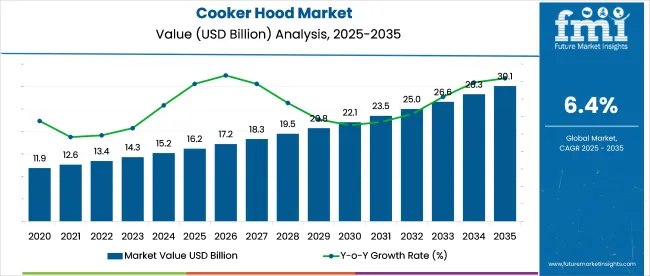

The Cooker Hood Market is estimated to be valued at USD 16.2 billion in 2025 and is projected to reach USD 30.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The cooker hood market is witnessing steady expansion, driven by rising global urbanization, improved living standards, and a heightened focus on indoor air quality. Consumer lifestyle shifts, particularly in urban households, have fueled the demand for modern kitchen appliances that combine functionality with aesthetic appeal.

Technological advancements in noise reduction, filtration efficiency, and energy-saving components have elevated consumer expectations and driven product innovation across the industry. Press releases from appliance manufacturers and home improvement retailers have pointed to growing sales in the premium kitchen segment, especially in developing regions where homeownership and modular kitchen adoption are rising.

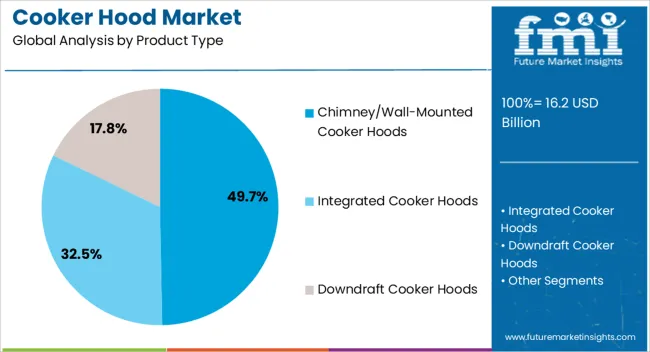

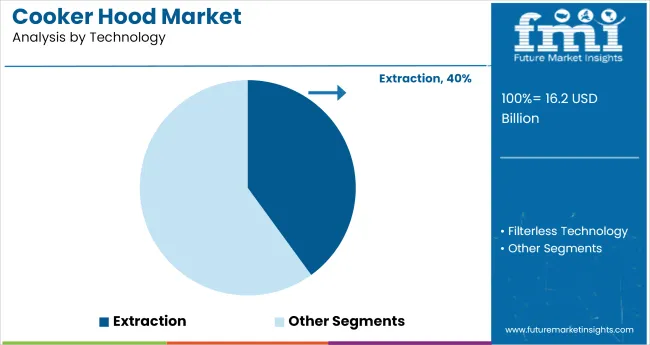

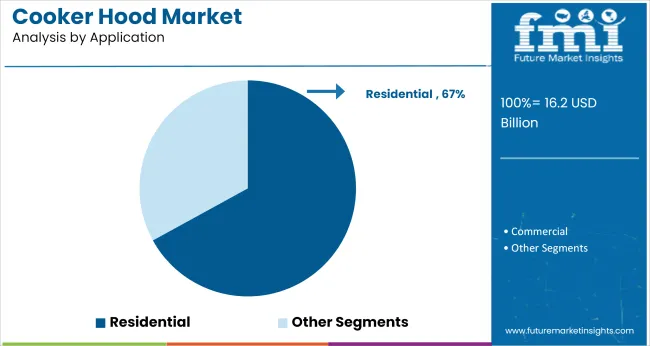

Regulatory initiatives targeting indoor air pollution and energy efficiency have further supported market penetration. With the residential sector leading adoption, future growth is expected to be reinforced by smart home integration, ductless technology development, and expanded product availability across e-commerce platforms. Segmental demand is expected to remain concentrated in Chimney/Wall-Mounted cooker hoods, extraction-based ventilation technologies, and residential kitchens due to their widespread applicability and installation convenience.

| Metric | Value |

|---|---|

| Cooker Hood Market Estimated Value in (2025 E) | USD 16.2 billion |

| Cooker Hood Market Forecast Value in (2035 F) | USD 30.1 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The market is segmented by Product Type, Technology, Application, and Sales Channel and region. By Product Type, the market is divided into Chimney/Wall-Mounted Cooker Hoods, Integrated Cooker Hoods, and Downdraft Cooker Hoods. In terms of Technology, the market is classified into Extraction and Filterless Technology. Based on Application, the market is segmented into Residential and Commercial. By Sales Channel, the market is divided into Online Stores, Modern Trade, Multi-Brand Stores, Exclusive Stores, Independent Stores, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Chimney/Wall-Mounted Cooker Hoods segment is projected to account for 49.7% of the cooker hood market revenue in 2025, maintaining its dominant share within product categories. This segment’s growth has been propelled by its compatibility with a wide range of kitchen layouts and its effectiveness in ventilating high-heat cooking zones.

Interior design trends have favored wall-mounted solutions due to their blend of utility and style, particularly in modular kitchens where visual appeal plays a significant role. Retail data and appliance showroom inventories have indicated that wall-mounted models are among the most stocked and promoted, reflecting their consumer popularity.

These units have also been preferred for their ease of installation and integration with chimney systems in residential kitchens. As more consumers prioritize space-saving yet powerful ventilation solutions, the Chimney/Wall-Mounted Cooker Hoods segment is expected to continue leading in unit sales and revenue contribution.

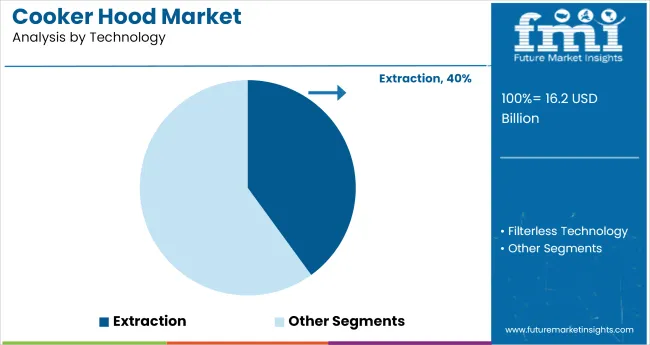

The Extraction segment is expected to represent 58.9% of the cooker hood market revenue in 2025, solidifying its position as the leading ventilation technology. This segment’s dominance has been driven by its high effectiveness in removing airborne grease, odors, smoke, and moisture directly from the kitchen environment.

Consumer product reviews and industry evaluations have consistently highlighted extraction hoods for their superior airflow performance and long-term reliability. Building codes and housing standards in many countries have also encouraged the installation of extraction-based systems, especially in homes with gas cooktops or closed kitchen designs.

Manufacturers have responded with expanded product lines in this category, offering quieter motors, multiple speed settings, and improved ducting compatibility. With rising consumer awareness of kitchen hygiene and air quality, extraction hoods have remained the top choice among buyers, and the segment is expected to maintain its market leadership as demand for efficient and durable ventilation systems grows.

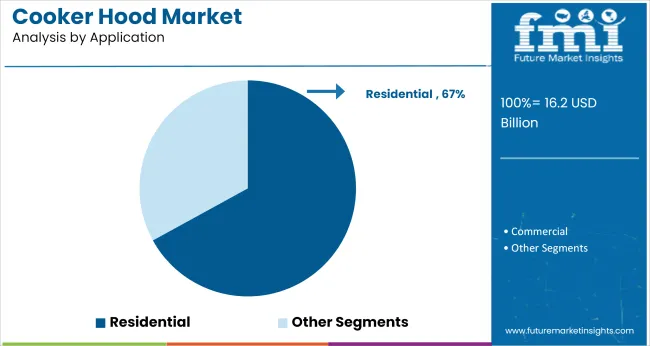

The Residential segment is projected to capture 74.6% of the cooker hood market revenue in 2025, maintaining its position as the leading application category. This segment’s expansion has been driven by the increasing adoption of modern kitchens, the rise in single-family housing units, and growing awareness of indoor pollution risks.

Consumer preferences have shifted toward functional kitchen designs that incorporate high-performance appliances, including cooker hoods capable of maintaining air cleanliness during daily cooking routines. Residential construction trends and home renovation activity have supported the integration of cooker hoods as standard fixtures, especially in urban housing markets.

Appliance manufacturers have also tailored their offerings to fit smaller kitchen spaces and varying cooking habits, enhancing relevance in diverse residential contexts. Additionally, product affordability and financing options through retail partnerships have increased accessibility to first-time buyers and middle-income households. As residential spaces continue to evolve with modern infrastructure and aesthetic preferences, the Residential segment is expected to retain the highest share in the cooker hood market.

Chimney-style cooker hoods dominate the product landscape, while ducted extraction remains the top-performing technology. Residential applications drive demand, especially in modular kitchens, and offline retail continues to lead sales despite the rise of e-commerce.

Chimney or wall-mounted cooker hoods are projected to hold nearly 70% of the global product type market in 2025, growing at a 4.9% YoY rate. Their dominance is rooted in modular kitchen integration, combining aesthetic appeal with efficient smoke extraction.

Preferred in urban homes, these hoods cater to both performance and visual appeal, making them the default option in most mid- to premium-range residential builds. In contrast, under-cabinet and island hoods are niche, with limited growth due to installation constraints. As home renovations accelerate in developing regions, chimney hoods remain the most scalable product category.

Ducted extraction systems account for the 40% technology share in the cooker hood market, favored for their 5.2% YoY growth driven by high-performance odor and grease removal. Especially in high-cooking-frequency households, ducted hoods outperform recirculation models in air purification.

Despite higher installation and space requirements, they dominate in Asia-Pacific and Europe due to stringent indoor air quality norms. Recirculation technology, while cost-effective and easier to retrofit, trails with a 2.3% YoY increase, mostly appealing to apartments and rental properties where permanent fixtures are impractical.

The residential segment constitutes around 67% of cooker hood demand in 2025, with a consistent 4.7% YoY growth. Growth is primarily driven by modular kitchen installations, increased awareness of indoor air quality, and aesthetic preferences in modern homes.

Urban apartment dwellers increasingly prioritize compact, low-noise, and energy-efficient hoods, often bundled with kitchen cabinetry. Commercial kitchens, while steady in growth, remain niche due to their specialized ventilation systems. Residential adoption is also stimulated by rising disposable income in Asia and renovation trends in Europe and North America.

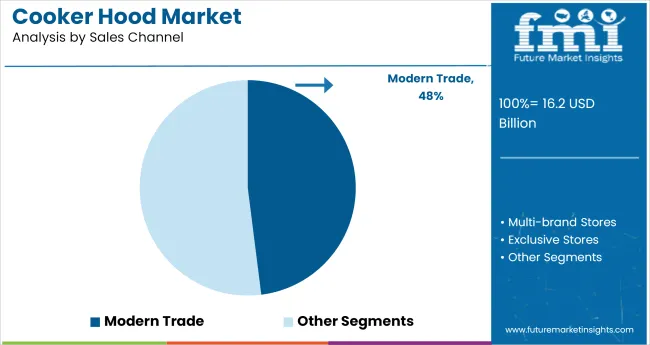

Modern trade-including specialty appliance stores and exclusive brand outlets-continues to lead sales channels with a 48% market share in 2025, despite e-commerce’s faster 9.1% YoY growth. Consumers still favor in-store purchase of large appliances like cooker hoods due to the need for consultation, live demonstrations, and bundled installation services.

Modern trade dominance persists in Tier 2 and Tier 3 cities, where brand showrooms offer localized service. While online channels attract tech-savvy buyers with discount models and reviews, the tactile and assisted nature of modern trade maintains loyalty in premium categories.

The cooker hood market is expanding steadily, fueled by rising home renovations, preference for efficient ventilation, and increasing demand for low-noise, design-forward appliances in modular kitchens across urban and suburban households.

Enhanced Indoor Air Quality and Design Integration Driving Purchases

Homeowners are prioritizing cooker hoods that effectively remove smoke, grease, and odors. Premium hoods offering extraction rates over 700 m³/h now make up nearly 40% of sales in remodeled kitchens. Designer finishes-such as stainless steel, matte black, and integrated downdraft systems-are creating style-first appeal.

Kitchen remodel firms report cooker hood inclusion in 85% of upgrade projects. As a result, extractors with low noise levels (<55 dB) and customizable lighting elements are increasingly seen as essential centerpieces in modern kitchen design.

Smart Features and Energy Efficiency Shaping Competitive Landscape

Manufacturers are embedding sensors, auto-adjustment modes, and energy-saving motors to stand out. Auto-activating hoods that adjust fan speed based on heat or steam detection are capturing 25% of new product launches. Energy-efficient brushless DC motors now power over 60% of models, reducing power use by 20% compared to induction motors.

Connectivity with kitchen IoT systems for remote control and maintenance alerts is also gaining ground. These features are improving consumer convenience, reducing operating costs, and supporting manufacturers’ efforts to differentiate through performance and smart functionality.

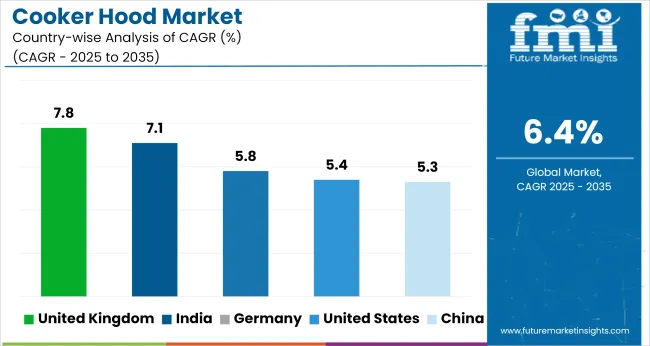

| Country | CAGR |

|---|---|

| United States | 5.4% |

| United Kingdom | 7.8% |

| Germany | 5.8% |

| India | 7.1% |

| China | 5.3% |

The global cooker hood market is projected to grow at a CAGR of 6.4% from 2025 to 2035, driven by rising urbanization, modular kitchen adoption, and demand for energy-efficient ventilation solutions. The United Kingdom leads growth among key markets with a 7.8% CAGR, supported by kitchen remodeling trends and premium appliance upgrades.

India follows at 7.1%, reflecting expanding middle-class housing, real estate development, and demand for ductless and auto-clean models. Among OECD countries, Germany (5.8%) and the United States (5.4%) show stable replacement demand and high penetration of built-in kitchen systems.

China, at 5.3%, reflects maturing demand with a shift toward smart features and IoT-enabled ventilation products.

This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

United States cooker hood sales are forecast to grow at a 5.4% CAGR, supported by residential kitchen remodeling and rising demand for energy-efficient smart appliances. YoY growth in ductless hood installations was 17% in 2024, driven by high-rise apartments and rental units.

Touchless controls and smart connectivity features expanded 2.2× YoY in premium kitchen setups. Builder-grade replacements remain steady, but the shift toward mid-range and customizable stainless steel models is gaining traction in suburban households. Home improvement retailers are reporting double-digit sales increases in combo bundles with cooktops.

Growing at a 5.3% CAGR, China’s cooker hood market is adapting to urban housing formats, with compact, high-suction models leading volume gains. Wall-mounted hoods under 800mm rose 28% YoY in 2024, particularly among young couples and renters.

AI-powered odor sensors and app-controlled models saw 32% YoY growth on Tier 1 e-commerce platforms. Local brands dominate with 71% market share, though imported luxury models are gaining visibility via livestream channels. Retrofit demand continues in older apartment blocks, aided by provincial subsidies for clean cooking upgrades.

India’s cooker hood market is expanding at a 7.1% CAGR, fueled by rising disposable incomes, real estate growth, and aspirational home improvements. Year-over-year growth of island chimney sales was 45% in metro cities, led by kitchen island adoption in new constructions.

Baffle filter models saw 38% YoY growth due to better suitability for Indian cooking styles. Online marketplaces posted a 2.6× YoY jump in demand from Tier 2 and Tier 3 cities, driven by financing schemes and influencer-led video demos. Builders are increasingly including hoods in premium home packages.

Germany is seeing a 5.8% CAGR in cooker hood demand, led by integrated, minimalist designs and regulatory standards for energy efficiency. Downdraft extractor sales grew 22% YoY, especially in open-plan kitchens where seamless aesthetics matter.

Silence-rated hoods with under-50 dB performance saw a 31% YoY increase across mid to premium builds. In-built carbon filter variants gained 27% YoY, meeting EU guidelines for indoor air quality. German consumers continue to prefer high-precision venting aligned with kitchen cabinetry, and domestic manufacturers are strengthening export-focused smart models.

United Kingdom is registering a strong 7.8% CAGR, driven by design-led renovations, space-saving appliances, and higher aesthetic value in modern kitchens. Slimline and angled hoods saw a 3.2× YoY sales increase in 2024, especially in renovated city flats.

Smart hoods with gesture controls expanded 44% YoY, integrated into IoT-based home ecosystems. Retailers report that recirculating models now comprise 62% of online purchases, highlighting retrofitting as a key market driver. Interior designers are increasingly selecting hood models with color and finish customization, pushing growth in premium design SKUs.

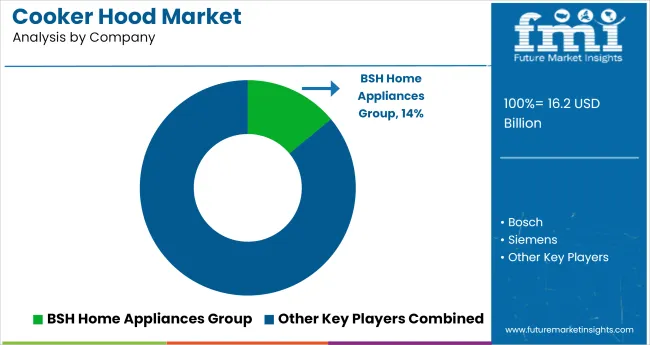

Leading Company - BSH Home Appliances Group

Market Share - 14%

The cooker hood market is defined by a tiered competitive structure based on technological sophistication, design innovation, and regional penetration. Tier 1 players such as BSH Home Appliances Group (Bosch, Siemens) and Elica S.p.A. lead through advanced filtration technologies, energy-efficient systems, and premium aesthetics tailored for modern kitchens.

Tier 2 companies including Falmec, Hafele, and Luxair focus on mid-to-high-end segments with a strong emphasis on silent operation, smart control integration, and modular designs. Tier 3 manufacturers like Inflame Appliances, Westin, and Eico A/S serve localized markets with cost-effective models, balancing performance with affordability. Product differentiation increasingly relies on smart ventilation, noise reduction, and compliance with energy and air quality regulations.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 16.2 billion |

| Projected Market Size (2035) | USD 30.1 billion |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand units for volume |

| Product Types Analyzed | Chimney/Wall-Mounted Cooker Hoods, Integrated Cooker Hoods, Downdraft Cooker Hoods |

| Technologies Analyzed | Extraction Technology, Filterless Technology |

| Applications Analyzed | Residential, Commercial |

| Sales Channels Analyzed | Modern Trade, Multi-Brand Stores, Exclusive Stores, Online Stores, Independent Stores, Others |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Key Players Influencing the Market | BSH Home Appliances Group, Bosch, Siemens, Luxair Limited, Inflame Appliances Ltd, Hafele Appliances, Falmec Kitchen Appliance Limited, Westin, Elica S.p.A., Eico A/S |

| Additional Attributes | Dollar by sales, share by product type and sales channel, growing demand for energy-efficient and smart kitchen appliances, rising residential kitchen renovations, online retail penetration, consumer preference for low-noise and high-suction systems, and strong demand across emerging economies. |

Based on product type, the industry is divided into chimney/wall-mounted cooker hoods, integrated cooker hoods, and downdraft cooker hoods.

By technology, the industry is bifurcated into extraction and filterless technology.

Different applications of range hoods include residential and commercial.

Various sales channels of range hoods consist of modern trade, multi-brand stores, exclusive stores, online stores, independent stores, and others.

Industry growth is examined in key countries of North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

The global cooker hood market is estimated to be valued at USD 16.2 billion in 2025.

The market size for the cooker hood market is projected to reach USD 30.1 billion by 2035.

The cooker hood market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in cooker hood market are chimney/wall-mounted cooker hoods, integrated cooker hoods and downdraft cooker hoods.

In terms of technology, extraction segment to command 58.9% share in the cooker hood market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Slow Cooker and Sous Vide Market Analysis – Trends, Growth & Forecast 2025 to 2035

Range Cookers Market Size and Share Forecast Outlook 2025 to 2035

Pressure Cookers Market

Commercial Cookers Market Size and Share Forecast Outlook 2025 to 2035

Electric Rice Cooker Market

Commercial Hot Dog Cooker Market Size and Share Forecast Outlook 2025 to 2035

Fume Hoods Market Size and Share Forecast Outlook 2025 to 2035

Wire Hoods Market

Kitchen Hood System Market Size and Share Forecast Outlook 2025 to 2035

Stretch Hood Films Market Analysis by Up to 50 microns, 50-100 microns, 100-150 microns, 150 microns & above Through 2035

Kitchen Hood Market Insights – Trends & Growth Forecast 2025 to 2035

Exhaust Hood Filters & Cleaning Kits Market – Market Innovations & Industry Growth 2025 to 2035

Stretch Hood Pallet Wrapping Market

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA