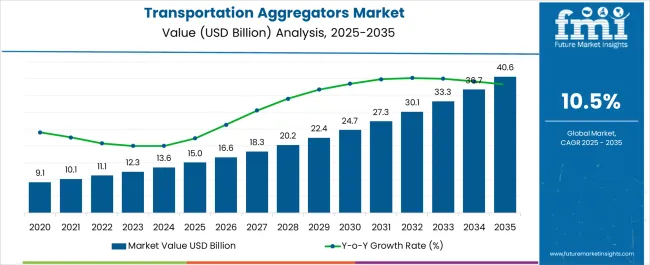

The Transportation Aggregators Market is estimated to be valued at USD 15.0 billion in 2025 and is projected to reach USD 40.6 billion by 2035, registering a compound annual growth rate (CAGR) of 10.5% over the forecast period.

| Metric | Value |

|---|---|

| Transportation Aggregators Market Estimated Value in (2025 E) | USD 15.0 billion |

| Transportation Aggregators Market Forecast Value in (2035 F) | USD 40.6 billion |

| Forecast CAGR (2025 to 2035) | 10.5% |

The transportation aggregators market is experiencing steady expansion, supported by rising digital adoption and the growing need for efficient, cost-effective, and user-friendly mobility solutions. Increasing smartphone penetration and internet connectivity are enabling seamless access to transportation services through aggregator platforms, which integrate multiple providers under a single interface. This model is being increasingly adopted across both developed and emerging markets due to its ability to enhance convenience, transparency, and competitive pricing.

Rapid urbanization and population growth are creating higher demand for reliable transportation networks, while evolving consumer behavior is shifting preference toward flexible, on-demand mobility rather than traditional ownership models. Strategic investments by technology companies and mobility providers are driving continuous innovation in areas such as route optimization, integrated payments, and real-time tracking.

Furthermore, government policies supporting shared mobility and sustainable transportation are influencing adoption across regions As sustainability and efficiency remain key priorities, the transportation aggregators market is positioned for long-term growth, with expanding opportunities in roadways, railways, air travel, and multimodal platforms.

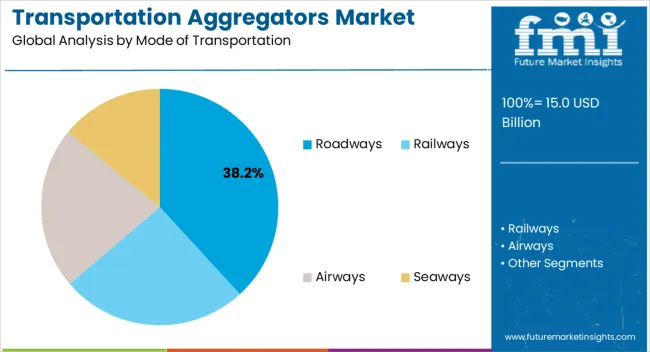

The transportation aggregators market is segmented by mode of transportation, and geographic regions. By mode of transportation, transportation aggregators market is divided into Roadways, Railways, Airways, and Seaways. Regionally, the transportation aggregators industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The roadways segment is projected to hold 38.2% of the transportation aggregators market revenue share in 2025, making it the leading mode of transportation. This dominance is being driven by the widespread availability of road networks and the growing reliance on road-based mobility for both passenger and freight transport. Roadways offer flexibility, last-mile connectivity, and affordability, which are critical factors influencing consumer choice in urban and semi-urban areas.

Transportation aggregators in this segment are benefiting from the increasing popularity of ride-hailing, carpooling, and on-demand logistics services that are enabled through digital platforms. The segment’s growth is being further supported by rising fuel efficiency, development of electric and hybrid fleets, and government initiatives aimed at reducing congestion and emissions through smart mobility programs.

Road-based transportation also provides scalability and adaptability, allowing platforms to cater to diverse user groups ranging from individual commuters to enterprises seeking logistics solutions As digital transformation reshapes mobility ecosystems, the roadways segment is expected to remain the cornerstone of transportation aggregators, reinforcing its strong market leadership in the years ahead.

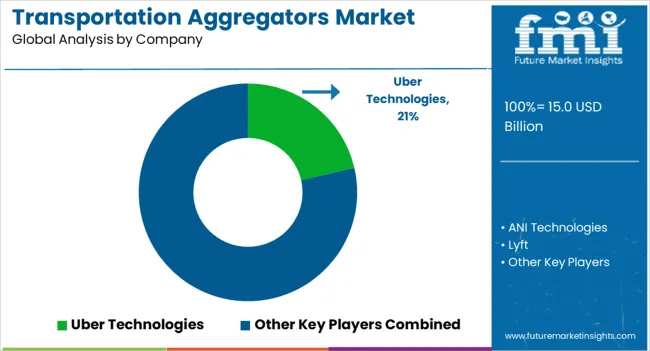

There are more than 30 mobile applications available for taxi aggregation across the world. Uber Technologies Inc. (Uber), Beijing Xiaoju Keji Co., Ltd. (Didi Dache), Lyft Inc, ANI Technologies Pvt. Ltd. (Ola Cabs), GrabTaxi Pte Ltd Block (Grab Taxi), Bla Bla Car, and Gett are some of the leading taxi aggregators in the world.

Transportation of people, goods, and animal is very important aspect in the current's era. Transportation aggregator is an entity which offers a selection of transportation services as core business either as a stand-alone providers or through partnerships solving numerous cascading problems of transportation.

Transportation aggregation includes all the passenger vehicles such as cars, buses, and aircrafts, logistic vehicles such as trucks, ships, and other commercial vehicles. A transportation aggregator can be a public or private entity providing transportation service for roadways, railways, airways, and waterways.

Transportation aggregation service is generally availed through online portal; however, currently the market has seen the introduction of several companies providing transportation aggregation services platforms in a form mobile applications.

With multiple ways to reach destination, it is very difficult at times for a passenger to find out the most economical and convenient way to travel. Transportation aggregators are shortening the gap between traveler and transportation service providers.

Taxi hailing mobile applications are creating disruption in the transportation aggregators market as these companies are serving day to day commuting need of passengers with very reasonable cost and additionally providing features such as payments options, car sharing, and fare splitting.

The inexorable technological advancements in the space of smartphones and internet is driving the growth of the global transportation aggregators market. Several online portal and mobile applications of transportations are providing ease of booking tickets in train, and airplane, booking taxi and delivery of goods to consumers.

These transportation aggregators provide various payment options such as secure online payment and cash on delivery. Another driving factors of transportation aggregator market is huge reduction in cost of commuting and delivery of goods. It is due to increasing competitive rivalry in the transportation aggregators market.

Increasing venture capitalist investments in the transportation aggregators market is one of the primary factors which has enabled the transportation providers to offer huge discounts to the consumers/passengers in order to retain them. However, the market is currently witnessing cash churning which is expected to be one of the major issue for the companies backed by venture investments in the future.

Transportation aggregation rules and regulation vary from country to country, making operations very complex for transportation aggregators. Transportation aggregators are more or less only present in metro cities of the world. Entering to tier 3, tier 4 and tier 5 cities of the world is still a significant challenge for the transportation aggregators.

Transportation aggregators market on the basis of mode of transportation:

Roadways:

Roads are main mean of transportations. Majority of the companies in transportation aggregators market are providing the roadways transport aggregation services. Road transportation is used to transmit goods over short and medium distances by motor vehicles. Several taxi hailing companies including Uber and Ola are funded with millions of dollars to run their operations, making roadways the biggest transportation aggregation market. Roadways transportation aggregation services are provided by both private and public entities.

Railways:

High volumes of heavy cargos are generally transported through railways over long distance. Railways are more convenient and secure mode of transportation within a country. Generally, railways transportation aggregation service is provided by country's national government; however, in certain regions, railways transportation service is also handled by private entities, especially for intercity transportation.

Airways:

Airways are more prominent ways of transportation for intra-country transportation. Airways are used for both transportation of passengers and goods. For passenger transportation, various online portals are available which aggregate the airlines services. Air Transport International provides separate online services for transportation of goods.

Seaways:

Seaways include carrier, seaports, terminals, and labor involved in the movement of cargo and passenger by water. Seaways segment accounts for largest percentage share in terms of value for transportation of cargo amongst the 4 modes of transportation of goods.

The transportation and logistics industry is highly competitive in North America. Silicon Valley is witnessing success of taxi aggregator Uber across the world which is currently ranked world's top startup and valued around US$ 51 billion in 2025, according to Business Insider. The highly integrated supply chain network of countries such as USA and Canada are paving the way for growth of transportation aggregators market.

With increasing awareness about supply chain innovations, transportation and logistics service providers are looking to redesign the supply chain network and are intensively focusing on calculating the security risk associated with passengers and goods which is also contributing in the growth of transportation aggregators market.

Global dynamics change, and change in trending patterns are putting direct impact on transportation aggregators market in the European region. Middle East and Africa and Latin America region are at the nascent stage; however, transportation aggregators are slowly and gradually expanding their business and paving the way for revenue growth in these regions

Transportation Aggregators Market Segments

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

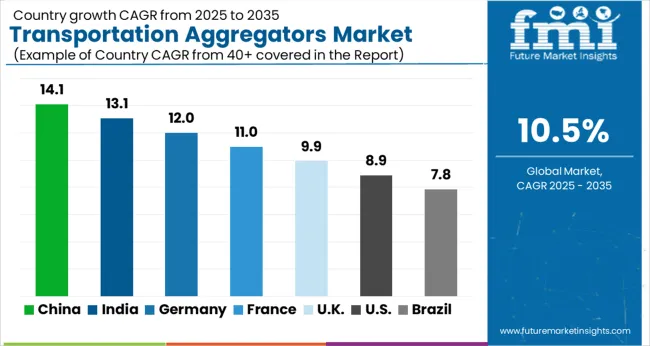

| Country | CAGR |

|---|---|

| China | 14.1% |

| India | 13.1% |

| Germany | 12.0% |

| France | 11.0% |

| UK | 9.9% |

| USA | 8.9% |

| Brazil | 7.8% |

The Transportation Aggregators Market is expected to register a CAGR of 10.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 14.1%, followed by India at 13.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 7.8%, yet still underscores a broadly positive trajectory for the global Transportation Aggregators Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 12.0%. The USA Transportation Aggregators Market is estimated to be valued at USD 5.6 billion in 2025 and is anticipated to reach a valuation of USD 13.0 billion by 2035. Sales are projected to rise at a CAGR of 8.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 718.2 million and USD 495.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.0 Billion |

| Mode of Transportation | Roadways, Railways, Airways, and Seaways |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Uber Technologies, ANI Technologies, Lyft, Gett, Shippr, Grab Holdings, Bla Bla, Fehr&Peers, and BlackBuck |

The global transportation aggregators market is estimated to be valued at USD 15.0 billion in 2025.

The market size for the transportation aggregators market is projected to reach USD 40.6 billion by 2035.

The transportation aggregators market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in transportation aggregators market are roadways, railways, airways and seaways.

In terms of , segment to command 0.0% share in the transportation aggregators market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transportation and Security System Market Size and Share Forecast Outlook 2025 to 2035

Transportation Biofuel Market Size and Share Forecast Outlook 2025 to 2035

Transportation Infrastructure Construction Market Size and Share Forecast Outlook 2025 to 2035

Transportation Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Transportation Analytics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Transportation Condensing Units Market Growth – Trends & Forecast 2025 to 2035

Transportation Composites Market Growth – Trends & Forecast 2022 to 2032

Transportation Coating Market Analysis 2022 to 2032

Transportation Predictive Analytics Market Report – Growth & Forecast 2017-2027

AI in Transportation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Smart Transportation Market

Public Transportation Full Payment Platform Market Size and Share Forecast Outlook 2025 to 2035

Patient Transportation Market Size and Share Forecast Outlook 2025 to 2035

Waterway Transportation Software Market Size and Share Forecast Outlook 2025 to 2035

Itinerary Aggregators Industry Analysis by Platform, by Destination Type, by Region (North America, Latin America, Europe, East Asia, South Asia, Oceania, MEA) – Forecast for 2025 to 2035

Intelligent Transportation System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Mobility Aids and Transportation Equipment Market is segmented by Product and Distribution Channel from 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA