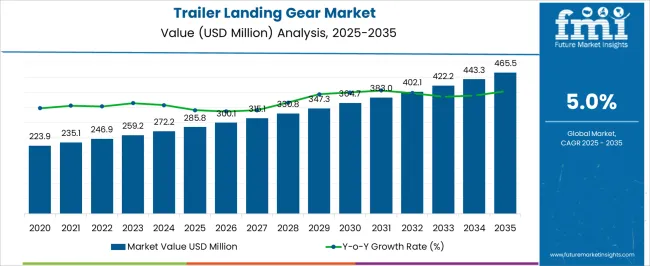

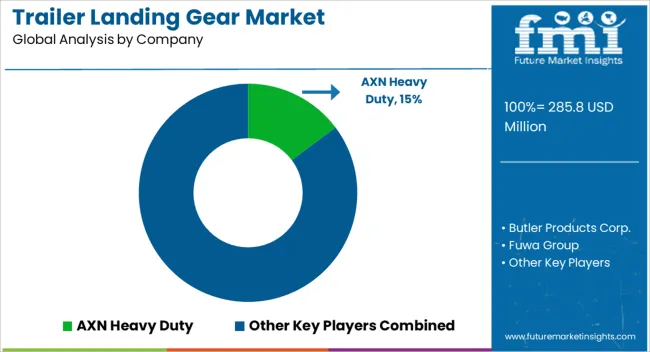

The Trailer Landing Gear Market is estimated to be valued at USD 285.8 million in 2025 and is projected to reach USD 465.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The trailer landing gear market is projected to reach USD 285.8 million in 2025 and grow to USD 465.5 million by 2035, exhibiting a CAGR of 5.0%. From 2021 to 2025, the market will experience steady incremental growth, with values increasing from USD 223.9 million in 2021 to USD 285.8 million by 2025. This steady growth is indicative of ongoing demand driven by the expansion of the transportation and logistics industries, with the increasing need for robust and reliable landing gear systems in trailers. Between 2021 and 2025, the market demonstrates a consistent upward trend, moving from USD 223.9 million in 2021 to USD 235.1 million in 2022, USD 246.9 million in 2023, USD 259.2 million in 2024. This reflects a half-decade weighted growth driven by factors such as increased freight transportation, regulatory demands for safer equipment, and innovations in product durability. By 2030, the market will have further expanded to USD 364.7 million, with the increasing adoption of higher-quality landing gear systems designed for heavier loads and more demanding environments. By 2035, the market will reach its projected value of USD 465.5 million, highlighting consistent growth in both global demand and technological advancements in landing gear design, particularly in the commercial trailer and transportation sectors.

| Metric | Value |

|---|---|

| Trailer Landing Gear Market Estimated Value in (2025 E) | USD 285.8 million |

| Trailer Landing Gear Market Forecast Value in (2035 F) | USD 465.5 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The trailer landing gear market is experiencing steady growth, driven by rising global freight transportation demand, expanding logistics networks, and increasing trailer production. Growth is further supported by the ongoing modernization of trailer fleets, where manufacturers are focusing on safety, efficiency, and durability enhancements. Adoption is being influenced by technological improvements in gear design, weight optimization, and corrosion-resistant materials, which extend product life cycles and reduce maintenance requirements.

The push for higher operational efficiency in transportation is leading to increased integration of landing gear systems that provide better stability and easier handling during loading and unloading operations. Infrastructure investments in road transport, coupled with a growing emphasis on load safety standards, are strengthening market adoption.

Additionally, the increasing use of heavy-duty trailers in sectors such as construction, manufacturing, and e-commerce is driving replacement demand for reliable landing gear solutions As regulations evolve to prioritize equipment safety and operational reliability, the trailer landing gear market is expected to sustain strong demand across OEM and aftermarket channels globally.

The trailer landing gear market is segmented by type, sales channel, lifting capacity, and geographic regions. By type, trailer landing gear market is divided into Manual and Automatic. In terms of sales channel, trailer landing gear market is classified into OEM and Aftermarket. Based on lifting capacity, trailer landing gear market is segmented into 20,000 lbs. to 50,000 lbs., Less than 20,000 lbs., and Above 50,000 lbs.. Regionally, the trailer landing gear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

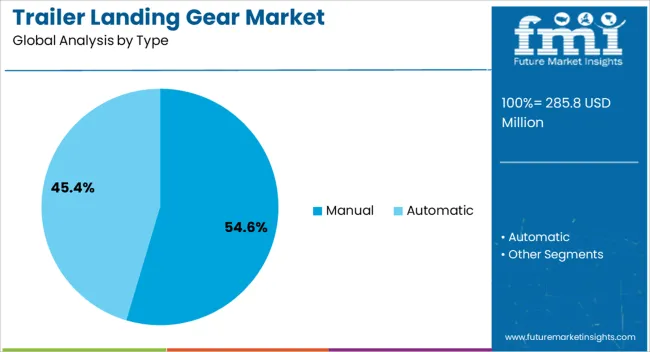

The manual type segment is projected to hold 54.6% of the trailer landing gear market revenue share in 2025, establishing it as the leading type category. Its dominance is being supported by cost-effectiveness, ease of operation, and minimal maintenance requirements, making it the preferred choice for a wide range of trailer applications. Manual landing gear systems are valued for their mechanical simplicity, durability, and capability to function without dependence on external power sources, which is critical in remote or high-utilization conditions.

Their proven reliability in heavy-duty and long-haul operations has reinforced their widespread adoption among fleet operators. The segment is also benefiting from global demand for budget-friendly solutions that maintain operational efficiency while meeting safety standards.

Manufacturers are improving manual landing gear designs through the use of lightweight yet strong materials, enhancing ergonomics, and optimizing gear ratios to reduce operator effort As these systems continue to offer dependable performance with lower total ownership costs, the manual type segment is expected to maintain its leadership position.

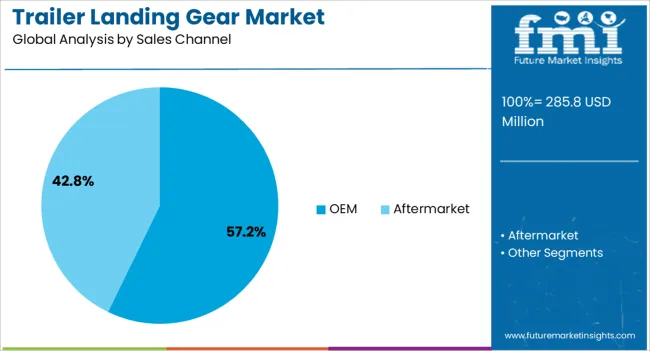

The OEM sales channel segment is expected to account for 57.2% of the trailer landing gear market revenue share in 2025, making it the dominant distribution channel. This leadership is being driven by the steady increase in new trailer production and the integration of landing gear systems directly at the manufacturing stage. OEM-installed landing gear offers the advantage of factory-quality installation, ensuring optimal fit and performance, which reduces operational risks and warranty claims for end users.

The segment is benefiting from close collaborations between trailer manufacturers and landing gear suppliers, leading to the development of customized solutions tailored to specific trailer designs and operational requirements. Rising demand for high-specification trailers in the logistics, construction, and industrial sectors is further supporting OEM growth.

Additionally, OEM channels ensure compliance with regional safety regulations and provide customers with reliable, ready-to-use solutions upon delivery With global trailer production projected to grow steadily, OEM sales are expected to remain the preferred channel for equipping trailers with advanced landing gear systems.

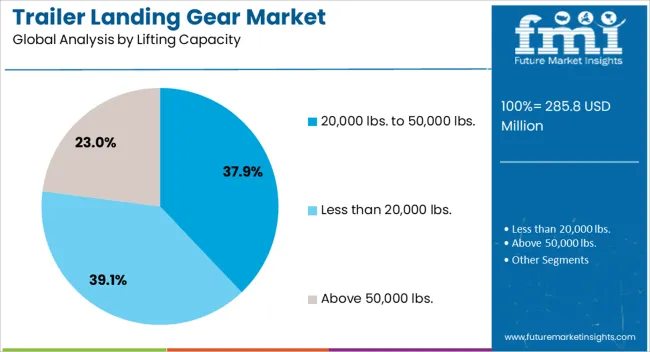

The 20,000 lbs. to 50,000 lbs. lifting capacity segment is projected to represent 37.9% of the trailer landing gear market revenue share in 2025, making it the leading capacity category. This dominance is being driven by its suitability for a wide range of medium to heavy-duty trailers, balancing robust load support with manageable operational requirements.

The segment is benefiting from increased demand for versatile landing gear that can handle varying cargo weights while ensuring stability and safety during stationary loading and unloading. Manufacturers are enhancing designs in this category by incorporating high-strength alloys, precision-engineered gears, and protective coatings to extend service life and performance in harsh operating environments. This capacity range is particularly valued in freight, construction, and industrial logistics due to its adaptability across multiple trailer types. Its compatibility with both manual and powered gear systems also broadens market adoption.

As transportation networks expand and heavy-duty hauling requirements increase, the 20,000 lbs to 50,000 lbs capacity segment is expected to maintain its leading position in the global market.

The trailer landing gear market is experiencing steady growth, driven by the increasing demand for efficient and reliable transportation solutions. Trailer landing gears play a crucial role in providing stability and support to trailers when they are detached from the tractor unit. The market is characterized by advancements in technology, leading to the development of automated and electric landing gear systems that enhance operational efficiency and safety. The growing emphasis on fuel efficiency and lightweight components is influencing the design and manufacturing of landing gear systems. The Asia Pacific region is witnessing significant growth in the trailer landing gear market due to rapid industrialization and the expansion of logistics networks.

One of the primary concerns is the high initial investment required for advanced landing gear systems, which may deter small and medium-sized enterprises from upgrading their equipment. Additionally, the complexity of integrating new landing gear systems into existing trailer designs can pose technical challenges. The maintenance and repair of advanced landing gear systems also require specialized knowledge and training, leading to increased operational costs. Furthermore, fluctuations in raw material prices can impact the production costs of landing gear components, affecting overall profitability. Addressing these challenges requires continuous innovation, cost optimization, and workforce development to ensure the sustainable growth of the market.

The growth of the trailer landing gear market is primarily driven by the increasing demand for efficient logistics and transportation solutions. The expansion of e-commerce and global trade activities has led to a surge in the need for trailers equipped with reliable landing gear systems to facilitate the movement of goods. Advancements in technology have also played a significant role, with the development of automated and electric landing gear systems that enhance operational efficiency and reduce manual labor. The growing emphasis on safety and regulatory compliance in the transportation industry further propels the adoption of advanced landing gear systems. Additionally, the rising focus on fuel efficiency and lightweight components is influencing the design and manufacturing of landing gear systems, contributing to market growth.

The trailer landing gear market presents numerous opportunities for innovation and expansion. The development of lightweight and durable materials for landing gear components can enhance the performance and efficiency of trailers. The integration of smart technologies, such as IoT-enabled sensors and predictive maintenance systems, offers opportunities to improve the reliability and lifespan of landing gear systems. Furthermore, the growing trend towards automation in the transportation industry creates demand for advanced landing gear systems that can operate autonomously, reducing the need for manual intervention. Expanding into emerging markets with developing infrastructure and logistics networks presents significant growth opportunities for manufacturers of trailer landing gear systems.

Several key trends are shaping the future of the trailer landing gear market. The increasing adoption of automated and electric landing gear systems is transforming the global market, driven by the need for better operator safety and efficiency. These systems significantly reduce the manual effort needed to detach and park trailers, thereby reducing operator fatigue and the chance of workplace injuries. They also offer reliable performance and contribute to fuel efficiency by reducing idle times during loading and unloading. Additionally, the development of lightweight materials and energy-efficient systems is a key area of focus for manufacturers seeking to gain a competitive edge. These trends indicate a shift towards more intelligent, efficient, and adaptable trailer landing gear systems in the coming years.

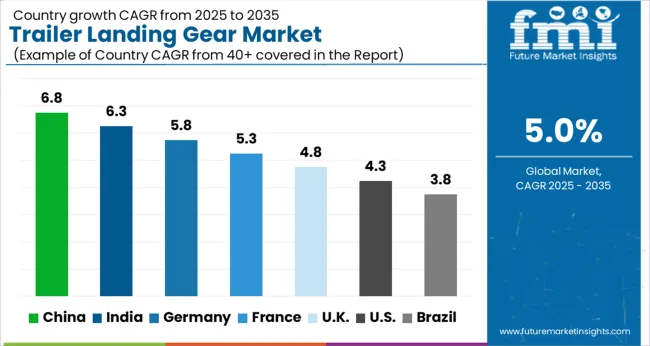

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global trailer landing gear market is projected to grow at a CAGR of 5.0% from 2025 to 2035. China leads with a growth rate of 6.8%, followed by India at 6.3%, and Germany at 5.8%. The United Kingdom and the United States show more moderate growth rates of 4.8% and 4.3%, respectively. The market growth is driven by increasing demand in logistics, transportation, and construction industries, fueled by urbanization, e-commerce, and infrastructure development. As regions invest in advanced logistics technologies and durable trailer solutions, the market for trailer landing gears continues to expand. The analysis spans over 40+ countries, with the leading markets shown below.

China is expected to lead the trailer landing gear market, expanding at a CAGR of 6.8% from 2025 to 2035. The growing demand for logistics, transportation, and construction equipment is a major factor driving the market’s growth. With a large-scale manufacturing base, China’s domestic production of trailer components, including landing gears, ensures the market remains competitive and cost-effective. The country’s vast infrastructure projects and the need for improved freight solutions to support e-commerce growth further boost demand. Rising urbanization and expanding commercial transportation systems are key contributors to this growth, with increasing investment in advanced logistics technologies.

The trailer landing gear market in India is projected to expand at a CAGR of 6.3% from 2025 to 2035. The demand for trailer components is closely linked to India’s booming transportation and logistics industries. Rapid infrastructure growth, driven by government initiatives, and the increasing manufacturing base are central to the growth of the market. With urbanization and rising consumer demand, especially for heavy-duty transport solutions, the need for durable and efficient landing gears is on the rise. Furthermore, India’s focus on enhancing transportation networks and integrating more advanced technologies into the sector supports the market's expansion.

Germany is projected to grow at a CAGR of 5.8% from 2025 to 2035, driven by its status as Europe’s transportation hub. The German market benefits from the country's advanced logistics, automotive, and manufacturing sectors, which place a high premium on quality and precision in trailer components. The demand for trailer landing gears is further fueled by Germany’s strong industrial production, with focus on reliability and performance. As e-commerce logistics and the need for efficient long-haul transportation continue to increase, demand for advanced trailer landing gear systems is expected to grow. Green initiatives and innovations in eco-friendly transportation systems are creating new opportunities.

The trailer landing gear market in the United Kingdom is anticipated to grow at a CAGR of 4.8% from 2025 to 2035. The demand for trailer landing gears in the UK is largely driven by the expansion of the country’s logistics and transportation sectors. As the UK continues to develop its infrastructure and improve transportation networks, the need for durable trailer components increases. The growing interest in premium trailer systems, supported by advancements in manufacturing and technology, has contributed to market expansion. The rise in online retail and the increasing demand for more efficient, long-lasting freight solutions further fuel market growth.

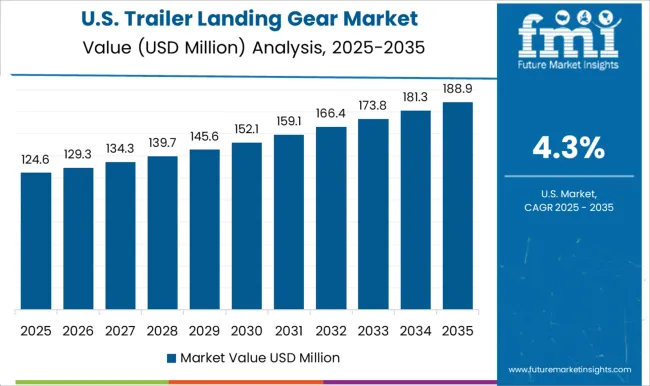

The USA trailer landing gear market is projected to expand at a CAGR of 4.3% from 2025 to 2035. The market growth is primarily driven by the increasing demand for freight solutions, particularly with the rise in e-commerce and logistics activities. Demand for durable, high-quality trailer components is on the rise, driven by the USA focus on long-haul transportation systems. The growing trend toward specialty trailers and custom-made freight solutions also contributes to this demand. Investments in environmentally-friendly and energy-efficient trailer systems are expected to drive further growth, aligning with broader goals.

The trailer landing gear market is driven by the need for enhanced load handling and operational safety in the transportation and logistics sectors. Leading players in this market include AXN Heavy Duty, Butler Products Corp., Fuwa Group, BPW Bergische Achsen KG, H.D. Trailers Pvt. Ltd., haacon, JOST Werke AG, SAF-HOLLAND, Sinotruck Howo Sales Co., Ltd., Yangzhou Tongyi Machinery Co., Ltd., and Zhenjiang Baohua Semi-Trailer Parts Co., Ltd..

AXN Heavy Duty is recognized for its durable landing gear systems designed for heavy-duty trailers, while Butler Products Corp. offers specialized landing gear solutions for commercial trailers, focusing on ease of use and reliability. Fuwa Group provides a wide range of trailer components, including landing gears, emphasizing innovative design and performance. BPW Bergische Achsen KG is known for its high-quality landing gears integrated with its advanced axle technology, catering to European and global markets.

JOST Werke AG and SAF-HOLLAND are prominent players offering robust, easy-to-maintain trailer landing gear systems that ensure stable support for trailers. Sinotruck Howo Sales Co., Ltd. and Yangzhou Tongyi Machinery Co., Ltd. focus on providing cost-effective and efficient landing gear solutions suitable for the Asian markets. Zhenjiang Baohua Semi-Trailer Parts Co., Ltd. offers a wide array of trailer landing gear models, catering to both domestic and international demand.

These players differentiate themselves through product innovation, quality, and tailored solutions that meet the specific needs of diverse global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 285.8 Million |

| Type | Manual and Automatic |

| Sales Channel | OEM and Aftermarket |

| Lifting Capacity | 20,000 lbs. to 50,000 lbs., Less than 20,000 lbs., and Above 50,000 lbs. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AXN Heavy Duty, Butler Products Corp., Fuwa Group, BPW Bergische Achsen KG, H.D. Trailers Pvt. Ltd., haacon, JOST Werke AG, SAF-HOLLAND, Sinotruck Howo Sales Co., Ltd., Yangzhou Tongyi Machinery Co., Ltd., and Zhenjiang Baohua Semi-Trailer Parts Co., Ltd. |

| Additional Attributes | Dollar sales by product type, with manual and automatic landing gears catering to different customer preferences and operational needs. Load capacity varies across light, medium, and heavy-duty options, with demand for heavy-duty models increasing due to their ability to handle larger trailers and heavier loads. Material types such as steel and aluminum play a crucial role in determining the durability and weight of the landing gear, with steel offering enhanced strength and aluminum providing lightweight alternatives. Regional trends indicate significant demand in North America and Europe, driven by the expansion of the logistics industry and the increasing need for durable, efficient trailer components to support heavy transportation operations. |

The global trailer landing gear market is estimated to be valued at USD 285.8 million in 2025.

The market size for the trailer landing gear market is projected to reach USD 465.5 million by 2035.

The trailer landing gear market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in trailer landing gear market are manual and automatic.

In terms of sales channel, oem segment to command 57.2% share in the trailer landing gear market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trailer & Cargo Container Tracking Market Size and Share Forecast Outlook 2025 to 2035

Trailer Surge Brake Market Growth - Trends & Forecast 2024 to 2034

Trailer Assist System Market

Trailer Stabilizer Market

Trailer Spindles Market

Boat Trailers Market Size and Share Forecast Outlook 2025 to 2035

Semi-Trailer Market Size and Share Forecast Outlook 2025 to 2035

Roll Trailer Market Growth – Trends & Forecast 2025 to 2035

Travel Trailer Market Size and Share Forecast Outlook 2025 to 2035

Modular Trailer Market Forecast and Outlook 2025 to 2035

Kitchen Trailers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hooklift Trailer Market Size and Share Forecast Outlook 2025 to 2035

Livestock Trailer Market Size and Share Forecast Outlook 2025 to 2035

Automotive Trailer Drawbar Market Growth – Trends & Forecast 2024-2034

Japan Boat Trailer Market Growth – Trends & Forecast 2024-2034

Korea Boat Trailer Market Growth – Trends & Forecast 2024-2034

Snowmobile Trailer Axle Market

Refrigerated Trailer Market Size and Share Forecast Outlook 2025 to 2035

Self loading Trailer Market

North America Boat Trailer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA