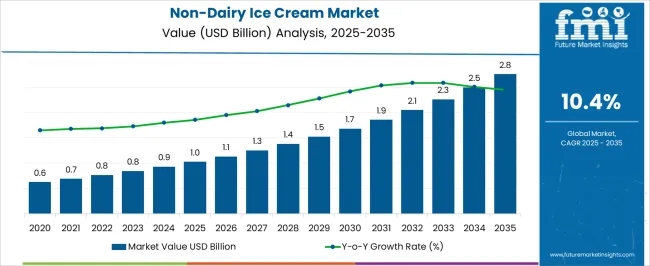

The non-dairy ice cream market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 10.4% over the forecast period.

The non-dairy ice cream market is valued at USD 1.0 billion in 2025 and is expected to reach USD 2.8 billion by 2035, growing at a compound annual growth rate (CAGR) of 10.4%. The market experiences steady growth throughout the forecast period, with early-phase expansion from USD 0.6 billion in 2021 to USD 1.0 billion in 2025. This initial growth is driven by increasing consumer demand for plant-based alternatives, fueled by rising concerns over lactose intolerance, veganism, and health-conscious eating habits.

As consumer preferences shift towards dairy-free options, product innovations, such as coconut, almond, and oat-based ice creams, gain traction. During the 2026 to 2030 phase, the market grows more rapidly, reaching USD 1.9 billion, with incremental values of USD 1.1 billion, 1.3 billion, and 1.5 billion. As awareness grows around the health benefits of non-dairy alternatives and availability expands across retail channels, the market sees broadening adoption. From 2031 to 2035, the market continues to gain momentum, reaching USD 2.8 billion.

Product diversification and improved taste and texture, along with sustainability initiatives in ingredient sourcing, drive continued market adoption. The absolute growth during this period reflects a shift toward mainstream consumption of non-dairy ice cream, with increased penetration in both developed and emerging markets.

| Metric | Value |

|---|---|

| Non-Dairy Ice Cream Market Estimated Value in (2025 E) | USD 1.0 billion |

| Non-Dairy Ice Cream Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

The non-dairy ice cream market is driven by five key parent markets that collectively shape its growth, consumer demand, and product innovations. The dairy alternatives market contributes the largest share, approximately 30-35%, as non-dairy ice cream serves as a popular alternative to traditional dairy ice cream for lactose-intolerant, vegan, or health-conscious consumers seeking plant-based options. The frozen dessert and ice cream market adds around 20-24%, as non-dairy ice cream products expand the variety of frozen dessert offerings available in retail and food service sectors, catering to the growing preference for indulgent yet dairy-free treats.

The health and wellness market contributes about 15-18%, with consumers increasingly choosing non-dairy ice creams that align with their dietary preferences, such as lower calorie, sugar-free, or organic formulations, alongside the rising awareness of environmental and ethical concerns associated with dairy consumption. The plant-based food market accounts for roughly 12-15%, as the demand for plant-based food products increases, with non-dairy ice creams made from ingredients such as almond, coconut, soy, and oat gaining popularity as part of the broader plant-based movement. Finally, the e-commerce and retail market represents about 8-10%, as online platforms provide greater access to niche, premium, and artisan non-dairy ice cream brands, making it easier for consumers to discover and purchase a wider range of products.

The non-dairy ice cream market is experiencing strong growth, supported by the rising adoption of plant-based diets, increasing prevalence of lactose intolerance, and growing consumer interest in sustainable food choices. Food industry publications and brand announcements have emphasized the expansion of product portfolios featuring alternative milk sources, innovative flavors, and functional ingredients.

The shift toward clean-label products, free from artificial additives, has further enhanced market appeal among health-conscious consumers. Advances in plant-based dairy alternatives have improved the taste and texture of non-dairy ice cream, making it more competitive with traditional dairy options.

Distribution has expanded across supermarkets, specialty stores, and online platforms, while marketing campaigns have leveraged social media to reach younger, trend-focused demographics. Sustainability considerations, including eco-friendly packaging and responsibly sourced ingredients, have also influenced purchasing decisions. Going forward, market momentum is expected to be driven by coconut milk as a preferred base, singles packaging formats catering to portion control and on-the-go consumption, and impulse product purchases encouraged by strategic retail placement.

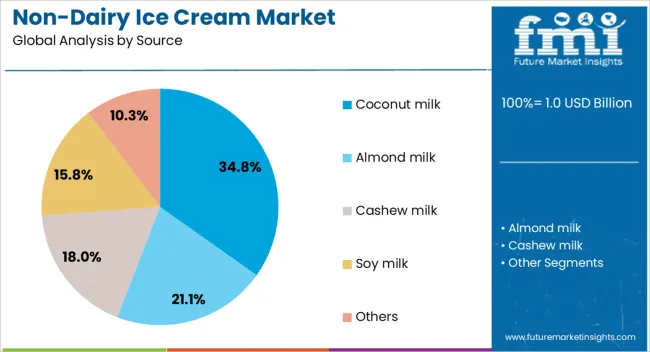

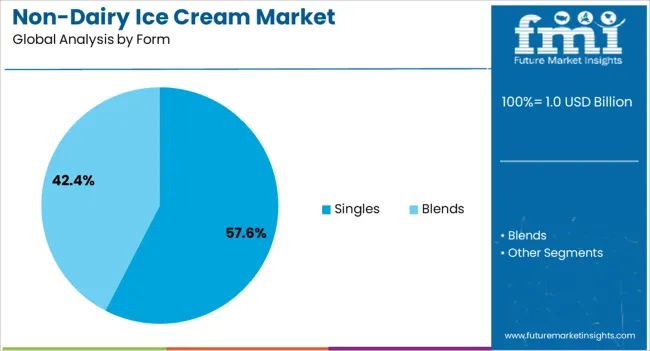

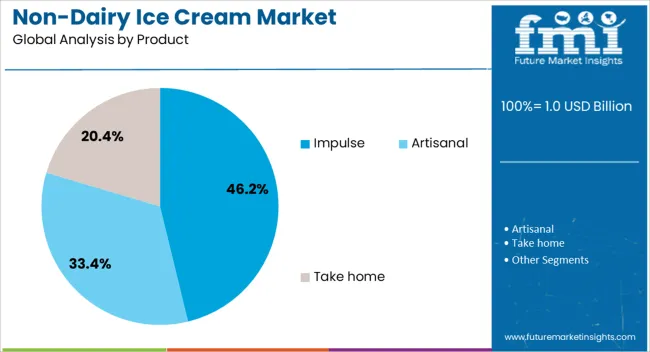

The non-dairy ice cream market is segmented by source, form, product, distribution channel, flavour, and geographic regions. By source, non-dairy ice cream market is divided into coconut milk, almond milk, cashew milk, soy milk, and others. In terms of form, non-dairy ice cream market is classified into singles and blends. Based on product, non-dairy ice cream market is segmented into impulse, artisanal, and take home. By distribution channel, non-dairy ice cream market is segmented into supermarket, convenience stores, food & drink specialists, restaurants, online store, and others. By flavour, non-dairy ice cream market is segmented into vanilla, chocolate, butter pecan, strawberry, neapolitan, cookies and cream, mint choco chip, caramel, and others. Regionally, the non-dairy ice cream industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The coconut milk segment is projected to account for 34.8% of the non-dairy ice cream market revenue in 2025, maintaining its lead due to its creamy texture, rich flavor, and widespread consumer acceptance. Food formulation experts have noted that coconut milk provides a mouthfeel similar to dairy cream, which has enhanced its popularity in plant-based frozen desserts.

Additionally, coconut milk’s natural sweetness and compatibility with a variety of flavor profiles have allowed brands to develop diverse product offerings.

Its nutritional appeal, including the presence of medium-chain triglycerides (MCTs), has also resonated with health-conscious consumers. Supply availability from major coconut-producing regions and the growing use of coconut-based ingredients in other food categories have strengthened production scalability. As the demand for indulgent yet plant-based frozen treats continues to grow, coconut milk is expected to remain a preferred choice for both manufacturers and consumers.

The singles segment is projected to contribute 57.6% of the non-dairy ice cream market revenue in 2025, leading the form category due to its convenience and suitability for portion-controlled consumption. This format has been favored by consumers seeking individual servings that fit on-the-go lifestyles and minimize food waste.

Retail and foodservice channels have capitalized on singles packaging to cater to impulse purchases, particularly in high-traffic areas such as convenience stores, cafes, and entertainment venues.

Product developers have leveraged singles to introduce seasonal and limited-edition flavors, encouraging trial and repeat purchases. The segment’s appeal is further supported by its alignment with wellness trends, as consumers can enjoy indulgence in moderation. With rising demand for portable and affordable frozen dessert options, singles are expected to sustain their dominant position in the non-dairy ice cream market.

The impulse segment is projected to hold 46.2% of the non-dairy ice cream market revenue in 2025, reflecting its strong presence in immediate-consumption channels. This segment’s growth has been driven by strategic placement in retail freezers and quick-service outlets, where visual appeal and accessibility stimulate unplanned purchases.

Eye-catching packaging designs and innovative flavor launches have further boosted impulse sales, particularly among younger consumers and tourists.

Food industry reports have highlighted that impulse products benefit from premium pricing opportunities due to their convenience factor and immediate gratification appeal. The segment has also seen increased adoption of eco-friendly and recyclable packaging, aligning with the sustainability preferences of the plant-based consumer base. As experiential and indulgent snacking continues to gain popularity, the impulse segment is expected to maintain its leadership through strong brand visibility and targeted in-store marketing.

The non-dairy ice cream market is expanding due to increasing demand for plant-based alternatives driven by health consciousness, dietary preferences, and environmental awareness. Technological advancements in flavor and texture innovation are enhancing the appeal of non-dairy ice cream. Healthier, lower-fat, and lactose-free options are appealing to consumers seeking better-for-you dessert alternatives. However, challenges related to the high cost of plant-based ingredients and supply chain issues remain. Opportunities lie in emerging markets and product diversification, including functional ingredients and sugar-free options. As consumer preferences continue to evolve, the non-dairy ice cream market is poised for continued growth.

The non-dairy ice cream market is experiencing significant growth, driven by the rising demand for plant-based alternatives to traditional dairy products. As consumers become more health-conscious and environmentally aware, many are opting for non-dairy ice cream made from plant-based ingredients like almond, coconut, oat, and soy milk. The rise in lactose intolerance, veganism, and other dietary restrictions has further fueled the shift toward non-dairy products. Leading brands like Ben & Jerry’s, Häagen-Dazs, and Magnum are capitalizing on this trend by expanding their product lines to include non-dairy ice cream options that cater to diverse consumer preferences. As plant-based diets continue to gain popularity, the demand for innovative, non-dairy ice cream flavors and formulations is set to increase globally.

Advancements in food technology are playing a key role in the growth of the non-dairy ice cream market. Manufacturers are constantly innovating to improve the taste, texture, and mouthfeel of non-dairy ice cream products, making them more comparable to traditional dairy-based ice creams. The use of new emulsifiers, stabilizers, and plant-based proteins allows for better texture and creaminess. Additionally, companies are exploring new flavor profiles and incorporating ingredients like coconut milk, almond butter, and various fruit purees to diversify their offerings. The trend towards healthier, clean-label ingredients is also gaining momentum, with many consumers preferring non-dairy ice creams with fewer additives and preservatives, further boosting product innovation.

Despite the rapid growth of the non-dairy ice cream market, challenges related to the cost of raw materials and supply chain constraints remain. The plant-based ingredients used in non-dairy ice cream, such as almonds, coconuts, and oats, can be more expensive than dairy, which increases production costs. Furthermore, sourcing high-quality, sustainable ingredients can be difficult, as some raw materials are subject to price fluctuations or shortages. These challenges can lead to higher retail prices, making non-dairy ice cream less accessible to some consumers. Manufacturers are working to find more cost-effective production methods and secure a steady supply of plant-based ingredients to make non-dairy ice cream more affordable and widely available.

The non-dairy ice cream market holds significant potential in emerging markets, where the awareness of lactose intolerance and veganism is increasing. Countries in Asia-Pacific, Latin America, and parts of Europe are seeing an uptick in demand for plant-based alternatives. Additionally, product diversification is creating new opportunities in the market. Companies are expanding their portfolios by introducing non-dairy ice cream products with functional ingredients, such as added probiotics, superfoods, or plant-based proteins, to cater to the growing demand for health-conscious, indulgent treats. As consumer preferences shift and plant-based options become more mainstream, non-dairy ice cream is poised to benefit from a broader global market.

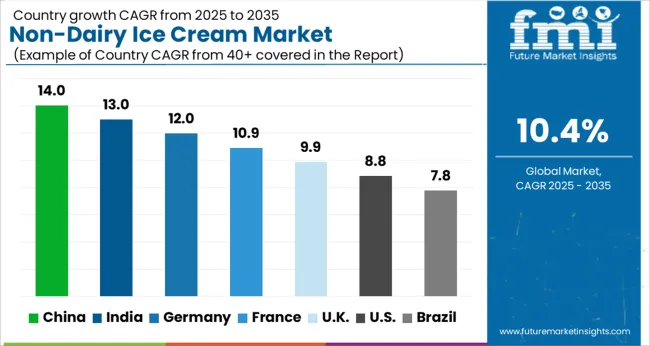

| Country | CAGR |

|---|---|

| China | 14.0% |

| India | 13.0% |

| Germany | 12.0% |

| France | 10.9% |

| UK | 9.9% |

| USA | 8.8% |

| Brazil | 7.8% |

The global non-dairy ice cream market is expected to grow at a CAGR of 10.4% from 2025 to 2035, with China leading the market at 14.0%, followed by India at 13.0%. Germany, the UK, and the USA show strong growth with CAGRs ranging from 12.0% to 8.8%. The market growth is driven by the increasing awareness of lactose intolerance, the rise of vegan and plant-based diets, and the growing demand for healthier frozen desserts. Innovation in ingredients, flavors, and formulations, along with increased availability through retail and online platforms, is fueling the expansion of the non-dairy ice cream market. The analysis spans over 40+ countries, with the leading markets shown below

The non-dairy ice cream market in China is expected to grow at a CAGR of 14.0% from 2025 to 2035, reflecting a significant shift in consumer preferences toward plant-based and dairy-free alternatives. The increasing awareness of lactose intolerance, coupled with a growing trend for healthier food options, is propelling demand for non-dairy ice cream. Additionally, the rise of veganism and the expanding range of non-dairy ice cream options across various flavor profiles are contributing factors. The market is further supported by China’s expanding e-commerce platforms, making it easier for consumers to access a variety of non-dairy ice cream products. The growing middle class and increasing disposable incomes are boosting consumption, while local manufacturers are introducing innovative products using plant-based ingredients like coconut, almond, and oat. As China continues to focus on improving health standards, the demand for dairy-free alternatives is expected to rise, making it one of the fastest-growing markets for non-dairy ice cream globally.

The non-dairy ice cream market in India is projected to grow at a CAGR of 13.0% from 2025 to 2035, driven by an increasing number of health-conscious consumers and the growing popularity of plant-based diets. India’s market is expanding due to the rising awareness of lactose intolerance and the shift toward dairy-free products. The country's strong tradition of dairy consumption is witnessing a transformation as more consumers opt for plant-based ice cream made from ingredients such as coconut, soy, and almond. The rising disposable income and the growing middle class are boosting demand for premium, healthier, and allergen-free food options. With increased product innovation and the introduction of a wide variety of flavors, non-dairy ice cream is becoming a preferred choice for consumers seeking alternative frozen desserts. E-commerce platforms are also helping increase the availability of non-dairy ice cream, making it more accessible to the general population.

The non-dairy ice cream market in Germany is expected to grow at a CAGR of 12.0% from 2025 to 2035, with a rising trend toward healthier eating and plant-based alternatives. The demand for non-dairy ice cream in Germany is primarily driven by the growing number of people embracing vegan and lactose-free diets. The country's well-established market for frozen desserts is shifting towards plant-based ice creams as consumers seek healthier options that cater to lactose intolerance, allergies, and dietary preferences. In addition, the increasing range of plant-based ingredients used in non-dairy ice cream, such as almond milk, coconut milk, and soy, is attracting more consumers. With a high focus on sustainability and ethical sourcing, German consumers are becoming more inclined toward environmentally friendly and cruelty-free products. The availability of diverse flavors and premium offerings in supermarkets and retail stores is enhancing the market’s growth.

The UK non-dairy ice cream market is projected to grow at a CAGR of 9.9% from 2025 to 2035, as more consumers adopt plant-based and lactose-free diets. With rising health consciousness and increasing incidences of lactose intolerance, the demand for non-dairy alternatives, including ice cream, is gaining traction. In the UK, non-dairy ice cream products are becoming increasingly popular due to the growing trend of veganism and plant-based diets. The market is supported by an expanding range of plant-based ingredients such as oat milk, soy milk, and coconut milk. The UK's robust food service industry and retail chains are increasingly offering non-dairy ice cream options, which are further driving demand. Innovations in flavor offerings and healthier ingredient profiles are helping expand the market share of non-dairy ice cream. With the growing focus on clean labels and allergen-free foods, the market for non-dairy ice cream is expected to continue its upward trajectory.

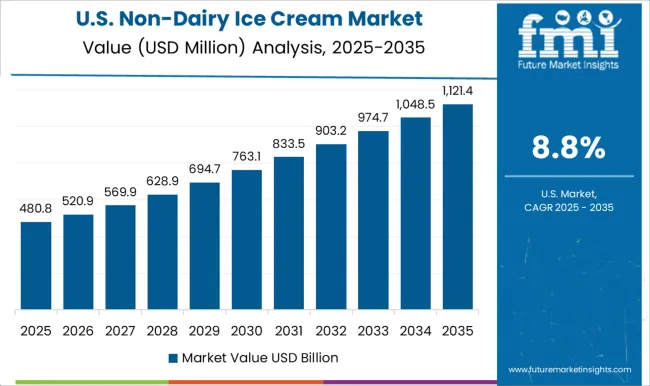

The USA non-dairy ice cream market is projected to grow at a CAGR of 8.8% from 2025 to 2035, reflecting a notable shift toward healthier, plant-based alternatives. The market is primarily driven by the growing popularity of plant-based diets and increasing awareness of lactose intolerance. As consumer preferences evolve, non-dairy ice cream products made from ingredients like oat, almond, and coconut milk are becoming more mainstream. The increased availability of non-dairy ice cream in retail stores and foodservice outlets is further fueling the market. Consumers are seeking indulgent yet healthier frozen desserts, which has prompted brands to innovate with better taste, texture, and nutritional content. The market's growth is also supported by the rise of the health-conscious millennial and Gen Z demographics, who are more inclined to choose dairy-free and allergen-friendly food options. Increased product availability through e-commerce platforms is expected to further expand market reach.

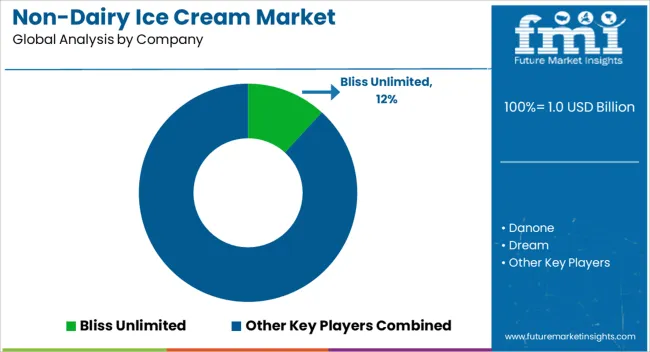

Competition in the non-dairy ice cream market is driven by innovation in flavor variety, nutritional benefits, and the growing demand for plant-based alternatives. Bliss Unlimited leads the market by offering indulgent non-dairy ice cream made from high-quality ingredients like coconut milk and almond milk. Their product brochures highlight a rich selection of flavors, emphasizing both taste and the inclusion of natural, non-GMO ingredients that cater to both vegan and lactose-intolerant consumers.

Danone competes with its popular "So Delicious" brand, offering a wide range of dairy-free ice cream options made from almond milk, coconut milk, and oat milk. Their brochures highlight the use of organic and sustainably sourced ingredients, alongside a focus on rich, creamy texture that rivals traditional dairy ice cream. Dream, another key player, focuses on creating non-dairy desserts that offer indulgence without compromising on quality. Their brochures emphasize a range of flavors using coconut milk, with a commitment to allergen-free, non-GMO formulations.

Eden Creamery stands out with its focus on using oat milk as a base for its non-dairy ice cream. Their brochures promote oat milk’s creaminess and ability to deliver rich, decadent flavors, catering to the growing demand for oat-based products. General Mills competes through its "Haagen-Dazs Non-Dairy" line, offering premium non-dairy ice cream options made with almond milk. Their brochures emphasize a luxurious, full-bodied texture and taste, as well as a commitment to high-quality ingredients.

Happy Cow and NadaMoo focus on creating delicious coconut milk-based ice creams that are both creamy and nutritious. Their product brochures highlight the use of organic coconut milk and natural sweeteners to deliver an indulgent yet wholesome experience. Over The Moo and Swedish Glace also offer plant-based ice creams, with brochures showcasing their extensive flavor ranges and dedication to offering dairy-free alternatives without compromising on taste or texture. The Booja-Booja targets the premium market with gourmet non-dairy ice cream, known for its rich, velvety texture made from cashew cream.

Product brochures focus on the company’s dedication to high-quality, organic ingredients and its indulgent flavor profiles. Tofutti Brands provides a variety of dairy-free frozen desserts, with brochures emphasizing the company’s long-standing commitment to offering a range of non-dairy options for diverse dietary needs.

Trader Joe’s and Unilever (through its Ben & Jerry’s and Breyers brands) cater to both the mainstream and premium segments of the market. Trader Joe’s promotes its affordable yet high-quality non-dairy ice cream offerings, while Unilever’s brochures highlight the variety, sustainability, and ethical sourcing behind its non-dairy lines.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 billion |

| Source | Coconut milk, Almond milk, Cashew milk, Soy milk, and Others |

| Form | Singles and Blends |

| Product | Impulse, Artisanal, and Take home |

| Distribution Channel | Supermarket, Convenience stores, Food & drink specialists, Restaurants, Online store, and Others |

| Flavour | Vanilla, Chocolate, Butter pecan, Strawberry, Neapolitan, Cookies and cream, Mint Choco chip, Caramel, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bliss Unlimited, Danone, Dream, Eden Creamery, General Mills, Happy Cow, NadaMoo, Over The Moo, Swedish Glace, The Booja-Booja, Tofutti Brands, Trader Joe’s, Unilever, and Van Leeuwen Artisan Ice Cream |

| Additional Attributes | Dollar sales by product type, flavor, and packaging are rising, driven by demand for plant-based, lactose-free frozen desserts. Growth is strong in North America, Europe, and Asia-Pacific amid health and sustainability trends. |

The global non-dairy ice cream market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the non-dairy ice cream market is projected to reach USD 2.8 billion by 2035.

The non-dairy ice cream market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in non-dairy ice cream market are coconut milk, almond milk, cashew milk, soy milk and others.

In terms of form, singles segment to command 57.6% share in the non-dairy ice cream market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-Dairy Creamer Market Size, Growth, and Forecast for 2025 to 2035

Market Share Breakdown of Non-Dairy Creamer Industry

Non-Dairy Creamer Market in Japan Analysis by Type, Source, Distribution Channels, Form, and Region Through 2035

Non-Dairy Creamer Powder Market

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

United States Non-Dairy Creamer Market Insights – Size, Demand & Forecast 2025–2035

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

ASEAN Non-Dairy Creamer Market Report – Trends, Demand & Industry Forecast 2025–2035

Comprehensive Analysis of Europe Non-Dairy Creamer Market by Form Type, Source Type, Packaging Type, Distribution Channel, Flavour Type, and Country through 2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Latin America Non-Dairy Creamer Market Outlook – Share, Growth & Forecast 2025–2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

ICE Start And Stop System Market Size and Share Forecast Outlook 2025 to 2035

Ice Boxes Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Iced Tea Business

Ice Detection System Market Trends, Growth & Forecast 2025 to 2035

Ice Cube Tray Market Trends & Growth Forecast 2024-2034

Ice Maker Machines Market

Ice Transport Buckets Market

Ice Cream Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA