The Latin America Non-Dairy Creamer market is set to grow from an estimated USD 308.0 million in 2025 to USD 644.6 million by 2035, with a compound annual growth rate (CAGR) of 7.7% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 308.0 million |

| Projected Latin America Value (2035F) | USD 644.6 million |

| Value-based CAGR (2025 to 2035) | 7.7% |

The gradual growth of the non-dairy creamer sector in Latin America is mainly attributed to the urge for more plant-based and lactose-free options by the consumers. The trend is more prominent in countries like Brazil, Mexico, Argentina, and Colombia, where consumers who get lactose intolerant are likely to go for non-dairy creamers and veganism become more common along with other dietary choices that are not inclusive of all dairy.

The increasing demand for functional ingredients in convenience beverages, and the expansion of product categories has been a great driving force for these creamers in households and foodservice alike.

The segmentation is based on product category, which is then further categorized into the forms of soya, almond, coconut, and other plant-based creamers respectively shape-wise such as liquid and powder. Applications cover beverages, bakery products, and confectionery sectors.

The industrial sector also includes the significant players such as coffee chains, food manufacturers, and the ready-to-drink (RTD) market that are utilized these creamers in their product ranges. Consumers are more and more often asking for clean-label, sugar-free, and fortified non-dairy creamers. They want alternatives to be more healthy while at the same time eating functional foods, such as protein, probiotics, and collagen.

The main players that can be seen in the segment would be Nestlé (Coffee-Mate), Danone, Kerry Group, FrieslandCampina, as well as regional firms that give attention to the local demand. The competition is found in product development, plant-based formulations, and sustainability, including schemes connected to dumping carbon dioxide and improving nutrition.

However, the trend toward plant-based products and the medicinal benefits acquired by implementing new consumer habits have shifted the region's non-dairy creamer industry towards progress and have caused the industry to pick a route that is focused on well-being and creating a better ecosystem for the next decade.

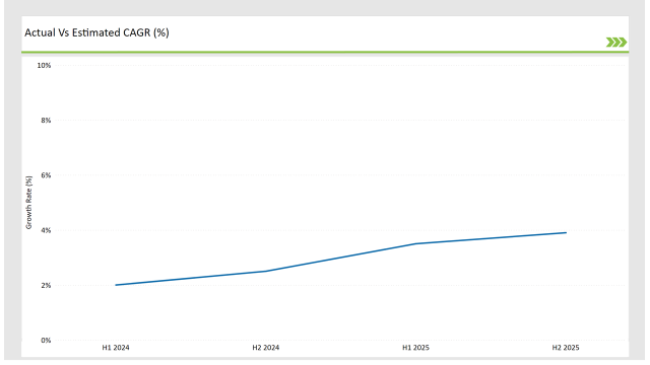

The table demonstrates a fragmentation assessment of changes in the compound annual growth rate (CAGR) with regard to 6 months on the base year (2024) and the current year (2025) Latin American Non-Dairy creamer market. This semi-annual analysis serves as a bellwether for critical market dynamics and addresses revenue attainment proxies. The first half of the year, H1, spans January to June, while the second half, H2, includes July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.0% |

| H2 (2024 to 2034) | 2.5% |

| H1 (2025 to 2035) | 3.5% |

| H2 (2025 to 2035) | 3.9% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin American Non-Dairy creamer market, it is expected that the sector will register a 2.0% compound annual growth rate (CAGR) in the first half of the year 2024, and this will increase to 2.5% in the second half of the same year. In 2025 the growth rate is anticipated to drop slightly to 3.5% in H1 but it is expected to rise to 3.9% in H2.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Key players in the market, such as Nestlé (Coffee-Mate) and Danone , have been expanding their product lines to cater to the rising demand for plant-based and lactose-free options. |

| 2024 | Local brands are also innovating to meet consumer preferences, focusing on clean-label, sugar-free, and fortified non-dairy creamer with added functional benefits. While specific product launch details are scarce, the overall market is experiencing growth, with companies actively developing new offerings to capture the expanding consumer base seeking dairy alternatives. |

Plant-Based and Lactose-Free Alternatives Are on the Rise

As the number of lactose-intolerant people increases and the improvements of life through the replacement of animal products with plant ones are more widely known the demand for non-dairy creamer in Latin America increases.

The drive of consumers to find healthy and dairy-free products like soy, almond, and coconut based-creamer is another big point of focus for companies especially in the coffee, tea, and other products. New products are still coming on stream and with the increasing plant-based products opening up more possibilities consumers are jumping at the chance to try the new product.

Expansion of the Foodservice and Ready-to-Drink (RTD) Beverage Industry

Quick-service restaurants, coffee chains, and RTD beverage sectors' continuous progress is the main factor for non-dairy creamer demand growing up in both retail and B2B segments. Well-known café chains and RTD beverage brands are including plant milk in their menus to stay up with the latest consumer preferences.

The market also grows due to innovations in function-based creamer featuring probiotics, collagen, and protein which are targeted mainly to health-focused consumers. The rapid spread of plant milk in cafes and food stores which are stocked with, non-dairy creamer, is further promoting the sales of the item and pushing the market to expand.

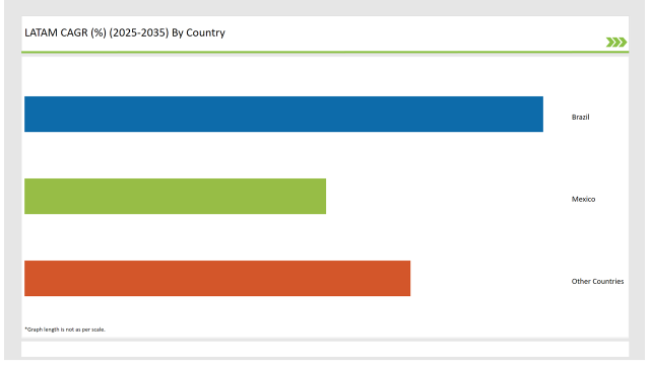

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Brazil | 43% |

| Mexico | 25% |

| Other Countries | 32% |

Brazil has experienced a good 43% market share and is the leading importer of the plant-based food category. This could be attributed to many factors, but the most important ones are the change in eating habits, health consciousness, and the spread of veganism.

More consumers are becoming aware of lactose intolerance and with this country, the increase in interest in a healthy lifestyle, it is no wonder that the interest in non-dairy products is on the rise. The people in Brazil are searching for non-dairy creaming for their beverages such as coffee, and smoothies, resulting in the increase in soy, almond, and coconut creamer. The parallel is supported by the introduction of more plant-based brands that will be made available, thus hailing the introduction of more products that cater to local preferences.

Mexico, with 25% market share, has been increasingly gaining popularity for non-dairy creamer that are especially in use at the coffee applications. The coffee culture in Mexico which is a big asset is the driver of this excellent performance with a big rise in coffee consumption, and the awareness of health-related risks associated with dairy. In addition, thanks to the involvement of local coffee shops and big international players that offer plant-based alternatives, the sales of non-dairy creamer are continuously ticking up.

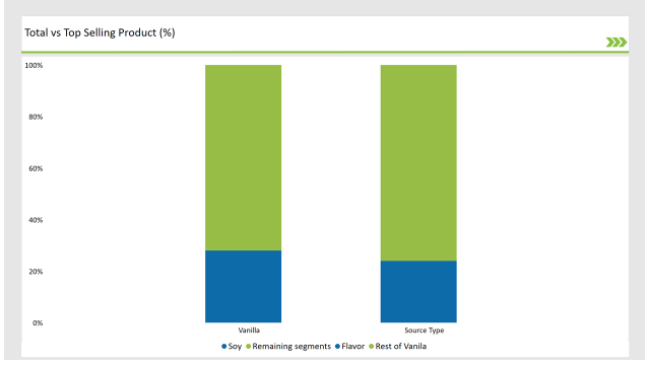

% share of Individual Categories Source and Flavour Type in 2025

| Main Segment | Market Share (%) |

|---|---|

| Source Type - Soy | 24% |

| Remaining segments | 76% |

Soy-based non-Dairy creamer occupy the largest market share of 24% in the Latin American region, and this is due to the following reasons. First, soybeans are among the most widely found and available plant-based ingredients. Hence, soy creamer are popular for both customers and manufacturers. This is a product has all the features of a traditional cream and is used widely as such with coffee, tea, smoothies, and in use for pastry applications.

With the other factors of affordability and functionality also driving soy-based products, their current health benefits factor has become the main promotion. Moreover, many choose to use soy milk and creamer because they are high in protein and low in fats thus promoting a healthier substitute to dairy. With the recent growth in the number of people who are lactose intolerant and the increase in veg diets people are opting for soy creamer which are free from allergens and dairy

| Main Segment | Market Share (%) |

|---|---|

| Vanilla - Flavor | 28% |

Non-dairy vanilla-flavored cream asserts to 28% market share in the Latin American region and are driven by the strong demand for this flavor and wide application in the food and beverage sectors. The popularity of vanilla, the most known flavor in the world, is an asset for the makers of non-dairy creamer. It is the flavor that customers consume the most when they are adding it to coffee, tea, smoothies, or baking which has helped this brand in gaining popularity in the household and foodservice sectors.

Moreover, vanilla-flavored creamer are always represented as a comforting and indulgent alternative to traditional dairy creamer, which copes with current personalization and taste innovations trends in the Latin American region. The option of natural or organic vanilla is available nowadays, making the product even more attractive to consumers interested in healthy choices and avoiding artificial ingredients.

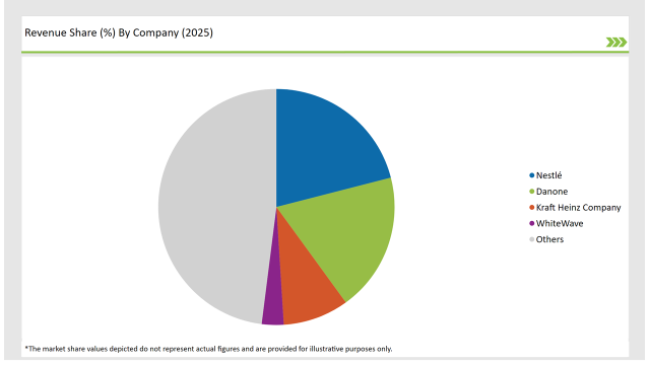

2025 Market share of Latin America Non-Dairy creamer manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Nestl é | 21% |

| Danone | 19% |

| Kraft Heinz Company | 9% |

| White Wave | 3% |

| Others | 48% |

The Latin American non-dairy creamer market is characterized by moderate market concentration, with a mix of global brands and regional players competing for market share. The presence of large multinational companies like Nestl é (Coffee-Mate), Danone, and Kerry Group provides strong competition in the region, while local players are also gaining ground by catering to specific regional preferences and offering tailored plant-based solutions.

Global players such as Nestl é (Coffee-Mate) and Danone (Alpro) dominate the market, accounting for a significant portion of sales. These brands benefit from their extensive distribution networks, strong brand recognition, and product variety, which includes soy, almond, and coconut-based creamer. Their ability to invest in innovative formulations, such as fortified and clean-label options, has positioned them as leaders in both retail and foodservice sectors across Latin America.

Apart from these multinational brands, regional companies are increasingly advancing by launching products that meet local tastes and cater to specific dietary needs. Some of the firms that are making it big in the plant-based and allergen-free segment include Vitasoy, Ecomil, and Oatly. The emergent local brands not only add a selection of plant-based products to the market but they also bring about a larger focus on organic, non-GMO, and environmentally friendly products which are the consumers` preferences.

As per Form Type, the industry has been categorized into Powder / Granules, and Liquid.

As per Source Type, the industry has been categorized into Coconut, Almond, Soy, Corn, and Others.

As per Packaging Type, the industry has been categorized into Sachets / Pouches, Bags, Canisters, and Bottles.

As per Distribution Channel, the industry has been categorized Food Service Channels, Hypermarkets / Supermarkets, Convenience Stores, Grocery Stores, Specialty Stores, and Online Retail.

As per Flavour Type, the industry has been categorized into Unflavoured, French Vanilla, Chocolate, Coconut, Hazelnut, and Others.

Industry analysis has been carried out in key countries of Mexico, Brazil and Rest of Latin America.

The Latin America Non-Dairy Creamer market is projected to grow at a CAGR of 7.7% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 644.6 million.

Key factors driving the Latin America non-dairy creamer market include the increasing demand for plant-based and lactose-free alternatives among health-conscious consumers and the growing popularity of coffee and tea beverages that utilize creamers. Additionally, innovations in product formulations and flavors are enhancing consumer interest and expanding market reach.

The main drivers include the growing popularity of plant-based diets, increasing awareness of lactose intolerance, and the rise in demand for healthier, functional alternatives such as sugar-free and fortified non-dairy creamer with added benefits like protein and probiotics.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA