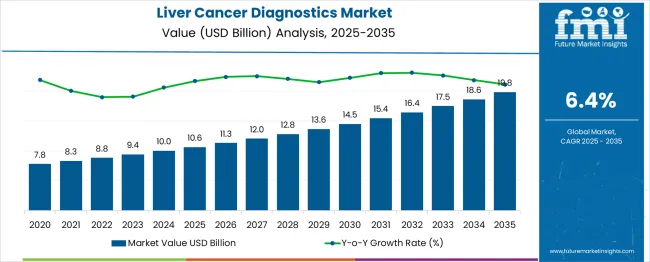

The liver cancer diagnostics market, valued at USD 10.6 billion in 2025, is projected to grow to USD 19.8 billion by 2035, with a CAGR of 6%. From 2025 to 2027, the market expands from USD 10.6 billion to USD 11.3 billion. The early growth is driven by continuous advancements in diagnostic technologies, such as imaging techniques, biomarker assays, and liquid biopsy solutions. Established players in the market gain share as their products continue to deliver accurate results and provide early detection of liver cancer.

Between 2027 and 2032, the market grows further, reaching USD 13.6 billion. During this period, competition intensifies as new entrants bring innovative diagnostic solutions to the market, particularly focused on non-invasive techniques. The established players continue to strengthen their market share by adapting to new technologies and offering comprehensive diagnostic solutions. The integration of artificial intelligence (AI) and precision medicine further accelerates market growth. By 2035, the market reaches USD 19.8 billion, with companies embracing the latest advancements in AI and early-stage diagnostics gaining substantial share. This growth highlights the shift toward more accurate, efficient, and accessible diagnostic tools, which are expected to shape the future of liver cancer diagnostics.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 10.6 billion |

| Forecast Value in (2035F) | USD 19.8 billion |

| Forecast CAGR (2025 to 2035) | 6% |

The liver cancer diagnostics market has shown consistent global growth, with steady annual increases, particularly in North America, which holds a significant share. The growth is driven by advanced healthcare infrastructure and widespread awareness of liver cancer. North America has seen a steady rise due to a strong focus on early cancer detection programs and sophisticated diagnostic technologies. Europe follows closely, with slightly lower annual growth, benefiting from well-established healthcare systems but growing at a slower pace due to a more mature market and the saturation of diagnostic solutions.

In the Asia-Pacific region, the market has experienced higher year-over-year growth, particularly in countries like China and India, where rising liver cancer incidence rates have accelerated demand. The growing adoption of advanced diagnostic tools and improvements in healthcare systems have played a key role in this trend. On the other hand, the Latin American and Middle East & Africa regions have exhibited slower growth, primarily due to challenges such as limited access to state-of-the-art diagnostic technologies and healthcare infrastructure.

Market expansion is being supported by the increasing global incidence of liver cancer and the corresponding demand for accurate diagnostic technologies that can enable early detection and precise tumour characterization. Modern healthcare systems are increasingly focused on improving cancer outcomes through early intervention and personalized treatment approaches that require sophisticated diagnostic capabilities. Liver cancer diagnostics' proven ability to detect malignancies at earlier stages and guide targeted therapy selection makes them essential components of comprehensive cancer care and patient management strategies.

The growing emphasis on precision medicine and molecular profiling is driving demand for liver cancer diagnostics that can provide detailed information about tumor characteristics, genetic mutations, and biomarker expression patterns. Healthcare providers' preference for diagnostic solutions that combine accuracy with clinical utility is creating opportunities for innovative diagnostic implementations. The rising influence of liquid biopsy and non-invasive testing approaches is also contributing to increased adoption of advanced diagnostic technologies that can monitor cancer progression and treatment response.

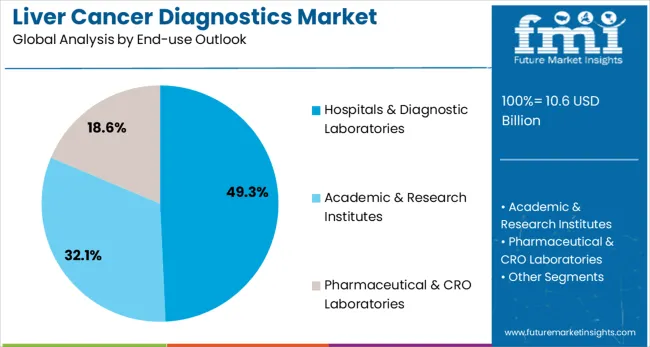

The market is segmented by test type, end-use, and region. By test type, the market is divided into laboratory tests (biomarkers, blood tests), imaging, endoscopy, and biopsy. Laboratory tests include biomarkers and blood tests as sub-categories. Based on end-use, the market is categorized into hospitals & diagnostic laboratories, academic & research institutes, and pharmaceutical & CRO laboratories. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The laboratory tests segment is projected to account for 40.5% of the liver cancer diagnostics market in 2025, reaffirming its position as the dominant test category. Healthcare providers increasingly rely on laboratory tests, including biomarkers and blood tests, for their accessibility, cost-effectiveness, and ability to provide quantitative results for liver cancer screening and monitoring. Laboratory tests' proven effectiveness in detecting tumor markers and assessing liver function directly addresses clinical needs for routine monitoring and early detection capabilities.

This test type forms the foundation of liver cancer diagnostic protocols, as it represents the most widely available and clinically validated approach for initial screening and ongoing patient management across diverse healthcare settings. Healthcare provider investments in automated laboratory systems and biomarker panels continue to strengthen the adoption of laboratory-based diagnostics. With healthcare systems prioritizing cost-effective screening and monitoring solutions, laboratory tests align with both clinical requirements and economic considerations, making them the central component of liver cancer diagnostic strategies.

Hospitals & diagnostic laboratories are projected to represent 49.3% of liver cancer diagnostics demand in 2025, underscoring their critical role as primary sites for cancer diagnosis and patient care. Healthcare providers prefer hospital-based diagnostic services for their comprehensive capabilities, multidisciplinary expertise, and ability to provide integrated diagnostic and treatment planning services. Positioned as essential infrastructure for cancer care delivery, hospitals & diagnostic laboratories offer both diagnostic accuracy benefits and care coordination advantages.

The segment is supported by established healthcare infrastructure and growing investment in advanced diagnostic technologies within hospital systems. Hospitals provide the clinical context and expertise necessary for accurate interpretation of complex diagnostic results and treatment planning. As cancer care becomes more sophisticated and multidisciplinary, hospitals & diagnostic laboratories will continue to dominate the market while supporting comprehensive patient management and care coordination.

The liver cancer diagnostics market is advancing steadily due to increasing liver cancer incidence and growing emphasis on early detection and precision medicine approaches in oncology care. The market faces challenges, including high costs of advanced diagnostic technologies, the complexity of molecular testing interpretation, and limited access to specialized diagnostic services in developing regions. Innovation in liquid biopsy technologies and artificial intelligence-assisted diagnosis continue to influence product development and market expansion patterns.

The growing adoption of liquid biopsy technologies is enabling non-invasive detection and monitoring of liver cancer through analysis of circulating tumor cells, cell-free DNA, and other biomarkers in blood samples. Liquid biopsy offers advantages including reduced patient discomfort, ability for serial monitoring, and potential for early detection of minimal residual disease. Healthcare providers are increasingly recognizing the clinical utility of liquid biopsy for treatment monitoring and recurrence detection.

Modern diagnostic companies are incorporating artificial intelligence and machine learning algorithms to improve diagnostic accuracy and assist healthcare providers in interpreting complex diagnostic data. These technologies enhance diagnostic precision while providing decision support tools that can improve clinical workflow efficiency. Advanced AI integration also enables pattern recognition in imaging studies and molecular data that may exceed human analytical capabilities.

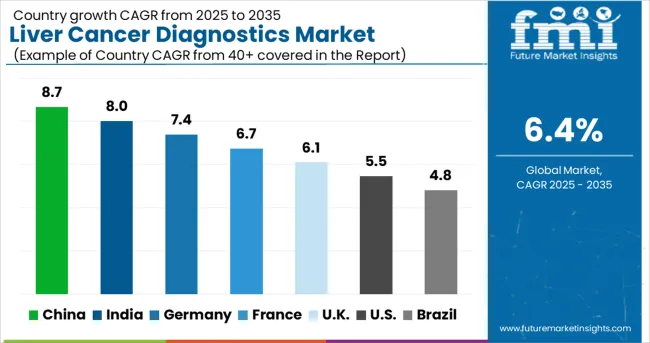

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.7% |

| India | 8% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.5% |

| Brazil | 4.8% |

The liver cancer diagnostics market is experiencing solid growth globally, with China leading at an 8.7% CAGR through 2035, driven by increasing liver cancer incidence, expanding healthcare infrastructure, and growing adoption of advanced diagnostic technologies. India follows closely at 8%, supported by rising cancer burden, improving healthcare access, and increasing awareness about early detection benefits. Germany shows strong growth at 7.4%, emphasizing precision medicine and advanced diagnostic capabilities. France records 6.7%, focusing on cancer research and healthcare innovation. The UK shows 6.1% growth, prioritizing integrated cancer care and diagnostic excellence.

The report covers an in-depth analysis of 40+ countries with top-performing countries are highlighted below.

The liver cancer diagnostics market in China is expected to grow at a CAGR of 8.7% through 2035. The country’s large patient base, increasing healthcare investments, and the growing prevalence of liver cancer are driving significant demand for early detection solutions. China’s expanding healthcare infrastructure and government focus on improving access to quality healthcare further support market growth. The adoption of advanced diagnostic technologies, including imaging techniques and biomarkers, is increasing among healthcare providers. International diagnostic companies and local vendors are investing in research and development to meet the rising demand for accurate and timely diagnostics. The country’s growing emphasis on precision medicine and improving diagnostic capabilities at hospitals and clinics also plays a crucial role in this growth.

The liver cancer diagnostics market in India is projected to expand at a CAGR of 8% through 2035. The rising prevalence of liver cancer, along with expanding healthcare access and greater diagnostic awareness, is fueling demand for advanced diagnostic solutions. India’s vast population and rising healthcare investments are contributing to the market’s growth. The adoption of new diagnostic technologies, such as advanced imaging systems and molecular biomarkers, is increasingly gaining momentum among healthcare providers. As the healthcare sector continues to expand, both domestic and international diagnostic companies are ramping up their service offerings to cater to the growing demand. India’s growing focus on cancer screening and early diagnosis is also positively influencing the market’s future.

Demand for liver cancer diagnostics in Germany is expanding at a CAGR of 7.4%, supported by the country's advanced healthcare system and strong emphasis on precision medicine and cancer research excellence. Germany is a global leader in medical research, driving innovation in diagnostic tools, particularly for liver cancer. The growing demand for early detection solutions, driven by the rising incidence of liver cancer, is fueling the market. Healthcare institutions in Germany increasingly prioritize advanced diagnostic technologies, including imaging and molecular diagnostics, to offer precise and timely diagnoses. The country’s robust regulatory framework ensures that only high-quality, efficient diagnostic solutions are deployed. Collaborations between healthcare providers and diagnostic technology companies are enhancing the availability of state-of-the-art diagnostic tools.

Revenue from liver cancer diagnostics in France is projected to expand at a CAGR of 6.7% through 2035, driven by the cancer research leadership and focus on innovative diagnostic approaches and precision oncology. French healthcare providers are increasingly adopting advanced imaging and molecular diagnostic tools to enhance liver cancer detection. The growing awareness among the population about liver cancer risks, along with the increasing number of cancer cases, is also contributing to the market expansion. France’s healthcare system focuses heavily on early detection, prevention, and treatment, creating a conducive environment for the growth of diagnostic technologies. Government-backed initiatives to improve cancer care and the implementation of new diagnostic technologies further support market growth. As patient awareness continues to rise, demand for specialized diagnostic services is increasing.

The liver cancer diagnostics market in the UK is growing at a CAGR of 6.1% through 2035, driven by the country’s strong healthcare system and focus on cancer detection. With the increasing incidence of liver cancer and the aging population, there is a growing demand for reliable diagnostic solutions. The UK’s healthcare system is focusing on improving early diagnosis and personalized treatment. National health initiatives supporting cancer research are encouraging the development of new diagnostic tools. The adoption of advanced diagnostic methods, including imaging and molecular testing, is on the rise. The growing demand for non-invasive diagnostic tests is also driving the market forward. Collaboration between healthcare providers and diagnostic technology companies is accelerating the availability of the latest solutions in the UK.

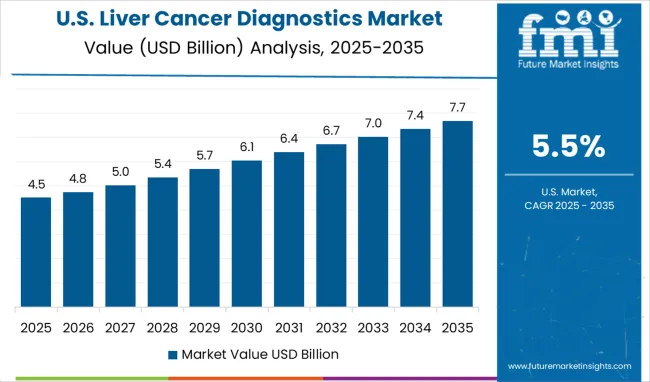

The liver cancer diagnostics market in the USA is expanding at a CAGR of 5.5% through 2035, driven by the increasing prevalence of liver cancer and chronic liver diseases. The USA healthcare system is embracing precision medicine, where advanced diagnostic tools are essential for providing personalized treatment. Imaging techniques, biomarker discovery, and liquid biopsy are transforming liver cancer diagnostics, improving the accuracy and speed of diagnosis. Research in medical technologies continues to fuel innovation in diagnostic solutions. The USA market is characterized by a strong investment in medical research, supporting the development of next-generation diagnostic tools. Healthcare providers are increasingly focused on delivering personalized treatment and improving patient outcomes. As these diagnostic technologies continue to evolve, the demand for reliable, advanced diagnostic solutions is expected to rise.

The liver cancer diagnostics market in Brazil is expected to grow at a CAGR of 4.8% through 2035, driven by the rising incidence of liver diseases and improving healthcare access. The country’s growing healthcare infrastructure and focus on cancer research are creating demand for more accurate diagnostic solutions. Brazilian healthcare providers are increasingly adopting advanced diagnostic technologies, such as imaging systems and biomarkers, for early detection of liver cancer. Though the market growth is slower compared to other countries, Brazil’s expanding middle class and increasing access to healthcare offer substantial opportunities. National health initiatives focused on cancer screening and early diagnosis are helping expand market opportunities, and foreign diagnostic companies are capitalizing on this potential.

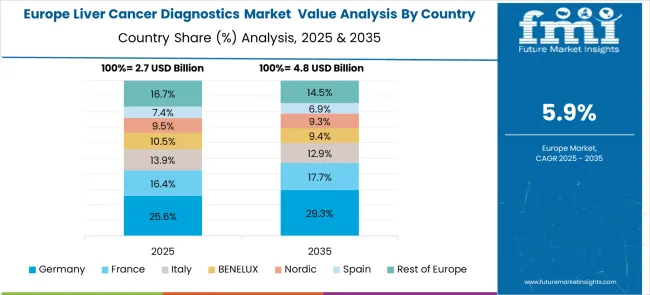

The liver cancer diagnostics market in Europe demonstrates mature development across major economies, with Germany showing a strong presence through its advanced healthcare system and emphasis on cancer research and diagnostic innovation, supported by healthcare providers leveraging clinical expertise to implement comprehensive liver cancer diagnostic solutions that emphasize accuracy, early detection, and integration with treatment planning across oncology and hepatology specialties. France represents a significant market driven by its healthcare system excellence and sophisticated understanding of cancer care and diagnostic requirements, with healthcare providers focusing on advanced liver cancer diagnostic approaches that combine French medical expertise with cutting-edge diagnostic technologies for enhanced patient outcomes and precision medicine implementation in oncology settings.

The UK exhibits considerable growth through its emphasis on cancer research and National Health Service integration, with strong adoption of liver cancer diagnostics across NHS hospitals, cancer centers, and specialized hepatology services. Germany and France show expanding interest in molecular diagnostic applications, particularly in personalized medicine and targeted therapy selection. BENELUX countries contribute through their focus on healthcare innovation and advanced medical technology adoption. At the same time, Eastern Europe and the Nordic regions display growing potential driven by increasing healthcare investment and expanding cancer care capabilities.

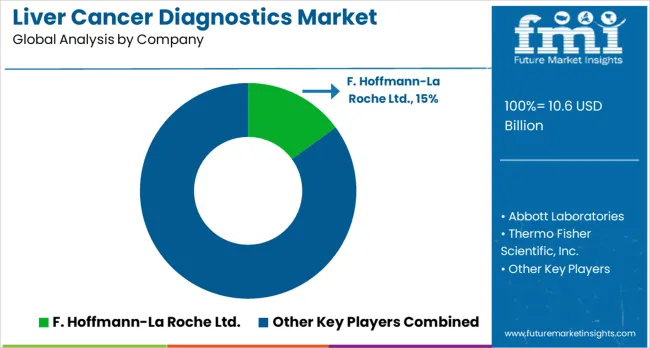

The liver cancer diagnostics market is highly competitive, with a diverse range of players including established diagnostic giants, specialized oncology testing providers, and emerging molecular diagnostic innovators. Companies are investing heavily in biomarker research, technology innovation, regulatory compliance, and clinical validation to provide accurate, reliable, and clinically valuable diagnostic solutions for liver cancer. Advances in liquid biopsy, molecular profiling, and AI-assisted diagnosis are central to strengthening their market position and driving clinical adoption.

F. Hoffmann-La Roche Ltd. leads the market with a significant global share, offering comprehensive oncology diagnostic solutions. Their focus on molecular testing and personalized medicine applications enables clinicians to provide targeted treatments based on individual genetic profiles. Abbott Laboratories delivers well-established diagnostic technologies with an emphasis on laboratory automation and point-of-care testing, making diagnostics faster and more accessible in various clinical settings. Thermo Fisher Scientific Inc. offers a wide array of molecular diagnostic solutions, focusing on genomics and precision medicine to advance personalized treatments for liver cancer. Qiagen N.V. specializes in molecular testing and sample preparation technologies, providing key tools for accurate testing and efficient workflows.

Siemens Healthineers provides advanced imaging and laboratory diagnostic solutions, integrating healthcare technology to offer comprehensive liver cancer diagnostics. Becton, Dickinson & Company offers diagnostic instrumentation and laboratory solutions that improve the accuracy and reliability of cancer detection. Illumina Inc., known for its genomic sequencing technologies, plays a crucial role in liver cancer research and clinical applications. Epigenomics AG specializes in DNA methylation-based cancer diagnostics, offering innovative approaches for early detection and diagnosis. Koninklijke Philips N.V. and Fujifilm Medical Systems USA Inc. provide advanced imaging technologies that help detect liver cancer and support patient management throughout the treatment journey.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 10.6 billion |

| Test Type | Laboratory Tests (Biomarkers, Blood Tests), Imaging, Endoscopy, Biopsy |

| End-use | Hospitals & Diagnostic Laboratories, Academic & Research Institutes, Pharmaceutical & CRO Laboratories |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd., Abbott Laboratories, Thermo Fisher Scientific Inc., Qiagen N.V., Siemens Healthineers, Becton Dickinson & Company, Illumina Inc., Epigenomics AG, Koninklijke Philips N.V., and Fujifilm Medical Systems USA Inc. |

| Additional Attributes | Dollar sales by test type and end-use category, regional demand trends, competitive landscape, buyer preferences for laboratory versus imaging diagnostics, integration with precision medicine approaches, innovations in liquid biopsy technology, AI-assisted diagnosis advancement, and molecular profiling development |

The global liver cancer diagnostics market is estimated to be valued at USD 10.6 billion in 2025.

The market size for the liver cancer diagnostics market is projected to reach USD 19.8 billion by 2035.

The liver cancer diagnostics market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in liver cancer diagnostics market are laboratory tests, biomarkers, blood tests, imaging, endoscopy and biopsy.

In terms of end-use outlook, hospitals & diagnostic laboratories segment to command 49.3% share in the liver cancer diagnostics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liver Health Supplements Market Analysis - Size, Growth, and Forecast 2025 to 2035

The Liver Transplantation Market is segmented by Treatment type and End User from 2025 to 2035

Liver Fibrosis Treatment Market - Innovations & Future Trends 2025 to 2035

Liver Fluke Treatment Market

Liver Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Delivery Management Software Market Size and Share Forecast Outlook 2025 to 2035

Delivery Tracking Platform Market Size and Share Forecast Outlook 2025 to 2035

IOL Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Gas Delivery Systems Market Growth - Trends & Forecast 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Stent Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Drone Delivery Service Market Analysis by Delivery Distance, Propeller Type, End User, and Region, and Forecast from 2025 to 2035

Parcel Delivery Vehicle Market Size and Share Forecast Outlook 2025 to 2035

The dental delivery system market is segmented by modality, and end user from 2025 to 2035

Oxygen Delivery Units Market

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA