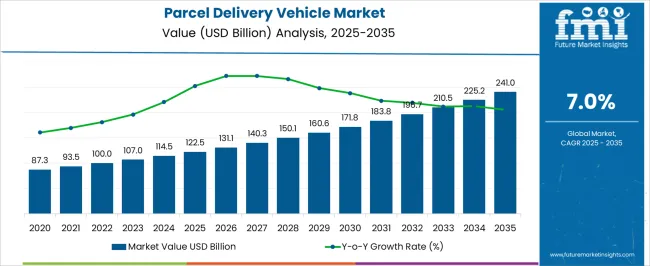

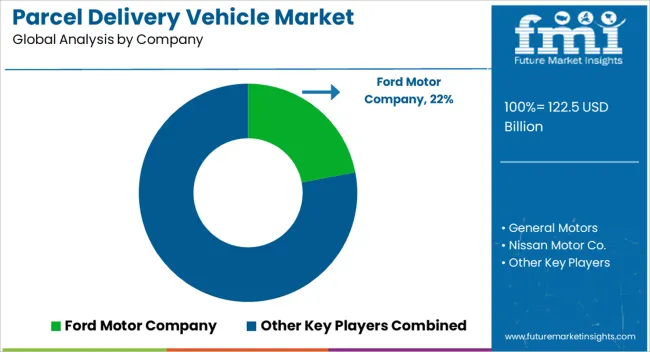

The parcel delivery vehicle market is estimated to be valued at USD 122.5 billion in 2025 and is projected to reach USD 241.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

Growth is fueled by rising e-commerce penetration, increasing demand for same-day and last-mile delivery, and the expansion of logistics and courier services globally. Technological advancements, including electric and hybrid delivery vehicles, route optimization software, and telematics, are enhancing operational efficiency and supporting market adoption. Seasonality and cyclicality detection in the market reveals predictable fluctuations linked to consumer demand and logistics activity. Peak seasons, such as holiday periods, back-to-school cycles, and festival months, significantly increase parcel volumes, driving temporary spikes in vehicle deployment and utilization. Conversely, low-demand periods in off-peak months show reduced vehicle turnover and slower fleet expansion.

Regional variations also influence cyclicality; for instance, North America and Europe experience strong seasonal spikes during the holiday season, while Asia Pacific shows multiple peaks throughout the year due to diverse regional festivals and online shopping trends. Long-term cyclicality is moderated by continuous growth in e-commerce and urbanization, which smooths out annual demand swings over time. Overall, while short-term seasonality impacts operational deployment, the market maintains a steady upward trajectory, with the USD 118.5 billion opportunity reflecting sustained demand and fleet expansion between 2025 and 2035.

| Metric | Value |

|---|---|

| Parcel Delivery Vehicle Market Estimated Value in (2025 E) | USD 122.5 billion |

| Parcel Delivery Vehicle Market Forecast Value in (2035 F) | USD 241.0 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The parcel delivery vehicle market is shaped by five key parent markets, each contributing a specific share. E-commerce logistics leads with 40%, driven by rapid growth in online shopping and demand for timely deliveries. Courier and express services hold 25%, providing specialized transportation for parcels and documents. Retail distribution contributes 15%, supporting supply chains for large and small retailers. Postal services account for 10%, managing national and regional deliveries. Third-party logistics (3PL) providers represent 10%, offering outsourced delivery solutions to businesses. These segments collectively define market demand, influencing vehicle types, fleet size, and investment in delivery infrastructure globally. Recent trends in the parcel delivery vehicle market focus on efficiency, sustainability, and technology integration.

Key players are introducing electric and hybrid delivery vehicles to reduce emissions and operational costs. Smart fleet management systems with GPS tracking, route optimization, and real-time delivery updates are enhancing operational efficiency. Autonomous and last-mile delivery solutions, including drones and robots, are being tested to improve delivery speed and reliability. E-commerce expansion is driving demand for compact, versatile vehicles capable of navigating urban environments. Investments in sustainable energy and advanced telematics indicate a shift toward greener, more technologically advanced parcel delivery solutions, reshaping the market landscape.

The market is experiencing notable expansion driven by the acceleration of e-commerce logistics and growing pressure on last-mile delivery networks. The rising demand for time-sensitive shipments, increased order volumes, and customer expectations for same-day or next-day delivery have intensified the need for efficient and purpose-built delivery fleets. Electric vehicle integration is being widely observed due to regulatory mandates targeting emission reduction and sustainability goals in urban transportation.

The market outlook remains positive, supported by advancements in vehicle electrification, route optimization technologies, and fleet connectivity systems. Additionally, parcel delivery operators are prioritizing fleet modernization to enhance delivery efficiency, reduce operational costs, and comply with environmental standards.

Strategic investments from major courier firms and logistics service providers are further accelerating vehicle adoption, especially in densely populated metropolitan regions As smart city initiatives expand and carbon-neutral targets become more stringent, the Parcel Delivery Vehicle market is expected to see continued momentum with scalable deployment across various use cases.

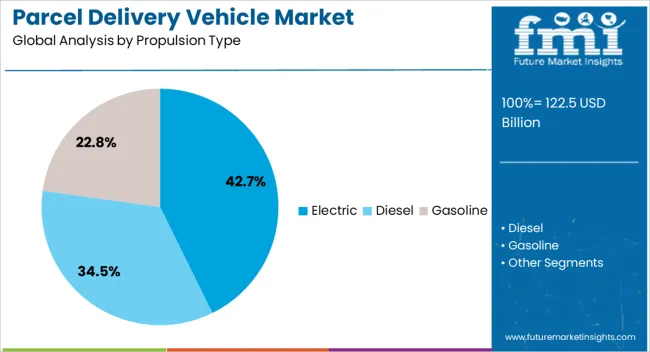

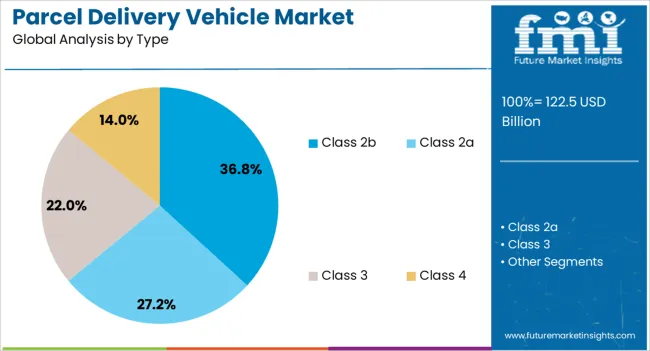

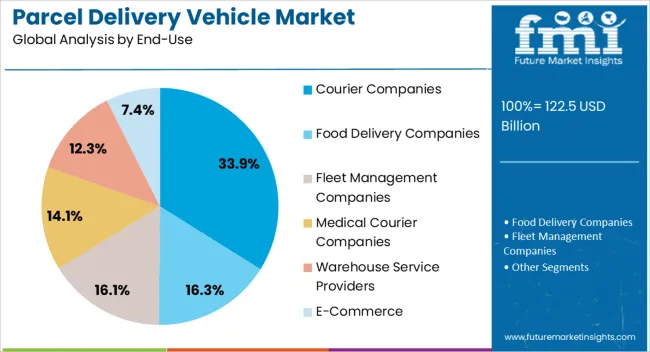

The parcel delivery vehicle market is segmented by propulsion type, type, end-use, and geographic regions. By propulsion type, parcel delivery vehicle market is divided into electric, diesel, and gasoline. In terms of type, parcel delivery vehicle market is classified into Class 2b, Class 2a, Class 3, and Class 4. Based on end-use, parcel delivery vehicle market is segmented into courier companies, food delivery companies, fleet management companies, medical courier companies, warehouse service providers, and e-commerce. Regionally, the parcel delivery vehicle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Electric propulsion type is projected to account for 42.70% of the parcel delivery vehicle market revenue share in 2025, making it the leading propulsion type. This dominance is being attributed to increasing environmental regulations, urban emission restrictions, and the operational benefits of electric drivetrains.

Electric delivery vehicles are being adopted at a rapid pace by logistics and parcel companies due to lower fuel and maintenance costs, quieter operation, and enhanced suitability for urban last-mile routes. Battery technology improvements and expanded charging infrastructure are further enabling higher fleet uptime and longer operational range.

Additionally, several government incentives and regulatory frameworks promoting electric mobility are being implemented globally, encouraging fleet operators to transition from internal combustion engines to electric alternatives As sustainability continues to influence corporate strategies, the preference for electric delivery vehicles is expected to rise, solidifying its position as the dominant propulsion type in the market.

The Class 2b vehicle type is expected to hold 36.80% of the market revenue share in 2025, making it the leading segment by vehicle class. The growth of this segment is being driven by its optimal payload capacity, maneuverability, and compatibility with high-frequency delivery operations in both suburban and urban settings.

Class 2b vehicles are being preferred by fleet operators due to their balance between cargo volume and fuel efficiency, enabling effective fulfillment of increasing parcel volumes without exceeding regulatory weight limits. These vehicles are also being deployed widely across courier and logistics networks due to their adaptability to electric propulsion systems and ease of customization.

As demand for cost-effective and versatile delivery solutions grows, the Class 2b segment is expected to maintain its lead in the market, supported by its proven operational suitability and alignment with last-mile delivery needs.

The courier companies end-use segment is projected to represent 33.90% of the market revenue share in 2025, establishing it as the top contributor by end-user category. This leadership is being driven by the continuous growth of e-commerce platforms and rising shipment volumes across residential and business addresses.

Courier companies are prioritizing investments in dedicated delivery fleets to improve delivery efficiency, route density, and on-time performance. The demand for branded, purpose-designed vehicles is increasing as courier providers seek to optimize operational costs and enhance customer experience.

Vehicle fleets are being increasingly integrated with advanced telematics, tracking systems, and automated load handling to support real-time logistics operations As customer expectations continue to evolve and delivery cycles shorten, courier companies are expected to remain the primary drivers of vehicle demand in the parcel delivery sector, leveraging innovation and fleet scalability to maintain service competitiveness.

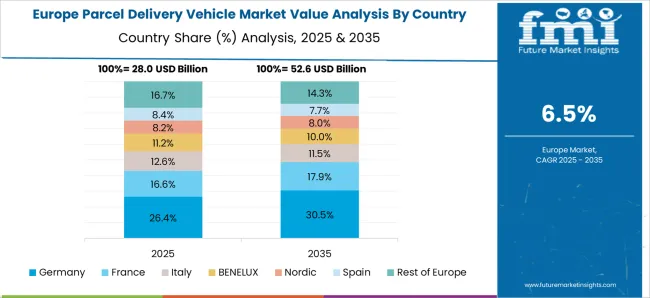

The parcel delivery vehicle market is expanding due to rising e-commerce, urban logistics, and demand for faster last-mile delivery. Global market revenue exceeded USD 16 billion in 2024, with Asia Pacific accounting for 40% of consumption due to growing online retail activity in China, India, and Southeast Asia. North America and Europe contribute 42% of revenue, driven by fleet modernization and high adoption of electric delivery vehicles. Parcel delivery vehicles, including vans, small trucks, and electric models, are deployed across logistics, courier, and retail sectors. Rising urbanization, traffic management solutions, and sustainability initiatives support market growth. Technological improvements in vehicle range, battery capacity, and telematics are enhancing operational efficiency globally.

Electric and alternative fuel parcel delivery vehicles are increasingly deployed to reduce operating costs and emissions. Electric vans achieve 15–20% lower fuel costs compared to diesel counterparts, while hybrid vehicles offer 10–15% improved efficiency. Asia Pacific leads adoption with a CAGR of 6–7% due to government incentives and urban fleet modernization programs. North America and Europe emphasize electric and hydrogen-powered vans for urban delivery to comply with emission regulations. Fleet operators prioritize low total cost of ownership, reliability, and operational efficiency. Expansion of urban delivery networks, rising e-commerce penetration, and environmental regulations are driving the adoption of energy-efficient parcel delivery vehicles globally.

Integration of telematics, GPS tracking, and route optimization systems enhances delivery efficiency by 15–20%. Battery technology improvements extend electric vehicle range by 10–15%. Lightweight chassis and aerodynamics reduce energy consumption while maintaining payload capacity. Advanced driver assistance systems, collision detection, and real-time monitoring improve operational safety. Asia Pacific manufacturers focus on cost-effective, high-capacity delivery vans for high-volume urban logistics. North America and Europe emphasize premium features, including refrigerated cargo modules and autonomous driving readiness. Continuous R&D ensures compatibility with urban fleet requirements, sustainable fuel alternatives, and delivery optimization software, supporting global parcel delivery operations with improved productivity and reduced environmental impact.

Parcel delivery vehicles are widely used in e-commerce, courier services, retail distribution, and last-mile logistics. E-commerce accounts for 45% of global vehicle adoption, driven by growing online shopping and demand for fast delivery. Logistics companies and courier fleets contribute 35% due to increasing package volumes and urban coverage. Asia Pacific dominates adoption with 40% of vehicles, led by China and India. North America and Europe focus on urban fleets with electric and hybrid vehicles for regulatory compliance. Retail chains deploy dedicated vans for store-to-home deliveries. Increasing package volumes, urban population growth, and demand for contactless delivery are sustaining market expansion globally.

High acquisition costs for electric and hybrid parcel delivery vehicles, often 25–30% above diesel models, restrict adoption among small fleet operators. Battery maintenance, replacement costs, and charging infrastructure add 10–15% to operational expenses. Limited charging stations in emerging markets constrain deployment. Variability in electricity costs and range anxiety impacts fleet efficiency. Manufacturers are addressing these challenges through modular battery designs, fast-charging systems, and fleet management telematics. Despite advantages in operational efficiency and emissions reduction, high vehicle costs, charging infrastructure limitations, and maintenance requirements remain key restraints for parcel delivery vehicle adoption worldwide.

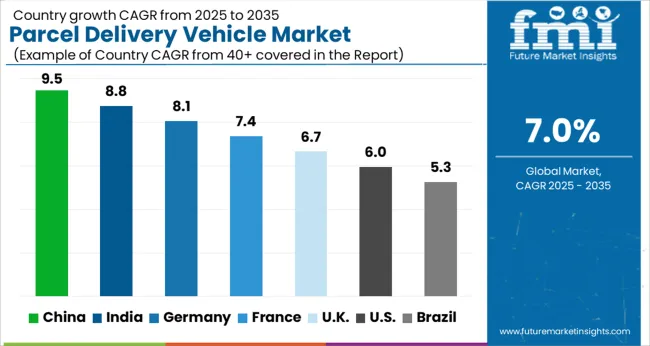

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

In 2025, the parcel delivery vehicle market is projected to grow at a global CAGR of 7% through 2035, driven by rising e-commerce, logistics expansion, and demand for faster and efficient delivery solutions. China leads at 9.5%, 36% above the global benchmark, supported by BRICS-driven growth in last-mile delivery, commercial vehicle manufacturing, and logistics infrastructure expansion. India follows at 8.8%, 26% above the global average, reflecting increasing demand from e-commerce, courier services, and urban distribution networks. Germany records 8.1%, 16% above the benchmark, shaped by OECD-backed innovations in electric and hybrid delivery vehicles, fleet modernization, and logistics efficiency programs. The United Kingdom posts 6.7%, 4% below the global rate, influenced by selective upgrades in urban delivery fleets, specialized vehicles, and green transport adoption. The United States stands at 6.0%, 14% below the benchmark, with steady uptake in urban and regional delivery networks, fleet electrification, and last-mile logistics solutions. BRICS economies drive volume growth, OECD countries emphasize efficiency, performance, and technological advancement, while ASEAN nations contribute through expanding urban logistics and commercial transport networks.

The parcel delivery vehicle market in China is projected to grow at a CAGR of 9.5%, well above the global CAGR of 7%, driven by rapid expansion in e-commerce, last-mile logistics, and urban delivery fleets. In 2024, 45% of new vehicles deployed were electric or hybrid models aimed at reducing operating costs and emissions. Production facilities in Guangdong, Jiangsu, and Shanghai increased capacity by 17% to meet domestic and regional demand. Adoption of lightweight, energy-efficient vehicles and telematics-enabled fleet management systems grew by 20%, enhancing delivery efficiency and route optimization. Leading suppliers including BYD, Foton, and Dongfeng introduced advanced electric and hybrid delivery vans. Market growth exceeds the global average due to strong e-commerce penetration, government incentives for clean energy vehicles, and expanding last-mile delivery networks.

The parcel delivery vehicle market in India is projected to grow at a CAGR of 8.8%, above the global CAGR of 7%, supported by rising e-commerce sales, expanding logistics infrastructure, and government policies promoting alternative-fuel vehicles. In 2024, 42% of new vehicles were electric or CNG-powered, reducing emissions and operating costs. Production facilities in Maharashtra, Tamil Nadu, and Gujarat increased capacity by 15% to meet domestic demand. Adoption of telematics, lightweight chassis, and high-capacity cargo vehicles grew by 18%, improving route efficiency and fleet management. Key suppliers including Tata Motors, Ashok Leyland, and Mahindra introduced electric and hybrid delivery vans with advanced telematics. Growth remains above global average due to increasing e-commerce penetration, logistics modernization, and clean energy adoption.

The parcel delivery vehicle market in Germany is projected to grow at a CAGR of 8.1%, above the global CAGR of 7%, driven by expansion of e-commerce, green logistics initiatives, and urban delivery demand. In 2024, 40% of new vehicles deployed were electric or hybrid models to comply with emissions regulations. Production facilities in Bavaria and Baden-Württemberg increased output by 13% to meet domestic and EU demand. Adoption of telematics systems, lightweight design, and energy-efficient drivetrains grew by 16%, improving delivery efficiency and sustainability. Leading suppliers including Daimler, Volkswagen, and MAN introduced electric and hybrid delivery vans for commercial and last-mile applications. Germanys market growth remains above global average due to stringent emission standards and growing e-commerce deliveries.

The parcel delivery vehicle market in the United Kingdom is projected to grow at a CAGR of 6.7%, slightly below the global CAGR of 7%, influenced by moderate growth in e-commerce and commercial fleet expansion. In 2024, 36% of new vehicles were electric or hybrid to reduce emissions and operating costs. Production facilities in Midlands and South East increased output by 11% to meet domestic demand. Adoption of telematics-enabled routing, lightweight chassis, and high-capacity cargo vehicles grew by 14%, enhancing delivery efficiency and fleet management. Key suppliers including Smith Electric Vehicles, Arrival, and Mercedes-Benz UK introduced electric and hybrid delivery vans for last-mile operations. Market growth remains slightly below global average due to mature delivery networks and moderate vehicle replacement cycles.

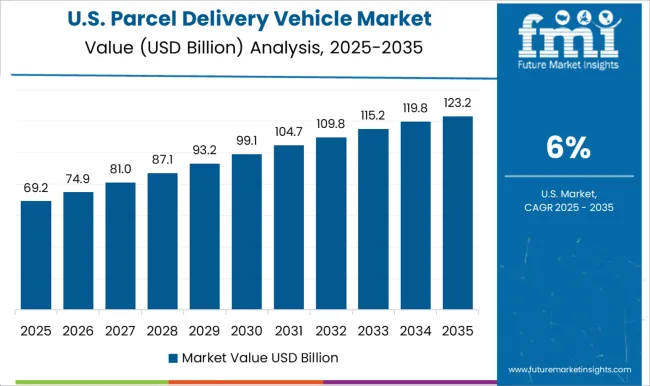

The parcel delivery vehicle market in the United States is projected to grow at a CAGR of 6.0%, below the global CAGR of 7%, influenced by mature logistics networks, stable e-commerce delivery fleets, and incremental adoption of clean energy vehicles. In 2024, 38% of new vehicles were electric or hybrid models for last-mile and regional delivery. Production facilities in California, Texas, and Michigan increased capacity by 10% to meet domestic demand. Adoption of telematics, lightweight materials, and high-capacity cargo designs grew by 12%, enhancing fleet efficiency and route optimization. Leading suppliers including Ford, Freightliner, and Rivian introduced electric and hybrid delivery vans with advanced telematics and cargo handling systems. Market growth remains below global average due to moderate fleet replacement rates and mature delivery infrastructure.

Competition in the parcel delivery vehicle market is being influenced by cargo capacity, fuel efficiency, and compliance with safety and emissions regulations. Market positions are being maintained through certified vehicle standards, service networks, and distribution channels that ensure operational reliability for last-mile and urban delivery services. Ford Motor Company is being represented with vans and compact trucks engineered for high payload capacity and fuel optimization, while General Motors is being promoted with commercial vehicles designed for efficiency and durability. Nissan Motor Co. is being highlighted with light-duty delivery vans structured for urban logistics and tight maneuverability.

Jeep is being applied with rugged utility vehicles suitable for versatile delivery routes, while Honda Motor Company is being positioned with compact and reliable vehicles tailored for small to medium parcel transport. Isuzu Motors Limited is being recognized with medium- and heavy-duty trucks engineered for sustained cargo operations and low maintenance. Rivian is being showcased with electric delivery vehicles designed for zero-emission operations and optimized urban performance. Strategies among these companies are being centered on efficiency improvements, regulatory compliance, and network expansion for service and parts availability. Research and development investments are being allocated to enhance fuel economy, battery range, load stability, and operational safety.

Product brochures are being structured with technical specifications covering payload capacity, engine or powertrain type, range, cargo volume, and vehicle dimensions. Features such as driver ergonomics, safety systems, and connectivity options are being emphasized to guide fleet managers and procurement specialists in decision-making. Each brochure is being arranged to highlight certification compliance, maintenance schedules, and application suitability. Technical data is being presented in a clear, evaluation-ready format to assist logistics companies, fleet operators, and purchasing teams in selecting delivery vehicles that meet performance, reliability, and operational efficiency requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 122.5 billion |

| Propulsion Type | Electric, Diesel, and Gasoline |

| Type | Class 2b, Class 2a, Class 3, and Class 4 |

| End-Use | Courier Companies, Food Delivery Companies, Fleet Management Companies, Medical Courier Companies, Warehouse Service Providers, and E-Commerce |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ford Motor Company, General Motors, Nissan Motor Co., Jeep, Honda Motor Company, Isuzu Motors Limited, and Rivian |

| Additional Attributes | Dollar sales by vehicle type and end use, demand dynamics across e-commerce, logistics, and courier services, regional trends in urban delivery and fleet expansion, innovation in electric and autonomous vehicles, environmental impact of emissions and battery disposal, and emerging use cases in last-mile delivery and smart routing solutions. |

The global parcel delivery vehicle market is estimated to be valued at USD 122.5 billion in 2025.

The market size for the parcel delivery vehicle market is projected to reach USD 241.0 billion by 2035.

The parcel delivery vehicle market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in parcel delivery vehicle market are electric, diesel and gasoline.

In terms of type, class 2b segment to command 36.8% share in the parcel delivery vehicle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Parcel Insulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Automated Parcel Delivery Terminals Market Growth – Trends & Forecast 2025 to 2035

Multicarrier Parcel Management Solutions Software Market Size and Share Forecast Outlook 2025 to 2035

Express and Small Parcel Market Size and Share Forecast Outlook 2025 to 2035

Delivery Management Software Market Size and Share Forecast Outlook 2025 to 2035

Delivery Tracking Platform Market Size and Share Forecast Outlook 2025 to 2035

IOL Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Delivery Systems Market Growth - Trends & Forecast 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Stent Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Drone Delivery Service Market Analysis by Delivery Distance, Propeller Type, End User, and Region, and Forecast from 2025 to 2035

The dental delivery system market is segmented by modality, and end user from 2025 to 2035

Oxygen Delivery Units Market

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network (CDN) Market Report - Growth, Demand & Forecast 2025 to 2035

Japan’s content delivery network (CDN) Industry Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Insulin Delivery Pen Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA