The ASEAN Non-Dairy Creamer market is set to grow from an estimated USD 1,082.3 million in 2025 to USD 2,311.7 million by 2035, with a compound annual growth rate (CAGR) of 7.9% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 1,082.3 million |

| Projected ASEAN Value (2035F) | USD 2,311.7 million |

| Value-based CAGR (2025 to 2035) | 7.9% |

Market growth of non-dairy creamers in the ASEAN region continues to remain steady because of shifts in consumer behavior alongside increasing lactose sensitivity and a rise in plant-based alternative preferences. The product group known as non-dairy creamers offers two varieties to substitute milk in beverages and culinary creations whereby plant-based milk (coconut, almond, and oat) as well as vegetable oils function as alternative components.

Non-dairy creamers have gained increasing market demand throughout ASEAN because vegan and flexitarian diets have become more popular. Consumers need lactose-free and cholesterol-free products to meet both their dietary requirements and personal health commitments.

Liquid and powdered non-dairy creamers provide versatile convenience making them preferred choices in residential consumers and commercial operations including food service settings.

The market expansion is driven by markets including India together with Malaysia and Thailand. India's tea-loving population along with rising lactose intolerance sensitivity drives market demand while both Malaysian and Thai markets strengthen their café sector and opt for plant-based products.

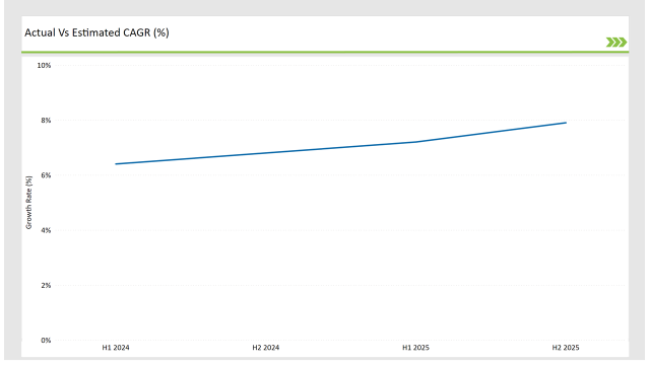

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Non-Dairy Creamer market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Non-Dairy Creamer market, the sector is predicted to grow at a CAGR of 6.4% during the first half of 2024, with an increase to 6.8% in the second half of the same year. In 2025, the growth rate is expected to decrease slightly to 7.2% in H1 but is expected to rise to 7.9% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April 2023 | A leading Thai brand, Plant Creamer , launched a range of coconut-based non-dairy Creamer for cafés and restaurants. |

| July 2023 | India ’s Nutri Plant introduced fortified almond milk Creamer enriched with calcium and omega-3 fatty acids, targeting health-conscious consumers in ASEAN markets. |

| September 2023 | Malaysia-based Cream Delight announced the launch of sugar-free flavored Creamer, including hazelnut and caramel variants, in retail and online channels. |

| November 2023 | Global company Creamy Earth expanded its production facility in Indonesia to meet the rising demand for plant-based Creamer in the ASEAN region. |

| February 2024 | Oat Creamer Innovations introduced a barista-grade oat milk creamer line in Vietnam, focusing on premium coffee applications. |

Rise in Plant-Based and Vegan Diets

A substantial shift toward plant-based and vegan eating has become a major market-influencing phenomenon within ASEAN Non-Dairy Creamer. Increasing awareness about health and the environment has led people to pursue non-dairy options that match their dietary mores and environmental commitments. People looking for dairy-free alternatives can choose plant-derived Creamer available in almond milk, coconut milk, and oat milk formats.

Plant-based non-dairy Creamer gain popularity from millennial and Generation-Z consumers because they support clean-label sustainable dietary choices simultaneously. Budding populations of vegans combined with flexitarians across Malaysia and Thailand drive increased non-dairy creamer usage at home and in both restaurants and cafes. Home and café customers who care about their health choose these Creamer because they contain zero cholesterol and are low in calories.

Growth of E-Commerce and Digital Platforms

Non-dairy Creamer experience a different marketing landscape and sales methodology through digital channels across the ASEAN region. The growth of online retail distribution represents a primary growth factor that gives manufacturers the capability to expand their market reach across multiple audiences while providing more product selection.

Non-dairy creamer purchases have migrated to e-commerce platforms because customers appreciate both convenient shopping and detailed product information and user testimonials. Plant-based and flavored non-dairy Creamer achieve rising popularity on Lazada, Shopee, and Amazon platforms while urban populations lead their market expansion.

Through e-commerce platforms, smaller brand operations can reach new audiences with their line of specialty products that include organic options and allergen-free and keto-friendly non-dairy Creamer. Subscription-based delivery models are becoming popular because they send people's selected creamer products automatically on regular schedules to professionals and families with busy lifestyles.

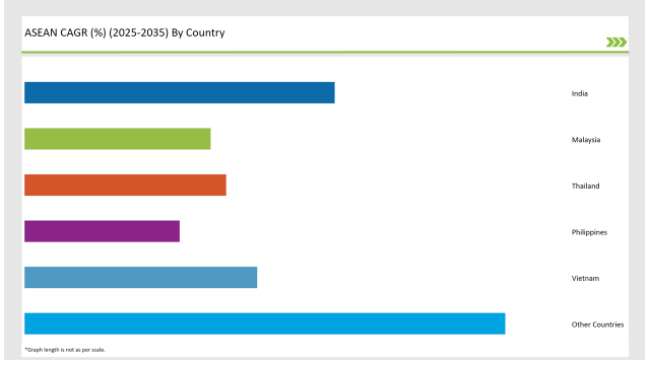

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

Non-dairy Creamer have gained substantial market demand because India has become more hyper-sensitive to lactose intolerance. The growing prevalence of lactose sensitivity among 60% of India's population has driven demand for plant-based along with vegetable-oil-based non-dairy Creamer. Plant-based Creamer have steadily grown in use across India since consumers choose them instead of milk for traditional tea recipes.

Veganism together with consumer concerns for personal health has pushed market dynamics forward. Indian consumers make deliberate choices to purchase cholesterol-free products along with food containing low calories while maintaining both ethical and sustainable standards. The urban populations including younger consumers prefer plant-based Creamer extracted from almond milk and oat milk together with coconut milk.

Malaysia's growing food service sector drives the Non-Dairy Creamer market through its main accelerating force. The convenient design and flexibility of Non-Dairy Creamer enable restaurants together with cafés and quick-service outlets to fulfill their needs. Non-Dairy Creamer serve as critical components for instant mashed potatoes and snack coating applications at every food service operation throughout the country.

The Malaysian market for Non-Dairy Creamer experiences substantial growth because Malaysian consumers increasingly choose environmentally sustainable organic products. Non-Dairy Creamer producers gained official acknowledgment from the government which supported their transition to sustainable farming while their customers drove market expansion through clean-label product selection for organic certification.

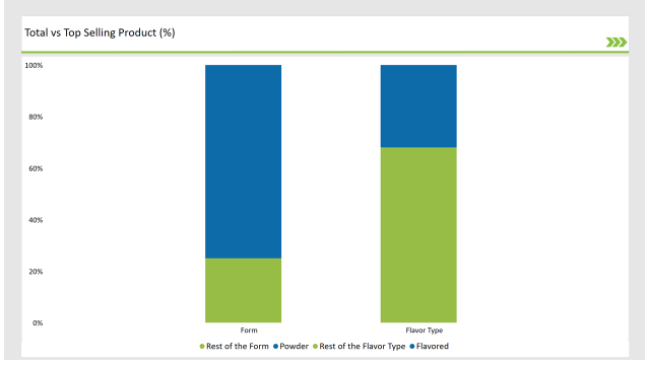

% share of Individual categories by Form and Flavours in 2025

Changes in market dynamics show consumption patterns of powder non-dairy Creamer leading through their points of easy use, economic benefits, and extended durability time. Home and office consumers choose these Creamer because they need no refrigeration and offer simple transportation and storage possibilities. Hot beverages including coffee tea and cocoa dissolve powder Creamer instantly which makes them perfect for swift beverage preparation and ideal for active office environments and domestic settings.

Food service establishments widely use powdered Creamer throughout their cafés and restaurants and vending machines to achieve stable beverage taste combinations. These products weigh less so businesses can buy them in large quantities which decreases manufacturer and distributor shipping expenses. End consumers find convenience in purchasing powdered non-dairy Creamer through small single-serving packets as these improve their reach beyond the airline industry and extend into office facilities and hotel establishments.

The ASEAN market wants flavored non-dairy Creamer that include French vanilla along with hazelnut and chocolate varieties. Foodservice operators widely use these Creamer to elevate beverage aesthetics because they make premium coffee and tea more sensory appealing.

Countries like Malaysia and Thailand have fostered café culture which produces substantial demand for flavored offerings since consumers desire restaurant-quality beverage experiences in both casual and mobile settings.Targeting young consumers who value trends retailers position their flavored Creamer as upscale products for the retail market.

Fusion flavors including caramel and coconut demonstrate high popularity because these exotic notes match consumer demand for strong sweet-tasting beverages in the area.

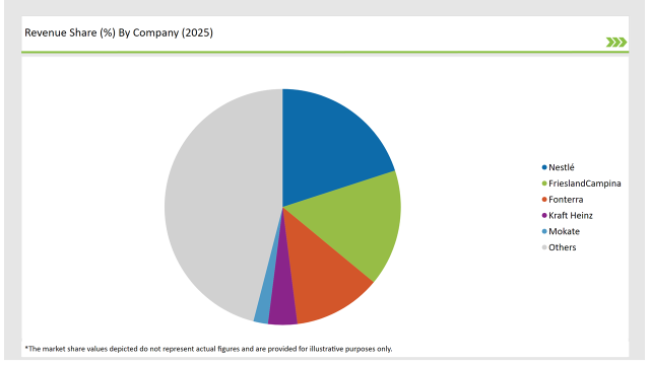

2025 Market share of ASEAN Non-Dairy Creamer Manufactures

The ASEAN Non-Dairy Creamer Market is characterized by fierce rivalry, being nested by both multinational conglomerates and regional businesses that endeavor to meet the demands of the continuously changing market. Leading entities such as Nestlé, Danone, and International Delight occupy the major part of the market due to their diversified product range and well-established distribution channels. They concentrate on flavors, formulas, and packaging to bypass their competitors.

Some of the local players like Malaysia's Cream Delight and Thailand's Plant Cream, have made their mark by offering products that cater to the specific requirements of the locals and by stressing the plant-based and sustainable options. The companies capitalize on the availability of sources like coconut and palm oil, which allows them to manufacture inexpensive but high-quality Creamer.

As per Form, the industry has been categorized into Granules and Liquid.

By Source the industry has been categorized into Type Coconut, Almond, Soy, Corn, Others.

As per Packaging Type, the industry has been categorized as Sachets / Pouches, Bags, Canisters, Bottles.

By Distribution Channels Food Service Channels, Hypermarkets / Supermarket, Convenience Stores, Grocery Stores, Specialty Stores, Online Retail.

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Non-Dairy Creamer market is projected to grow at a CAGR of 7.9% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 2,311.7 million.

India are key Country with high consumption rates in the ASEAN Non-Dairy Creamer market.

Leading manufacturers include Nestlé, Friesland Campina, Fonterra, and Kraft Heinz others are the key players in the ASEAN market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA