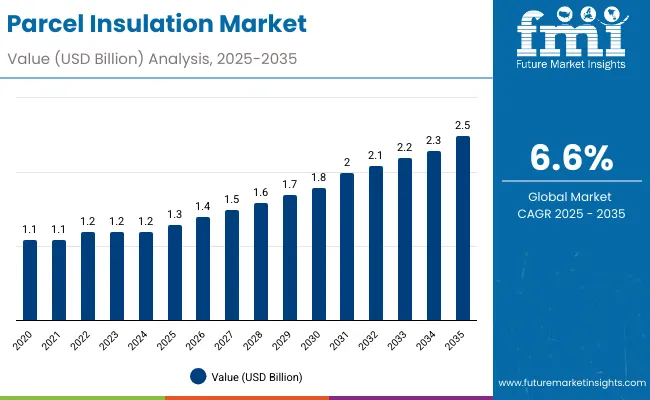

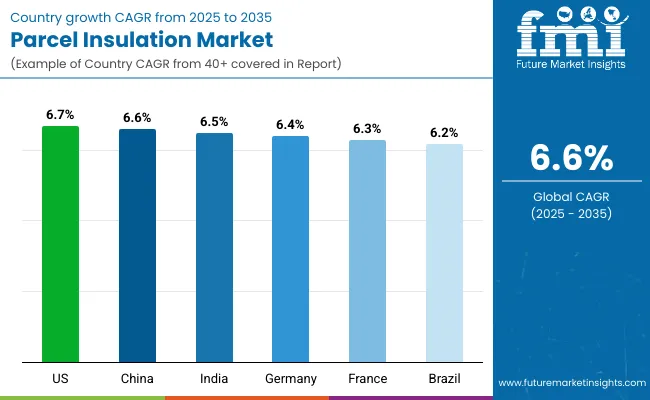

The parcel insulation market will expand from USD 1.3 billion in 2025 to USD 2.5 billion by 2035, advancing at a CAGR of 6.6%. This growth is supported by rising e-commerce, food delivery services, and pharmaceutical logistics requiring reliable temperature-sensitive packaging. Sustainability concerns are also fueling adoption of paper-based and biodegradable insulation alternatives.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.3 billion |

| Industry Value (2035F) | USD 2.5 billion |

| CAGR (2025 to 2035) | 6.6% |

Between 2025 and 2030, the market will add USD 0.5 billion as cold chain logistics and food delivery expand. From 2030 to 2035, another USD 0.7 billion will be added, driven by healthcare packaging and industrial logistics. Box liners and e-commerce end use will anchor global demand, with Asia-Pacific expected to lead growth.

From 2020 to 2024, parcel insulation demand rose as e-commerce deliveries surged and cold chain integrity became critical for food and healthcare. Paper-based and recycled cotton liners gained traction as sustainable replacements for EPS. Pharmaceutical shipments expanded insulated pouch and thermal insert adoption, while regulatory pressure against non-recyclable plastics grew globally.

By 2035, the market will reach USD 2.5 billion at 6.6% CAGR. Paper-based insulation will dominate as governments enforce circular economy policies. Box liners will remain the primary product type, balancing affordability and protection. E-commerce and healthcare logistics will anchor demand, while Asia-Pacific leads with the highest growth. Europe and North America will emphasize sustainability and compliance, while emerging markets expand insulated solutions for food and pharma supply chains.

The parcel insulation market is growing due to the expansion of cold chain logistics, rising food delivery platforms, and increased pharmaceutical shipping. Companies prioritize packaging that maintains temperature integrity during last-mile delivery. Food and beverages dominate usage, supported by consumer preference for fresh and ready-to-eat meals.

Sustainability is another driver, with retailers adopting paper-based and biodegradable materials to replace EPS and polyurethane foam. E-commerce and retail further accelerate adoption by integrating parcel insulation into scalable packaging systems. With stricter regulations and consumer awareness, demand for sustainable and efficient insulated packaging solutions continues to strengthen globally.

The parcel insulation market is segmented by material, product type, application, end-use industry, and region. Material categories include paper-based insulation, recycled cotton, wool, EPS, polyurethane foam, biodegradable foam, and aerogels. Product types cover box liners, envelopes, pouches, and thermal pads. Applications span food and beverages, pharmaceuticals, personal care, chemicals, and industrial goods. End-use industries include e-commerce, food delivery, pharmaceutical logistics, and industrial packaging across global regions.

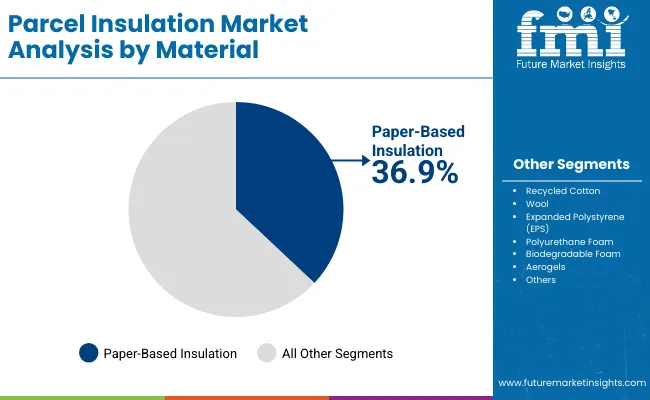

Paper-based insulation will hold 36.9% share in 2025, supported by recyclability, affordability, and compliance with global plastic bans. Its strength and thermal performance make it suitable for food delivery and healthcare logistics. Retailers and logistics providers favor it as a scalable, sustainable solution.

Future demand will be reinforced by improved barrier coatings and certifications for food contact. Innovations in moisture resistance and lightweight formats will expand usage. Paper-based insulation will remain the leading material through 2035, aligning with regulatory mandates and consumer expectations.

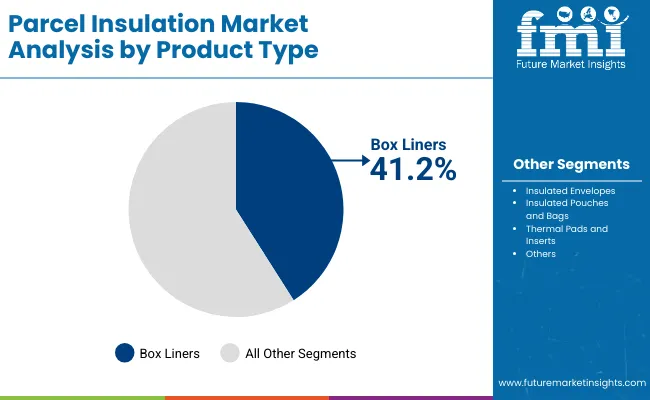

Box liners will account for 41.2% share in 2025 due to their widespread use in food, grocery, and pharmaceutical shipments. They provide flexibility, low cost, and strong protective performance. E-commerce and food delivery companies adopt liners to ensure thermal stability during transport.

Innovation in biodegradable and recyclable liners will drive further adoption. Custom sizing and automation-ready designs enhance efficiency. Box liners will continue to dominate, particularly in high-volume retail and food logistics channels.

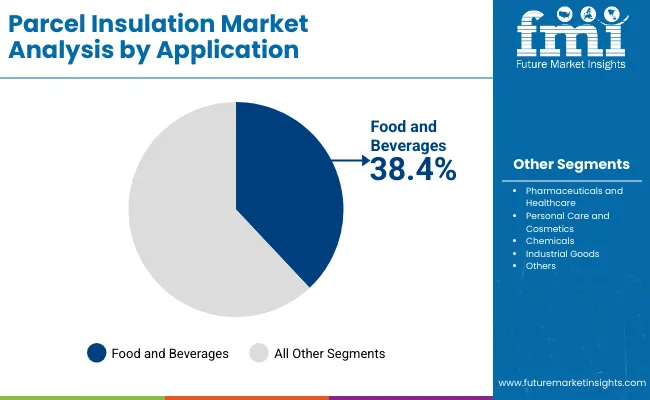

Food and beverages will command 38.4% share in 2025, driven by demand for temperature-controlled delivery of fresh and frozen items. Foodservice operators rely on insulated packaging to maintain safety and quality. Online grocery platforms also accelerate adoption.

Future growth will be reinforced by ready-to-eat meals and subscription services. Paper and foam alternatives offering recyclability will support expansion. Food and beverage shipments will remain a cornerstone of market demand through 2035.

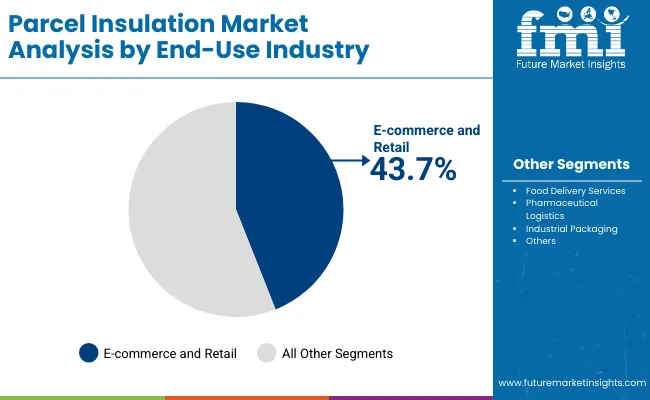

E-commerce and retail will represent 43.7% share in 2025, reflecting parcel insulation’s role in protecting perishable and sensitive goods. Retailers expand use of insulated packaging to improve delivery outcomes and reduce spoilage.

By 2035, e-commerce will remain dominant as online food and healthcare delivery scales. Automation-ready insulated solutions and recyclable designs will further anchor growth. This segment will continue leading adoption globally.

Market growth is driven by rising cold chain logistics, expansion of food delivery, and global pharmaceutical trade. Insulated packaging ensures compliance with safety regulations, while sustainability mandates drive paper and biodegradable foam adoption. E-commerce and healthcare logistics expand rapidly, reinforcing long-term demand.

High costs of advanced materials like aerogels and biodegradable foams limit adoption in cost-sensitive markets. Recycling infrastructure gaps restrict uptake of certain insulation products. Price competition from traditional EPS continues to hinder transition toward sustainable solutions.

Opportunities lie in biodegradable insulation, automation-ready packaging, and healthcare logistics. Pharmaceutical cold chains require precise temperature control, boosting insulated envelopes and pouches. Emerging markets provide significant potential as e-commerce and food delivery scale.

Trends include recyclable paper-based liners, biodegradable foams, and lightweight aerogels. Integration with digital monitoring solutions enhances cold chain visibility. Partnerships between packaging suppliers and logistics providers drive innovation. Circular economy initiatives push eco-friendly materials to the forefront.

The market is expanding globally as sustainability and cold chain needs align. Asia-Pacific leads growth with Japan and South Korea adopting advanced solutions. North America emphasizes compliance and healthcare logistics, while Europe enforces strict recycling mandates. Emerging markets expand with e-commerce and food delivery.

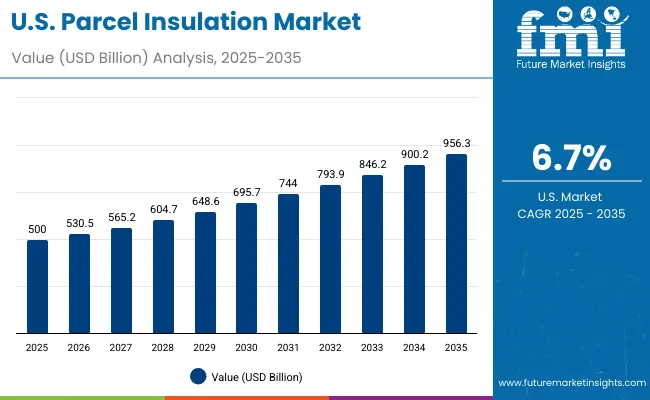

The USA insulated packaging market is projected to grow at 6.7% CAGR, supported by strong e-commerce expansion and healthcare logistics requirements. Rising emphasis on sustainability is driving significant adoption of paper-based insulation materials as replacements for conventional formats. In addition, the growing penetration of food delivery platforms further expands insulated packaging use, ensuring products reach consumers in optimal condition while simultaneously reinforcing eco-conscious practices and enhancing service reliability across industries.

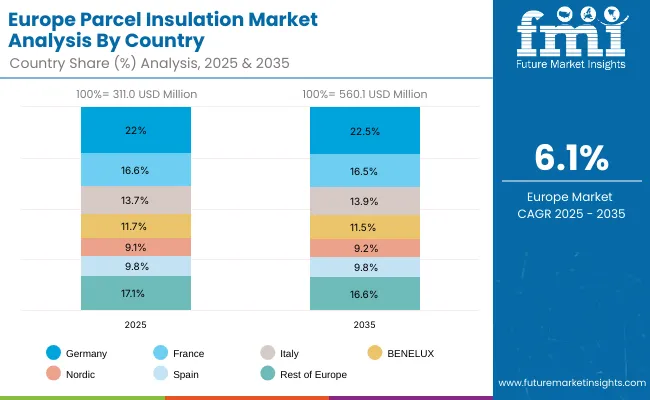

Germany is forecast to expand at a 6.4% CAGR, primarily underpinned by the enforcement of strict EU recycling and packaging laws. Pharmaceutical logistics remain a cornerstone, with insulated packaging used extensively in maintaining drug quality. Simultaneously, demand is enhanced by biodegradable foam innovations that support sustainable cold chain operations, enabling Germany to balance regulatory compliance, consumer expectations, and packaging performance within healthcare and food-related logistics.

The UK insulated packaging market will grow at 6.5% CAGR, supported by extended producer responsibility (EPR) and new packaging regulations. Food delivery services are expanding quickly, driving the adoption of insulated packaging to maintain product integrity. Retailers are also prioritizing recyclable formats, ensuring compliance while capturing environmentally conscious consumers, which reinforces sustainability’s role in shaping demand across industries such as groceries, restaurants, and online retail platforms.

China is anticipated to grow at 6.6% CAGR, driven by rapid e-commerce penetration and accelerated cold chain expansion supporting food and pharmaceuticals. Demand is increasingly shifting toward EPS alternatives, with sustainable insulation materials dominating new adoption. As large online retail platforms and logistics companies scale operations, insulated packaging use expands to accommodate perishable and sensitive products, highlighting the country’s strategic emphasis on logistics modernization and environmentally safe material solutions.

India’s insulated packaging market will record 6.5% CAGR, supported by rapid scaling of food and beverage delivery platforms. Retail sector expansion contributes strongly to usage, as both urban and semi-urban markets demand reliable thermal solutions. Sustainability initiatives further strengthen usage, with businesses investing in eco-friendly insulation materials to balance environmental responsibility with the rising consumer demand for convenience-driven, temperature-sensitive food, grocery, and medical shipments across India’s diverse and growing economy.

Japan will expand at a 7.2% CAGR, with demand driven by stringent healthcare logistics and cold chain standards that require consistent thermal packaging. Paper-based insulation and advanced foams dominate adoption, offering lightweight, durable, and recyclable alternatives. The country’s focus on innovation ensures insulated packaging solutions meet sustainability mandates, enhance logistics efficiency, and align with consumer expectations for premium quality across food, pharmaceutical, and high-value delivery applications.

South Korea is projected to lead growth globally with a 7.3% CAGR, supported by e-commerce expansion and food delivery platforms. Recyclable materials dominate adoption, reflecting strong consumer awareness and regulatory alignment. As logistics providers and food delivery companies scale, insulated packaging is increasingly integrated into distribution systems, positioning South Korea as a hub of innovation and sustainability in reusable and recyclable thermal packaging solutions.

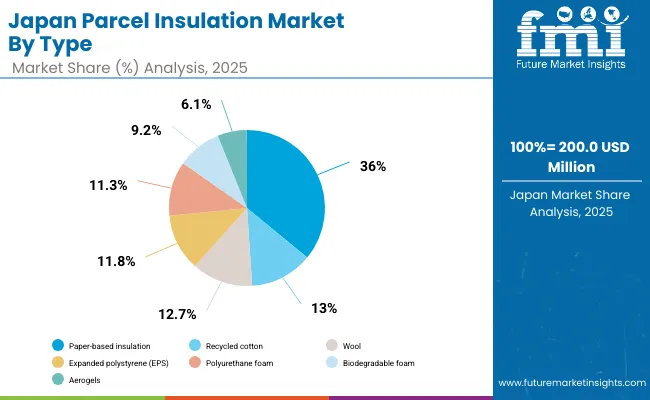

Japan’s parcel insulation market, valued at USD 200 million in 2025, is dominated by paper-based insulation with a 36.0% share, reflecting strong adoption of recyclable packaging. Recycled cotton (13.0%) and wool (12.7%) contribute significantly, offering thermal stability and eco-friendly alternatives to conventional plastics. Expanded polystyrene (EPS) at 11.8% and polyurethane foam at 11.3% continue to serve heavy-duty insulation requirements, though facing regulatory scrutiny. Biodegradable foam (9.2%) and aerogels (6.1%) show emerging growth potential in lightweight, high-performance packaging solutions. Overall, the material mix highlights Japan’s balancing of performance with sustainability goals as e-commerce and pharmaceutical cold chain logistics expand.

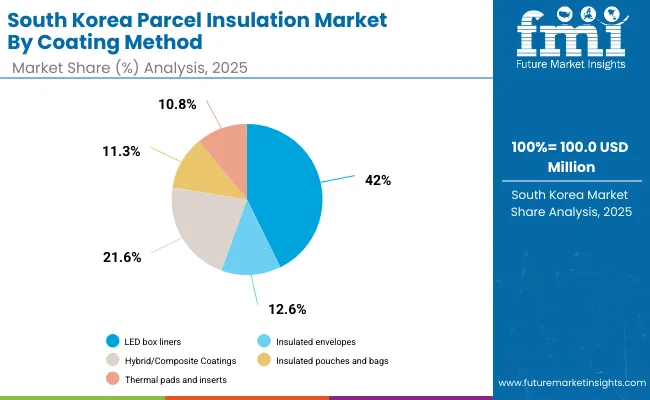

South Korea’s parcel insulation market, sized at USD 100 million in 2025, is led by box liners with a 42.0% share, driven by their versatility in perishable and pharmaceutical shipments. Insulated envelopes (12.6%) are preferred for smaller parcel logistics, particularly in e-commerce and food delivery. Insulated pouches and bags (11.3%) provide convenience for retail and household applications, ensuring thermal efficiency for short-haul distribution. Thermal pads and inserts (10.8%) round out the product base, supporting niche cold chain requirements. South Korea’s product distribution demonstrates a clear emphasis on practical, scalable packaging designs tailored to last-mile delivery and temperature-sensitive transportation needs.

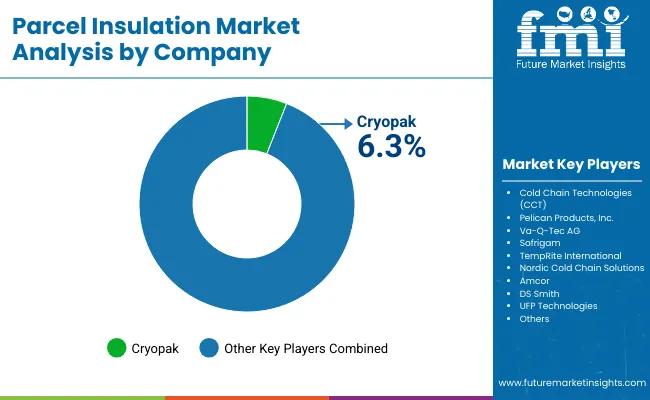

The market is moderately fragmented with global leaders such as Cryopak, Cold Chain Technologies (CCT), Pelican Products Inc., Va-Q-Tec AG, Sofrigam, TempRite International, Nordic Cold Chain Solutions, Amcor, DS Smith, and UFP Technologies. These companies invest in recyclable materials, advanced foam, and digital monitoring solutions.

Amcor and DS Smith dominate paper-based innovation, while Va-Q-Tec and Sofrigam lead high-performance cold chain packaging. Cryopak and Pelican Products specialize in protective thermal shipping. Regional players like TempRite and Nordic Cold Chain focus on customized supply. Competition centers on sustainability, cost-efficiency, and scalability, with strong emphasis on healthcare and food sectors.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| By Material | Paper-Based, Recycled Cotton, Wool, EPS, Polyurethane Foam, Biodegradable Foam, Aerogels |

| By Product Type | Box Liners, Envelopes, Pouches, Thermal Pads |

| By Application | Food & Beverages, Pharmaceuticals & Healthcare, Personal Care & Cosmetics, Chemicals, Industrial Goods |

| By End-Use Industry | E-commerce & Retail, Food Delivery, Pharma Logistics, Industrial Packaging |

| Key Companies Profiled | Cryopak, Cold Chain Technologies (CCT), Pelican Products Inc., Va -Q-Tec AG, Sofrigam, TempRite International, Nordic Cold Chain Solutions, Amcor, DS Smith, UFP Technologies |

| Additional Attributes | Growth driven by e-commerce, healthcare logistics, and sustainable materials. |

The market will be valued at USD 1.3 billion in 2025.

The market will reach USD 2.5 billion by 2035.

The market will grow at a CAGR of 6.6% during 2025-2035.

Paper-based insulation will lead with a 36.9% share in 2025.

Food and beverages will anchor demand with a 38.4% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Parcel Delivery Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Automated Parcel Delivery Terminals Market Growth – Trends & Forecast 2025 to 2035

Multicarrier Parcel Management Solutions Software Market Size and Share Forecast Outlook 2025 to 2035

Express and Small Parcel Market Size and Share Forecast Outlook 2025 to 2035

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Insulation Market Size and Share Forecast Outlook 2025 to 2035

Insulation Coatings Market Size and Share Forecast Outlook 2025 to 2035

Insulation Boards Market Size and Share Forecast Outlook 2025 to 2035

Insulation Testing Instrument Market Size and Share Forecast Outlook 2025 to 2035

OEM Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cork Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Products Market Size and Share Forecast Outlook 2025 to 2035

Wool Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA