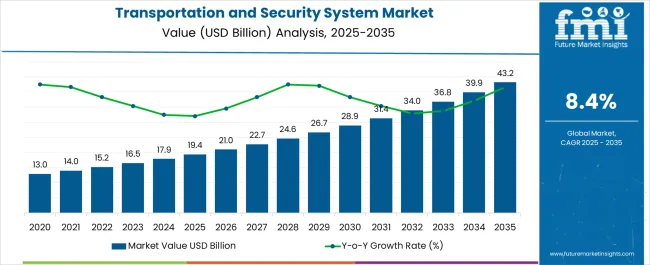

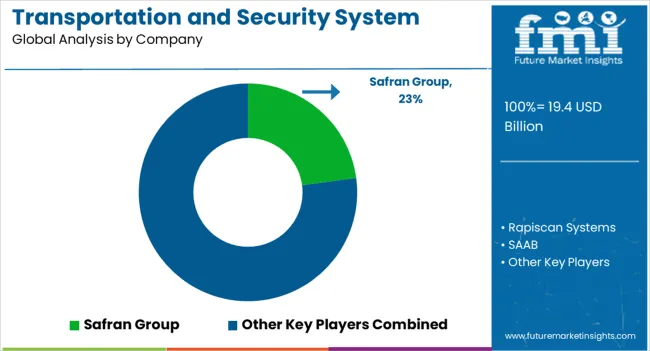

The Transportation and Security System Market is estimated to be valued at USD 19.4 billion in 2025 and is projected to reach USD 43.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Transportation and Security System Market Estimated Value in (2025 E) | USD 19.4 billion |

| Transportation and Security System Market Forecast Value in (2035 F) | USD 43.2 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The transportation and security system market is expanding steadily due to rising global concerns around safety, surveillance, and efficient traffic management. Growing urbanization and the rapid development of smart city projects are increasing the demand for integrated security infrastructures across roadways, railways, airports, and seaports.

Governments and private sector players are investing heavily in advanced monitoring, biometric verification, and real time access solutions to enhance passenger safety and asset protection. Technological progress in artificial intelligence, IoT, and cloud connectivity is further boosting the efficiency and scalability of security systems.

Heightened focus on regulatory compliance, terrorism prevention, and seamless passenger flow is also driving adoption. With increasing reliance on digitalized and automated transport security solutions, the market outlook remains highly positive, supported by strong policy frameworks and continuous innovation.

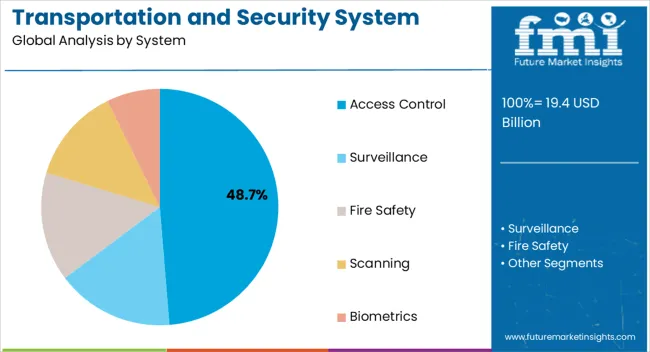

The access control system segment is projected to account for 48.70% of total revenue by 2025 within the system category, establishing itself as the leading segment. This leadership is driven by the growing importance of controlled entry, biometric verification, and multi level authentication systems in transportation hubs.

The demand for secure identification and restricted access to sensitive areas has intensified due to heightened global security threats. Integration with advanced surveillance technologies and seamless digital platforms has further reinforced the role of access control systems.

The scalability and ability to integrate with broader smart infrastructure initiatives have strengthened their adoption, making access control a cornerstone of transportation security strategies.

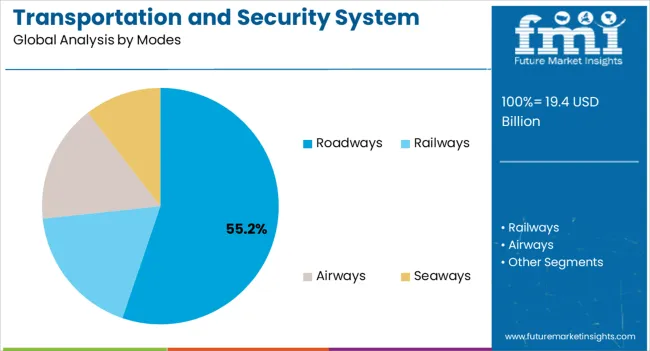

The roadways mode segment is expected to capture 55.20% of total market revenue by 2025, positioning it as the most prominent mode of application. This dominance is attributed to the widespread movement of passengers and goods through road transport, requiring advanced monitoring and security solutions.

Rising investments in smart traffic systems, toll management, and highway surveillance are supporting the growth of security deployments in this segment. Governments are prioritizing roadway security as part of smart city initiatives and national infrastructure safety programs.

With the integration of AI enabled traffic monitoring, automated incident detection, and access verification systems, roadways are increasingly becoming the focal point for large scale security system adoption. This focus on safety, efficiency, and real time responsiveness continues to drive the strong market presence of the roadways segment.

According to FMI, transportation and security systems grew at a CAGR of 11.7% between 2020 to 2025. Interconnected systems are being created within transportation networks using the Internet of Things.

Through the integration of sensors and devices, the Internet of Things enables real-time monitoring and control of transportation infrastructure, such as roads, bridges, railways, and airports. As a result, the transportation system becomes more efficient, safer, and easier to maintain.

Due to the increasing reliance on digital infrastructure in transportation systems, protecting them from cyber threats is of paramount importance. Data breaches and hacks are common in transportation networks due to interconnected systems and IoT devices. In order to protect transportation systems, it is critical to use robust encryption, network monitoring, and vulnerability assessments.

With blockchain technology, supply chain security is made more secure and transparent. With blockchain technology, transportation can be more traceable and accountable by recording goods' origins, ownerships, and handlings immutably. By implementing this technology, counterfeiting will be prevented, cargo tracking will be improved, and customs processes will be streamlined. According to FMI’s analysis, transportation and security system market sales are expected to grow at an 8.8% CAGR between 2025 and 2035.

With the goal of improving transportation efficiency and safety, ITS integrates various technologies, including sensors, communication networks, and data analytics. Connected vehicles, traffic management, real-time information, and automated toll collection are some of the features that are included in the system.

Traffic flow is being optimized, congestion is being reduced, and overall transportation experience is being improved by integrating ITS into existing infrastructure.

A revolution in transportation systems could be brought about by the development of self-driving cars and trucks. The use of AVs can reduce traffic congestion, increase safety, and make transportation more efficient. Fully autonomous vehicles are in the process of developing rapidly, with a large number of companies investing in their research and development.

Advanced security systems are continually explored at airports to ensure passenger safety while minimizing inconveniences. Security screening processes are being streamlined through the use of biometric identification methods, such as facial recognition and fingerprint scanning. The system analyzes passenger behavior and detects potential threats using machine learning algorithms as well.

Expanding Infrastructure and Accelerating Economies to Grow the Market

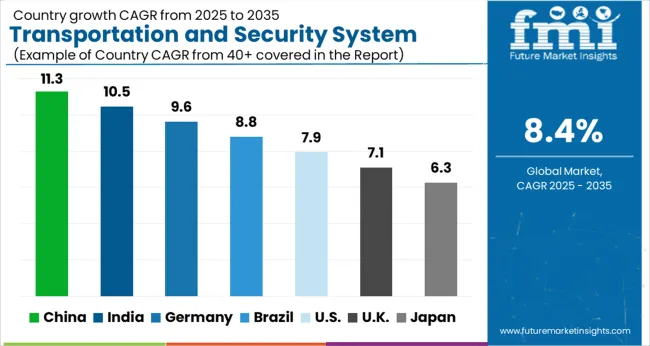

With its increasing number of automotive manufacturers, China will continue to be a significant exporter and importer of transportation and security systems. The market is expected to grow at a CAGR of 10.2% during the forecast period.

The rapid growth of China's economy and urbanization have created a significant demand for transportation systems. Several significant investments have been made in the country's transportation infrastructure, such as high-speed railways, extensive roads, modern airports, and expanded ports. Due to its massive population and growing economy, China's demand for transportation systems continues to rise.

China has also increased its demand for security systems in order to protect its critical assets and enhance public safety. Chinese authorities have implemented a variety of security initiatives, such as video surveillance and facial recognition technology. In order to maintain social stability and ensure safety within the country, advanced security systems have been designed for transportation hubs, public areas, and critical infrastructure.

Government Support and Growing Investments to Grow Demand

Transport and security system are among the top consumers in the United States; however, government regulations are expected to affect their demand. According to the forecast, transport and security system demand will grow at a CAGR of 7.6% in the United States.

Considering the country's vast size and population, transportation systems are in high demand in the United States. Roadways, railways, air transportation, and waterways are all modes of transportation in the transportation sector. Highways, bridges, airports, and ports, which provide efficient and sustainable transportation, remain in high demand.

Intelligent transportation systems (ITS) utilizing technologies such as traffic management, tolling, and vehicle-to-infrastructure communication are increasingly in demand. For public safety and the protection of critical infrastructure, security systems are crucial in the United States.

Cybersecurity, access control, intrusion detection, perimeter security, and video surveillance are among the security systems that are in demand. Transportation hubs, airports, seaports, and public spaces are among the sectors with an increasing demand for advanced security technologies and systems due to concerns about terrorism, crime, and cybersecurity threats.

A recent investment of nearly USD 1 billion by the United States government in airport security systems may also contribute to demand growth. The United States transportation and security systems market, though lacking a clear consensus, is likely to grow in demand.

Global Air Travel is Expected to Drive Growth for Transportation and Security Systems Market

According to FMI, the market for transportation and security systems is expected to hold a market share of 13.1% during the forecast period. Increasing demand for roadway vehicles in this country will result in an increase in market growth. Due to the growth of oil and gas industries in the market, demand is expected to increase.

Several major companies have substantial operations in the United Kingdom, including Thales and G4S. Airport security is governed by the United Kingdom Department for Transport, and the country has well-connected air transport. Transport and security solutions could also be driven by smart transportation systems in the United Kingdom.

A Growing Population and Demand for Automobiles will lead to an Increase in Demand for Transportation and Security Systems

Roadways transportation and security system modes are projected to hold a dominant position throughout the forecast period. This can be attributed to the growing demand for logistic industries and transportation vehicles. The market is projected to grow at a CAGR of 8.6% during the forecast period.

A traffic management system monitors and manages traffic flow with the goal of reducing congestion and improving overall efficiency. Their strategy involves collecting real-time data, analyzing traffic patterns, and implementing strategies like adaptive traffic signal control using technologies like traffic cameras, loop detectors, and vehicle-to-infrastructure communication.

Roadway surveillance cameras monitor traffic, detect incidents, and provide evidence for investigations. Advanced video analytics can be used to identify suspicious or illegal activities with these cameras, including license plate recognition and object tracking.

With the aid of technologies like automatic license plate recognition (ALPR), vehicles can be identified for a variety of purposes, such as law enforcement, toll collection, and traffic management. From images or video footage, ALPR systems extract license plate information using optical character recognition.

Physical Barriers are expected to Increase Demand for Access Controls in the Market

Entry and exit points have physical barriers like gates, bollards, and barriers to control car traffic. To verify and authorize access, access control gates are either manual or automated and usually equipped with sensors, card readers, or biometrics.

The use of card readers is common when individuals or vehicles are trying to gain access to controlled areas. An RFID card reader reads RFID cards, key fobs, or access codes issued to authorized employees or vehicles. The use of biometrics, such as fingerprint scanners or iris scanners, may also improve security.

Automated License Plate Recognition (ALPR) and Radio Frequency Identification (RFID) are technologies that enable automatic identification and authentication of vehicles. While ALPR systems capture license plate information, dedicated readers at access points can read RFID tags attached to vehicles.

Start-ups play a key role in identifying opportunities for growth in transportation and security. Adapting to market uncertainties and transforming them into results contributes to the industry's expansion. Market growth for transportation and security systems is being driven by a few start-up companies.

For key players to maintain a competitive edge and keep their dominance in the market, new and innovative products, solutions, and technologies are needed.

Considering that a small percentage of the market is dominated by a few key players across the globe, the global market can be considered fairly consolidated. The excellent scope of demand creates a high level of participation in the market.

Some of the leading companies operating in the market are:

Market developments in recent years are:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for value |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, Singapore, Thailand, Indonesia, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Kay Segments Covered | System, Modes, Region |

| Key Companies Profiles | Safran Group; Rapiscan Systems; SAAB; ABB; Smiths Group; ORBCOMM Inc.; Lockheed Martin; L-3 Communications; Kapsch Group; Honeywell International; Alstom S.A. (France); Raytheon Company; Cisco Systems Inc.; ASSA Abloy; FLIR systems; Bosch security systems; ADT Corporation; Broadcom Limited; Fortinet |

| Customization & Pricing | Available Upon Request |

The global transportation and security system market is estimated to be valued at USD 19.4 billion in 2025.

The market size for the transportation and security system market is projected to reach USD 43.2 billion by 2035.

The transportation and security system market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in transportation and security system market are access control, surveillance, fire safety, scanning and biometrics.

In terms of modes, roadways segment to command 55.2% share in the transportation and security system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transportation Biofuel Market Size and Share Forecast Outlook 2025 to 2035

Transportation Infrastructure Construction Market Size and Share Forecast Outlook 2025 to 2035

Transportation Aggregators Market Size and Share Forecast Outlook 2025 to 2035

Transportation Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Transportation Analytics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Transportation Condensing Units Market Growth – Trends & Forecast 2025 to 2035

Transportation Composites Market Growth – Trends & Forecast 2022 to 2032

Transportation Coating Market Analysis 2022 to 2032

Transportation Predictive Analytics Market Report – Growth & Forecast 2017-2027

AI in Transportation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Smart Transportation Market

Patient Transportation Market Growth - Trends & Forecast 2024 to 2034

Waterway Transportation Software Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Transportation System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Mobility Aids and Transportation Equipment Market is segmented by Product and Distribution Channel from 2025 to 2035

Hydrogen Storage Tank Market Growth – Trends & Forecast 2024-2034

5G in Automotive and Smart Transportation Market by Solution ,Application,Industry , Warehousing & Logistics, Warehousing & Logistics, Public Safety and Others & Region Forecast till 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA