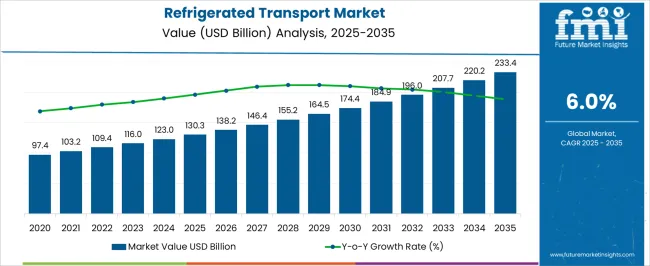

The refrigerated transport market, register at USD 130.3 billion in 2025 and projected to reach USD 233.4 billion by 2035, is expanding at a CAGR of 6.0%. Between 2020 and 2024, the market rises from USD 97.4 billion to USD 123.0 billion, reflecting steady growth driven by the surging need for temperature-controlled logistics across pharmaceuticals, fresh produce, and frozen food sectors. Yearly increments of USD 103.2 billion in 2021, USD 109.4 billion in 2022, and USD 116.0 billion in 2023 highlight consistent momentum, supported by e-commerce grocery demand and advancements in cold chain infrastructure. By 2025, the market reaches USD 130.3 billion, marking the start of the scaling phase. From 2026 to 2030, the market expands from USD 138.2 billion to USD 174.4 billion, contributing nearly 39% of the total projected increase. This period is characterized by higher adoption of fuel-efficient refrigeration units, hybrid cooling systems, and data-driven telematics to improve fleet performance and regulatory compliance. Growing global trade in perishable goods also strengthens mid-term expansion. Between 2031 and 2035, the market advances from USD 184.9 billion to USD 233.4 billion, adding nearly 38% of the overall growth. This stage reflects widespread integration of smart temperature monitoring, expansion of pharmaceutical cold chains, and rising demand for frozen ready-to-eat products. The refrigerated transport market demonstrates consistent and long-term growth, supported by global supply chain modernization, consumer preference for frozen and chilled goods, and continuous innovation in refrigeration technologies.

| Metric | Value |

|---|---|

| Refrigerated Transport Market Estimated Value in (2025 E) | USD 130.3 billion |

| Refrigerated Transport Market Forecast Value in (2035 F) | USD 233.4 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The refrigerated transport market holds a significant position within the broader cold chain logistics and temperature-controlled supply ecosystem, representing approximately 14–17% share of total freight and logistics operations. Within the global logistics and transportation sector, refrigerated transport accounts for around 20–23% share, driven by the rising need for temperature-sensitive cargo handling, including perishable foods, pharmaceuticals, and specialty chemicals. In the food and beverage industry, refrigerated transport contributes nearly 25–28% share, as cold storage vehicles ensure freshness, reduce spoilage, and comply with hygiene regulations across retail and distribution channels. The pharmaceutical and life sciences segment commands about 12–15% share, where controlled temperature logistics are critical for vaccine, biologic, and diagnostic supply chains. Growth is fueled by regulatory frameworks enforcing cold chain compliance, rising consumer demand for fresh and processed foods, and expanding e-commerce channels that rely on last-mile refrigerated delivery. Innovation in multi-temperature trailers, real-time monitoring systems, and energy-efficient cooling units enhances operational efficiency, fleet management, and reliability, reinforcing refrigerated transport as a vital link in global supply networks. Increasing international trade in perishable goods, coupled with investment in cold chain infrastructure in emerging economies, is expected to sustain long-term growth and market relevance.

The refrigerated transport market is undergoing rapid expansion, fueled by the surge in global food trade, growth in pharmaceutical cold chain requirements, and stricter safety regulations for temperature-sensitive goods. Rising consumer demand for fresh produce and frozen food, especially through e-commerce and quick commerce platforms, has intensified the need for reliable cold chain logistics.

Technological innovation in refrigeration systems, combined with fleet electrification and digital monitoring, is further enhancing operational efficiency. Emerging markets are adopting cold chain logistics at scale, while regulatory agencies are pushing for fuel efficiency and emissions compliance.

These converging factors are reinforcing long-term investments in refrigerated transport across road, rail, air, and sea logistics.

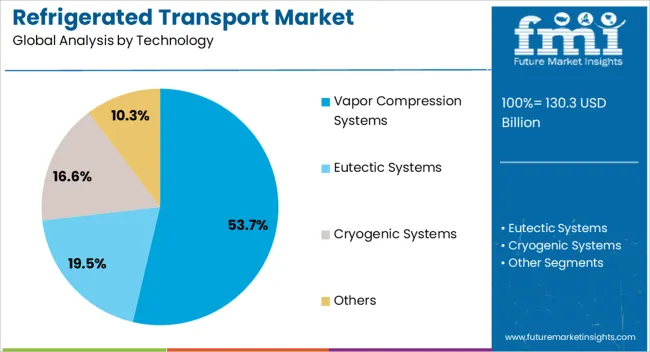

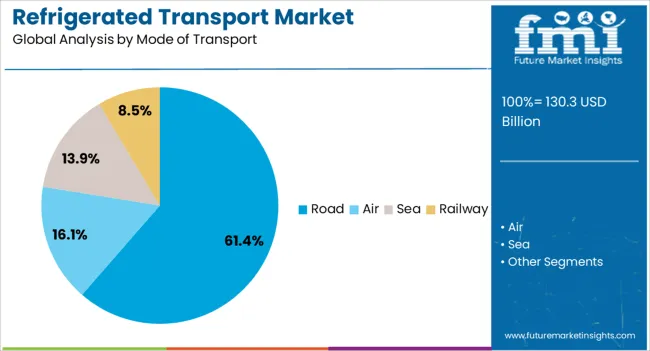

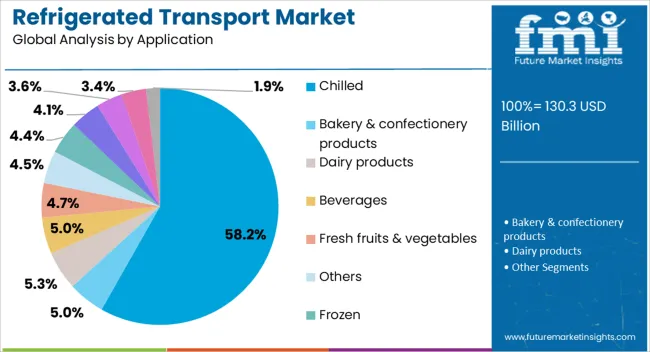

The refrigerated transport market is segmented by technology, mode of transport, application, temperature, and geographic regions. By technology, refrigerated transport market is divided into Vapor Compression Systems, Eutectic Systems, Cryogenic Systems, and Others. In terms of mode of transport, refrigerated transport market is classified into Road, Air, Sea, and Railway. Based on application, refrigerated transport market is segmented into Chilled, Bakery & confectionery products, Dairy products, Beverages, Fresh fruits & vegetables, Others, Frozen, Ice cream, Frozen bakery products, Meat-processed, and Others. By compartment configuration, the market is segmented into Multi-temperature and Single-temperature. Regionally, the refrigerated transport industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Vapor compression systems are projected to account for 53.7% of the technology segment in 2025, making them the dominant refrigeration method in the market. Their popularity stems from proven reliability, energy efficiency, and adaptability across various transport modes.

This system’s scalability and compatibility with both diesel and electric-powered fleets have made it a preferred choice among cold chain operators. Manufacturers are also integrating smart controls and eco-friendly refrigerants into vapor compression units to comply with global emissions mandates.

These enhancements are expected to drive continued dominance of this technology segment across both developed and emerging economies.

Road transport is expected to hold 61.4% share of the refrigerated transport market by 2025, emerging as the leading logistics mode. Its dominance is primarily due to last-mile delivery needs and flexible routing, which are vital for perishable goods such as fresh food, dairy, and pharmaceuticals.

The rise in refrigerated trucks, vans, and trailers catering to urban and intercity networks has reinforced road transport's critical role. Continued investment in highway infrastructure, growing use of insulated containers, and compliance with Good Distribution Practice (GDP) standards are further supporting this segment’s leadership.

As consumer expectations for fast and fresh delivery rise, road-based cold transport is set to remain at the forefront.

By temperature range, chilled (0–15 °C) is projected at 58.2% in 2025, leading over frozen (≤–18 °C). The growing demand for fresh fruits, vegetables, dairy, bakery, and certain pharmaceuticals that require chilling rather than freezing is driving this trend.

Chilled transport offers temperature consistency in the range of 0°C to 15°C, which is ideal for maintaining product integrity without freezing. Retailers and manufacturers are emphasizing shelf-life extension and quality preservation, particularly in fresh categories.

Additionally, stricter food safety regulations and the rising trend of health-conscious consumption are increasing chilled logistics demand, ensuring this application remains the market’s largest.

Refrigerated transport growth is driven by food, beverage, and pharmaceutical demand, fleet optimization, and expanding cold chain networks. Investments in temperature control, monitoring, and energy-efficient operations strengthen operational reliability and market relevance globally.

Refrigerated transport is increasingly critical for maintaining quality and safety in food and beverage logistics, accounting for significant share in global cold chain operations. Demand is driven by perishable product flows, including dairy, meat, seafood, frozen foods, and ready-to-eat items, where controlled temperature conditions prevent spoilage and extend shelf life. Retailers and distributors rely on refrigerated trucks, trailers, and vans for last-mile deliveries, while wholesalers prioritize multi-temperature transport solutions to manage diverse product categories. Adoption is supported by stringent food safety standards and traceability requirements that enforce temperature monitoring, ensuring compliance with regulatory frameworks. Expansion of e-commerce channels and direct-to-consumer cold delivery services further drives the need for reliable refrigerated fleets. Efficient load planning and real-time tracking improve operational performance, cost management, and service reliability.

Temperature-controlled transport is essential for pharmaceutical, biotechnology, and life sciences sectors, where cold chain integrity directly impacts product efficacy. Vaccines, biologics, diagnostic kits, and specialty drugs require precise temperature control during transit, storage, and distribution, representing a growing segment of refrigerated transport share. Companies increasingly invest in validated packaging, insulated containers, and GPS-enabled monitoring systems to ensure compliance with FDA, EMA, and WHO guidelines. Logistics providers are expanding specialized refrigerated fleets with modular temperature zones to handle simultaneous cold, frozen, and ambient products. Strategic partnerships with third-party logistics operators strengthen supply chain reach, while digital monitoring allows real-time alerts for deviations, enhancing accountability and reducing product loss. Controlled temperature documentation and certifications remain decisive for contract wins.

Refrigerated transport operators focus on optimizing fleet utilization, load capacity, and route efficiency to reduce operational costs while maintaining cargo quality. Investments in multi-compartment trailers, energy-efficient refrigeration units, and hybrid power solutions improve performance and reduce downtime. Fleet management software supports predictive maintenance, vehicle tracking, and fuel management, allowing operators to scale services in line with demand fluctuations. Cold chain operators prioritize modular systems for flexible temperature zones, supporting diverse cargo types in a single trip. Growing emphasis on energy-efficient refrigeration minimizes fuel consumption and carbon footprint, while advanced telematics and IoT-enabled devices provide insights for operational planning. Efficient scheduling ensures timely deliveries and reduces spoilage risk.

Global trade in temperature-sensitive products and rising consumption of perishable foods present opportunities for refrigerated transport growth across emerging and mature markets. Investments in refrigerated hubs, cold storage facilities, and last-mile delivery networks are expanding reach and improving service reliability. E-commerce penetration in fresh and frozen foods has driven the adoption of smaller, agile refrigerated vehicles for urban deliveries. Strategic expansions into under-served regions, coupled with public-private infrastructure projects, are enhancing network coverage. Regulatory frameworks in international trade enforce temperature compliance, boosting demand for certified logistics solutions. Operators are leveraging integrated cold chain solutions to offer end-to-end visibility, ensure product integrity, and reduce losses across long-haul, regional, and urban distribution.

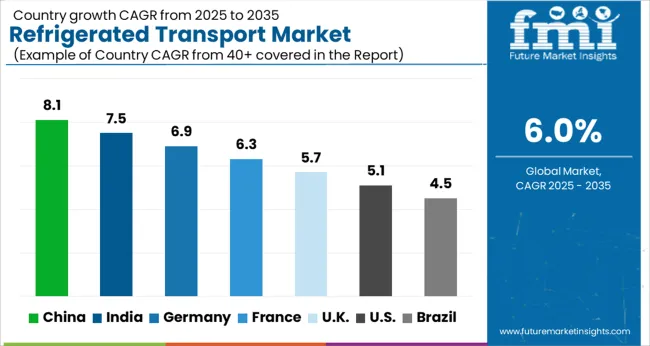

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

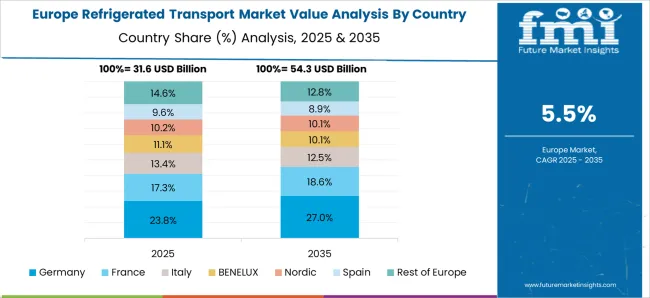

The refrigerated transport market is expected to grow globally at a CAGR of 6.0% from 2025 to 2035, driven by rising demand for temperature-controlled logistics in food, beverage, and pharmaceutical sectors. China leads with a CAGR of 8.1%, supported by expanding e-commerce cold delivery networks, rising perishable food consumption, and investments in modern refrigerated fleets. India follows at 7.5%, fueled by growing urban demand for dairy, meat, and frozen foods, alongside increased pharmaceutical cold chain requirements and expanding logistics infrastructure. France posts a CAGR of 6.3%, supported by stringent food safety regulations, widespread adoption of cold chain solutions, and modernization of transportation fleets. The United Kingdom grows at 5.7%, driven by urban deliveries, grocery e-commerce expansion, and regulatory compliance for temperature-sensitive cargo. The United States posts 5.1%, where established supply chains and stable refrigerated transport infrastructure sustain moderate growth. The analysis spans over 40 global markets, with these five countries serving as benchmarks for evaluating cold chain adoption, fleet modernization, regulatory frameworks, and end-to-end logistics efficiency.

China is projected to post a CAGR of 8.1% from 2025 to 2035, up from approximately 6.7% during 2020–2024, well above the global 6.0% benchmark. Initial growth was supported by rapid expansion of e-commerce cold chains, increasing perishable food consumption, and investments in modern refrigerated fleets. The acceleration in 2025–2035 is fueled by higher demand for pharmaceutical cold chain logistics, integration of advanced monitoring systems, and expansion of regional distribution hubs. Supply chain optimization, government support for cold storage infrastructure, and rising private-label adoption by retailers strengthen market growth. Overall, the market benefits from both domestic consumption and export-oriented refrigerated logistics.

India is expected to achieve a CAGR of 7.5% during 2025–2035, up from roughly 5.9% in 2020–2024, outperforming the global average of 6.0%. Early-stage growth was driven by increasing dairy, meat, and frozen food consumption, coupled with emerging pharmaceutical cold chain requirements. Growth acceleration in 2025–2035 is supported by expanding logistics networks, larger fleet investments, and regulatory compliance for food safety. Private-sector cold storage development and improved road and rail connectivity are strengthening supply reliability. In my assessment, India’s refrigerated transport sector is bolstered by rising perishable consumption, fleet modernization, and integration of digital monitoring tools for temperature-sensitive goods.

France is positioned to post a CAGR of 6.3% during 2025–2035, rising from about 5.4% in 2020–2024, slightly above the global 6.0% baseline. Initial growth was fueled by strict food safety standards, widespread adoption of cold chain services, and modernization of refrigerated trucks and vans. From 2025 onward, higher adoption in pharmaceuticals, ready-to-eat meals, and gourmet food deliveries is expected to sustain momentum. Investments in advanced monitoring systems, urban last-mile distribution, and fleet optimization contribute to growth. In my analysis, France benefits from high regulatory standards, strong consumer expectations, and expanding retail and foodservice demand, supporting incremental adoption of refrigerated transport solutions.

The United Kingdom is projected to post a CAGR of 5.7% during 2025–2035, rising from approximately 4.9% in 2020–2024, slightly below the global 6.0% benchmark. Early growth was driven by grocery e-commerce expansion, urban perishable food deliveries, and regulatory compliance with temperature-sensitive cargo. The rise from 4.9% to 5.7% is explained by increased fleet efficiency, private-label and retail adoption, and higher demand for pharmaceutical logistics. Infrastructure upgrades and advanced monitoring of temperature-sensitive goods reduce spoilage risks and optimize operational efficiency. In my view, consistent regulatory oversight, urban logistics expansion, and investment in refrigerated fleet modernization strengthen growth prospects for the UK sector.

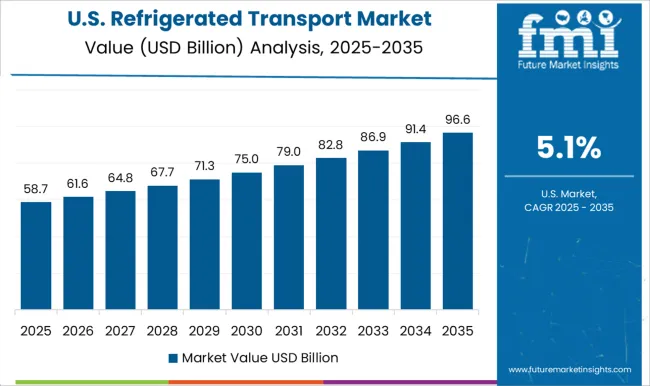

The United States is expected to achieve a CAGR of 5.1% during 2025–2035, slightly below the global 6.0% average, rising from approximately 4.6% in 2020–2024. Early-stage growth was influenced by mature cold chain infrastructure, high perishable food consumption, and stable regulatory frameworks. Growth in 2025–2035 is supported by e-commerce expansion, higher pharmaceutical cold chain logistics, and investment in fleet electrification and monitoring systems. Upgraded urban and intercity logistics networks enhance reliability and reduce spoilage. In my assessment, the US refrigerated transport market maintains steady growth due to stable infrastructure, technological integration in fleet operations, and rising demand for specialized cold chain services.

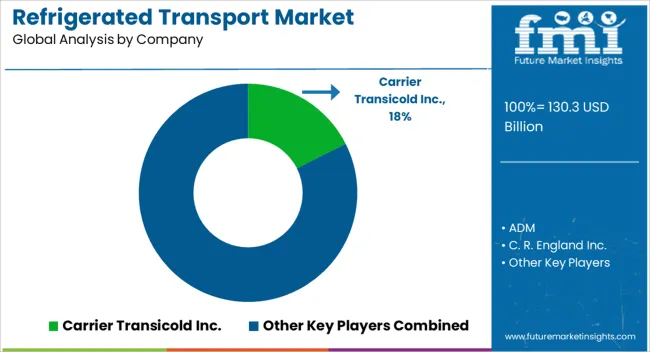

The refrigerated transport market is shaped by leading global players such as Carrier Transicold Inc., ADM, C. R. England Inc., C.H. Robinson Worldwide, Inc., Cargill Incorporated, and a wide range of regional operators and logistics service providers. These companies compete by leveraging fleet efficiency, cold chain management technologies, and strategic route optimization to maintain high-quality temperature-controlled transport and steady dollar sales growth. Carrier Transicold Inc. maintains a dominant position through advanced refrigeration units and integrated telematics, ensuring reliable performance and strong market share.

ADM and Cargill focus on integrated supply chains and specialized logistics for food and agricultural products, optimizing refrigerated freight operations. C. R. England Inc., J. B. Hunt Transport Services, Inc., and Schneider National, Inc. emphasize fleet scale, route management, and customized cold chain solutions to meet client demands. Kuehne + Nagel and GAH Refrigeration Ltd. provide niche and regional services, focusing on specialized temperature-sensitive cargo and operational flexibility. Great Dane LLC leverages trailer manufacturing expertise to support efficiency and reliability. Competitive strategies include partnerships with retailers and food distributors, investment in monitoring systems, and expansion of regional networks.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Technology | Vapor Compression Systems, Eutectic Systems, Cryogenic Systems, and Others |

| Mode of Transport | Road, Air, Sea, and Railway |

| Application | Chilled, Bakery & confectionery products, Dairy products, Beverages, Fresh fruits & vegetables, Others, Frozen, Ice cream, Frozen bakery products, Meat-processed, and Others |

| Temperature | Multi-temperature and Single temperature |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Key players include OEMs & equipment (Carrier Transicold; GAH Refrigeration; Great Dane), 3PLs (Kuehne + Nagel; C.H. Robinson), and fleet carriers (C.R. England; J.B. Hunt; Schneider). Shippers such as ADM and Cargill participate via captive cold chains and partnerships. |

| Additional Attributes | Dollar sales, market share, CAGR by country, fleet demand by segment, adoption in cold chain industries, regulatory impact on operations, competitive landscape, pricing trends, growth drivers, and logistics infrastructure. |

The global refrigerated transport market is estimated to be valued at USD 130.3 billion in 2025.

The market size for the refrigerated transport market is projected to reach USD 233.4 billion by 2035.

The refrigerated transport market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in refrigerated transport market are vapor compression systems, eutectic systems, cryogenic systems and others.

In terms of mode of transport, road segment to command 61.4% share in the refrigerated transport market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refrigerated Display Case Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Trailer Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated / Frozen Dough Products Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Ice Cream Merchandise Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Vending Machine Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Refrigerated and Frozen Soup Market

Refrigerated Snacks Market Trends - Healthy & Fresh Innovations 2025 to 2035

Refrigerated Vans Market Growth - Trends & Forecast 2025 to 2035

Multi-Deck Refrigerated Display Cases Market Growth – Trends & Forecast 2025 to 2035

Transport Cases & Boxes Market Size and Share Forecast Outlook 2025 to 2035

Transportation and Security System Market Size and Share Forecast Outlook 2025 to 2035

Transport Management System Market Size and Share Forecast Outlook 2025 to 2035

Transportation Biofuel Market Size and Share Forecast Outlook 2025 to 2035

Transportation Infrastructure Construction Market Size and Share Forecast Outlook 2025 to 2035

Transportation Aggregators Market Size and Share Forecast Outlook 2025 to 2035

Transport Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Transportation Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Transportation Analytics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Transport Protein Assays Kits Market Trends - Industry Forecast 2025 to 2035

Transportation Condensing Units Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA