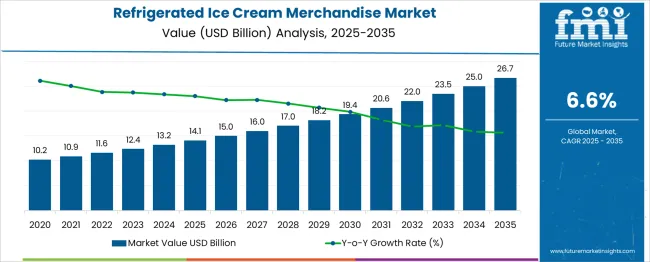

The Refrigerated Ice Cream Merchandise Market is estimated to be valued at USD 14.1 billion in 2025 and is projected to reach USD 26.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period. Regulatory frameworks play a significant role in shaping market expansion and operational practices, particularly in areas related to food safety, energy efficiency, and refrigeration standards.

Agencies such as the FDA in the United States, EFSA in Europe, and various national food safety authorities impose stringent guidelines on storage temperatures, labeling, and hygiene requirements, which directly influence equipment specifications and product handling practices. Compliance with these regulations ensures consumer safety but also drives incremental costs for manufacturers and distributors, impacting pricing and profit margins.

Energy efficiency regulations, such as minimum energy performance standards and mandates for low-global-warming-potential refrigerants, further shape technology adoption. Manufacturers are compelled to invest in advanced compressors, insulation materials, and environmentally friendly refrigerants, accelerating the transition to more sustainable and efficient systems.

These regulatory drivers create a dual effect: they increase upfront capital requirements while simultaneously enabling differentiation through certified energy-efficient and compliant equipment, which can enhance market acceptance. The evolving health and safety policies, such as mandatory regular inspections and certifications for commercial ice cream refrigeration units, influence maintenance cycles and aftermarket services, generating secondary revenue streams.

Overall, regulatory impact on the market reinforces structured growth, ensures adherence to international standards, and catalyzes technological upgrades, driving a steady upward trajectory from USD 14.1 billion in 2025 to USD 26.7 billion in 2035 under a 6.6% CAGR.

| Metric | Value |

|---|---|

| Refrigerated Ice Cream Merchandise Market Estimated Value in (2025 E) | USD 14.1 billion |

| Refrigerated Ice Cream Merchandise Market Forecast Value in (2035 F) | USD 26.7 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The Refrigerated Ice Cream Merchandise market is experiencing notable growth supported by evolving consumer preferences, retail modernization, and heightened focus on energy efficiency. The current market scenario is marked by strong demand from food service and retail sectors, where reliable, visually appealing, and environmentally compliant refrigeration solutions are prioritized.

Industry announcements and corporate press releases have highlighted advancements in eco-friendly refrigerants and digital temperature control technologies that are transforming product offerings. Future growth is expected to be influenced by stringent environmental regulations, increasing adoption of sustainable refrigerants, and rising investments in organized retail infrastructure.

According to technology and trade journals, product innovations focused on minimizing energy consumption and enhancing display aesthetics are also contributing to the market’s momentum. These dynamics collectively pave the way for continued expansion as manufacturers and retailers align with regulatory standards and consumer expectations for sustainable and efficient refrigeration solutions.

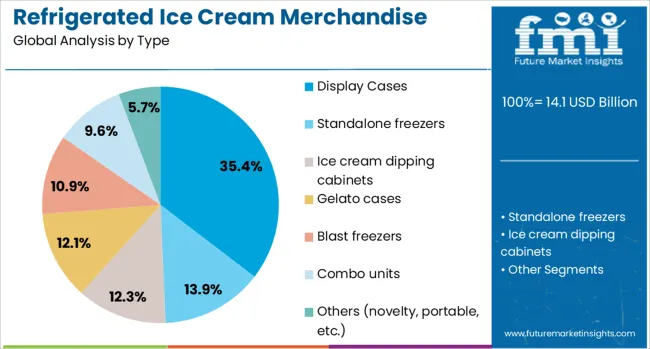

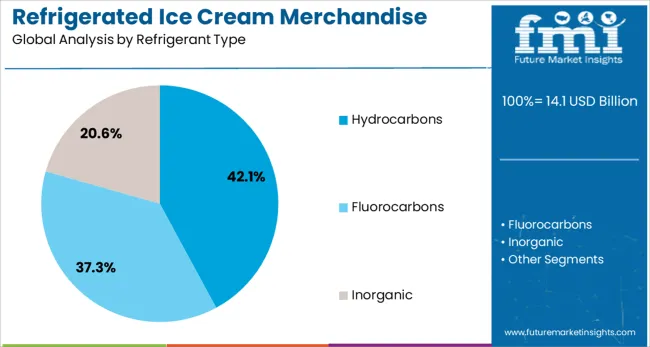

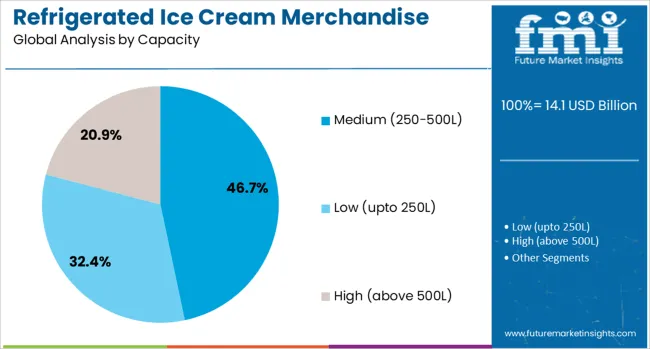

The refrigerated ice cream merchandise market is segmented by type, refrigerant type, capacity, price range, end use, and geographic regions. The refrigerated ice cream merchandise market is divided into Display Cases, Standalone freezers, Ice cream dipping cabinets, Gelato cases, Blast freezers, Combo units, and others (novelty, portable, etc.). In terms of refrigerant type, the refrigerated ice cream merchandise market is classified into Hydrocarbons, Fluorocarbons, and Inorganic.

The capacity of the refrigerated ice cream merchandise market is segmented into Medium (250-500L), Low (up to 250L), and High (above 500L). The price range of the refrigerated ice cream merchandise market is segmented into Mid (1000$-2000$), Low (up to 1000$), and High (above 2000$). The end use of the refrigerated ice cream merchandise market is segmented into Ice cream parlours, Restaurants and cafes, and others (Individual stores, etc.).

Regionally, the refrigerated ice cream merchandise industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The display cases type segment is expected to account for 35.4% of the Refrigerated Ice Cream Merchandise market revenue share in 2025, maintaining its lead among product types. This prominence is being driven by the segment’s ability to effectively showcase products while ensuring optimal preservation conditions, as reported in product launch announcements and industry publications.

Retailers have increasingly adopted display cases to attract consumer attention with improved lighting and visibility, which enhances impulse purchases. Furthermore, corporate updates have indicated that these units support advanced temperature controls and open architecture designs, making them compatible with evolving refrigerants and energy standards.

The durability, ease of maintenance, and ability to integrate into various retail formats have further reinforced their market position. The consistent innovation in design and compliance with sustainability regulations have ensured that display cases continue to command a significant share of the market in 2025.

The hydrocarbons refrigerant type segment is projected to hold 42.1% of the Refrigerated Ice Cream Merchandise market revenue share in 2025, emerging as the leading refrigerant category. This growth is attributed to the increasing regulatory push toward environmentally friendly alternatives and the superior energy efficiency offered by hydrocarbons, as highlighted in environmental agency statements and manufacturer press releases.

Industry updates have underscored that hydrocarbons such as propane and isobutane exhibit low global warming potential and comply with stringent emissions regulations, which has strengthened their adoption. Manufacturers have also invested in enhancing the safety and performance of hydrocarbon-based systems, which has improved retailer confidence and accelerated deployment.

Additionally, hydrocarbons have been recognized in sustainability reports for reducing operational costs and extending equipment lifespan, further solidifying their position as the preferred choice in the market.

The medium capacity segment, ranging between 250 and 500 liters, is forecasted to capture 46.7% of the Refrigerated Ice Cream Merchandise market revenue share in 2025, establishing itself as the largest capacity category. This leadership is being driven by its suitability for a wide range of retail environments, offering an optimal balance between storage volume and space utilization, as highlighted in corporate presentations and trade publications.

Retailers have favored medium capacity units for their flexibility in small and medium-sized stores while still providing adequate product visibility and accessibility. Company updates have emphasized that these units align well with energy efficiency goals and accommodate advanced refrigerants, enhancing their appeal.

The segment’s dominance has also been supported by the increasing availability of modular and customizable design,s which cater to diverse retail layouts and operational needs. These factors have collectively reinforced the medium capacity segment’s prominence in the market in 2025.

The market has been growing due to the rising demand for frozen desserts in retail, convenience stores, and foodservice outlets. Merchandisers have been utilized to store, display, and preserve ice cream and frozen treats while maintaining product quality and temperature consistency. Market expansion has been supported by technological advancements in refrigeration systems, energy-efficient designs, and aesthetic displays. Increasing consumption, new product launches, and expansion of organized retail chains have further strengthened the adoption of refrigerated ice cream merchandisers globally.

Retail chains, supermarkets, and foodservice operators have been major contributors to the refrigerated ice cream merchandise market due to growing consumer demand for frozen desserts. Merchandisers have been deployed to enhance product visibility, maintain optimal storage temperatures, and improve customer convenience. The expansion of convenience stores and hypermarkets in urban and suburban regions has increased the requirement for energy-efficient and high-capacity display units. Seasonal demand peaks during warmer months have necessitated larger inventories and improved cooling performance to prevent product spoilage. The ice cream brands have leveraged aesthetically designed merchandisers to promote impulse purchases and support marketing campaigns. With rising per capita ice cream consumption and expansion of organized retail, the integration of advanced refrigerated merchandising solutions has been reinforced across multiple markets, driving sales and improving operational efficiency.

Advancements in cooling technology have significantly influenced the refrigerated ice cream merchandise market. Modern merchandisers have been equipped with precise temperature control, LED lighting, low-noise compressors, and energy-efficient insulation to maintain product quality and reduce operating costs. Glass doors with anti-fog coatings, transparent lids, and enhanced shelving designs have improved product visibility and consumer engagement. Smart sensors and IoT-enabled monitoring systems have allowed real-time temperature tracking and predictive maintenance, minimizing spoilage and operational interruptions. The modular and customizable units have facilitated seamless integration into different store layouts and foodservice setups. These technological improvements have enhanced reliability, energy efficiency, and user convenience, encouraging adoption by retailers and distributors seeking to optimize product presentation, minimize losses, and elevate customer experience in frozen dessert merchandising.

The seasonal and climatic variations in ice cream consumption have driven the deployment of refrigerated merchandisers to meet fluctuating demand. Summer months, festivals, and holiday periods have resulted in higher consumer purchases of frozen desserts, requiring efficient storage and display solutions. Merchandisers have been designed to handle varying capacities, adjustable shelving, and rapid cooling to ensure product availability during peak periods. Shifts in consumer preferences toward premium, artisanal, and health-oriented ice cream products have also necessitated specialized display configurations, including separate compartments for dairy-free, low-sugar, or protein-rich options. Retailers and foodservice operators have increasingly relied on flexible merchandising units to balance seasonal demand, maintain product quality, and optimize inventory management. By addressing both operational efficiency and consumer expectations, refrigerated ice cream merchandisers have become integral in driving frozen dessert sales.

Emerging markets have presented substantial growth opportunities for refrigerated ice cream merchandisers due to rising disposable incomes, expanding retail infrastructure, and increasing ice cream consumption. Investments in energy-efficient refrigeration solutions, such as inverter-based compressors and environmentally friendly refrigerants, have enhanced adoption while reducing operational costs and environmental impact. The proliferation of convenience stores, supermarkets, and specialty frozen dessert outlets in Asia-Pacific, Latin America, and the Middle East has increased demand for high-quality merchandisers. Customizable, modular, and aesthetically appealing designs have attracted retailers seeking to enhance product visibility and consumer engagement. The government initiatives promoting energy-efficient appliances and sustainability have encouraged the use of advanced refrigeration systems. The combination of urbanization, retail expansion, and technological innovation is expected to drive the continued growth of the refrigerated ice cream merchandise market globally.

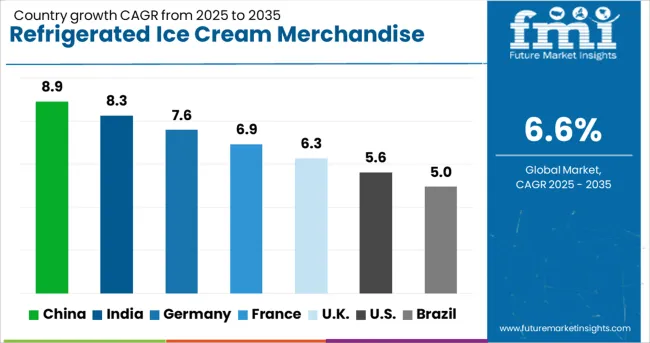

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The market is projected to expand at a CAGR of 6.6% between 2025 and 2035, driven by growing retail demand for frozen desserts, technological advancements in refrigeration, and increasing adoption of energy-efficient display units. China leads with an 8.9% CAGR, supported by rapid expansion of supermarkets and convenience stores. India follows at 8.3%, with growth fueled by rising cold chain infrastructure and modern retail formats. Germany, at 7.6%, benefits from advanced retail refrigeration systems and strong consumer demand. The UK, with a 6.3% CAGR, sees steady adoption through supermarket chains and convenience retail. The USA, at 5.6%, experiences growth due to innovation in merchandising solutions and expansion of frozen dessert offerings. This report includes insights on 40+ countries; the top markets are shown here for reference.

The industry in China is anticipated to grow at a CAGR of 8.9% from 2025 to 2035, driven by the expansion of modern retail chains and cold storage infrastructure. Leading manufacturers are integrating energy-efficient refrigeration systems to reduce operational costs while enhancing storage capacity. Urban commercial centers and tourist hubs are witnessing increased demand for impulse frozen desserts, supporting market volume. Partnerships between local equipment providers and international refrigeration technology firms are fostering advanced product offerings. Demand for smart temperature-controlled displays and modular units is rising in supermarket and convenience store channels. Consumer preference for premium and artisanal ice cream products is further strengthening adoption.

The Indian market is projected to expand at a CAGR of 8.3%, supported by rising supermarket penetration and growing consumer preference for frozen desserts. Local players are introducing compact and low-energy models suitable for small retail outlets. Demand for ice cream vending units and counter-top display cabinets is growing in tier 1 and tier 2 cities. Integration of IoT-enabled temperature monitoring and energy-efficient compressors is enhancing operational efficiency. Collaboration with international refrigeration technology providers is driving innovation and reliability. Retailers are increasingly adopting visually appealing units to boost customer engagement.

Germany is expected to witness a CAGR of 7.6%, fueled by the modernization of cold storage facilities in supermarkets and convenience stores. Energy efficiency and environmental compliance are key priorities, prompting adoption of units with eco-friendly refrigerants. Demand for modular and flexible display solutions is growing across retail chains. Manufacturers are leveraging smart monitoring systems to optimize temperature control and reduce energy consumption. Growth in premium ice cream consumption is driving customization of display cabinets. European regulatory standards are influencing equipment design and operational safety features.

The United Kingdom is projected to grow at a CAGR of 6.3% from 2025 to 2035, driven by retail modernization and rising demand for frozen desserts in foodservice outlets. Market adoption is supported by energy-efficient cabinet designs and compact units suitable for urban convenience stores. Retailers are investing in visually attractive refrigerated units to enhance product visibility and sales. Partnerships between domestic manufacturers and global technology providers are fostering innovative product features. Seasonal demand variations are influencing inventory and display strategies.

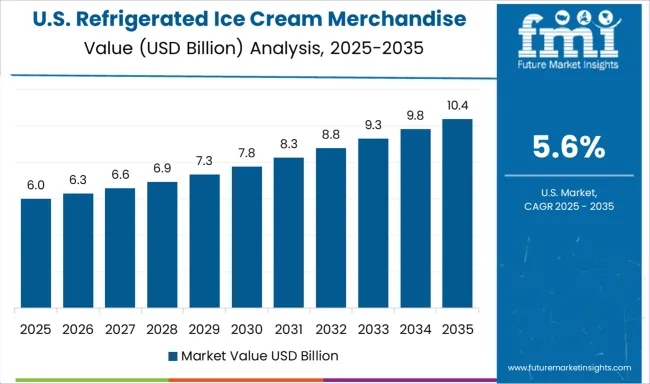

The United States market is forecast to grow at a CAGR of 5.6%, driven by the replacement of outdated refrigeration equipment and expansion of convenience store chains. Innovation in modular and energy-efficient cabinets is supporting adoption. Consumer preference for specialty and premium ice creams is influencing product design and merchandising strategies. Smart temperature monitoring systems and IoT-enabled displays are becoming standard across major retailers. Partnerships between technology providers and retail chains are optimizing cold chain efficiency. Demand is particularly strong in regions with high footfall and tourist activity.

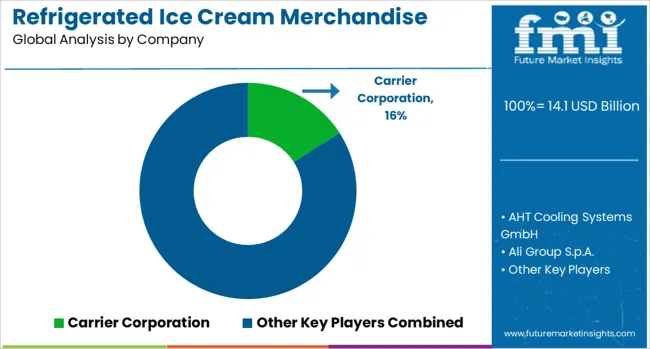

The market is dominated by established global refrigeration and appliance companies, offering advanced cooling technologies for retail, foodservice, and commercial applications. Carrier Corporation leverages its extensive HVAC and refrigeration expertise to deliver energy-efficient ice cream display units with uniform temperature control.

AHT Cooling Systems GmbH focuses on modular and customizable refrigeration solutions that cater to supermarket chains and specialty stores. Ali Group S.p.A. and Beverage-Air Corporation provide integrated merchandising solutions combining aesthetic appeal with operational efficiency, while Blue Star Limited addresses emerging markets with cost-effective and durable units. Dover Corporation and Frigoglass S.A.I.C. emphasize innovation through transparent display designs and smart energy management systems, enhancing customer experience and reducing operating costs.

Hussmann Corporation and Lennox International Inc. integrate IoT-enabled monitoring for real-time temperature control and predictive maintenance. Liebherr Group and Mafirol S.A. offer premium, high-capacity units suitable for large-scale commercial deployments, whereas Metalfrio Solutions S.A. and Thermo King Corporation provide specialized solutions for mobile or point-of-sale refrigeration.

United Technologies Corporation and Vestfrost Solutions complement the market with energy-efficient designs and adherence to global safety and hygiene standards. Market entry requires significant investment in refrigeration technology, distribution networks, and regulatory compliance, making established brand presence a critical advantage. Companies focusing on combining operational efficiency, compliance, and innovative display features are positioned to expand market share in a highly competitive and regulated sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.1 Billion |

| Type | Display Cases, Standalone freezers, Ice cream dipping cabinets, Gelato cases, Blast freezers, Combo units, and Others (novelty, portable, etc.) |

| Refrigerant Type | Hydrocarbons, Fluorocarbons, and Inorganic |

| Capacity | Medium (250-500L), Low (upto 250L), and High (above 500L) |

| Price Range | Mid (1000$-2000$), Low (upto 1000$), and High (above 2000$) |

| End Use | Ice cream parlours, Restaurants and cafes, and Others (Individual stores, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Carrier Corporation, AHT Cooling Systems GmbH, Ali Group S.p.A., Beverage-Air Corporation, Blue Star Limited, Dover Corporation, Frigoglass S.A.I.C., Hussmann Corporation, Lennox International Inc., Liebherr Group, Mafirol S.A., Metalfrio Solutions S.A., Thermo King Corporation, United Technologies Corporation, and Vestfrost Solutions |

| Additional Attributes | Dollar sales by product type and retail channel, demand dynamics across supermarkets, convenience stores, and specialty outlets, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in energy-efficient refrigeration, display aesthetics, and modular merchandising units, environmental impact of refrigerant use, energy consumption, and equipment lifecycle, and emerging use cases in impulse sales promotion, interactive customer engagement, and multi-temperature product displays. |

The global refrigerated ice cream merchandise market is estimated to be valued at USD 14.1 billion in 2025.

The market size for the refrigerated ice cream merchandise market is projected to reach USD 26.7 billion by 2035.

The refrigerated ice cream merchandise market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in refrigerated ice cream merchandise market are display cases, _vertical display cases, _horizontal display cases, _curved glass display cases, _multi-deck display cases, standalone freezers, _chest freezer, _upright freezer, ice cream dipping cabinets, gelato cases, blast freezers, combo units and others (novelty, portable, etc.).

In terms of refrigerant type, hydrocarbons segment to command 42.1% share in the refrigerated ice cream merchandise market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ice Cream Coating Market Size and Share Forecast Outlook 2025 to 2035

Ice-cream Premix and Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Ice Cream Equipment Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Ice Cream and Frozen Dessert Market from 2025 to 2035

Ice Cream Packaging Market - Outlook 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Ice Cream Service Supplies Market - Premium Serving Essentials 2025 to 2035

Ice Cream Parlor Market Analysis by Type, Product Type, and Region Through 2035

Breaking Down Market Share in the Ice Cream Parlor Industry

Ice Cream Container Market Size & Trends Forecast 2024-2034

Ice-cream Maker Market

A2 Ice Cream Market Size and Share Forecast Outlook 2025 to 2035

Licensed Sports Merchandise Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Ice Cream Market – Trends & Forecast 2025 to 2035

Non-Dairy Ice Cream Market Size and Share Forecast Outlook 2025 to 2035

Alcoholic Ice Cream Market

Soft Serve Ice Cream Machines Market

Plant-Based Ice Creams Market Analysis by Form, Product Type, Flavor, Source, Sales Channel, and Region through 2035

Liquor Flavored Ice Cream Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Display Case Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA