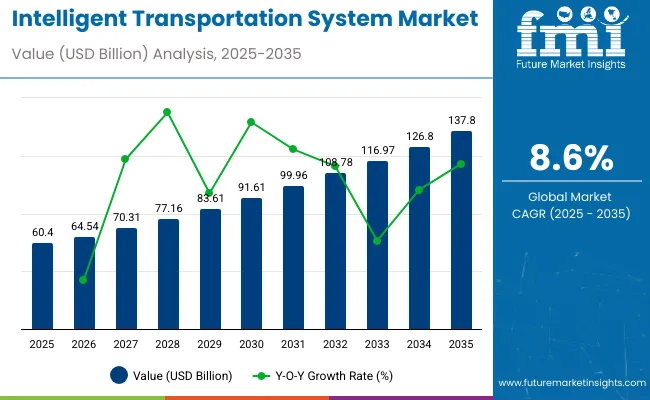

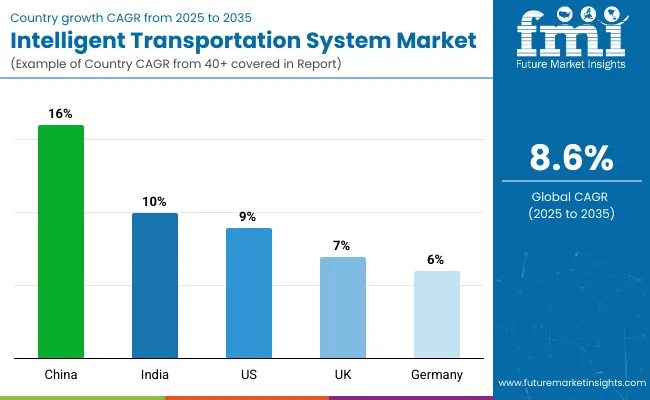

The intelligent transportation system market is valued at USD 60.4 billion in 2025 and is projected to reach about USD 137.8 billion by 2035, CAGR of 8.6%. The year-on-year growth trend indicates steady expansion supported by wider deployment of traffic management solutions, integration of real-time data analytics, and adoption of connected vehicle technologies. Rising demand for road safety and efforts to minimize congestion have strengthened the adoption of advanced mobility platforms in both developed and developing markets.

From 2025 to 2035, the market is set to add nearly 77.4 billion USD in value, showing consistent annual progress. Each year will contribute incremental growth driven by government initiatives, investment in smart city projects, and technological innovation in transport networks. Increasing reliance on automated traffic flow systems, digital platforms, and collaborative public-private partnerships is expected to maintain momentum, supporting year-on-year expansion. The trajectory signals strong market prospects with consistent yearly improvements in efficiency, safety, and environmental impact across the global intelligent transportation system industry.

The market is shaped by five parent markets that drive its development. Information and Communication Technology contributes about 30%, enabling IoT platforms, cloud systems, and data analytics. Automotive and Transportation accounts for nearly 25%, integrating connected vehicles, autonomous driving, and safety solutions.

Electronics and Semiconductor provide close to 20%, supplying sensors, microcontrollers, and radar components. Infrastructure and Smart City projects hold around 15%, creating smart traffic networks, tolling systems, and public transport platforms. Telecommunication and Networking represent nearly 10%, delivering 4G, 5G, and satellite communication that supports real-time traffic management and vehicle connectivity.

Recent industry trends in Intelligent Transportation Systems highlight groundbreaking innovations and strategies by key players. Companies such as Siemens, Cisco, Hitachi, and Kapsch are advancing Vehicle-to-Everything communication and investing in 5G-enabled transport solutions. Artificial Intelligence and Machine Learning are being applied to real-time traffic control, predictive maintenance, and congestion management.

Cloud-based platforms are gaining momentum, helping cities deploy scalable and efficient mobility solutions. Public-private partnerships are increasing, with governments working alongside technology providers and automotive manufacturers to build smart infrastructure. Strategic mergers and collaborations continue to strengthen market presence while enabling faster adoption of connected and automated mobility solutions.

The intelligent transportation system market is expanding as cities experience heavier traffic volumes and higher demand for efficient road management. About 55% of the global population currently lives in urban areas and this share is expected to cross 60% by 2030. Road accidents remain a major concern with more than 1.1 million fatalities each year, creating urgency for smarter mobility infrastructure. Governments are focusing on modernizing transport systems, improving logistics performance, and reducing delays through digital monitoring, automated signals, and connected road technologies.

Driving Force Rising Congestion and Road Safety Needs

Traffic congestion continues to affect productivity, with drivers in dense cities losing 100 to 150 hours annually in delays. Intelligent transportation systems reduce waiting times by up to 20% using adaptive signals and predictive analytics. Safety is another factor driving adoption, as poor traffic coordination contributes to over 20% of accidents worldwide.

Deployment of systems such as incident detection, lane control, and automated monitoring improves mobility and lowers accident rates. Developed markets are introducing large-scale ITS infrastructure across highways and metropolitan areas, while developing countries are adopting modular projects to gradually enhance safety and efficiency. Both passenger and freight networks are benefitting from shorter travel times and reduced road risks.

Growth Avenue Integration of 5G and V2X Connectivity

Global 5G connections are expected to exceed 5 billion by 2030, providing a platform for connected mobility. Latency under 1 millisecond enables real-time communication between vehicles and road infrastructure. ITS projects integrated with 5G and vehicle-to-everything technology have shown congestion reductions of up to 35% and accident risk reduction by as much as 70% in controlled settings.

Expansion of smart corridors and connected highways is opening opportunities for automakers, telecom operators, and infrastructure developers. Countries in Asia and Europe are moving quickly to combine ITS with 5G networks, while other regions are preparing investment plans. This combination is laying the foundation for safer, more efficient, and data-driven mobility ecosystems.

Emerging Trend Expansion of Smart City Programs

Urban growth is expected to add nearly 2.5 billion people to cities by 2050, intensifying pressure on transport systems. Smart city programs are increasingly embedding ITS to address congestion and mobility efficiency. Deployment of connected public transport, smart traffic signals, and digital tolling reduces congestion by 15–25% and enhances fuel efficiency by 8–10%.

Nations across Asia are prioritizing ITS adoption within smart city strategies, while European regions are channeling funding into digital road infrastructure. North America is expanding city-level initiatives with a focus on data integration. The growing use of AI, IoT, and big data analytics is supporting real-time traffic management, enabling faster decisions and smoother travel for urban populations.

Market Challenge High Cost of Deployment and Up keep

High financial requirements remain a hurdle for large-scale ITS adoption. Advanced traffic management systems can cost between USD 500,000 and USD 1 million per freeway mile. Ongoing maintenance adds 10–15% of the original deployment expense, including software updates, sensor calibration, and security monitoring. Increasing reliance on connected infrastructure has raised cyber vulnerability, requiring extra budget allocation.

Training and retaining skilled personnel further adds to the overall cost. These factors make adoption difficult for countries with limited funding capacity, slowing down project execution timelines. While demand for better road safety and reduced congestion is strong, high upfront and recurring expenses continue to limit faster penetration of ITS technologies in developing markets.

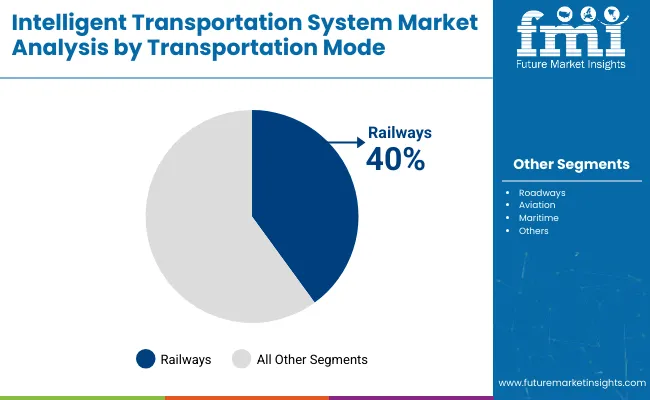

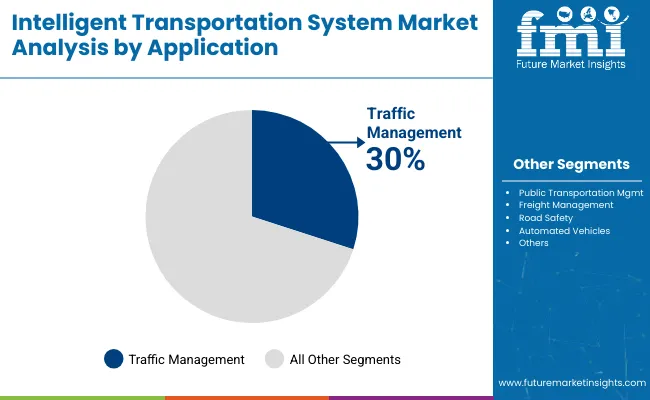

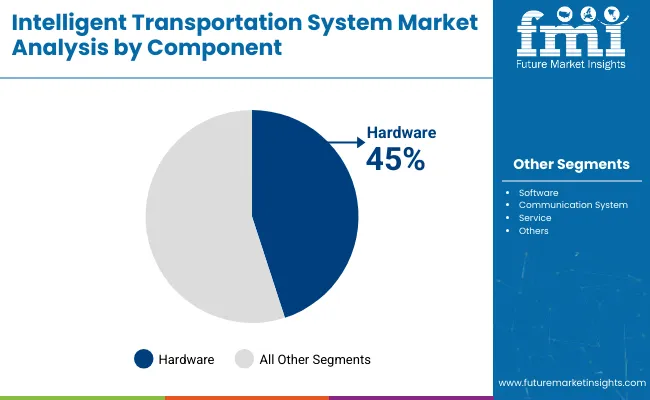

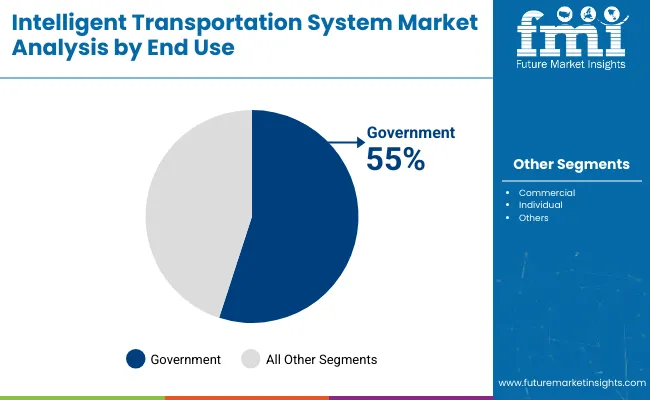

The market demonstrates strong demand in railways, traffic management, hardware, and government programs. Railways hold 40% share as modernization projects expand across metros and freight corridors. Traffic management captures 30% of applications with cities deploying adaptive control and incident response platforms.

Hardware leads components at 45% as agencies prioritize controllers, cameras, and roadside infrastructure. Government accounts for 55% of end use due to long term contracts and national funding schemes. These segments remain the primary investment avenues for vendors, integrators, and service providers shaping transportation efficiency and safety.

Railways represent the largest transportation mode at 40% supported by large scale modernization. ETCS and CBTC programs are deployed to increase train frequency and reduce headways. Predictive maintenance software combined with IoT enabled sensors is lowering operational costs and extending fleet cycles.

Global suppliers including Siemens Mobility, Alstom, Thales, Hitachi Rail, and Wabtec have secured multiyear contracts to deliver onboard units and centralized control systems. Metro expansions in Asia and intercity freight corridors in North America are particularly active, creating long horizon opportunities for technology suppliers.

Traffic management accounts for 30% of applications as urban regions invest in congestion relief and safer road operations. Adaptive signal control is applied in dense corridors, reducing travel delays during peak hours. Control centers integrate feeds from thousands of cameras and roadside sensors, creating real time visibility for operators.

Companies such as KapschTrafficCom, Cubic Transportation Systems, Indra, Iteris, and Siemens are expanding deployments through public contracts. Rising vehicle volumes in Asia Pacific and North America ensure traffic management continues to secure high priority funding in ITS programs.

Hardware holds the highest component share at 45% as reliable field devices form the backbone of deployments. Traffic signal controllers, dynamic message signs, weigh in motion sensors, and advanced cameras are upgraded to meet stricter operational standards.

Siemens, Econolite, Bosch, FLIR ITS, Axis Communications, and Sensys Networks are active in supplying equipment certified for heavy duty use. Contracts emphasize interoperability with existing platforms and protection against cyber threats. Hardware spending is highest across North America and Europe where legacy roadside systems are undergoing widespread replacement.

Government buyers dominate with 55% share of end use, reflecting reliance on public budgets for large scale ITS adoption. National and regional tenders bundle infrastructure, software, and service agreements under outcome based contracts.

Thales, Indra, KapschTrafficCom, TransCore, Cubic, Conduent, and Siemens are awarded multi corridor projects, particularly in Europe and Asia. Grant programs in the United States and EU fund safety upgrades and connected vehicle integration. Government demand remains critical for long term vendor stability, securing ITS as a policy driven market.

The global intelligent transportation system market is set to grow at a CAGR of 8.6% from 2025 to 2035. China records the highest growth at 16%, which is +86% above the global benchmark, driven by large-scale deployment of traffic optimization and connected mobility projects across BRICS. India follows at 10%, delivering a +16% premium and supported by ASEAN-linked partnerships in digital transport solutions. The United States, an OECD member, stands at 9%, or +5% above the average, backed by road modernization and investment in vehicle-to-infrastructure programs.

The United Kingdom grows at 7%, showing a −19% difference, with gradual integration of transport digitalization. Germany posts 6%, or −30% below the global rate, reflecting structured adoption strategies aligned with automotive and regulatory transitions. The market shows OECD economies advancing at steady yet moderate levels, while BRICS members, particularly China and India, drive accelerated adoption of next-generation transportation systems.

The intelligent transportation system market in the United States is expanding at a CAGR of 9%, supported by federal and state-level investments in smart mobility. The country has integrated ITS into metropolitan transit, freight logistics, and highway management, driven by the need to reduce congestion and enhance road safety.

Investments are heavily directed toward connected vehicle infrastructure and traffic analytics platforms. Public-private partnerships play a role in deploying autonomous shuttle programs across urban and suburban regions. Rising demand for vehicle-to-infrastructure communication is another factor boosting ITS growth. The pace of adoption reflects the combined effect of advanced digital technologies, strong ITS hardware manufacturing, and regulatory initiatives supporting data-driven networks.

The intelligent transportation system market in the United Kingdom is progressing at a CAGR of 7%, with growing integration of ITS into road and rail systems. The market is advancing through government-backed programs such as the Future Transport Zones initiative. Advanced traffic signal control and smart ticketing solutions are gaining traction in cities including London, Birmingham, and Manchester. Increased adoption of telematics, traffic monitoring sensors, and congestion charging systems supports market expansion.

The strategy is focused on improving traffic management efficiency, transport accessibility, and safety outcomes. The steady pace of growth indicates strong digital innovation combined with active government participation.

The demand of intelligent transportation system in China is recording the fastest growth globally at a CAGR of 16%, driven by nationwide smart city programs and heavy infrastructure investment. The country has developed extensive networks of smart highways equipped with IoT-enabled traffic sensors and AI-based monitoring platforms.

Strong emphasis on ITS adoption in freight and port logistics is accelerating expansion, supported by 5G deployment. China is also advancing ITS integration with electric and autonomous vehicle ecosystems, strengthening its leadership in next-generation mobility. State-backed vehicle-to-everything communication projects across tier-1 cities contribute to further market advancement. Manufacturing capabilities in ITS hardware and software development enhance both domestic and international positioning.

The intelligent transportation system market in Germany is advancing at a CAGR of 6%, supported by the country’s strong automotive industry and precision engineering capabilities. Focus areas include connected vehicle technologies, highway tolling systems, and traffic management software, particularly across industrial regions with heavy commuter and freight movement.

German automotive manufacturers are collaborating with ITS providers to integrate telematics into new vehicles. Public investment is directed toward autonomous driving infrastructure and cross-border freight corridors. Adoption is steady across Bavaria, North Rhine-Westphalia, and other industrial hubs where traffic optimization is increasingly essential. The market’s progress highlights a combination of industrial demand and advanced engineering partnerships.

The demand of intelligent transportation system in India is expanding at a CAGR of 10%, driven by government programs such as the Smart Cities Mission and the National Electric Mobility Mission Plan. Rapidly expanding metropolitan transport networks and growing demand for advanced traffic monitoring are strengthening adoption.

Cities including Delhi, Bengaluru, and Mumbai are deploying electronic toll collection, real-time traffic analytics, and smart fleet management systems for buses. ITS in public transport is helping to address traffic bottlenecks while enhancing commuter experience. Partnerships between domestic IT firms and international ITS companies are creating opportunities for technology scaling across highways and urban regions.

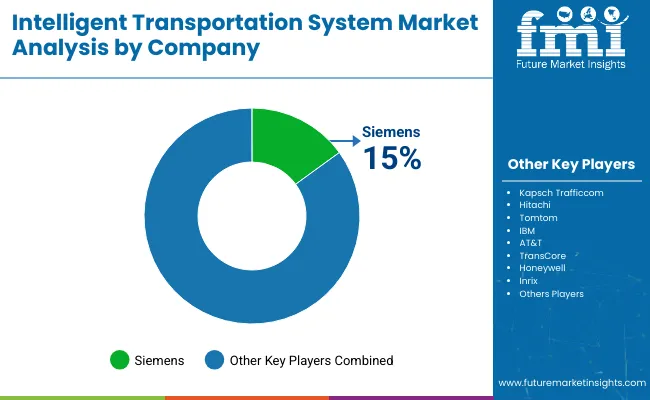

Intelligent transportation system manufacturers are focusing on product development, research activities, and collaborations to strengthen their market reach. KapschTrafficcom has expanded its tolling and traffic management portfolio across different regions. Hitachi invests in integrated mobility platforms, while Tomtom continues to refine mapping and navigation solutions for public agencies and private operators. IBM and AT&T are working together on data-driven transport solutions that combine cloud services with connected vehicle systems.

Transcore delivers electronic tolling and traffic monitoring systems, and Honeywell develops traffic control technologies designed to improve road efficiency. Siemens provides integrated traffic management platforms, Inrix specializes in analytics to ease congestion, and Motorola Solutions focuses on communication systems that support road safety and emergency response.

Thales group, Garmin, and Cubic corporation are investing heavily in research and development. Thales develops advanced surveillance and signaling systems, Garmin designs navigation tools for connected vehicles, and Cubic corporation enhances fare collection systems linked with transportation management platforms. Alstom focuses on railway signaling and coordination systems, while Cisco provides secure network infrastructure that connects multiple transportation services. Strategies among these players include partnerships with public authorities, pilot projects in connected mobility, and expansion of digital platforms to improve operational efficiency and traffic safety.

Recent Industry News

In June 2025, Mark Pittman, Senior Director of Transportation AI at Bentley, announced that Bentley Systems is committed to advancing innovation in the transportation technology ecosystem by making data-driven insights more accessible and easier to integrate for a broader audience. He emphasized that the company’s new open API is expected to remove barriers, encourage deeper collaboration, support innovation, and contribute to safer and more efficient transportation systems worldwide.Intelligent Transportation System Market Analyzed by Key Investment Segments

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 60.4 billion |

| Projected Market Size (2035) | USD 137.8 billion |

| CAGR (2025 to 2035) | 8.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Transportation Modes Analyzed (Segment 1) | Roadways, Railways, Aviation, Maritime |

| Applications Analyzed (Segment 2) | Traffic Management, Public Transportation Management, Freight Management, Road Safety, Automated Vehicles |

| Components Analyzed (Segment 3) | Hardware, Software, Communication System, Service |

| End-Use Segments Analyzed (Segment 4) | Government, Commercial, Individual |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific; Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, Japan, India, UAE, South Africa |

| Key Players Influencing the Market | Kapsch Trafficcom , Hitachi, Tomtom , IBM, AT&T, TransCore , Honeywell, Siemens, Inrix , Motorola Solutions, Thales Group, Garmin, Cubic Corporation, Alstom, Cisco |

| Additional Attributes | Dollar sales by system type and application , demand dynamics across traffic management, public transport, and logistics, regional adoption trends, innovation in AI traffic analytics, V2I communication, environmental impact of reduced congestion, and emerging uses in autonomous vehicle coordination. |

The market is expected to reach nearly USD 137.8 billion by 2035.

The market is growing at a CAGR of 8.6% during this period.

Railway systems lead with 40% market share in 2025.

Government end users capture 55% of the market by share.

Siemens holds a leading 15% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Intelligent Touch Screen Cash Register Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Road Test Instruments Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Driving Technology Solution Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Completion Market Size and Share Market Forecast and Outlook 2025 to 2035

Intelligent Rubber Tracks Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Cervical Massager Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Multifunctional Laser Bird Repeller Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Platform Management Interface (IPMI) Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Lighting Control Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Enterprise Data Capture Software Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Intelligent Vending Machine Market Insights – Demand, Size & Industry Trends 2025–2035

Intelligent Virtual Store Design Solution Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Enterprise Data Capture Software Market Size, Growth, and Forecast 2025 to 2035

Intelligent Fencing Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Intelligent Enterprise Data Capture Software Market in Korea – Trends & Forecast 2025 to 2035

Intelligent Power Module Market Trends - Growth & Forecast 2025 to 2035

Intelligent Prosthetics Market Analysis - Size, Share, and Forecast 2025 to 2035

Intelligent Traffic Management Market Trends – Growth & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA