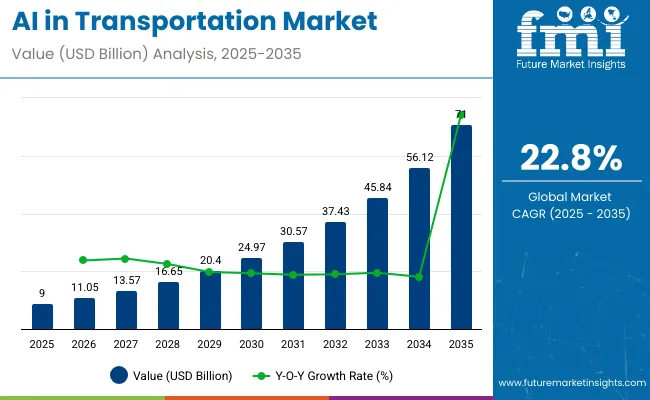

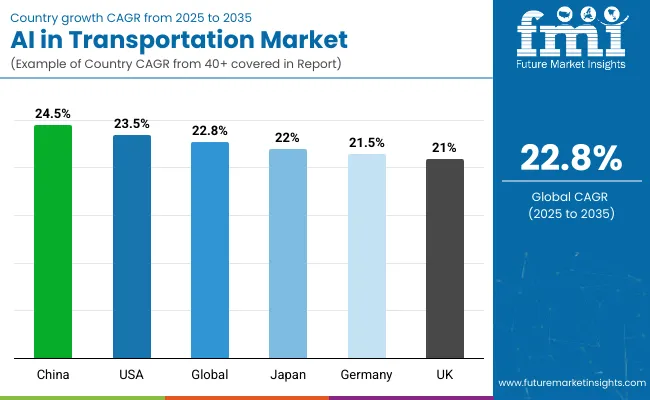

The AI in transportation market is valued at USD 9 billion in 2025 and will expand to nearly USD 71 billion by 2035, advancing at a CAGR of 22.8%, equal to a multiplying factor of about 7.9x.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 9 billion |

| Industry Value (2035F) | USD 71 billion |

| CAGR (2025 to 2035) | 22.8% |

A compound absolute growth analysis highlights how incremental value accumulation progresses over the forecast horizon. From 2025 to 2028, absolute gains remain moderate, with yearly increases driven by early adoption of AI-enabled fleet management, route optimization, and predictive maintenance solutions. These applications generate measurable cost savings for logistics providers and public transport operators, creating a steady base for further expansion.

During the middle phase, from 2028 to 2032, the annual absolute growth becomes sharper as advanced driver assistance, automated freight systems, and AI-powered traffic management platforms see wider rollout across developed economies. By the later years, from 2032 to 2035, absolute yearly gains peak as large-scale deployment of autonomous mobility services, integrated smart city infrastructure, and AI-based energy optimization in transportation systems accelerate market momentum. This compounding effect results in significant cumulative value creation over the decade. The analysis shows that while percentage growth remains high, the true scale of expansion lies in the absolute dollar increase each year, underscoring the transformative financial impact of AI integration in transportation.

The AI in transportation market is shaped by multiple contributing sectors. Automotive and commercial vehicle manufacturing accounts for approximately 36%, reflecting integration of AI in driver assistance and fleet automation. Software and AI platform providers represent about 24%, delivering machine learning algorithms for route optimization, predictive maintenance, and autonomous driving. Sensor and hardware suppliers contribute nearly 20%, offering lidar, radar, and telematics equipment. Logistics and fleet management services hold close to 12%, adopting AI for fuel optimization and predictive scheduling. Traffic management and infrastructure solutions comprise the remaining 8%, focusing on smart traffic lights, urban mobility platforms, and connected road systems.

The market is experiencing accelerated adoption across both passenger and freight applications. Predictive maintenance enabled by AI has reduced downtime by 15-20% in large fleet operations, improving cost efficiency. AI-powered route optimization has cut logistics fuel expenses by up to 12%, supporting sustainable transport goals. Level 2 and Level 3 assisted driving systems are becoming common, installed in over 45% of new premium vehicles delivered in 2024. In logistics, demand for autonomous middle-mile trucking pilots increased by 18% year-on-year, driven by e-commerce expansion. Cities are deploying AI-based traffic management systems, reducing congestion times by an estimated 10-15% in trial deployments.

The market is expanding due to rising adoption of autonomous vehicles, AI powered fleet management, and connected mobility solutions. Passenger vehicles contribute the largest share, while freight and logistics are growing rapidly through AI for route optimization, predictive maintenance, and operational efficiency. Smart city initiatives in Asia Pacific and government-backed intelligent transport programs in North America are driving adoption. The demand for data-driven decision making in transport planning and real-time monitoring is increasing, and OEMs are integrating AI software and sensors into vehicles. AI adoption is becoming essential to enhance safety, efficiency, and reliability across both urban and intercity transport networks.

AI in transportation is accelerating because it delivers safety, operational efficiency, and predictive analytics. AI powered predictive maintenance reduces breakdowns and can lower repair costs by up to 20%. Route optimization in freight fleets decreases fuel consumption and delivery time by 10-15%. AI enabled safety features, including adaptive cruise control, lane departure warnings, and collision prevention systems, help reduce accidents by minimizing human error. Autonomous capabilities in passenger cars and commercial vehicles increase driver comfort and productivity. In my view, integrating AI into transportation is no longer optional; it is a core requirement to meet rising mobility demand, manage urban traffic efficiently, and ensure passenger and freight safety in evolving transport systems worldwide.

Opportunities are emerging as Level 3 and Level 4 autonomous vehicles enter urban shuttles, robo taxis, and passenger cars. AI powered logistics systems optimize fleet utilization, reduce empty miles, and enhance route planning for long-haul freight. Smart city AI platforms improve traffic flow, reduce congestion, and lower emissions. Integration of predictive analytics and real-time monitoring allows operators to enhance operational efficiency while minimizing costs. From my perspective, combining AI software with vehicle hardware ecosystems will define the next phase of transportation. Companies investing in AI enabled mobility platforms are likely to capture market share in both private and commercial transport, driving adoption across regions with advanced infrastructure.

The integration of AI with connected mobility and smart infrastructure is reshaping transportation. Vehicle to everything (V2X) communication allows real-time coordination between cars, traffic signals, and road infrastructure, improving safety and traffic management. Cloud based AI platforms process large datasets to optimize vehicle operations and predictive decision making. Sensor fusion integrating lidar, radar, and cameras improves autonomous navigation accuracy. Adoption of AI enabled smart city platforms allows transport operators to monitor performance, adjust routes dynamically, and manage congestion efficiently. In my assessment, future transportation systems will rely on connected infrastructure to fully exploit AI capabilities, reducing accidents, fuel consumption, and operational inefficiencies while enabling new mobility services.

High costs of AI systems and infrastructure limitations are slowing adoption. Advanced sensors, AI processors, and communication modules increase vehicle and fleet costs, restricting access to premium and large-scale operators. Emerging regions face challenges from limited digital connectivity, inadequate road networks, and inconsistent traffic management, delaying deployment. Cybersecurity risks targeting connected vehicles create additional operational concerns. Training operators and maintaining AI systems require skilled labor, adding complexity. In my view, successful AI adoption in transportation will depend on reducing costs, strengthening infrastructure, and implementing robust cybersecurity measures. Without these interventions, market growth in urban and intercity transport will remain uneven despite technological advancements.

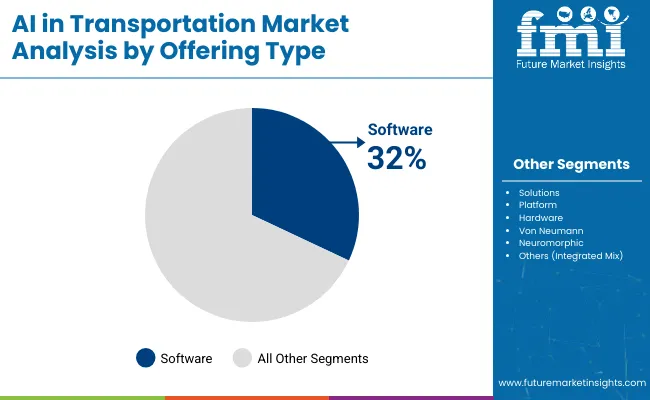

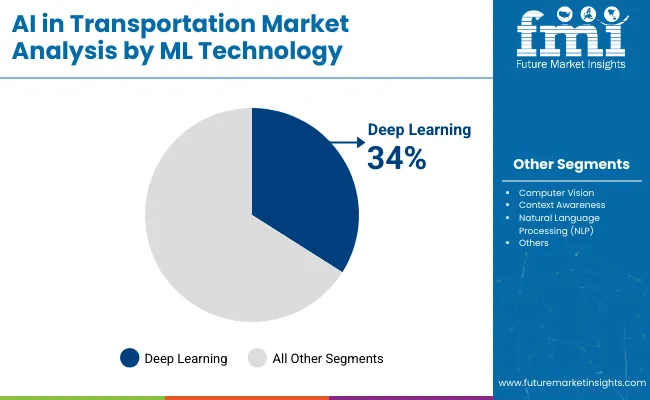

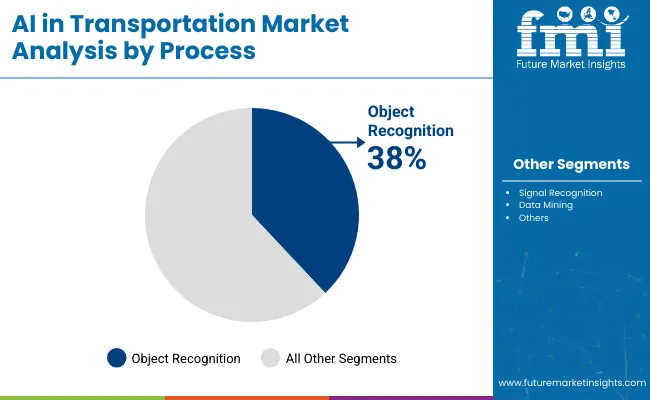

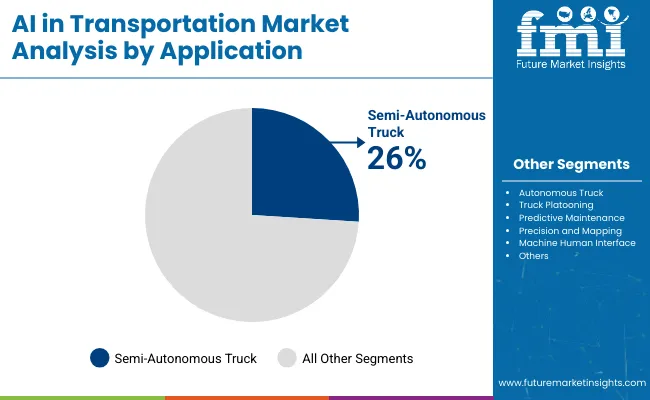

The market in 2025 is shaped by growing reliance on predictive systems, automated freight, and smart logistics. Software solutions lead offerings with 32% share, while deep learning dominates machine learning technologies at 34%. Object recognition is the leading process with 38% share, followed by signal recognition at 34%. Semi-autonomous trucks account for 26% of application demand, with autonomous trucks at 22%. OEMs such as Daimler, Volvo, and PACCAR, along with technology providers including NVIDIA, Waymo, and Mobileye, drive adoption. Market expansion is defined by safety optimization, cost reduction, fleet efficiency, and predictive analytics. Investments focus on data-rich applications integrating AI-driven perception, planning, and decision-making for freight and passenger transport.

Software solutions dominate the offering segment with 32% share, supporting predictive maintenance, route optimization, and fleet analytics. Software platforms contribute 24%, enabling integration of AI tools into transportation ecosystems, with NVIDIA DRIVE and Waymo Driver as leading platforms. Hardware components such as Von Neumann architecture hold 18%, powering conventional AI accelerators, while neuromorphic hardware contributes 14% with companies like Intel and BrainChip developing advanced processors. The remaining 12% is an integrated mix of solutions combining software and hardware. OEMs and logistics operators adopt offerings tailored to operational scale. Growth is driven by rising demand for predictive operations, adaptive routing, and driver-assist functionalities.

Deep learning leads machine learning adoption in transportation with 34% share, powering decision-making in semi-autonomous and autonomous trucks. Computer vision accounts for 28%, widely applied in perception tasks such as lane detection, obstacle recognition, and traffic sign reading. Context awareness contributes 22%, supporting adaptive driving through environmental analysis and predictive modeling. NLP holds 16%, enhancing human-machine interfaces in vehicle communication systems. NVIDIA, Tesla, and Mobileye lead in deep learning and computer vision frameworks, while Baidu Apollo and Aurora integrate context-aware systems. ML adoption is centered on achieving safety, efficiency, and reliability across long-haul logistics and urban transport.

Object recognition dominates the process segment with 38% share, ensuring detection of vehicles, pedestrians, and road obstacles through LiDAR, radar, and camera fusion. Signal recognition follows with 34%, focusing on interpreting traffic lights, signs, and V2X communications. Data mining accounts for 28%, applied to predictive maintenance and fleet analytics for operational cost reduction. Companies including Tesla, Waymo, and NVIDIA apply object recognition in semi-autonomous platforms, while Continental and Bosch specialize in signal recognition modules. Data mining solutions are deployed by fleet operators for predictive efficiency. Demand is centered on safety, real-time decision-making, and streamlined logistics management.

Semi-autonomous trucks dominate applications with 26% share, offering driver assistance and automated long-haul capabilities. Autonomous trucks account for 22%, tested by Waymo, TuSimple, and Daimler across major logistics corridors. Truck platooning contributes 18%, enabling convoys for fuel efficiency and traffic flow optimization. Predictive maintenance holds 12%, while precision mapping contributes 10%, machine-human interface 7%, and other applications 5%. OEMs such as Volvo, PACCAR, and Daimler partner with NVIDIA and Aurora for integrated AI systems. Application demand is driven by operational cost savings, reduced driver fatigue, and supply chain optimization. Adoption is particularly strong in North America and Asia for long-distance freight operations.

China leads the AI in transportation market with a CAGR of 24.5% from 2025 to 2035, +7% above the global average of 22.8%. Growth is supported by BRICS-led initiatives in autonomous vehicle testing, smart logistics, and large-scale investment in digital mobility platforms. The United States follows at 23.5%, +3% over the global benchmark, driven by OECD-backed innovation in connected infrastructure, AI software development, and supportive regulatory frameworks. Japan records 22.0%, slightly below the global rate, with progress influenced by its strength in robotics and automation but moderated by limited fleet expansion. Germany posts 21.5%, −6% under the global CAGR, shaped by integration of AI in logistics networks and premium automotive manufacturing. The United Kingdom stands at 21.0%, −8% below the global average, reflecting gradual infrastructure readiness. Overall, BRICS economies emphasize adoption at scale, while OECD countries focus on regulated, technology-intensive integration.

The AI in transportation market in China is projected to grow at a CAGR of 24.5%, fueled by rapid deployment of AI-powered autonomous vehicles and smart fleet management solutions. Major cities such as Beijing, Shanghai, and Guangzhou are leveraging AI for traffic optimization, predictive maintenance, and intelligent route planning. Baidu Apollo and Pony.ai are expanding pilot robo-taxi services, while BYD integrates AI in electric commercial fleets. Logistics companies adopt AI-based predictive routing to enhance delivery efficiency and reduce operational costs. Investments in AI-enabled roadside sensors and vehicle-to-everything communication are increasing system reliability and safety. Urban hubs are prioritizing smart traffic control, and AI-driven analytics are shaping real-time decision-making in public transport and freight networks.

The United States AI in transportation market is expected to expand at a CAGR of 23.5%, driven by autonomous vehicles, AI-enabled freight systems, and connected infrastructure. Companies like Waymo, Tesla, and Aurora lead in Level 3 and Level 4 automation for passenger and commercial fleets. Freight operators increasingly use AI for predictive routing and load optimization, reducing fuel consumption. Arizona, California, and Texas provide large-scale testing environments for autonomous vehicles, while e-commerce companies implement AI-driven delivery scheduling. Integration of AI-based analytics allows fleet operators to improve safety, reduce congestion, and monitor vehicle health in real time. Adoption is strongest in regions with high industrial density and logistics hubs.

The market for AI in transportation in Japan is projected to grow at a CAGR of 22.0%, supported by widespread adoption of autonomous driving technology and intelligent fleet solutions. Toyota, Honda, and Nissan integrate AI into Level 2 and Level 3 systems for passenger cars, while public transportation authority’s deploy AI-driven predictive maintenance. Automated bus programs are piloted in Tokyo and Fukuoka, enhancing safety and reducing delays. AI-assisted logistics systems optimize routing for commercial vehicles, reducing idle time and fuel usage. Government mobility-as-a-service initiatives promote seamless integration of AI in multi-modal transportation. Japan’s focus on robotics and AI in urban traffic systems strengthens efficiency and supports smart city initiatives.

Germany’s AI in transportation market is forecasted to grow at a CAGR of 21.5%, driven by automotive, logistics, and industrial applications. BMW, Mercedes-Benz, and Volkswagen integrate Level 3 and Level 4 autonomous functions in production models, while Bosch and Continental provide sensor fusion and AI-based decision-making solutions. AI-assisted fleet management is widely used in Rhine-Ruhr industrial corridors to optimize cargo routing and improve safety. Public-private initiatives fund smart mobility projects, deploying AI in urban traffic control and autonomous shuttle systems. Investment in high-precision AI tools for real-time data processing strengthens operational efficiency and enables predictive maintenance. Industrial corridors prioritize AI deployment in both freight and passenger transportation systems.

The United Kingdom AI in transportation market is projected to grow at a CAGR of 21.0%, driven by autonomous vehicle testing, AI-enabled logistics, and connected infrastructure. Oxfordshire and London serve as testbeds for Level 4 autonomous systems developed by Oxbotica and FiveAI. Jaguar Land Rover integrates AI-driven lane management, collision avoidance, and driver-assist features in premium models. Public sector programs support AI-enabled mobility projects for urban shuttle services and last-mile delivery networks. Logistics operators adopt AI-powered route optimization to enhance efficiency and reduce fuel consumption. Expansion focuses on smart infrastructure integration, real-time monitoring, and predictive analytics to improve operational reliability across freight and passenger services.

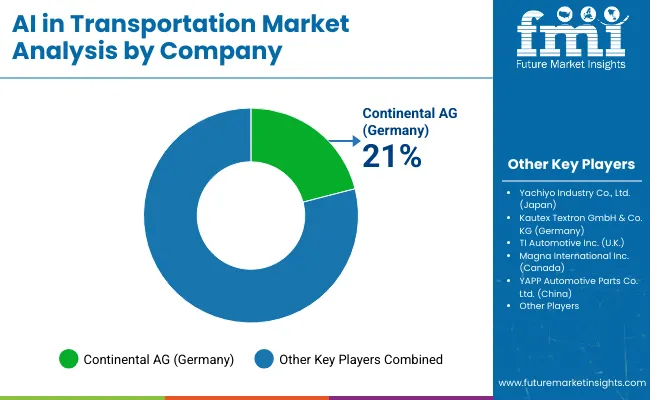

The market is driven by global automotive and technology companies delivering intelligent solutions for traffic management, vehicle systems, and fleet operations. Continental AG (Germany) is considered the leading player, supported by its extensive AI-enabled transportation solutions, including smart vehicle components, connected systems, and advanced traffic analytics. The company focuses on integrating AI with sensor technologies and telematics to improve safety, efficiency, and operational reliability for both commercial and passenger vehicles. Yachiyo Industry Co., Ltd. (Japan) and Kautex Textron GmbH & Co. KG (Germany) hold strong positions by providing automotive components optimized for AI applications and connected mobility systems. TI Automotive Inc. (UK) and Magna International Inc. (Canada) specialize in advanced vehicle electronics and fluid management systems integrated with AI capabilities.

Other players contribute by expanding regional reach and developing niche AI-driven transportation solutions. YAPP Automotive Parts Co. Ltd. (China) provides scalable components for connected vehicles, while other regional suppliers enhance adoption in emerging markets through tailored solutions for local fleets and OEMs. These companies emphasize data-driven system design, predictive maintenance, and operational efficiency, allowing fleets and vehicle manufacturers to leverage AI for safer, more reliable, and cost-effective transportation. Strategic partnerships, continuous R&D, and targeted product launches further strengthen their position in a competitive global market.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 9 billion |

| Projected Market Size (2035) | USD 71 billion |

| CAGR (2025 to 2035) | 22.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Offering Segments | Hardware (Neuromorphic, Von Neumann), Software, Platforms, Solutions |

| Machine Learning Technology | Deep Learning, Computer Vision, Context Awareness, Natural Language Processing |

| Process Segments | Signal Recognition, Object Recognition, Data Mining |

| Application Segments | Semi-Autonomous Truck, Truck Platooning, Predictive Maintenance, Precision & Mapping, Autonomous Truck, Machine-Human Interface, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Germany, France, Italy, United Kingdom, Spain, China, Japan, India, South Korea, Australia, United Arab Emirates, Saudi Arabia, South Africa |

| Leading Players | Continental AG (21%), Yachiyo Industry Co. Ltd., Kautex Textron GmbH & Co. KG, TI Automotive Inc., Magna International Inc., YAPP Automotive Parts Co. Ltd |

| Additional Attributes | Dollar sales by offering, machine learning technology, and application, demand dynamics across semi-autonomous and autonomous trucks, regional adoption trends across North America, Europe, and Asia-Pacific, innovation in AI-driven vehicle systems, predictive maintenance, and smart fleet management solutions |

The market size is valued at USD 9 billion in 2025.

It is projected to reach USD 71 billion by 2035.

The market is expected to grow at a CAGR of 22.8% during 2025-2035.

Software - Solutions holds the largest share with 32% in 2025.

Continental AG is the leading player with 21% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

AIOps Platform Market Size and Share Forecast Outlook 2025 to 2035

AI Image Editor Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Venison Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Fish Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Chicken Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA