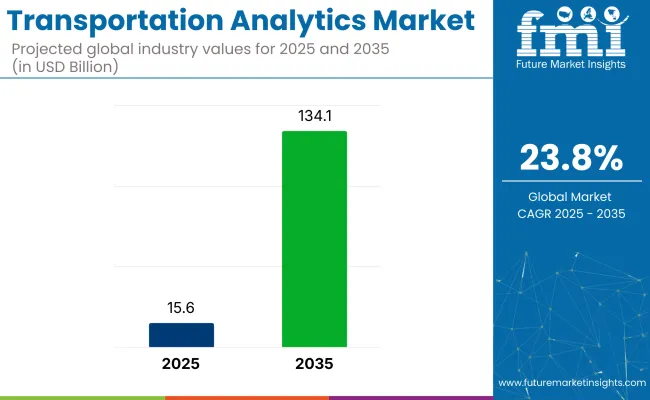

The transportation analytics market is expected to reach USD 15.6 billion in 2025 and grow to USD 134.1 billion by 2035, expanding at a CAGR of 23.8%. Growth is being shaped by rising use of predictive traffic models, logistics network simulations, and multi-modal data platforms across freight corridors and metro systems.

Advanced route planning and congestion forecasting have been integrated into fleet telematics by logistics providers seeking lower fuel costs and tighter ETAs. Data from sensors, GPS, and connected infrastructure is being processed through AI-driven analytics engines that support smart tolling and dynamic signal control.

Stronger traction has been observed in North America and East Asia, where transport departments are standardizing open-data ecosystems. Vendor competition is intensifying around real-time event detection, capacity modeling, and cost-to-serve analytics.

In an interview with Women in Transport, Deborah Kobewka, CEO of Ito World, emphasized the importance of data analytics in the transit sector, stating, “Ensuring the availability of mission-critical data analytics to the transit sector is really important, and I believe Ito has a crucial role to play in this. Our vision is to transform the future of transport through innovative transit intelligence, helping our customers solve challenges and improve communities.”

The industry holds a specialized but growing share within its parent markets. In the transportation market, its share is approximately 2-3%, as transportation analytics is a niche segment focused on optimizing operations across various modes of transport. Within the big data and analytics market, the share is around 1-2%, as the analytics leverages large datasets but is just one aspect of the broader data analytics field.

In the fleet management market, the share is about 5-7%, as analytics are essential for optimizing fleet operations and logistics. In the supply chain and logistics market, its share is approximately 3-4%, driven by the need to improve supply chain efficiency using transportation data. In the Internet of Things (IoT) market, the analytics contributes around 3-5%, as IoT devices generate valuable real-time data for analysis in transportation systems.

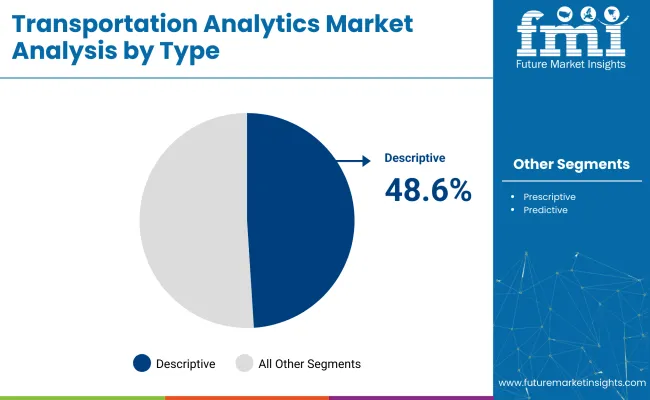

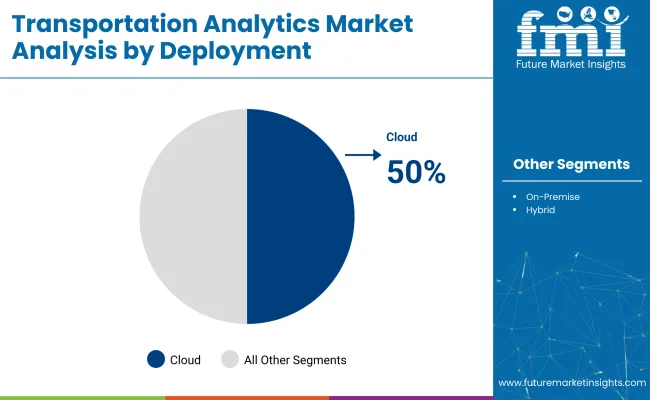

The industry is projected to grow, with descriptive analytics capturing 48.6% of the industry share in 2025. Cloud deployment will hold 50%, while traffic management will dominate the application segment with 43.5% share.

Descriptive analytics is expected to dominate the industry, capturing 48.6% of the industry share in 2025. This segment focuses on analyzing historical data to uncover patterns and trends that help stakeholders understand past transportation performance.

Descriptive analytics is widely used to generate reports and visualizations that support decision-making processes in areas like route optimization, fleet management, and infrastructure planning. By summarizing past events, this type of analytics provides valuable insights for transportation operators looking to improve efficiency and reduce costs.

Cloud deployment is projected to hold 50% of the industry share in 2025, driven by the flexibility, scalability, and cost-efficiency it offers to transportation analytics. Cloud-based platforms enable real-time data processing, easier integration with other systems, and the ability to scale operations according to demand.

With transportation networks becoming increasingly complex, the cloud’s ability to provide centralized data access across various stakeholders-such as traffic management centers, logistics providers, and municipalities-plays a key role in improving operational efficiency. The growing adoption of cloud computing across industries is expected to continue driving the growth of this segment.

Traffic management is expected to capture 43.5% of the application segment in 2025, as cities and municipalities continue to seek solutions for optimizing traffic flow and reducing congestion. The analytics plays a critical role in managing real-time traffic data, analyzing congestion patterns, and providing actionable insights for better traffic control.

By using traffic management systems powered by data analytics, cities can optimize traffic signal timing, monitor road usage, and predict traffic bottlenecks. The demand for these solutions is rising due to the increasing need to manage transportation systems efficiently.

The industry is growing due to increasing urban congestion and the rise of smart mobility, with real-time analytics improving traffic flow and efficiency. However, high implementation costs, data integration issues, and regulatory challenges limit scalability, particularly in smaller cities and developing industries.

Smart Mobility Adoption and Urban Congestion Fueling Transportation Analytics Integration

The industry is expanding due to the rising urban congestion and the growth of smart mobility ecosystems. Cities worldwide are adopting intelligent traffic systems, connected vehicle platforms, and AI-powered route optimization to manage traffic and improve commuter experience.

Real-time analytics are being utilized to reduce travel time, improve fuel efficiency, and enable predictive maintenance across public and private transit networks. As smart city initiatives gain traction, transportation agencies are leveraging cloud-based analytics to streamline operations and enhance safety, boosting the sector’s integration across metropolitan transport systems.

High Implementation Costs and Fragmented Data Systems Restrict Industry Scalability

Despite strong demand, the scalability is restricted by high implementation costs and data integration challenges. Governments and logistics firms face difficulties in modernizing legacy systems, dealing with siloed databases, and the absence of unified standards, which hinder effective deployment of advanced analytics.

High upfront investments in IoT devices, cloud storage, and skilled personnel make implementation expensive, particularly for smaller cities and mid-sized operators. Additionally, ensuring data security and meeting regional privacy regulations adds complexity, slowing adoption, especially in developing sectors with inconsistent infrastructure.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 23.2% |

| China | 22.5% |

| United States | 21.8% |

| United Kingdom | 10.2% |

| Brazil | 10.2% |

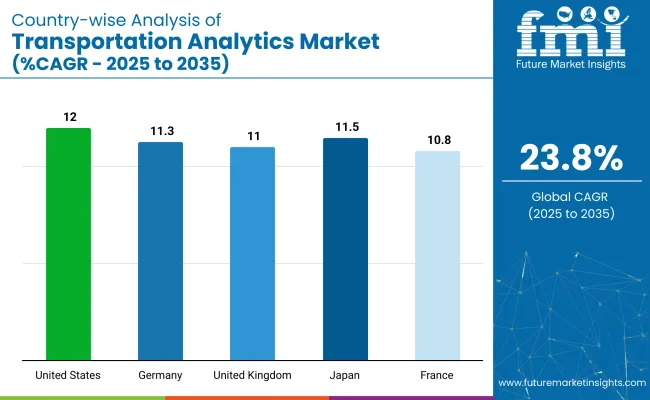

The industry demand is projected to rise at a 23.8% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, India leads at 23.2%, followed closely by China at 22.5%, and the United States at 21.8%, while both the United Kingdom and Brazil post 10.2%.

These rates translate to a growth premium of -2% for India, -5% for China, and -8% for the United States versus the baseline, while the United Kingdom and Brazil show slower growth. Divergence reflects local catalysts: rapidly advancing transportation infrastructure and adoption of analytics in India and China, along with steady demand in the United States driven by technological advancements, and more moderate growth in the United Kingdom and Brazil due to existing infrastructure and industry saturation.

The industry in the United States is projected to grow at a CAGR of 21.8% through 2035. Nationwide investment in intelligent transportation systems, cloud-integrated mobility platforms, and AI-driven decision tools has reshaped traffic management, freight routing, and multimodal scheduling.

Public-private programs such as the Smart City Challenge have linked municipal data lakes with edge-computing sensors, enabling predictive congestion control and autonomous-vehicle simulations. Major suppliers-including IBM, Oracle, and INRIX-package prescriptive dashboards that support transit-safety metrics and infrastructure-funding benchmarks.

Sales of transportation analytics solutions in the United Kingdom are forecast to rise at a CAGR of 10.2% through 2035. Net-zero transport goals and the Future of Mobility regulatory framework steer agencies toward data-sharing platforms and 5 G-powered vehicle networks.

Transport for London leverages geospatial analytics to balance bus headways, pedestrian flows, and congestion-charging zones. Cloud providers, telecom operators, and start-ups co-create real-time dashboards for last-mile logistics and active-travel corridors.

Demand for transportation analytics platforms in China is projected to expand at a CAGR of 22.5% between 2025 and 2035. “Digital China” and “Smart Transportation” policies underpin large-scale AI deployments across high-speed rail, metro, and express-delivery networks.

Providers such as Alibaba Cloud, Baidu, and Huawei fuse 5G, computer vision, and IoT sensors to forecast traffic density and freight-lane utilization. E-commerce growth and multi-city logistics corridors intensify need for dynamic route optimization.

The industry in India is anticipated to grow at a CAGR of 23.2% through 2035. Smart Cities Mission and Gati Shakti initiatives generate high-resolution mobility datasets, allowing cloud vendors-TCS, Tech Mahindra, MapmyIndia-to deliver fleet-tracking and traffic-simulation suites.

FASTag toll platforms and expanding EV infrastructure create granular transaction feeds for predictive maintenance and tariff planning. Public-transit agencies adopt AI dashboards to forecast ridership and fine-tune timetable adherence.

The industry in Brazil is expected to increase at a CAGR of 10.2% from 2025 to 2035. Urban-congestion and safety imperatives prompt municipalities in São Paulo and Rio to adopt AI-based traffic-control suites and emergency-response predictors.

Toll-operator Sem Parar digitizes user data streams for dynamic-pricing pilots, while fleet-management firms optimize fuel burn and driver shifts. Regional transit agencies integrate scheduling analytics to raise bus reliability under federal mobility-funding targets.

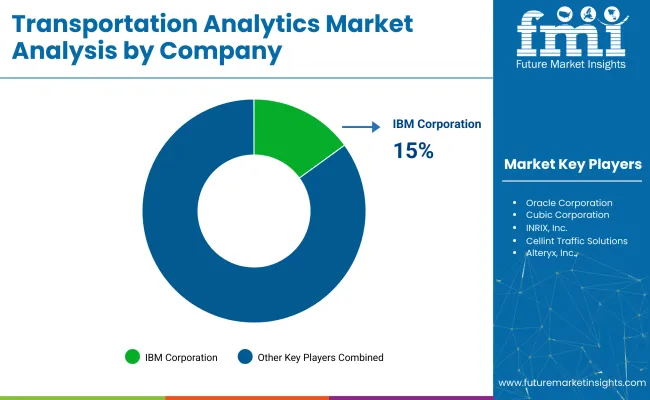

Leading Company - IBM Corporation Industry Share - 15%

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as IBM Corporation, Oracle Corporation, and Cubic Corporation lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across urban mobility, logistics, and infrastructure sectors.

Key players including Sisense Ltd., INRIX, Inc., and Cellint Traffic Solutions offer specialized solutions tailored to specific applications and regional industries. Emerging players, such as Alteryx, Inc., Hitachi, Ltd., and SmartDrive Systems, Inc., focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Transportation Analytics Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 15.61 billion |

| Projected Industry Size (2035) | USD 134.14 billion |

| CAGR (2025 to 2035) | 23.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Type Outlook (Segment 1) | Descriptive, Predictive, Prescriptive |

| Deployment Outlook (Segment 2) | On-premise, Cloud, Hybrid |

| Application Outlook (Segment 3) | Traffic Management, Logistics Management, Planning & Maintenance, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, United Arab Emirates, South Africa |

| Key Players Influencing the Industry | IBM Corporation, Oracle Corporation, Cubic Corporation, INRIX, Inc., Cellint Traffic Solutions, Alteryx, Inc., Hitachi, Ltd., SmartDrive Systems, Inc., Omnitracs, Sisense Ltd. |

| Additional Attributes | Dollar sales by analytics type and deployment model, Growth in predictive and prescriptive use cases, Role of AI and big data in traffic and logistics insights, Regional infrastructure adoption trends, Government investment in smart mobility, Integration of analytics in connected and autonomous transport systems |

Segmentation by type includes descriptive, predictive, and prescriptive analytics.

Deployment models comprise on-premise, cloud, and hybrid configurations.

Applications span traffic management, logistics management, planning & maintenance, and other use cases.

Regional coverage includes North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is projected to reach USD 134.1 billion by 2035.

The industry is expected to grow at a CAGR of 23.8% from 2025 to 2035.

Descriptive analytics is expected to hold 48.6% of the industry share in 2025.

Traffic management will dominate the industry, representing 43.5% of the share in 2025.

India is expected to grow at a CAGR of 23.2% from 2025 to 2035.

IBM Corporation is the leader in the industry with a 15% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transportation Predictive Analytics Market Report – Growth & Forecast 2017-2027

Analytics Of Things Market Size and Share Forecast Outlook 2025 to 2035

Transportation and Security System Market Size and Share Forecast Outlook 2025 to 2035

Transportation Biofuel Market Size and Share Forecast Outlook 2025 to 2035

Transportation Infrastructure Construction Market Size and Share Forecast Outlook 2025 to 2035

Transportation Aggregators Market Size and Share Forecast Outlook 2025 to 2035

Transportation Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Transportation Condensing Units Market Growth – Trends & Forecast 2025 to 2035

Analytics as a Service (AaaS) Market - Growth & Forecast 2025 to 2035

Analytics Sandbox Market

Transportation Composites Market Growth – Trends & Forecast 2022 to 2032

Transportation Coating Market Analysis 2022 to 2032

Ad Analytics Market Growth - Trends & Forecast 2025 to 2035

HR Analytics Market

AI-Powered Analytics – Transforming Business Intelligence

NFT Analytics Tools Market Size and Share Forecast Outlook 2025 to 2035

App Analytics Market Trends – Growth & Industry Forecast 2023-2033

Dark Analytics Market Size and Share Forecast Outlook 2025 to 2035

Text Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA