wineries. The cost-effectiveness of modern fermenters combined with their longevity and ease of cleaning has further reinforced their dominance as a core component of commercial winery operations.

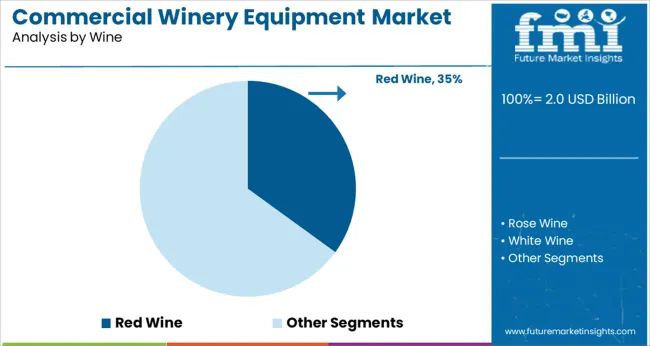

Segmented by wine type, red wine is projected to account for 35.0% of the market revenue in 2025, making it the largest segment. This dominance has been driven by the sustained global demand for red wines, supported by their perceived health benefits and cultural prominence in key wine-consuming regions.

Commercial wineries have prioritized investments in equipment tailored to red wine production, as it typically requires longer fermentation periods, specialized vessels, and controlled aging environments

The growing popularity of premium and artisanal red wines has encouraged producers to adopt equipment that delivers consistency, enhances color extraction, and preserves the complex flavor profiles expected by consumers. These factors have collectively positioned red wine production at the forefront of commercial winery equipment utilization

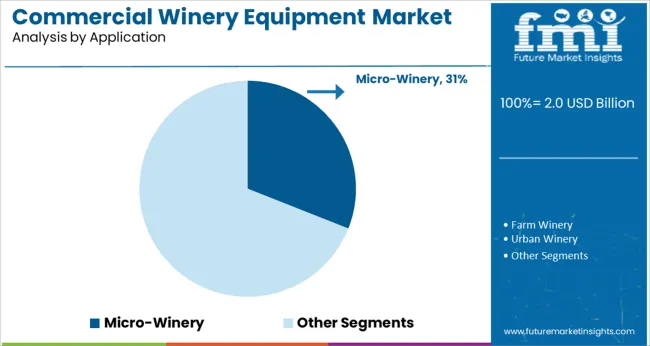

When segmented by application, micro-wineries are anticipated to capture 31.0% of the market revenue in 2025, emerging as the leading application segment.

This growth has been driven by the rise of boutique and craft wineries that cater to niche consumer segments seeking unique, small-batch wines. Micro-wineries have increasingly invested in flexible, space-efficient equipment that allows them to produce high-quality wines without the scale of larger facilities.

The emphasis on authenticity and innovation among micro-wineries has fostered demand for advanced but compact solutions that can handle diverse varietals and experimental techniques. The ability of equipment suppliers to deliver customized, modular setups has further encouraged the proliferation of micro-wineries, consolidating this segment’s position as a key driver of market expansion.

The global market for commercial winery equipment increased from USD 1,473.1 million to USD 1,716.7 million between 2020 and 2025 with a CAGR of 3.9%.

The growth of the commercial winery equipment market is driven by factors such as the increasing demand for wine, rising disposable incomes, and changing lifestyles. The growing popularity of wine tourism is also driving the demand for Commercial Winery Equipment. However, the high initial investment required for setting up a winery and the stringent regulations governing the alcohol industry are restraining the growth of this market.

During the forecast period, the global commercial winery equipment market is anticipated to grow from USD 1,792.2 billion in 2025 to USD 2,756.7 billion by 2035 with a healthy CAGR of 4.4%.

Rise in the Number of Winery Owners

Commercial winemakers are developing different styles of wine and using a wide variety of grapes to make their wine, which appears to be attracting consumers' attention. Consumption of wine is mostly observed in urban areas.

It is expected that the commercial winery equipment market will experience strong growth due to the growing number of commercial winemakers and prominent winemakers switching to new technologies.

Additionally, increasing consumption of natural or organic wines around the world is encouraging commercial winemakers to expand their business; this should drive the growth of the commercial winery equipment market.

Implementation of Strict Laws

Commercial wineries are hindered by stringent laws that are implemented by regional governments for producing and selling quality wine. A challenge for the growth of commercial winemakers is also the fluctuation in the production of grapes and supply of wine by owners, as well as the presence of alternative products such as beer and processed wine.

There is a direct impact on the sale of commercial winery equipment as a result of this. Aside from conventional practices in winemaking, owners opting for conventional methods also influence the growth of commercial winery equipment.

There are several types of winery equipment, each serving a specific purpose in the wine-making process. The most common pieces of equipment are fermenters, crushers and filtration systems, centrifuges, and pumps.

Fermenters are large vats in which the grape juice is converted into wine through fermentation. Crushers and filtration systems are used to extract the juice from the grapes before it goes into the fermenter. Centrifuges are used to separate the solid particles from the liquid after fermentation is complete. Pumps are used to move the wine throughout the winery during both fermentation and bottling. Wine is transferred from one place to another using pumps without losing quality. A pump's primary function is to remove old wine from a tank and replace it with new wine, maintaining the tank's level. Pumps used in commercial wineries come in two types: mechanical and electric.

The market for commercial winery equipment is directly linked to the popularity of red wine. As more and more people develop a taste for this type of drink, the demand for better-quality wines increases. This, in turn, drives up the need for better-quality winemaking equipment.

Commercial winery equipment is most commonly used in farm wineries, urban wineries, and other industries. Farm wineries use commercial winery equipment to produce wine from grapes grown on the farm. Urban wineries use commercial winery equipment to produce wine from grapes grown in the city. Other industries that use commercial winery equipment include restaurants, hotels, and bars.

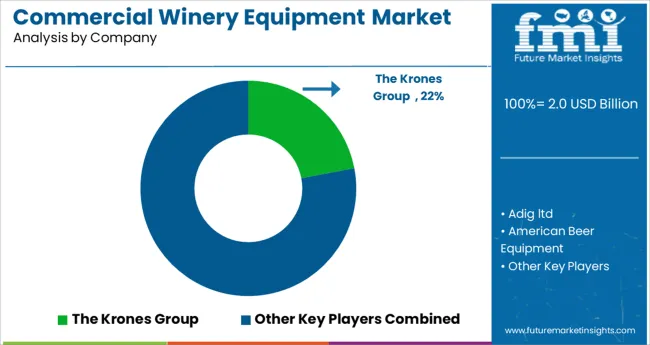

The USA accounted for 33.0% of the global market with a value of USD 2 million in 2025. In recent years, the commercial winery equipment market has seen a shift in the United States. The industry is now moving towards more technologically advanced and efficient equipment. This change is being driven by the need for higher-quality wines and the desire to be more environmentally friendly.

The United Kingdom commercial winery equipment Market will grow at 6.5% CAGR between 2025 and 2035. The United Kingdom's market share for Commercial Winery Equipment is expected to grow in the coming years as more vineyards are planted and production increases. The United Kingdom has a large share of the Commercial Winery Equipment market. The country is home to many well-known wineries and producers and has a long history of wine production.

The India commercial winery equipment market will grow at 6.1% CAGR between 2025 and 2035. One of the biggest reasons for the growth of the Commercial Winery Equipment market in India is the increasing popularity of wine. In recent years, wine consumption in the country has been increasing at a rapid rate. This is due to several factors, such as the growing middle class and the increasing awareness of the health benefits of wine.

The global market for commercial winery equipment is highly competitive with a large number of regional and international players. The key players in the market are focused on expanding their product portfolio and geographic reach to gain a competitive edge. The leading players in the market are investing in research and development activities to develop new and innovative products. There is a strong focus on offering technologically advanced equipment at competitive prices to meet the needs of end users worldwide. The key players in the market are as follows:

Recent Developments

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; The Middle East and Africa; East Asia |

| Key Countries Covered | USA, Mexico, Canada, United Kingdom, Germany, France, Italy, China, Spain, India, Japan, South Korea, Australia, Argentina, Brazil, South Africa, UAE |

| Key Segments Covered | Type, Wine, Application, Distribution Channel, Region |

| Key Companies Profiled | Adig ltd; American Beer Equipment; Brauhaus Technik Austria; Criveller Group; Deutsche Beverage Technology; GW Kent; Jma Engineering; JV Northwest, Inc.; Master Vintner; Sierra Nevada Brewing Co.; The Krones Group; The Olde Mecklenburg Brewery; Kinnek; GEA; METO; Hypro; BrewBilt; Psycho Brew |

| Report Coverage | Company Share Analysis, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives, Market Forecast, Competitive Landscape, |

| Customization & Pricing | Available upon Request |

The global commercial winery equipment market is estimated to be valued at USD 2.0 billion in 2025.

It is projected to reach USD 3.0 billion by 2035.

The market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types are fermenters, crushers & filtration, centrifuge, pumps, chillers, filling and bottling, others, _monitoring devices and _packaging.

red wine segment is expected to dominate with a 35.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA