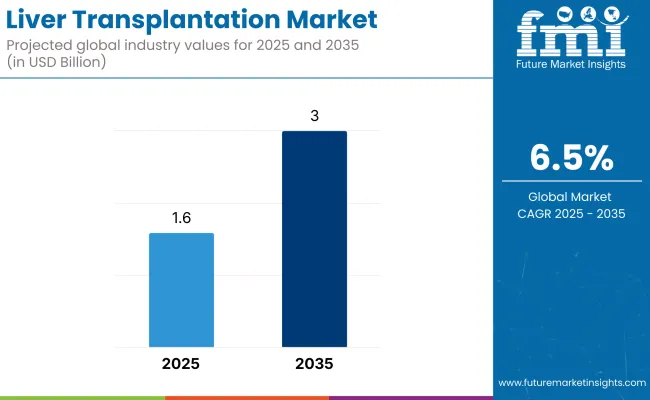

The global liver transplantation market is expected to reach approximately USD 1.60 billion in 2025 and expand to nearly USD 3.00 billion by 2035, registering a CAGR of 6.5% over the forecast period. Growth is being driven by the increasing prevalence of end-stage liver diseases and rising acceptance of transplantation as a curative treatment.

Advancements in surgical techniques, donor organ preservation, and immunosuppressive therapy have been incorporated to improve patient outcomes. Enhanced government support for organ donation programs and the implementation of centralized transplant registries have enabled higher procedural volumes. Additionally, access to transplant services has been broadened through infrastructure development in emerging regions. As technological innovations continue to evolve, greater efficiency and success rates are anticipated in liver transplant procedures globally.

The liver transplantation market has witnessed significant advancements in 2024 and 2025, driven by innovative product launches and technological developments by leading manufacturers. The liver transplantation market has been significantly influenced by strategic initiatives undertaken by leading manufacturers. Companies such as Astellas Pharma Inc., Novartis AG, Sanofi, Bristol-Myers Squibb, Thermo Fisher Scientific, OrganOx Limited, TransMedics Group, Veloxis Pharmaceuticals, and Paragonix Technologies have been at the forefront of advancing transplantation technologies.

In April 2025, Bristol Myers Squibb received FDA approval for Opdivo® (nivolumab) plus Yervoy® (ipilimumab) as a first-line treatment for unresectable or metastatic hepatocellular carcinoma (HCC), based on the global Phase 3 CheckMate-9DW trial results. The combination therapy demonstrated a statistically significant overall survival benefit versus existing tyrosine kinase inhibitor monotherapies.

“Bringing Opdivo plus Yervoy to patients with HCC in the first-line setting is a testament to our ongoing commitment to research and delivering important progress for people living with cancer,” said Wendy Short Bartie, senior vice president of Oncology Commercialization at Bristol Myers Squibb. These advancements, encompassing novel immunotherapies, enhanced organ preservation techniques, and xenotransplantation breakthroughs, are collectively propelling the liver transplantation market forward, addressing critical challenges, and improving patient outcomes.

The liver transplantation market in North America and Europe has been characterized by region-specific advancements and structured healthcare frameworks. In North America, growth has been driven by expanded transplant networks, such as UNOS, and policy-led investments in high-incidence states like Texas and California. AI-powered monitoring systems and improved donor access protocols have been implemented across leading transplant centers.

In Europe, progress has been supported by centralized registries like Eurotransplant and cross-border treatment access under EU frameworks. Tools for donor risk stratification and national audit systems have been deployed to enhance surgical outcomes, particularly in Germany, France, and the UK. Collectively, these developments have reinforced both regions as technologically mature and operationally coordinated markets in liver transplantation.

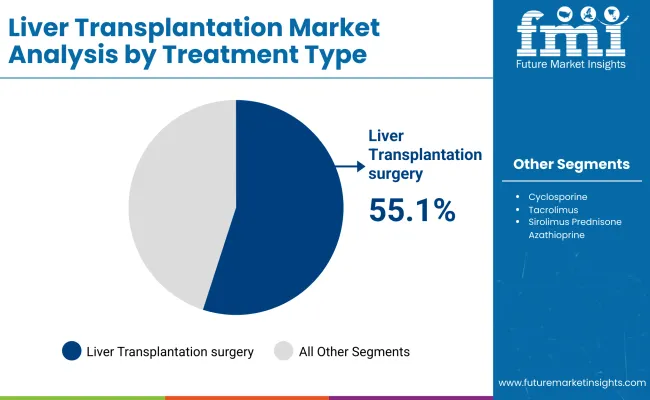

In 2025, Liver Transplantation Surgery has been estimated to contribute 55.1% of the total revenue in the global liver transplantation market. The segment’s leading position has been driven by the growing incidence of chronic liver diseases such as cirrhosis, hepatocellular carcinoma, and hepatitis-related liver failure. Increased organ donation awareness has been promoted through national health initiatives and government-backed programs, which has led to higher transplant volumes across both developed and emerging markets.

Advances in surgical techniques and improved post-operative care have been introduced, significantly enhancing procedural success rates and long-term survival outcomes. Additionally, transplant eligibility criteria have been broadened, enabling more patients with advanced liver conditions to undergo surgery. As a result, liver transplantation has been recognized as the most effective therapeutic intervention for end-stage liver disease, securing its dominance in the treatment type category.

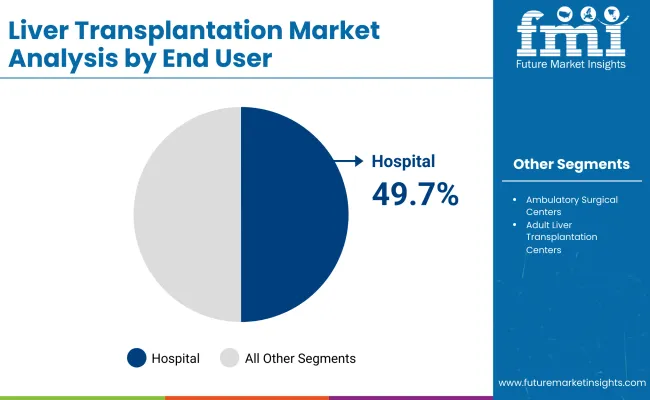

By 2025, Hospitals have been projected to hold a 49.7% revenue share in the liver transplantation market, making them the top-performing end-user segment. This dominance has been supported by the concentration of advanced transplant infrastructure in hospital environments, including access to surgical units, critical care resources, and experienced multidisciplinary teams. The majority of transplant procedures have been performed in hospital settings due to the ability to deliver end-to-end patient management spanning from pre-surgical diagnostics to post-operative immunosuppressive care.

Both government and private sectors have prioritized investments in hospital-based transplant centres, particularly in high-burden regions across North America, Europe, and Asia-Pacific. Furthermore, hospitals have been favoured for their adherence to clinical standards, regulatory compliance, and accreditation protocols. These factors have reinforced hospitals as the most trusted and capable end-users in the liver transplantation landscape.

Organ Shortages, High Costs and Post-Transplant Risks Act as a Barrier to the Market Growth

The transplant industry for the liver has serious issues to address. Organs are insufficient, waiting lists are long, and complications such as rejection & infections may occur post-transplant. It is very costly and not always accessible to patients from lower socio-economic communities at transplant centers. Furthermore, the manner in which the donor organs are allocated is not fair in all respects.

The prevention of rejection by these drugs also carries risks. They contribute to the eventual development of infectious and other diseases. The path also has regulatory and ethical speed bumps for the medicines since the new techniques include using organs from animals or printing organs in 3D. These aspects make it difficult for new procedures to be mainstreamed.

Innovations in Regenerative Medicine Advancing Liver Transplantation Therapies

There is more interest in regenerative medicine and creating bioartificial livers. New work in stem cell therapy and tissue engineering could help regenerate the liver, which means fewer people would need a transplant. Robotic and less invasive surgery techniques are also making surgeries safer and recovery faster.

In addition, there is a rise in investments for smart tech that helps match donors and patients. New tracking systems for donor organs and telemedicine for aftercare can make transplants easier to access. Government programs that raise awareness and offer financial help for patients are also helping the market grow.

Cutting-edge Techniques in Organ Preservation and Machine Perfusion: Normothermic machine perfusion (NMP) is emerging as a transformative technology in organ preservation, significantly improving transplant success rates while reducing the wastage of donor organs. Unlike traditional static cold storage, NMP maintains organs at body temperature, continuously supplying oxygen and nutrients, thereby preventing ischemic injury and extending preservation times.

This technique enhances organ viability, allowing for better assessment of marginal donor organs, which can expand the donor pool. Additionally, the ability to optimize and repair organs before transplantation offers new opportunities to improve post-transplant outcomes.

Ongoing research in perfusion technologies, including the integration of regenerative therapies and ex vivo drug treatments, is further enhancing transplant efficiency. As healthcare systems worldwide face organ shortages, advancements in machine perfusion are paving the way for more effective organ utilization, minimizing rejection risks, and increasing access to life-saving transplants across different regions.

The Increasing Trend of Living Donor Liver Transplantation (LDLT): Living Donor Liver Transplantation (LDLT) is witnessing a significant rise as a preferred alternative to deceased donor transplantation, particularly in regions where organ donation rates are low. LDLT offers a viable solution to organ shortages by allowing patients to receive timely transplants, reducing waiting list mortality.

Medical advancements in liver regeneration have improved donor safety, as the liver possesses a remarkable ability to regenerate within months after partial donation. Additionally, LDLT enables precise planning of transplant procedures, leading to better surgical outcomes and lower risks of graft dysfunction compared to deceased donor transplants.

Market Outlook

The field of liver transplantation has evolved progressively in America as the surgical management of conditions necessitating transplantation has progressed with surgical refinements. As cirrhosis becomes more rampant, liver failures become more frequent, and the proliferation of surgical and post-operative advances in medical science continues, the demand for transplantation rises for enhanced survival and accessibility.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

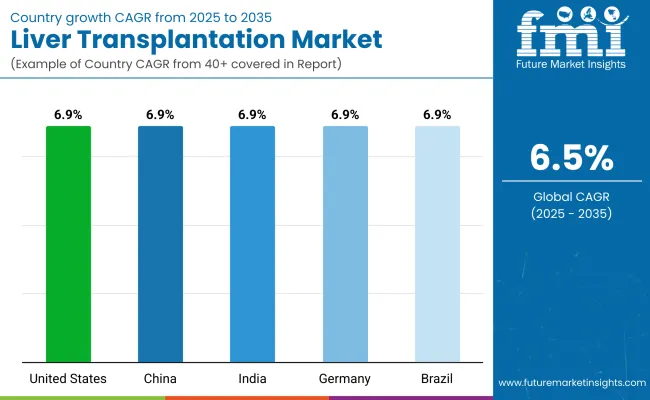

| United States | 3.8% |

Market Outlook

India's liver transplantation market is booming, bolstered by enhanced healthcare investments and an increase in the number of liver-related ailments. Hospitals are upgrading their transplantation facilities and surgeons are adopting new techniques and expecting improved outcomes. At present, the social awareness about organ donation is improving by the day, thereby saving more lives through transplants.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.4% |

Market Outlook

This burgeoning market of liver transplantations in China has given much of its emphasis to health-care network development with public attention paid to treatment of liver-disease-related disorders. The countries have broadened the transplant programs in hospitals, and the handling of surgery to improve outcomes utilized advanced techniques by the surgeon.

Generally, an increased public awareness related to their health regarding the liver and to organ donation is taking place, thus helping more individuals gain timely access to transplants. Also, policies of the government are favoring medical advances and making them affordable to the public in the country, which paves a way toward getting accessibility to liver transplantations.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.8% |

Market Outlook

he German liver transplantation market is steadily progressing, founded on a very good healthcare infrastructure and ongoing technological advances in hepatology research. While innovations in immunosuppressive therapies and post-transplant care contribute to better patient outcomes, high-end medical institutions are perfecting transplant techniques with improvements being made through organ donation awareness and access initiatives put in place by the government.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.2% |

Market Outlook

This lends continued expansion to Brazil's market for liver transplantation as healthcare investments continue to grow and the number of individuals with liver diseases rises. Intervention-the improvement within the country, along with modernized surgical methodologies and additional government initiatives towards organ donation, are adding to the growth of the market. Awareness developed around transplantation and improved post-operative care is, furthermore, enhancing patient outcomes and driving access to liver transplantation across the country.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 3.9% |

The liver transplantation market runs high on competition, driven by rising prevalence rates of liver ailments, progressive transplant technologies, as well as awareness of organ donation. Various companies are investing in immunosuppressive therapies, bioengineering innovations, and techniques for preserving transplants in order to provide them competitive advantage.

The market has fused well with pharmaceutical companies, transplant device manufacturers, and emerging biotech innovators to keep evolving in the liver transplantation solutions arena.

Astellas Pharma

Astellas is the giant in liver transplantation and spearheads the market with Prograf, a routine immunosuppressant used by transplant recipients.

Novartis AG

Novartis, offers more targeted therapies to attack immunosuppression in an effort to boost graft survival rates.

Sanofi

It specializes in immunotherapy, and it offers major post-transplant drugs that promote organ acceptance in the long term.

Bristol-Myers Squibb

It is a trailblazing transplant immunology company, which offers Nulojix, a breakthrough treatment in the field of immunosuppressive therapy.

BioLife Solutions

It is a new entrant in the field of transplant preservation, which also deals with organ transport technologies for enhancing liver viability.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

These companies focus on expanding the reach of liver transplantation solutions, offering competitive pricing and cutting-edge innovations to meet diverse patient and healthcare provider needs.

Liver Transplantation Surgery, Post-Surgery Anti-Rejection Treatment, Cyclosporine, Tacrolimus, Sirolimus Prednisone Azathioprine and Mycophenolate Mofetil

Hospitals, Adult Liver Transplantation Centers and Ambulatory Surgical Centers

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for Liver Transplantation Market was USD 1.60 billion in 2025.

The Liver Transplantation Market is expected to reach USD 3.00 billion in 2035.

Rise in Interventional Cardiology & Peripheral Vascular Procedures has significantly increased the demand for Liver Transplantation Market.

The top key players that drives the development of Liver Transplantation Market are Astellas Pharma Inc., Novartis AG, Sanofi, Bristol-Myers Squibb, Thermo Fisher Scientific.

Liver Transplantation Surgery is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 13: Global Market Attractiveness by Treatment Type, 2023 to 2033

Figure 14: Global Market Attractiveness by End Use, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 28: North America Market Attractiveness by Treatment Type, 2023 to 2033

Figure 29: North America Market Attractiveness by End Use, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Treatment Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Treatment Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Treatment Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Treatment Type, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Treatment Type, 2023 to 2033

Figure 104: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Treatment Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liver Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Liver Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Liver Health Supplements Market Analysis - Size, Growth, and Forecast 2025 to 2035

Liver Fibrosis Treatment Market - Innovations & Future Trends 2025 to 2035

Liver Fluke Treatment Market

Delivery Management Software Market Size and Share Forecast Outlook 2025 to 2035

Delivery Tracking Platform Market Size and Share Forecast Outlook 2025 to 2035

IOL Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Gas Delivery Systems Market Growth - Trends & Forecast 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Stent Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Drone Delivery Service Market Analysis by Delivery Distance, Propeller Type, End User, and Region, and Forecast from 2025 to 2035

Parcel Delivery Vehicle Market Size and Share Forecast Outlook 2025 to 2035

The dental delivery system market is segmented by modality, and end user from 2025 to 2035

Oxygen Delivery Units Market

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA