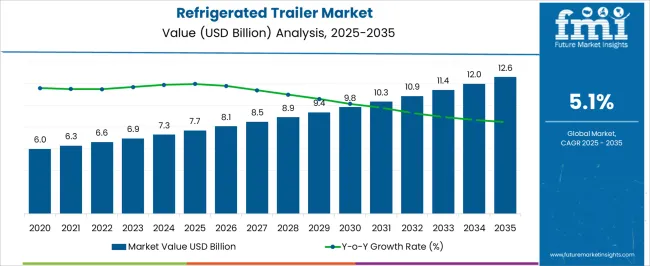

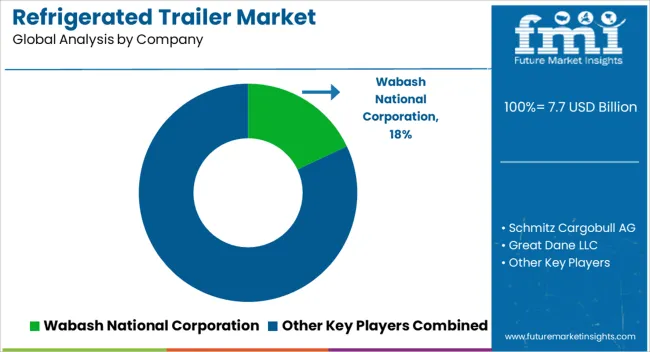

The refrigerated trailer market is estimated to be valued at USD 7.7 billion in 2025 and is projected to reach USD 12.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

From 2020 to 2024, the market increased from USD 6.0 billion to USD 7.3 billion, supported by rising demand for cold-chain logistics in pharmaceuticals, dairy, and fresh produce distribution. Annual increments such as USD 6.3 billion in 2021, USD 6.6 billion in 2022, USD 6.9 billion in 2023, and USD 7.3 billion in 2024 highlight steady growth, reflecting the growing importance of temperature-controlled transport in ensuring food safety and medicine efficacy. Between 2025 and 2030, the market progresses from USD 7.6 billion to USD 9.8 billion, contributing nearly 44% of the absolute dollar opportunity. This phase is driven by e-commerce expansion in grocery delivery, the adoption of energy-efficient refrigeration technologies, and fleet upgrades across developed economies.

Key annual milestones such as USD 8.1 billion in 2026, USD 8.9 billion in 2029, and USD 9.4 billion in 2030 demonstrate consistent gains. Between 2031 and 2035, the market rises from USD 10.3 billion to USD 12.6 billion, delivering the remaining 56% of the dollar opportunity, as developing regions strengthen cold-chain infrastructure and adopt smart refrigerated trailers integrated with telematics and IoT solutions. Increasing global trade in perishable commodities and stricter food safety regulations further accelerate adoption. Overall, the absolute dollar opportunity of USD 5.0 billion highlights the sector’s transformation, underpinned by lifestyle-driven demand for fresh and frozen goods, regulatory compliance, and technological innovation in temperature-controlled logistics.

| Metric | Value |

|---|---|

| Refrigerated Trailer Market Estimated Value in (2025 E) | USD 7.7 billion |

| Refrigerated Trailer Market Forecast Value in (2035 F) | USD 12.6 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The refrigerated trailer market holds a significant position within the global logistics and cold chain ecosystem, contributing nearly 12–14% of the overall refrigerated transport segment, where refrigerated trucks and containers dominate larger volumes. Within the broader commercial trailer industry, refrigerated trailers account for around 8–9%, driven by their necessity in moving perishable goods across long-haul and regional routes. In the food and beverage cold storage logistics category, their share is estimated at 15–17%, supported by rising demand for safe transportation of dairy, frozen foods, seafood, and meat products. Within the pharmaceutical cold chain, refrigerated trailers represent approximately 6–7%, providing a critical link for vaccines, biologics, and temperature-sensitive drugs across regional supply networks.

The agriculture and horticulture produce logistics sector accounts for nearly 10–12%, where refrigerated trailers are essential for extending shelf life and reducing spoilage of fruits and vegetables. Growth has been shaped by rising international trade in perishables, supermarket distribution expansion, and e-commerce penetration in frozen and fresh grocery delivery. Although competition from reefer containers is strong, refrigerated trailers remain indispensable for regional and cross-border transport efficiency. Manufacturers are focusing on enhancing insulation, fuel efficiency, and telematics integration, which strengthens their adoption across industries. Despite challenges from high operating costs and maintenance requirements, refrigerated trailers have secured a firm role in the global transport chain, with increasing importance in both developed and emerging economies.

The market is experiencing sustained growth driven by the rising demand for efficient cold chain logistics across various industries. The increasing need to maintain product integrity during transportation has prompted significant investments in advanced temperature control technologies. Growth is being further supported by regulatory requirements for the safe handling of perishable goods and the expansion of global trade in temperature-sensitive products.

Technological advancements such as telematics integration, real-time temperature monitoring, and energy-efficient refrigeration systems are enhancing operational efficiency and reliability. The market is also benefiting from the growing adoption of sustainable solutions, including lightweight materials and alternative refrigerants, to reduce carbon emissions.

As consumer demand for fresh and frozen goods continues to rise, particularly in emerging economies, manufacturers are focusing on product innovation and fleet expansion These trends, combined with evolving logistics infrastructure and increased urbanization, are expected to reinforce the market’s upward trajectory in the coming years.

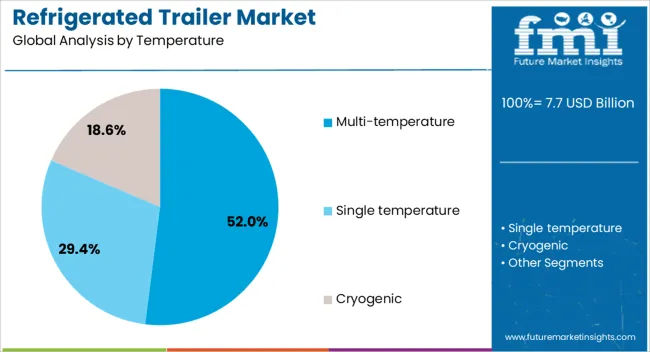

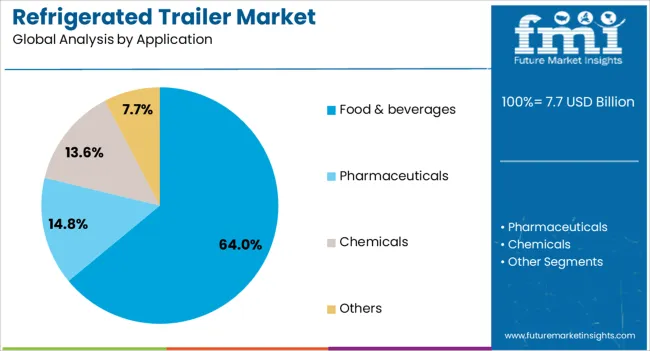

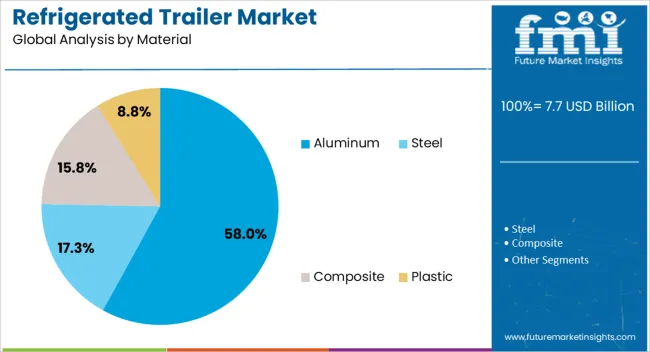

The refrigerated trailer market is segmented by temperature, application, material, end use, and geographic regions. By temperature, refrigerated trailer market is divided into multi-temperature, single temperature, and cryogenic. In terms of application, refrigerated trailer market is classified into food & beverages, pharmaceuticals, chemicals, and others. Based on material, refrigerated trailer market is segmented into aluminum, steel, composite, and plastic. By end use, refrigerated trailer market is segmented into transportation, storage, and distribution. Regionally, the refrigerated trailer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The multi temperature segment is projected to hold 52% of the refrigerated trailer market revenue share in 2025, making it the leading category under the temperature segment. This leadership is attributed to the growing demand for transporting diverse goods that require separate temperature zones within a single trailer. The flexibility offered by multi temperature systems allows operators to handle mixed loads efficiently, improving logistical efficiency and reducing operational costs. The ability to cater to multiple clients or product categories simultaneously has enhanced its adoption in large-scale distribution networks. Integration with advanced control systems enables precise temperature management for each compartment, ensuring compliance with stringent quality standards. Businesses involved in perishable goods transportation have increasingly relied on these trailers to optimize delivery schedules while maintaining product integrity As supply chains continue to expand globally, the preference for multi temperature configurations is expected to strengthen, consolidating its position as the preferred choice in the refrigerated trailer market.

The food and beverages segment is expected to account for 64% of the market revenue share in 2025, securing its position as the dominant application category. This growth is being driven by the rising consumption of perishable products such as fresh produce, dairy, frozen foods, and beverages, which require strict temperature control throughout the supply chain. Increasing consumer expectations for product freshness and safety have pushed companies to invest in reliable refrigerated transport solutions. The segment has also benefited from the expansion of modern retail channels, food service operations, and cross-border trade of temperature-sensitive products. Regulatory frameworks mandating proper handling and storage of food items have further stimulated demand for specialized trailers in this sector. Technological enhancements in refrigeration systems and real-time monitoring tools have helped ensure compliance with these standards, making refrigerated trailers an indispensable asset for the food and beverage industry This sustained reliance reinforces its leading role in the market.

The aluminum segment is projected to command 58% of the market revenue share in 2025, emerging as the leading material choice. This dominance has been supported by aluminum’s lightweight yet durable properties, which contribute to improved fuel efficiency and higher payload capacity. The material’s corrosion resistance and long service life reduce maintenance requirements, providing cost advantages for fleet operators. Its ability to withstand varying environmental conditions while maintaining structural integrity has increased its adoption across diverse geographies. The use of aluminum also aligns with the industry’s shift toward sustainability, as it is highly recyclable and supports eco-friendly manufacturing practices. Manufacturers have leveraged aluminum to design trailers that balance strength, weight, and thermal efficiency, further enhancing operational performance As transportation companies prioritize efficiency, durability, and environmental responsibility, aluminum is anticipated to maintain its stronghold as the preferred material in refrigerated trailer manufacturing.

The refrigerated trailer market is gaining strength from expanding cold chain logistics and retail distribution. High costs and operational barriers remain, but steady demand across food and pharmaceuticals ensures future growth.

The refrigerated trailer market is expanding as demand for reliable cold chain solutions intensifies across food, pharmaceutical, and agricultural sectors. Global food trade, supermarket distribution, and cross-border exports require temperature-controlled transport to reduce spoilage and maintain product quality. Dairy, seafood, meat, and frozen foods are driving consistent adoption, with retailers and logistics providers expanding their fleets to meet rising consumer expectations. Pharmaceuticals, especially vaccines and biologics, add another critical layer of demand. The essential role of refrigerated trailers as a backbone in modern supply chains ensures that operators continue to invest despite high costs. This dependence highlights their position as an indispensable asset in cold chain infrastructure across developed and emerging economies.

Opportunities for refrigerated trailers have grown as e-commerce and retail grocery chains expand their delivery reach. Online platforms offering frozen and fresh groceries rely heavily on reliable last-mile and regional cold transport. Supermarkets are also strengthening their distribution centers, pushing logistics providers to increase fleet capacity. Growth in meal kit deliveries and frozen convenience foods has further widened the application base. This shift creates opportunities for manufacturers to develop flexible trailers with efficient cooling systems that cater to short-haul and long-haul requirements. The expansion of retail networks and consumer preference for fresh and frozen categories are opening new avenues for refrigerated trailer adoption, strengthening their long-term commercial relevance.

Competition in the refrigerated trailer industry is shaped by innovation in insulation, cooling efficiency, and integration of telematics for monitoring temperature and performance. Global manufacturers compete by offering solutions that improve fuel efficiency and reduce downtime, while regional players differentiate through affordability and customization. Partnerships with fleet operators, leasing companies, and logistics service providers enhance market penetration. Differentiation is increasingly based on reliability, operational lifespan, and total cost of ownership. Larger firms with global networks maintain stronger positions, while niche companies serve regional markets with tailored solutions. This competitive balance ensures a wide variety of offerings, addressing diverse customer requirements across sectors relying on temperature-controlled logistics.

The refrigerated trailer market faces challenges including high operational costs, rising fuel expenses, and complex maintenance requirements. Smaller fleet operators often struggle with financing, as advanced trailers require higher upfront investments. Limited infrastructure in developing regions can also constrain adoption, reducing access to reliable cold storage and repair facilities. Environmental regulations around refrigerants and fuel efficiency add pressure on manufacturers and operators, demanding continuous adaptation. The requirement for skilled technicians to manage complex refrigeration systems further adds to operational costs. While growth remains steady, these barriers restrict broader market penetration and delay adoption among smaller logistics providers and regional transporters.

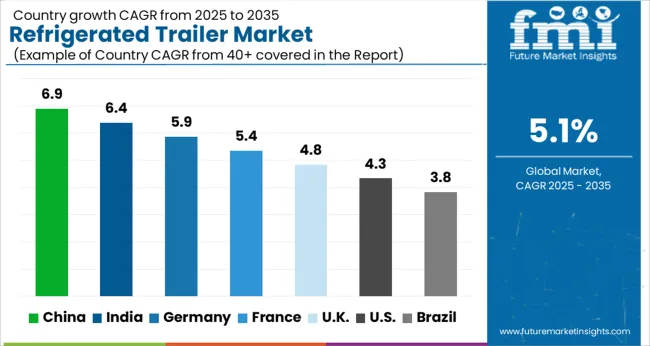

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The refrigerated trailer market is projected to grow globally at a CAGR of 5.1% from 2025 to 2035, driven by the rising need for temperature-controlled logistics across food, pharmaceuticals, and agriculture. China leads with a CAGR of 6.9%, supported by expanding cold chain infrastructure, rapid growth in frozen food consumption, and large-scale exports of perishables. India follows at 6.4%, with growth powered by government-backed cold storage initiatives, wider retail penetration, and rising e-commerce grocery distribution. France posts 5.4%, as the country emphasizes fresh produce exports and strong retail partnerships. The United Kingdom grows at 4.8%, with demand tied to retail chains and meal delivery services. The United States remains moderate at 4.3%, supported by food service logistics and pharmaceutical shipments but at a slower pace than Asia and Europe. This growth trajectory highlights Asia as the strongest momentum hub, while Europe ensures steady expansion through structured logistics, and North America records a measured but consistent progression.

The CAGR for the refrigerated trailer market in the United Kingdom was 4.1% during 2020–2024 and improved to 4.8% for the 2025–2035 period, indicating a steady but important progression. Earlier momentum was restricted by modest fleet modernization and higher operational costs, which limited wider penetration into small logistics operators. In the subsequent phase, stronger uptake was supported by growth in meal-kit delivery, supermarket-led frozen food logistics, and expanding pharmaceutical cold chain operations. Partnerships with large retailers and greater investment in advanced refrigeration systems further contributed to the upward shift. This gradual strengthening positions the United Kingdom as a mature but steadily advancing market in Europe.

China’s CAGR for the refrigerated trailer market stood at 6.2% during 2020–2024 and advanced to 6.9% for 2025–2035, strengthening its position as the top-performing region. Early growth was supported by government-backed investments in cold chain infrastructure and rising demand for frozen food products across urban centers. The following decade saw accelerated adoption due to export-oriented agriculture, e-commerce-led grocery distribution, and expanding pharmaceutical cold chain networks. Local manufacturers focused on cost-efficient trailer designs, which enabled rapid deployment across logistics providers. These developments reinforced China’s leadership as a high-growth hub, with its ability to scale refrigerated logistics at both regional and cross-border levels.

India recorded a 5.8% CAGR during 2020–2024 and progressed to 6.4% in the 2025–2035 period, highlighting stronger growth prospects. The earlier phase was shaped by limited cold chain infrastructure and uneven penetration across smaller cities, restricting fleet capacity. In the subsequent decade, momentum improved with government support for food security, expanding retail grocery chains, and pharmaceutical distribution. Large agribusiness exporters and e-commerce platforms also began deploying refrigerated trailers more widely, which added to steady adoption. Increasing partnerships with global cold chain service providers further accelerated fleet scaling, cementing India’s role as one of the fastest-growing refrigerated logistics markets in Asia.

The CAGR for the refrigerated trailer market in France was 4.7% during 2020–2024 and improved to 5.4% for 2025–2035, reflecting measured growth. Earlier gains were linked to strong exports of fresh produce and seafood, which formed the foundation for trailer adoption. In the next stage, demand broadened as supermarkets, processed food companies, and pharmaceutical firms scaled logistics requirements. France’s emphasis on food safety and export quality further encouraged investment in advanced refrigeration systems. Regional logistics operators also played a role in extending fleet size, ensuring wider distribution coverage. This balance of traditional agricultural exports and evolving retail cold chain demand supported steady CAGR improvement.

The CAGR for the refrigerated trailer market in the United States was 3.8% during 2020–2024 and rose to 4.3% for 2025–2035, showing a measured but consistent rise. Earlier growth was tempered by high operating costs and competition from reefer containers, restricting adoption among mid-sized operators. In the later period, demand was reinforced by retail food distribution, expansion of meal-kit services, and pharmaceutical cold chain programs. Investments in trailer telematics and more fuel-efficient refrigeration units also helped extend adoption across large logistics providers. While growth remains below Asia and Europe, the United States maintains a stable trajectory anchored by food service and healthcare logistics demand.

The refrigerated trailer market is shaped by a mix of global leaders and specialized regional manufacturers that emphasize capacity, durability, and efficiency in cold chain logistics. Wabash National Corporation remains a key player in North America, focusing on lightweight composite technologies and enhanced insulation performance to improve fleet efficiency. Schmitz Cargobull AG dominates Europe with advanced trailer refrigeration systems and integrated telematics for better fleet management. Great Dane LLC and Utility Trailer Manufacturing Company both hold strong positions in the USA, offering trailers designed for long-haul operations and demanding cold chain requirements. CIMC Vehicles Group Co., Ltd. leverages its extensive manufacturing network in China to deliver cost-competitive refrigerated trailers, extending its global reach. Hyundai Translead, Inc. contributes through innovation in trailer aerodynamics and structural strength, targeting North American logistics providers. Kögel Trailer GmbH & Co. KG and Lamberet SAS play vital roles in the European market, with Lamberet recognized for premium refrigerated transport solutions across food and pharmaceuticals.

Gray & Adams Ltd. strengthens its position in the UK and Ireland, focusing on customized trailers for regional logistics providers. Key strategies across the competitive landscape include integration of telematics, use of advanced insulation materials, and partnerships with logistics operators to expand market presence. Emphasis is placed on reducing operational costs, improving cooling efficiency, and meeting stricter regulatory requirements for temperature-controlled transport. The competitive field is expected to evolve further as manufacturers invest in new product designs, supply chain optimization, and collaborations with retailers and food distributors to capture long-term growth opportunities.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.7 billion |

| Temperature | Multi-temperature, Single temperature, and Cryogenic |

| Application | Food & beverages, Pharmaceuticals, Chemicals, and Others |

| Material | Aluminum, Steel, Composite, and Plastic |

| End Use | Transportation, Storage, and Distribution |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wabash National Corporation, Schmitz Cargobull AG, Great Dane LLC, Utility Trailer Manufacturing Company, CIMC Vehicles Group Co., Ltd., Hyundai Translead, Inc., Kögel Trailer GmbH & Co. KG, Lamberet SAS, and Gray & Adams Ltd. |

| Additional Attributes | Dollar sales, share, regional demand shifts, fleet replacement cycles, competitive benchmarking, pricing trends, fuel efficiency improvements, regulatory impact, and cold chain expansion opportunities. |

The global refrigerated trailer market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the refrigerated trailer market is projected to reach USD 12.6 billion by 2035.

The refrigerated trailer market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in refrigerated trailer market are multi-temperature, single temperature and cryogenic.

In terms of application, food & beverages segment to command 64.0% share in the refrigerated trailer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refrigerated Display Case Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Transport Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated / Frozen Dough Products Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Ice Cream Merchandise Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Vending Machine Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Refrigerated and Frozen Soup Market

Refrigerated Snacks Market Trends - Healthy & Fresh Innovations 2025 to 2035

Refrigerated Vans Market Growth - Trends & Forecast 2025 to 2035

Multi-Deck Refrigerated Display Cases Market Growth – Trends & Forecast 2025 to 2035

Trailer & Cargo Container Tracking Market Size and Share Forecast Outlook 2025 to 2035

Trailer Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Trailer Surge Brake Market Growth - Trends & Forecast 2024 to 2034

Trailer Assist System Market

Trailer Stabilizer Market

Trailer Spindles Market

Boat Trailers Market Size and Share Forecast Outlook 2025 to 2035

Semi-Trailer Market Size and Share Forecast Outlook 2025 to 2035

Roll Trailer Market Growth – Trends & Forecast 2025 to 2035

Travel Trailer Market Size and Share Forecast Outlook 2025 to 2035

Modular Trailer Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA