The non-dairy creamer market globally reveals a well-distributed balance among the players from various market structures. Multinationals account for 48%, through companies like Nestlé (Coffee-Mate) and Danone (Silk), who make use of the latter's global distribution and innovation advantage.

Regional powerhouses, for example, are Califia Farms (USA) and Oatly (Sweden) with 28%, where players bank on localized products and plant-based innovations. Startups and niche brands nutpods, Laird Superfood, along with others like these, generate 17 percent of the demand through health-focused or premium alternatives.

Private labels also contribute 7 percent, such as Trader Joe's and Walmart's Great Value brand, which satisfy the budget shopper by offering extremely low-priced options. The top five players, Nestle, Danone, Califia Farms, Oatly, and nutpods combined, hold a 35% market share-a moderately consolidated space with room for smaller firms to innovate and grow.

Global Market Share by Key Players

| Global Market Share, 2025 | Industry Share% |

|---|---|

| Top Multinationals (Nestlé, Danone, Califia Farms) | 42% |

| Regional Leaders ( Oatly , Ripple Foods, Minor Figures) | 31% |

| Startups & Niche Brands ( nutpods , Laird Superfood, Milkadamia ) | 17% |

| Private Labels (Trader Joe’s, Walmart’s Great Value) | 10% |

The market remains moderately consolidated, with multinational companies leading but regional and niche players are fast expanding their influence through innovation and targeted offerings.

Powdered non-dairy creamers dominate 65 percent of the market share due to their long shelf life and cost-effectiveness as well as for use on an extremely large scale. These creamers are highly in demand in emerging markets like India, Southeast Asia, and Africa. Affordability and convenience become the main purchase drivers in such markets.

The top brands in this segment include Nestlé's Coffee-Mate, which has various formulations to cater to different consumer preferences. Liquid creamers have 33% of the market share, primarily driven by demand in premium and urban markets across North America and Europe. Califia Farms and Silk have taken advantage of this taste by introducing their barista blends, which are enhanced for frothing and latte art.

Coconut-based creamers lead the market by 32% due to their rich texture and adaptability as well as suitability in plant-based diets. Coconut creamers enjoy significant popularity, particularly within Southeast Asia and the Pacific Islands, where coconuts are a traditional diet component. The globally dominant brands in this segment are nutpods and Califia Farms, which have dominated the coconut-based products for the vegan and health-conscious consumer.

Almond-based creamers lead with a 25% share, preferred due to their light flavor, low calorie content, and perceived health benefits. North America remains the largest market for almond-based creamers, where brands like Silk and Milkadamia have carved a niche with unsweetened and flavored variants. Soy creamers, although smaller in share, serve the consumer in East Asia, where soy is a culturally significant crop.

The year saw big growth in the global non-dairy creamers market, driven by innovation, sustainability, and regional expansion. Leading players such as Nestle and Danone used the platforms of their global networks to introduce vegan and plant-based options that reflected changing consumer preferences. Collaborations with food service giants like Starbucks and eco-friendly packaging initiatives led by brands such as Oatly defined a sustainable industry.

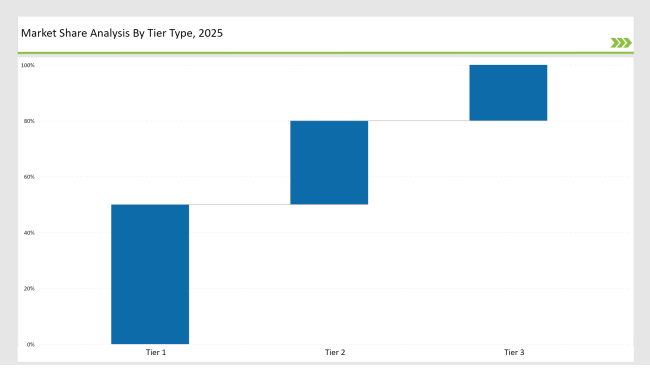

| By Tier Type | Tier 1 |

|---|---|

| Market Share % | 50% |

| Example of Key Players | Nestlé, Danone, Califia Farms |

| By Tier Type | Tier 2 |

|---|---|

| Market Share % | 30% |

| Example of Key Players | Oatly Ripple Foods, Minor Figures |

| By Tier Type | Tier 3 |

|---|---|

| Market Share % | 20% |

| Example of Key Players | nutpods, Laird Superfood, Private Labels |

| Brand | Key Focus |

|---|---|

| Nestlé Expands Production | New manufacturing facilities to meet rising plant-based demand. |

| Danone Partners with Retailers | Collaborations with supermarket chains for better shelf placement. |

| Califia Farms’ Recipe Innovations | Focus on clean-label and reduced-sugar products. |

| Ripple Foods’ Marketing Campaigns | Targeted advertising for health-conscious consumers. |

| Oatly’s Global Expansion | Entry into South America with oat-based creamers. |

| nutpods' Social Media Strategy | Leveraging Instagram and TikTok for consumer engagement. |

| Milkadamia’s Barista Training Programs | Educating cafes on the benefits of macadamia-based creamers. |

| Trader Joe’s Affordable Creamers | Focused on expanding private-label ranges. |

| Laird Superfood’s Retail Partnerships | Collaborated with Whole Foods for premium placements. |

| Silk’s Regional Distribution Hubs | Improved supply chain efficiency in North America. |

Over the next ten years, plant-based creamers will lead the market, and coconut and almond-based products will be the ones with the most growth. These segments are the strongest in developed regions such as North America and Europe, where veganism is on the rise. Manufacturers need to work on perfecting the formulation for taste and texture to get repeat consumers.

Asia and Africa will offer the greatest growth opportunities, particularly for sachet-based products. Low-cost, single-serve options will penetrate cost-sensitive markets. Local partnerships and region-specific marketing strategies will further enhance growth. Online platforms will allow small and niche brands to compete with multinationals. Subscription models and tailored marketing through digital platforms will increase customer loyalty and retention.

Protein, vitamins, and functional ingredient-enriched creamers are going to enjoy tremendous demand across the world. Long term for brands is investing in R&D to innovate and launch product lines targeting sub-segments such as the fitness-conscious or health-conscious consumers. Crafting unique, locally inspired flavors like lychee for Southeast Asia or lavender honey for Europe will target specific flavor preferences. Customization will be key in terms of winning over a variety of consumer bases.

As per form, the industry has been categorized into Powder and Liquid.

This segment is further categorized into Unflavored and Flavored (French Vanilla, Chocolate, Coconut, Hazelnut, Others).

This segment is further categorized into Plant-Based Milk (Coconut Milk, Oat Milk, Almond Milk, Macadamia Milk, others) and Vegetable Oil Based Creamers (Palm Oil, Coconut Oil, and Soybean Oil).

This segment is further categorized into Direct/B2B Sales and Indirect/B2C Sales (Hypermarket/Supermarket, Grocery Store, Specialty Stores, and Online Retail).

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Top companies include Nestlé (Coffee-Mate), Danone (Silk), and Califia Farms, collectively holding around 38% of the market.

Asia and Africa are the fastest-growing regions, with sachet-based products driving demand in cost-sensitive markets.

Sustainability initiatives, such as eco-friendly packaging and ethically sourced ingredients, are pivotal in driving consumer preference.

E-commerce contributes around 12% of sales, with higher penetration in premium and niche segments.

Startups leverage direct-to-consumer channels, social media, and unique product innovations like functional and premium creamers.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-Dairy Creamer Market Size, Growth, and Forecast for 2025 to 2035

Non-Dairy Creamer Market in Japan Analysis by Type, Source, Distribution Channels, Form, and Region Through 2035

Non-Dairy Creamer Powder Market

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

United States Non-Dairy Creamer Market Insights – Size, Demand & Forecast 2025–2035

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

ASEAN Non-Dairy Creamer Market Report – Trends, Demand & Industry Forecast 2025–2035

Comprehensive Analysis of Europe Non-Dairy Creamer Market by Form Type, Source Type, Packaging Type, Distribution Channel, Flavour Type, and Country through 2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Latin America Non-Dairy Creamer Market Outlook – Share, Growth & Forecast 2025–2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Coffee Creamer Market Analysis by Form, Nature, Category, Application and Sales Channel Through 2025 to 2035

Foaming Creamer Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Soluble Creamer Market Growth - Base & Function Trends

Sales Analysis of Tourism Industry in the Middle East Size and Share Forecast Outlook 2025 to 2035

Semen Analysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Stone Analysis Software Market – Trends & Forecast 2025 to 2035

Water Analysis Instrumentation Market Analysis – Size, Share, and Forecast 2025 to 2035

Spend Analysis Software Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA