The transportation infrastructure construction market is projected to reach 3.8 USD trillion in 2025 and expand to 5.7 USD trillion by 2035, registering a CAGR of 4.0% over the forecast period. Market expansion is anticipated to be driven by government investments in highways, railways, ports, and urban transit systems, alongside growing demand for modernized logistics networks to support trade and mobility.

Between 2025 and 2030, the market is estimated to grow steadily from 3.8 USD trillion to around 4.5 USD trillion, supported by large-scale highway upgrades, airport expansions, and railway modernization projects across emerging and developed economies. From 2031 to 2035, growth is expected to accelerate moderately, reaching 5.7 USD trillion, as urban mobility projects, smart transportation initiatives, and public-private partnerships gain traction.

Investments in intelligent traffic management, bridge rehabilitation, and port efficiency enhancements further drive market adoption. Rising focus on regional connectivity, cross-border trade facilitation, and sustainable transportation planning reinforces long-term growth prospects. Incremental yearly gains reflect a combination of planned government budgets, private sector participation, and technological integration in construction processes.

| Metric | Value |

|---|---|

| Transportation Infrastructure Construction Market Estimated Value in (2025 E) | USD 3.8 trillion |

| Transportation Infrastructure Construction Market Forecast Value in (2035 F) | USD 5.7 trillion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The transportation infrastructure construction market is shaped by several interrelated parent markets, each influencing its expansion and adoption across urban, regional, and national projects. The largest contributor is the civil engineering and heavy construction market, holding approximately 35% share, as highway construction, bridges, tunnels, and railway networks form the backbone of transportation infrastructure development worldwide. The urban mobility and public transit market contributes around 25%, driven by metro rail, bus rapid transit, and light rail projects aimed at improving city connectivity and reducing congestion. The construction materials and equipment market accounts for nearly 20%, providing essential inputs such as asphalt, concrete, steel, and heavy machinery that enable large-scale project execution. Logistics and freight transportation services add roughly 10%, reflecting the critical role of efficient transport corridors in enabling trade, supply chain optimization, and regional economic growth. Finally, smart transportation systems and intelligent traffic management solutions contribute about 10%, integrating digital monitoring, automated signaling, and data-driven planning into modern infrastructure projects. Together, these parent markets ensure the transportation infrastructure construction sector remains robust, with traditional civil works complemented by smart, technology-enabled solutions that enhance efficiency, safety, and connectivity. The combined impact of these markets underscores how investments in construction, urban transit, and digital systems drive sustained growth in the global transportation infrastructure sector.

The transportation infrastructure construction market is witnessing robust momentum, underpinned by sustained public and private sector investments aimed at modernizing connectivity networks and meeting growing mobility demands. Current expansion is being supported by large-scale government infrastructure programs, favorable policy frameworks, and the integration of advanced construction technologies to enhance efficiency and durability. Urbanization, industrial expansion, and rising trade volumes are driving the need for upgraded and expanded transport corridors.

Meanwhile, public–private partnerships and targeted funding allocations are accelerating project execution timelines. Despite cost pressures from fluctuating raw material prices and labor shortages, strategic procurement and digital project management tools are enabling improved cost control and operational efficiency.

Over the forecast period, increasing emphasis on climate-resilient infrastructure, smart transport systems, and sustainable construction practices is expected to elevate quality standards and broaden long-term growth opportunities. This trajectory positions the sector for steady capacity expansion, improved operational resilience, and enhanced socio-economic impact across both developed and emerging economies.

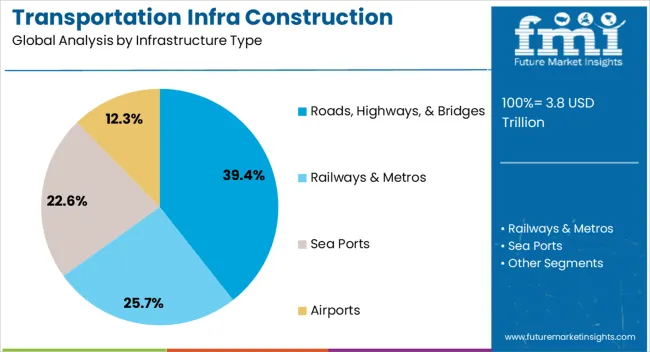

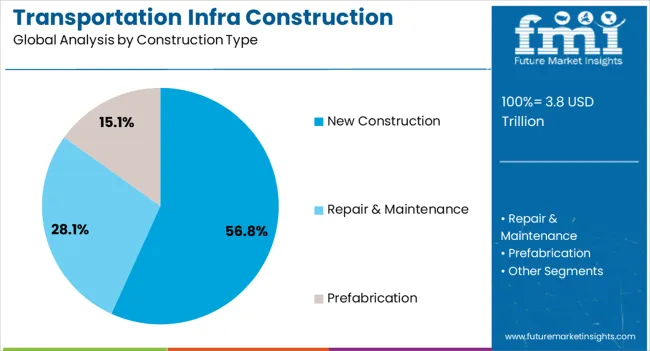

The transportation infrastructure construction market is segmented by infrastructure type, construction type, and geographic regions. By infrastructure type, transportation infrastructure construction market is divided into Roads, Highways, & Bridges, Railways & Metros, Sea Ports, and Airports. In terms of construction type, transportation infrastructure construction market is classified into New Construction, Repair & Maintenance, and Prefabrication. Regionally, the transportation infrastructure construction industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The roads, highways, and bridges segment, holding 39.4% of the infrastructure type category, is leading market share due to its critical role in facilitating national and regional connectivity. Demand within this segment is being fueled by rising vehicle ownership rates, increased freight transportation, and the prioritization of road network expansion in economic development plans. Investment flows have been bolstered by large-scale rehabilitation and expansion programs, often supported by multilateral funding agencies.

Advances in materials science, such as high-performance concrete and asphalt technologies, are enabling longer service life and reduced maintenance needs, thereby improving cost-efficiency. Geographic accessibility enhancements, coupled with the need to reduce congestion in urban and peri-urban areas, are prompting accelerated project approvals. Additionally, cross-border trade facilitation is creating opportunities for upgrading strategic highway and bridge corridors.

The new construction segment, accounting for 56.8% of the construction type category, is maintaining its lead through the commissioning of greenfield projects aimed at expanding transportation capacity and addressing infrastructure deficits. Significant capital allocations from national infrastructure budgets and global investment funds are fueling project initiation rates. The segment’s dominance is further supported by the adoption of advanced design and engineering solutions, enabling faster completion timelines and enhanced durability.

Rapid urban sprawl, industrial park developments, and emerging logistics hubs are driving demand for entirely new road, bridge, and highway networks rather than relying solely on refurbishments. Policy incentives, such as streamlined land acquisition procedures and tax benefits for large infrastructure projects, are accelerating execution.

Additionally, the integration of digital twin modeling, automated machinery, and sustainable construction practices is improving operational efficiency and reducing lifecycle costs. With continued emphasis on strategic connectivity, this segment is projected to retain its strong position throughout the forecast horizon.

The transportation infrastructure construction market is driven by road and rail expansions, ports and airport projects, mass transit systems, and high-performance construction materials. Coordinated investments across these areas ensure steady global market growth.

The transportation infrastructure construction market is being propelled by escalating investments in road and rail networks globally. Governments are prioritizing highway expansions, bridge rehabilitation, and railway modernization to support growing trade and mobility needs. Large-scale public-private partnerships are being implemented to finance projects efficiently, while regulatory frameworks encourage timely execution and quality compliance. Investments also focus on strengthening regional connectivity and improving freight and passenger movement efficiency. Countries with emerging economies are upgrading existing networks, whereas developed regions are emphasizing maintenance and capacity enhancement. The steady inflow of funds ensures that both new and existing projects are adequately supported, creating opportunities for contractors, equipment suppliers, and material providers to participate in long-term infrastructure development programs.

Port and airport development is playing a pivotal role in driving the transportation infrastructure construction market. Global trade growth and rising air passenger traffic are increasing demand for larger, more efficient terminals and cargo handling systems. Ports are being upgraded with deeper berths, container handling equipment, and automated logistics systems, while airports are expanding runways, terminals, and passenger amenities to accommodate higher traffic. Investments in multimodal transport hubs integrate air, road, and rail networks for smoother cargo and passenger flow. These projects enhance trade competitiveness, reduce congestion, and support economic growth. Contractors and engineering firms are leveraging such opportunities to deploy large-scale construction solutions and optimize project timelines across critical logistics gateways.

Mass transit infrastructure projects, including metro lines, light rail, and bus rapid transit, are significantly influencing market growth. These systems are being implemented to address increasing commuter demand and reduce traffic congestion in metropolitan regions. Long-term government plans emphasize efficient urban mobility networks and improved connectivity between suburban and central business districts. Funding from municipal budgets, loans, and international financial institutions accelerates project execution. Additionally, integration of monitoring systems, signaling equipment, and supporting facilities enhances reliability and operational efficiency. The adoption of advanced design methodologies and modular construction practices allows faster deployment of metro and transit lines. This focus on public transit development ensures continuous market expansion for civil engineering and specialized construction services.

High-performance construction materials are driving efficiency and durability in transportation infrastructure projects. Asphalt, reinforced concrete, steel, and composite materials are being increasingly used for highways, bridges, and tunnels to withstand heavier loads and extreme weather conditions. Suppliers are responding to rising demand by producing specialized mixtures, pre-fabricated segments, and modular components that reduce project timelines. Efficient material logistics and onsite handling are becoming key for cost-effective project execution. The emphasis on quality control, structural longevity, and compliance with engineering standards ensures reliability across projects. Contractors and project managers are benefiting from material innovations that allow safer, faster, and more durable construction, supporting the overall growth trajectory of the transportation infrastructure sector.

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

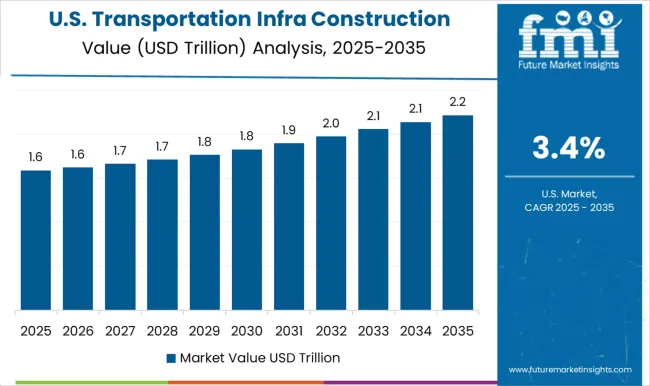

| USA | 3.4% |

| Brazil | 3.0% |

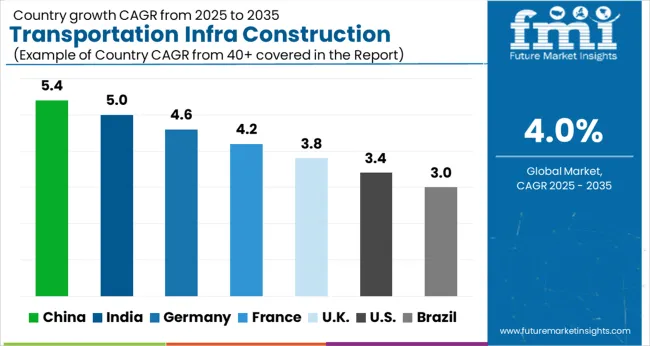

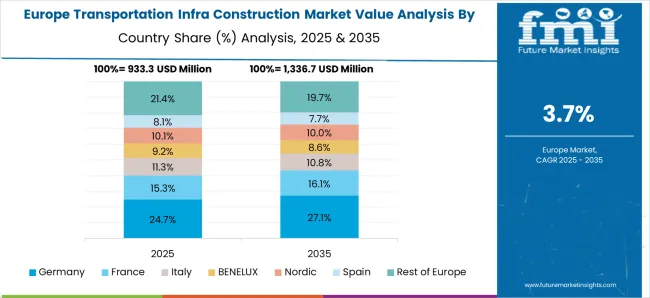

The global transportation infrastructure construction market is forecasted to grow at a CAGR of 4.0% between 2025 and 2035. China and India lead growth with 5.4% and 5.0% respectively, driven by massive investments in highways, railways, ports, and urban transit projects that support trade, mobility, and regional connectivity. Germany follows at 4.6%, with focus on modernizing existing infrastructure, maintaining high safety standards, and integrating intelligent traffic and monitoring systems. The United Kingdom shows a 3.8% growth rate, supported by airport expansions, bridge rehabilitation, and metro system development, while the United States grows at 3.4%, emphasizing grid-linked transport corridors, logistics efficiency, and urban transit modernization. Growth is fueled by public-private partnerships, international funding, and government-led initiatives in emerging and developed markets. The analysis spans over 40+ countries, highlighting the leading contributors to global transportation infrastructure development and construction adoption.

The transportation infrastructure construction market in China is projected to grow at a CAGR of 5.4% from 2025 to 2035, driven by massive government investments in highways, high-speed rail networks, ports, and urban transit systems. Large-scale projects for regional connectivity, cross-border trade facilitation, and modernization of existing infrastructure are fueling demand. China’s industrial and construction sectors are leveraging advanced project management, prefabricated materials, and large workforce deployment to accelerate execution. Public-private partnerships are increasingly being used to finance ambitious projects efficiently, while local and international contractors contribute to meeting stringent quality and safety standards. Rising domestic trade, urban population mobility, and logistics optimization further strengthen growth prospects.

India’s transportation infrastructure construction market is expected to grow at a CAGR of 5.0% from 2025 to 2035, driven by rapid expansion of highways, metro systems, and airport facilities. Government initiatives like the National Infrastructure Pipeline and regional connectivity programs are accelerating road, rail, and urban transit development. Industrial corridors and smart logistics hubs are also increasing demand for upgraded transport infrastructure. Private sector participation through concessions and public-private partnerships is supporting project funding and execution. Rising freight volumes, urban commuter growth, and strategic international trade initiatives are further fueling investments. Contractors and suppliers are focusing on modular construction, improved material logistics, and modern project planning to capitalize on long-term opportunities.

Germany’s transportation infrastructure construction market is projected to grow at a CAGR of 4.6% from 2025 to 2035, supported by modernization of highways, railway lines, and airport terminals. Investments focus on upgrading existing infrastructure to meet stricter safety, efficiency, and environmental standards. Rail electrification, bridge rehabilitation, and port improvements are key growth drivers. The country emphasizes integration of intelligent monitoring systems, automated traffic control, and predictive maintenance for long-term operational efficiency. Strong regulatory frameworks and public funding ensure high-quality project delivery. Private engineering and construction firms are partnering with utilities and government agencies to implement complex projects efficiently, leveraging modular construction techniques and advanced material usage.

The UK transportation infrastructure construction market is anticipated to grow at a CAGR of 3.8% from 2025 to 2035, driven by airport expansions, bridge repairs, and metro and light rail projects. Investment focus is on improving regional connectivity, reducing congestion, and modernizing urban transit systems. Public-private partnerships and government funding are supporting large-scale projects, while compliance with strict safety and environmental standards ensures long-term project sustainability. Industrial contractors are deploying advanced project management, prefabricated materials, and innovative construction techniques to reduce costs and timelines. Growth is further fueled by increasing freight volumes, commuter demand, and cross-border trade facilitation across Europe.

The transportation infrastructure construction market in the USA is projected to grow at a CAGR of 3.4% from 2025 to 2035, supported by highway expansions, bridge repairs, and modernization of rail networks. Federal and state funding for smart highways, intelligent traffic systems, and intermodal logistics corridors strengthens market growth. Industrial contractors and engineering firms focus on modular construction, advanced materials, and sustainable project planning to reduce cost and time overruns. Expansion of ports and airports to accommodate increasing freight and passenger volumes is also a key driver. Public-private partnerships, infrastructure stimulus packages, and urban mobility initiatives create additional opportunities for construction companies and material suppliers across the country.

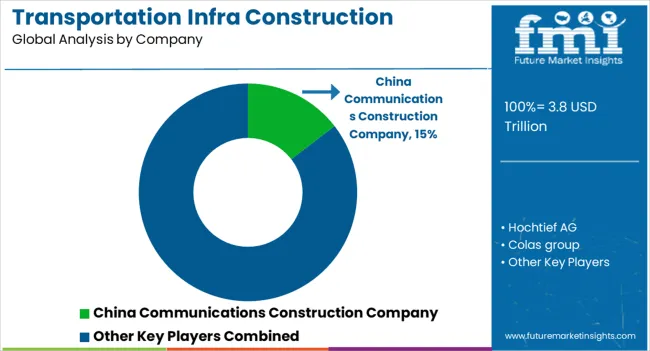

Competition in the transportation infrastructure construction market is defined by project scale, engineering expertise, and execution efficiency. China Communications Construction Company (CCCC) leads with extensive experience in large-scale highways, ports, and urban transit systems, leveraging government backing and international project portfolios. Hochtief AG and Fluor Corporation maintain strong positions by combining global engineering capabilities with complex project management, focusing on high-value contracts in Europe, North America, and the Middle East. Colas Group and Bouygues Construction emphasize road, airport, and urban infrastructure projects, leveraging technical innovation in materials and construction methods.

Beijing Urban Construction Group dominates domestic urban projects in China, while AECOM, Jacobs Engineering Group, and Balfour Beatty provide consultancy-driven solutions integrated with construction execution, targeting smart transportation systems and multimodal hubs. ACS Group and Bechtel Corporation maintain global footprints, executing mega infrastructure programs including bridges, railways, and metro lines. CRH plc specializes in materials supply, offering cement, aggregates, and modular solutions to support project scalability. Shuffle Construction Company, though smaller, focuses on regional and niche infrastructure developments with agile delivery models.

Strategies across these firms emphasize integrated project management, modular construction, risk mitigation, and adherence to international standards. Partnerships with local governments, technology integrators, and logistics providers enhance competitiveness, enabling efficient execution of multi-billion-dollar projects. Companies differentiate by leveraging prefabrication, advanced construction materials, and digital project monitoring tools.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Trillion |

| Infrastructure Type | Roads, Highways, & Bridges, Railways & Metros, Sea Ports, and Airports |

| Construction Type | New Construction, Repair & Maintenance, and Prefabrication |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | China Communications Construction Company, Hochtief AG, Colas group, Fluor Corporation, Beijing Urban Construction Group, AECOM, Balfour Beatty, Shuffle Construction Company, Bouyges Construction, Jacobs Engineering Group Inc., ACS Group, Bechtel Corporation, and CRH plc |

| Additional Attributes | Dollar sales, CAGR, regional and country-wise share, segment growth by road, rail, airport, and port projects, public-private partnership trends, material demand, competitive landscape, and regulatory impacts. |

The global transportation infrastructure construction market is estimated to be valued at USD 3.8 trillion in 2025.

The market size for the transportation infrastructure construction market is projected to reach USD 5.7 trillion by 2035.

The transportation infrastructure construction market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in transportation infrastructure construction market are roads, highways, & bridges, railways & metros, sea ports and airports.

In terms of construction type, new construction segment to command 56.8% share in the transportation infrastructure construction market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transportation and Security System Market Size and Share Forecast Outlook 2025 to 2035

Transportation Biofuel Market Size and Share Forecast Outlook 2025 to 2035

Transportation Aggregators Market Size and Share Forecast Outlook 2025 to 2035

Transportation Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Transportation Analytics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Transportation Condensing Units Market Growth – Trends & Forecast 2025 to 2035

Transportation Composites Market Growth – Trends & Forecast 2022 to 2032

Transportation Coating Market Analysis 2022 to 2032

Transportation Predictive Analytics Market Report – Growth & Forecast 2017-2027

AI in Transportation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Smart Transportation Market

Patient Transportation Market Size and Share Forecast Outlook 2025 to 2035

Waterway Transportation Software Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Transportation System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Mobility Aids and Transportation Equipment Market is segmented by Product and Distribution Channel from 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

5G in Automotive and Smart Transportation Market by Solution ,Application,Industry , Warehousing & Logistics, Warehousing & Logistics, Public Safety and Others & Region Forecast till 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA